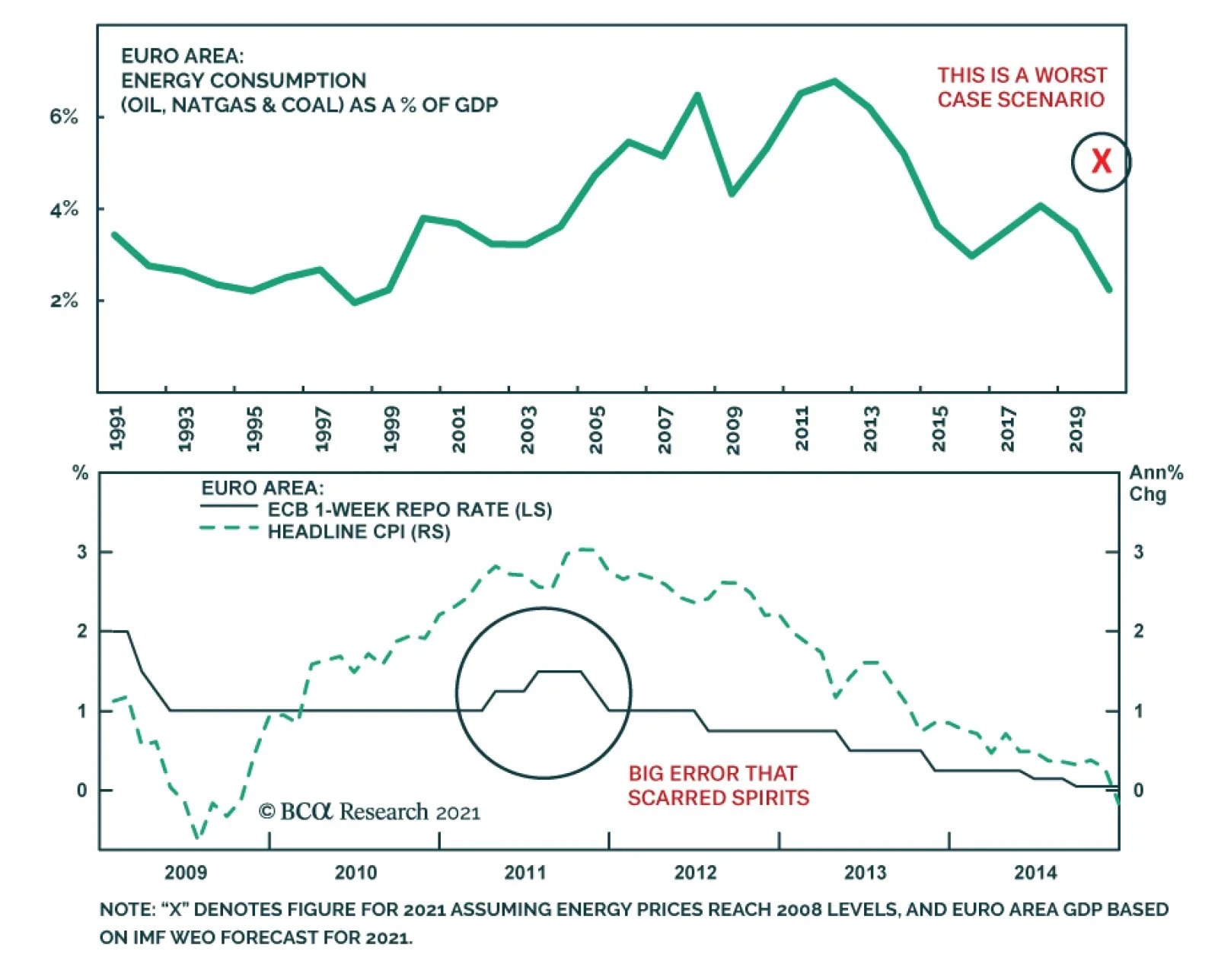

Highlights The surge in energy prices going into the Northern Hemisphere winter – particularly coal and natgas prices in China and Europe – will push inflation and inflation expectations higher into the end of 1Q22 (Chart of…

Highlights Cross-Atlantic Policy Divergence: A steadily tightening US labor market means that the Fed remains on track to formally announce tapering next month. Meanwhile, the ECB is signaling that they are in no hurry to do the same…

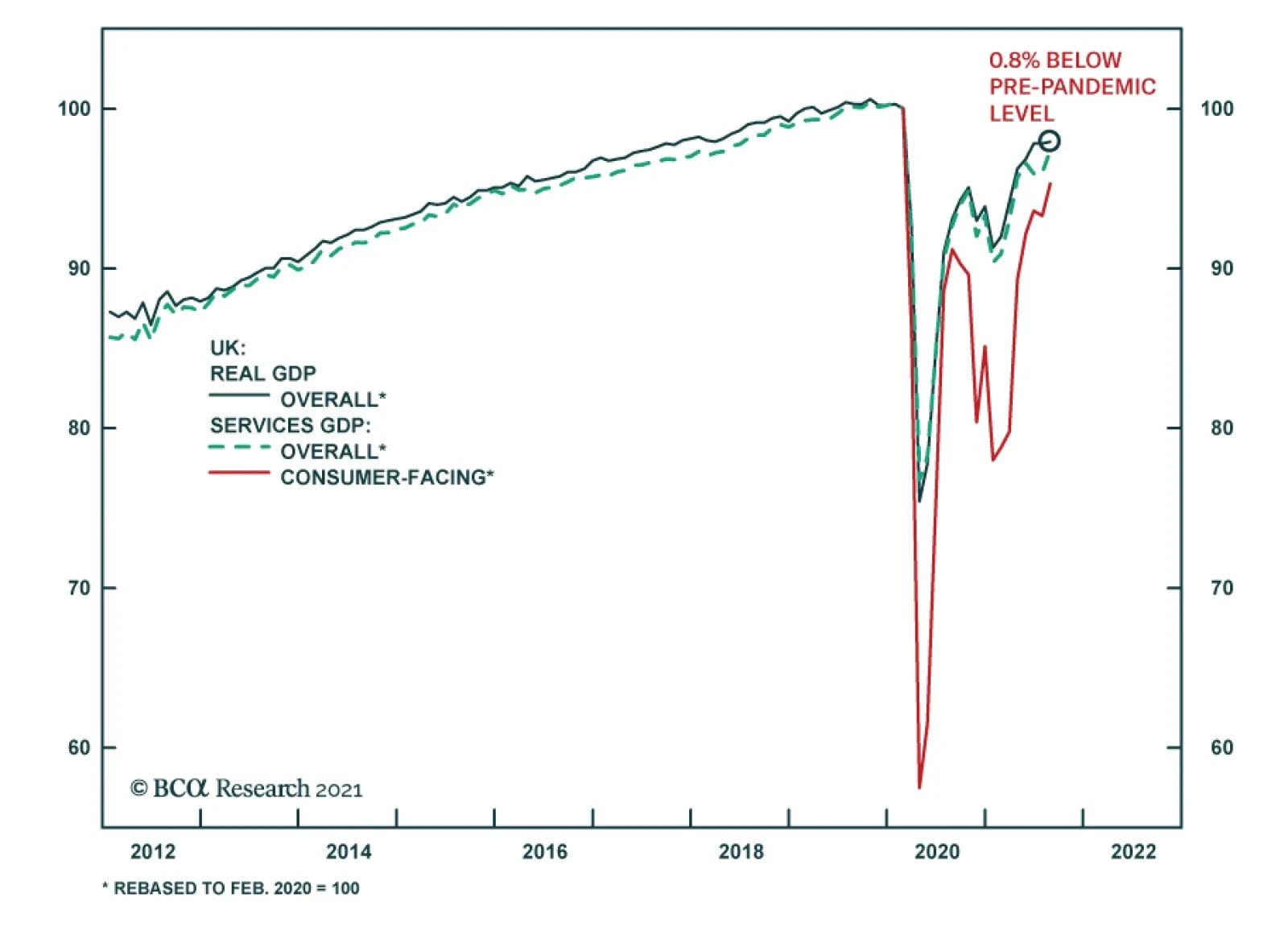

The UK economy continued to recover in August. GDP grew 0.4% m/m – 0.1 percentage points below expectations but an improvement from July’s downwardly revised 0.1% m/m contraction. The UK GDP now sits only 0.8 percent…

According to BCA Research’s European Investment Strategy service as long as the energy price surge does not threaten a policy response by the ECB, it will not plunge Europe into a significant downturn. Natural gas, oil, and…

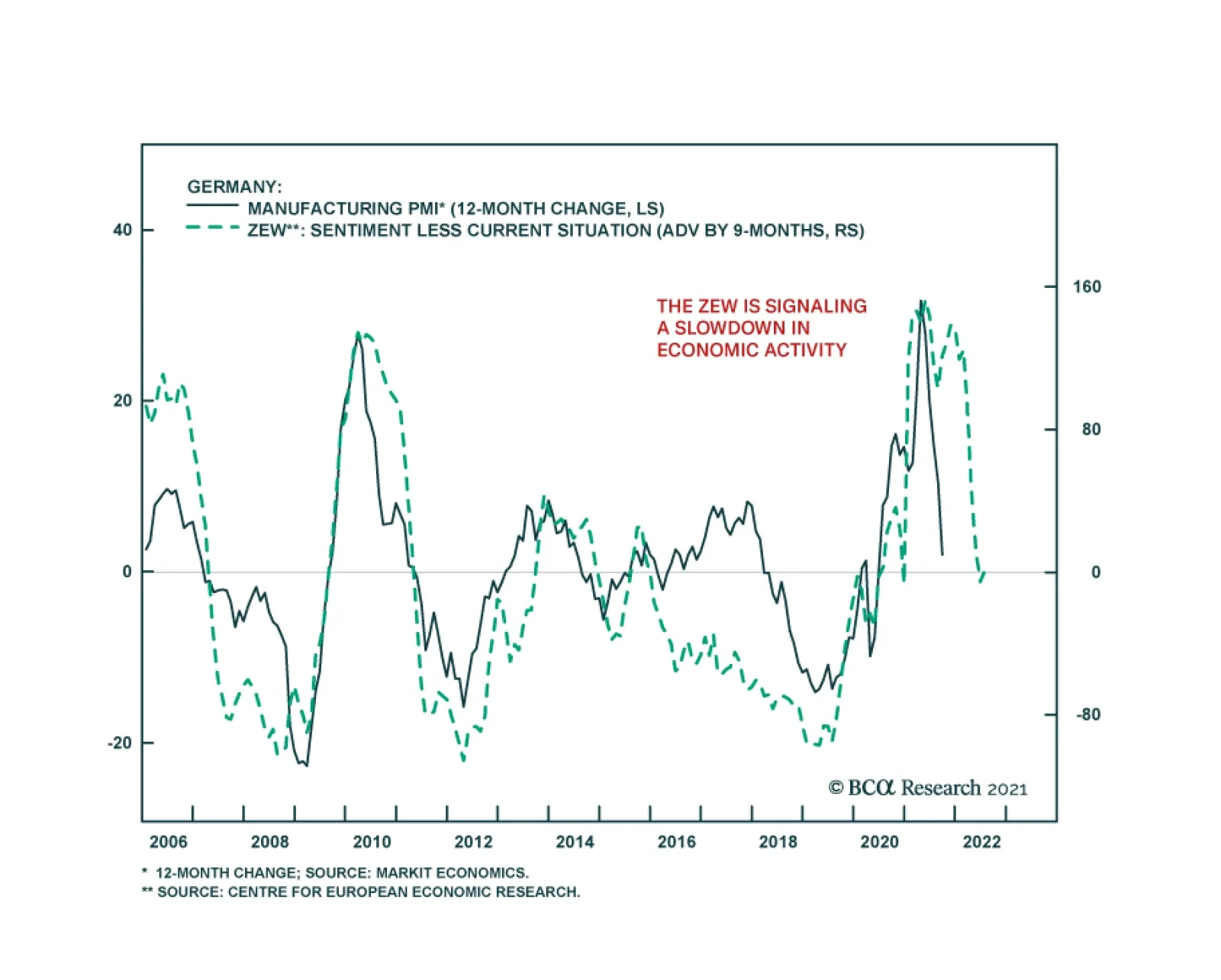

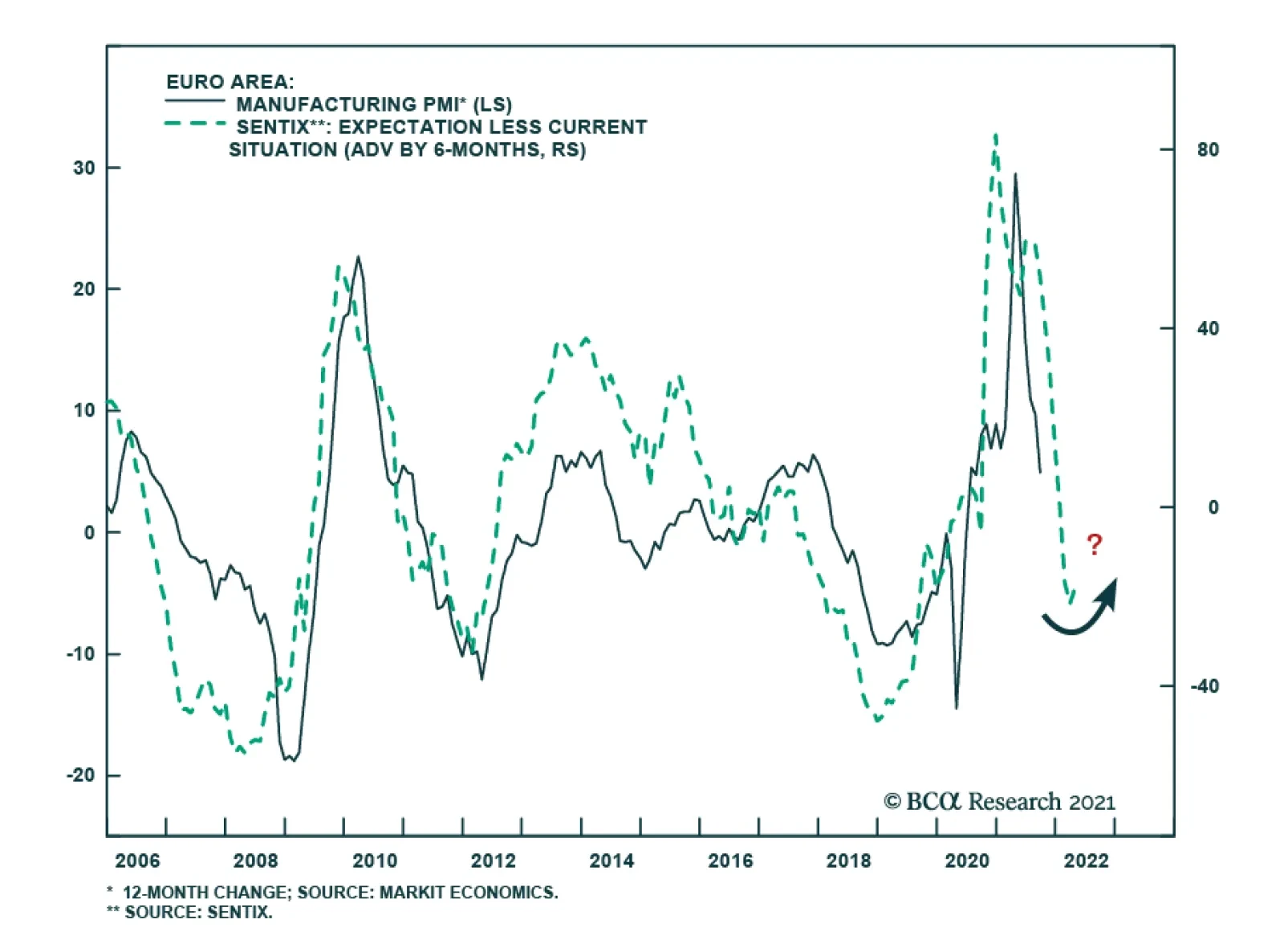

The ZEW survey of investor sentiment sent a cautionary signal on Tuesday. The German Expectations index lost more than four points and came in at 22.3, below the anticipated 23.5. Similarly, the Current Situation component of the…

Highlights The surge in European natural gas prices is a consequence of China’s effort to wean itself off its coal addiction and of the energy supply problems around the world. As long as the energy price surge does not threaten…

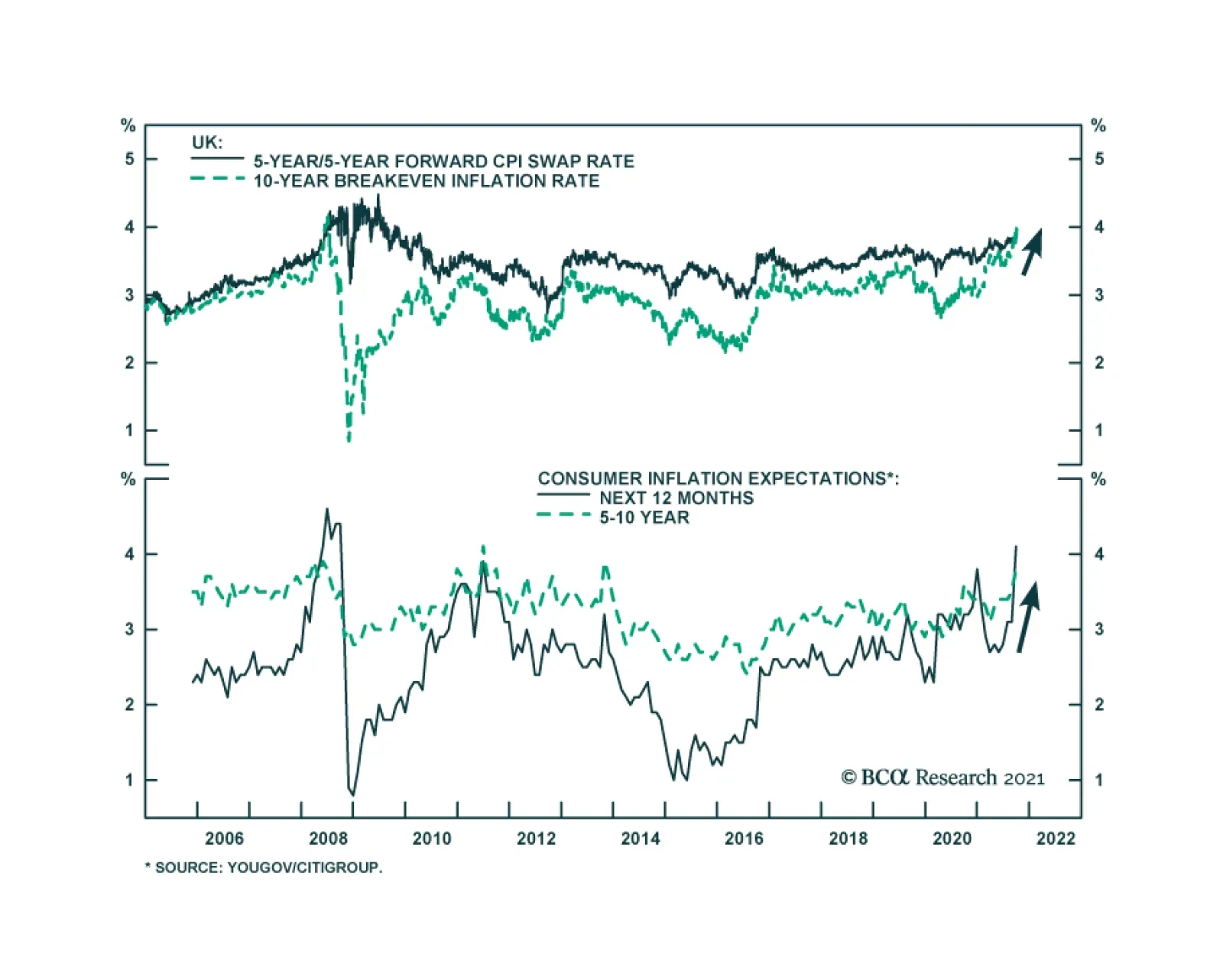

In his first public comments as the chief economist of the Bank of England, Huw Pill highlighted that “the balance of risks is currently shifting towards great concerns about the inflation outlook.” He also noted that “the…

Highlights Q3/2021 Performance Breakdown: Our recommended model bond portfolio outperformed the custom benchmark index by +8bps during the third quarter of the year. Winners & Losers: The government bond side of the portfolio…

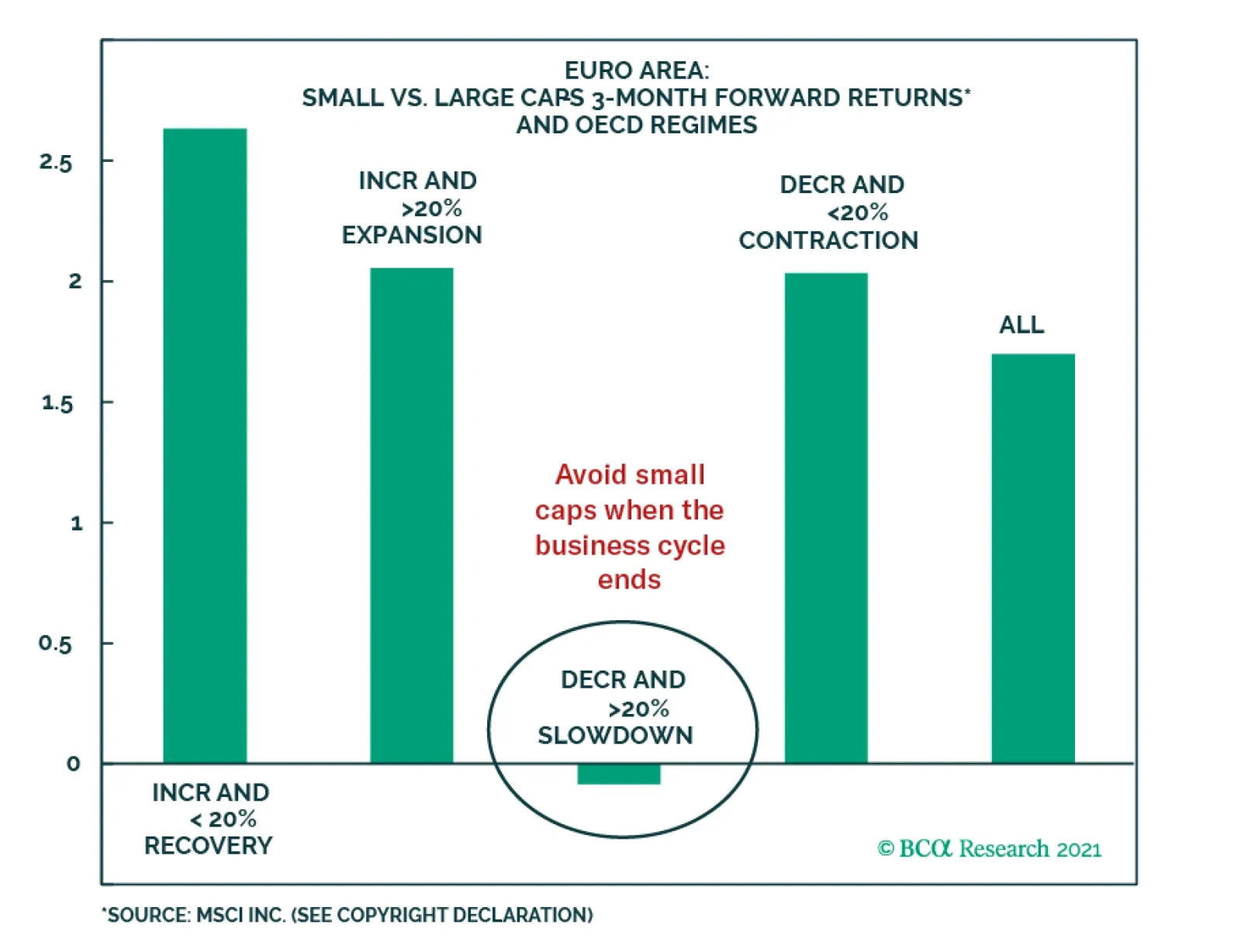

BCA Research’s European Investment Strategy service concludes that an opportunity to overweight European small-cap stocks will emerge in the coming weeks. The relative performance of European small-cap stocks is pro-cyclical.…

The Sentix Economic Index for the Eurozone showed a deterioration in investor confidence in October. The headline index fell from 19.6 to 16.9, below expectations of 18.6. Notably, both the current situation and expectations…