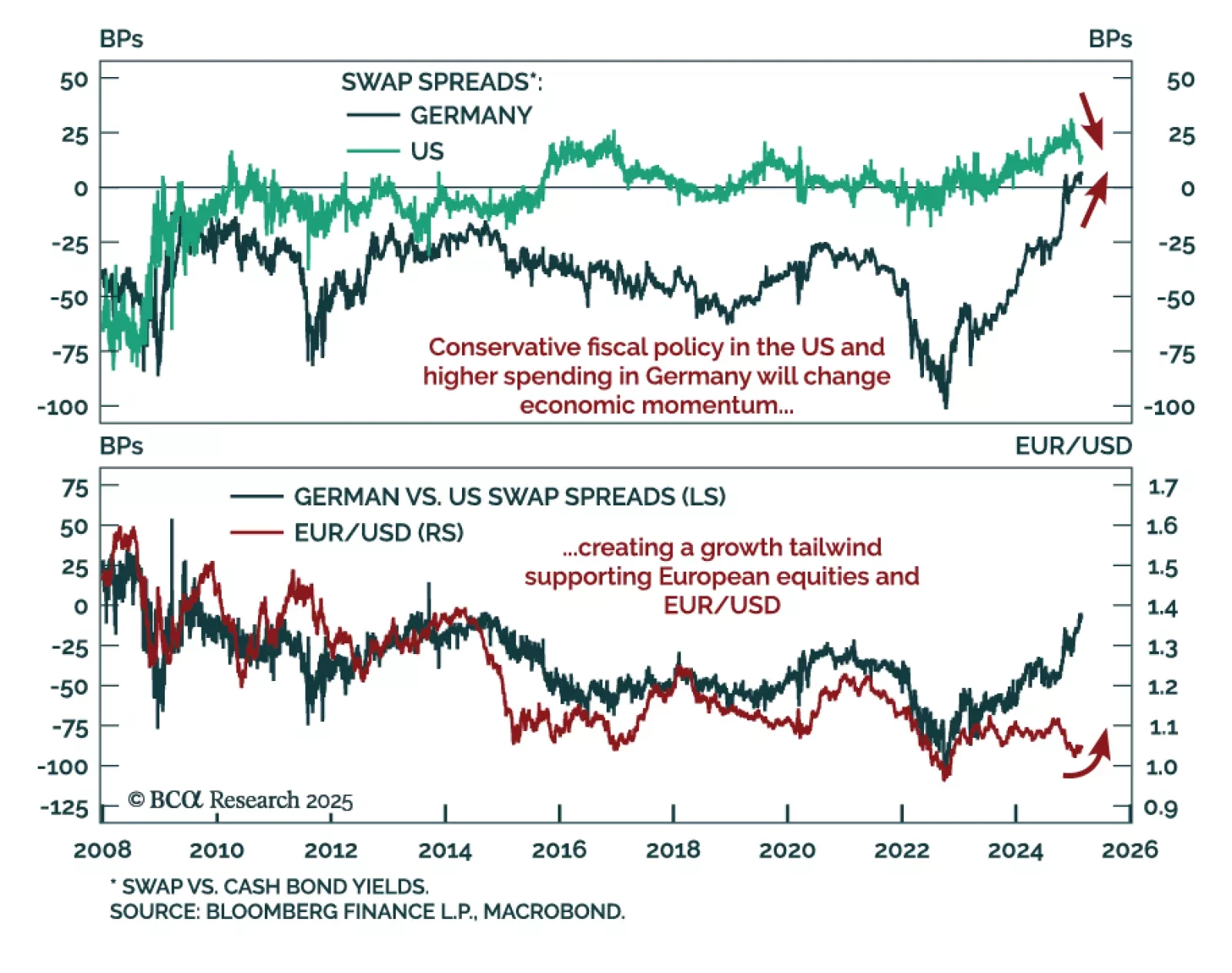

European equities have outperformed the US so far in 2025, especially after Euro Area economic surprises started outperforming as the US is starting to disappoint. The current leadership change between US and European assets reflects…

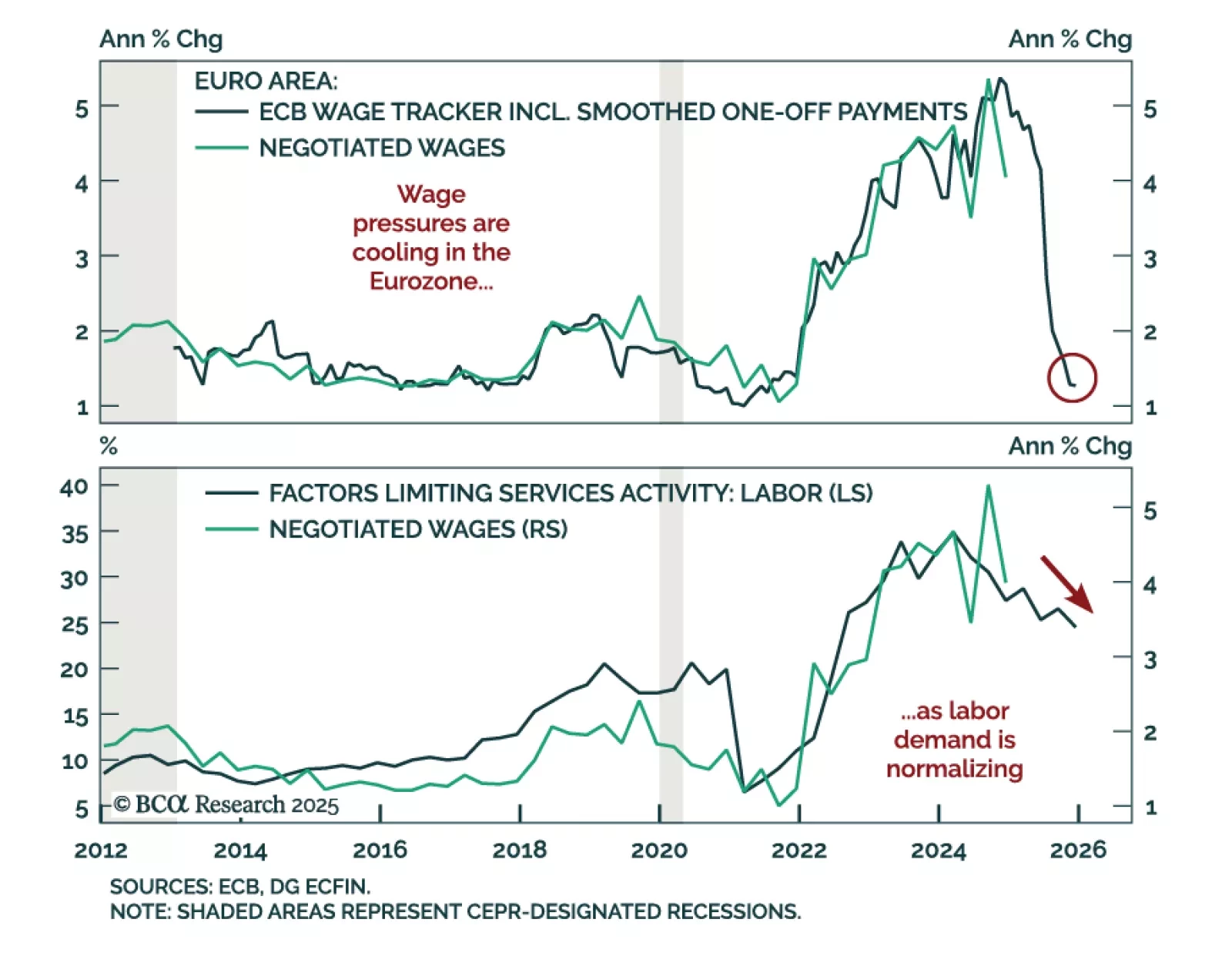

Fourth-quarter European negotiated wages growth cooled to 4.1% y/y, down from the 5.4% peak seen in Q3. The cooling is in line with the ECB’s Wage Tracker showing wage growth decelerating to 1.3% by the end of the year. Labor…

German election results were roughly as expected, but Europe’s biggest economy suddenly just got more interesting. While the details of the governing coalition have yet to be finalized, Chancellor Merz has floated options to ease the…

Trump’s ceasefire talks are positive for Germany – and so was the German election result. But Trump’s tariffs will hit Germany soon. Investors should use near-term volatility to increase exposure to Germany.

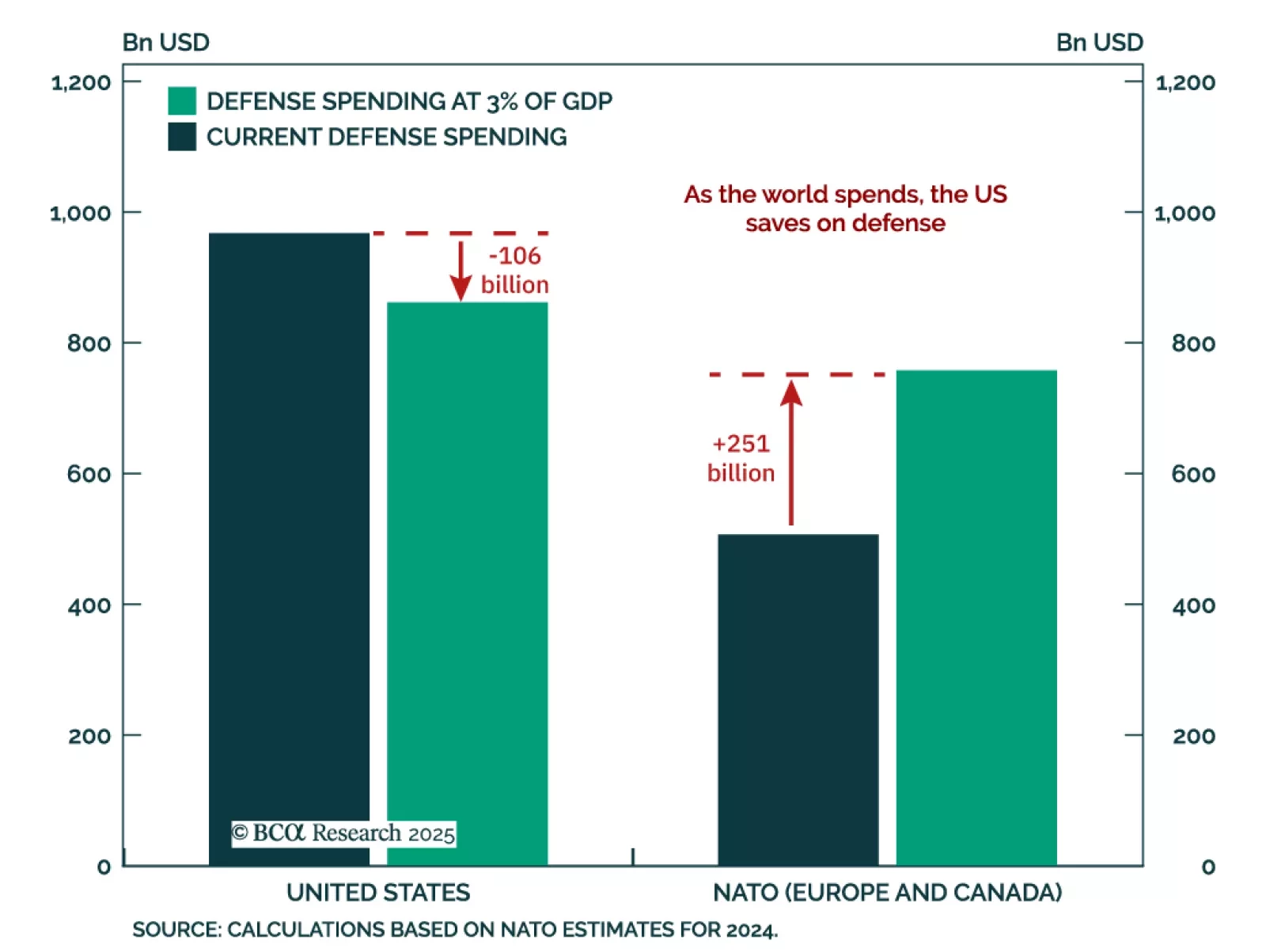

Our GeoMacro and Global Investment strategists crunched the numbers to determine what the world owes the US for its security commitments. The US administration views trade deficits and defense commitments as interconnected…

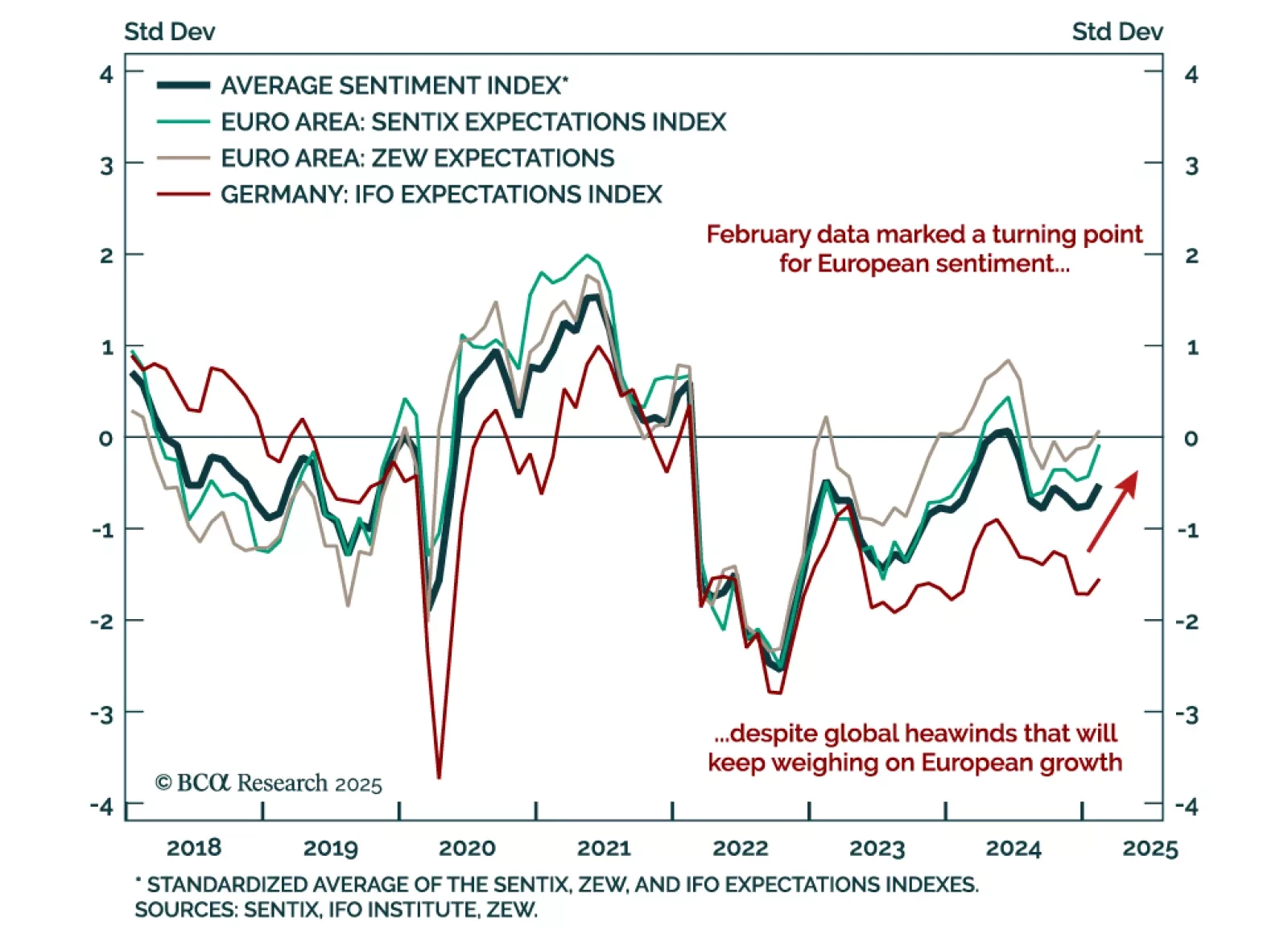

The February Ifo Business Climate index for Germany slightly missed estimates, staying unchanged from 85.2 in January. While respondents’ assessment of the current situation weakened, expectations rebounded to 85.4 from 84.3. …

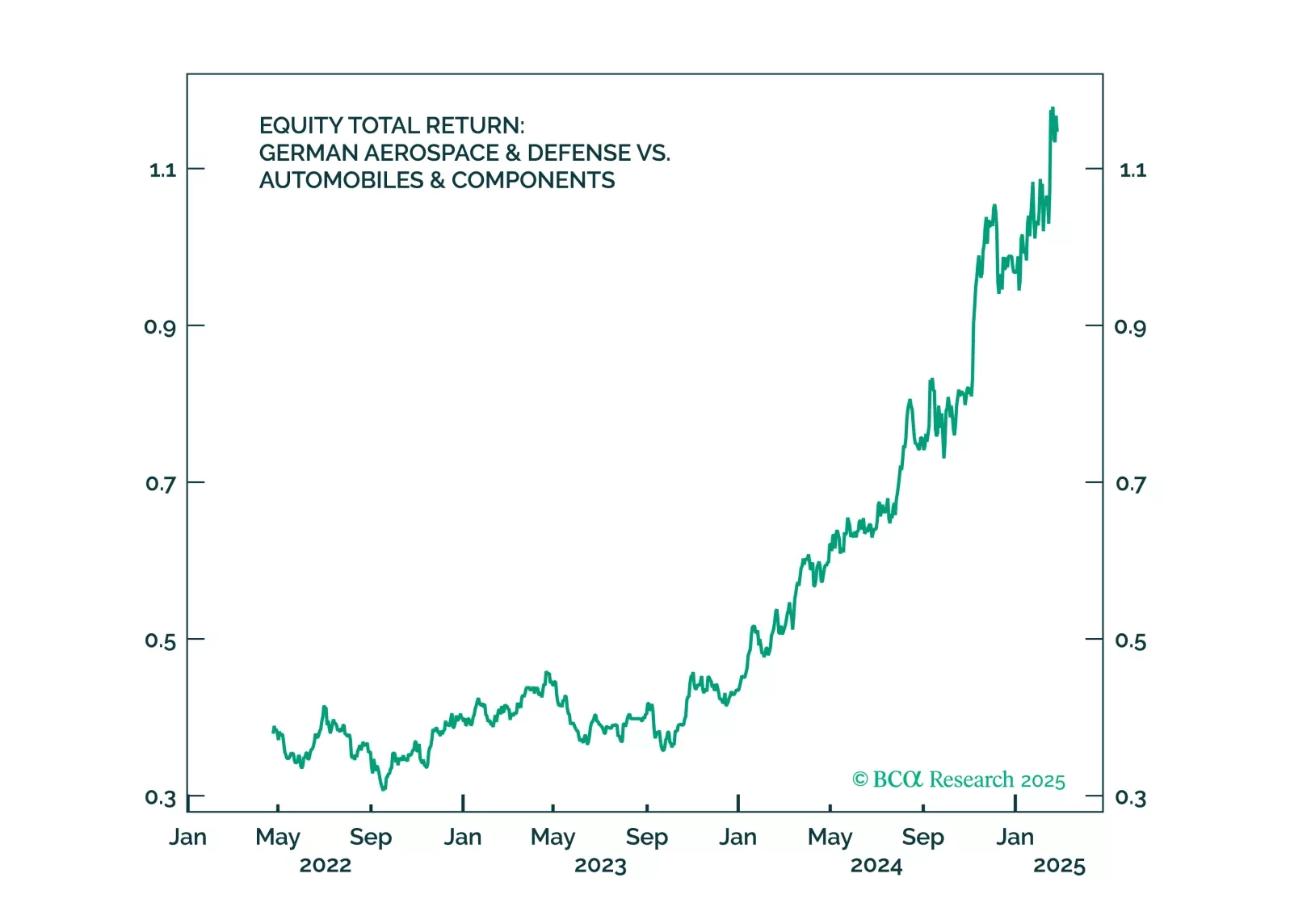

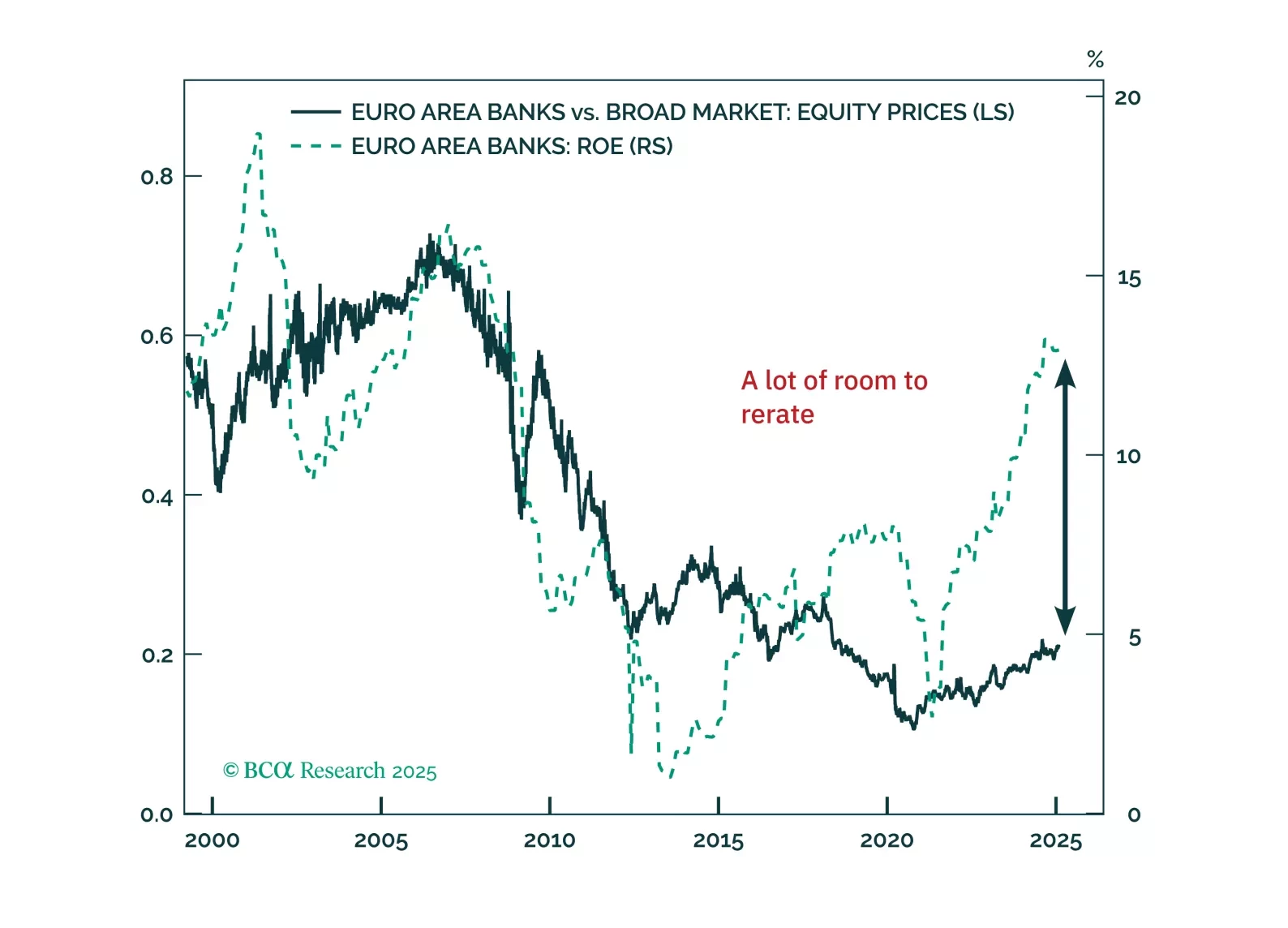

Eurozone banks have quietly outpaced the Magnificent 7—can they keep winning? With strong balance sheets, rising profitability, and structural tailwinds, European lenders still offer value despite short-term risks. Meanwhile, German…

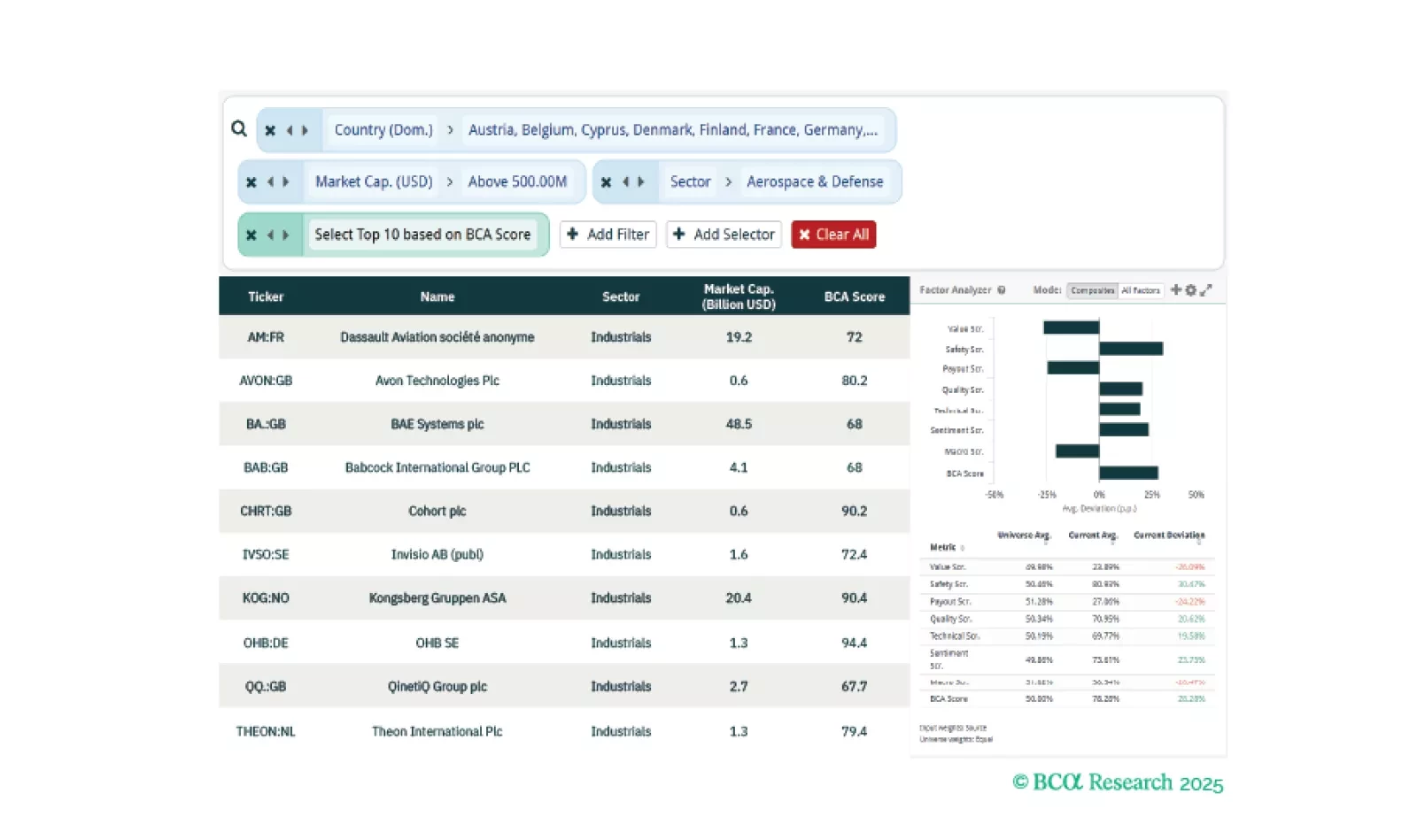

This week, our three screeners cover equity plays in European Defense, Chinese Tech, and “Boring Stocks”.

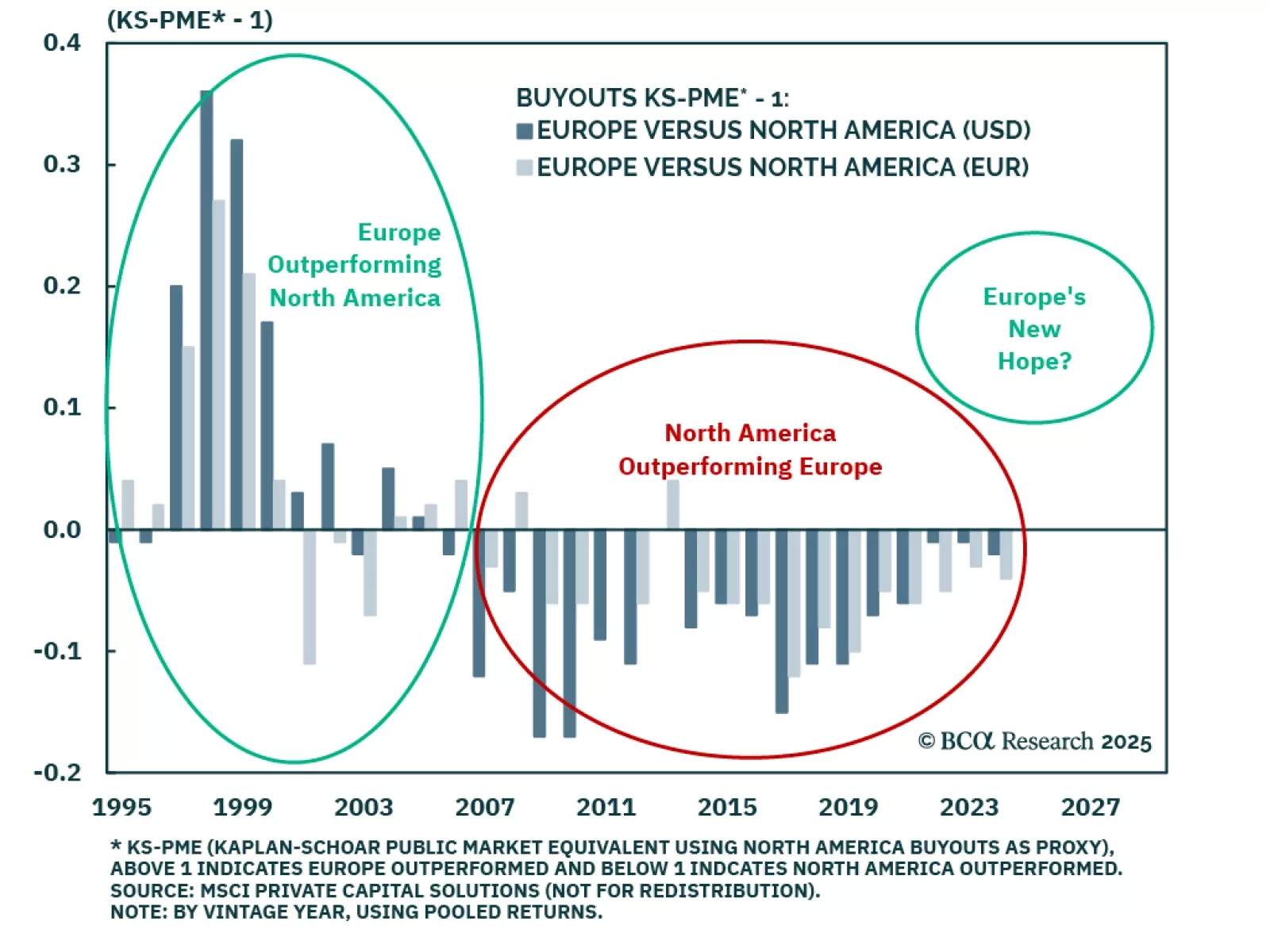

Our Private Markets & Alternatives strategists built on our European and GeoMacro strategists’ recent work, and looked at the private credit and equity opportunities in Europe. Structural reforms and macro catalysts are…

A nascent theme in the latest data is the broad improvement in European sentiment. The February Sentix and ZEW surveys both improved, and flash estimates for European consumer confidence beat estimates, ticking up to -13.6%.…