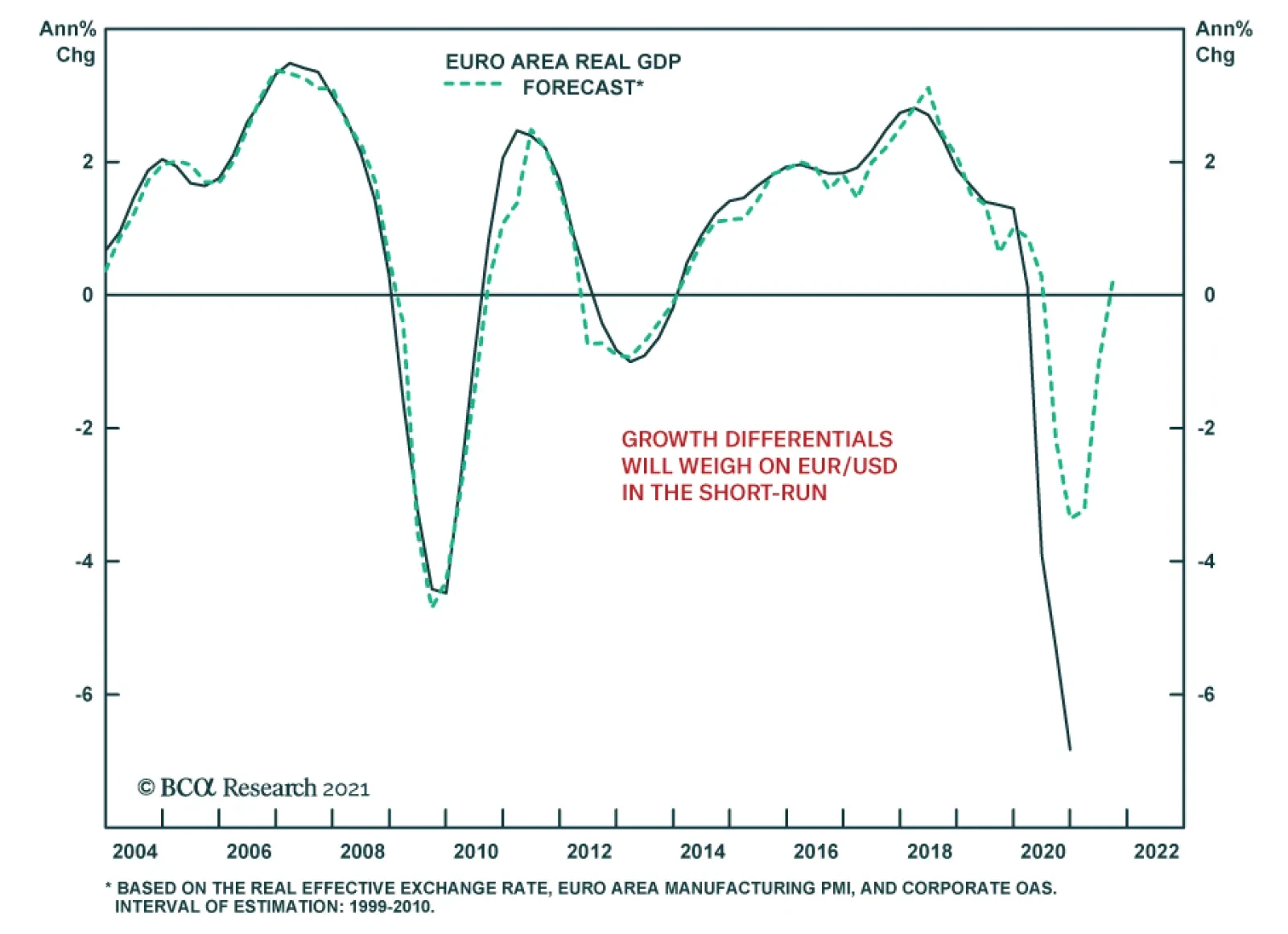

Euro area GDP deteriorated in Q4 on the back of a violent resurgence in the pandemic. On an annualized basis, the economy contracted 0.7% q/q following a 12.4% expansion in Q3. This translates to a 5.1% y/y decline in Q4,…

Highlights GameStop & Bond Yields: The reflationary conditions that helped create a backdrop highly conducive to the wild stock market speculation on display last week – namely, aggressive monetary and fiscal policy stimulus…

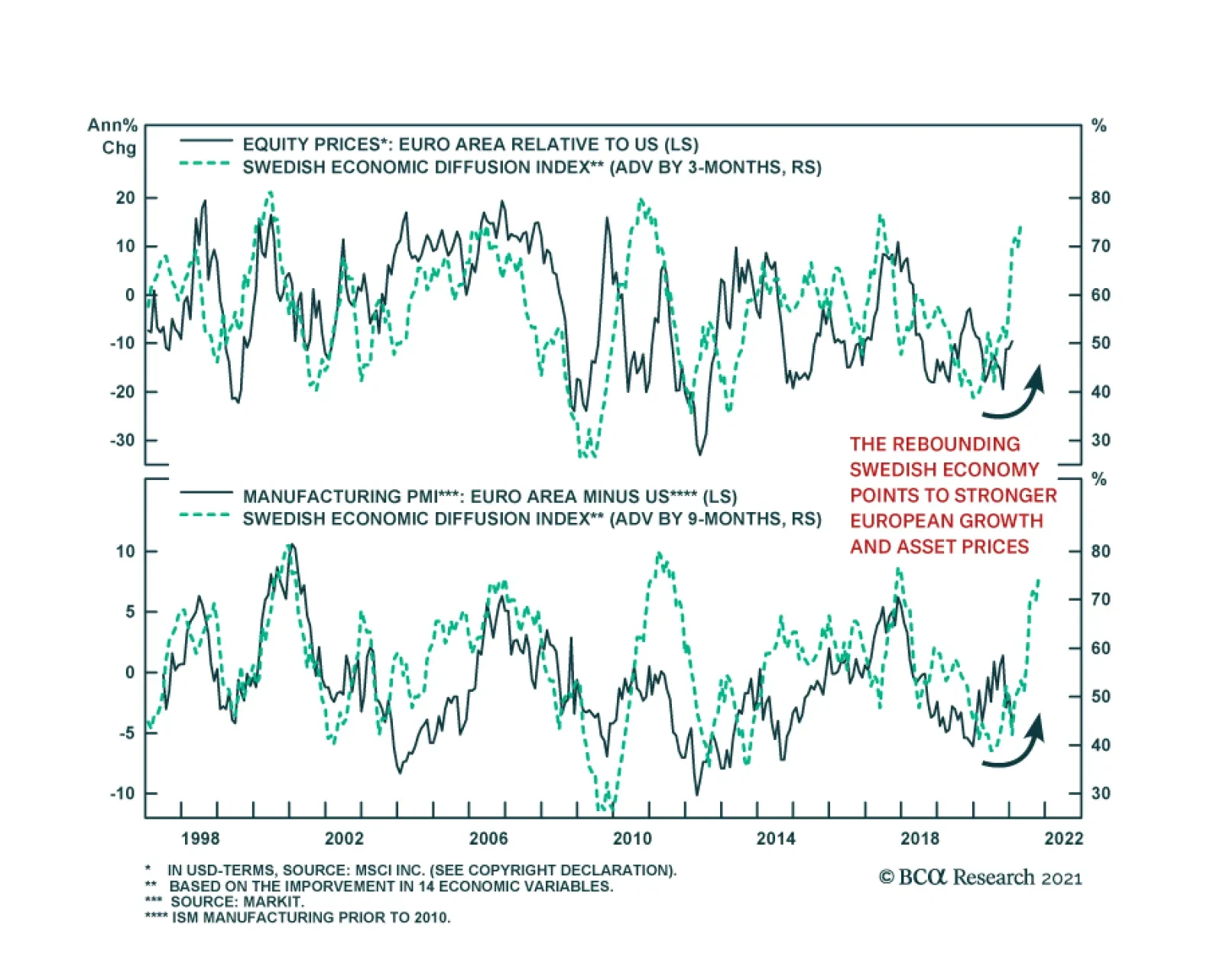

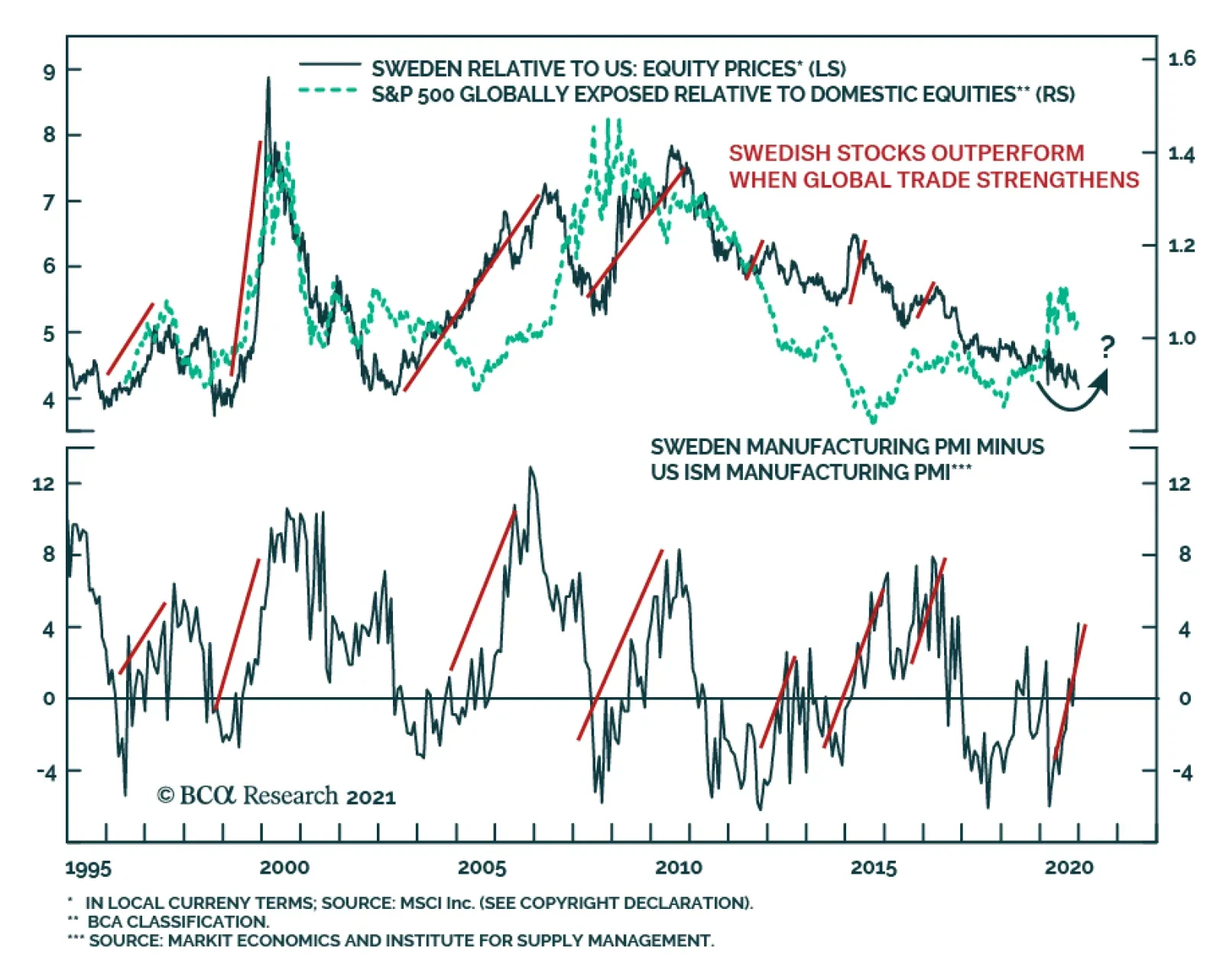

Sweden has a small open economy that specializes in the exports of intermediate industrial goods. This property not only makes Sweden extremely sensitive to the global business cycle, but also, Sweden is among the first advanced…

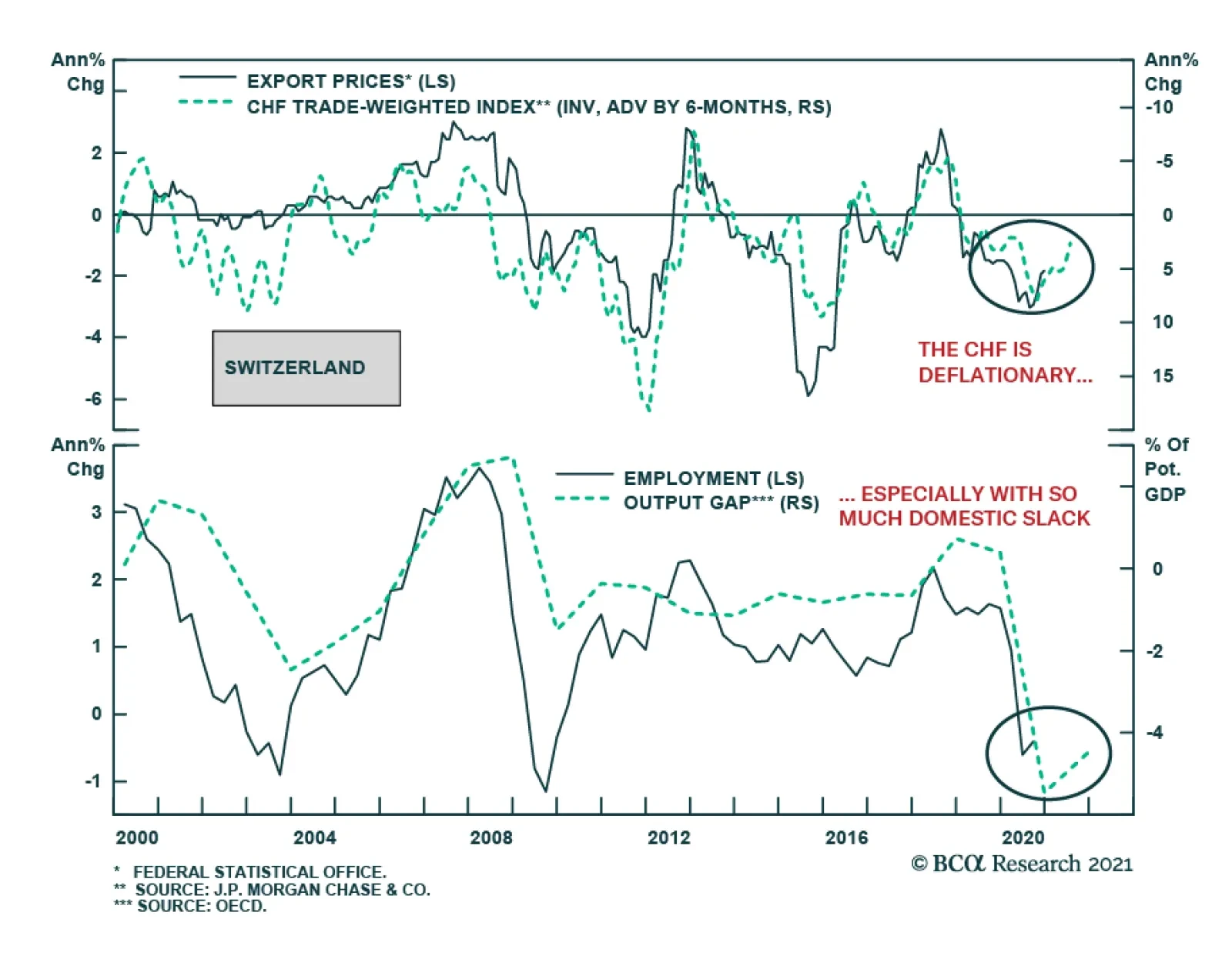

Switzerland has been named a currency manipulator, yet, the SNB will persevere with its aggressive balance sheet policy because it has no choice. The Swiss economy remains under the threat of deflationary pressures, with…

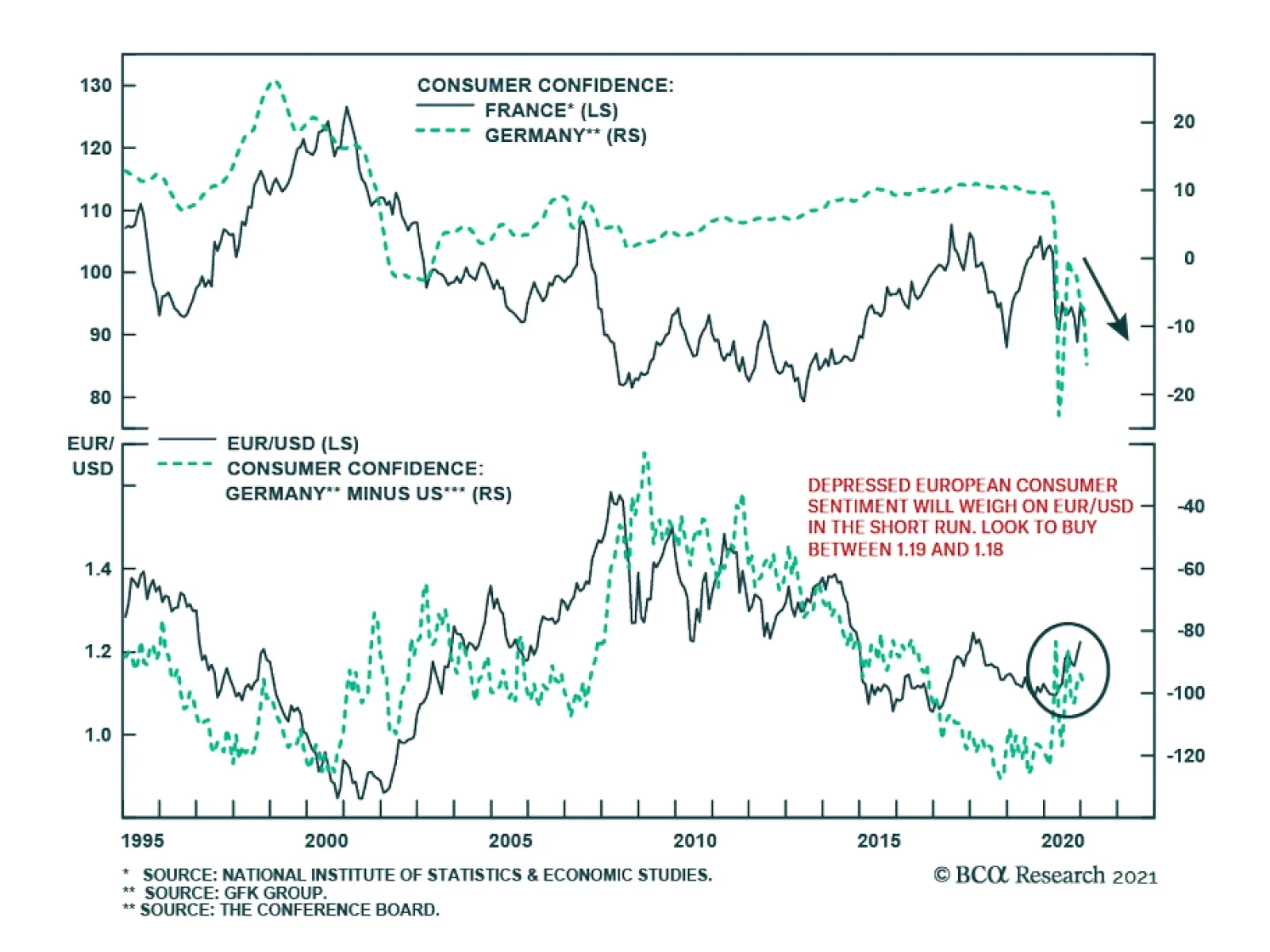

Consumer confidence is collapsing in Europe amid widespread lockdowns to contain the latest wave of infections. Germany’s GfK survey dropped to -15.6 for February, marking the lowest reading since July, the third-lowest…

Highlights Global Yields: The fall in global bond yields over the past two weeks represents a corrective pullback from an overly rapid rise in inflation expectations, especially in the US. The underlying reflationary themes that drove…

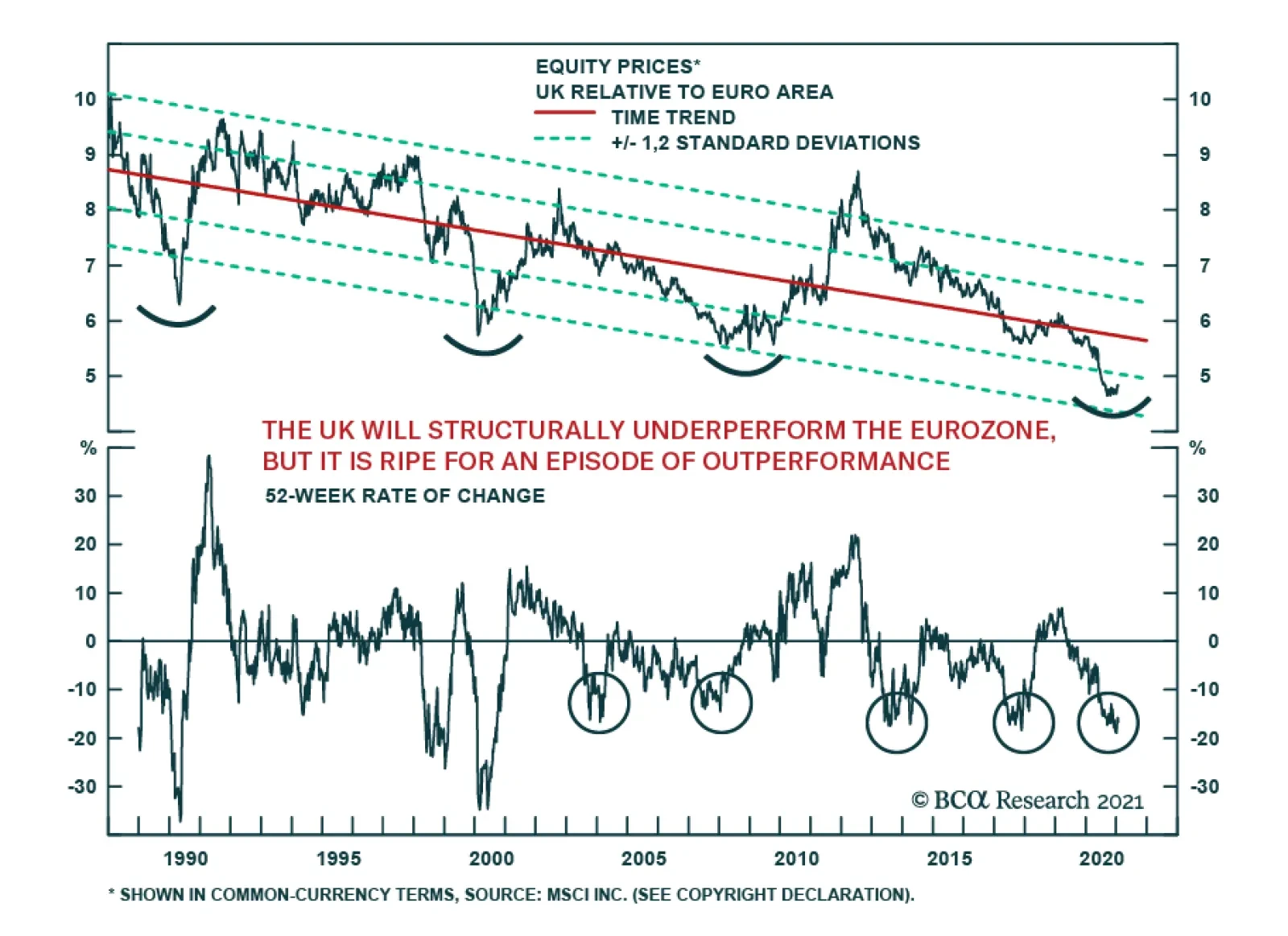

While it is well known that UK equities have been in a secular downtrend against the US, it is often less appreciated that they have greatly underperformed euro area stocks for the past 32 years. There is little reason to believe…

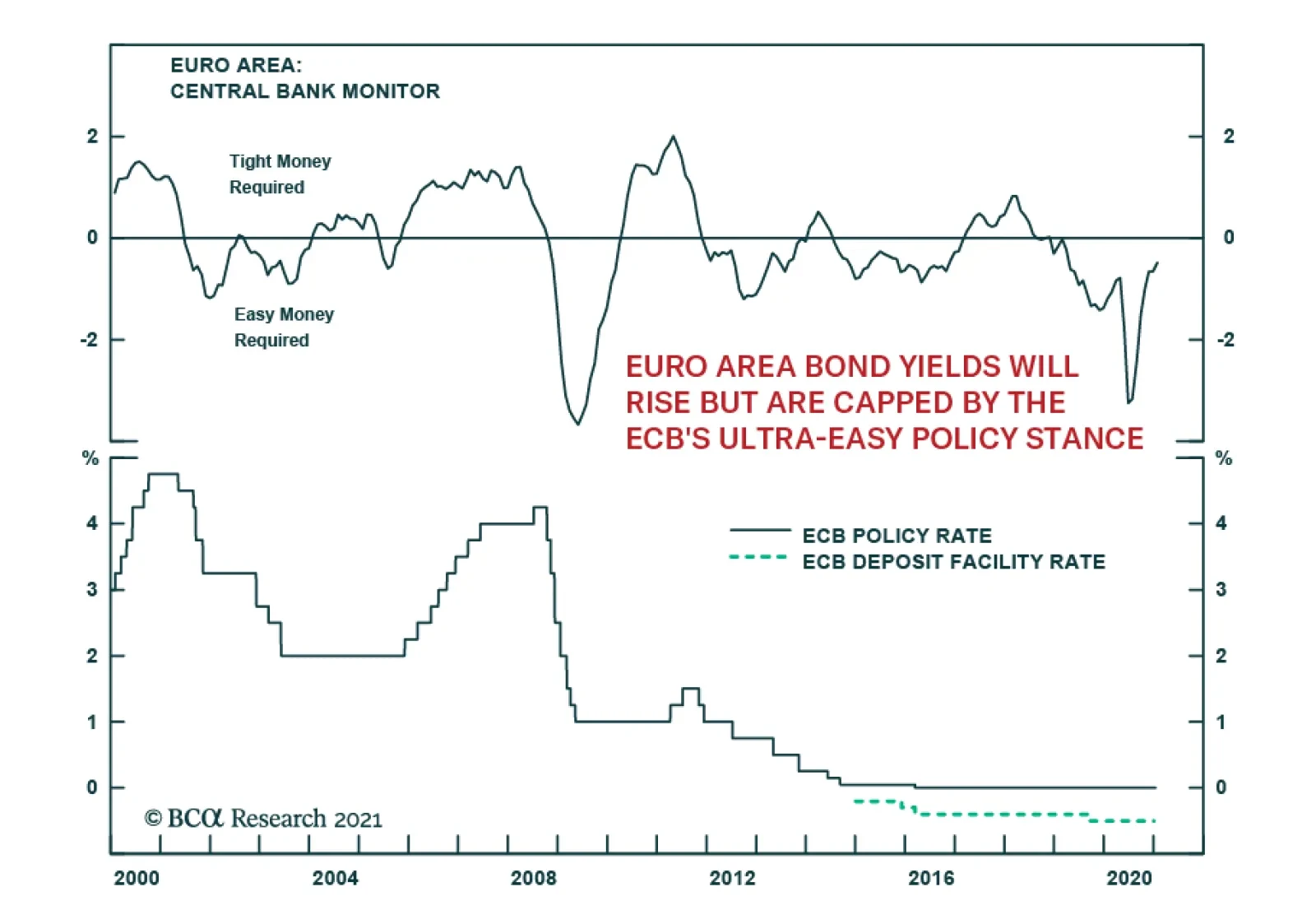

As expected, the European Central Bank did not make any changes to its policy at its first monetary policy meeting of the year yesterday. The benchmark deposit rate was maintained at -0.5% and the quota for bond purchases under…

Over the coming 12 to 18 months, investors should overweight Swedish equities relative to US ones. Swedish equities overweight value stocks and cyclical sectors. This characteristic means that an acceleration in global…

Highlights In the wake of COVID-19, the low-probability, high-impact “Black Swan” event is as relevant as ever. Investors should already expect US terrorist incidents, a fourth Taiwan Strait crisis, and crises involving…