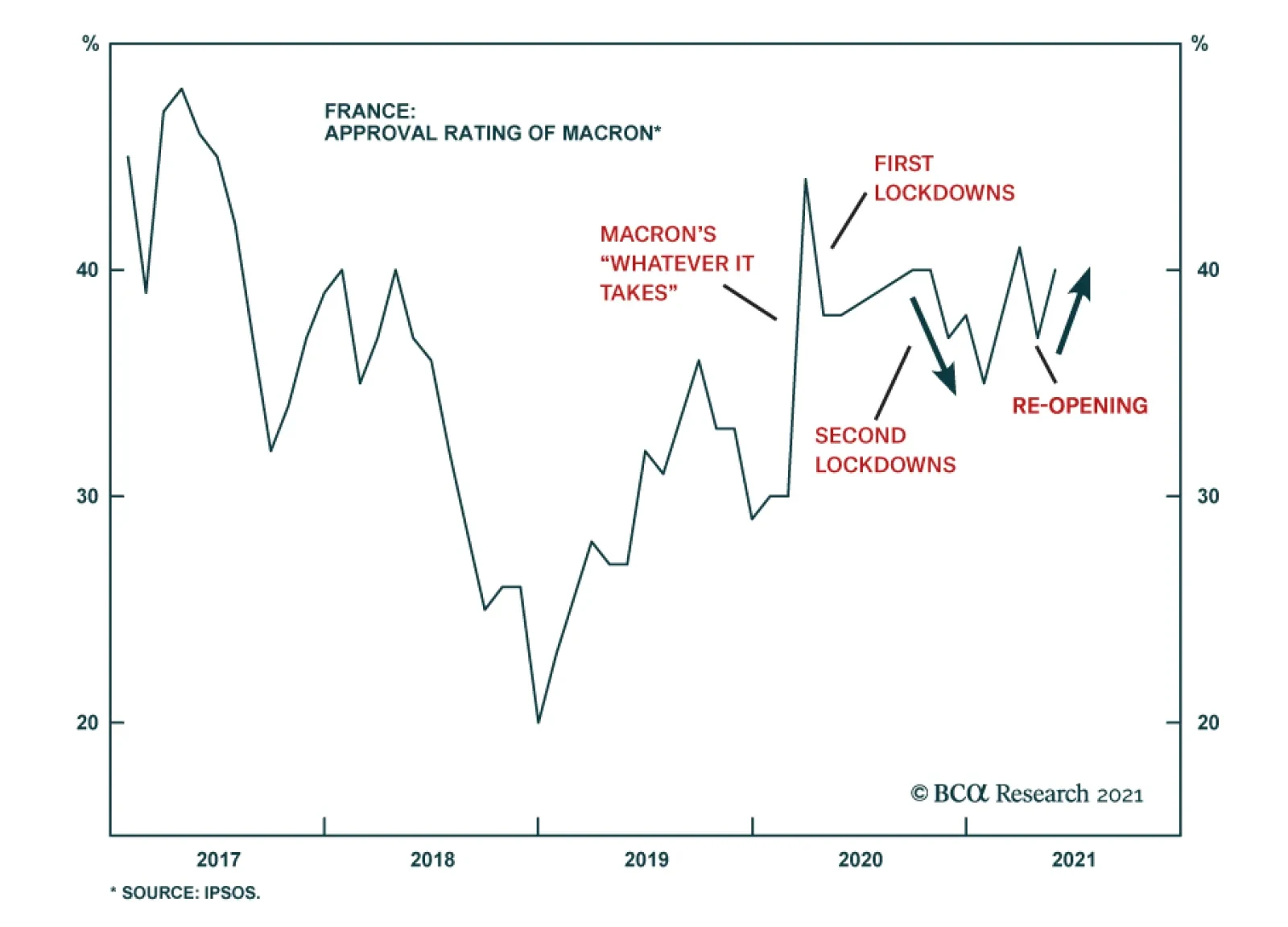

The French presidential election is nine months away, and it is already starting to catch investors’ attention as one of the main political events in Europe in 2022. According to BCA Research’s European Investment…

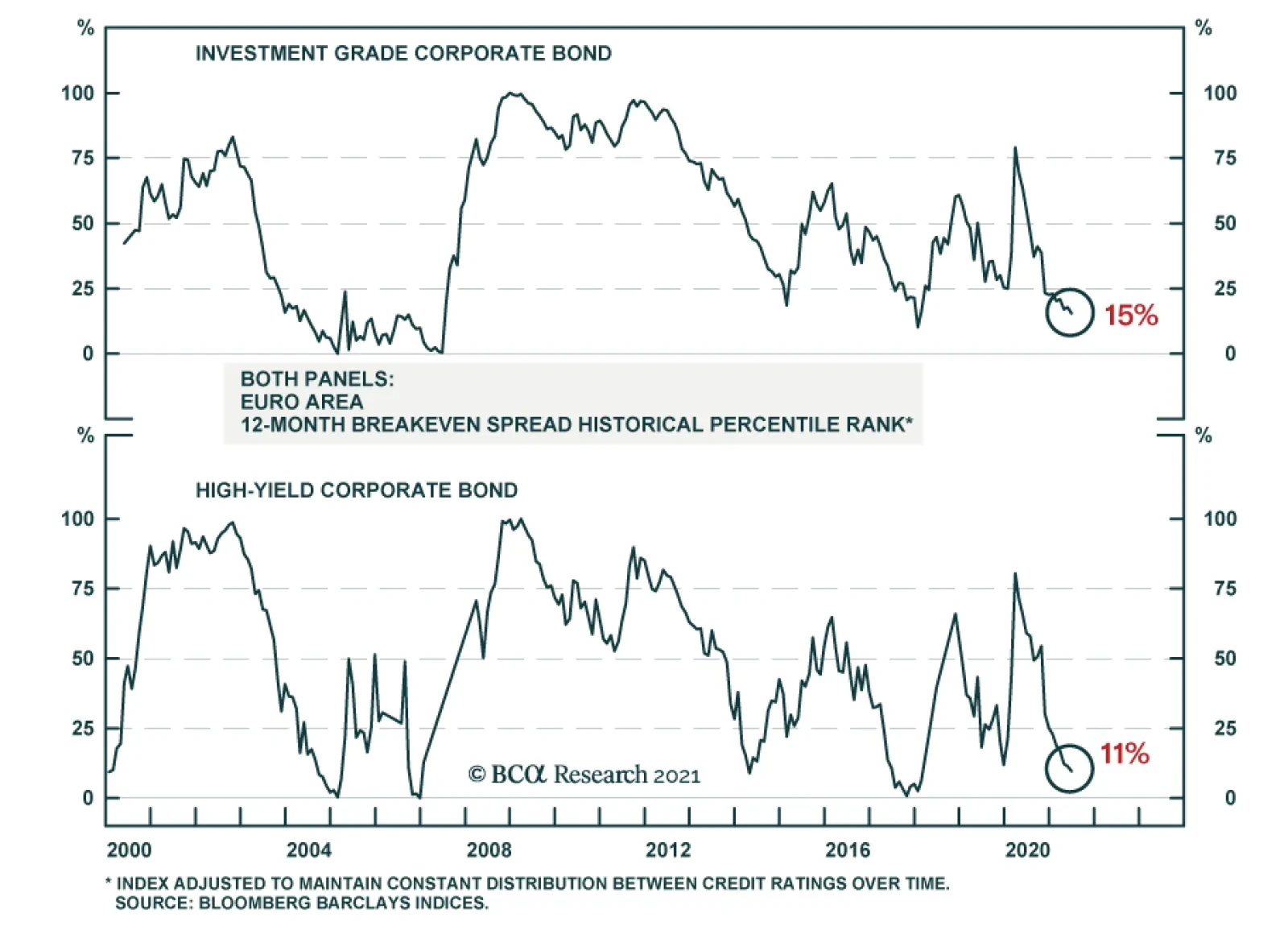

BCA Research’s European Investment Strategy service recommends that investors continue to favor investment grade corporate bonds within European fixed-income portfolios over high-yield corporate bonds. Eurozone investment…

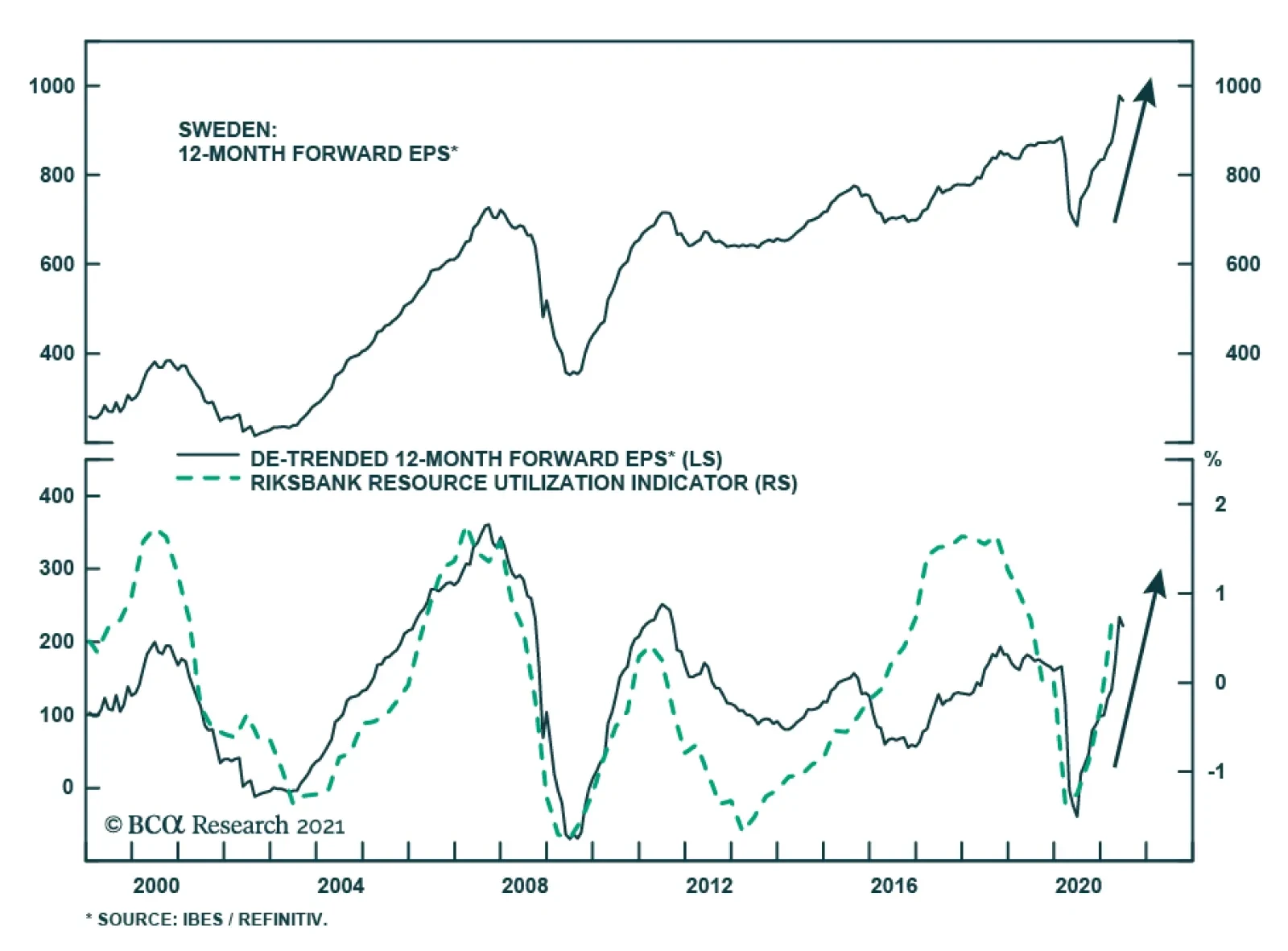

The Swedish retail sales are growing smartly. After a 0.4% contraction in April, they expanded 2.3% in May and annual growth accelerated from 7% to 10.3%. House prices are rising at a double digit pace, which historically leads…

Highlights Euro Area debt loads have increased significantly during the pandemic. Debt loads are not uniform. While Germany and, to a lesser extent, Spain look best, France has a less attractive total debt profile than Italy.…

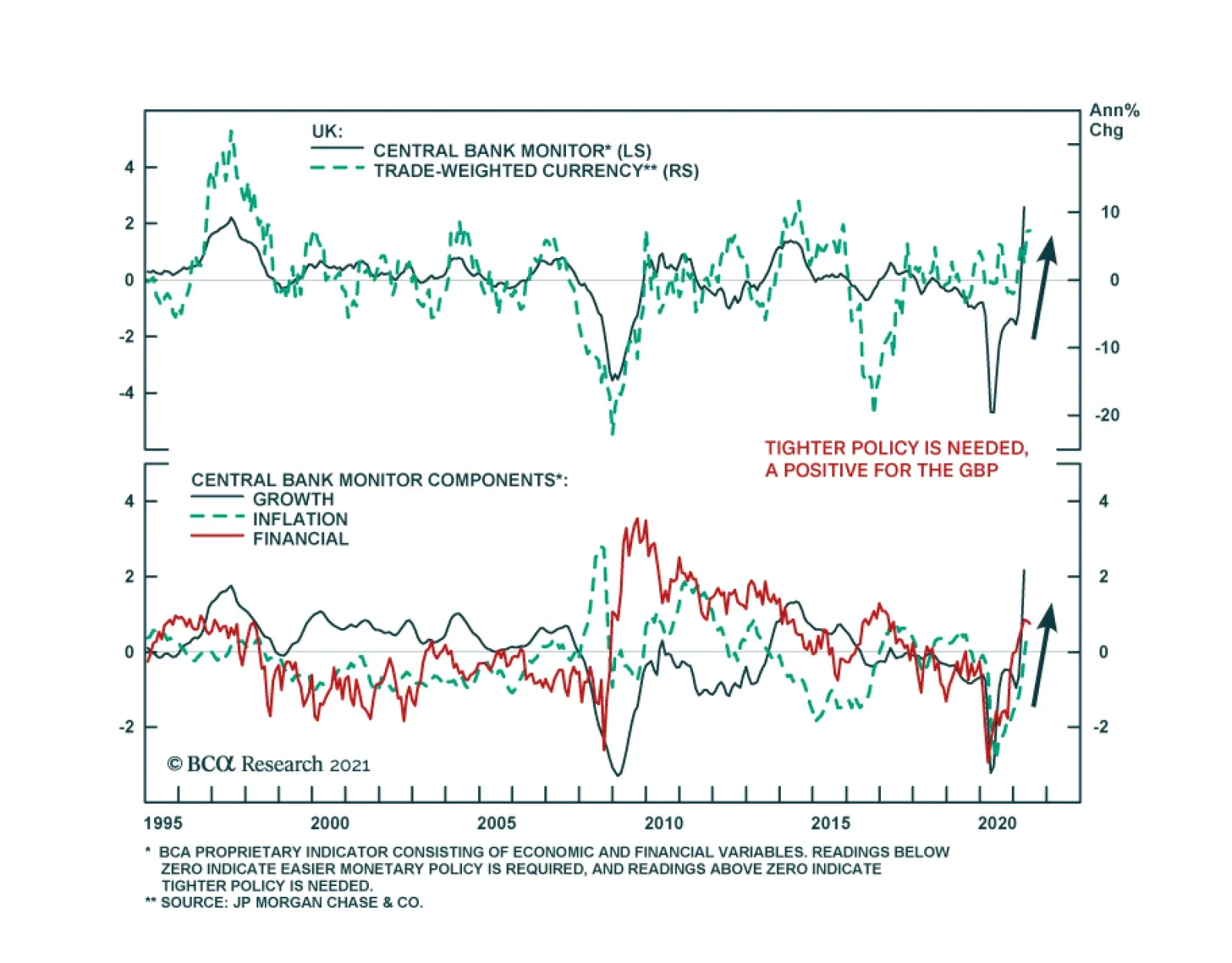

The Bank of England did not announce any policy changes following the conclusion of the MPC meeting on Thursday. Instead, the central bank now projects that inflation will “exceed 3% for a temporary period” – an…

Highlights The US is withdrawing from the Middle East and South Asia and making a strategic pivot to Asia Pacific. The third quarter will see risks flare around Iran and the US rejoin the 2015 Iranian nuclear deal. The result is…

Highlights The ongoing transition to a post-pandemic state and fiscal policy are either positive or net-neutral for risky asset prices. Fiscal thrust will turn to fiscal drag over the coming year, but the negative impact this will…