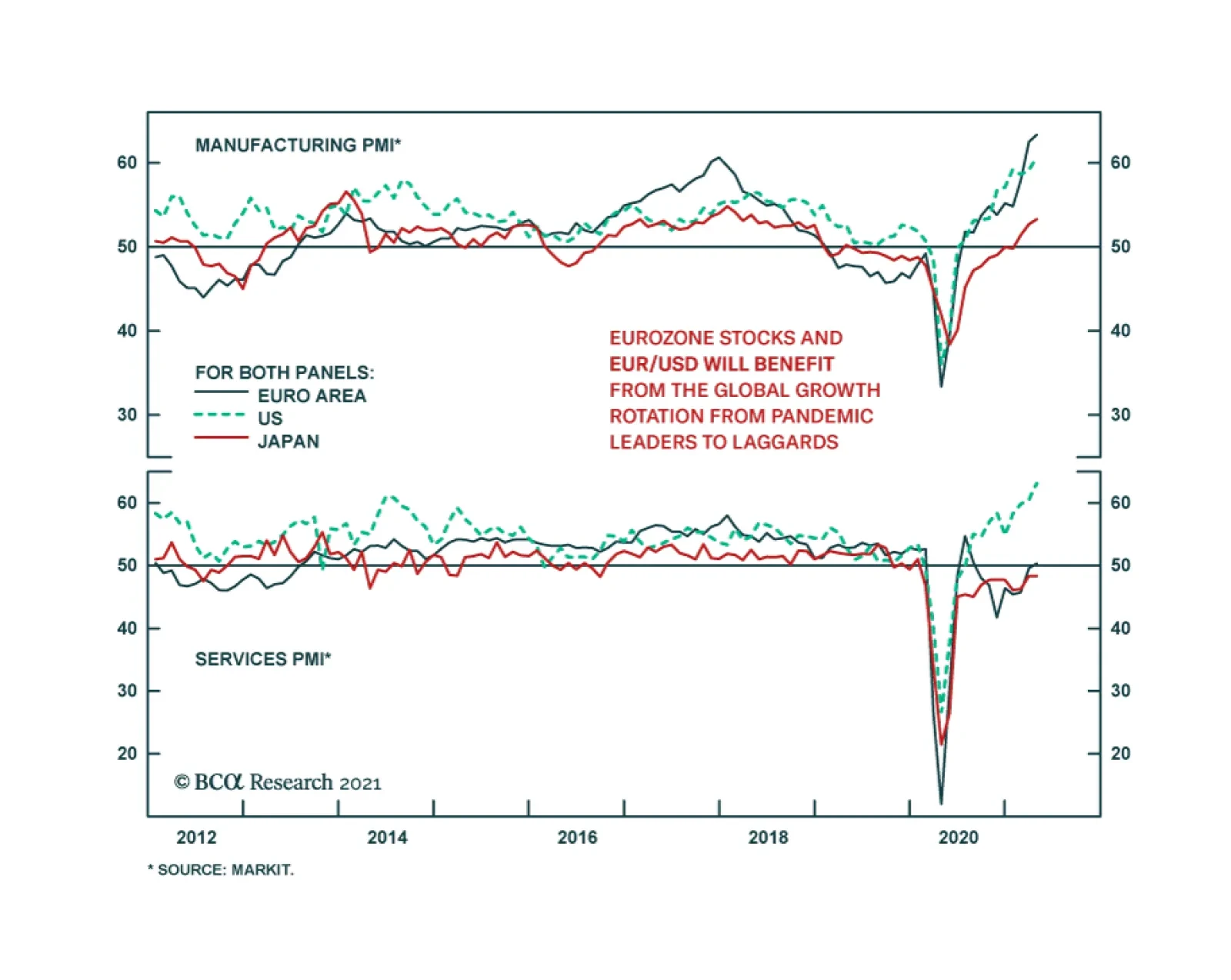

April’s flash Markit PMIs show that the economic recovery is firming across developed markets. The US composite PMI strengthened to 62.2 from 59.7. The Eurozone composite index surprised to the upside and gained 0.5 point…

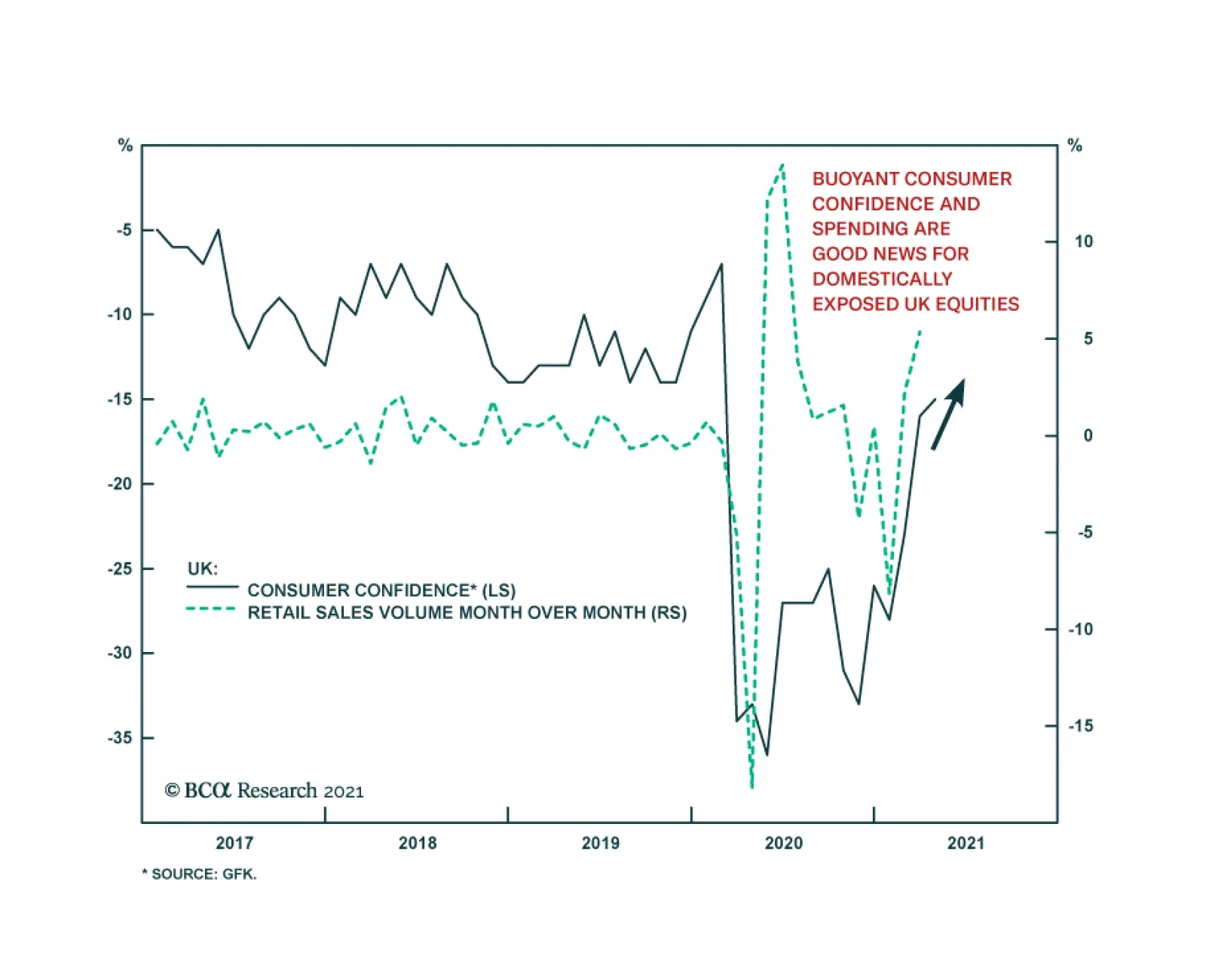

UK retail sales surged in March, which indicates that the domestic demand recovery is taking shape. Retail sales including auto fuel accelerated 5.4% m/m, surprising expectations of a deceleration to 1.5% m/m from a revised 2.…

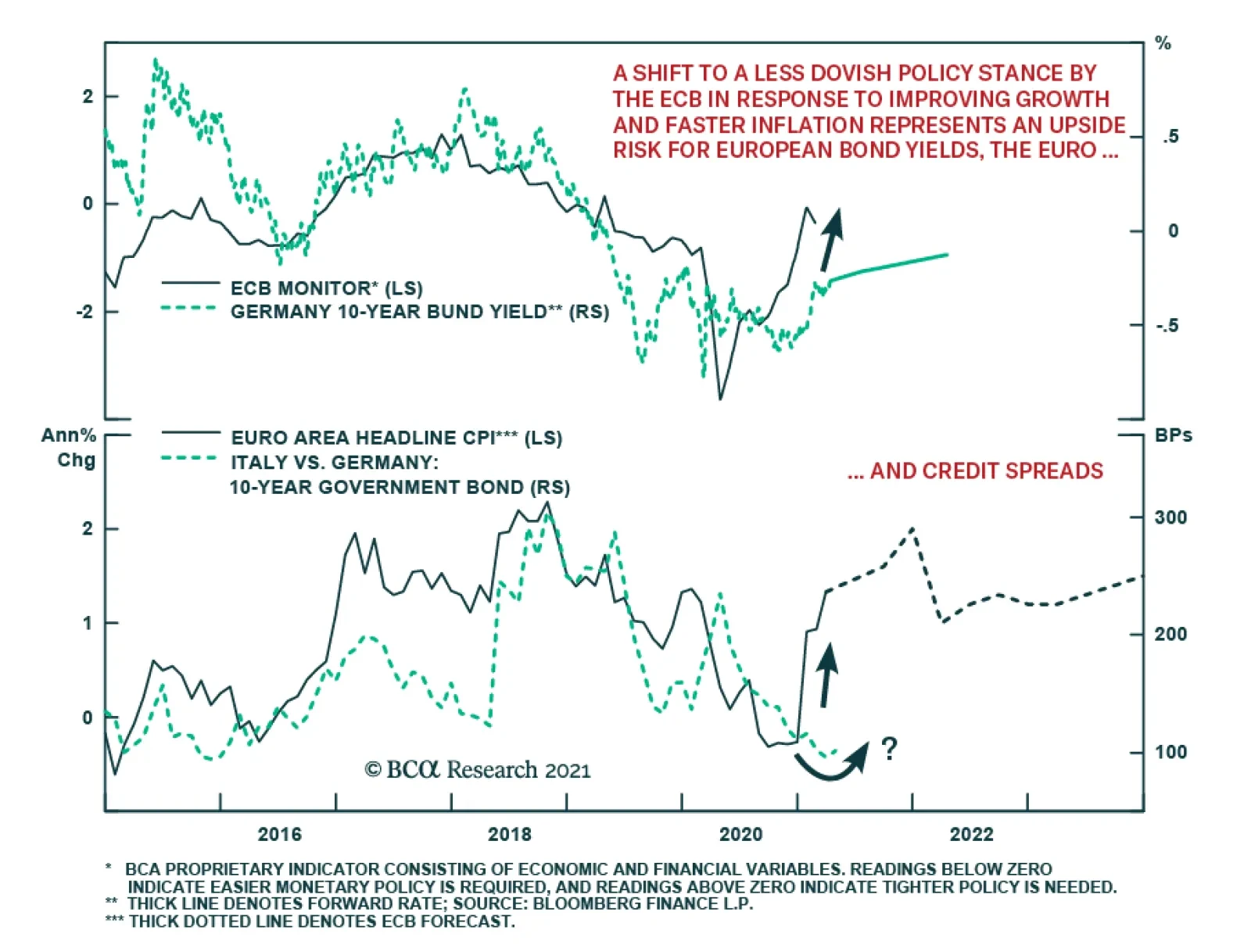

Yesterday’s ECB monetary policy meeting offered no surprises for investors. All policy interest rates were left unchanged, as were the sizes of the ECB’s asset purchase programs. In the press conference…

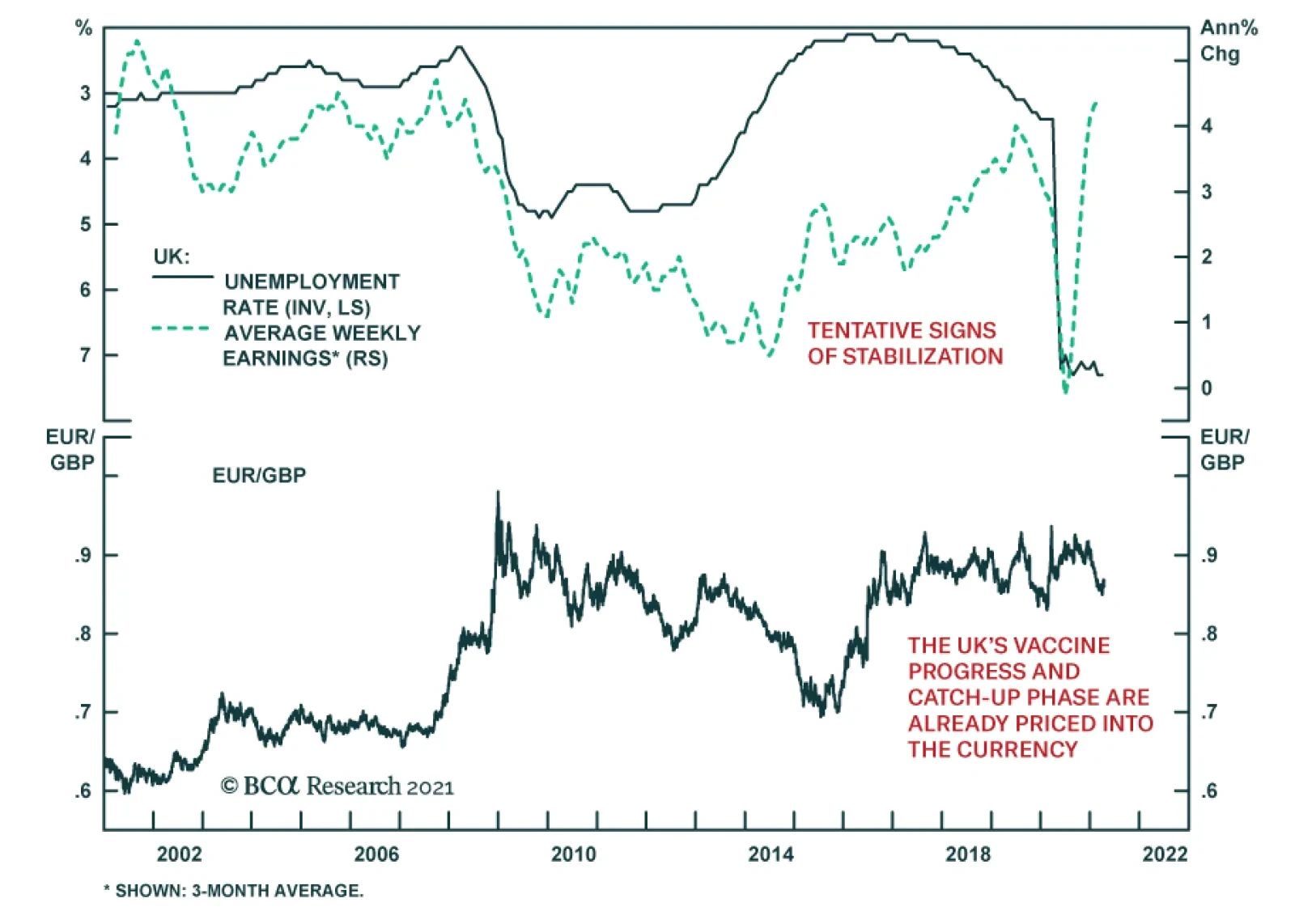

The UK jobs report showed tentative signs of stabilization in the British labor market in March. Jobless claims rose by 10.1 thousand versus a revised 67.3 thousand increase in the prior month, and the claimant rate remained flat…

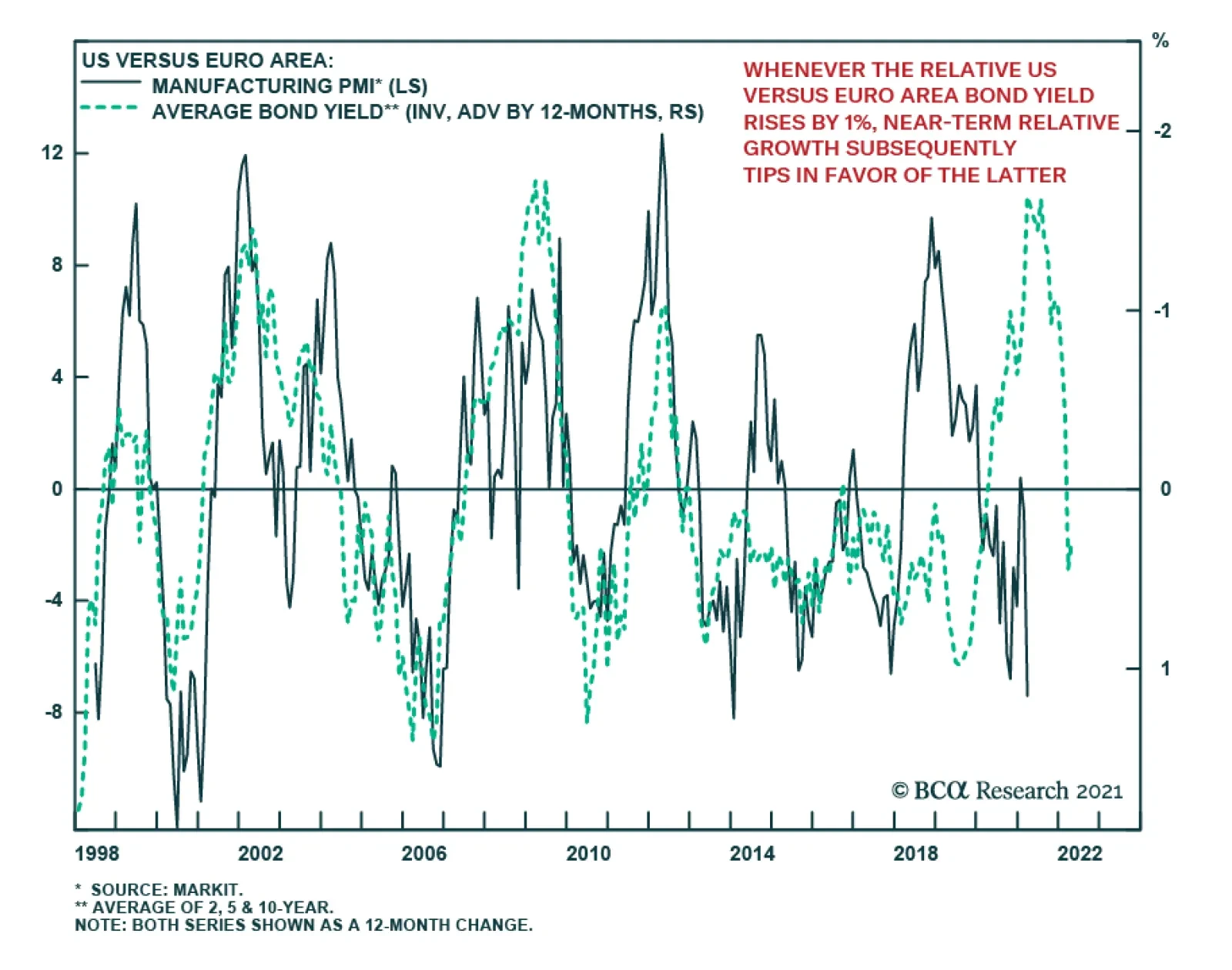

Determining the relationship between relative growth, relative bond yields and foreign exchange movements can be an arduous task. According to our FX Strategists, a circular approach works best. Long bond yields can be…

Highlights There are tentative signs that US growth outperformance is ebbing. The recovery in the manufacturing sector abroad is already taking leadership from the US. This trend will soon rotate to the service sector. As such, long-…

Highlights Stronger global growth in the wake of continued and expected fiscal and monetary stimulus, and progress against COVID-19 are boosting oil demand assumptions by the major data suppliers for this year. We lifted our…

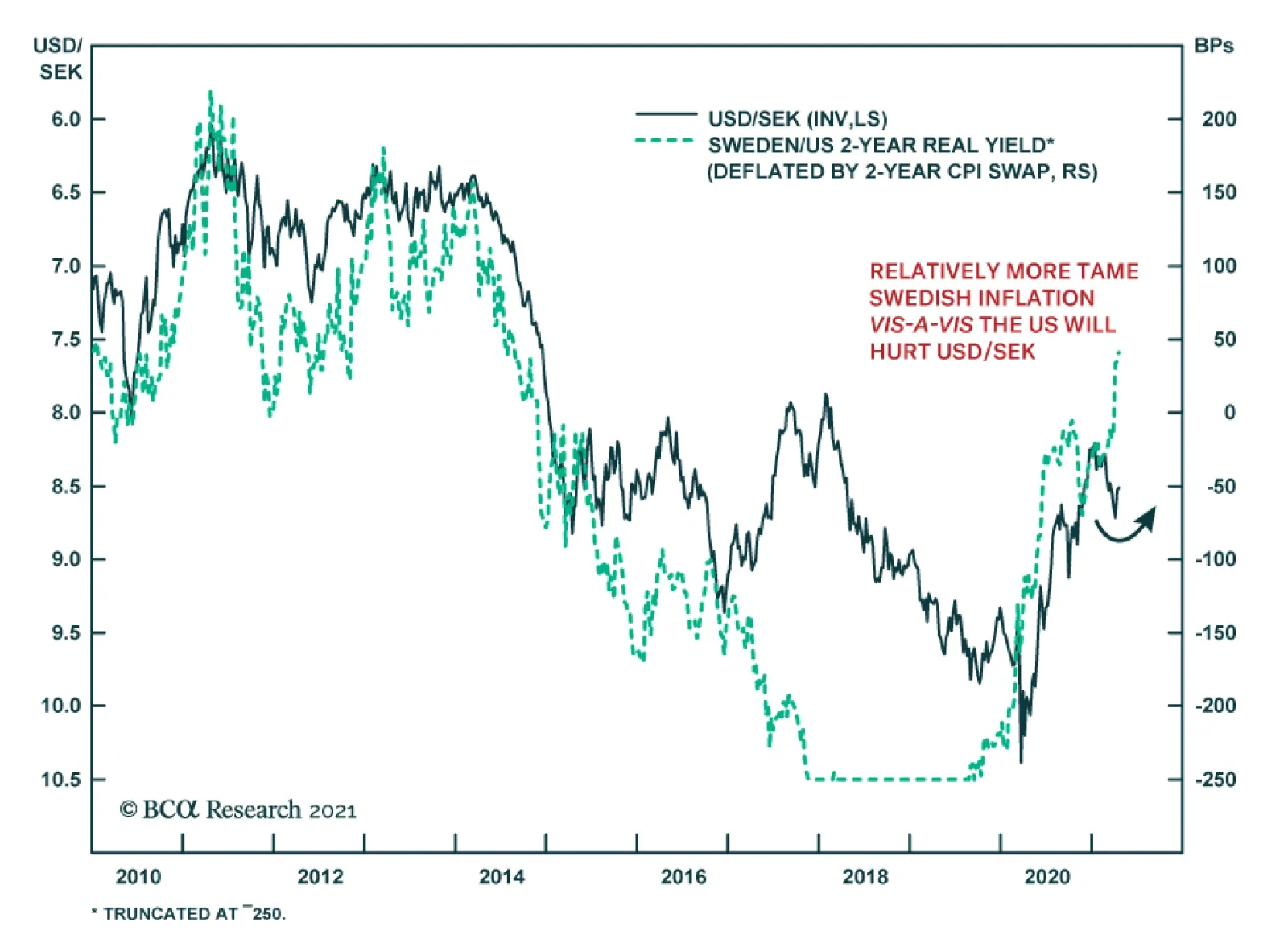

Swedish inflation accelerated in March, beating expectations of a more muted pick up. The CPIF measure favored by the Riksbank came in at 1.9% y/y, higher than the 1.5% reading in February and just shy of the central bank’s…

Highlights Global Inflation: The case for maintaining a strategic overall allocation to inflation-linked bonds (ILBs) versus nominal government debt in dedicated global fixed income portfolios remains intact. Global growth expectations…