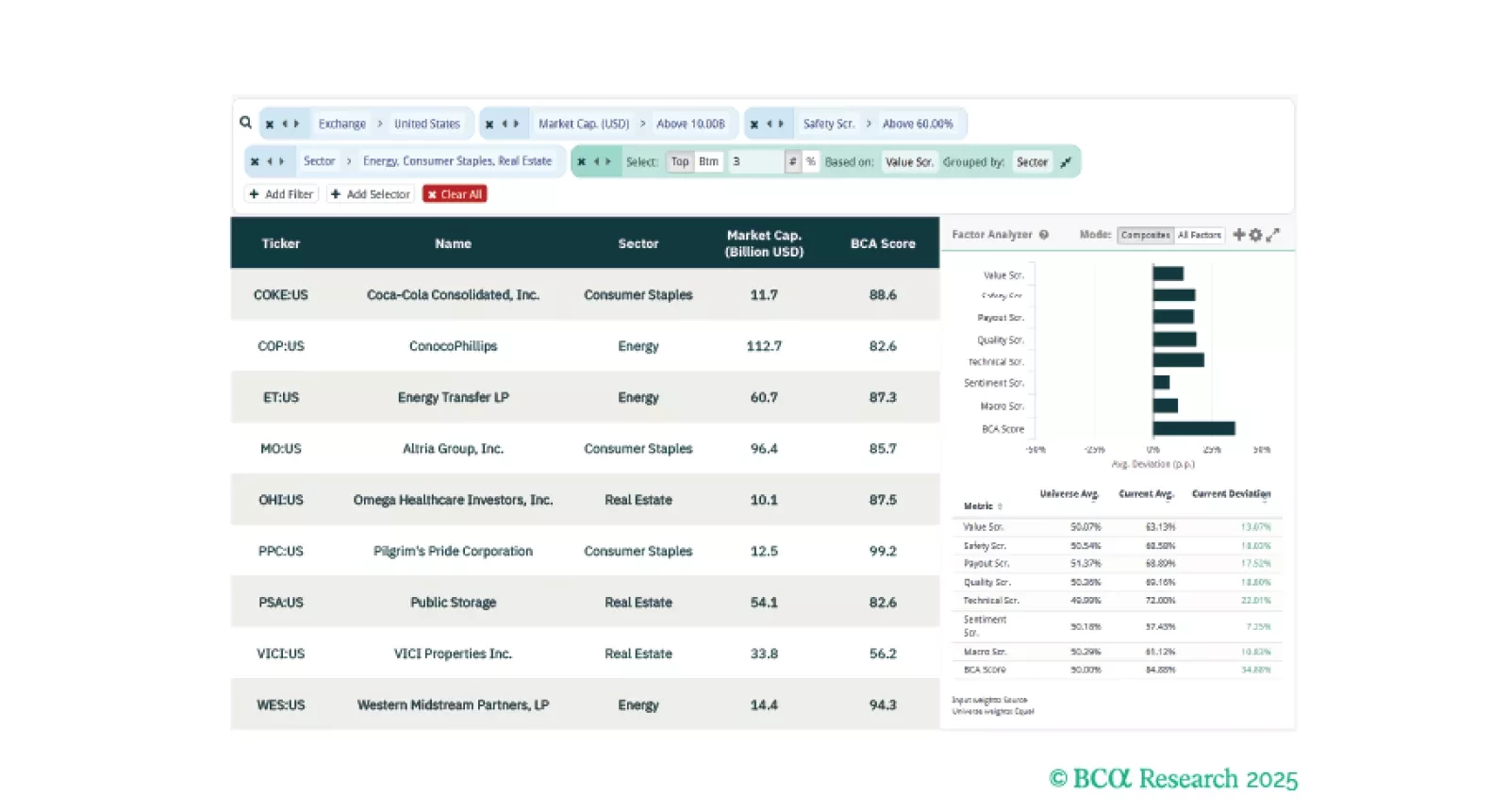

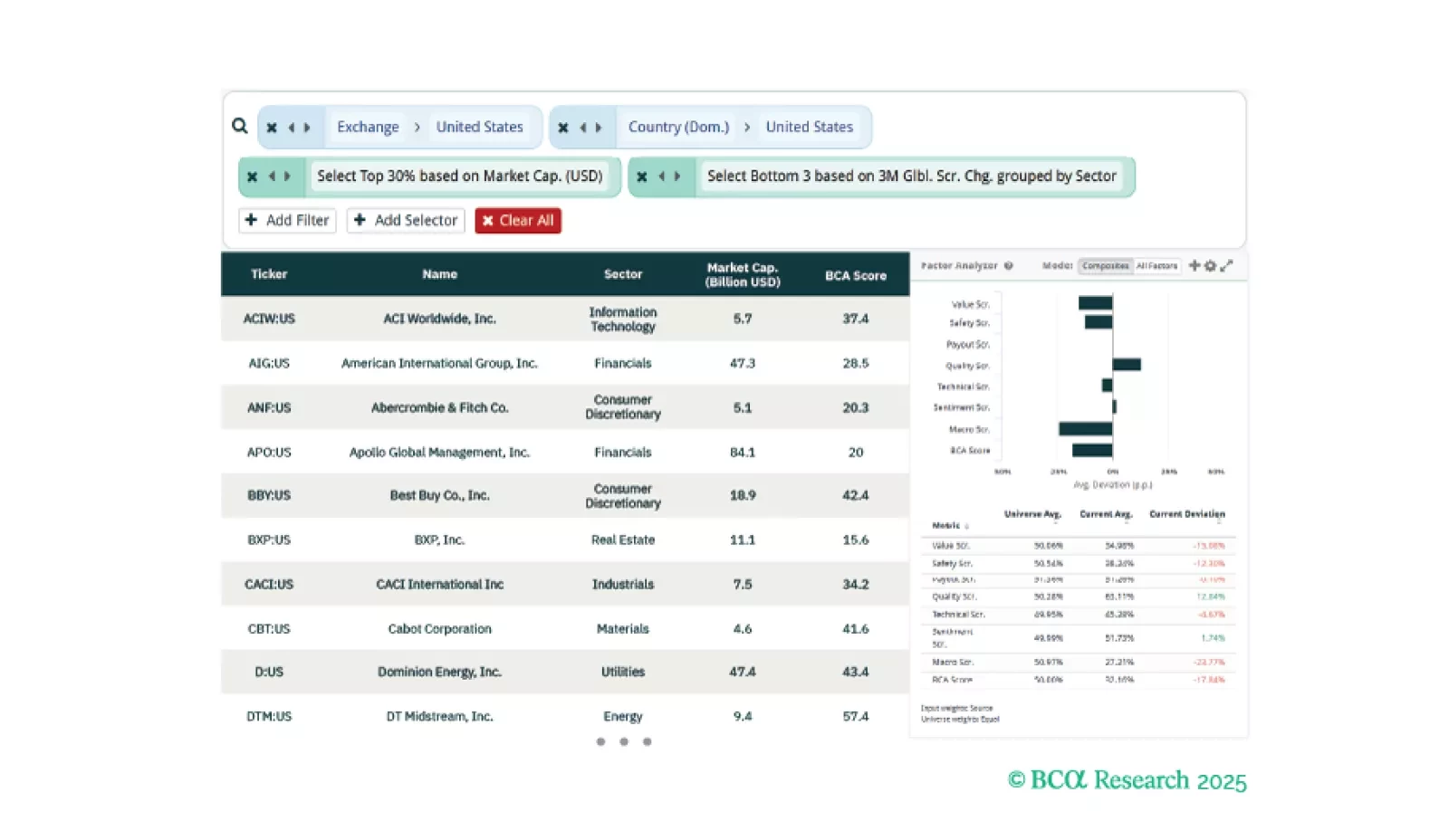

This week, our three screeners cover equity plays in US defensives, US Tech, and European Small Cap Value.

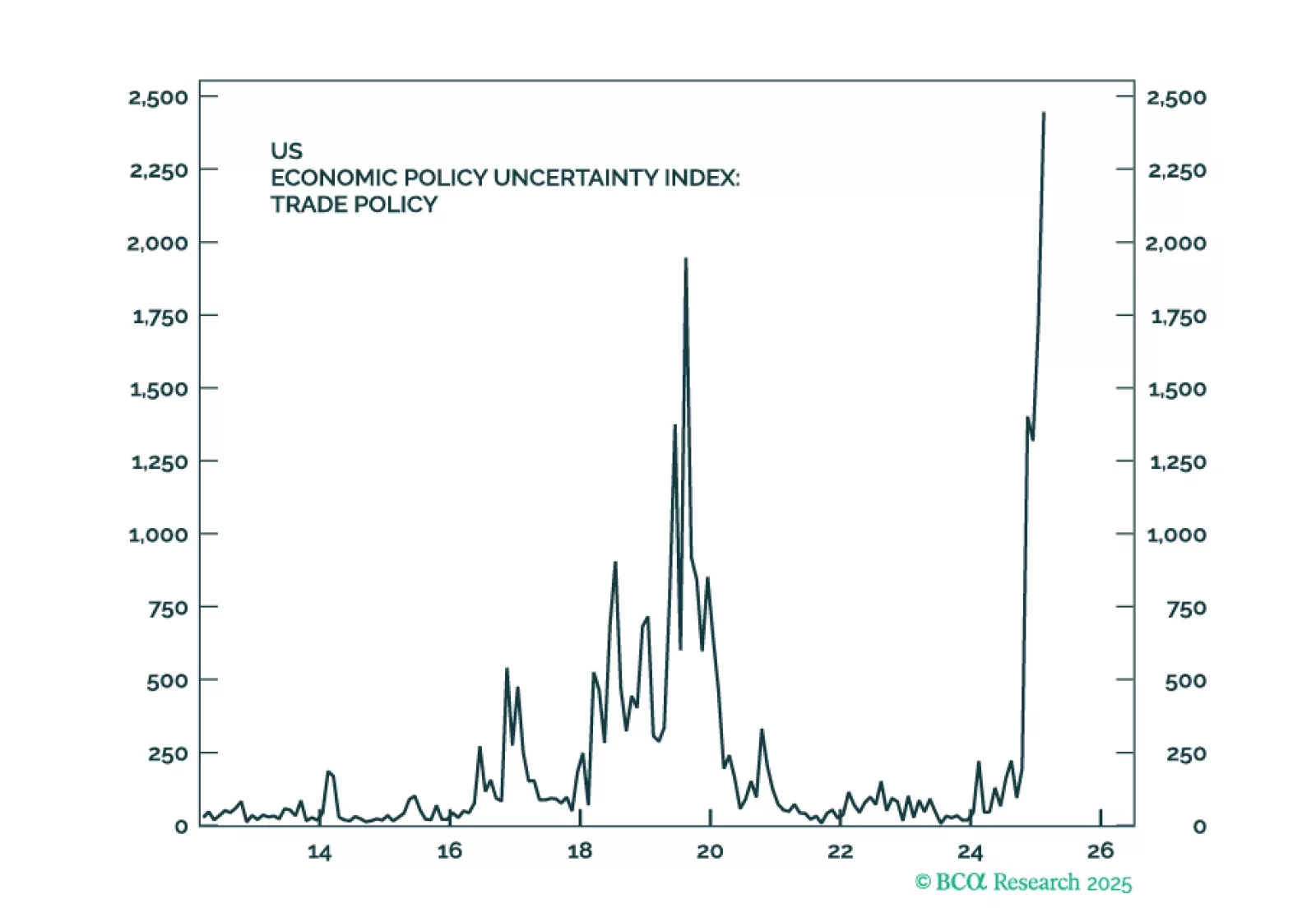

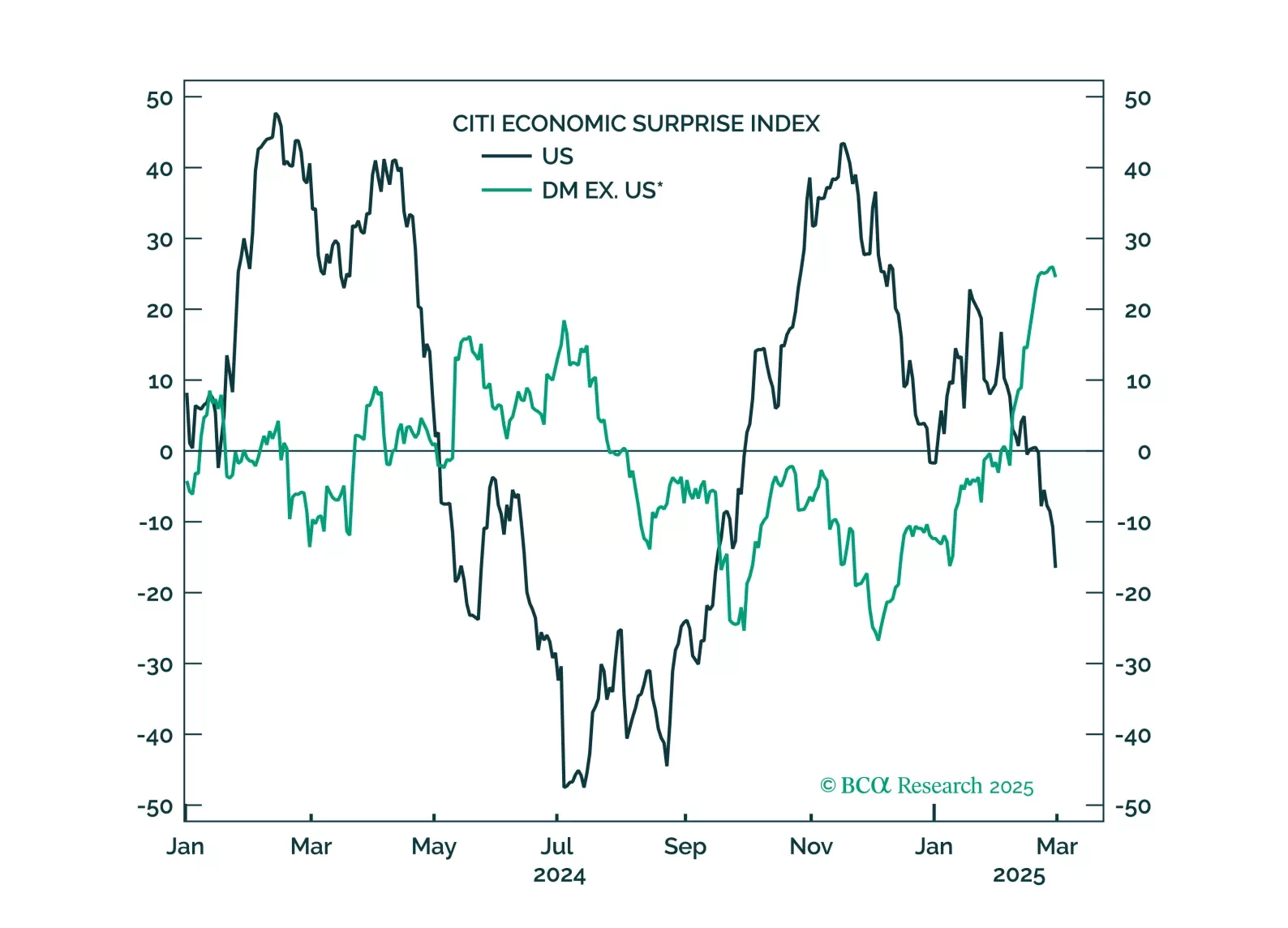

The US economy is set to enter a recession within the next few months. Stay underweight equities and overweight cash. Look to increase fixed-income duration exposure over the coming months. The euro is likely to strengthen and…

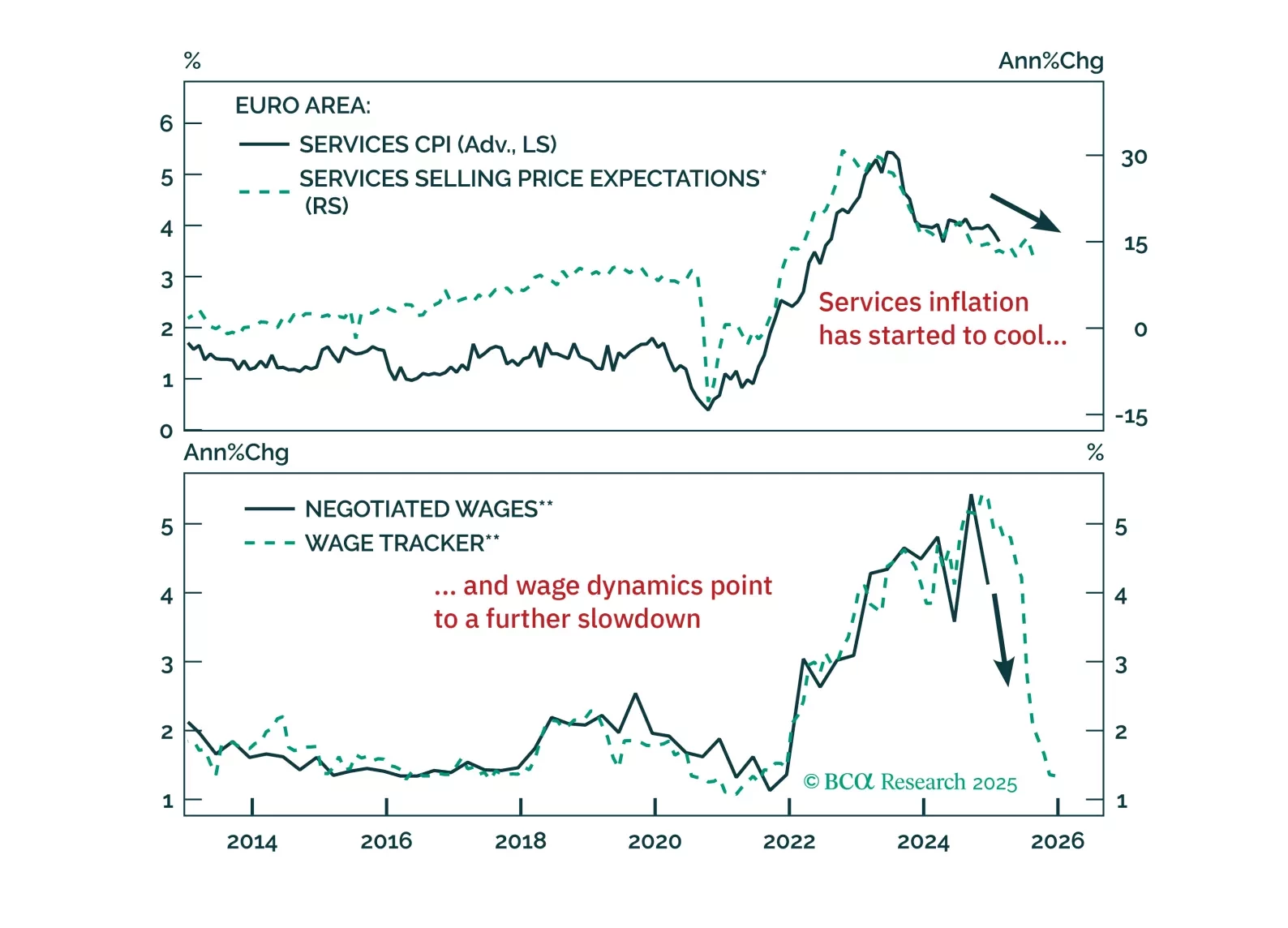

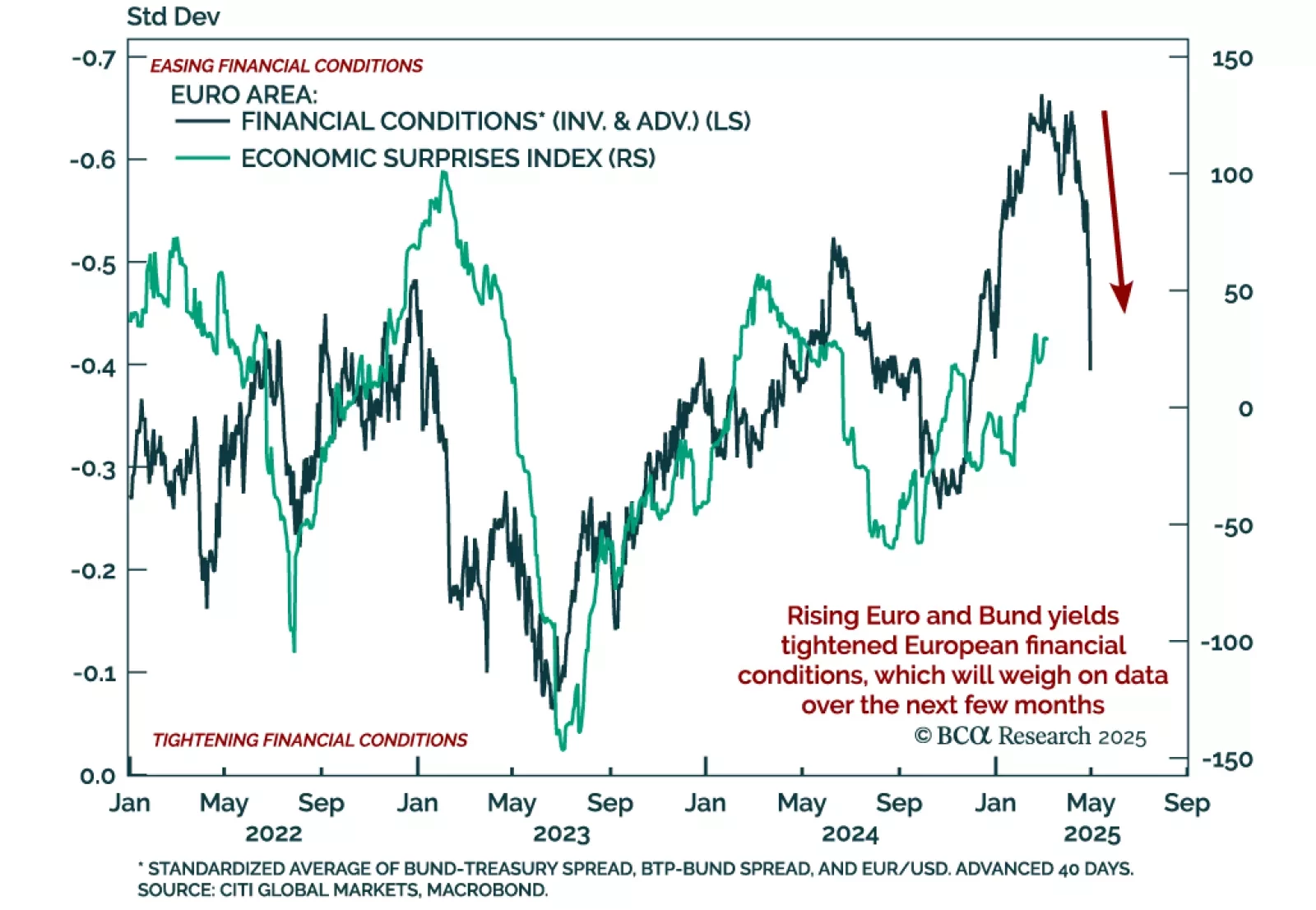

The ECB cut 25 bps as expected, bringing the deposit facility rate to 2.5%. President Lagarde reiterated the disinflationary process is “well on track” and described the policy stance as “meaningfully less restrictive”, signalling…

The ECB cut rates as expected, but rising yields and a stronger euro are tightening financial conditions just as fiscal policy shifts the macro landscape. With more rate cuts ahead and market positioning stretched, we outline the key…

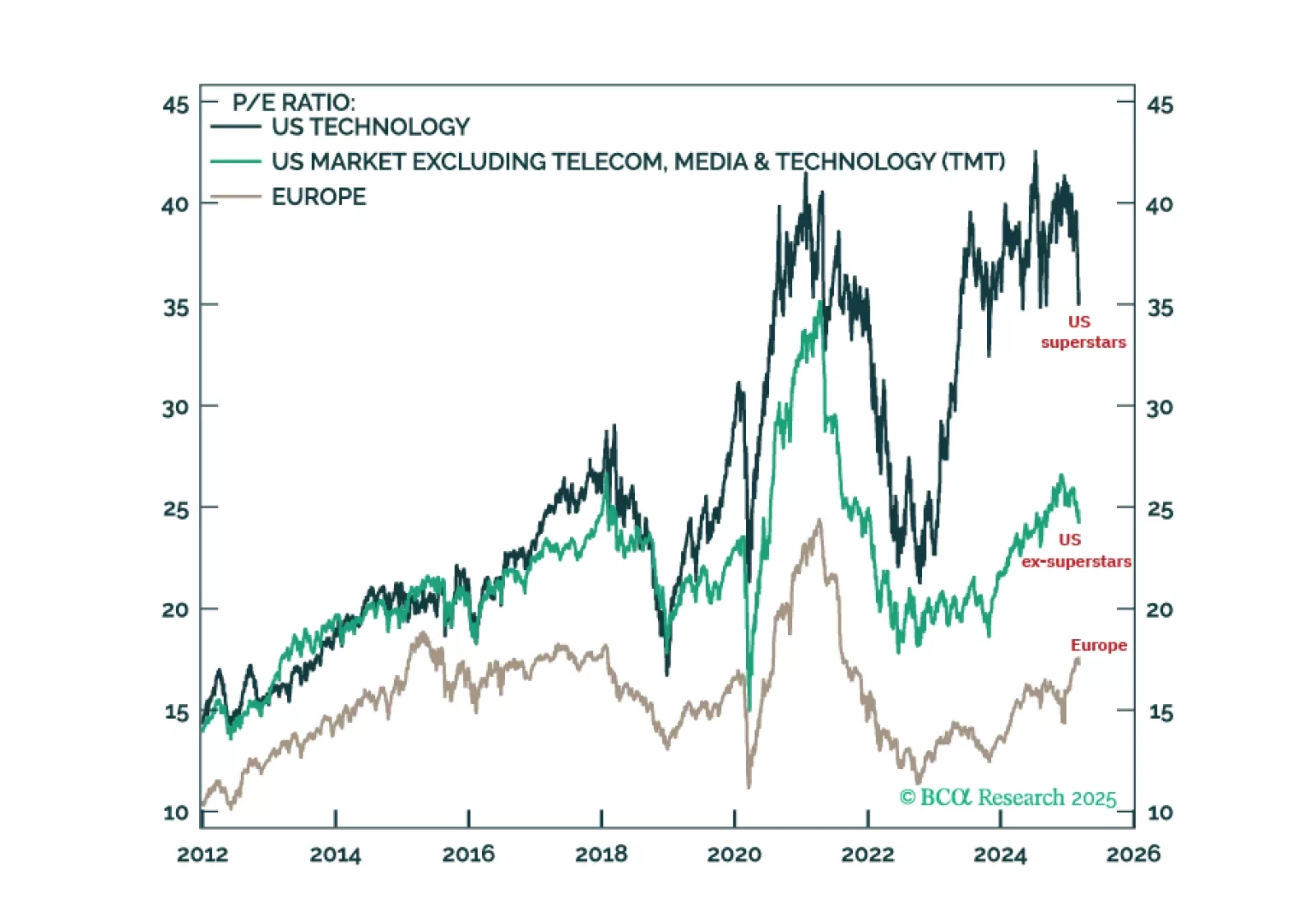

US stock market outperformance has been driven entirely by the 0.0002 percent of US superstar companies. But this superstar outperformance is based on two highly questionable assumptions: that all productivity gains from the…

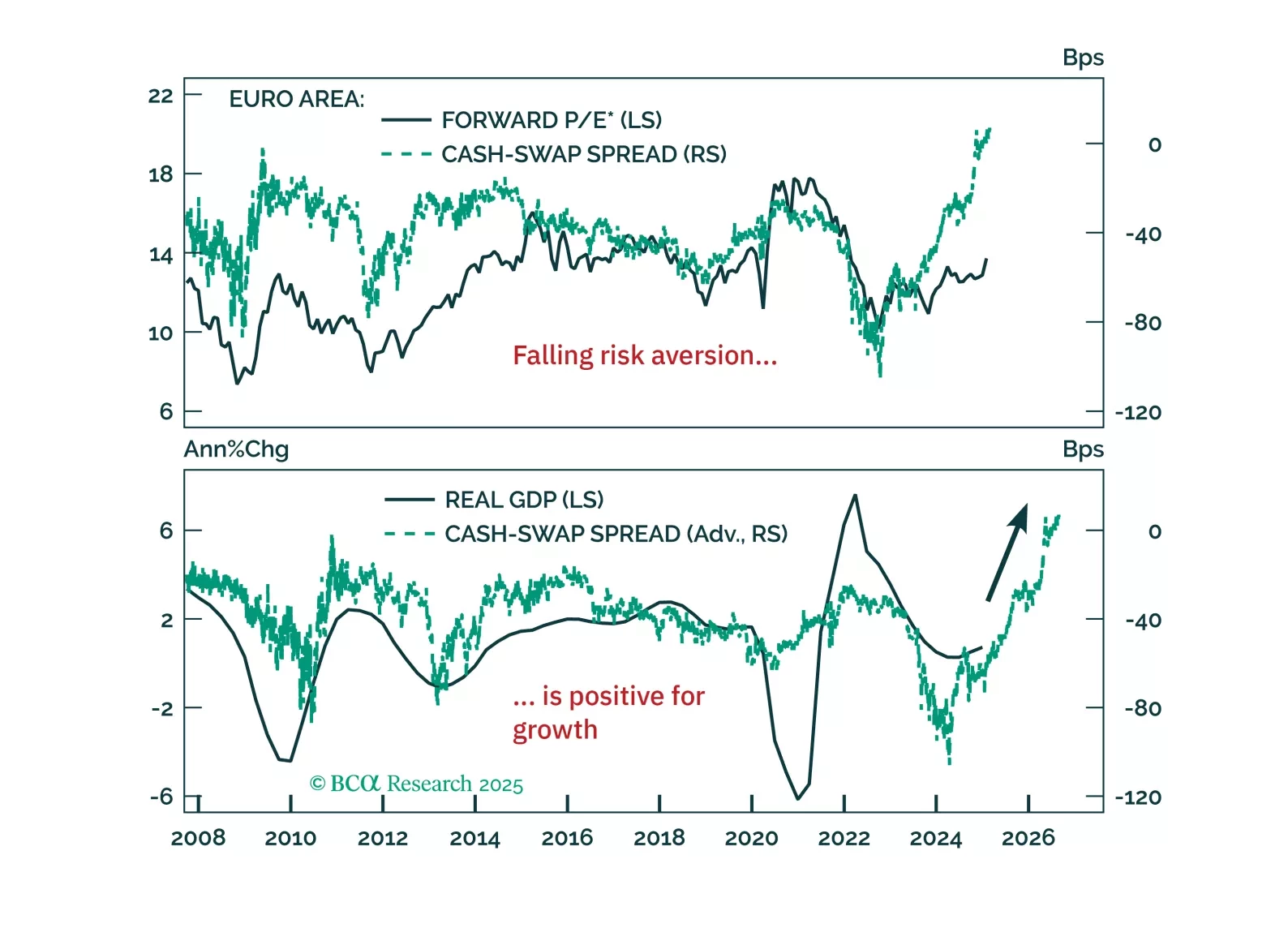

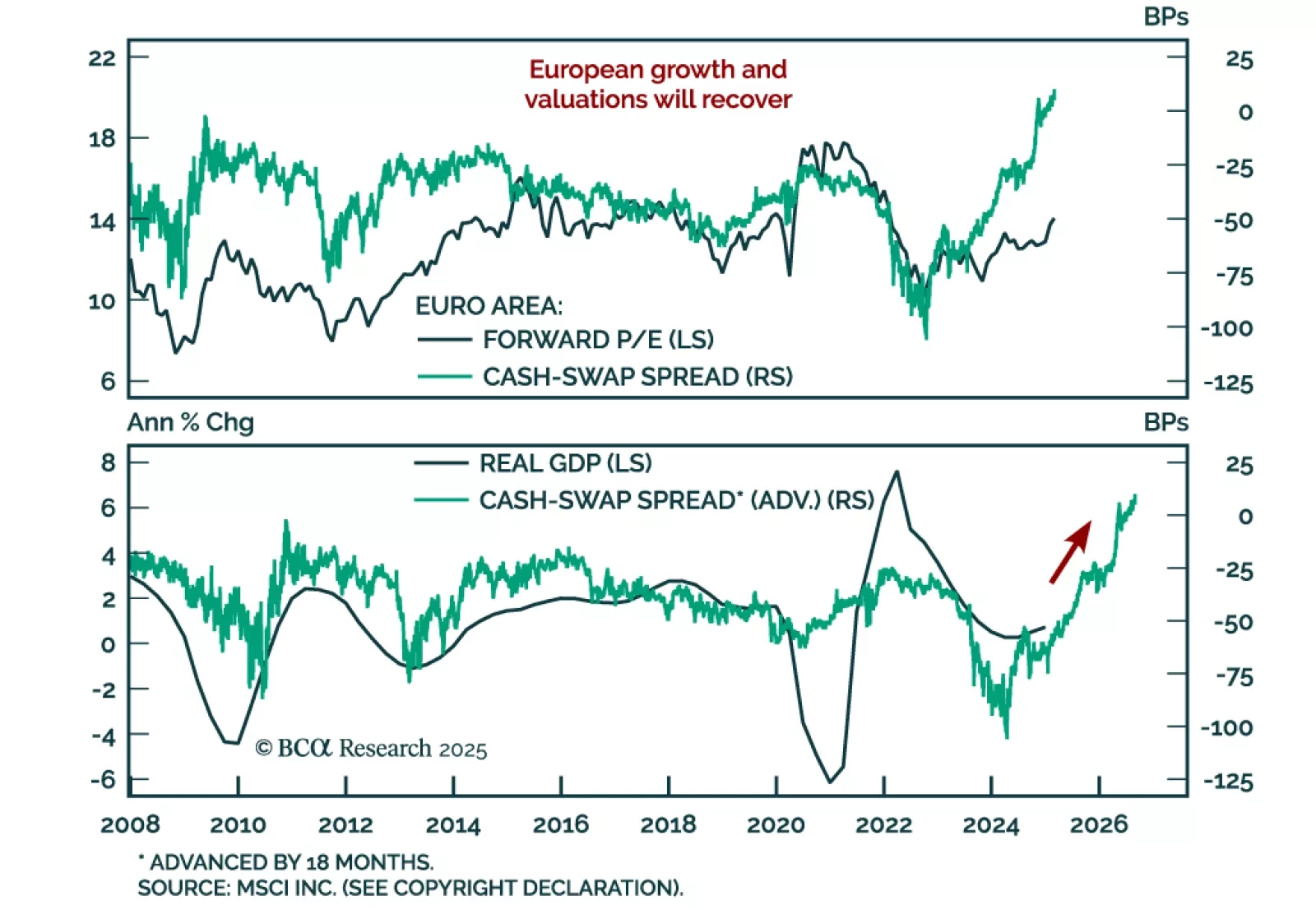

Our European strategists see Europe escaping its liquidity trap, which will create a structural tailwind for European assets. Europe’s resilience amid global shocks is supported by a shift away from precautionary money demand,…

February flash inflation for the Eurozone was slightly hotter than expected but nonetheless declined, with both headline and core inflation falling 0.1% to 2.4% y/y and 2.6%, respectively. Services inflation also declined to 3.7%…

Investors see Europe as a museum: A continent stuck in the past, with no ability to innovate, much less generate profits. But is this view accurate? In this report we argue that the structural headwinds to European profitability are…

Europe’s resilience to global liquidity deterioration isn’t a fluke—it signals a structural shift. Our latest report explains why the decline in precautionary money demand marks the end of Europe’s liquidity trap and what it means…

This week, our three screeners cover equity plays in European Banks, US Financials, And US Stocks that are “Grave Diggers”.