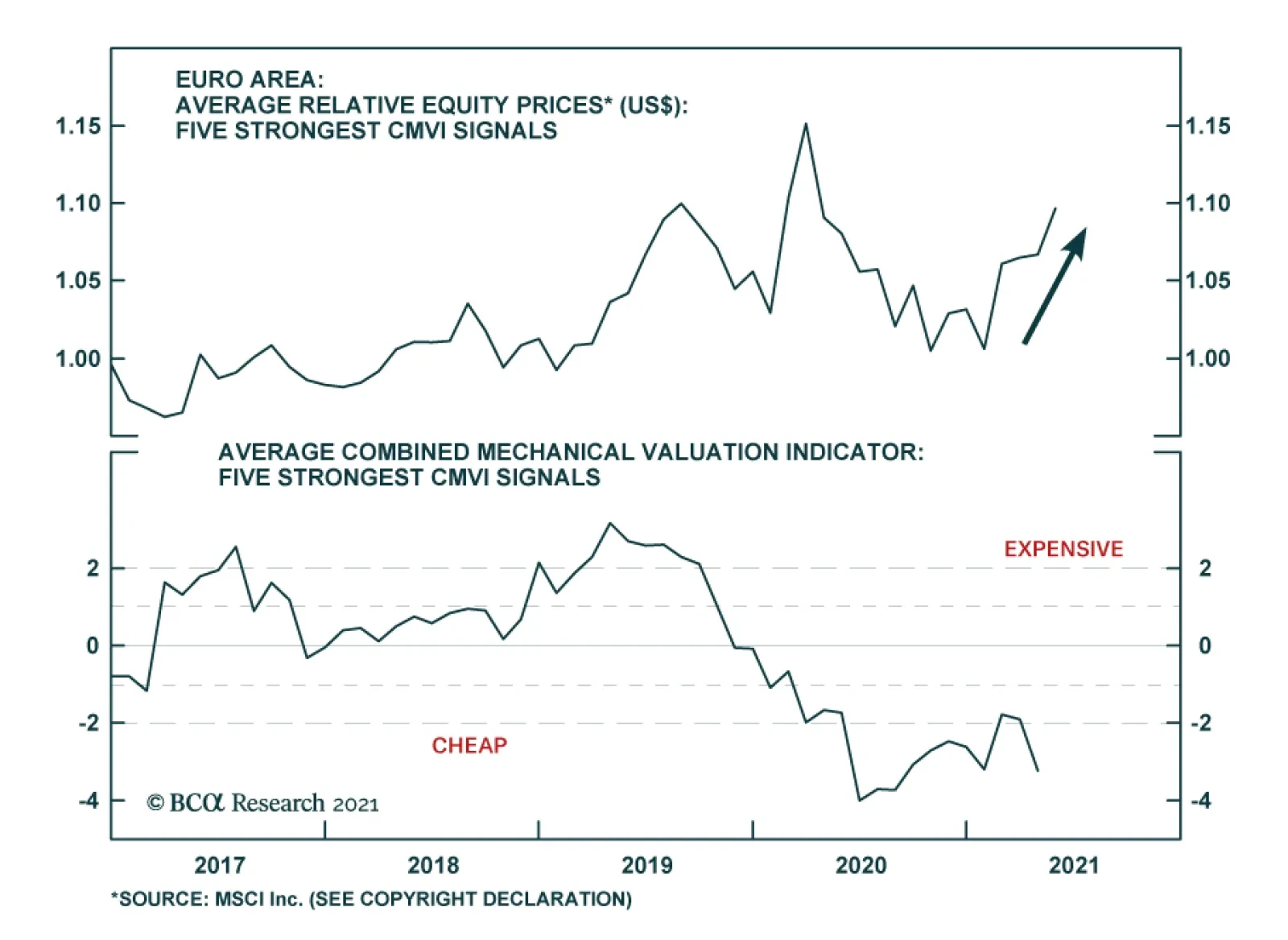

BCA Research’s European Investment Strategy service introduces its Combined Mechanical Valuation Indicator for European equities to identify extreme valuations at the country and sector level. At present, the Combined…

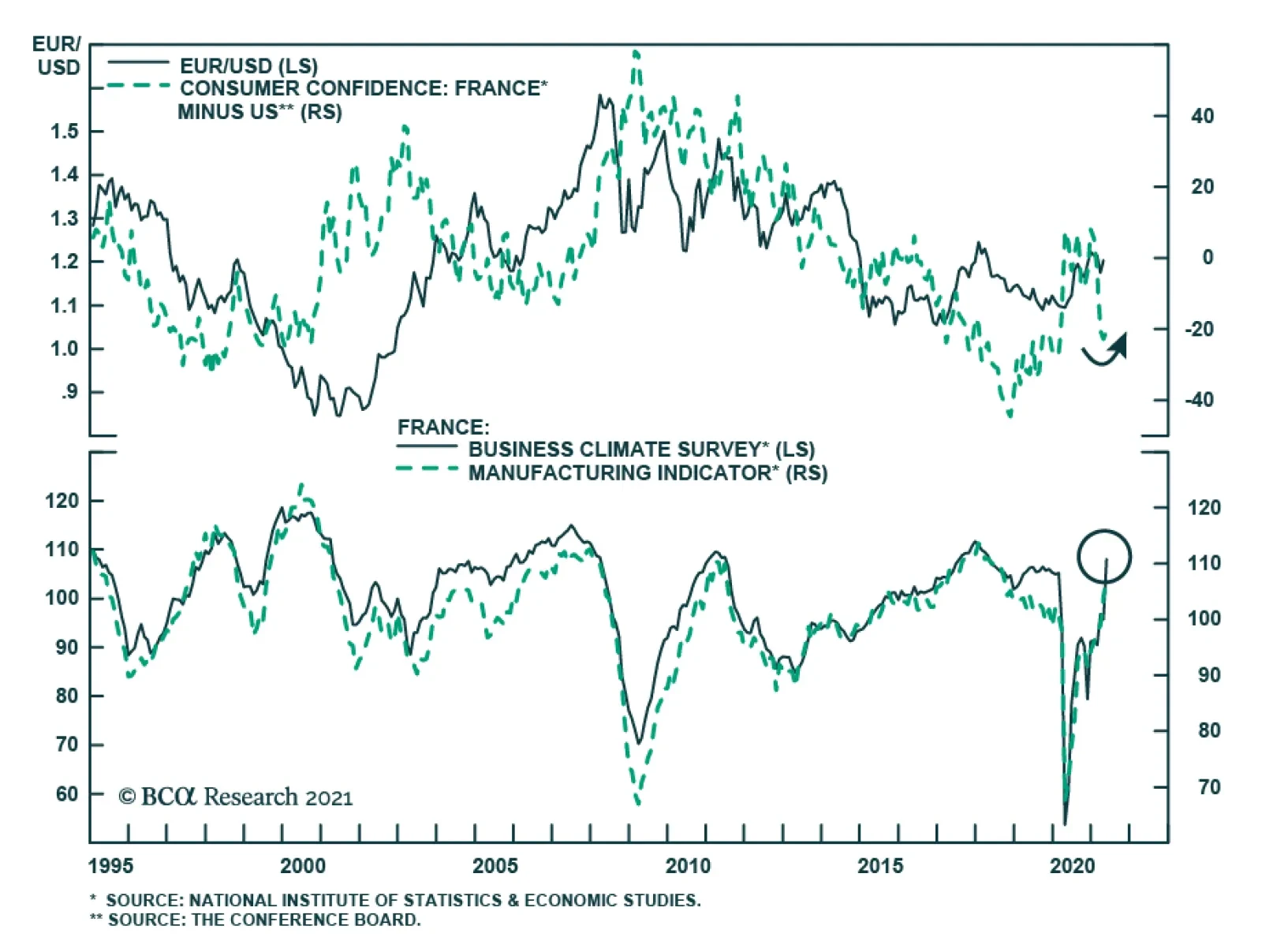

French sentiment improved markedly in May. The INSEE business confidence index jumped to a pandemic-high of 108 in May from 95, beating expectations by 10 points The last time business sentiment was so elevated was in August 2018…

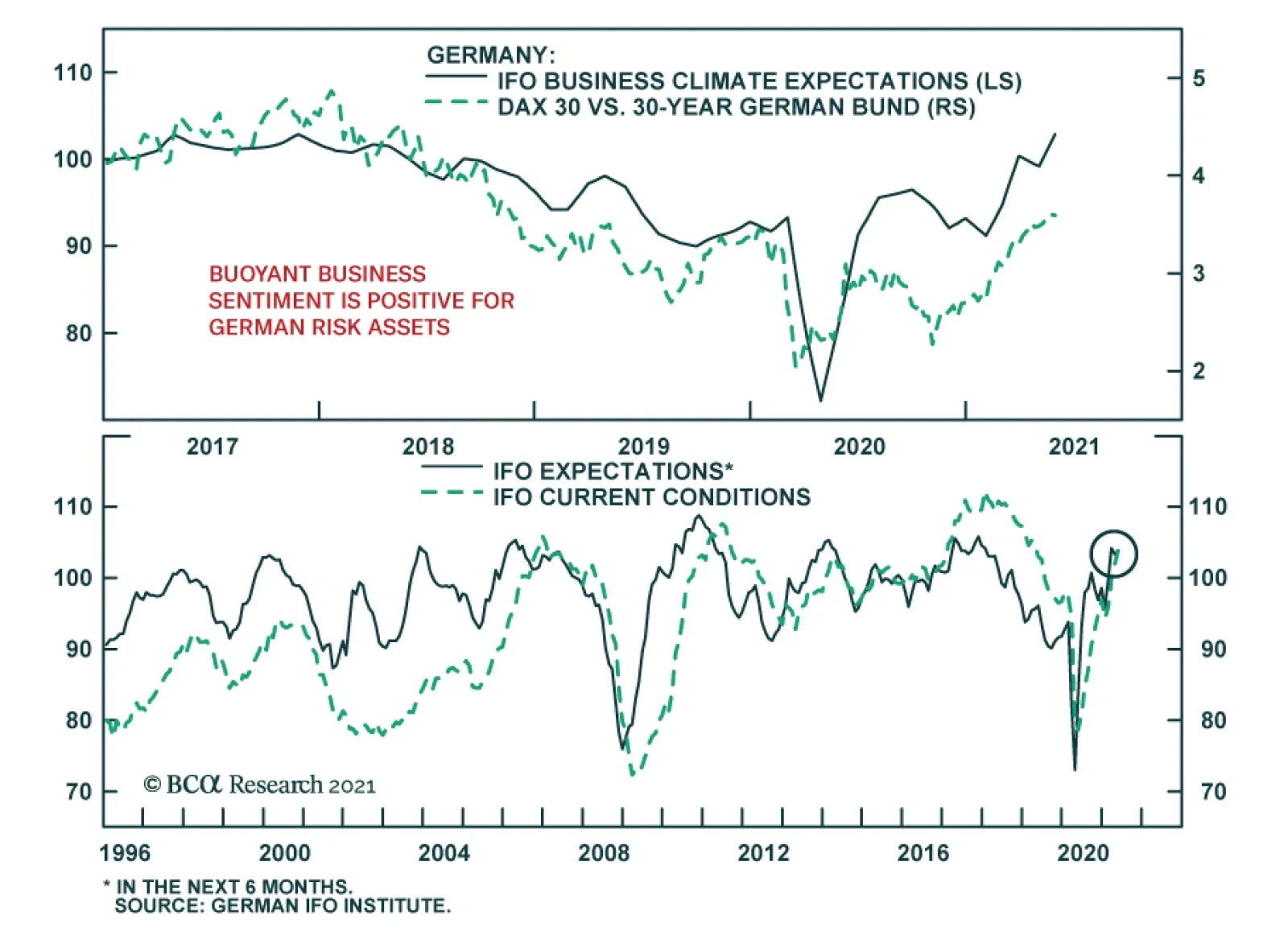

The German IFO rose sharply in May, indicating that business confidence is firming. After a disappointing release in April, the Business Climate index jumped 2.6 points to 99.2, beating expectations of a more muted increase to 98…

Highlights The number one risk to our upbeat view on European economic activity and assets is a Chinese economic slowdown. The second most important risk to our view is a potential deterioration in the global credit impulse, even…

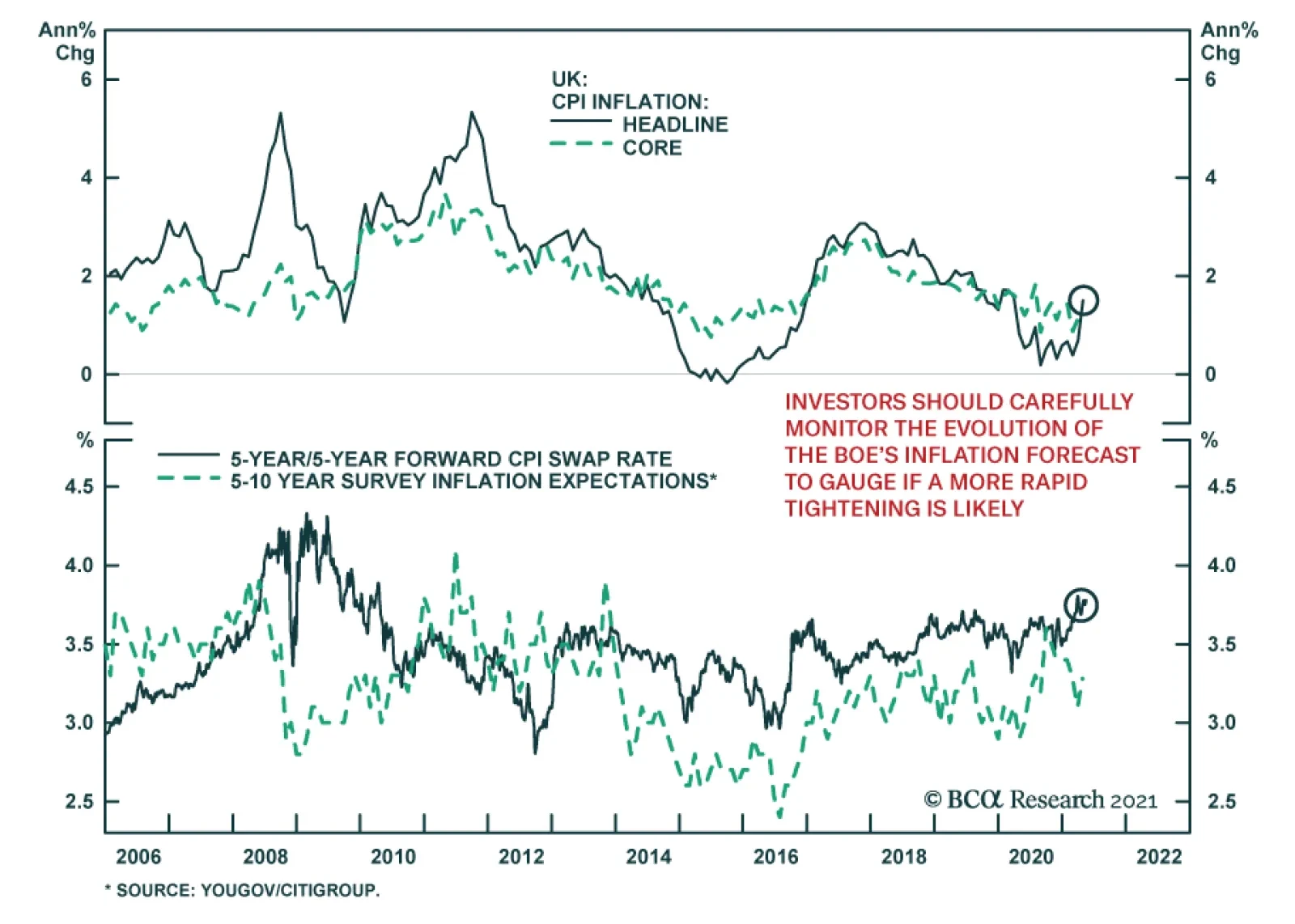

UK inflation doubled in April, rising to the highest level since last March. The consumer price index increased to 1.5% y/y. The acceleration in the monthly pace to 0.6% m/m from 0.3% m/m suggests that more than just base effects…

Highlights ECB Tapering?: Investor fears that the ECB could follow the Bank of Canada and Bank of England and begin to taper its bond buying sooner than expected – perhaps as soon as next month’s policy meeting – are…

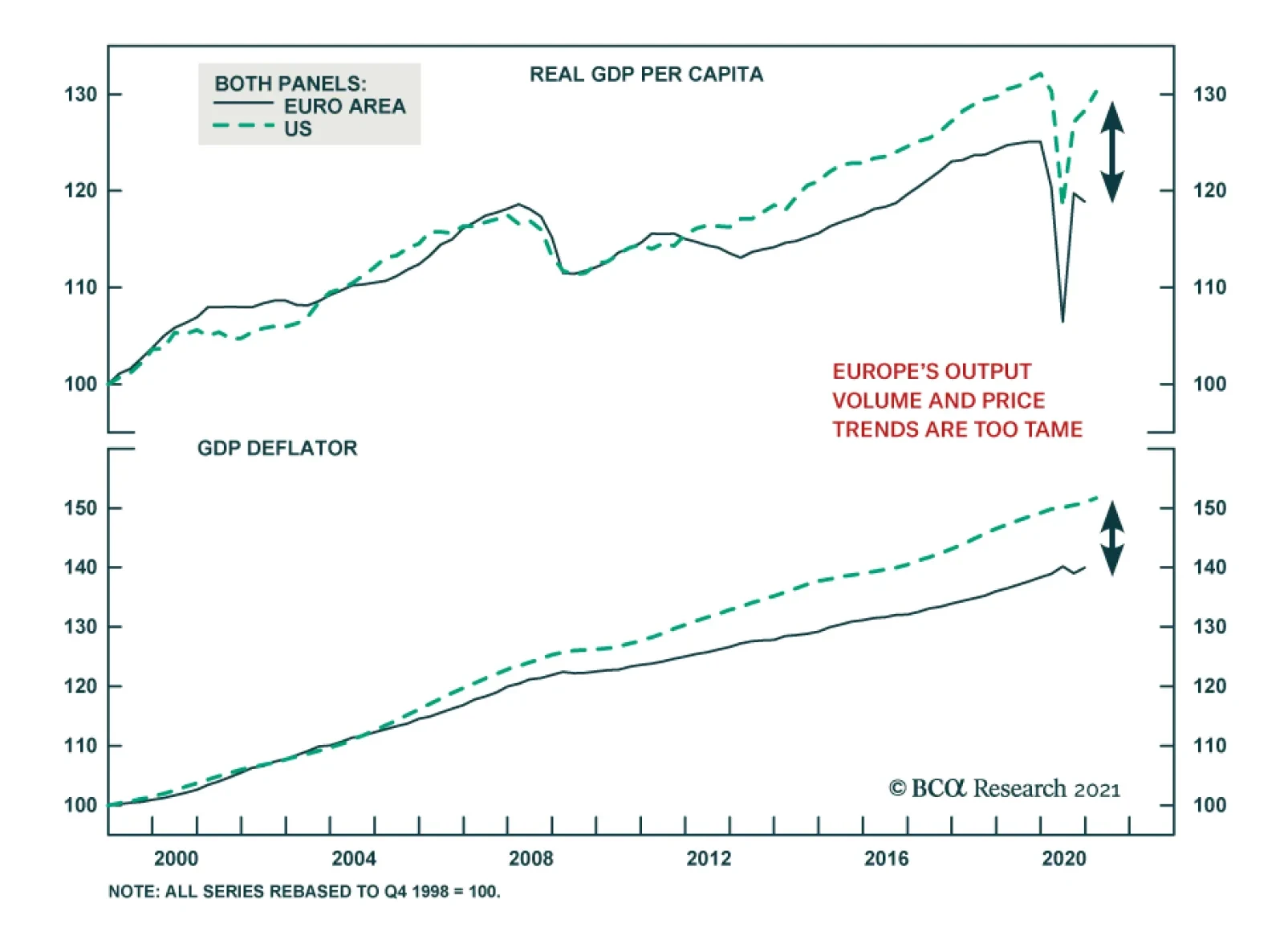

The ECB is not conducting financial repression; rather, it is responding to powerful economic forces in Europe and beyond that are depressing interest rates. Financial repression shows these clear symptoms that the Euro Area does…