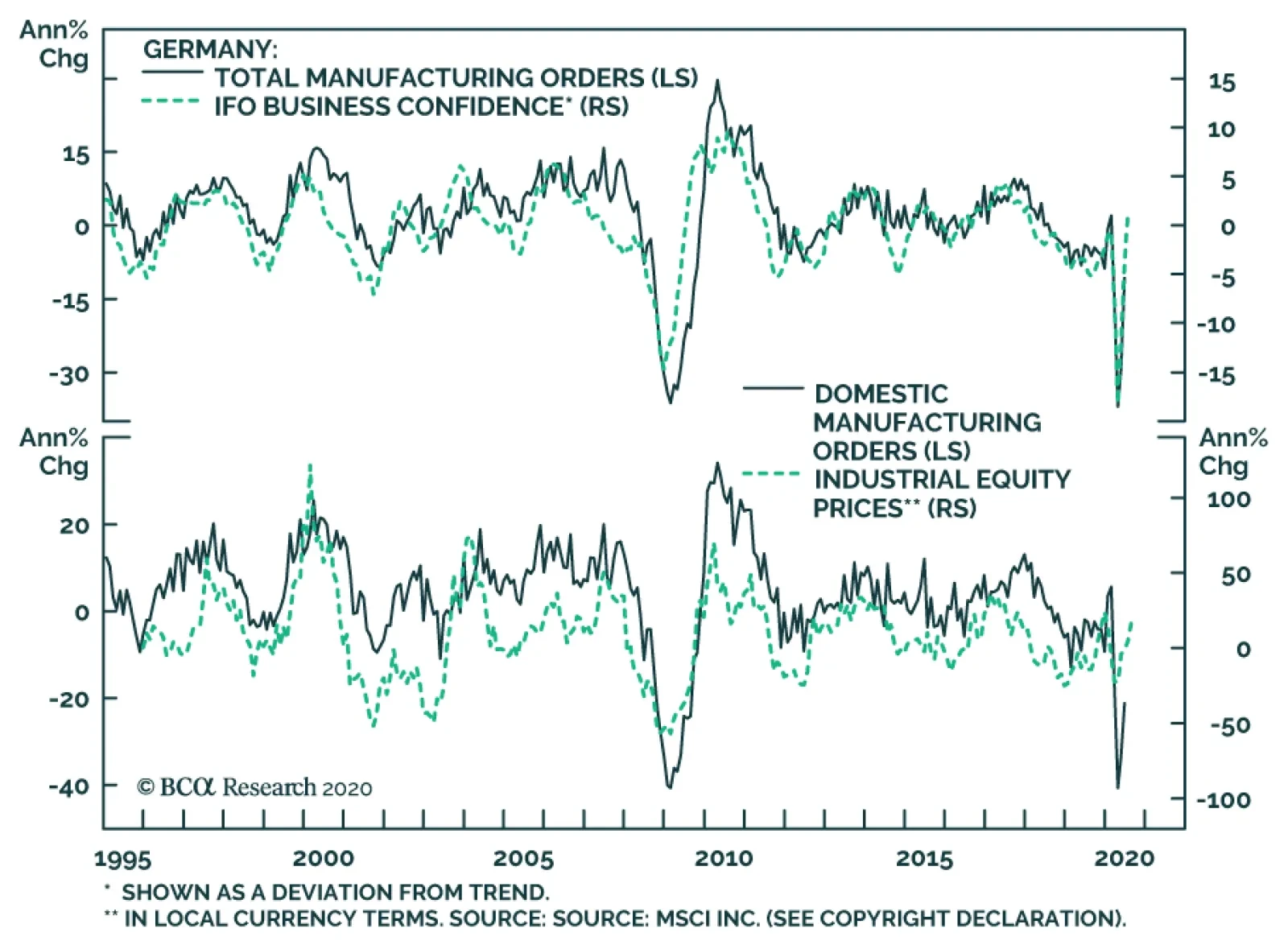

German assets maintain the most appealing risk profile in the euro area. The DAX’s attraction reflects two forces. First, German equities are heavily overweight industrial stocks. The global manufacturing sector is…

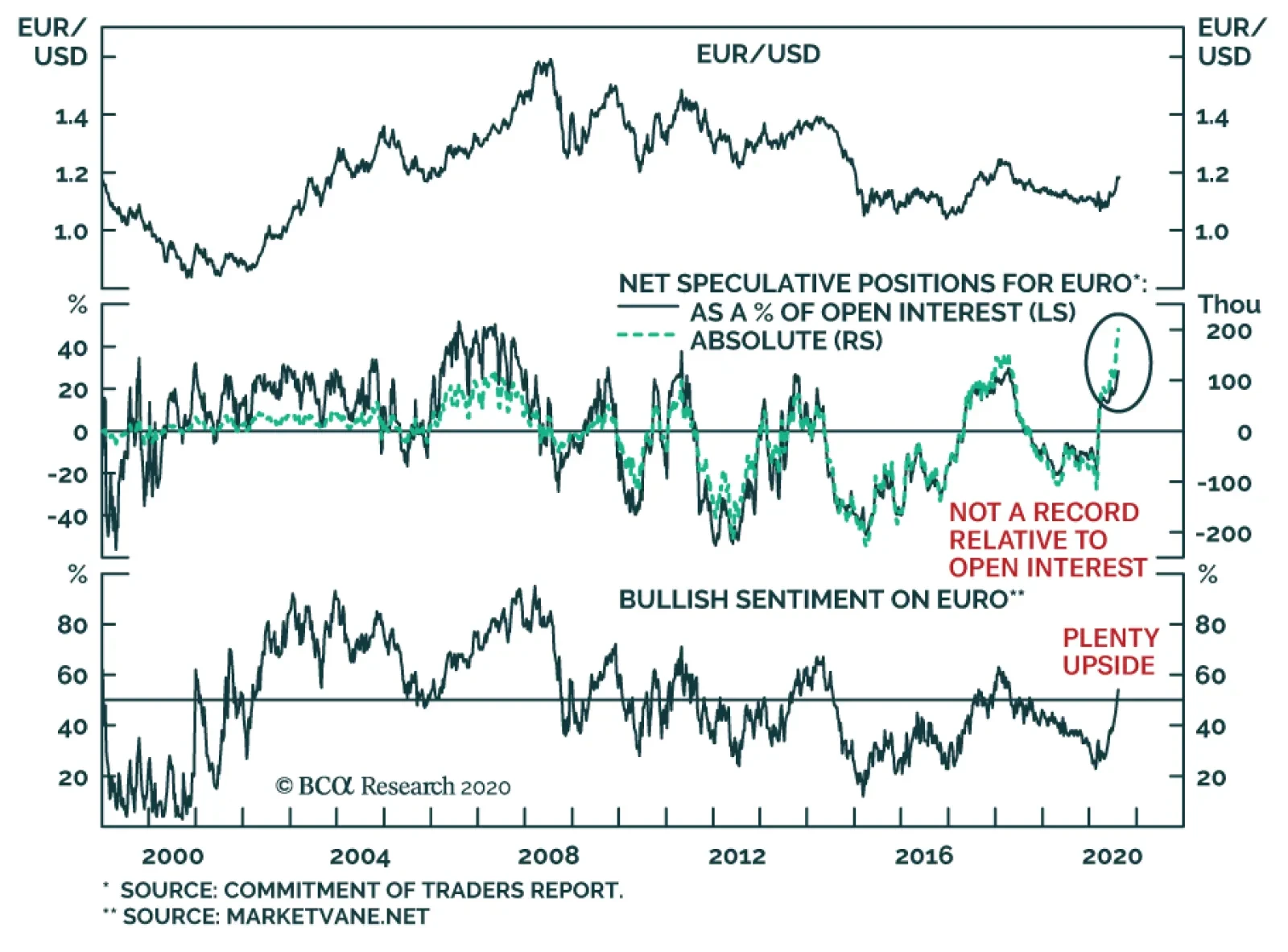

Many commentators have become worried that the euro may soon top because the broad trade weighted euro tracked by the ECB is flirting with all-time highs and because net speculative positions in the euro stand at a record.…

Highlights Global Credit Spreads: The relentless rally in global credit markets since the rout in February and March has driven corporate spreads to near pre-pandemic lows in the US, Europe and even emerging markets. Central bank…

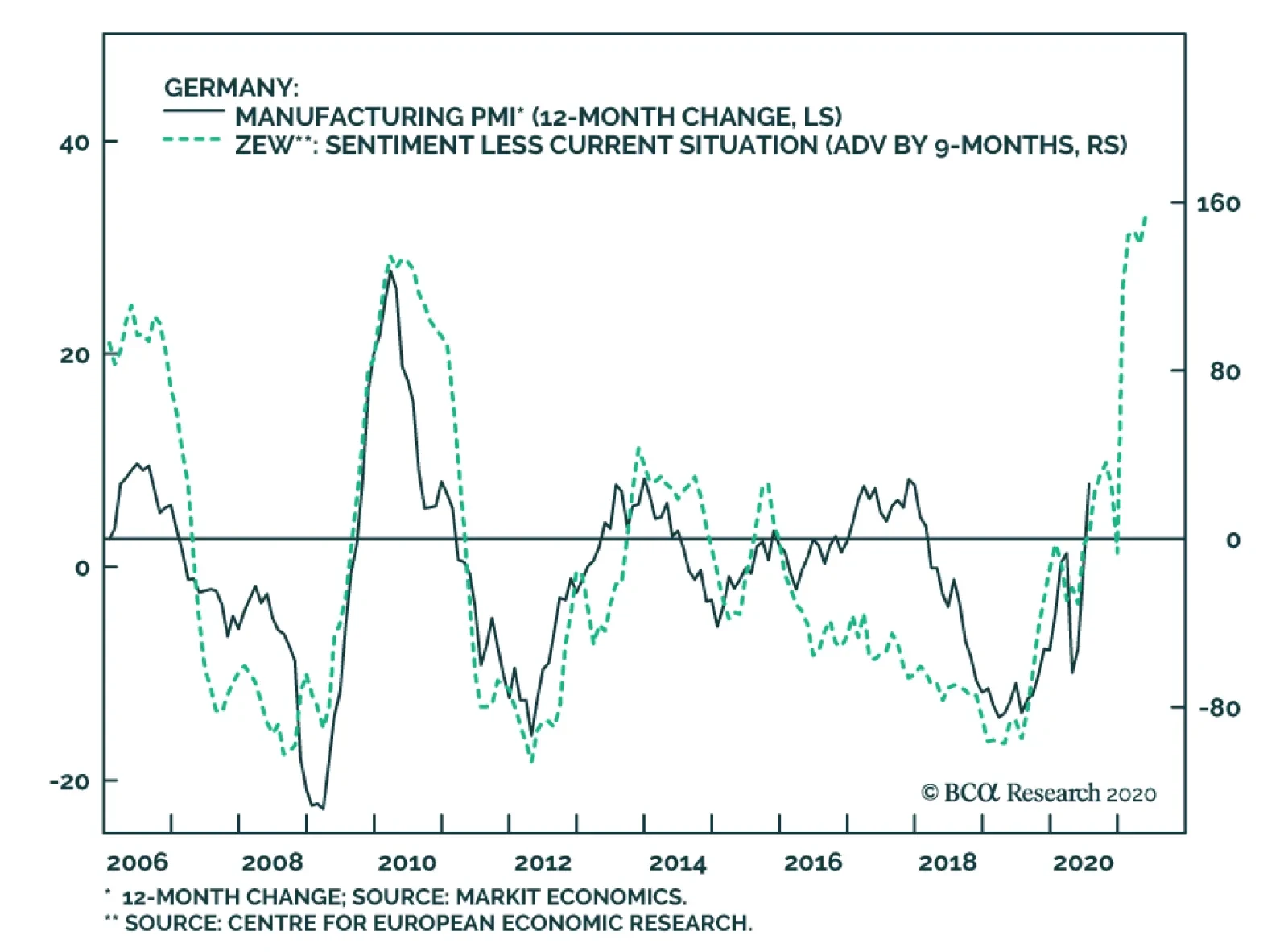

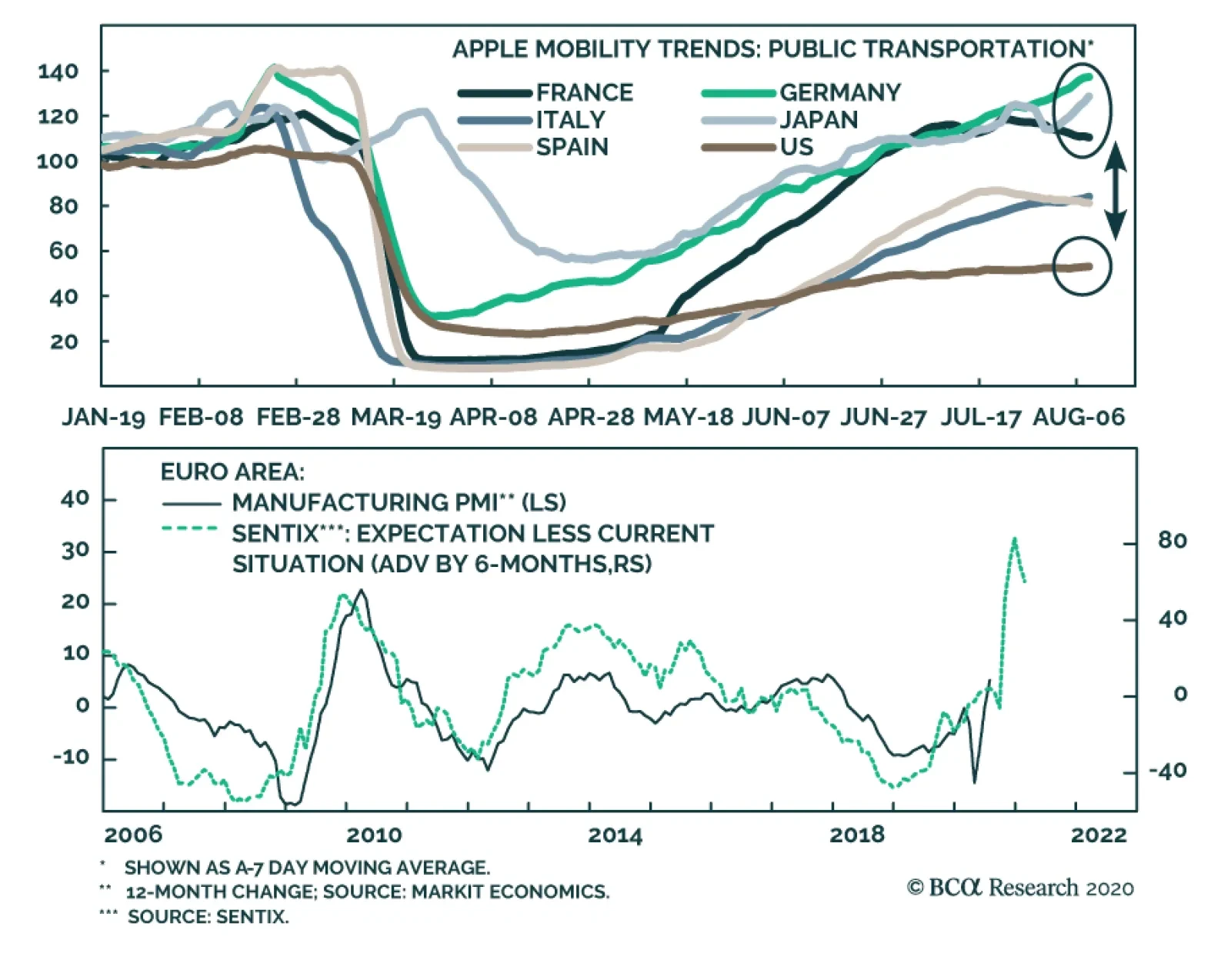

The ZEW survey of German investor sentiment surged in August, moving up to 71.5 from 59.3 in July. This burst of positive sentiment comes right on the heels of last week’s PMI release, which showed that the Eurozone…

The euro was at the center of the decline in the DXY index for the month of July. First, the de facto declaration of a fiscal union catalyzed euro bulls in what was a historic agreement, as explained here. Second, the rate of new…

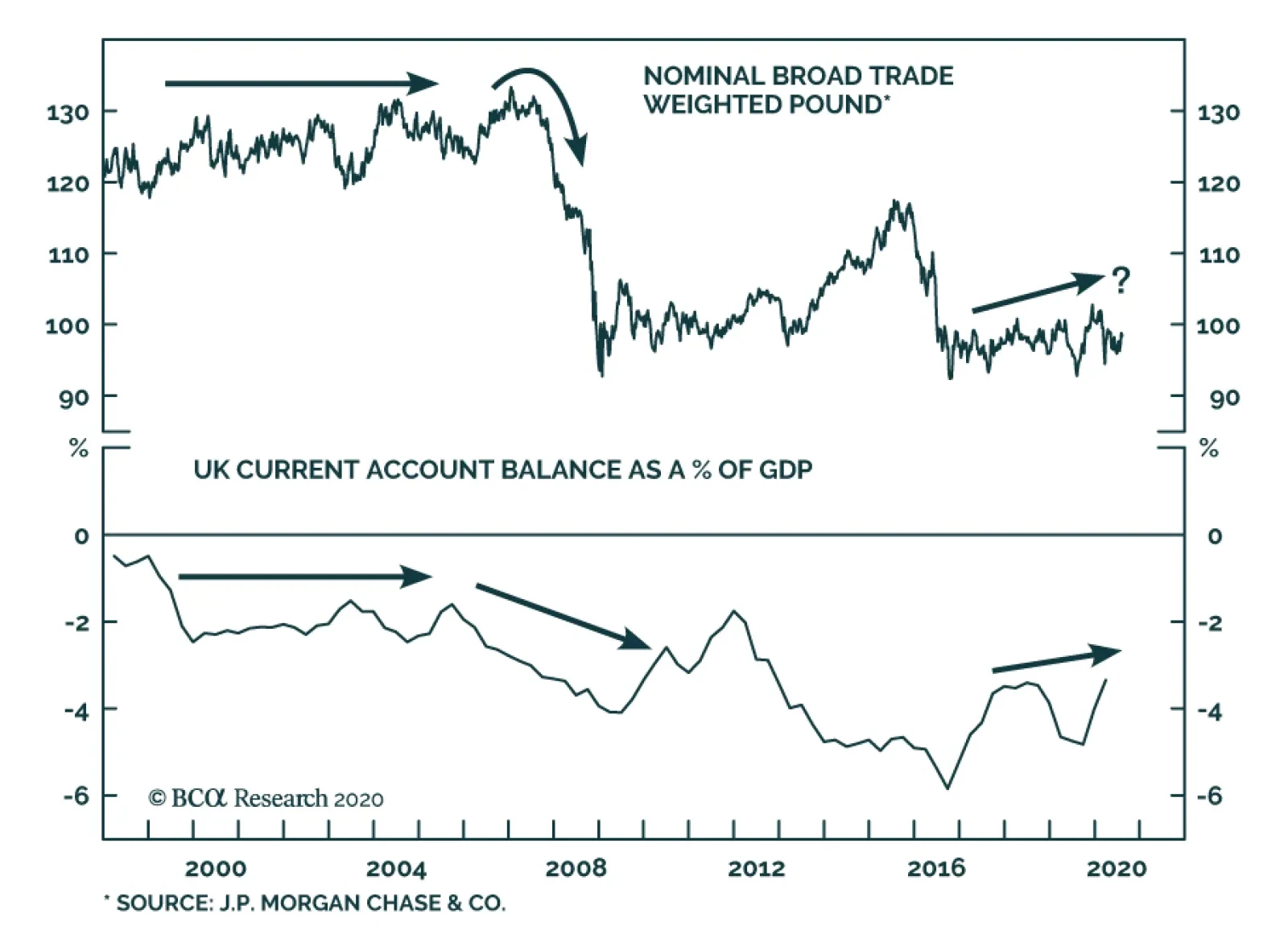

BCA Research's Foreign Exchange Strategy service continues to favor the British pound over the long term due to its cheap valuation. The key development in the UK’s balance-of-payment dynamics is that…

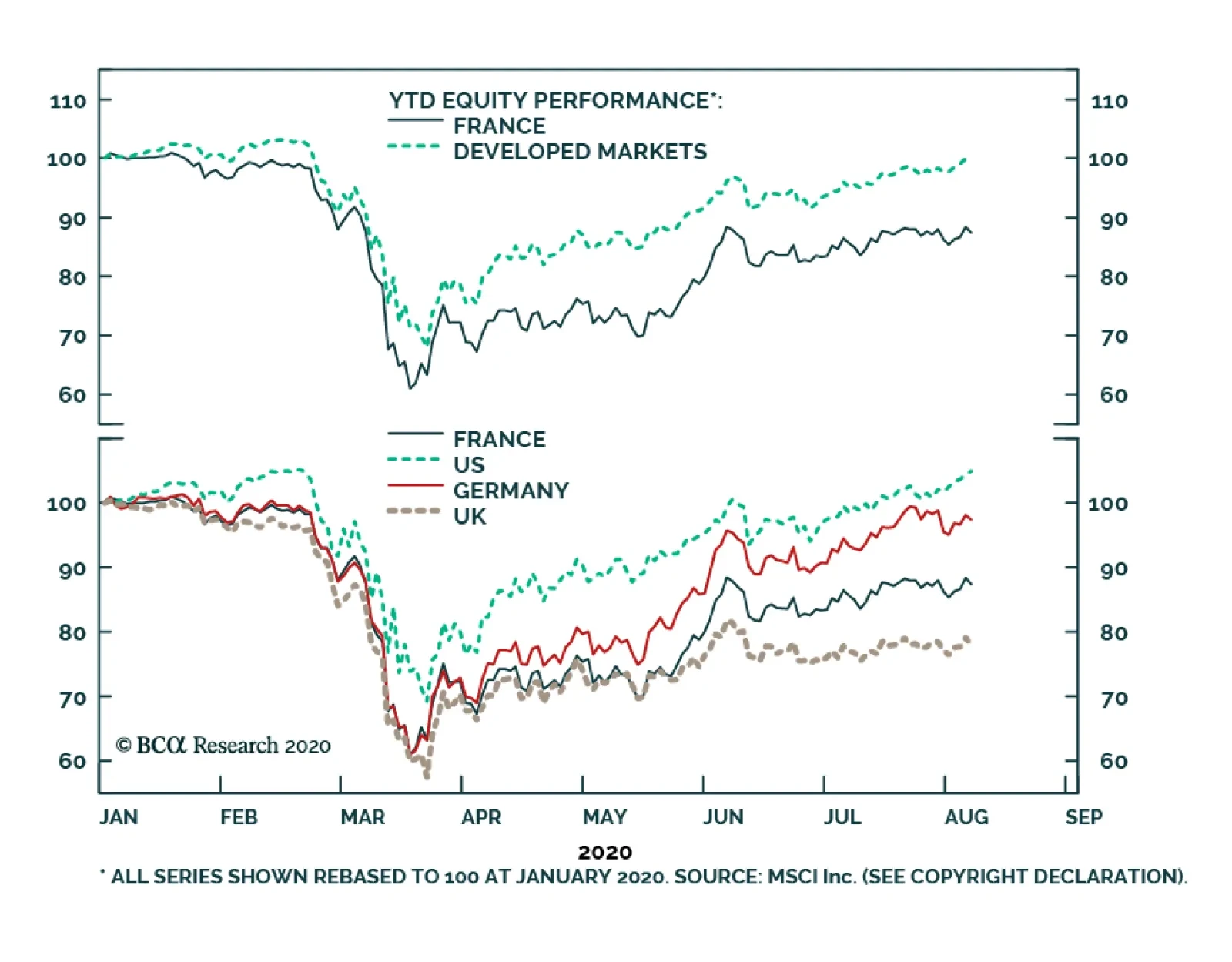

BCA Research's Geopolitical Strategy service recommends that long-term investors overweight French equities over other developed market bourses. French equities have underperformed developed market equities by 12% this…

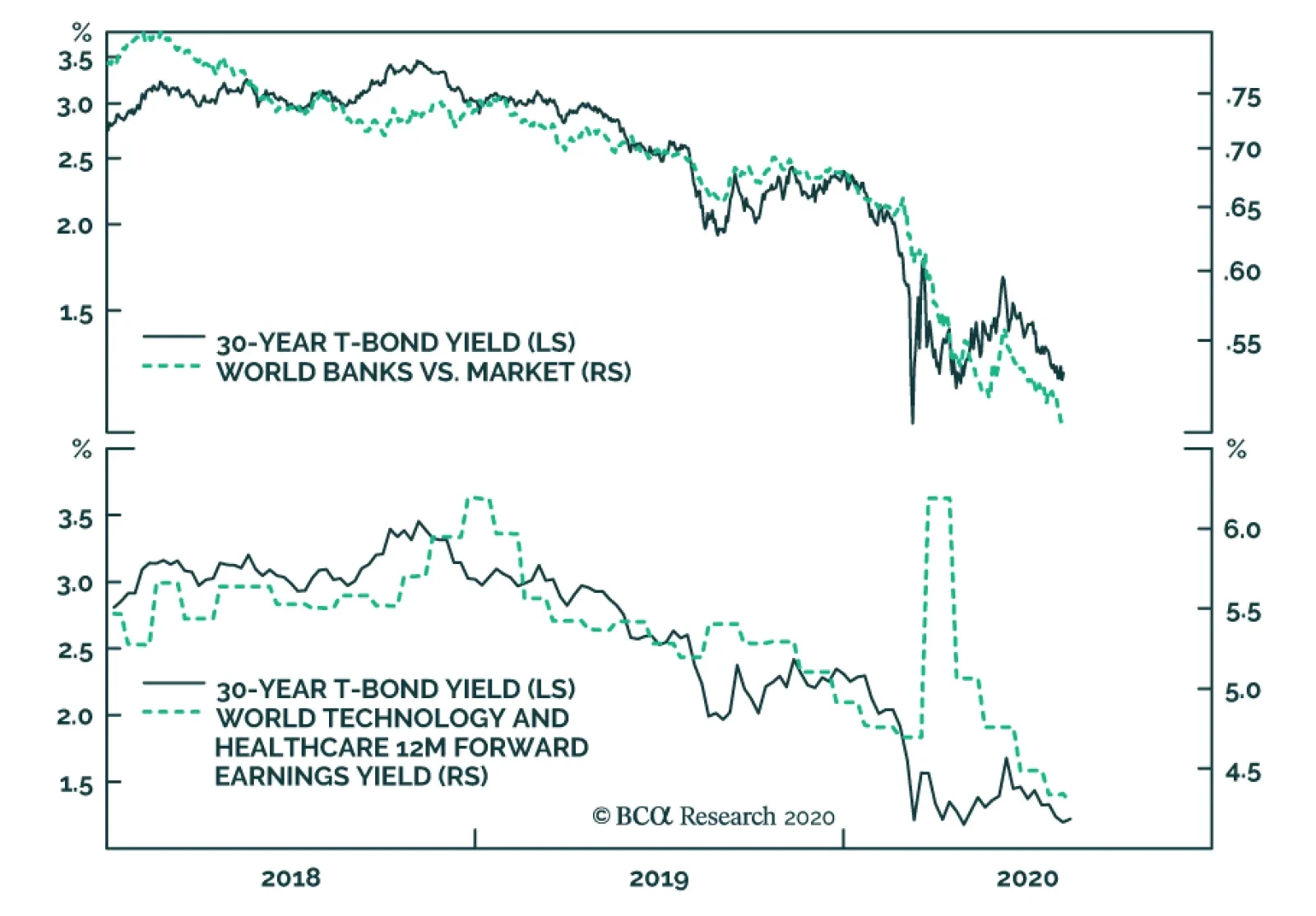

BCA Research's European Investment Strategy service believes that the 30-year bond yield is the driving variable in financial markets right now. The relative performance of banks has closely tracked the collapse in the 30-…