Highlights The Federal Reserve’s ultra-dovish stance is not the only reason for markets to cheer. The US is booming, China is unlikely to overtighten monetary and fiscal policy, and Europe remains a source of positive political…

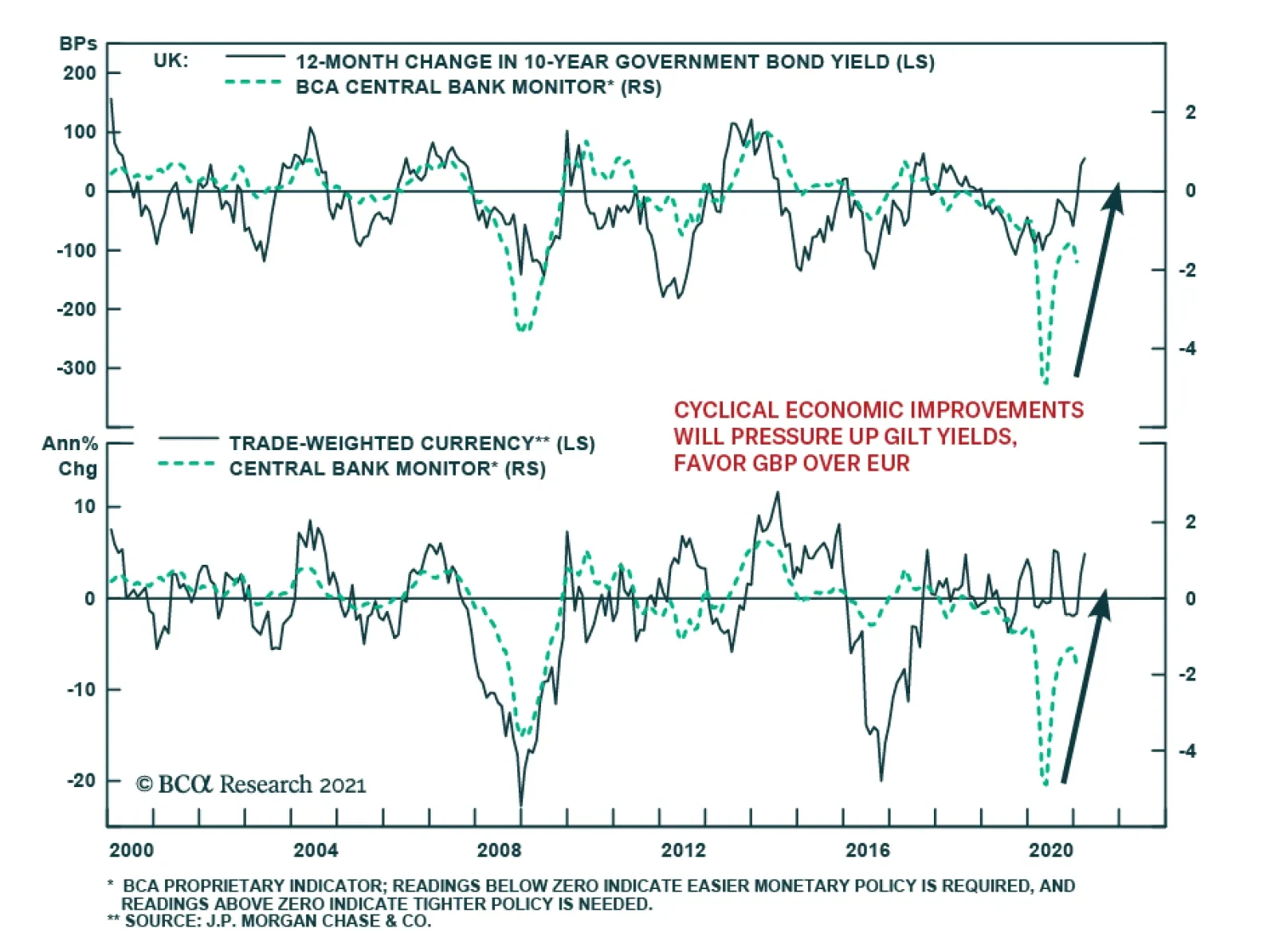

The Bank of England took a page from the Fed’s playbook at its Thursday meeting, acknowledging that economic conditions and the pandemic have improved since February’s central projections, but emphasizing its…

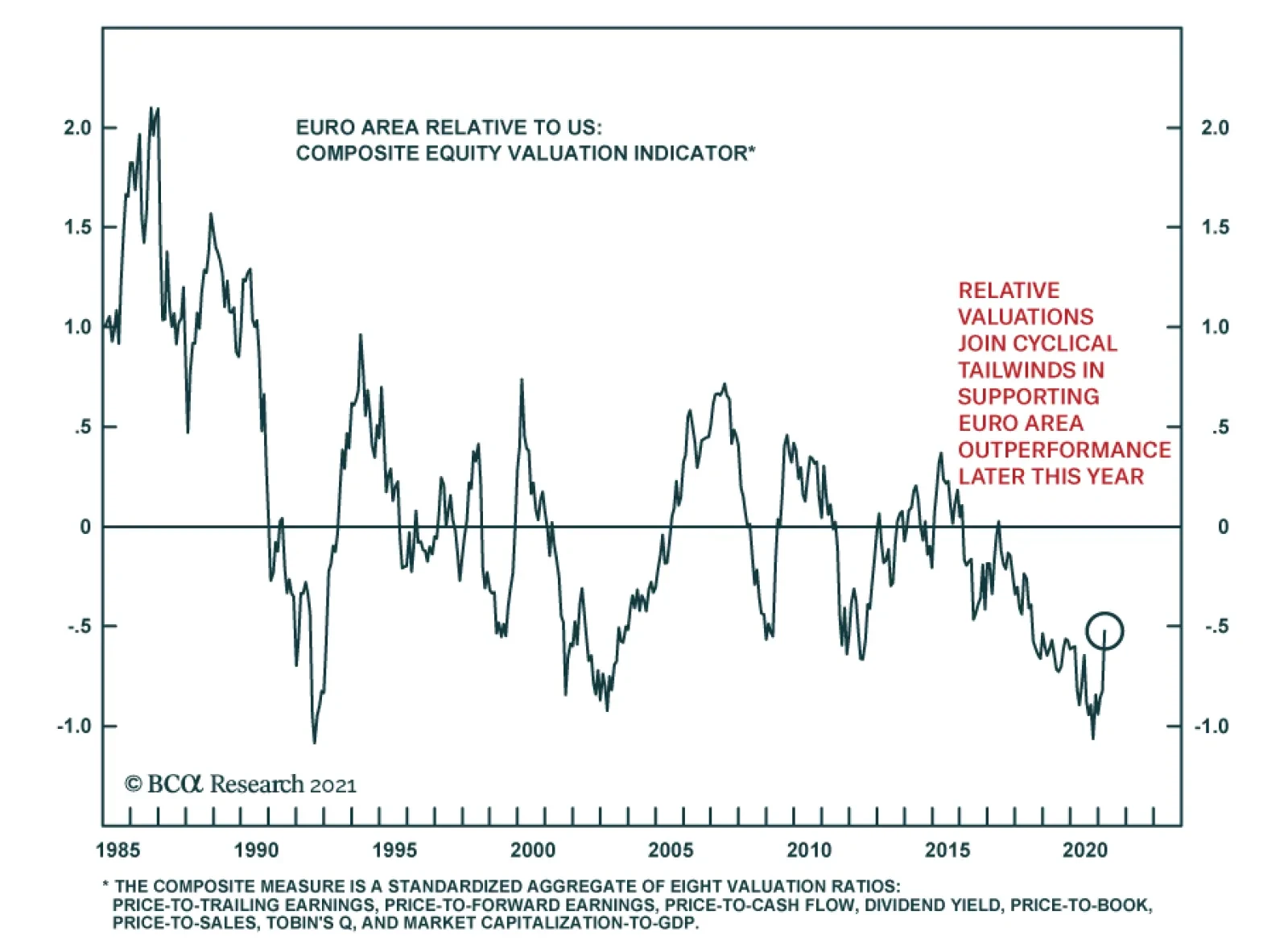

European equities underperformed US stocks for the most part of last year, and after a brief bounce in Q4, have largely stalled in relative terms. The latest wave of infections led to prolonged restrictions in the Old Continent,…

Highlights Global Duration: Markets are correctly interpreting the $1.9 trillion US fiscal stimulus package as a factor justifying higher global growth expectations and bond yields. Maintain a below-benchmark stance on overall global…

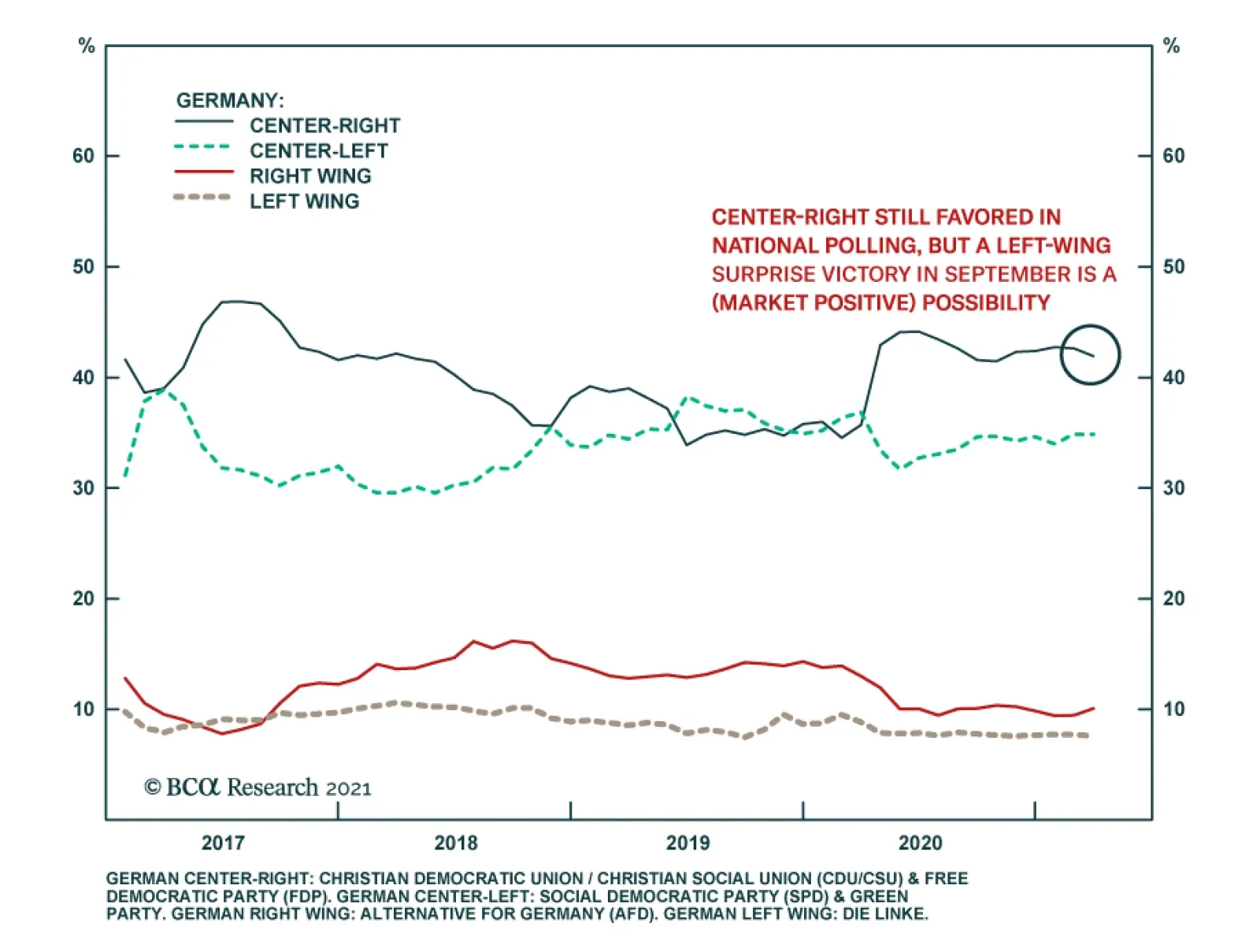

The CDU’s historic defeats in Baden-Wurttemberg and Rhineland-Palatinate regional elections over the weekend highlight the risk of a change in government in Germany later this year. Our Geopolitical Strategists…

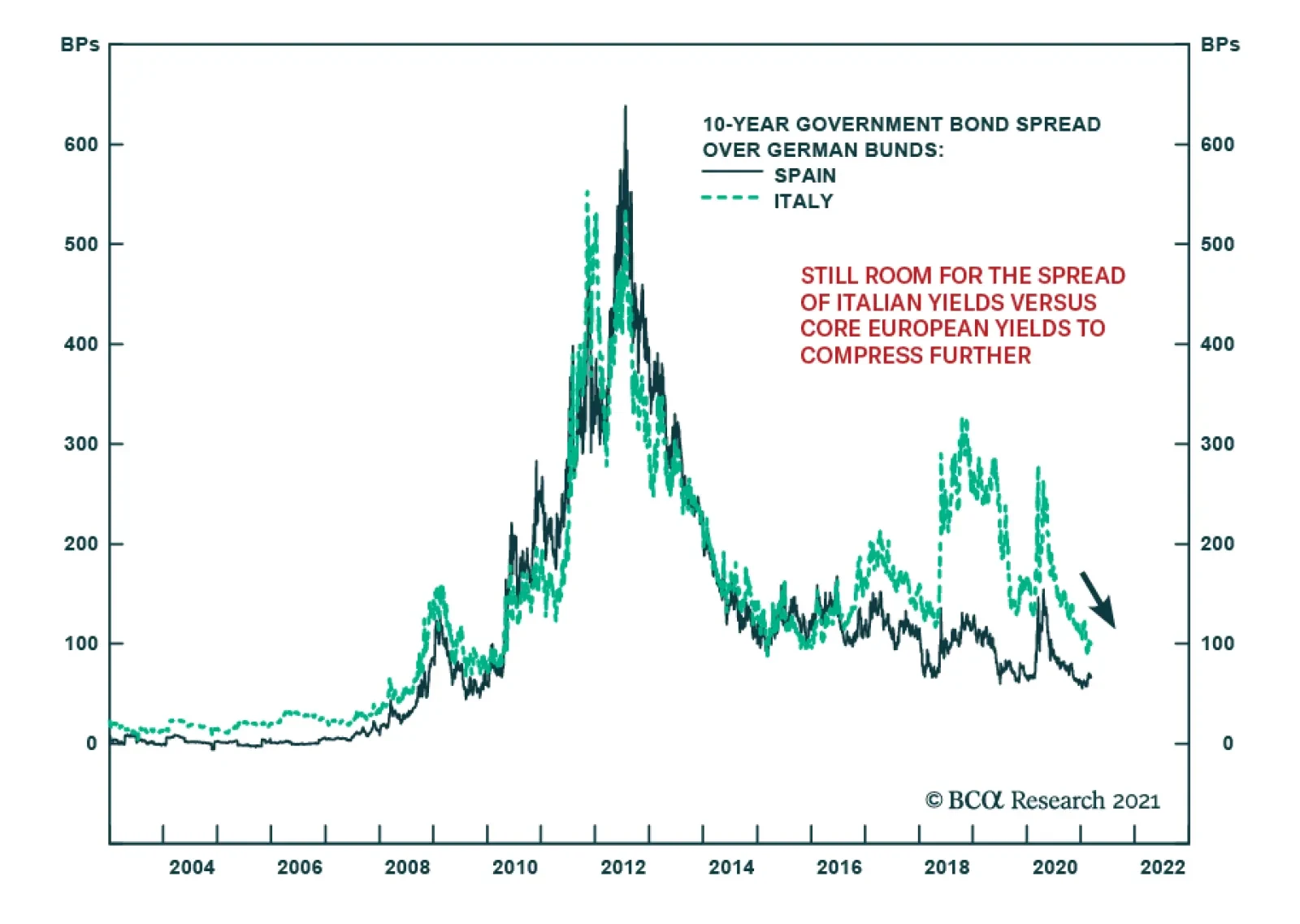

European assets rallied and peripheral spreads narrowed on Thursday on the ECB’s announcement it would keep the size of its PEPP envelop unchanged but would accelerate the pace of asset purchases next quarter. The ECB…

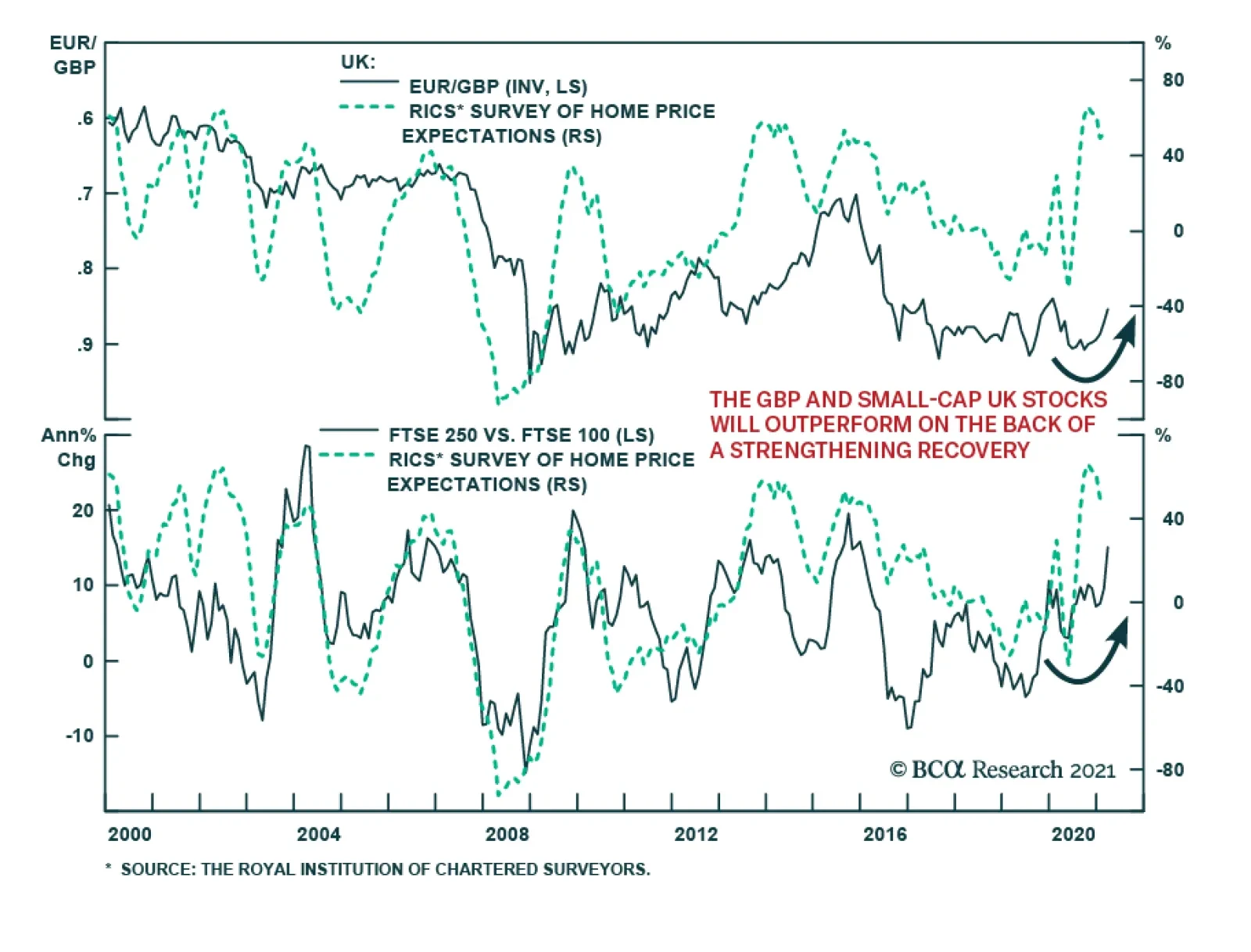

The UK’s RICS House Price Balance Indicator increased to 52% in February from a revised 49%, beating expectations it would dip to 45%. While the headline number remains below October’s 66%, it is nevertheless a strong…

Recent messages from the ECB’s Governing Council have been dissonant. GC member Panetta recently hinted that the backup in yields justified an expansion of the ECB’s PEPP program. Meanwhile, Chief economist Philippe…

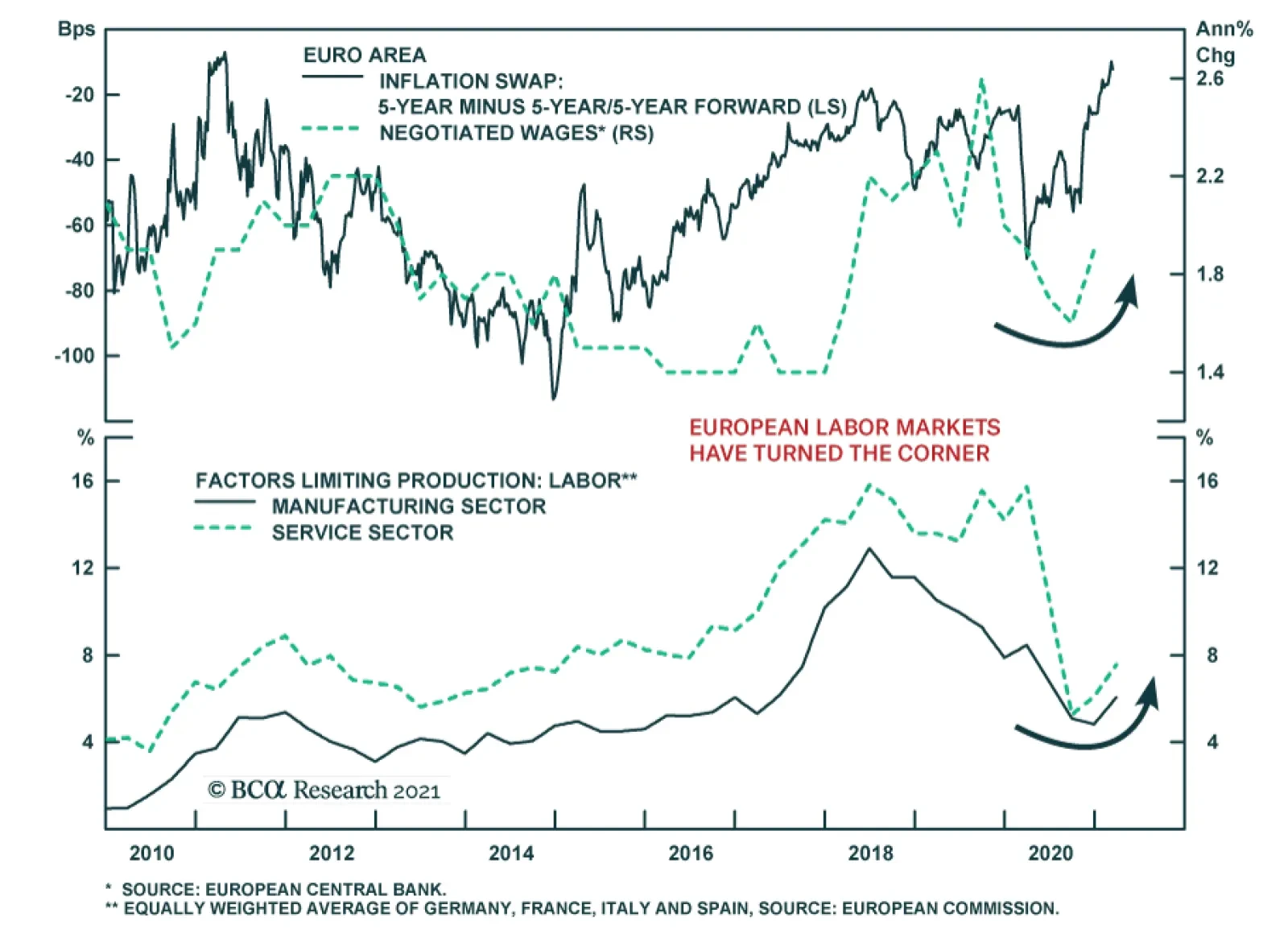

In the US, the inflation breakeven curve has inverted, with the 5-year breakeven rates standing at their highest levels relative to the 5-year/5-year forward rates since the pre-GFC days. In Europe, the CPI swap curve has greatly…