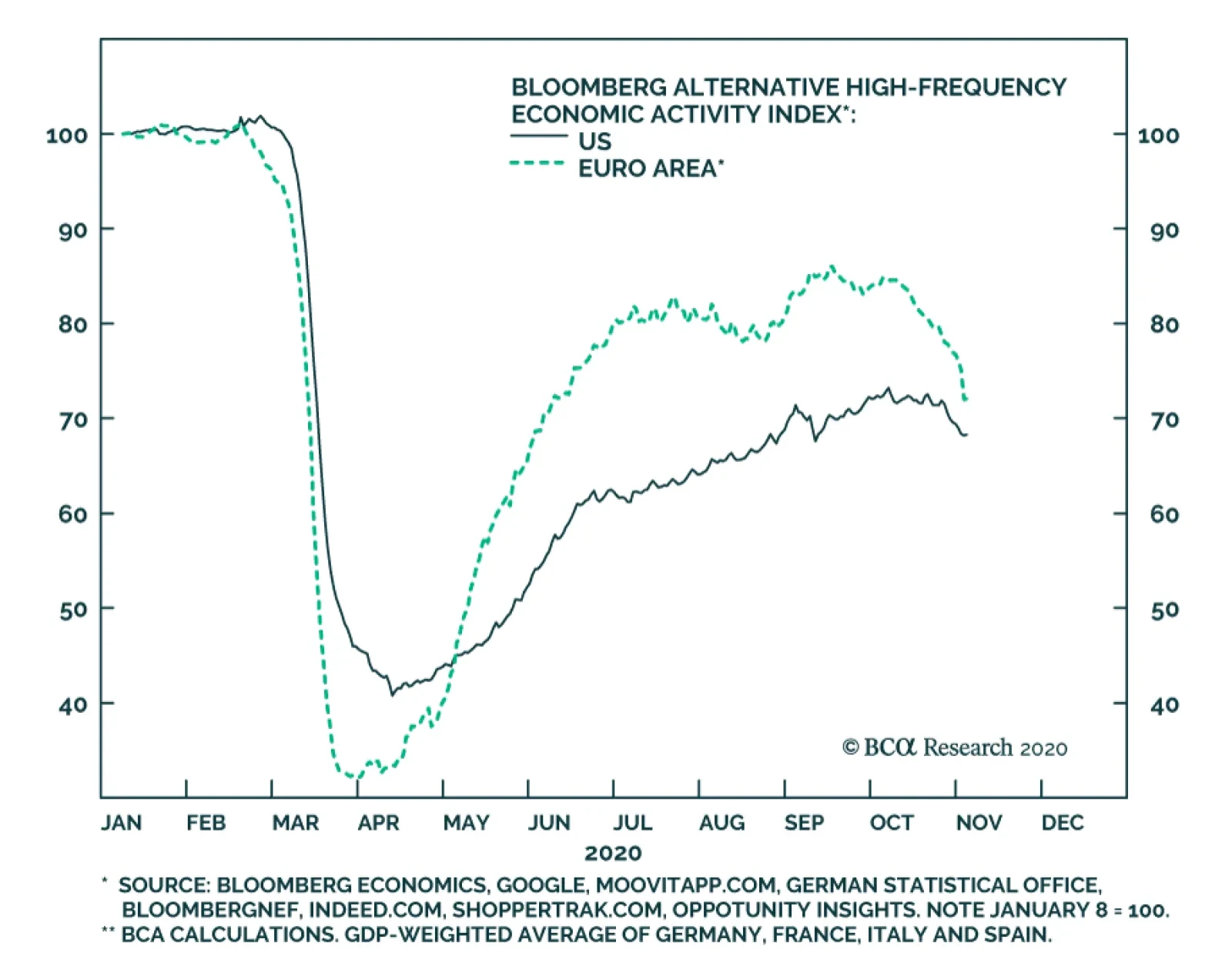

Alternative, high-frequency indicators of economic activity highlight that the US and euro area economies are already slowing in response to a new wave of COVID-19 infections. The chart above highlights Bloomberg's…

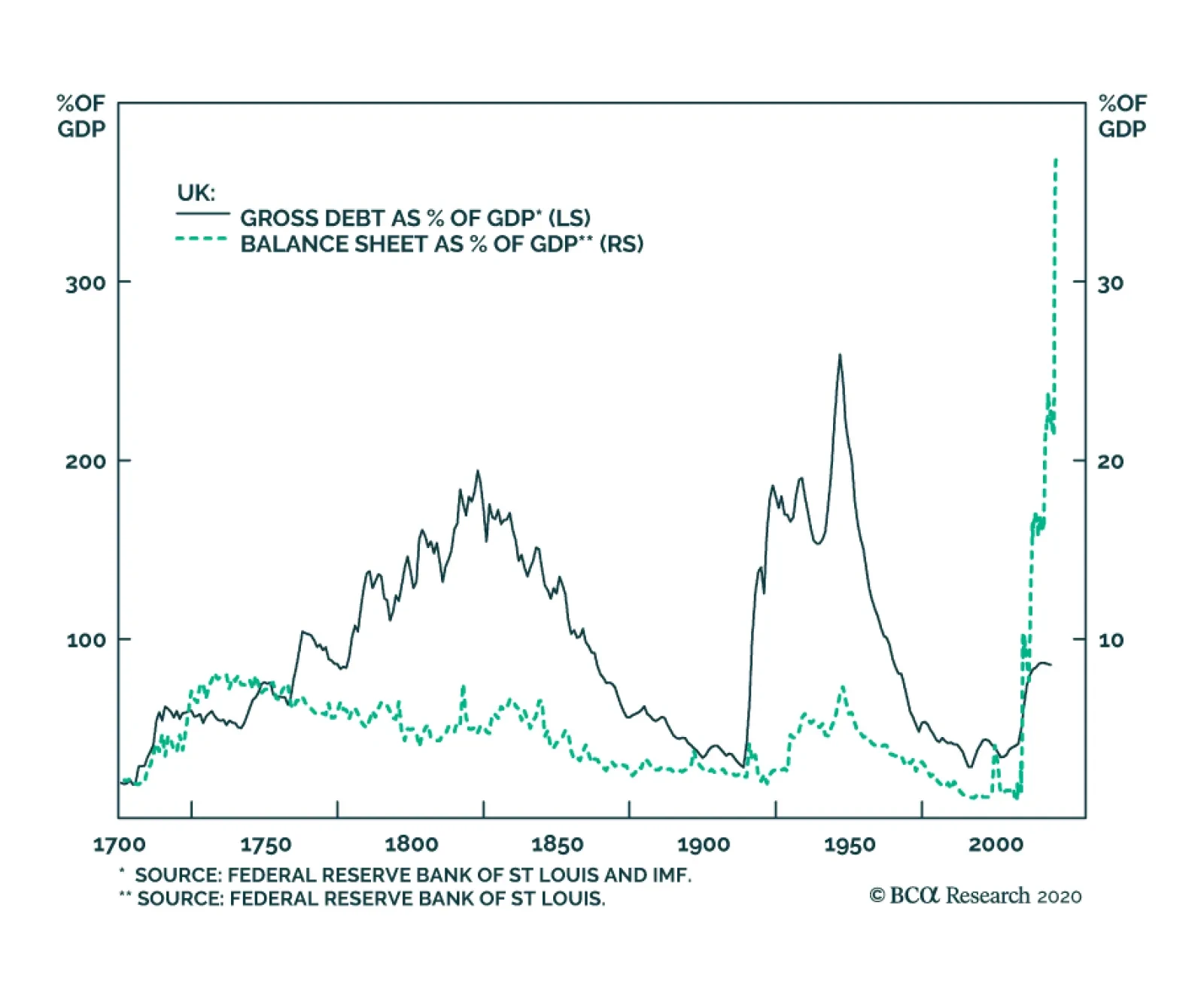

According to BCA Research's Foreign Exchange Strategy service, currency markets also continue to ignore the risks of a no-deal Brexit and the significant acceleration in the pace of COVID-19 infections. The Bank of England…

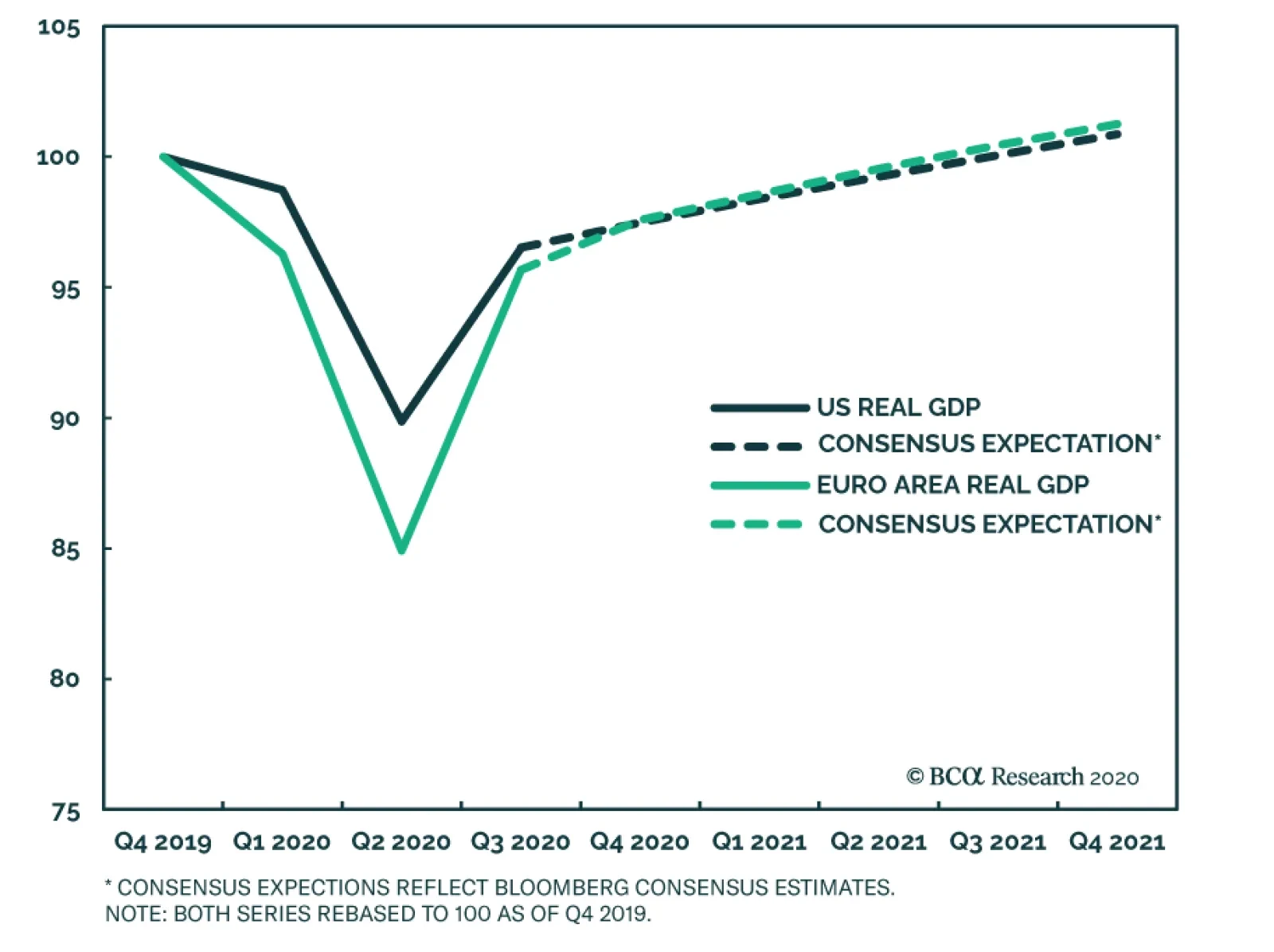

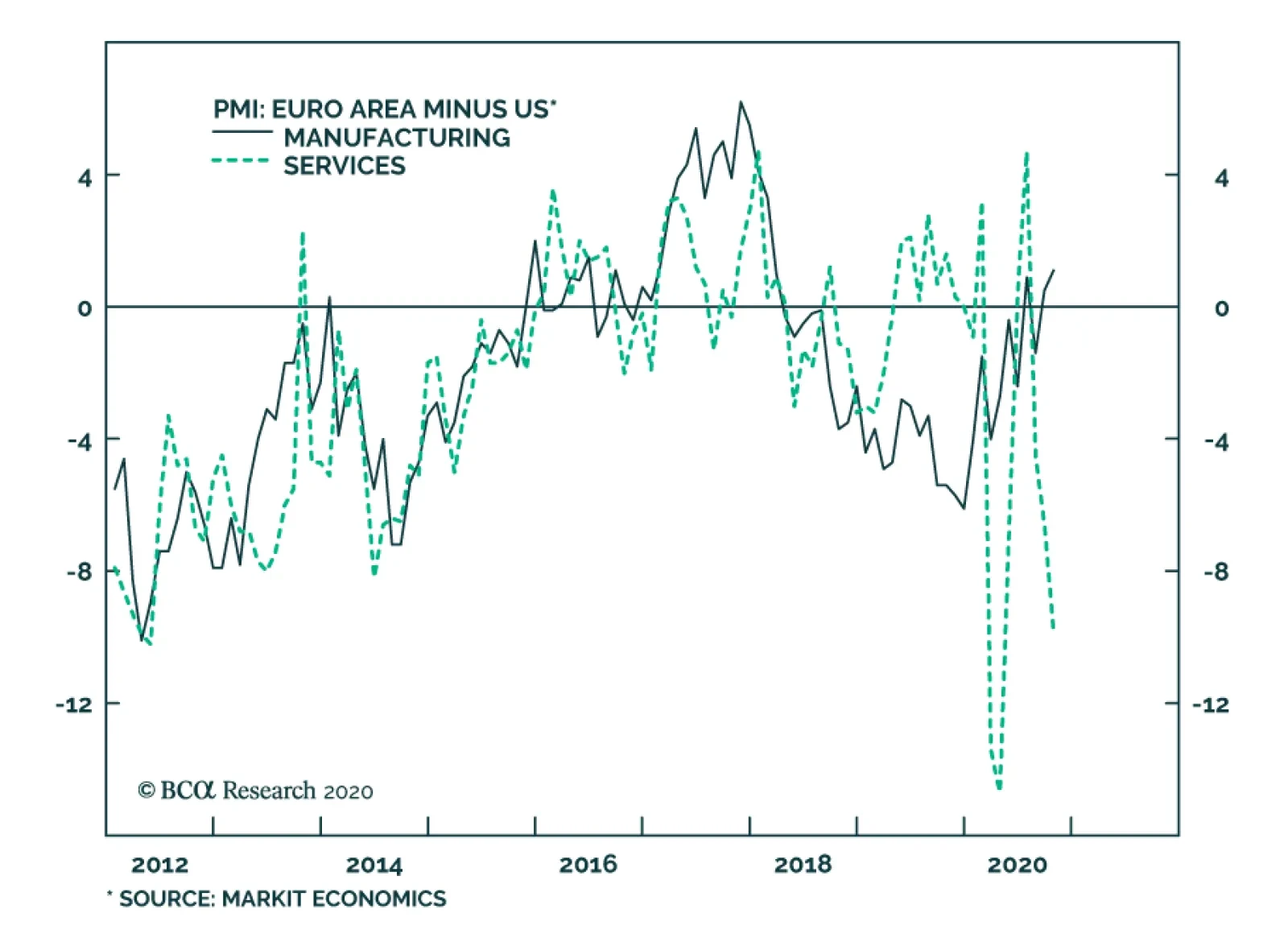

In a previous Insight, we noted that the October euro area services PMI showed the region was at risk of a relative growth disappointment. The October survey was taken before the region re-imposed COVID-19 suppression measures of…

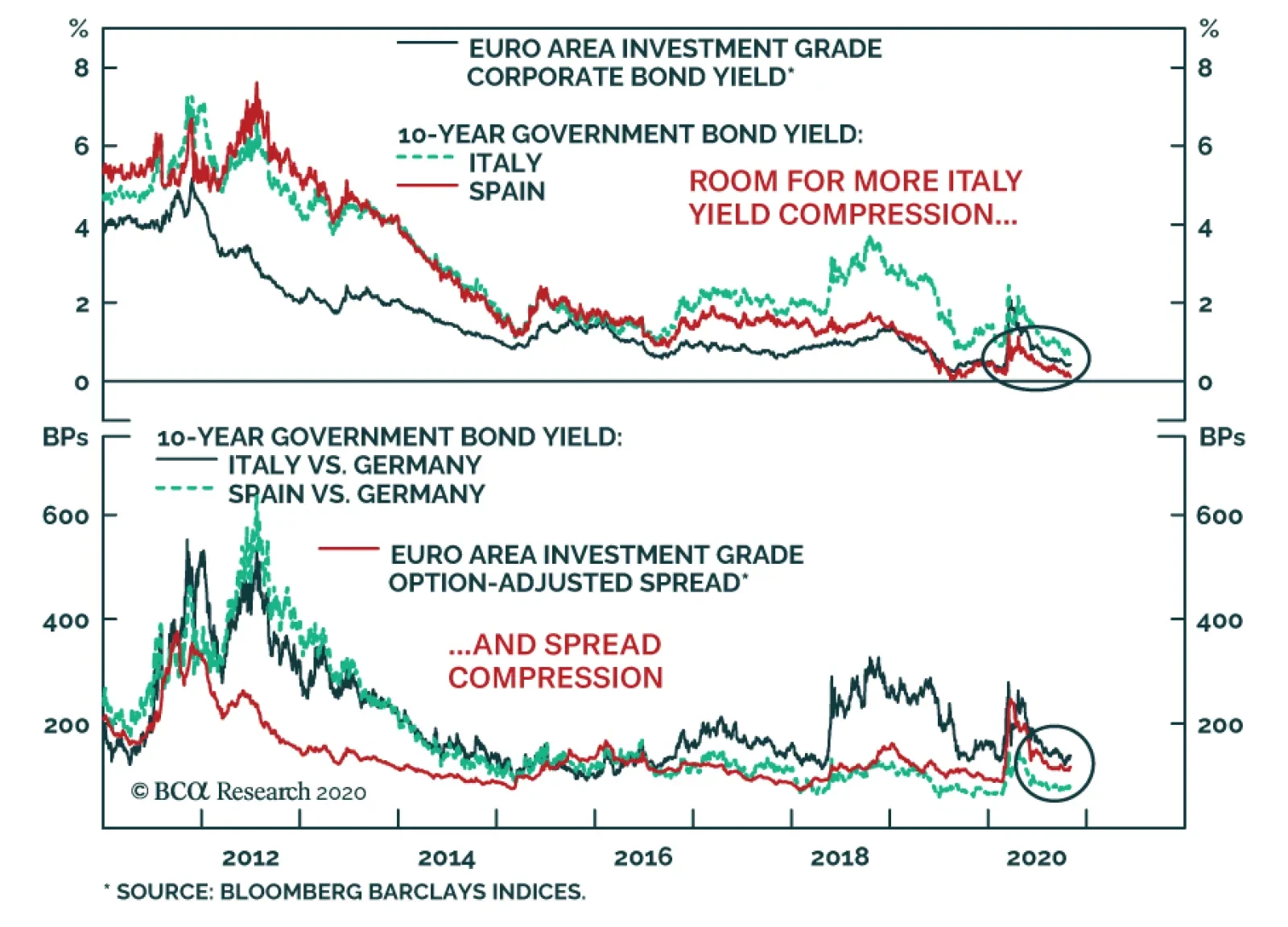

According to BCA Research's Global Fixed Income Strategy service, the latest surge in COVID-19 cases in Europe has unnerved investors who now see renewed national lockdowns increasing the risk of a double-dip European…

Highlights COVID-19 In Europe: The latest surge in COVID-19 cases in Europe has unnerved investors who now see renewed national lockdowns increasing the risk of a double-dip European recession and continued deflationary pressures. ECB…

Highlights A Biden victory with a Republican Senate (28% odds) poses the greatest risk to the global reflation trade. The US is the most susceptible to social unrest of all the developed markets. Europe is stable relative to the US,…

Highlights Global Duration: US Treasury yields have started to creep higher and the move is likely to continue in the coming months regardless of who wins the White House. Reduce overall global duration exposure to below-benchmark,…

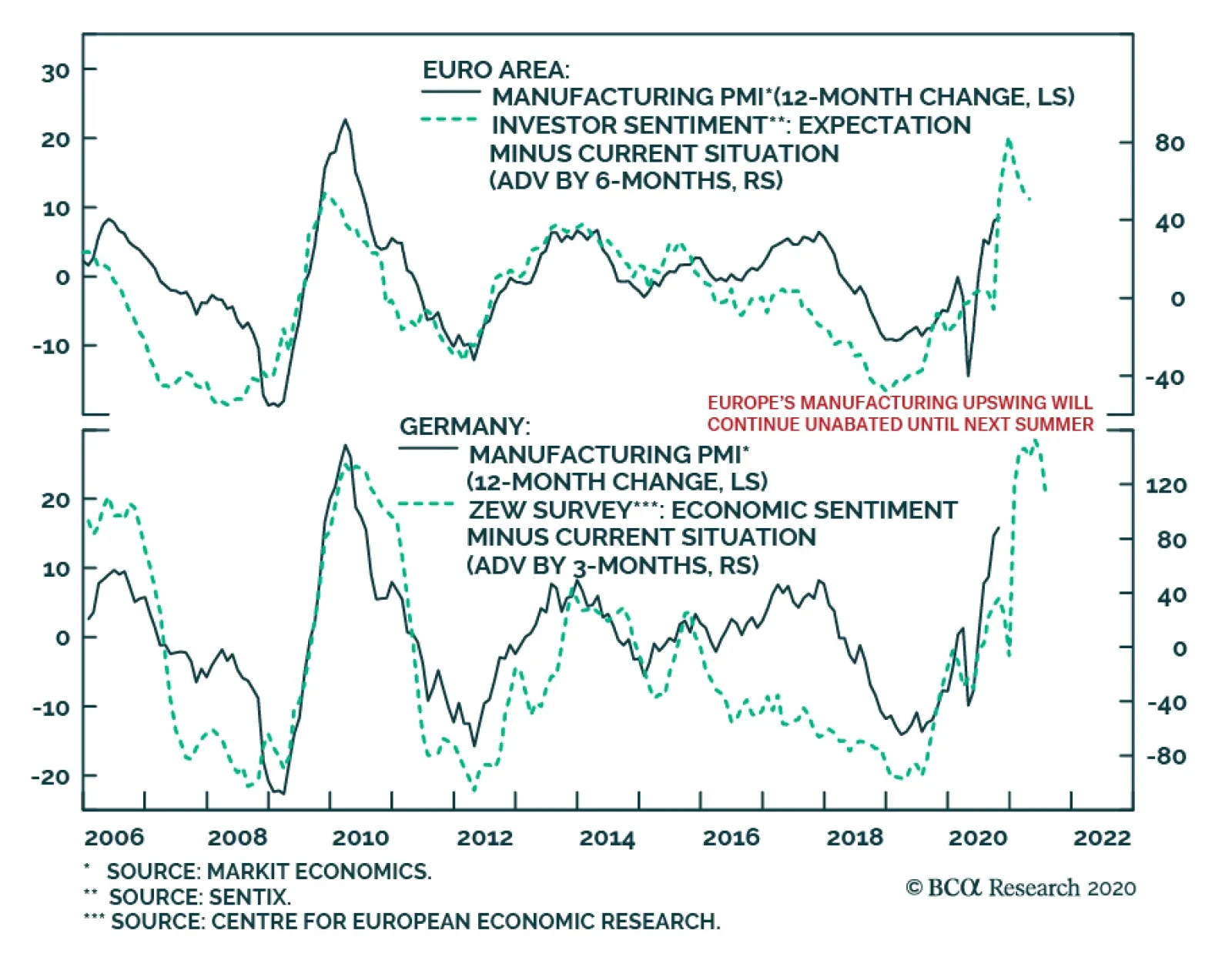

In yesterday’s Insight, we highlighted the resilience of the euro area’s manufacturing PMI and noted that a robust industrial sector is consistent with a continued recovery – even in the face of the negative…

The Eurozone Flash Composite PMI declined one point to 49.4 in September, but nonetheless managed to outperform expectations marginally. The outperformance of the Composite index reflected the 0.7-point increase in the…