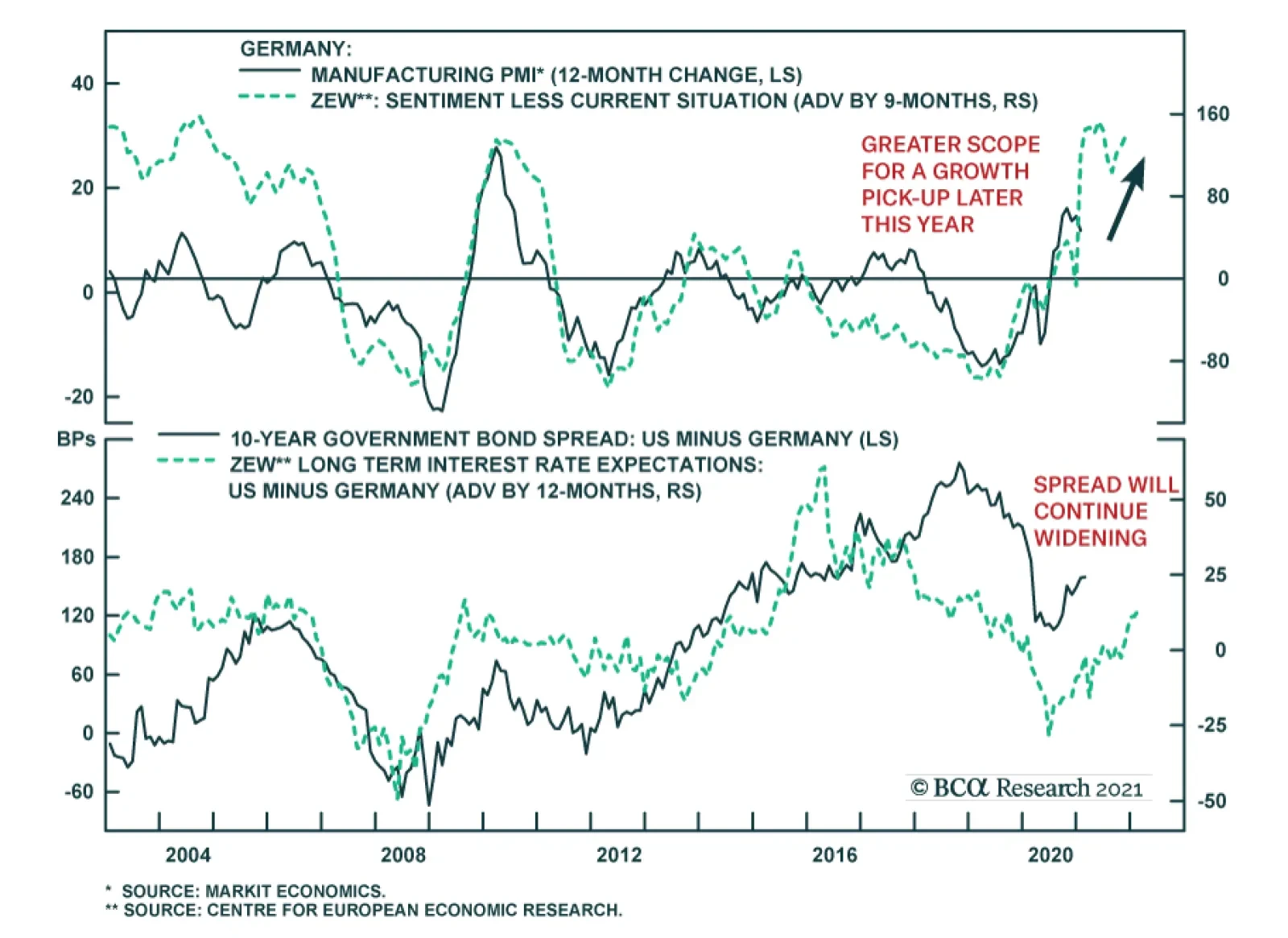

February’s reading of the ZEW Indicator of Economic Sentiment for Germany shows a surge in optimism about the economic outlook. The expectations index jumped nearly 10 points to 71.2, significantly beating consensus…

Highlights This week, we present the second edition of the BCA Research Global Fixed Income Strategy (GFIS) Global Credit Conditions Chartbook—a review of central bank surveys of bank lending standards and loan demand. Feature…

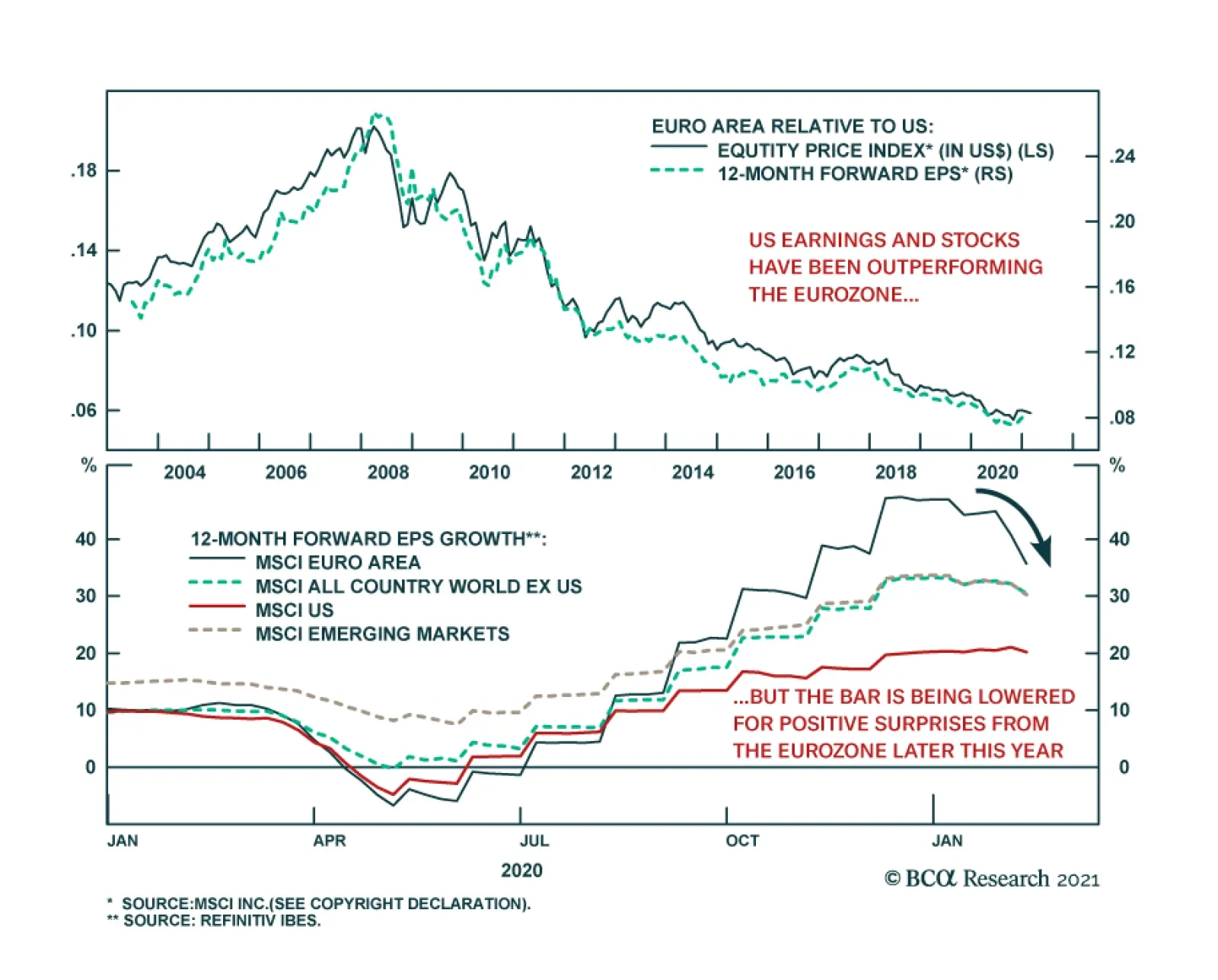

European equities lagged US ones throughout the bulk of last year, and continue to do so in 2021. Several factors explain this mediocre performance. The euro’s strength tightened monetary conditions in the euro area and…

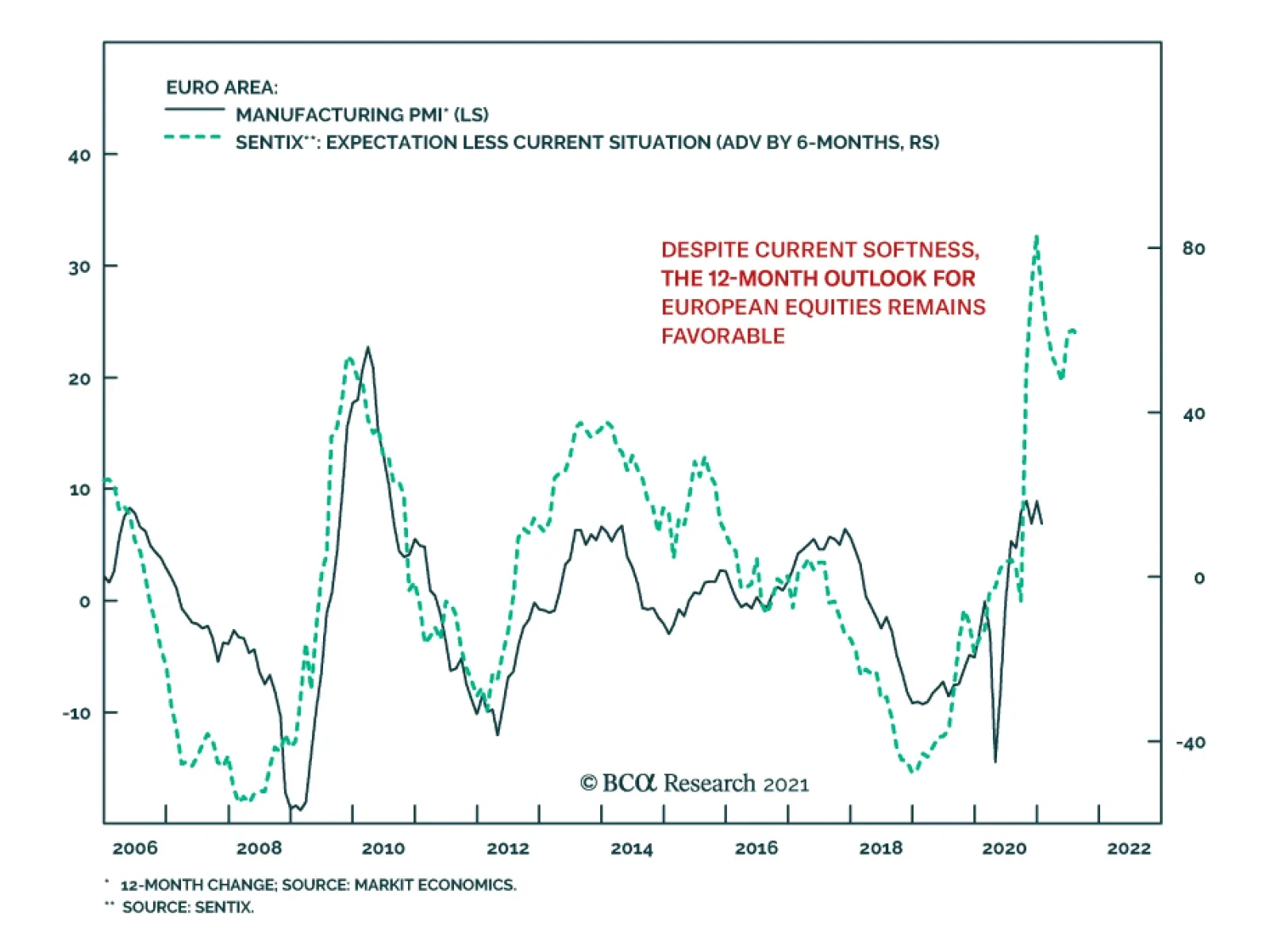

The February Sentix investor confidence index for the euro area was a miss. The headline index fell back below zero following its first positive reading in 10 months in November. At -0.2, the headline index disappointed consensus…

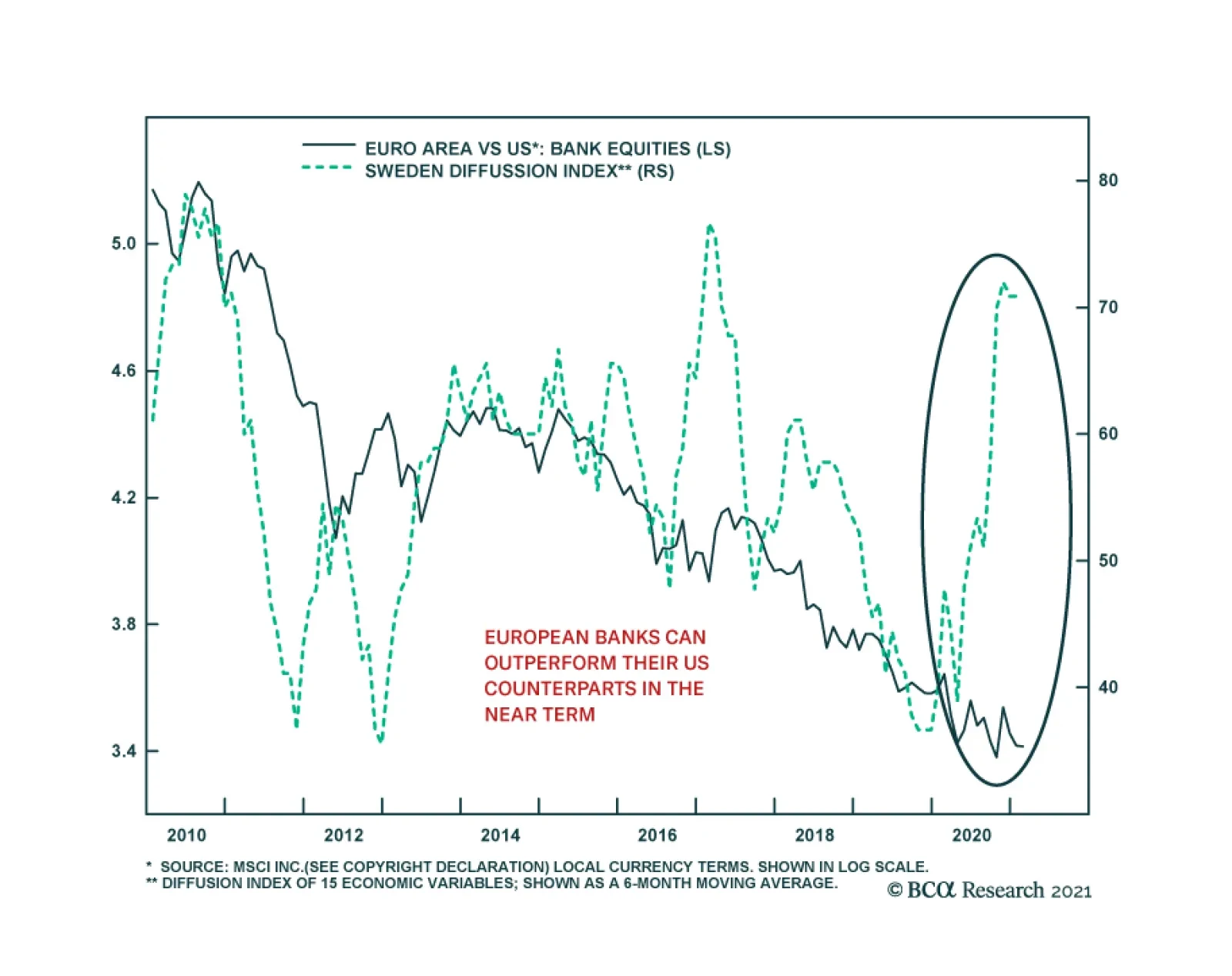

European banks face structural hurdles against their US counterparts. The return on equity of European banks stands well below that of the US, and the lower neutral rate of interest in Europe suggests that European banks will…

Highlights For the month of February, our trading model recommends shorting the US dollar versus the euro and Swiss franc. While we agree a barbell strategy makes sense, we would rather hold the yen and the Scandinavian currencies.…

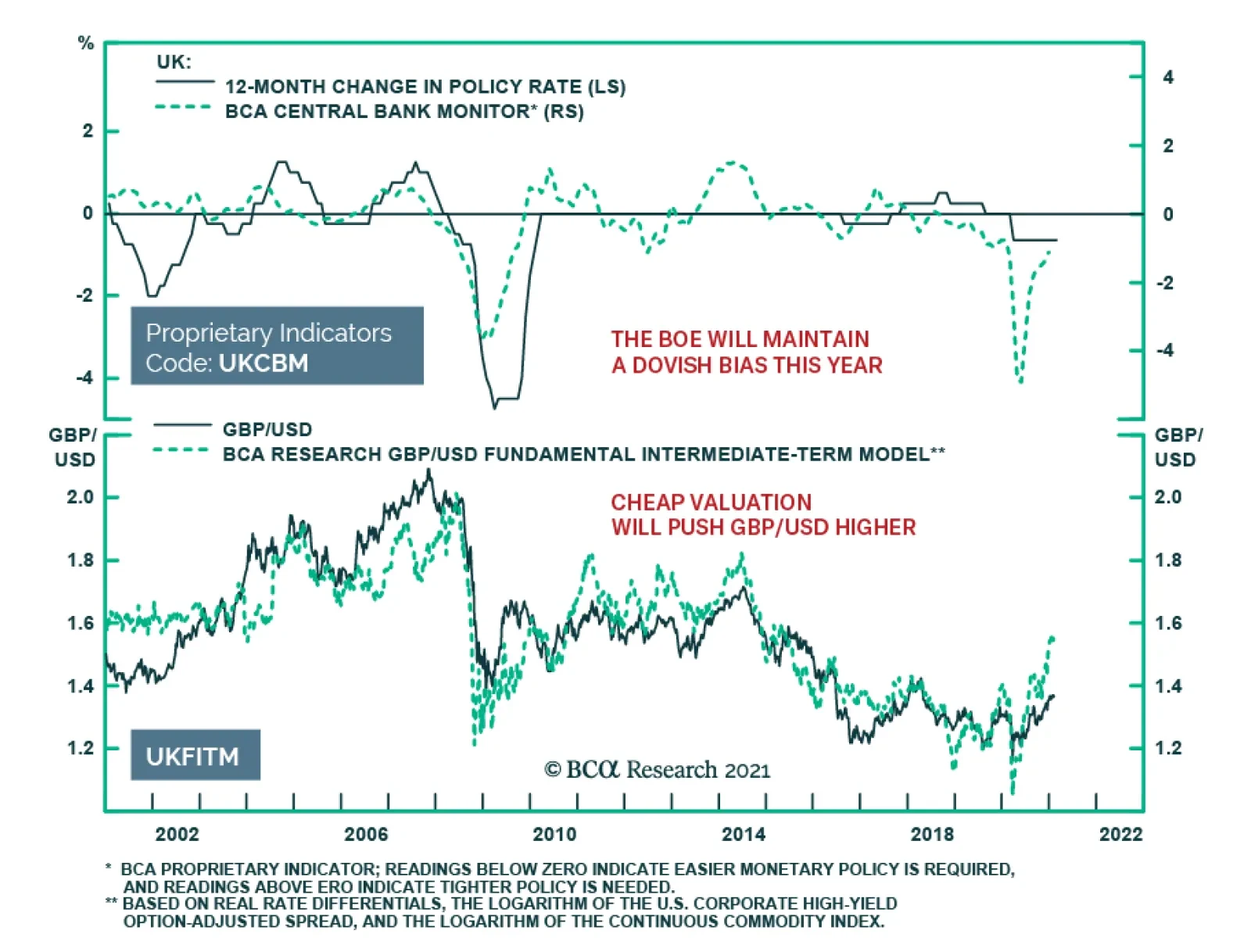

The Bank of England did not adjust monetary policy at the conclusion of its meeting on Thursday. The Bank Rate was maintained at 0.1% and its target stock of asset purchases was held at GBP 895 billion. Although the BoE revised…

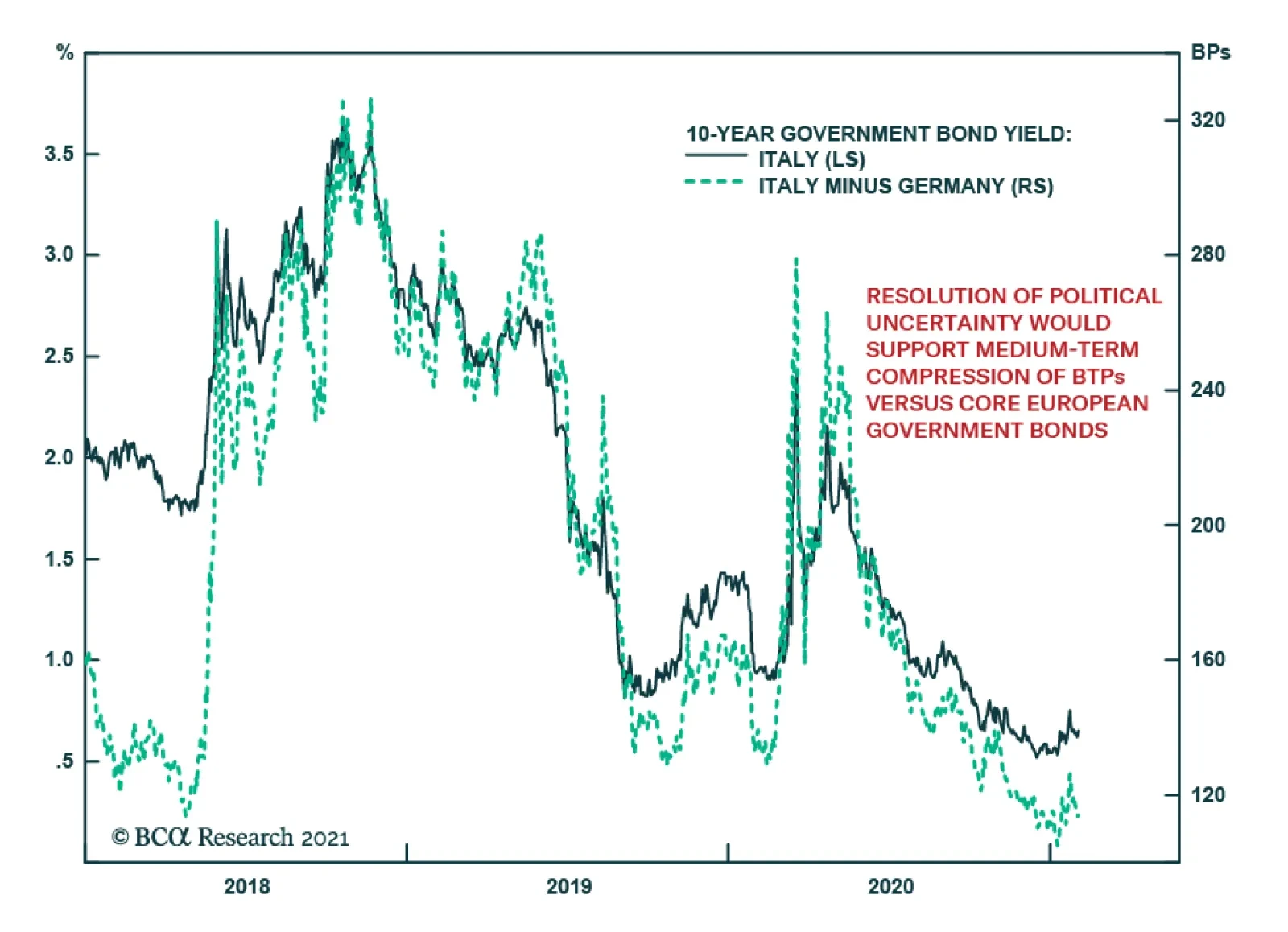

Italian markets are cheering Mario Draghi’s acceptance of President Mattarella’s request to form a national unity government. If the former ECB head succeeds, it would eliminate the political uncertainty accompanying…

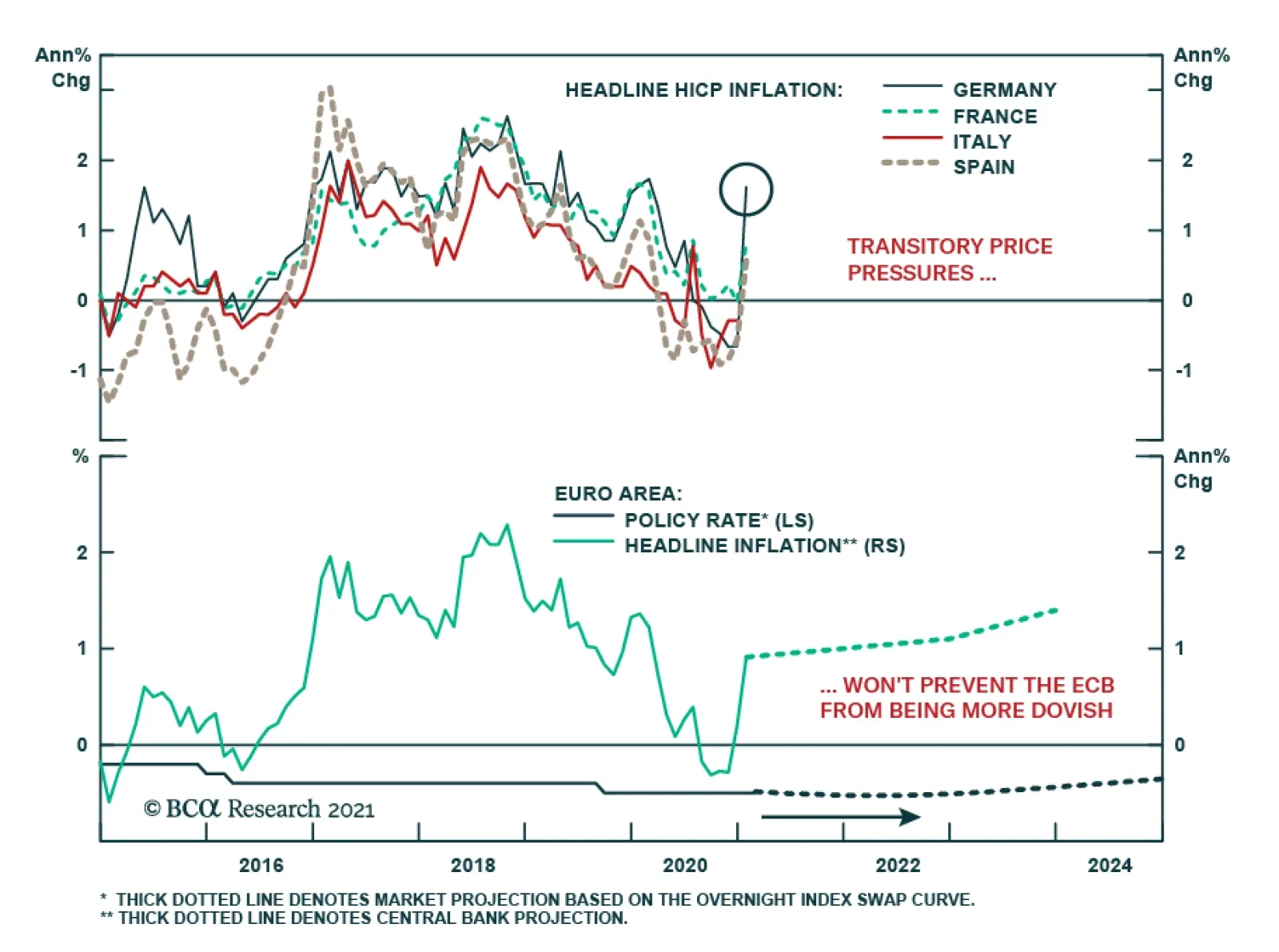

Euro area inflation surprised to the upside in January. The flash headline measure jumped to 0.9% y/y, marking the first annual price increase since July and surpassing expectations of a 0.6% y/y acceleration. Similarly, core CPI…