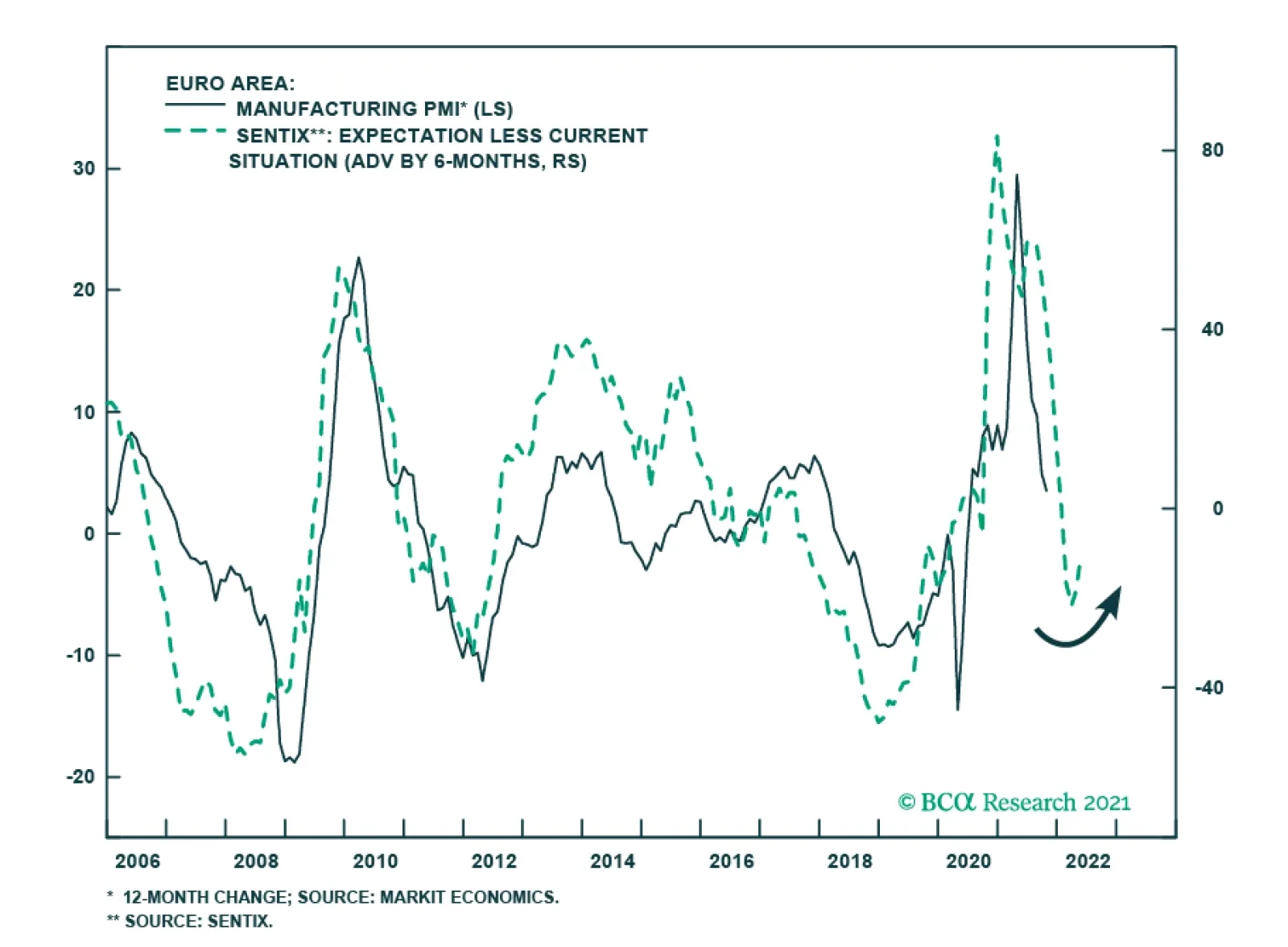

The Sentix Economic Index for the Eurozone unexpectedly increased in November. The overall index rose 1.4 points to 18.3 – marking the first improvement since July 2021 and beating expectations of a decline to 15. The…

The Bank of England kept policy unchanged at its meeting on Thursday. The Monetary Policy Committee voted by a majority of 6-3 to maintain UK bond purchases and a majority of 7-2 to keep the Bank Rate at 0.1%. Governor Bailey…

Highlights Duration & Country Allocation: Global bond yields have been driven by growth and inflation expectations over the past year, but shifting policy expectations are now the more important driver. Tighter monetary policies…

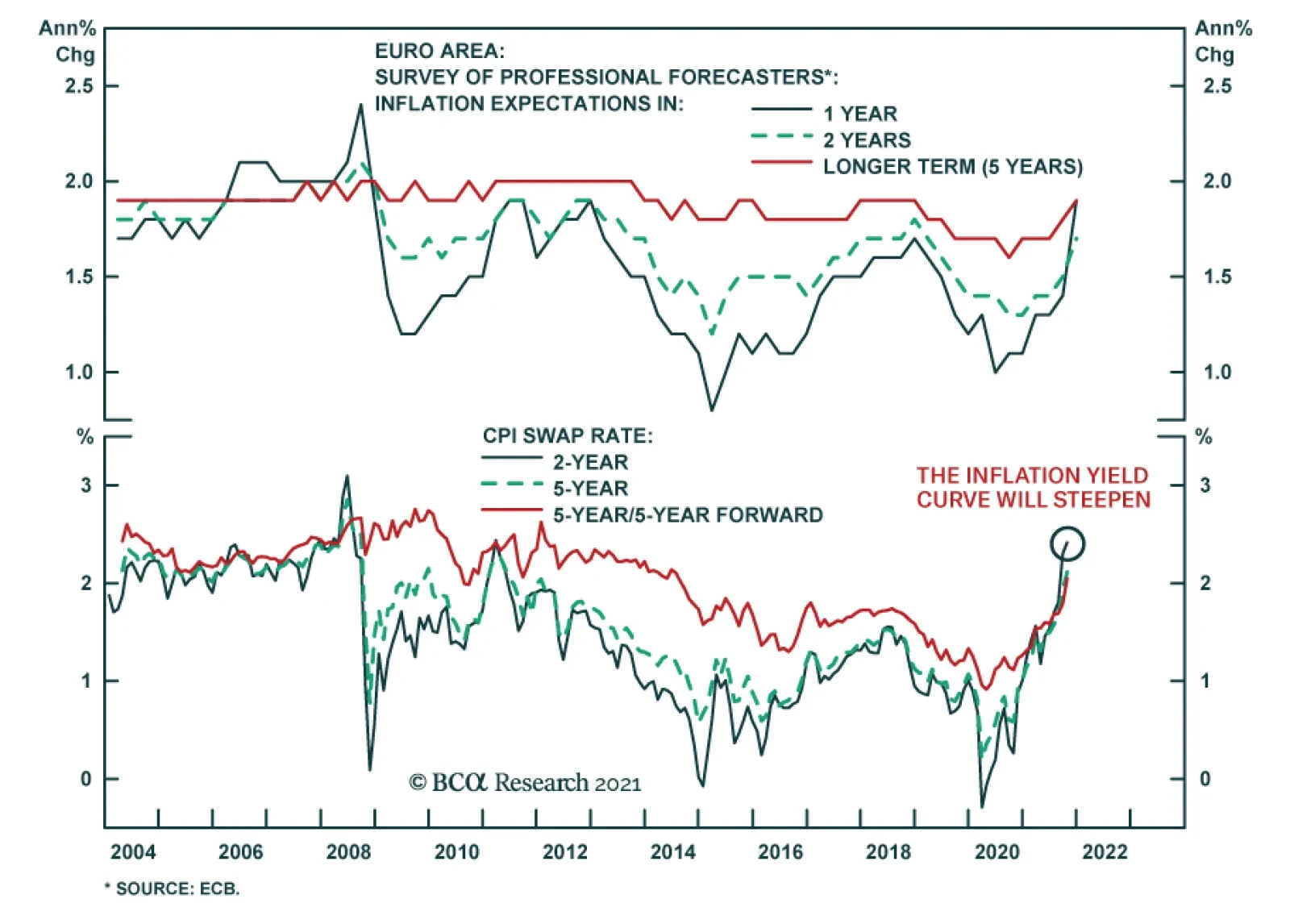

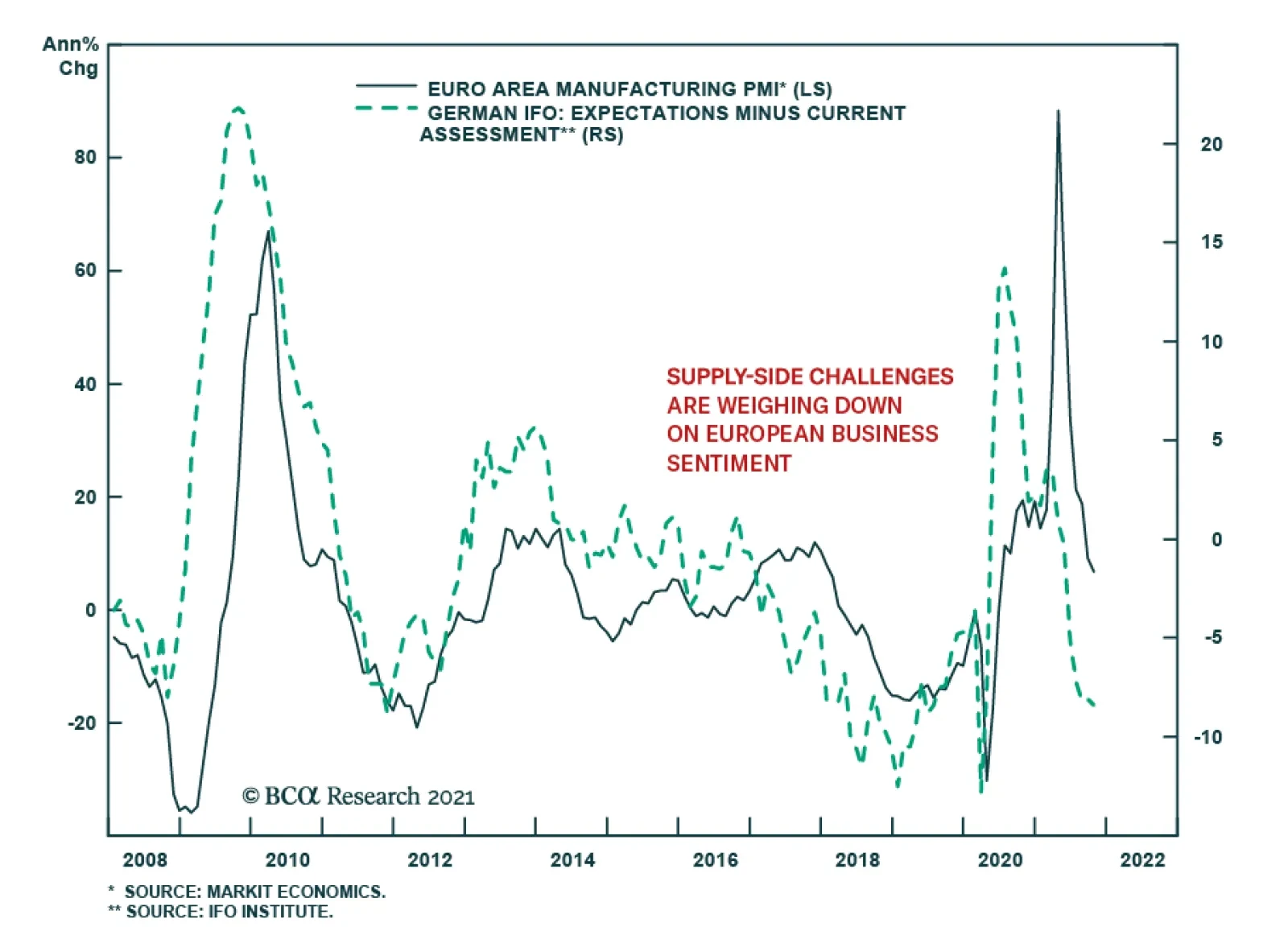

Highlights The market pricing of the ECB is too aggressive. More so than in the US, temporary factors explain the European inflation surge. Energy, taxes, and base effects account for the bulk of the price increases. In contrast to…

Eurozone bonds continued to sell off on Friday on the expectation that higher inflation would eventually force the ECB to bring forward its rate hikes timeline. Indeed, the Euro Area’s preliminary inflation estimates show…

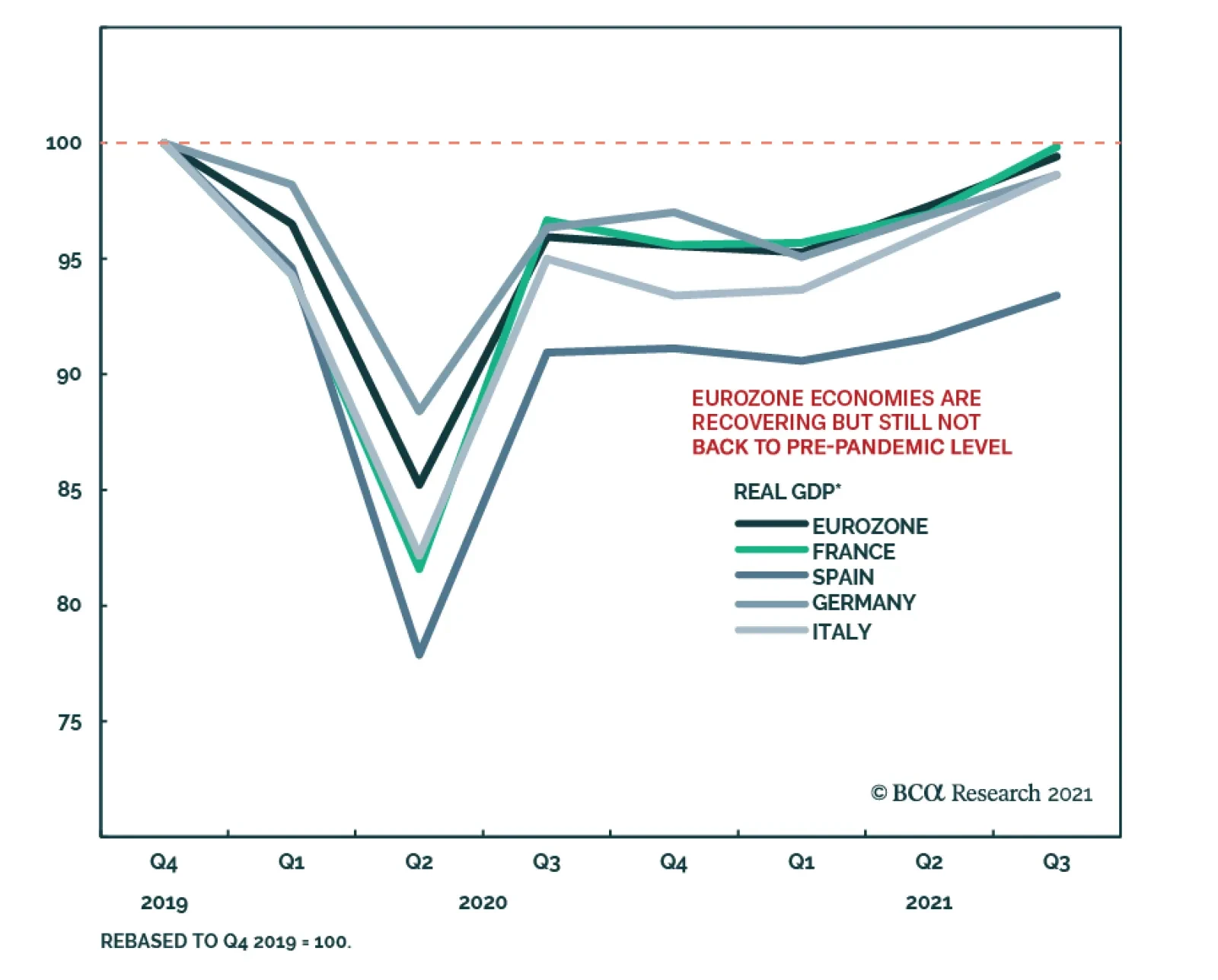

The preliminary Q3 GDP release for the Eurozone was a slight positive surprise. The bloc’s economy is estimated to have grown 2.2% q/q, slightly above the anticipated 2.1%. This improvement brings the Euro Area’s GDP…

Highlights The 26th Conference of the Parties (COP26) will open this weekend in Glasgow, Scotland, amid a global crisis induced in no small measure by policies and regulations that led to energy-market failures. Price-distorting…

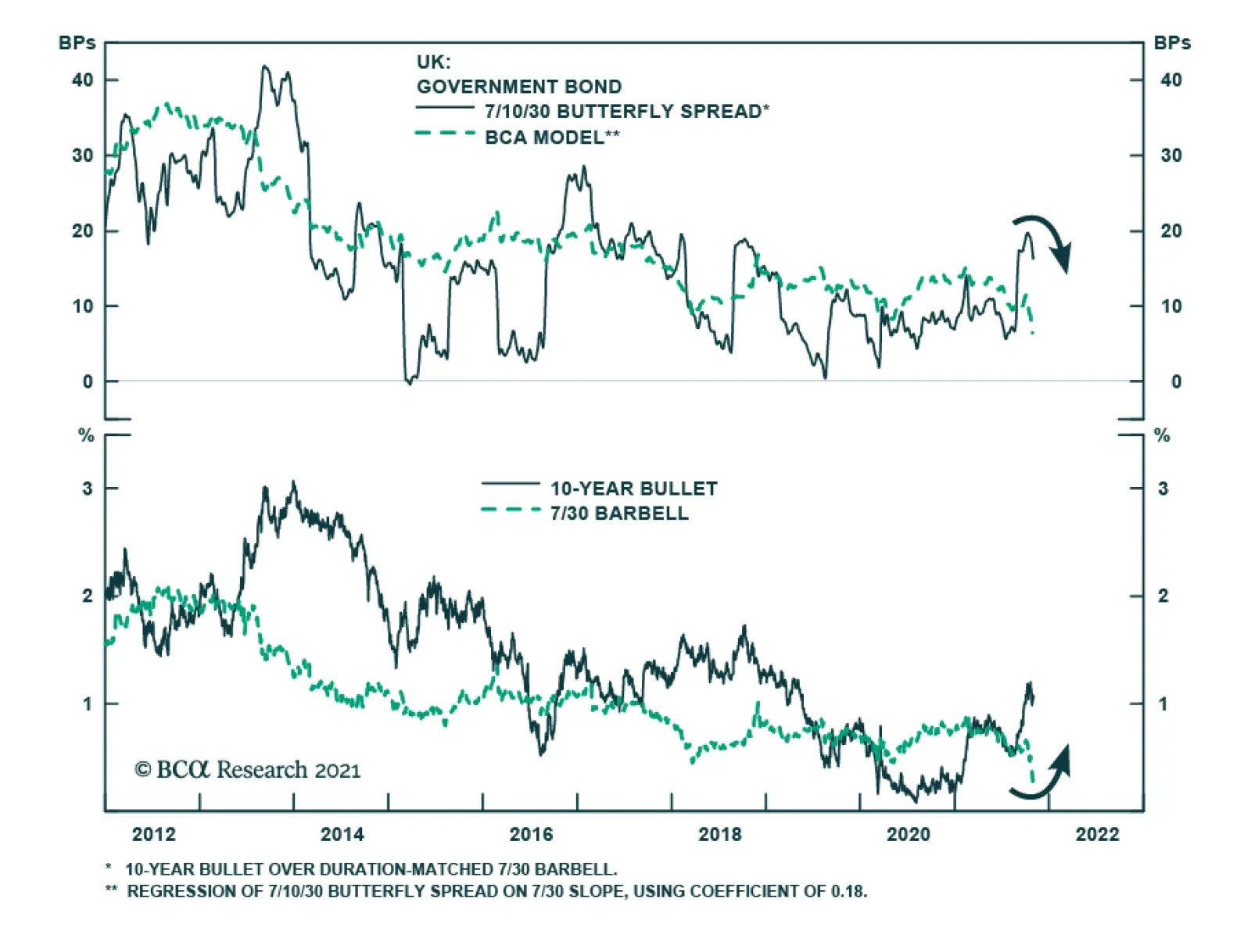

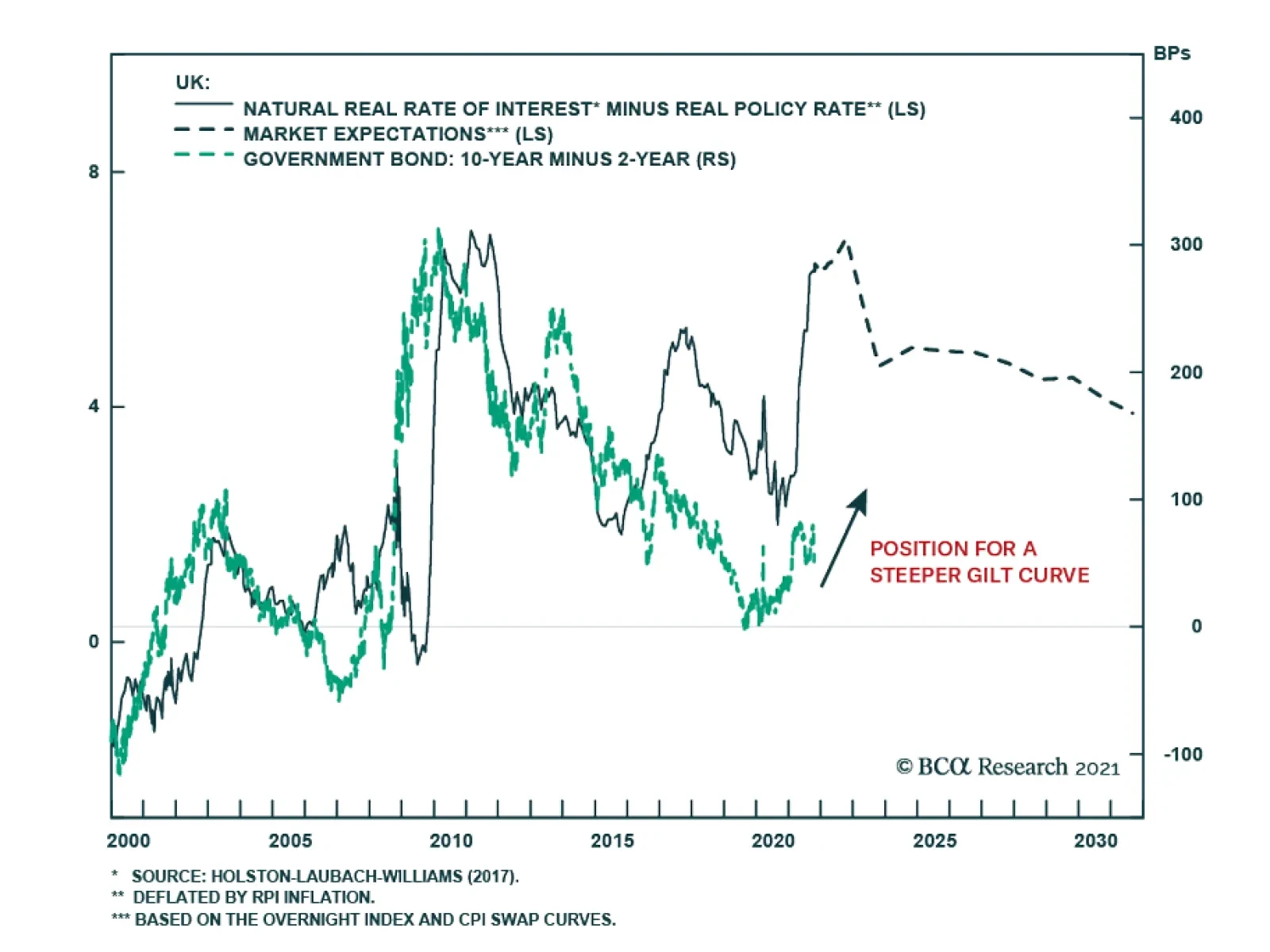

UK 10-year government bond yield fell by 12.8 bps on Wednesday, leading the rally in global long-dated sovereign bonds. The proximate cause of the decline in long-dated Gilt yields is the release of the UK budget which revealed…

Highlights Bank of Canada: Rising inflation, high capacity utilization, and monetary policy constraints will force the Bank of Canada to taper further and move up the timing of its first rate hike to H1/2022. Stay underweight Canadian…

Germany’s IFO Business Climate index fell for the fourth consecutive month in October, suggesting that business sentiment continues to weaken. The headline index dropped 1.2 points to 97.7, slightly below expectations of 98…