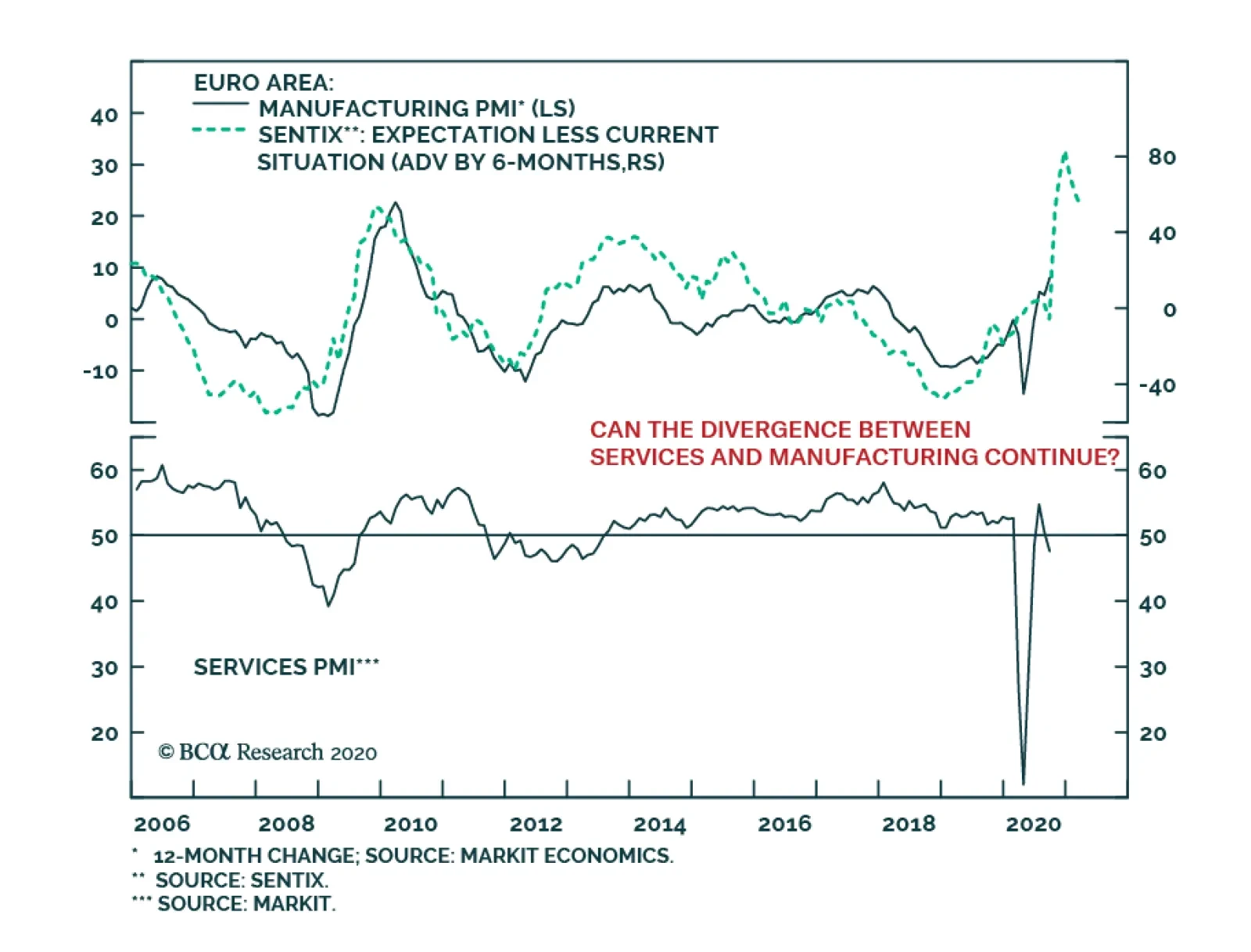

Yesterday, the release of the September Flash PMIs in the euro area bore the imprint of the COVID-19 second wave. The Composite measure declined from 51.9 to 50.1, dragged down by a sharp fall in Services from 50.5 to 47.6.…

Highlights The great political surprises of 2016 are approaching key deadlines on November 3 and December 31. Investors should not let Brexit take their eye off the US election. Globalization will retreat faster under Trump regardless…

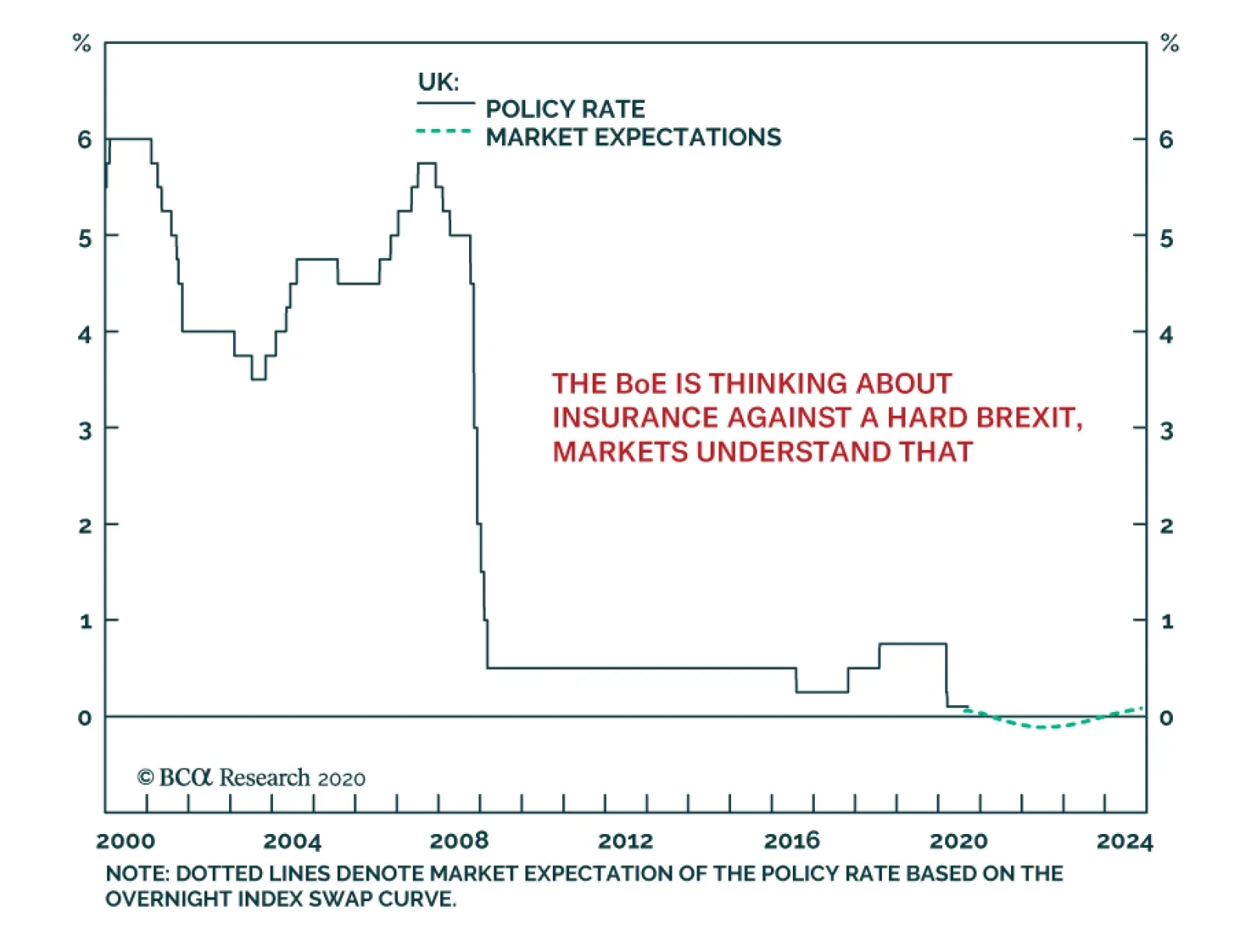

The Bank of England met yesterday and left policy unchanged. However, the meeting’s minutes revealed that the MPC is actively exploring the implementation of a negative Bank rate. So serious is the idea, the BoE is in talks…

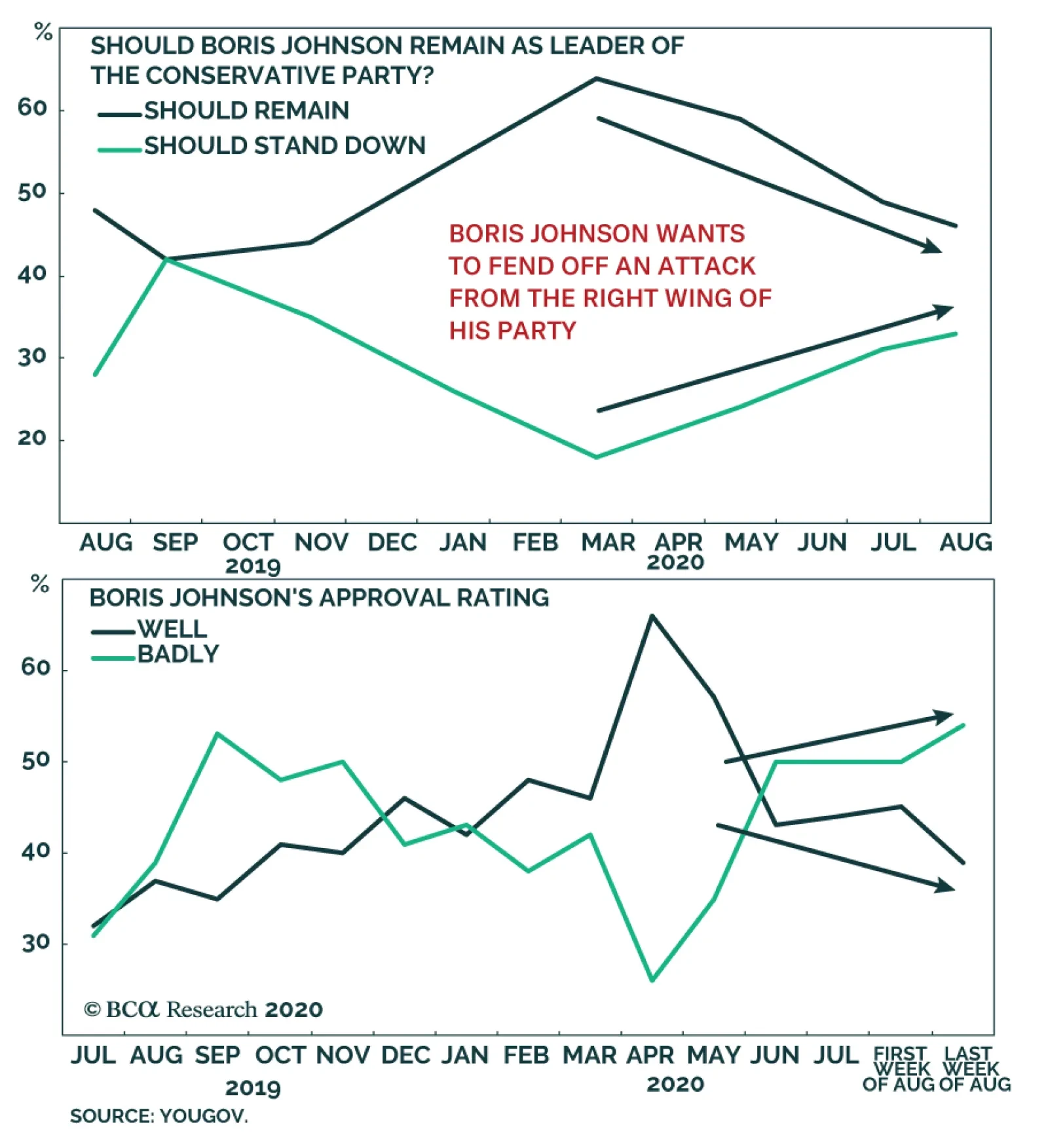

The UK is once again playing hardball with the EU. The proposed Internal Market Bill would violate the terms of the post-Brexit deal already agreed with the EU. If implemented, the UK seriously risks being treated as a trading…

BCA Research's Foreign Exchange Strategy service estimates that Scandinavian currencies (NOK and SEK) are the best way to express its bearish dollar view over the coming 12 months. Both Norway and Sweden are well poised to…

Highlights We remain bearish on the US dollar over the next 12 months. The best vehicle to express this view continues to be the Scandinavian currencies (NOK and SEK). Precious metals remain a buy so long as the dollar faces downside…

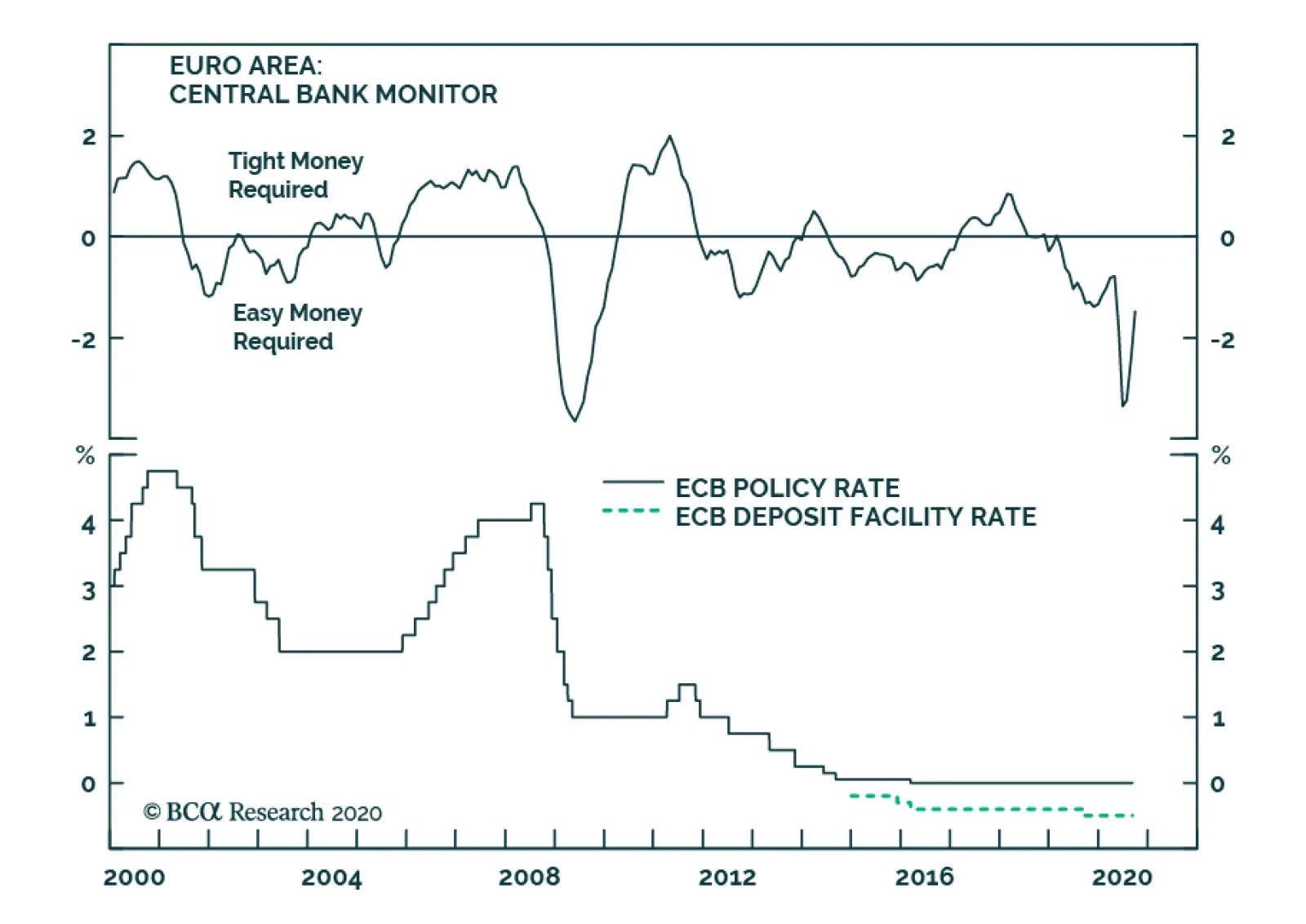

Yesterday, the European Central Bank left policy unchanged and the tone of the press conference that followed the meeting indicated that the ECB is comfortable with the evolution of the economic recovery in Europe. The upgrade of…

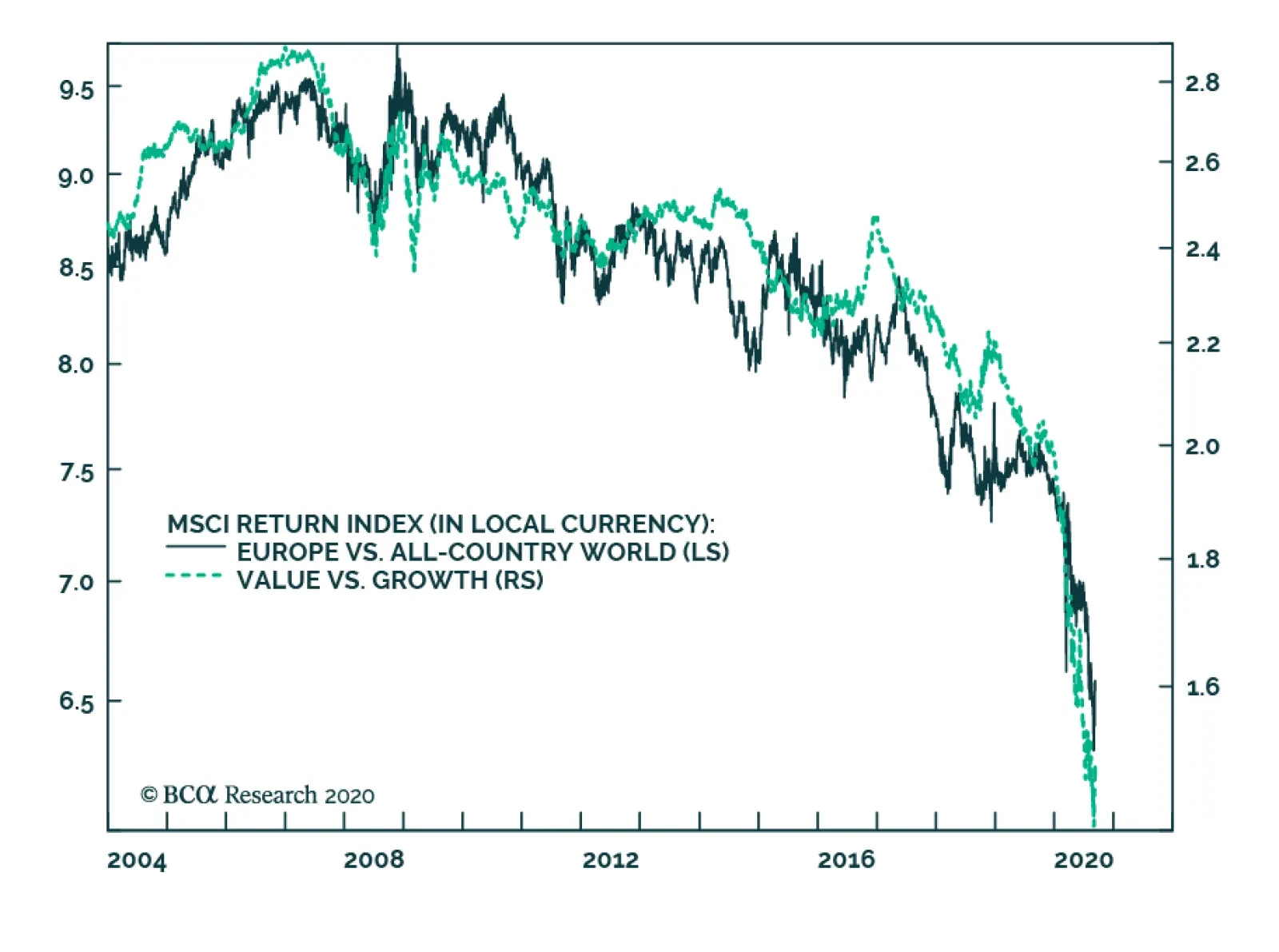

BCA Research's European Investment Strategy service believes that the tactical correction in growth stocks is healthy. This service also recommends that long-term equity investors still favor growth over value, which diverges…

To all clients, Next week, in lieu of publishing a regular report, I will be hosting a webcast on September 15th at 10 am EDT, discussing our latest views on global fixed income markets. Sign up details for the Webcast will…

Highlights The dollar has entered a structural bear market but is at risk of a countertrend bounce. The catalyst for such a bounce will be the underperformance of G10 economies, specifically the euro area relative to the US.…