While inflation concerns prevail in the US, Swiss inflation hit its lowest level in almost four years. Headline CPI contracted 0.1% m/m in January, leaving the annual inflation rate at 0.4%, near the bottom of the Swiss National Bank…

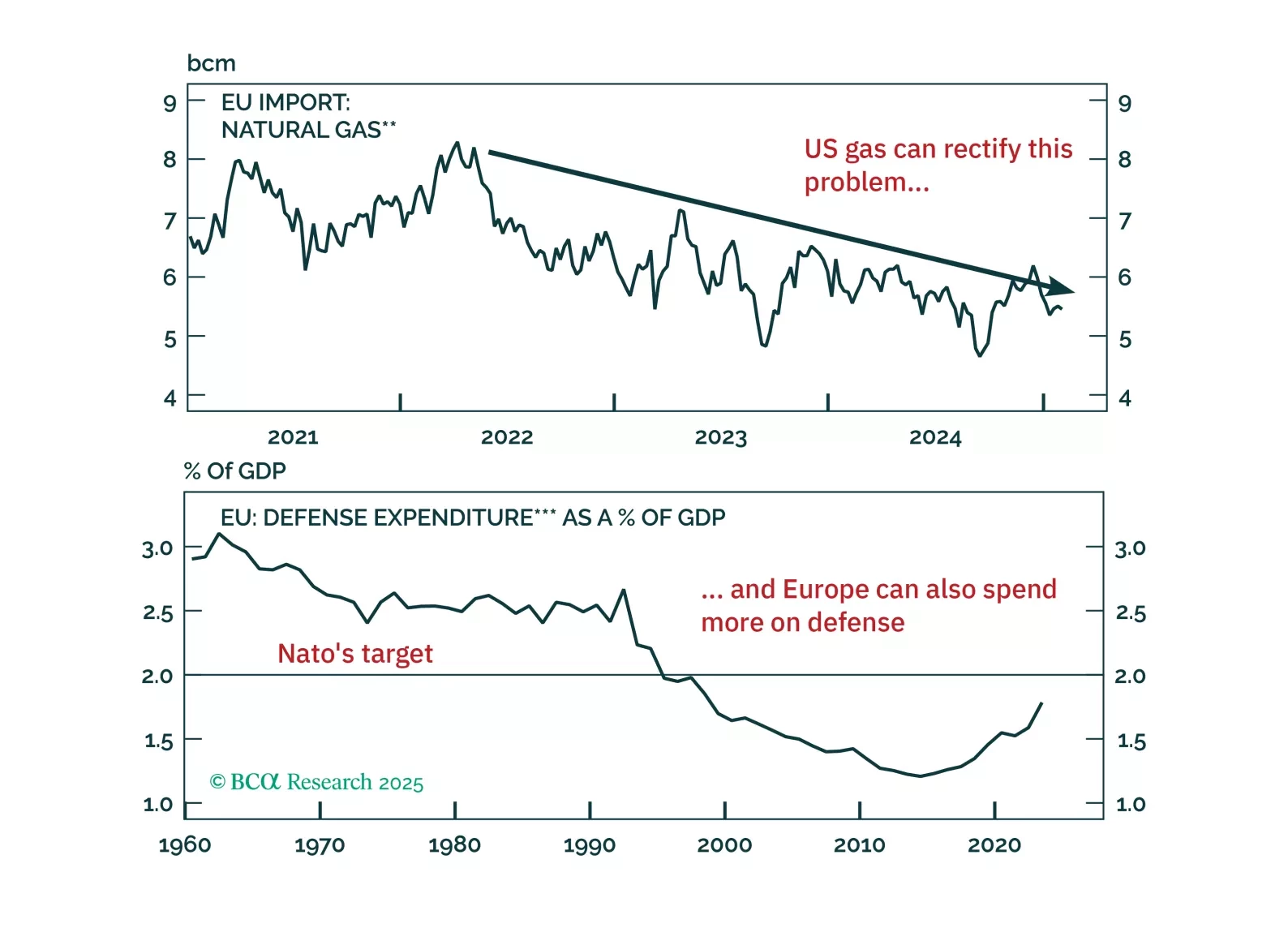

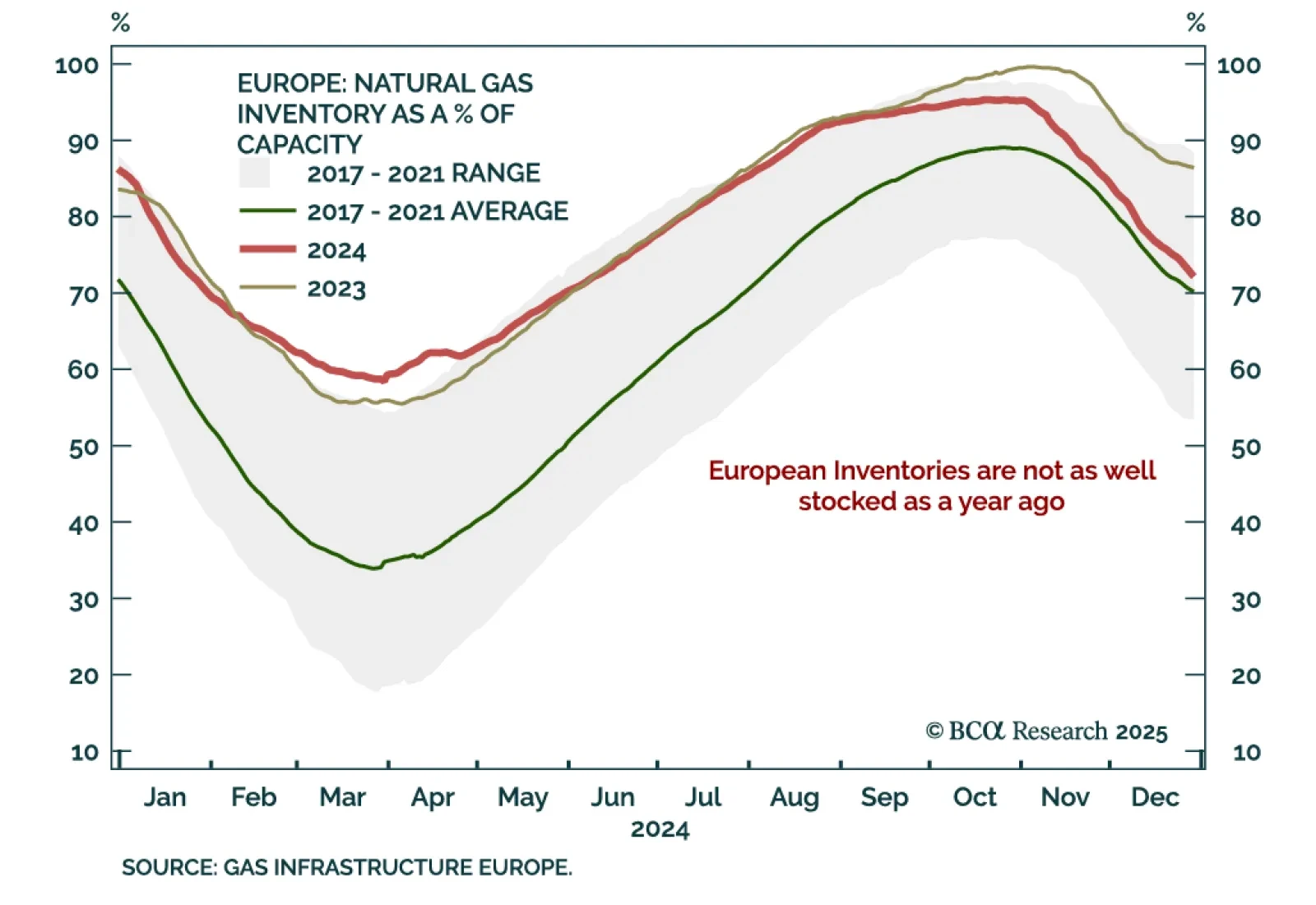

As a push for Russia-Ukraine peace talks emerges, energy prices are easing. Reduced geopolitical risk and the potential lifting of sanctions on Russia would be a headwind for oil and European natural gas prices. Should investors bet…

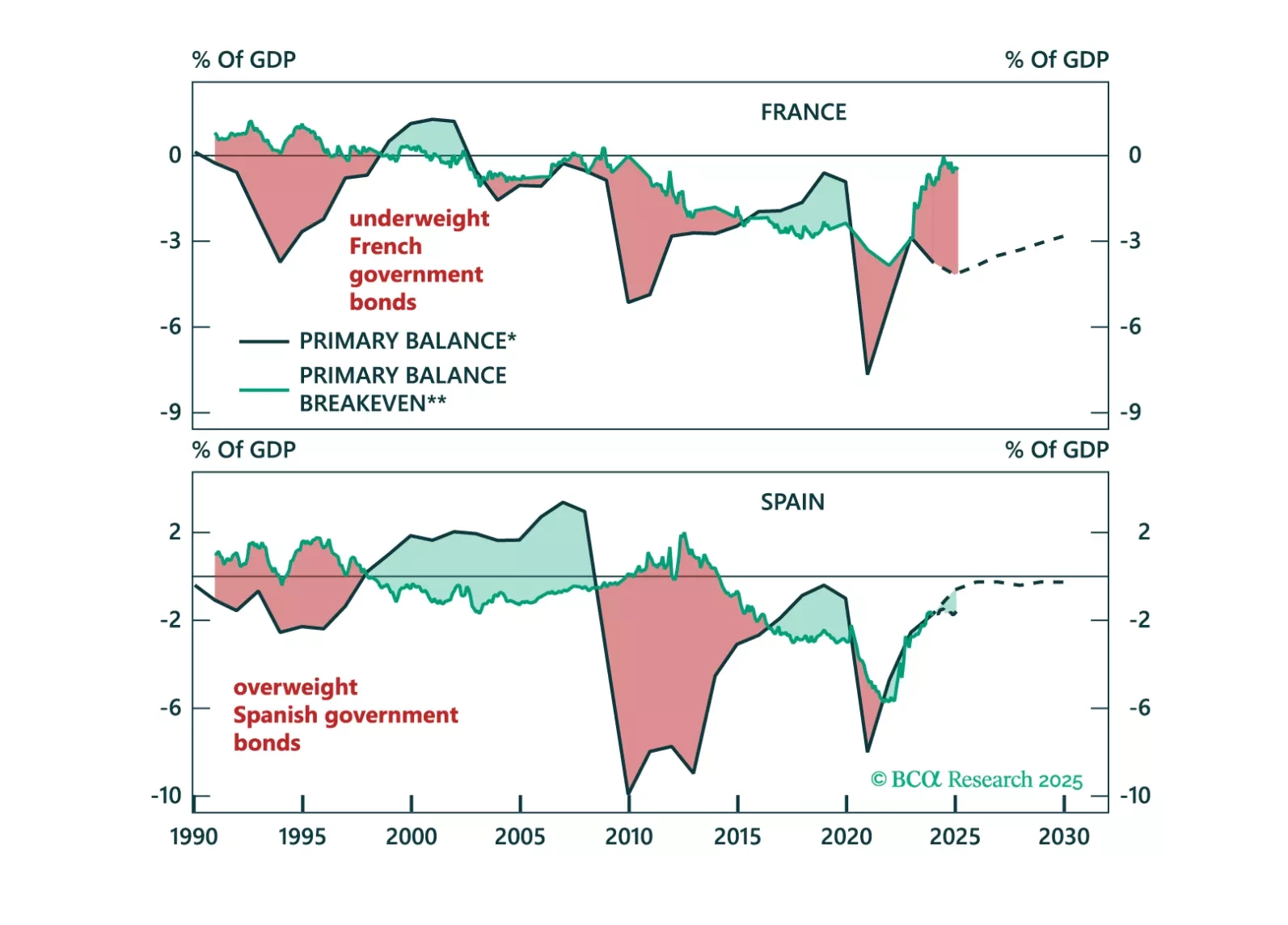

Europe is about to become President Trump’s next target. The good news: a US/EU trade war will be short as common ground to achieve a deal exists. The bad news: European assets remain at the mercy of heightened uncertainty. How…

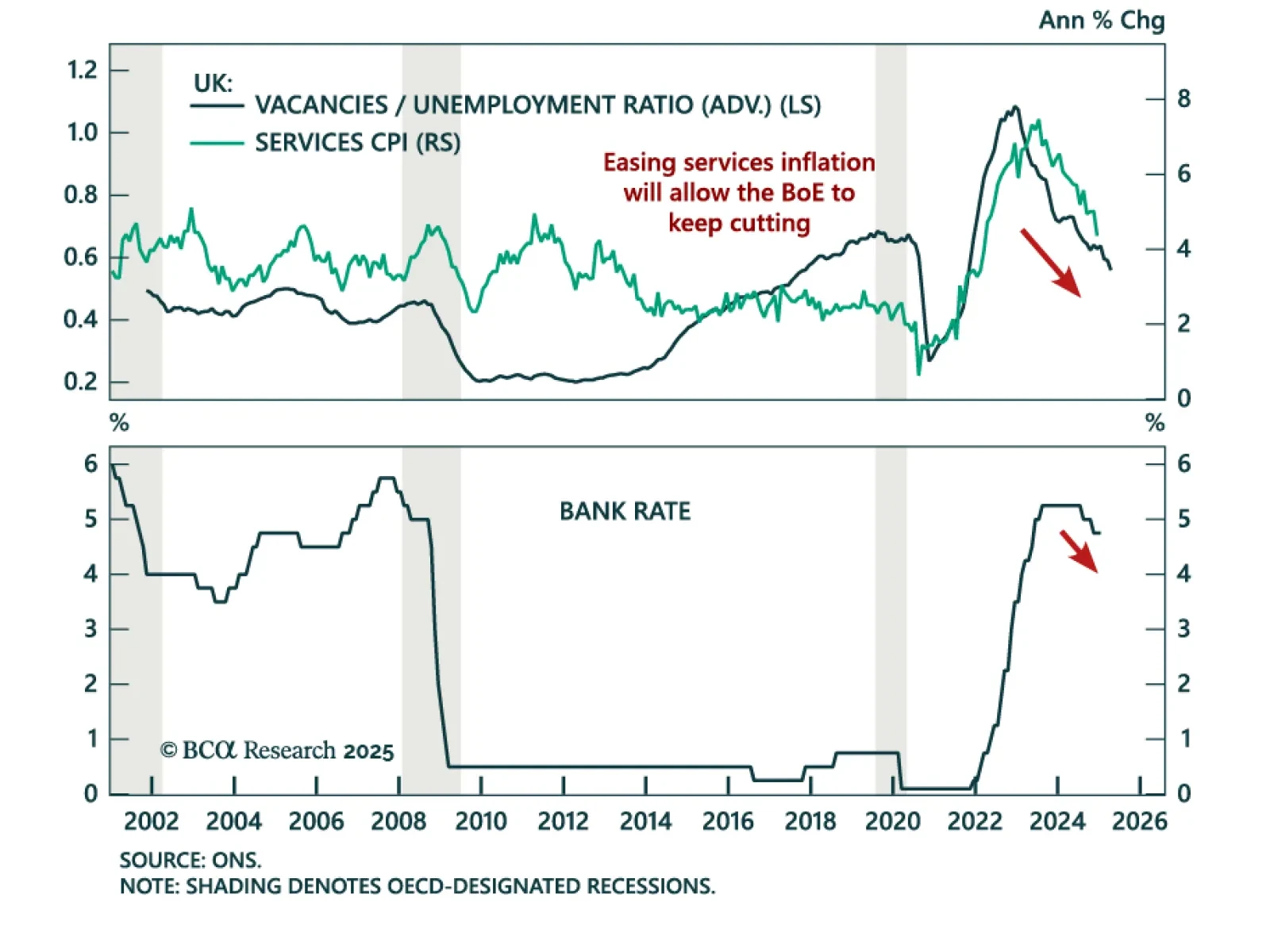

The Bank of England cut its policy rate by 25 bps to 4.5%, with two members of the MPC voting to cut 50 bps instead. The BoE acknowledged “substantial progress on disinflation”, driven by a tight policy stance and stabilized…

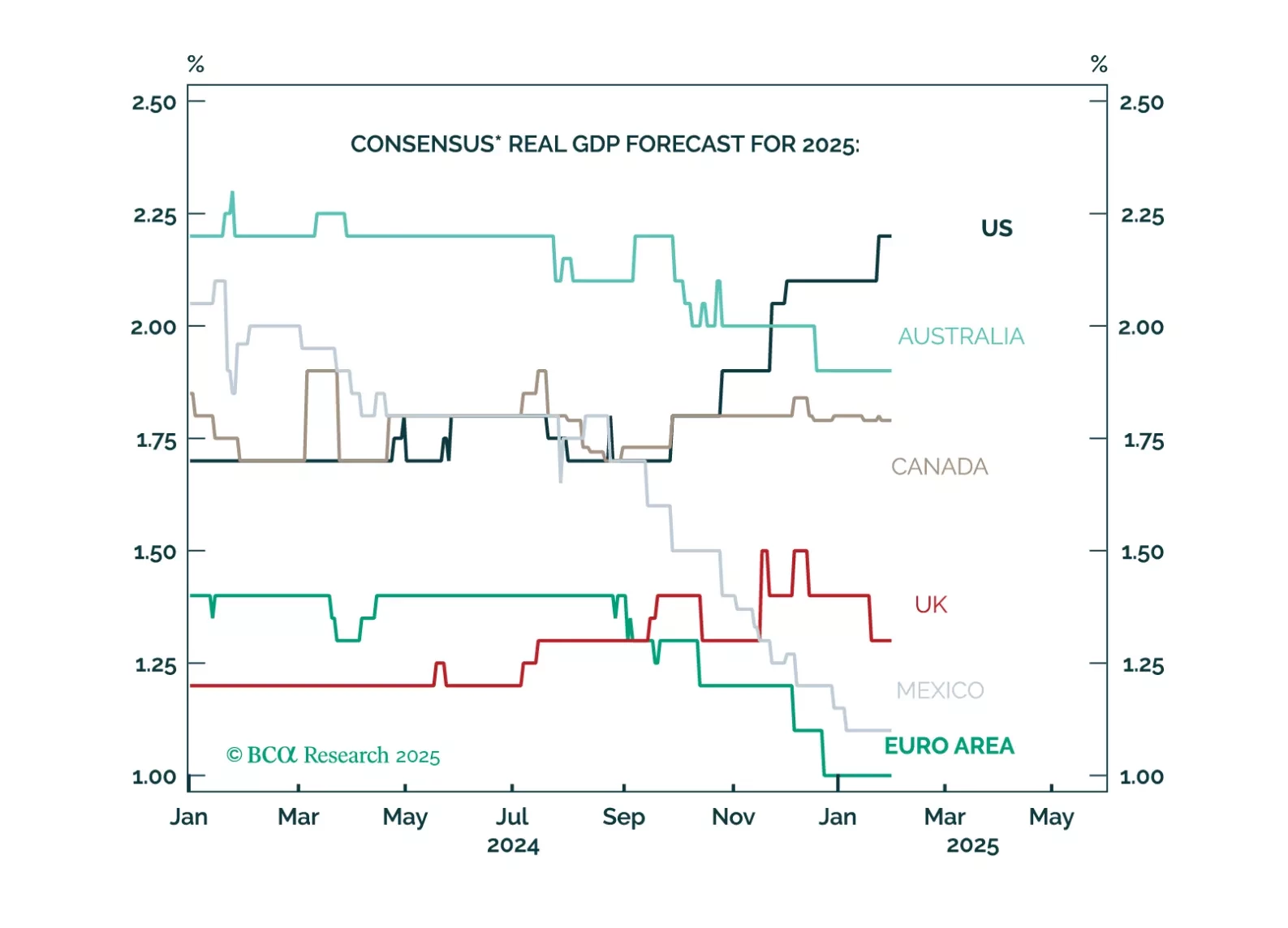

Markets and forecasters anticipate a “Golden Age” for Trump’s America, with US growth expectations soaring while the rest of the world lags. However, this extreme optimism means that there is a lot of room for disappointment. Cooling…

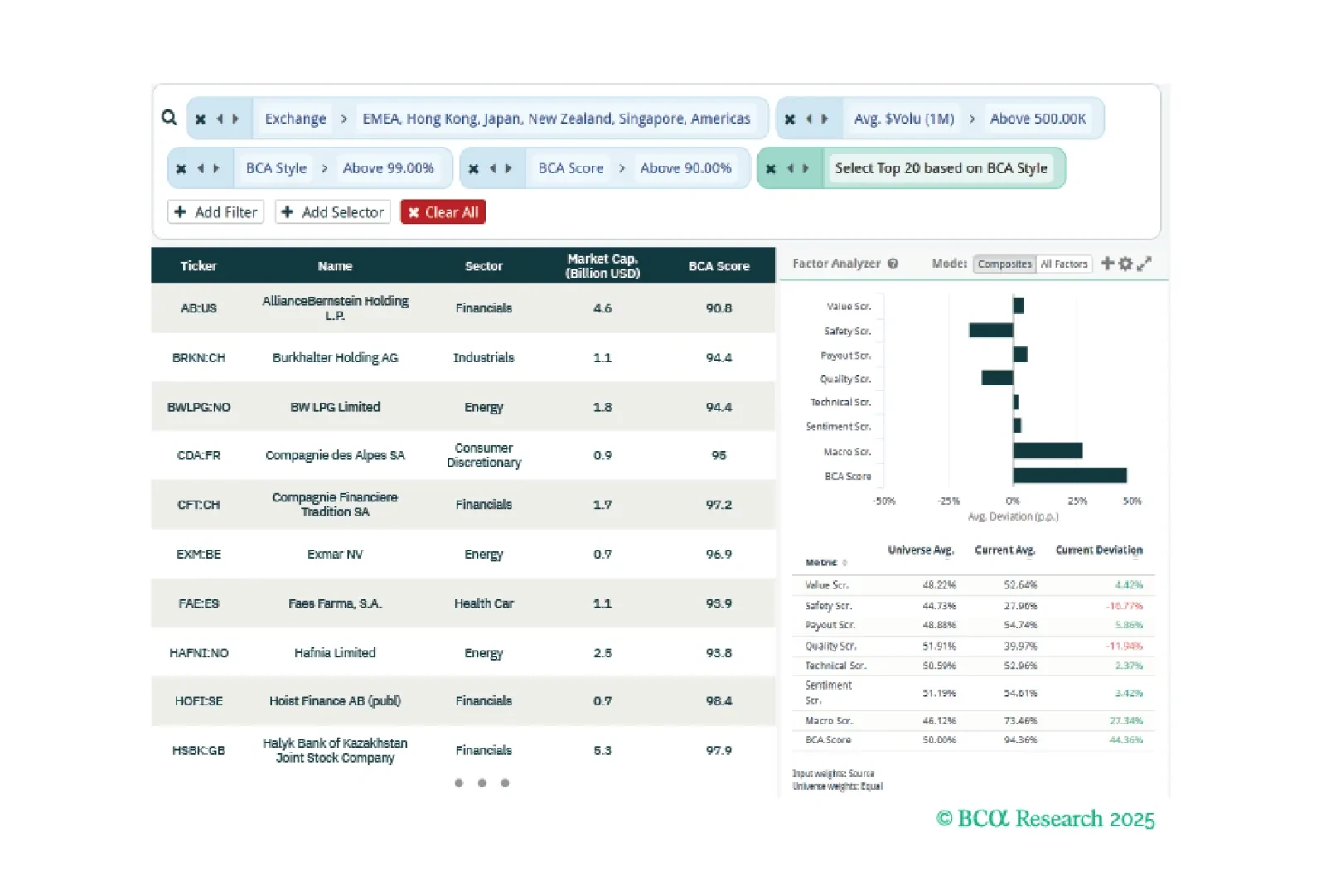

This week, our three screeners explore global small-cap value stocks, European equities, and BCA’s nuclear energy themed equity baskets.

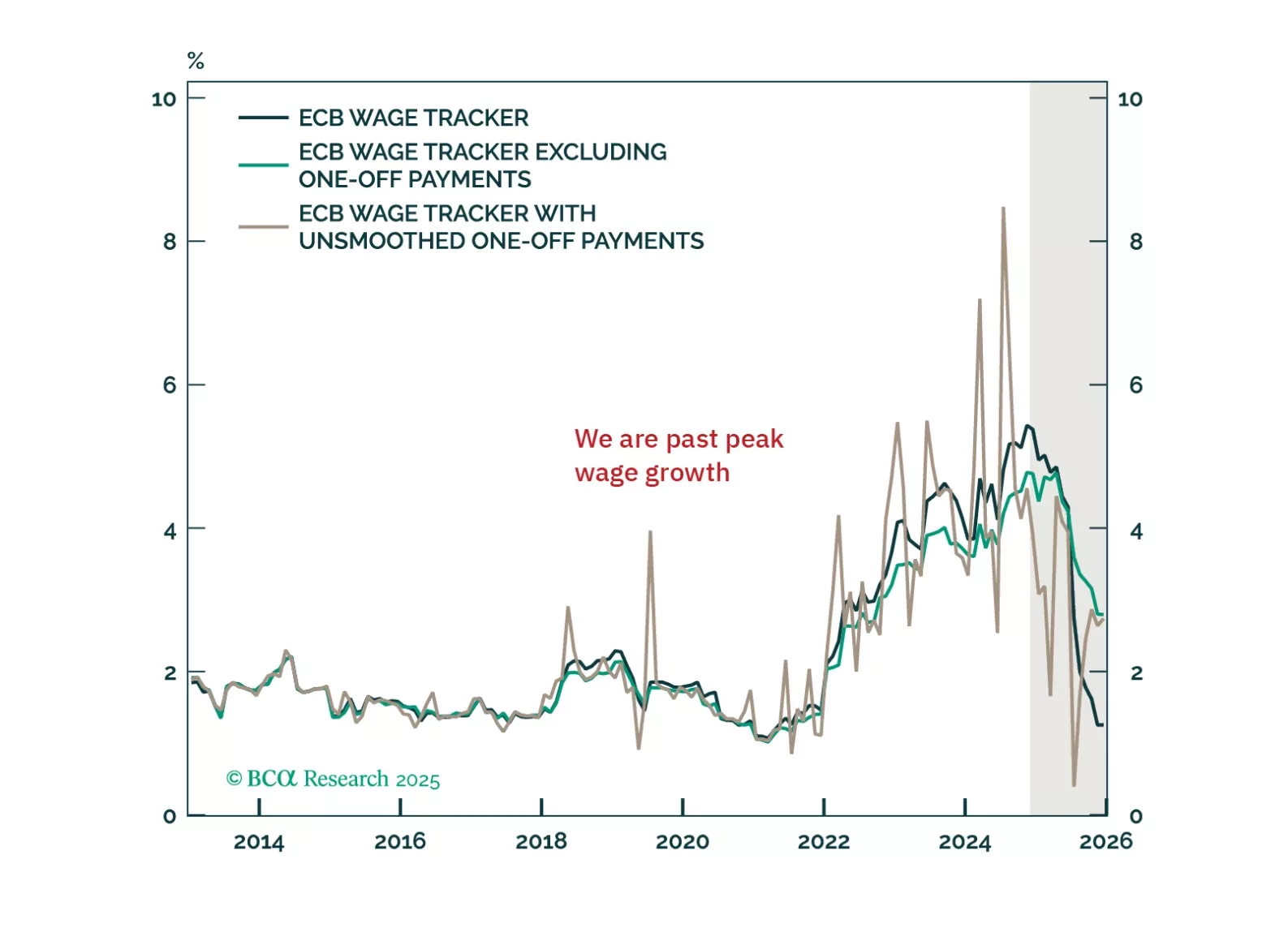

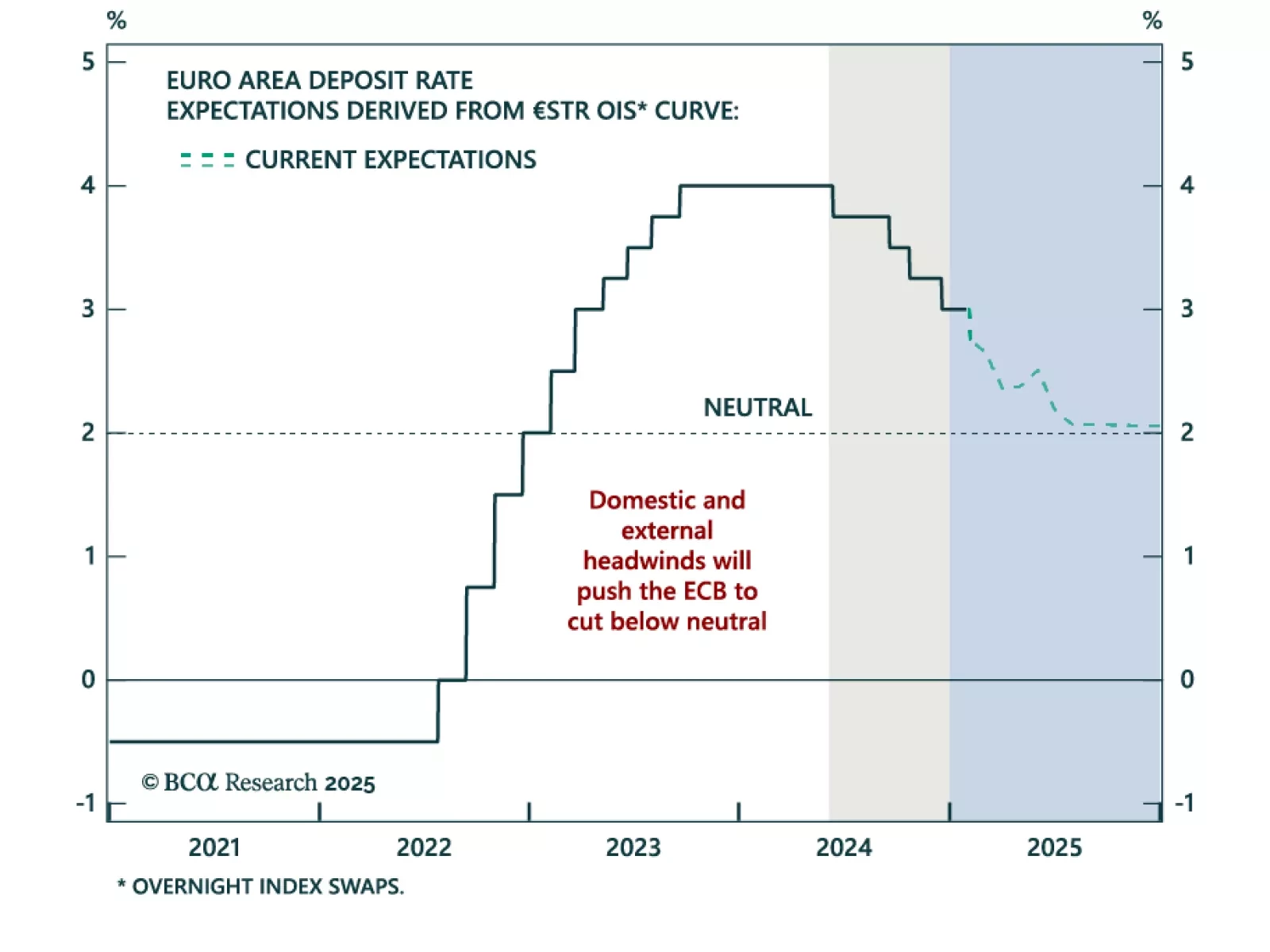

The ECB cut its deposit rate to 2.75%, as was widely anticipated. President Christine Lagarde did not provide any fireworks, but the Governing Council’s message was clear: Policy is restrictive, and inflation will fall further. As a…

The ECB cut by 25 bps as expected, bringing the deposit facility rate to 2.75%. Despite avoiding committing to a path for policy, President Lagarde reiterated the disinflationary process is “well on track”, and did not push against…

Vous êtes cordialement invité(e) à rejoindre Jérémie Peloso pour un webcast présenté en français le mercredi 29 janvier à 10:00 AM EST (3:00 PM GMT, 4:00 PM CET).