Highlights The countertrend yield rally is near its end. Despite the deteriorating Chinese credit impulse, the outlook for global growth remains robust. An ample global liquidity backdrop, an inventory restocking cycle, and an upbeat…

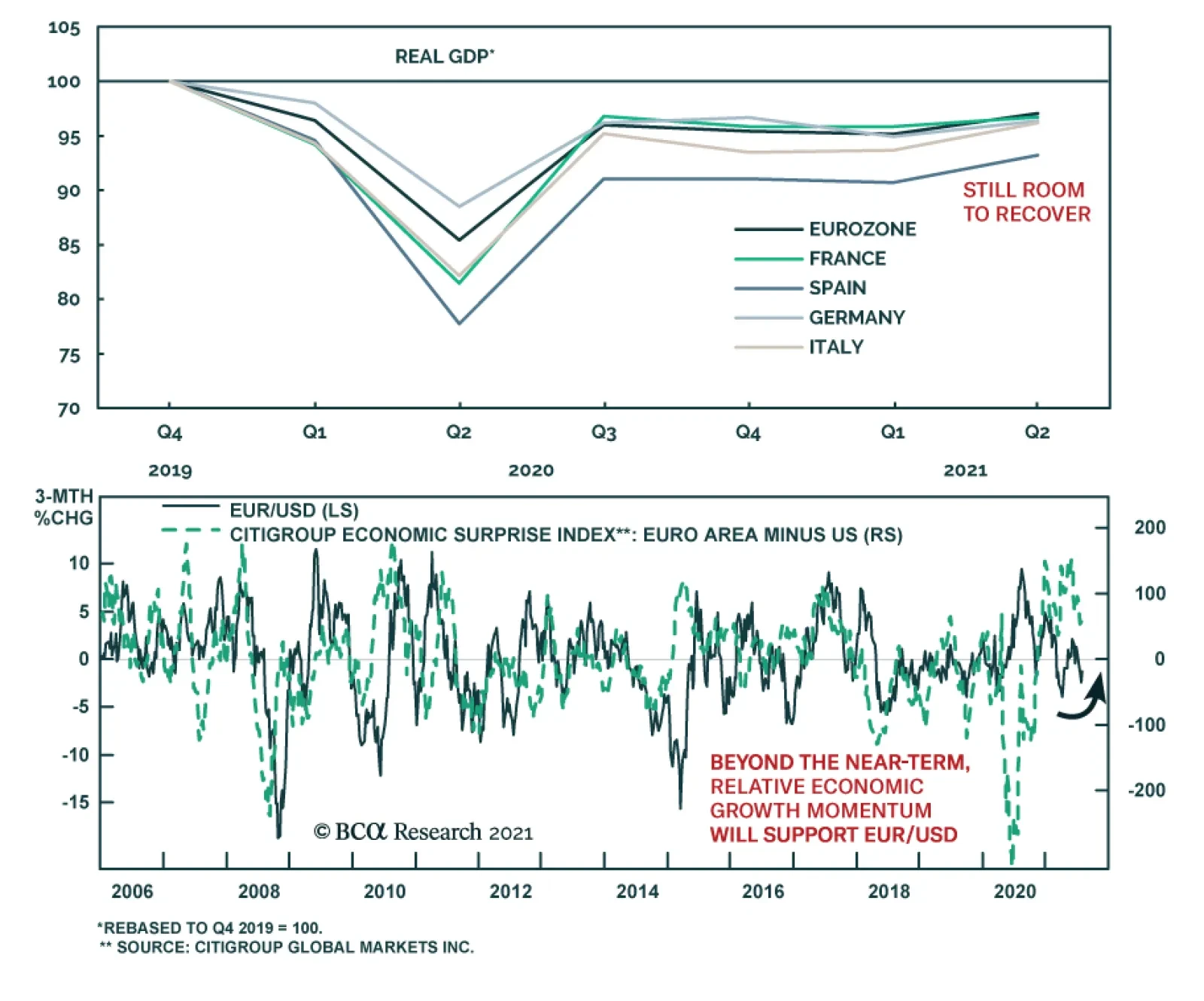

Euro Area economic data releases surprised to the upside on Friday: Eurozone growth exceeded expectations: After a 0.3% q/q contraction in Q1, the bloc’s GDP expanded 2.0%, above the anticipated 1.5%. Because of…

Highlights The dollar is fighting a tug of war between two diverging forces: an economic slowdown around the world but plunging real interest rates in the US. The litmus test for determining which force will gain the upper hand is if…

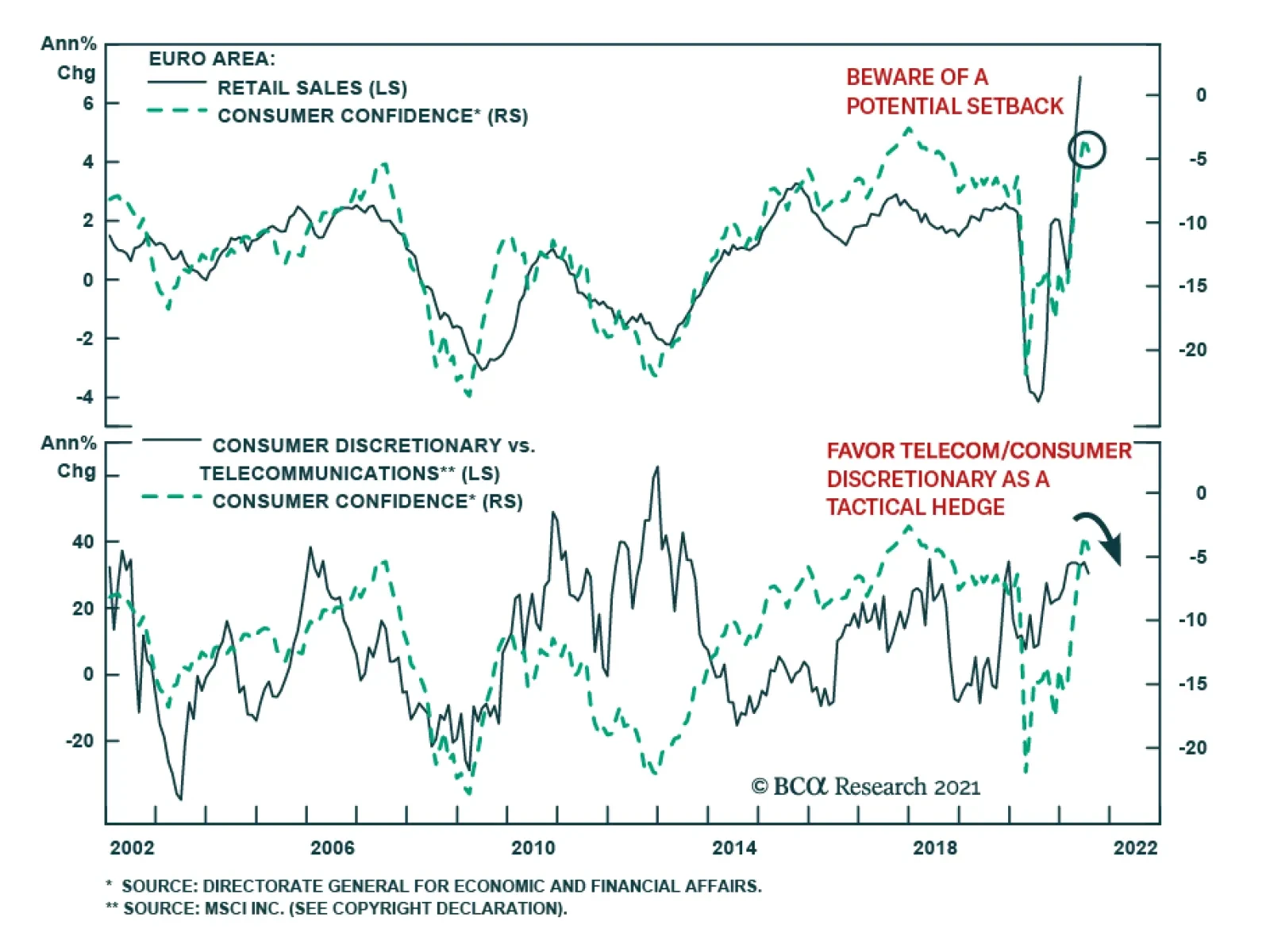

The European Commission’s Euro Area economic sentiment index increased 1.1 points in July, climbing to 119 – the highest level in the history of the series dating back to 1985. This improvement is especially…

Highlights Recent progress on the path to a post-pandemic state and the return to pre-COVID economic conditions has been mixed. The share of vaccinated individuals continues to rise globally, and the number of confirmed UK cases has…

Highlights Portfolio Duration: The decline in US bond yields is overdone. We anticipate that strong US employment data will catalyze a jump in bond yields this fall and that the 10-year US Treasury yield will reach a range of 2% - 2.25…

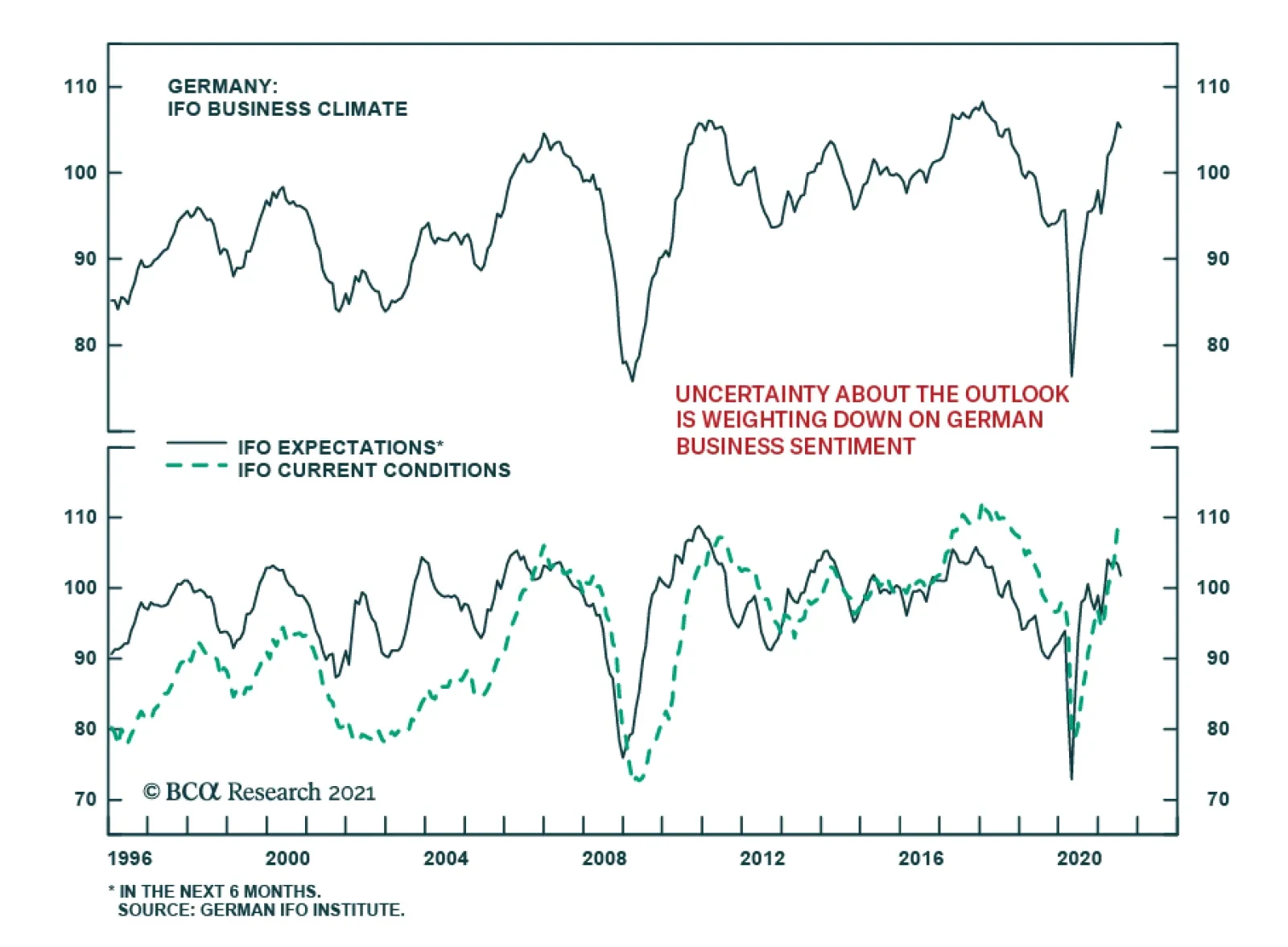

The German IFO disappointed in July and indicated that business confidence is wobbling. The headline index slipped 0.9 points to 100.8, versus an anticipated increase to 102.5. The deterioration reflects a 2.5-point fall in the…

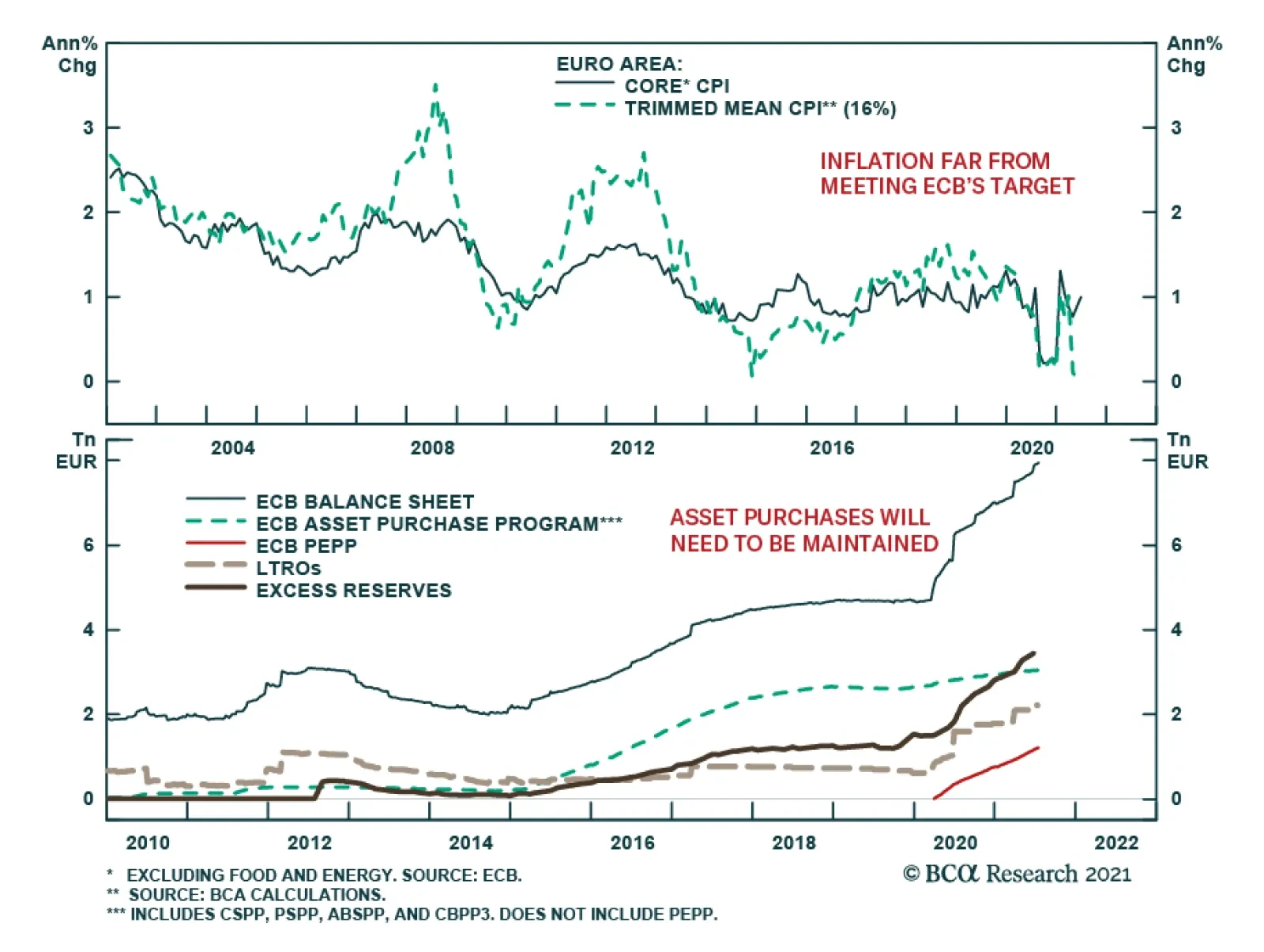

In its first meeting since its strategic review, the ECB revised its forward guidance on interest rates to reinforce its commitment to accommodative policy. The revision underscores that the central bank will not hike rates until…