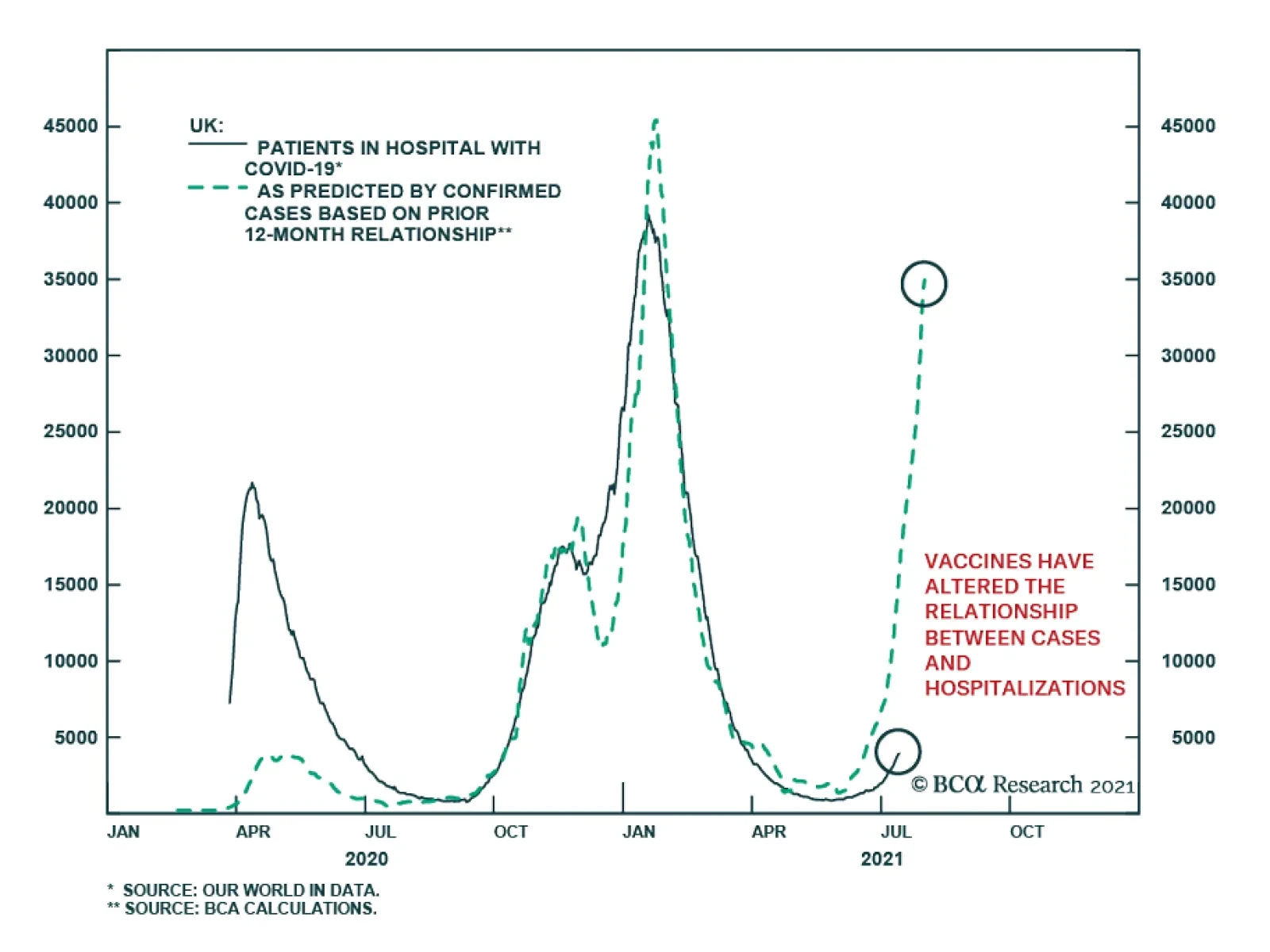

Stock markets rebounded on Tuesday after a meaningful Monday selloff, which was driven by concerns that the delta variant of COVID-19 may delay the transition to a post-pandemic world. The chart above presents the optimistic…

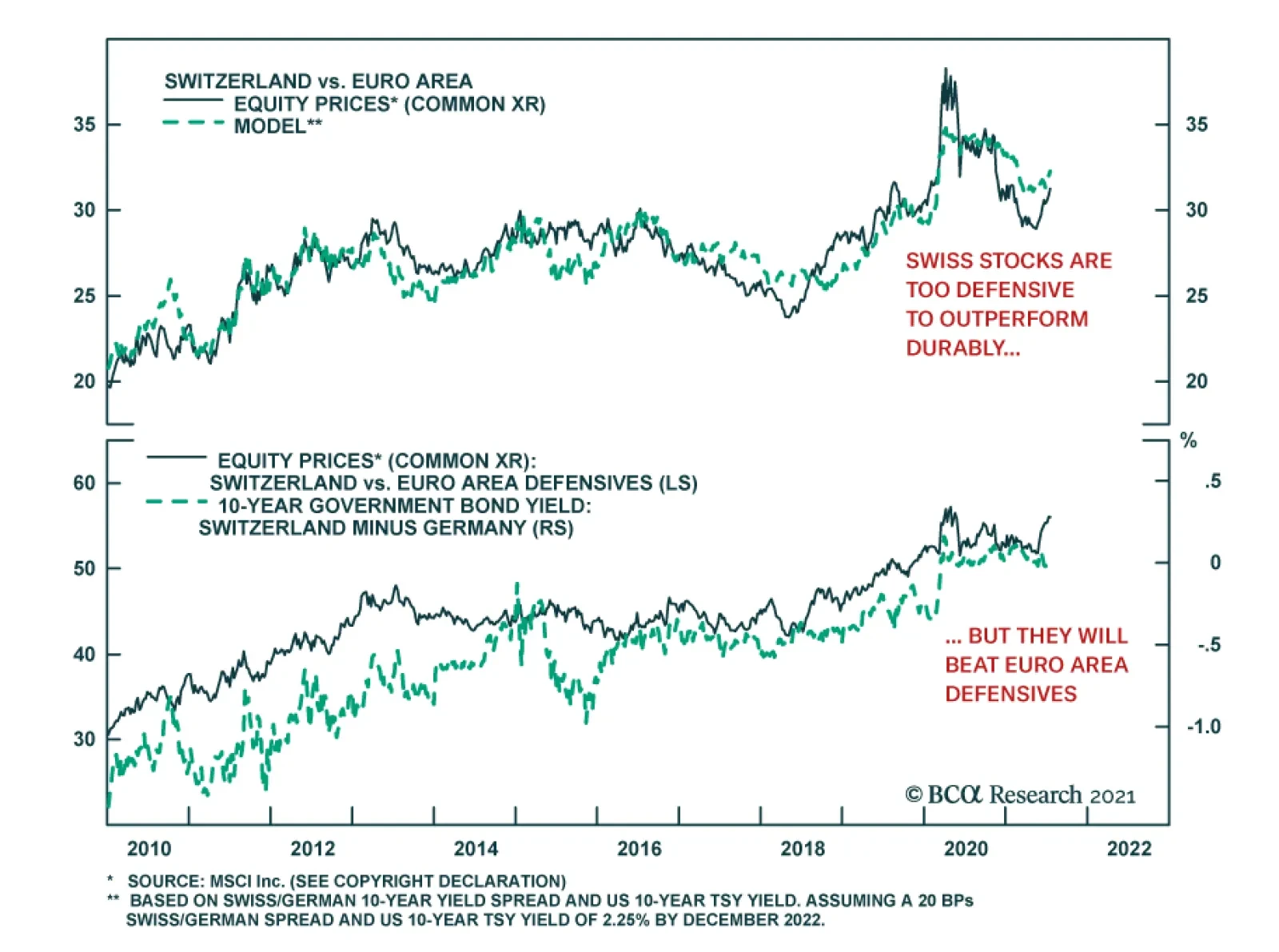

BCA Research’s European Investment Strategy service concludes that the Swiss National Bank will follow the ECB and expand its balance sheet further. Swiss headline and core inflation linger at 0.6% and 0.4%, respectively…

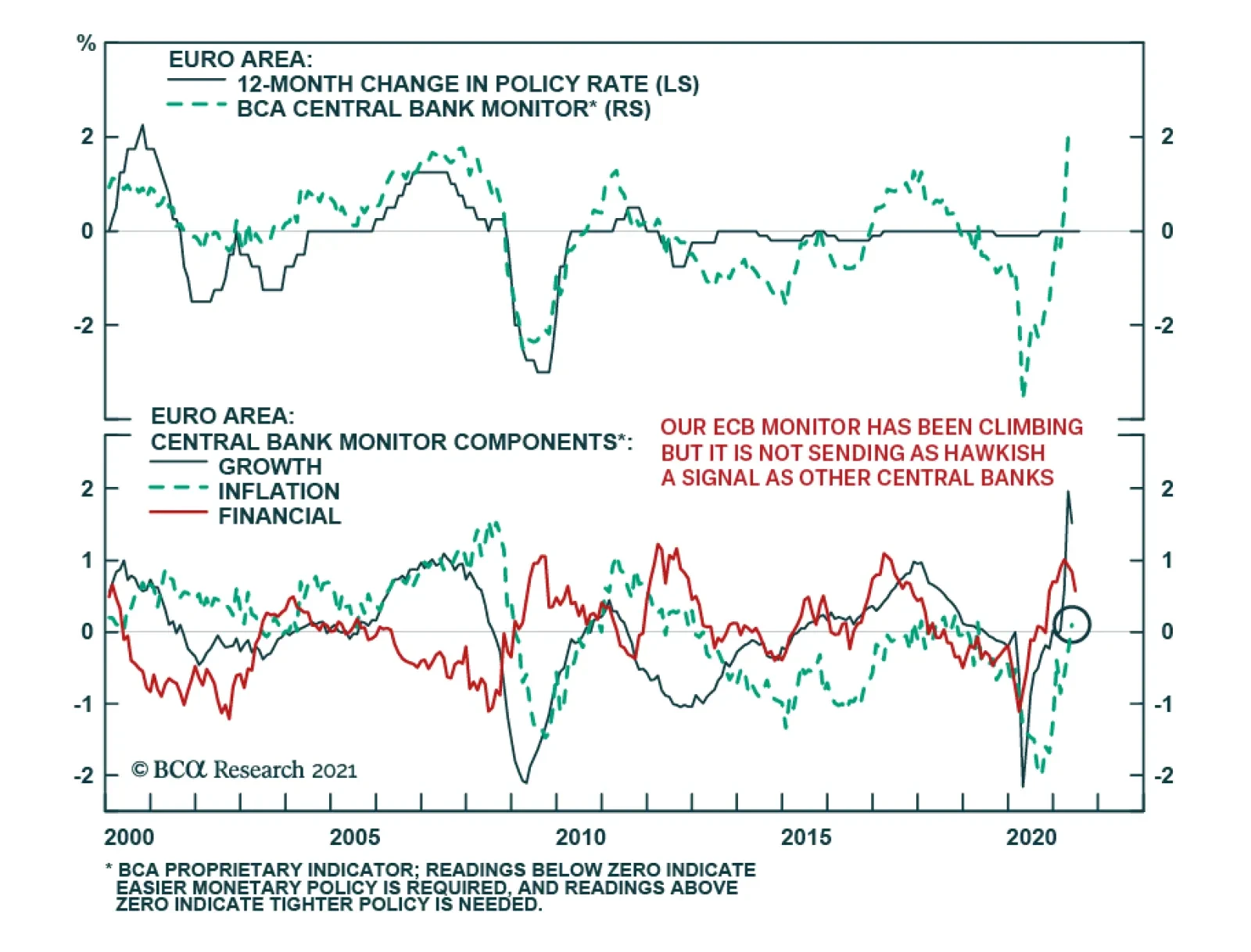

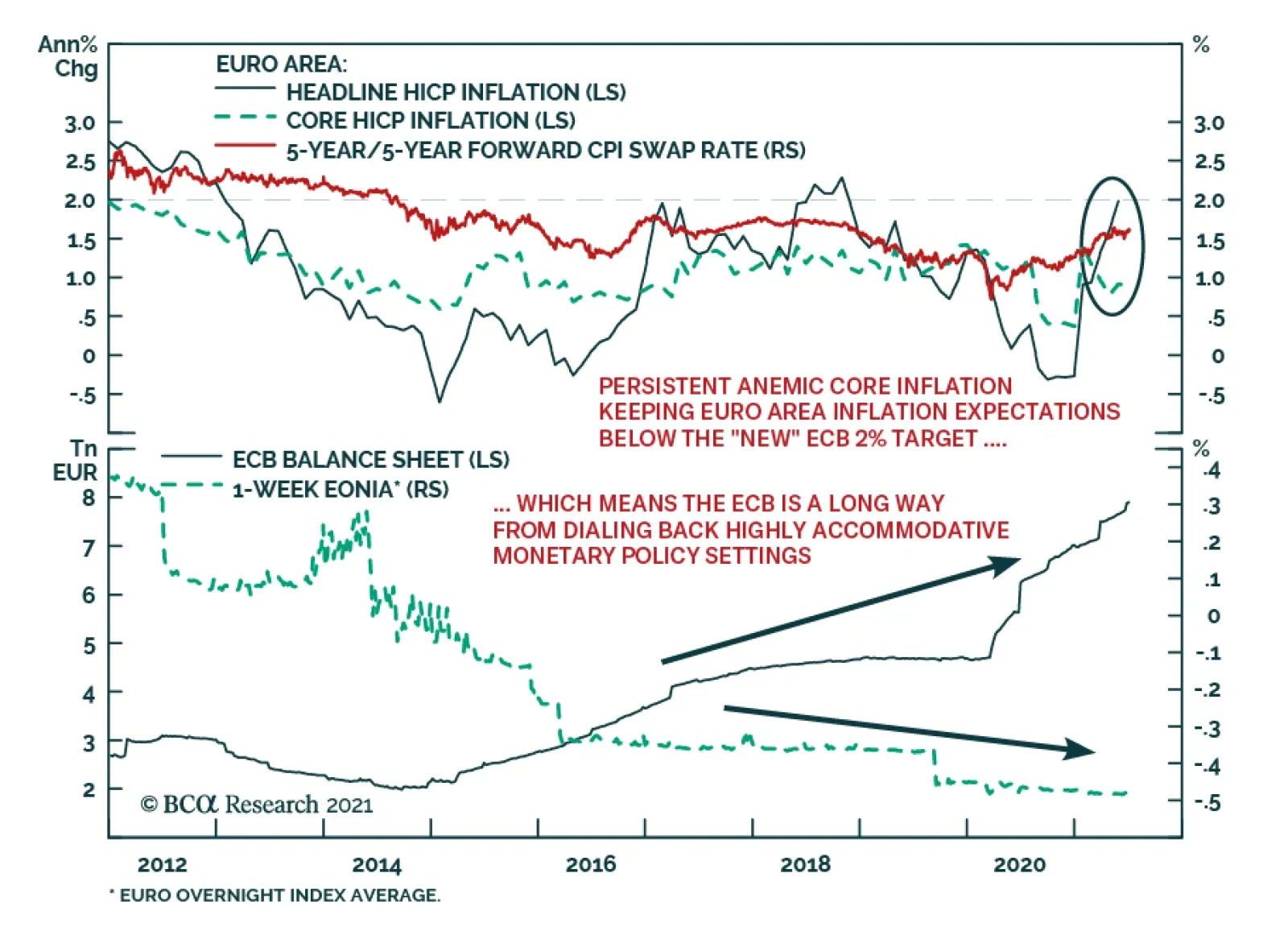

Highlights The ECB has changed its inflation target, but its credibility remains weak. Inflation will not allow the ECB to tighten policy anytime soon. Instead, the ECB will have to add to its asset purchase program next year and may…

Highlights Global oil demand will remain betwixt and between recovery and relapse through 3Q21, as stronger DM consumer spending and increasing mobility wrestles with persistent concerns over COVID-19-induced lockdowns in Latin America…

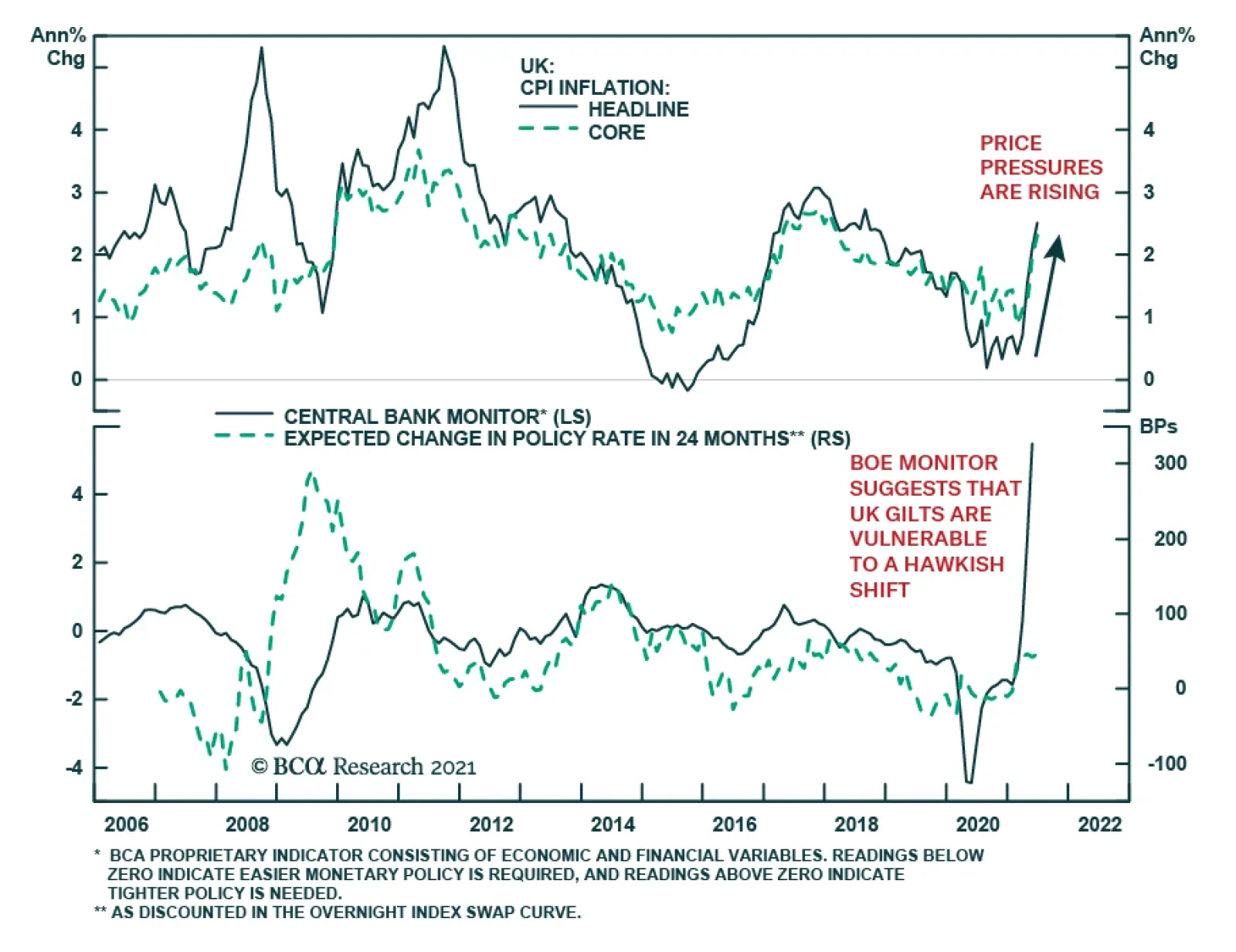

The UK’s various inflation indicators surprised to the upside in June. Headline CPI inflation rose to a 3-year high of 2.5% from 2.1%, above the anticipated 0.1pp increase. Similarly, at 2.3% y/y, core CPI inflation…

ECB messaging indicates that the central bank is in no rush to tighten policy. ECB President Christine Lagarde highlighted in a Bloomberg Television interview over the weekend that the pandemic remains a threat and that the…

Feature Since the end of the first quarter, the decline in Treasury yields has been the most important trend in global financial markets. It has contributed to the return of the outperformance of growth stocks relative to value stocks,…

The ECB unveiled the results of its strategic review yesterday, with some noteworthy tweaks to the policy framework. The central bank shifted to a symmetric inflation target of 2%, a change from the prior goal of aiming for…

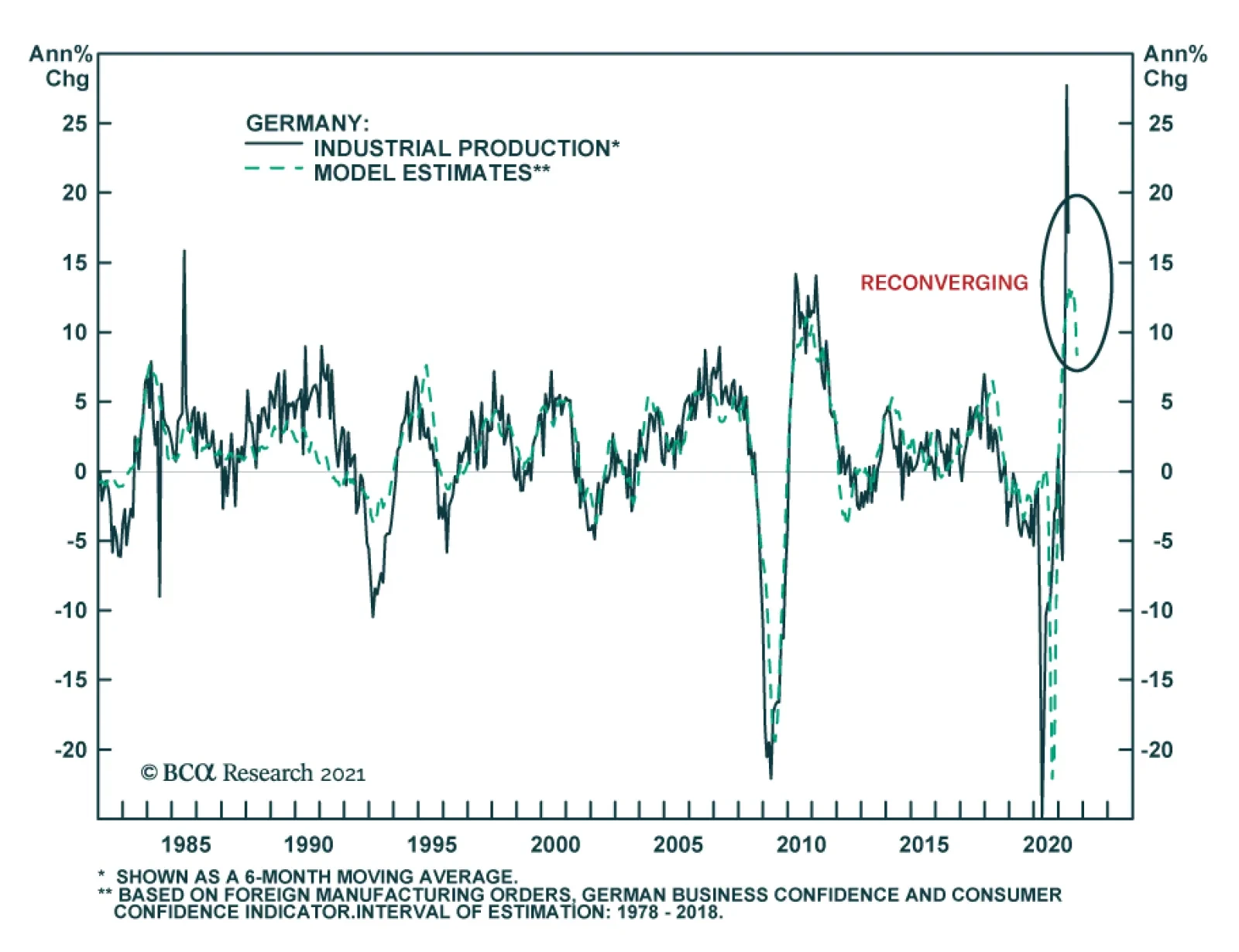

Germany’s May industrial production contracted for the second month in a row. Although it has underperformed market expectations of 0.5%, these results are rather unsurprising given the previous recovery pace of the past…

GFIS Model Bond Portfolio Q2/2021 Performance Review & Current Allocations: Hitting A Few Roadblocks

Highlights Q2/2021 Performance Breakdown: Our recommended model bond portfolio underperformed the custom benchmark index by -6bps during the second quarter of the year. Winners & Losers: The government bond side of the portfolio…