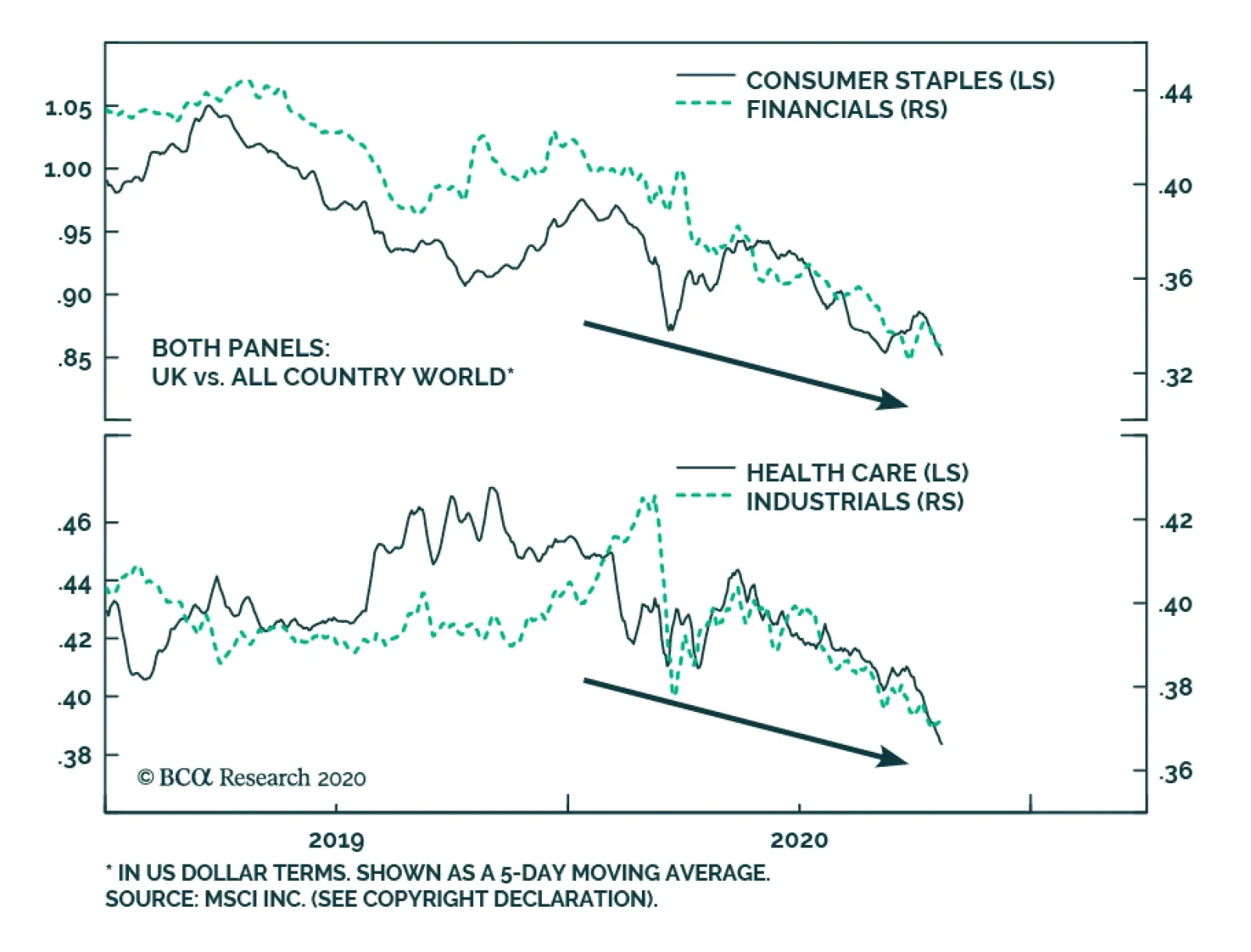

We noted in an Insight earlier this week that the performance of UK equities this year has been especially bad, in part due to the heavy tech underweight of the UK equity market. When analyzing regional equity performance,…

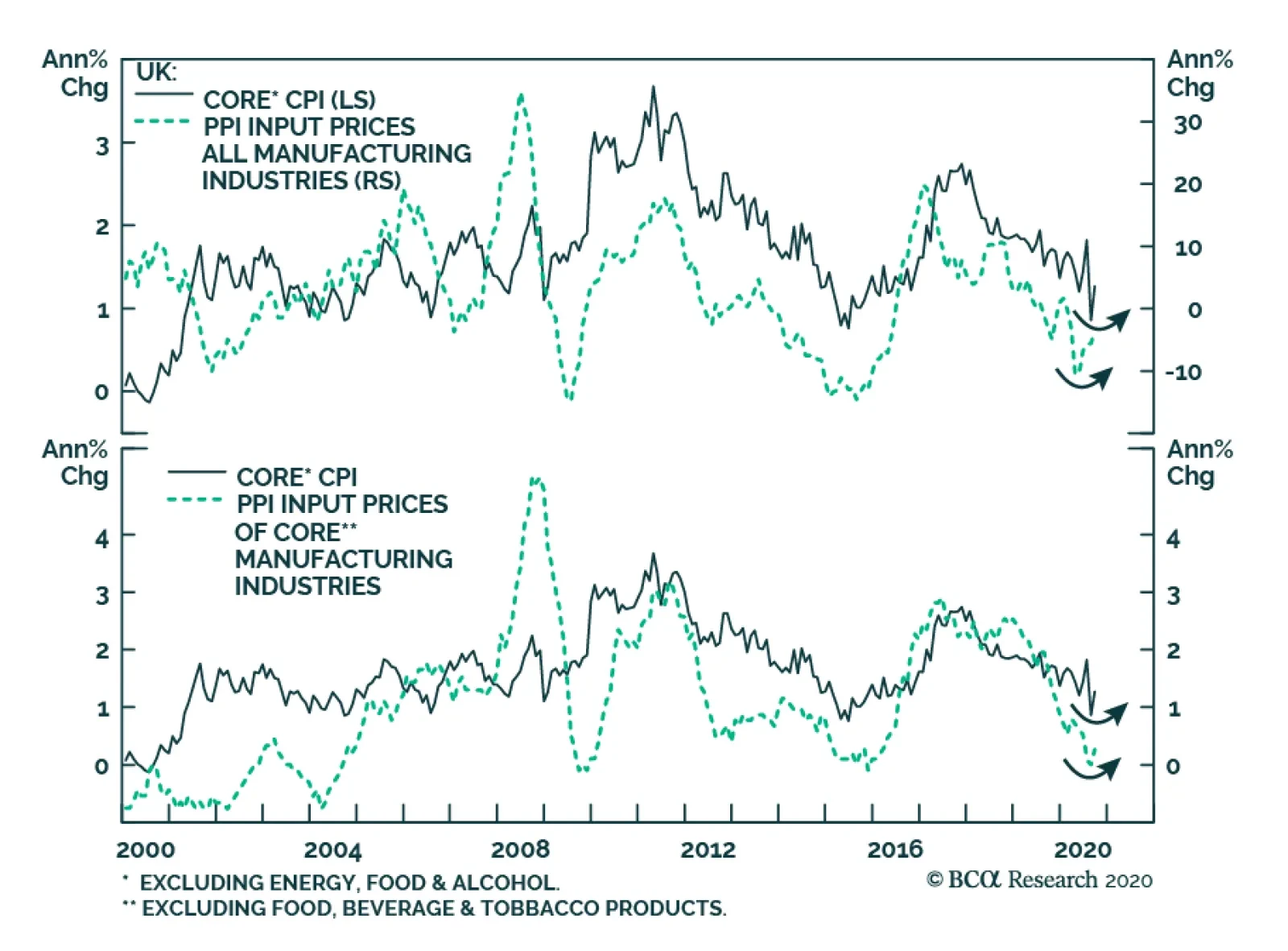

The various inflation indicators for the UK in September were a mixed bag. While Core CPI inflation hit expectations of 1.3% annually, the monthly headline CPI print hit 0.4%, below expectations of 0.5%. The most positive element…

Highlights Long-term investors should seek companies and sectors that facilitate and support a new way of doing things: specifically, a way of life and business that is more de-centralised and de-urbanised… …and a way of…

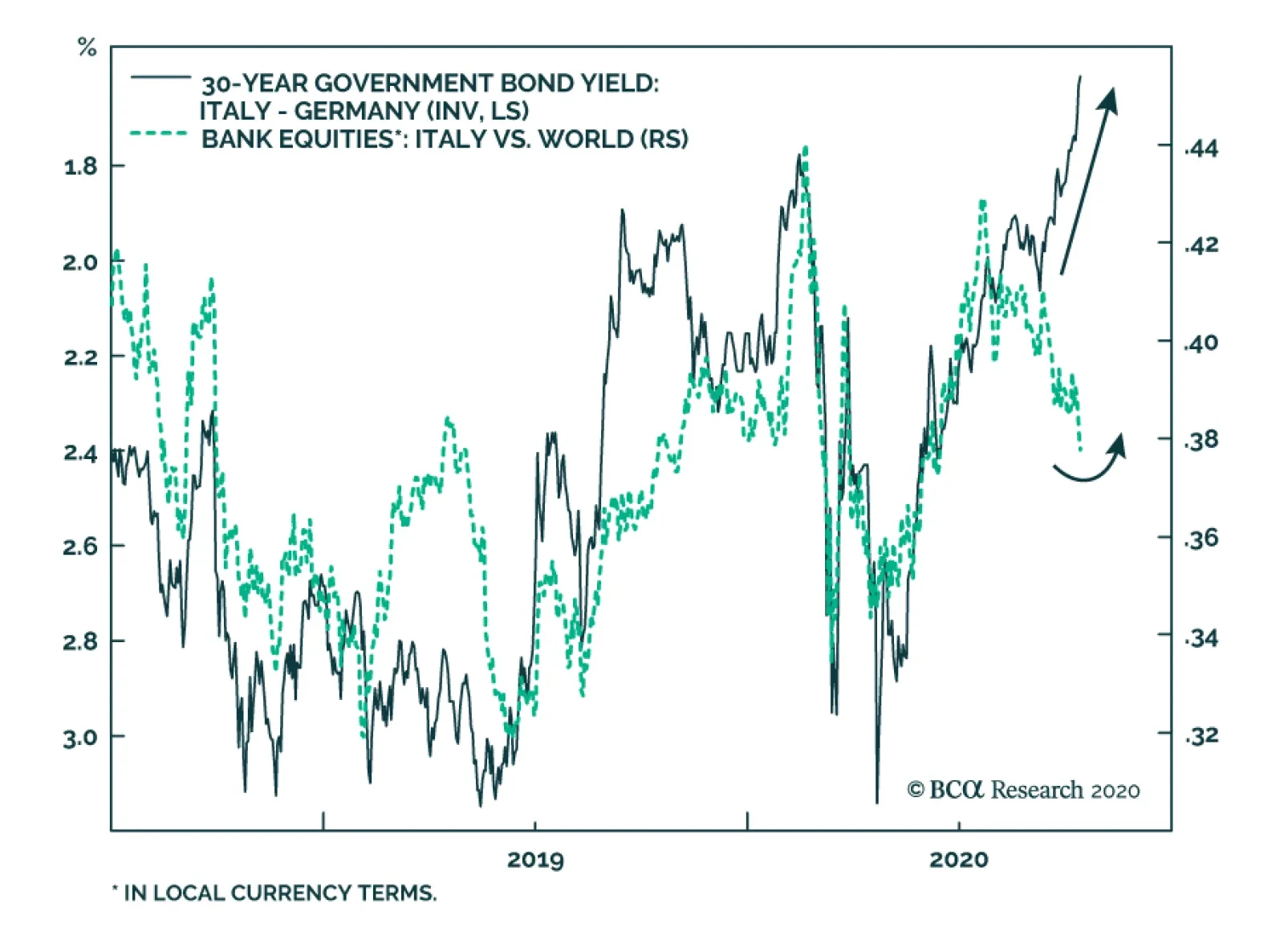

It is in fashion to talk about the collapse of Italian yields to record lows, but one of the key investment implications of this move is often overlooked: it makes Italian banks attractive relative to lenders in other nations…

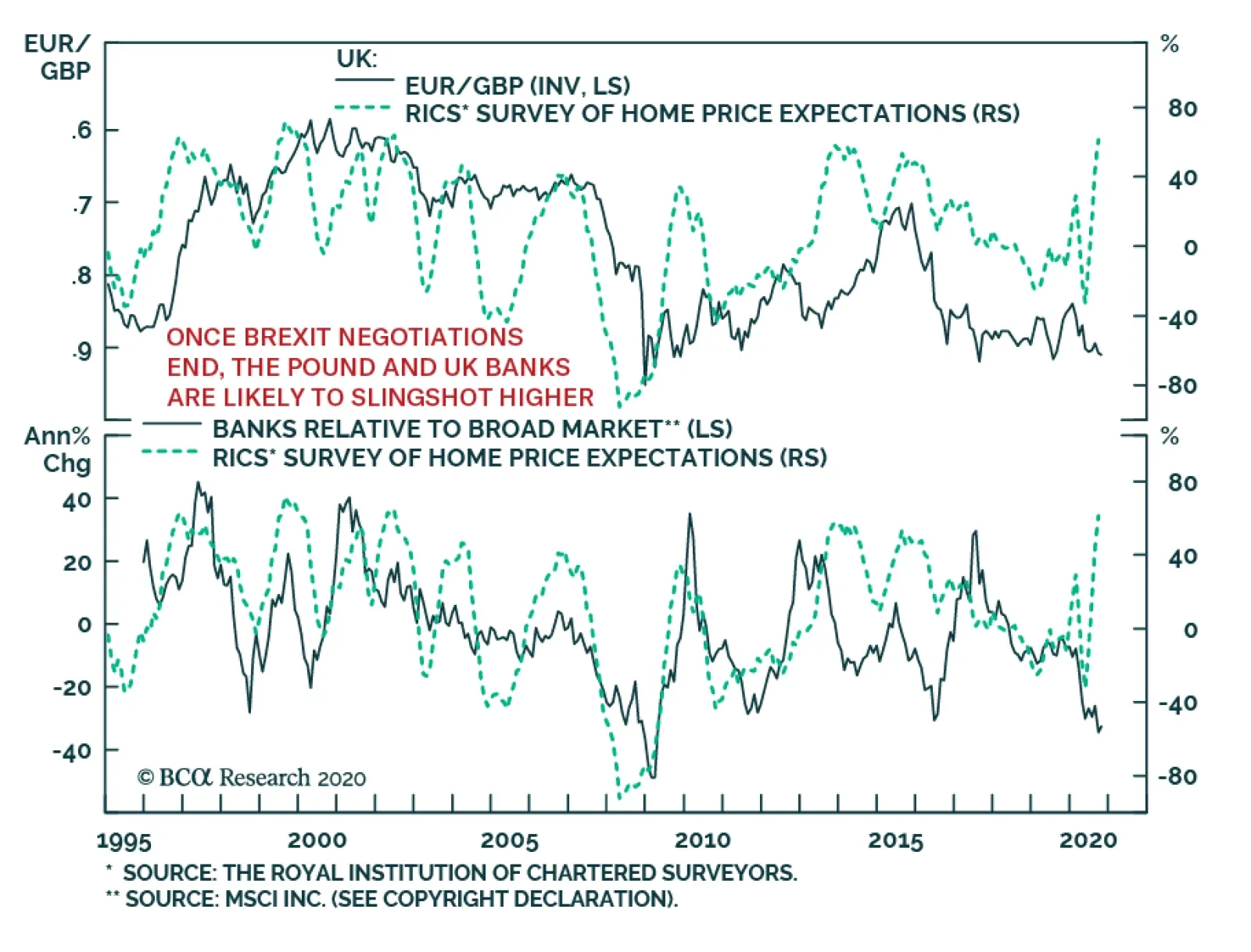

The UK’s RICS House Price Balance indicator surged to 61% in September, handily beating expectations of a decline to 40% from 44%. A strong RICS argues in favor of an acceleration in UK house price gains, which creates a…

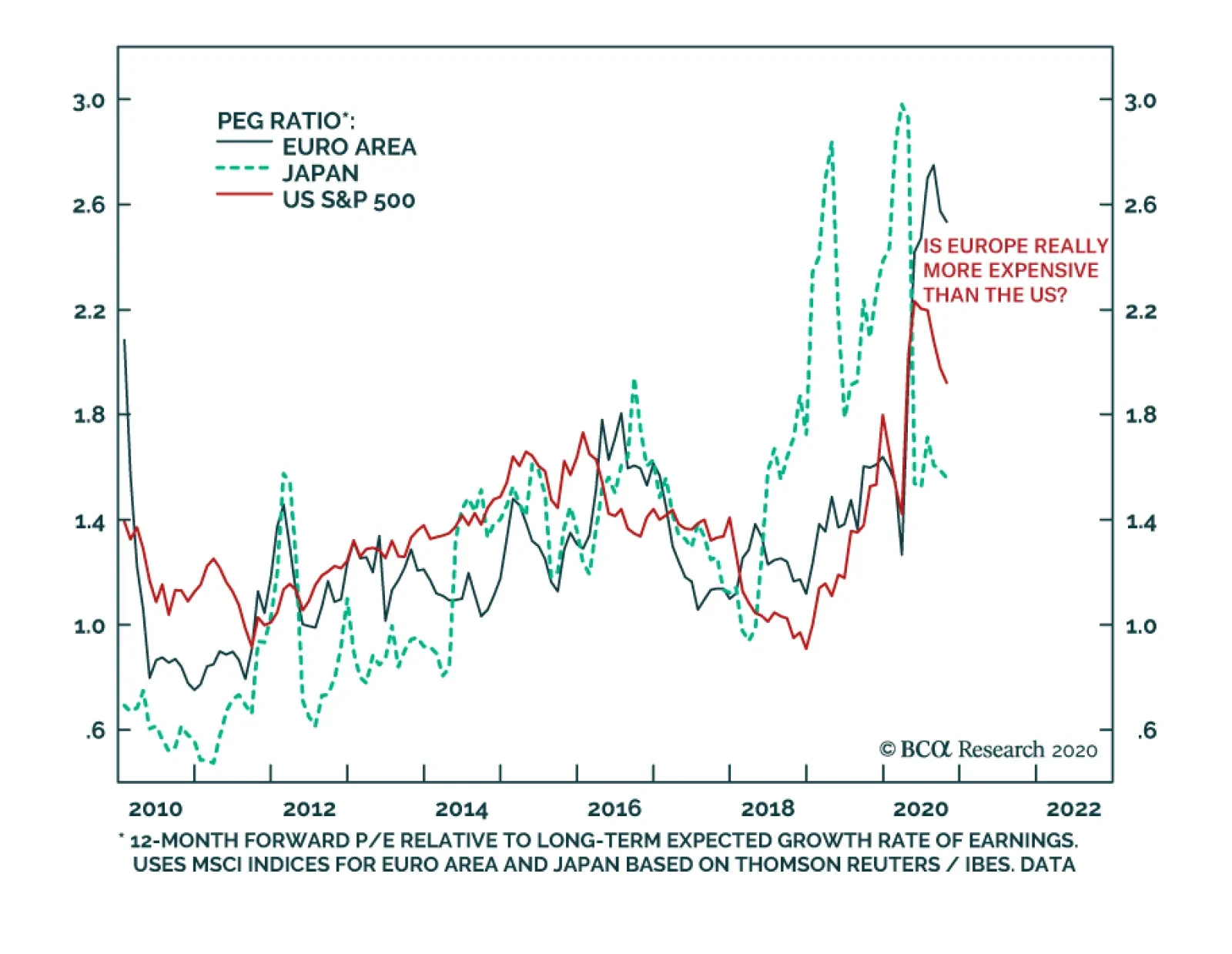

When looking at multiples like the price-to-book or price-to-earnings ratios, it is easy to paint the S&P 500 as exceptionally expensive compared to other major equity markets. However, the picture becomes murkier if we take…

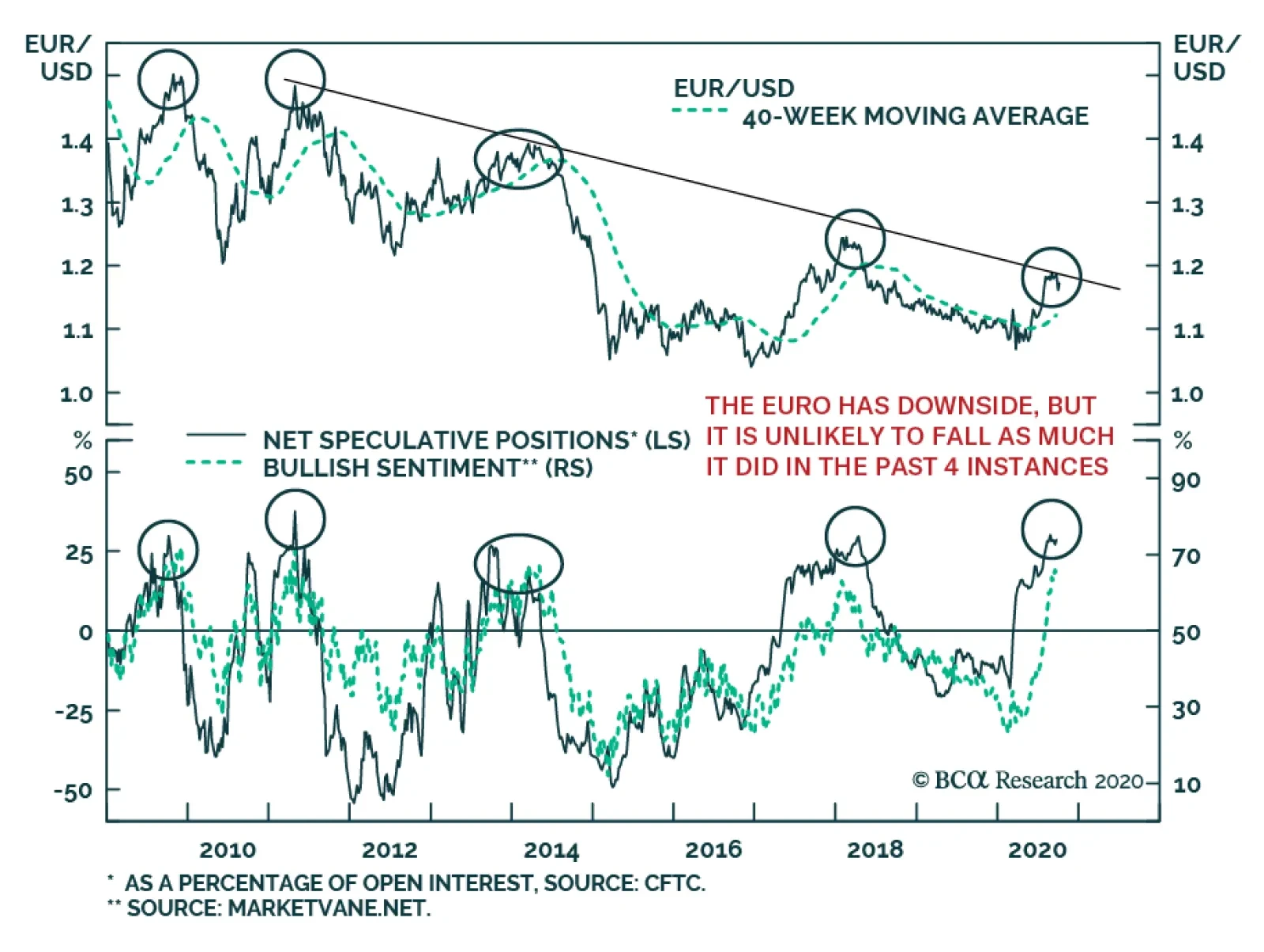

In recent weeks, we have repeatedly warned that since March, the dollar had fallen too quickly and risked staging a countertrend bounce. As a corollary, the euro was expected to undergo a temporary correction that could see it…

Highlights Misunderstanding 1: The danger of Covid-19 is its short-term mortality rate. In fact, the danger of Covid-19 is its long-term mortality and morbidity rate. Misunderstanding 2: The government-imposed lockdown causes the…

Highlights Bank credit 6-month impulses are plunging, and the pandemic is resurging. Maintain an overweight to growth defensives (technology and healthcare). In the short term, profits will be more resilient in a resurgent pandemic.…