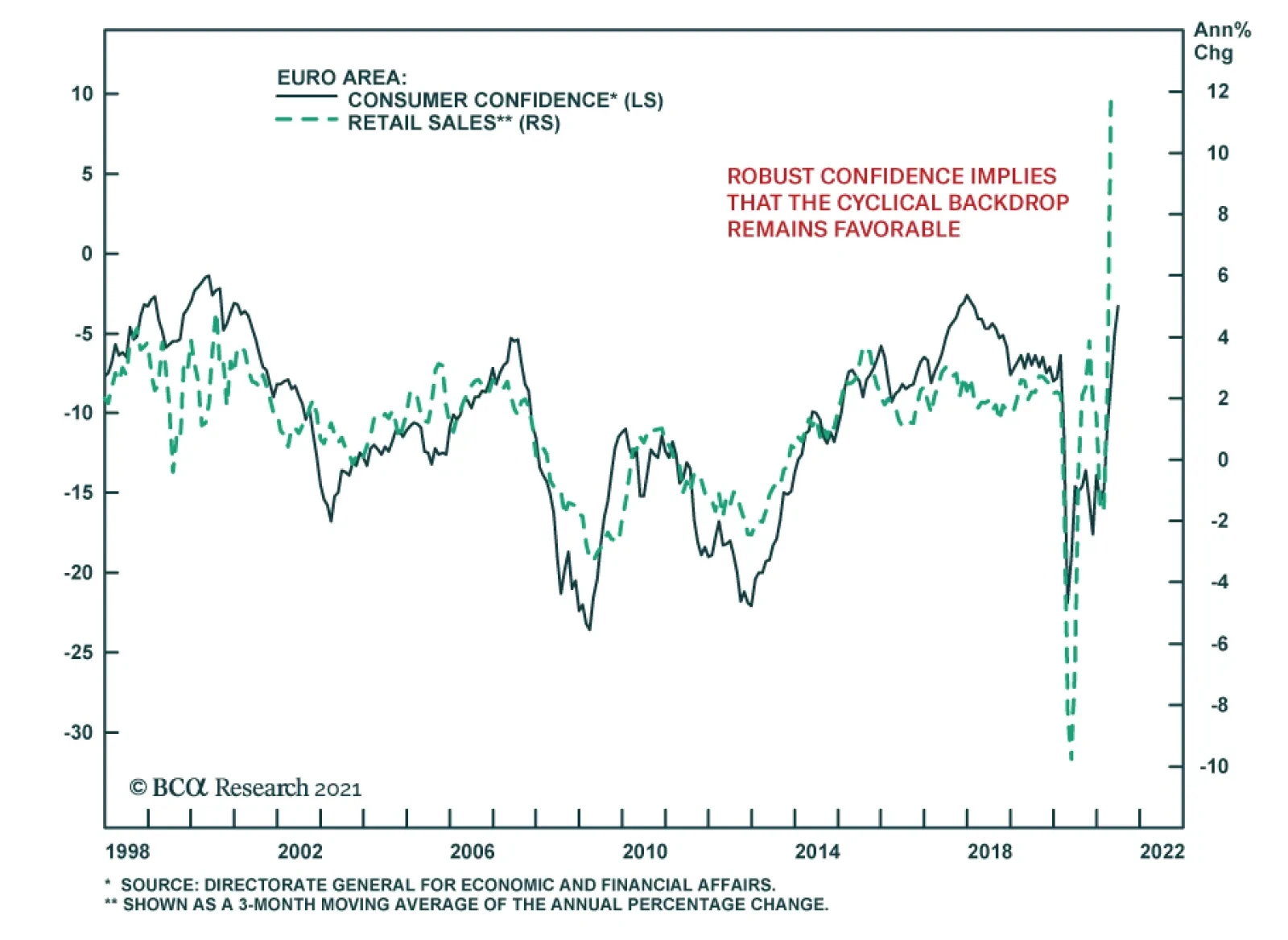

Falling COVID-19 infections, broadening vaccine campaigns, and easing restrictions are having a positive impact on European sentiment. Eurozone consumer confidence increased 1.8 points in June to -3.3, broadly in line with…

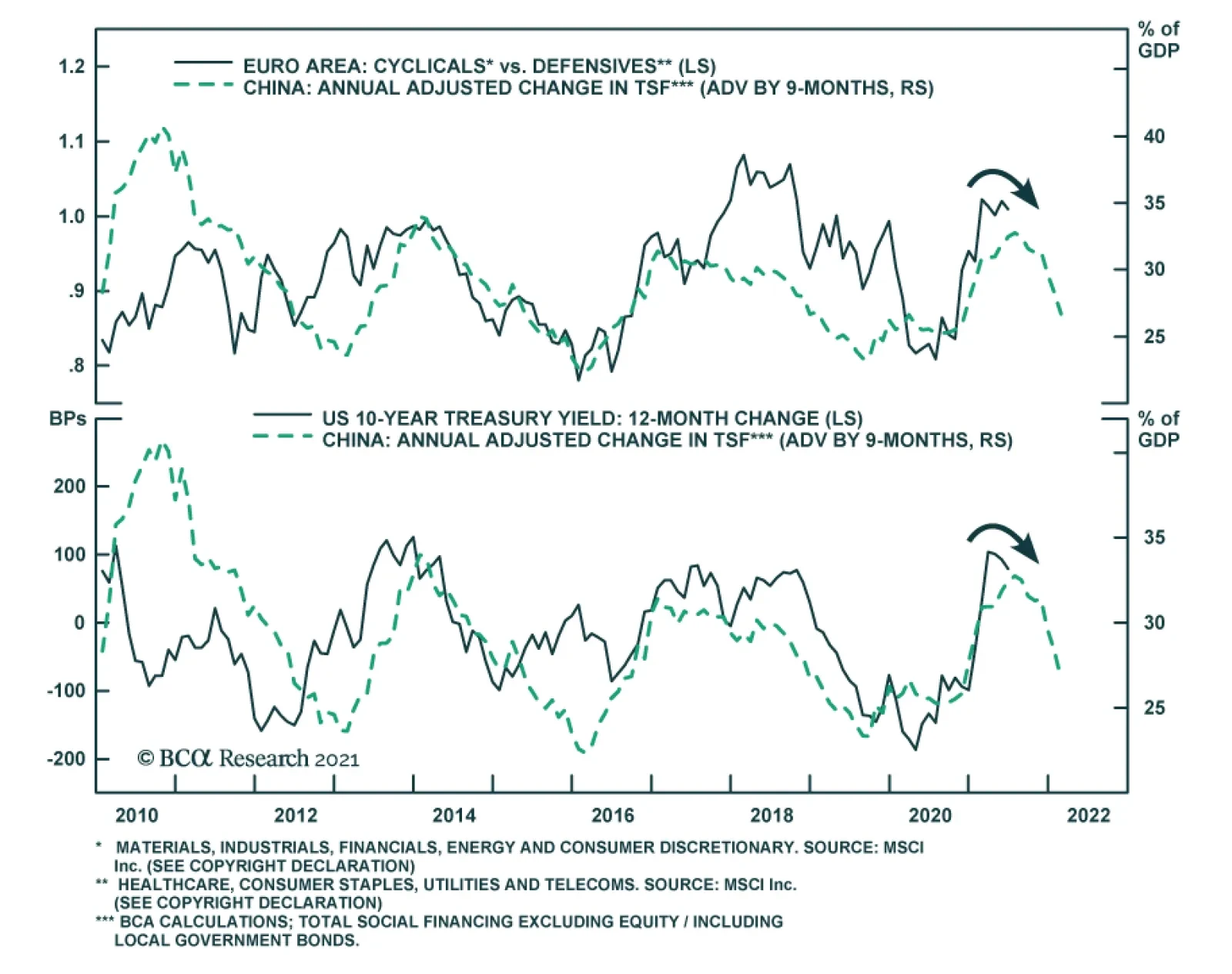

BCA Research’s European Investment Strategy service recommends that investors tactically downgrade cyclical equities from overweight in Europe. This summer, three forces will feed some downside risk in the market and,…

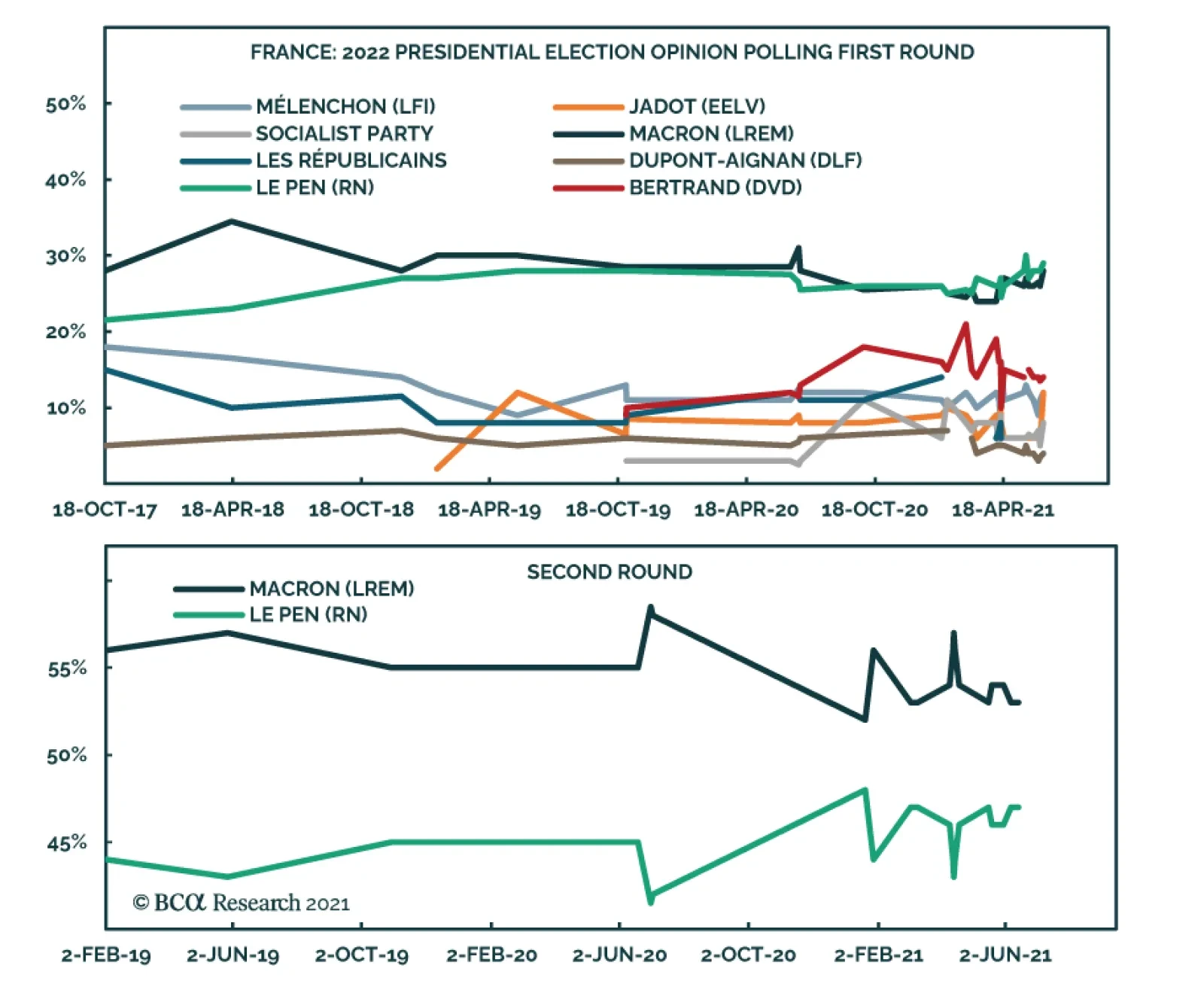

The first round of French regional elections was a disappointment for both Marine Le Pen’s Rassemblement National (RN) as well as President Emmanuel Macron’s La République En Marche (LREM). RN obtained 19% of…

Highlights Tactically downgrade cyclical equities from overweight in Europe. The shift in global growth drivers, the beginning of the global liquidity withdrawal, and lingering COVID worries create headwinds for the cyclicals-to-…

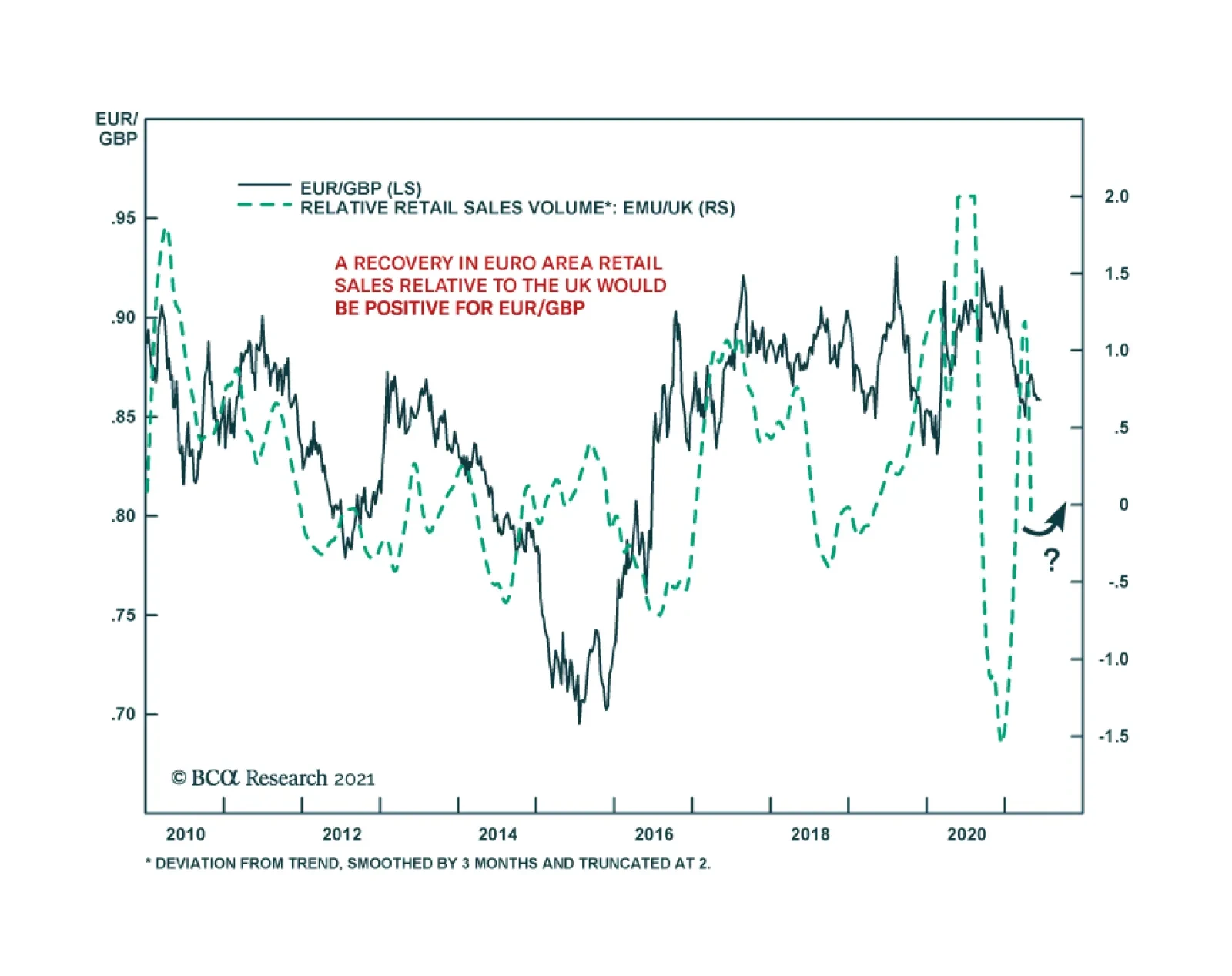

UK retail sales declined unexpectedly in May. The headline number fell 1.4% m/m following a 9.2% m/m jump in April, disappointing expectations of a deceleration to 1.5%. Similarly, sales excluding auto fuel were down 2.1% m/m…

Highlights Oil demand expectations remain high. Realized demand continues to disappoint. This means OPEC 2.0's production-management strategy – i.e., keeping the level of supply below demand – will continue to dictate…

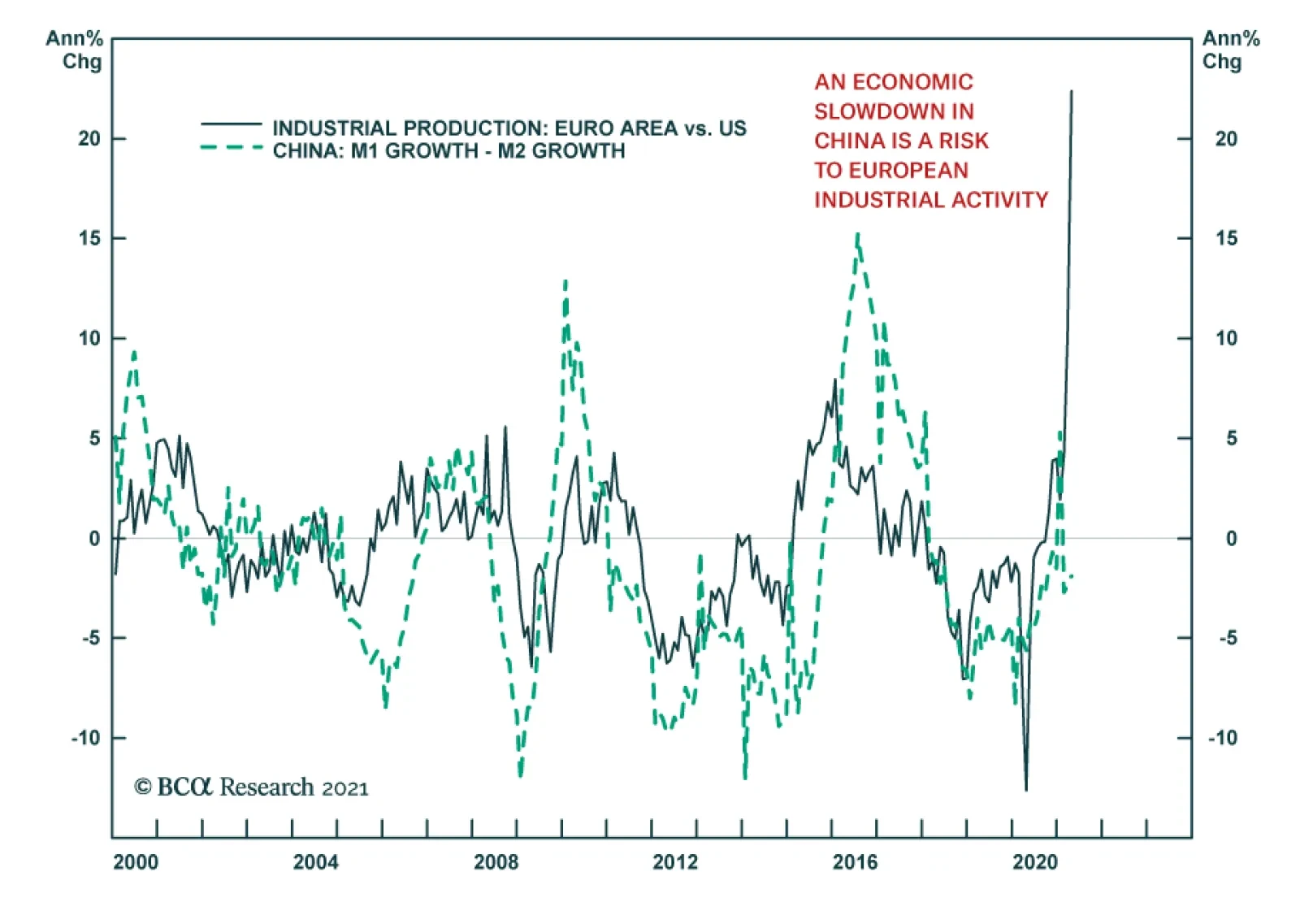

Euro Area industrial production surprised to the upside in April. IP surged 39.3% y/y, following an 11.5% y/y increase in March. However, most of this acceleration reflects the impact of last year’s base effect. On a…

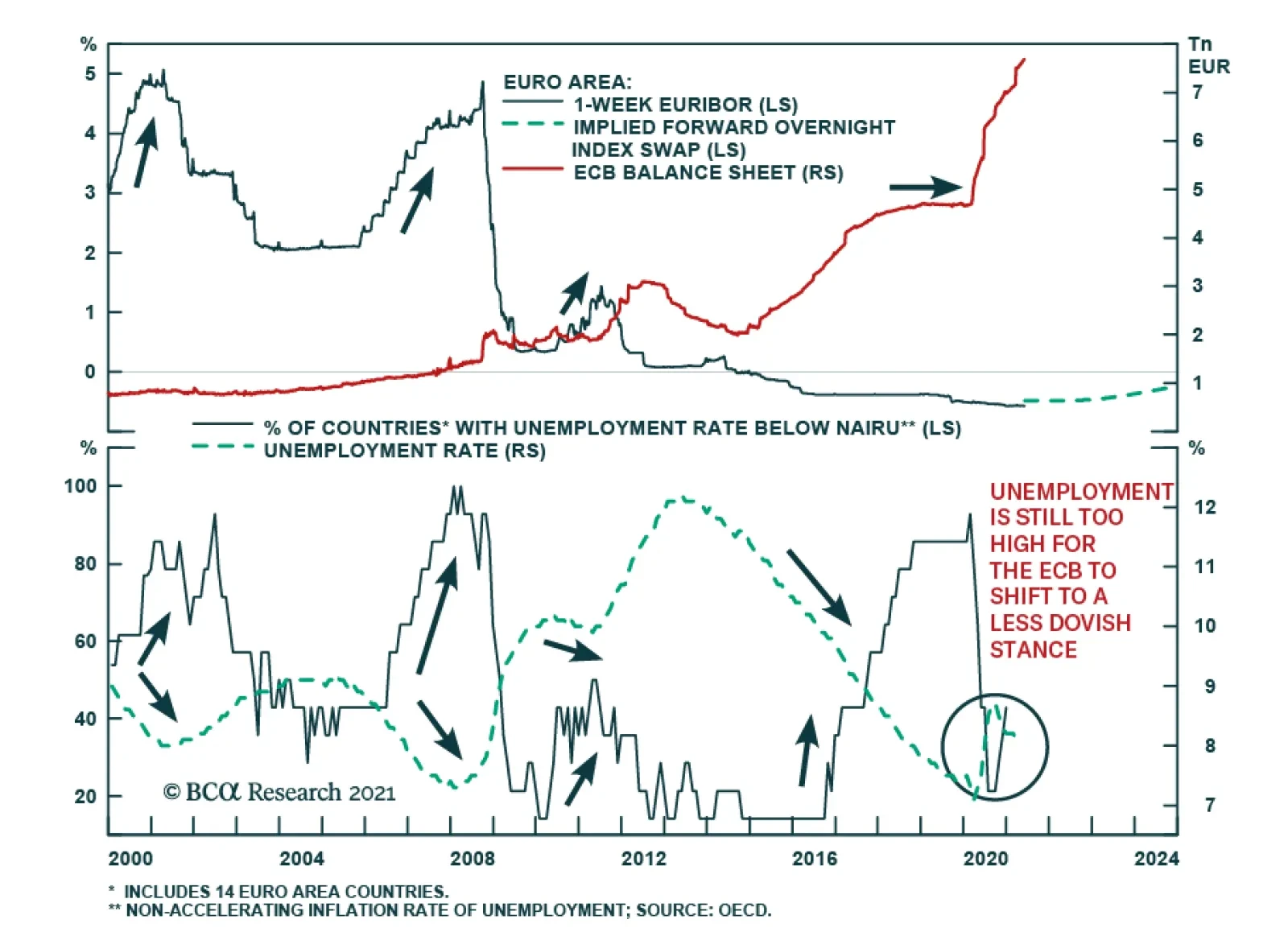

Highlights The ECB did not tighten policy, despite its upgrade to the Euro Area growth outlook. The rise in the Eurozone inflation will be transitory. The Euro Area continues to suffer from excessive slack, and current price…

Highlights Geopolitical risk is trickling back into financial markets. China’s fiscal-and-credit impulse collapsed again. The Global Economic Policy Uncertainty Index is ticking back up after the sharp drop from 2020. All of our…

Even though the ECB revised up its GDP growth and inflation forecasts for 2021 and 2022 at its latest meeting on Thursday, it kept policy unchanged and did not signal a plan to taper purchases. Instead, the press statement…