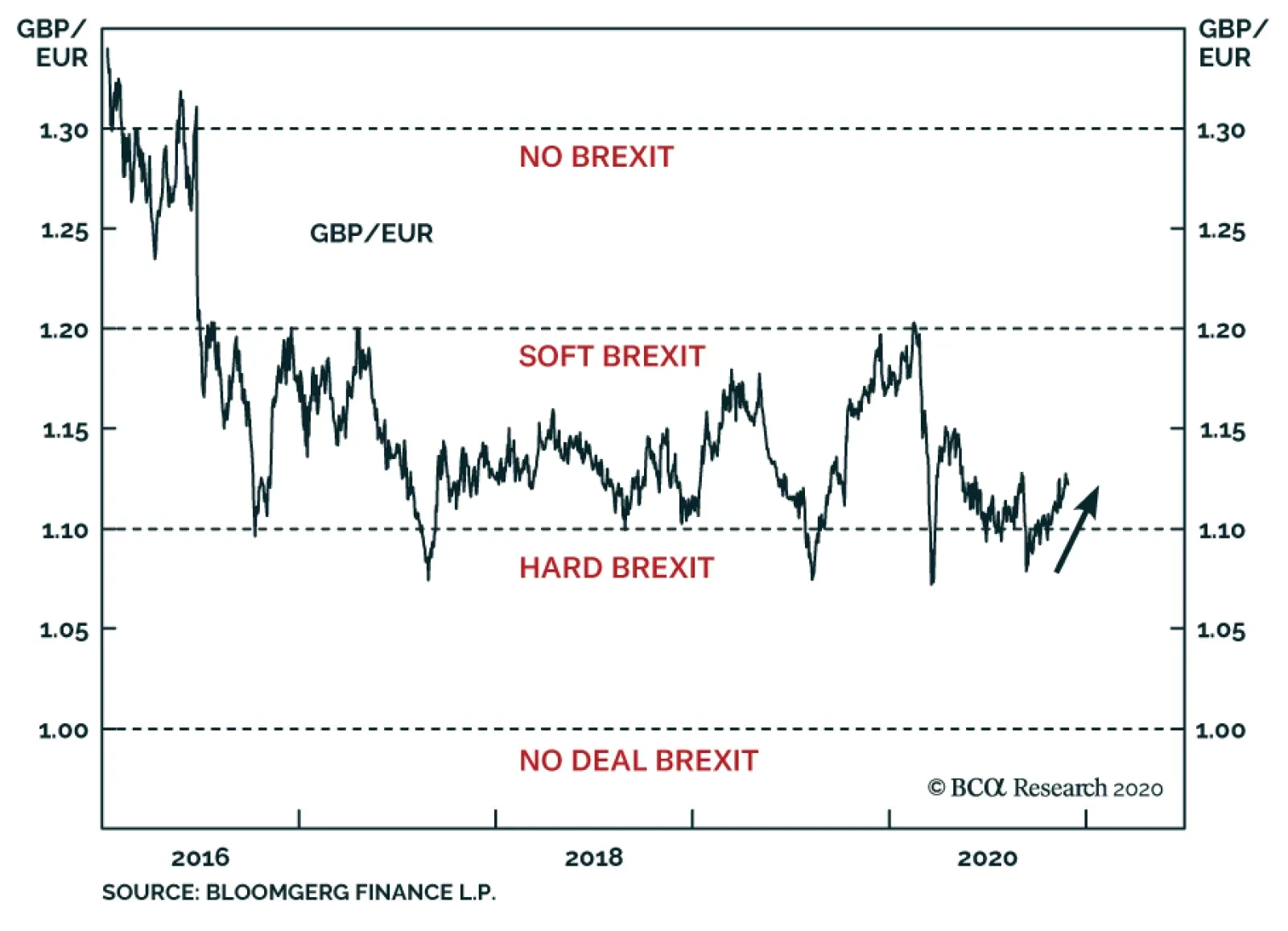

According to BCA Research's Geopolitical Strategy service, it is not too late to go long GBP-EUR. A near-term global risk-off move would work against this trade, but it is a strategic opportunity. The Brexit finale is…

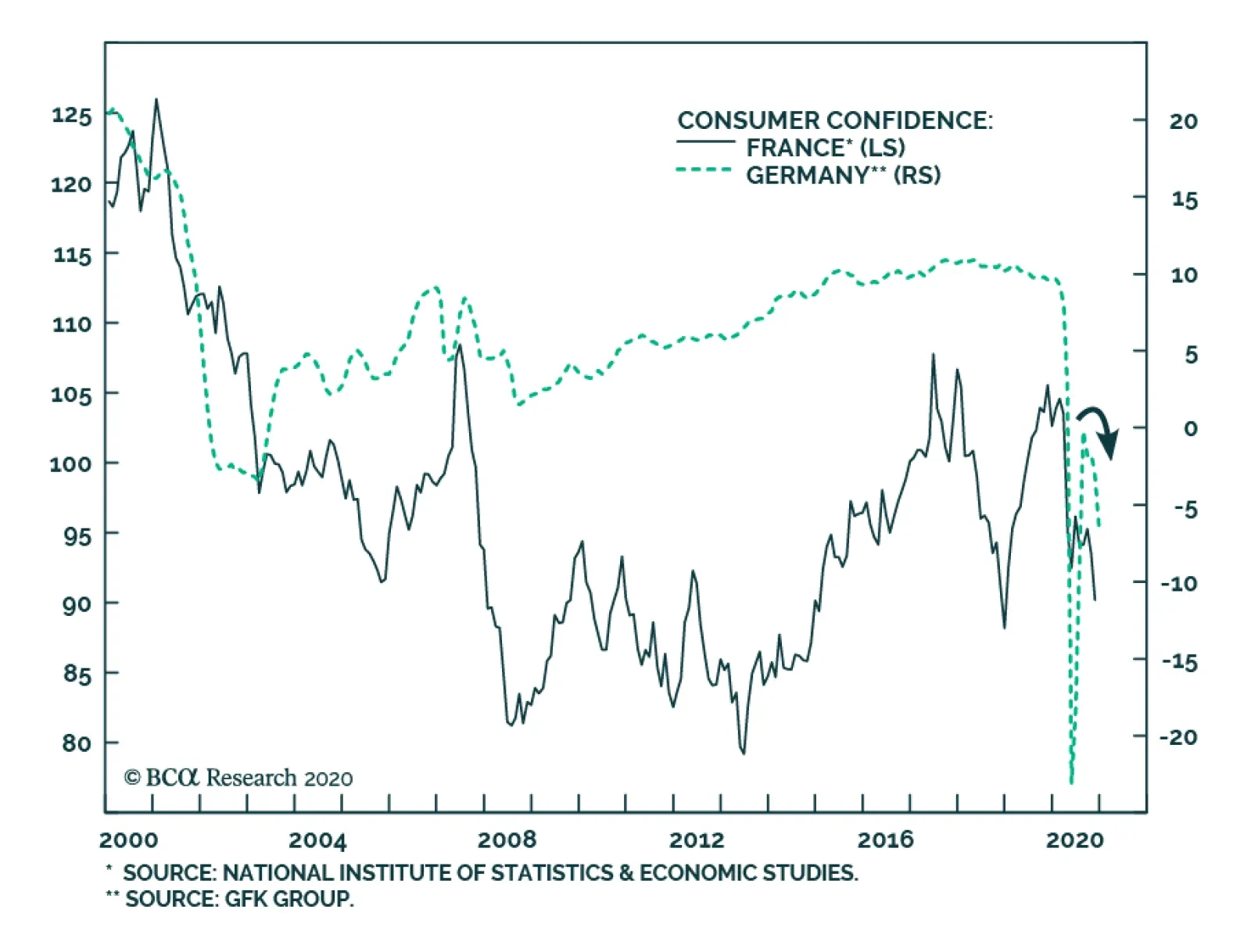

Consumer sentiment in the euro area’s two largest economies is souring amid the institution of renewed measures to control the pandemic. Germany’s GfK consumer confidence survey slipped to -6.7 from -3.2, missing…

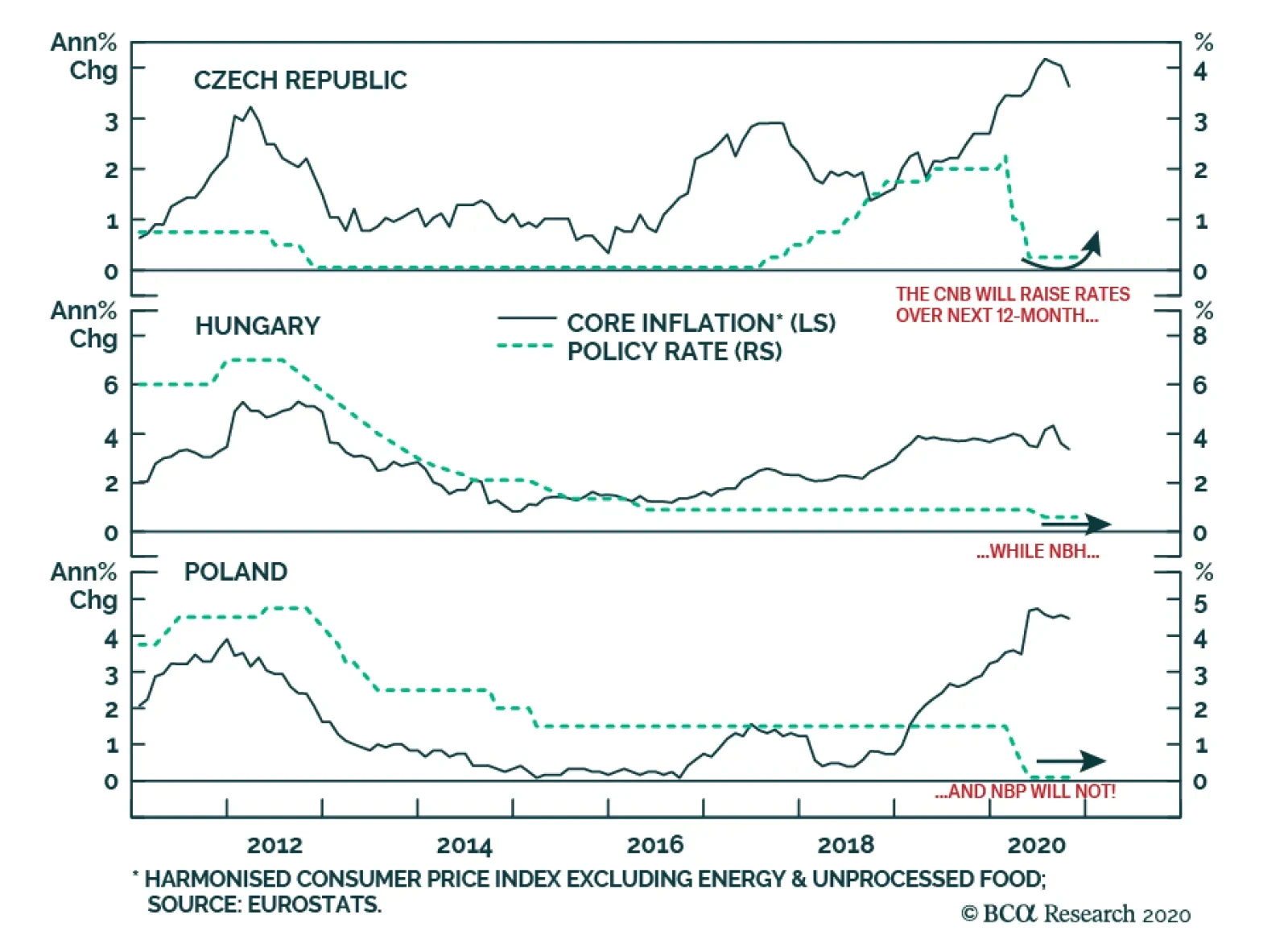

Among Central European (CE) currencies, BCA Research's Emerging Markets Strategy service remains upbeat on the Czech koruna (CZK) due to a relatively hawkish central bank. Meanwhile, the Hungarian forint and Polish zloty are…

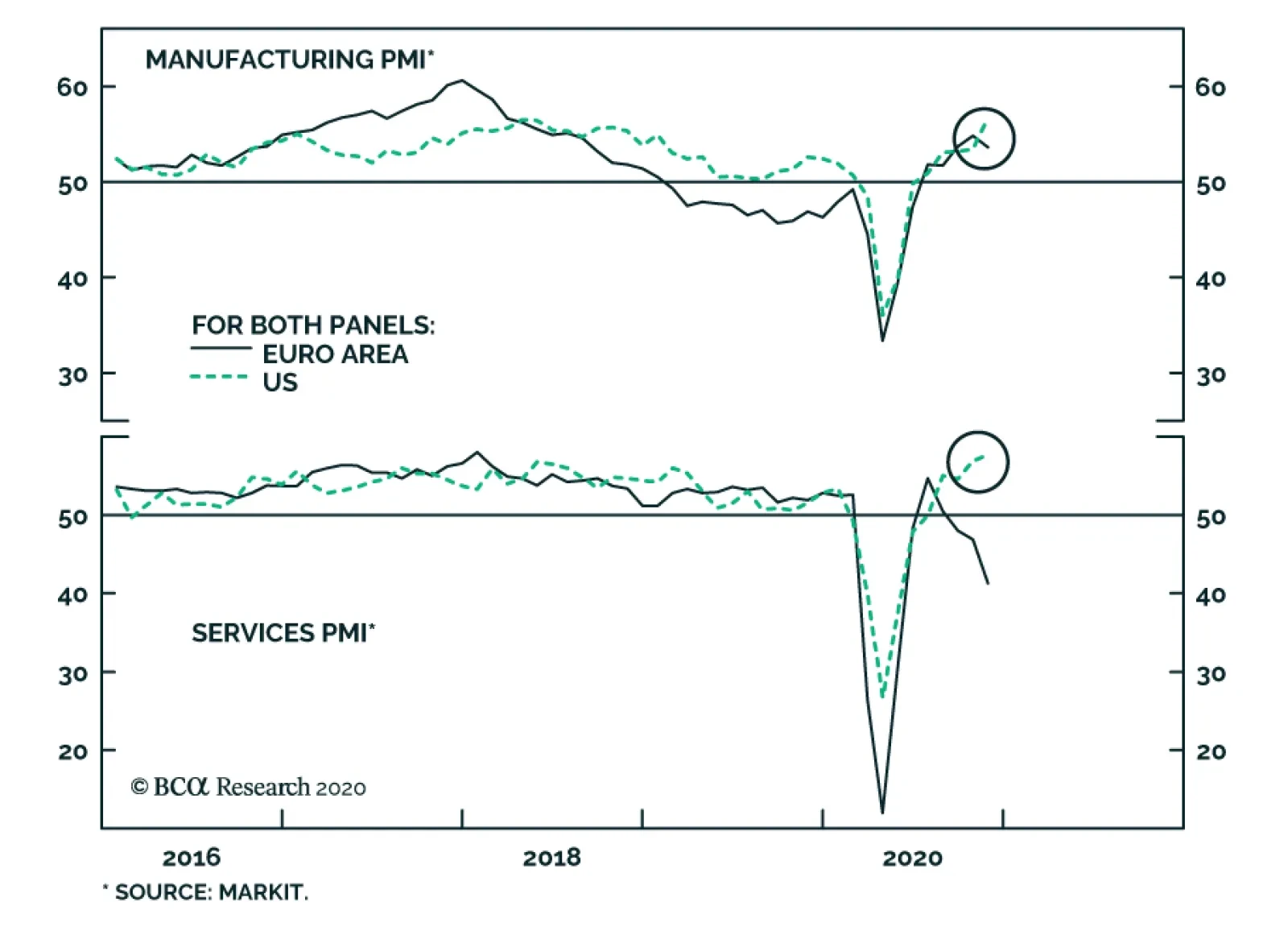

The Eurozone Flash Composite PMI in November fell from 50 to 45.1, the lowest reading since May. The collapse in services led the overall index lower. It fell to 41.3 from 46.9, slightly below expectations of 42 and reflecting…

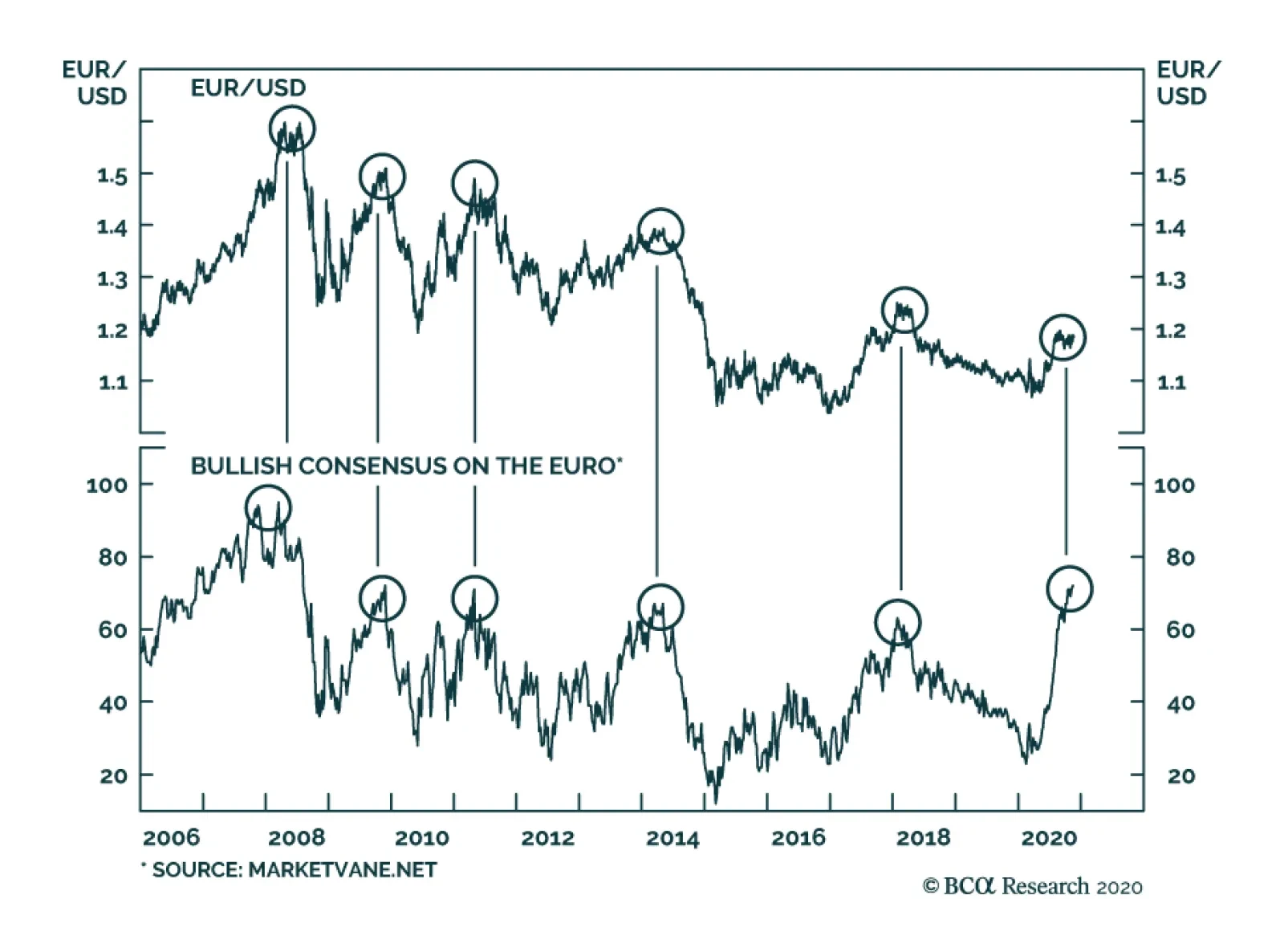

According to BCA Research's Foreign Exchange Strategy service, there is some evidence that the euro could gravitate to 1.50 over the next few years. The key assumption is that the equilibrium rate of interest will rise in…

Highlights There is some evidence that the euro could gravitate to 1.50 over the next few years. The key assumption is that the equilibrium rate of interest will rise in the euro area relative to that in the US. Our bias is that fair…

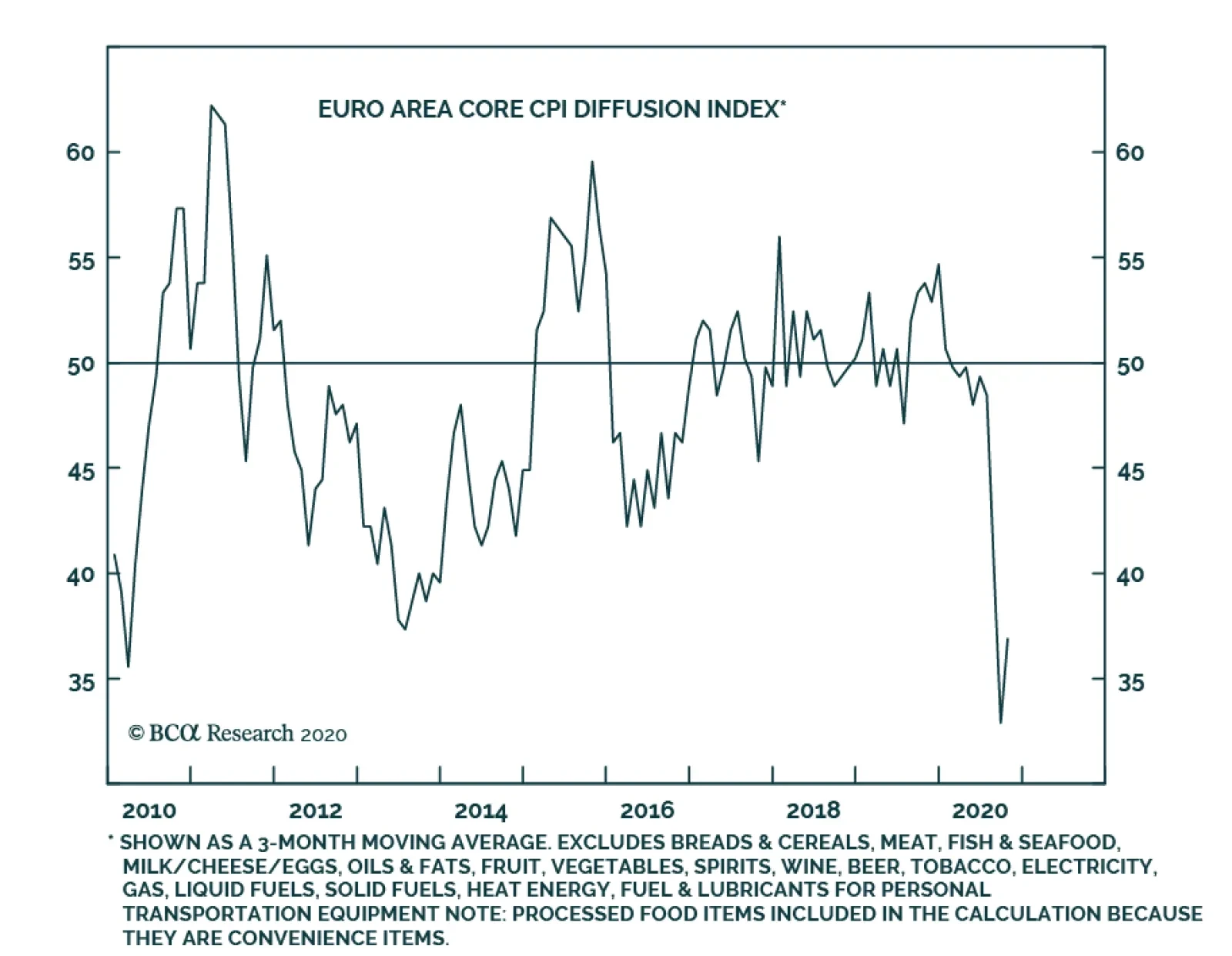

The chart above presents a diffusion index for euro area core inflation. The index is calculated based on the number of CPI subcomponents whose inflation rates are accelerating (i.e. a rising year-over-year growth rate), and…

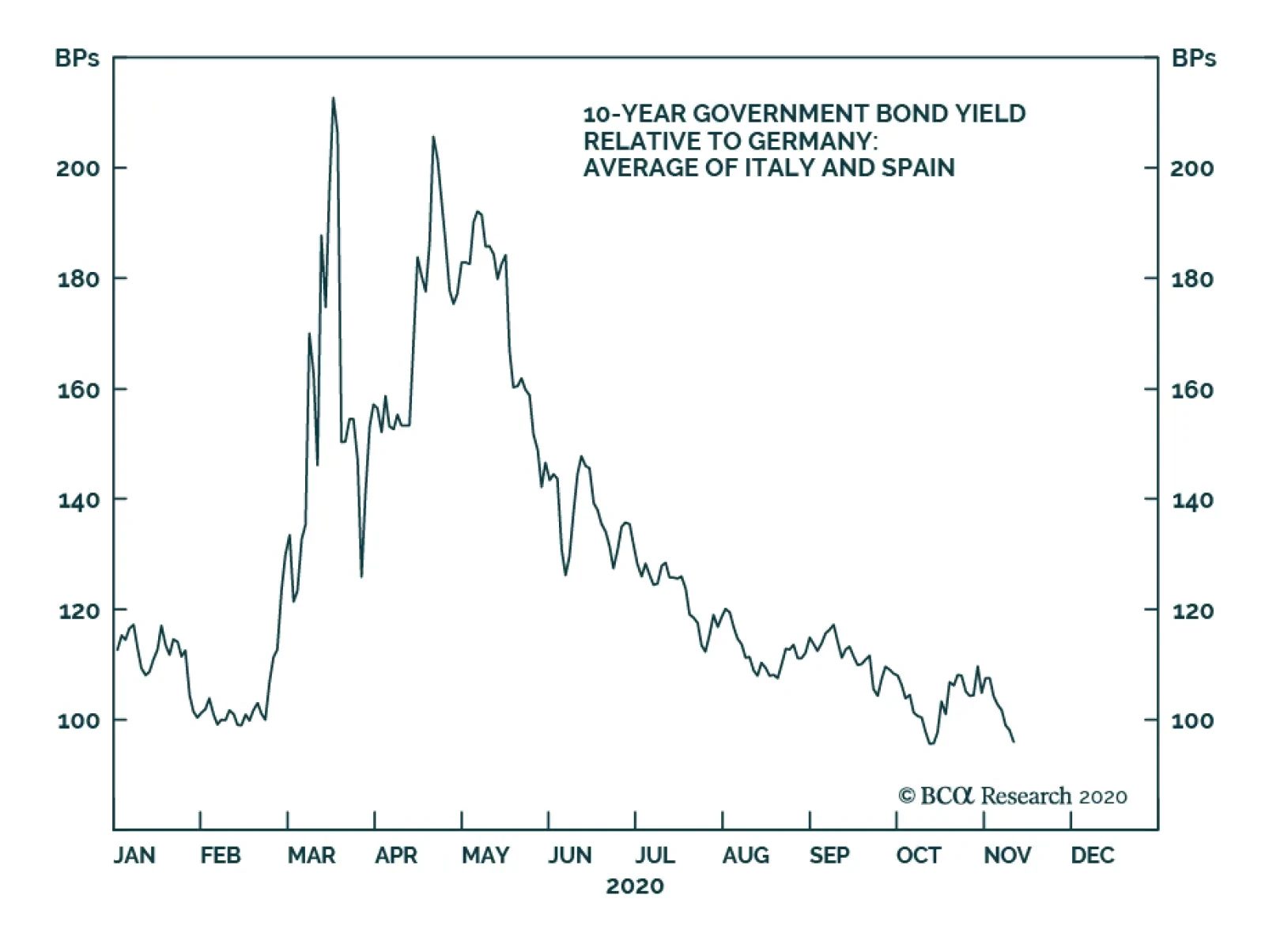

In an Insight published yesterday, we noted that the euro area is now projected to contract in Q4, as a result of the recent second wave in COVID-19 cases and the associated lockdown measures to suppress its spread. We also noted…

Yesterday, Christine Lagarde provided a clear signal that vaccine optimism would not prevent the ECB from easing further in December, reinforcing the message that she gave at the last ECB meeting: that the central bank would…

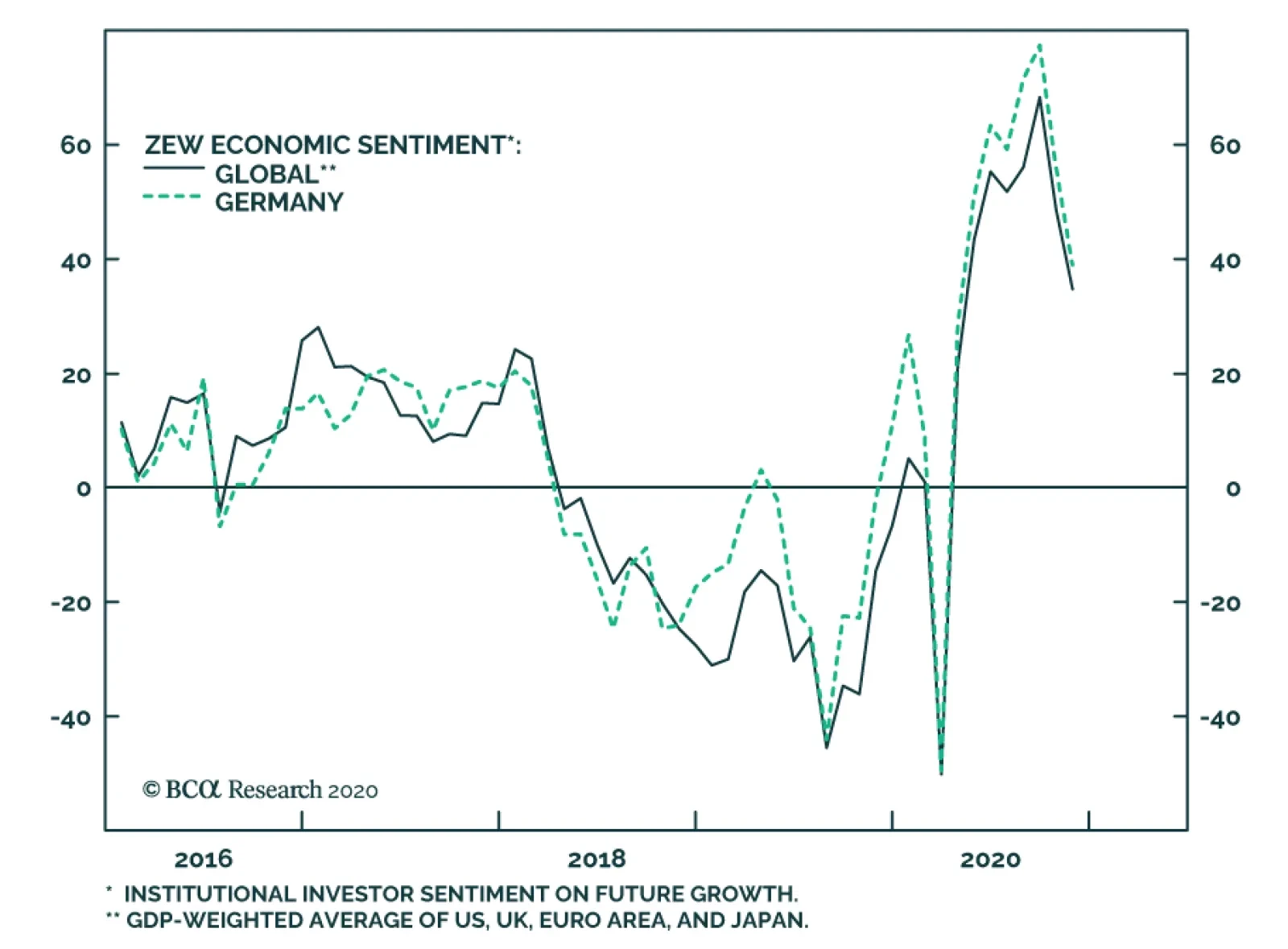

The ZEW survey of German investor sentiment plunged in November, declining to 39 from 56.1 in October. It fell short of expectations and marks the second consecutive monthly decline. The weak print confirms the somber outlook…