As 2021 draws to a close, we thank you for your ongoing readership and support. We wish you and your loved ones a happy holiday season and all the best for a healthy and prosperous 2022. Highlights Over the coming three months, the…

Highlights Global growth will remain above-trend in 2022, although with more divergence between regions than at any time during the pandemic (US strong, Europe steady, China slowing). Global inflation will transition from being driven…

Dear Client, Thank you for your continued readership and support this year. This is the last European Investment Strategy report for 2021. In this piece, we review ten charts covering important aspects of the European economy and…

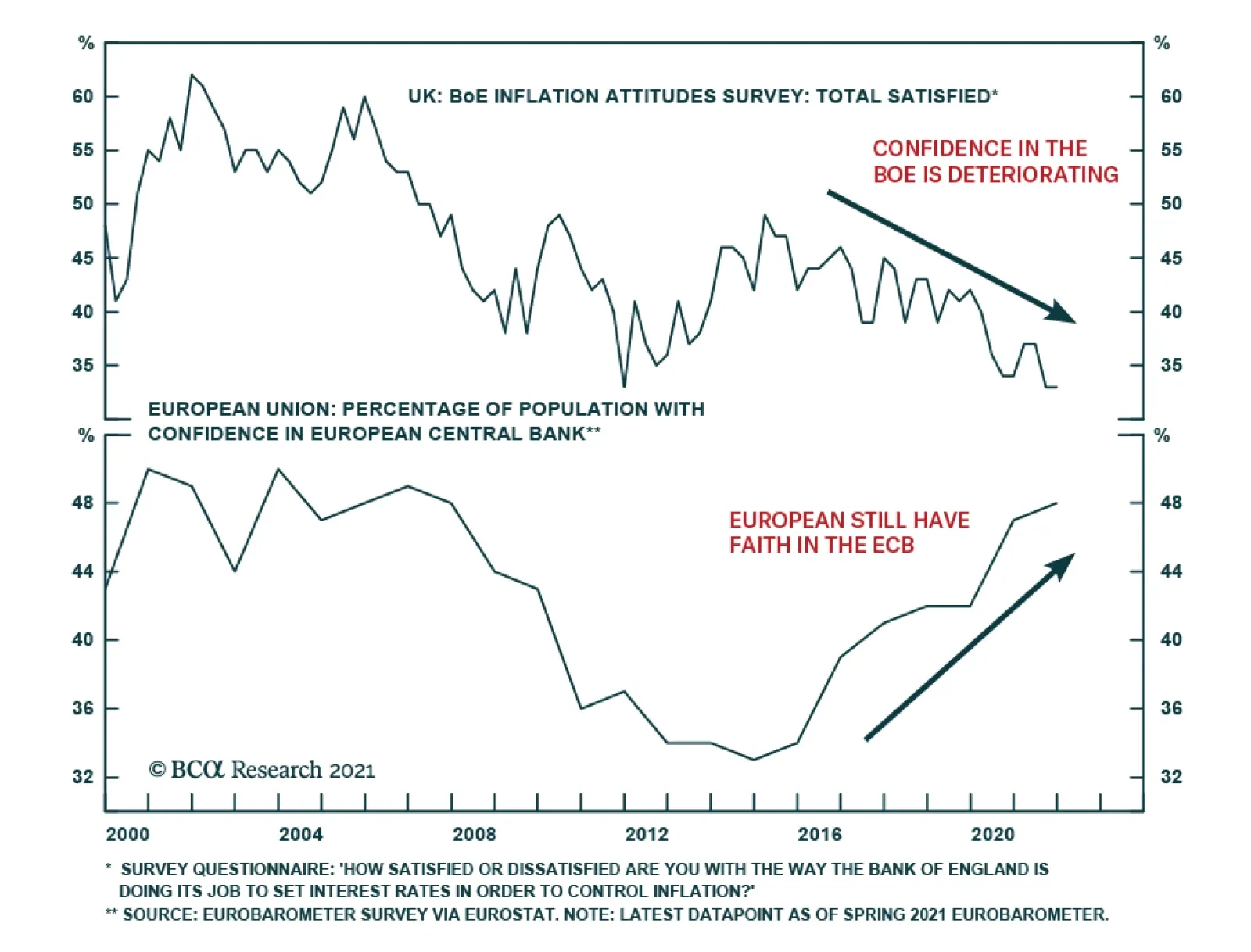

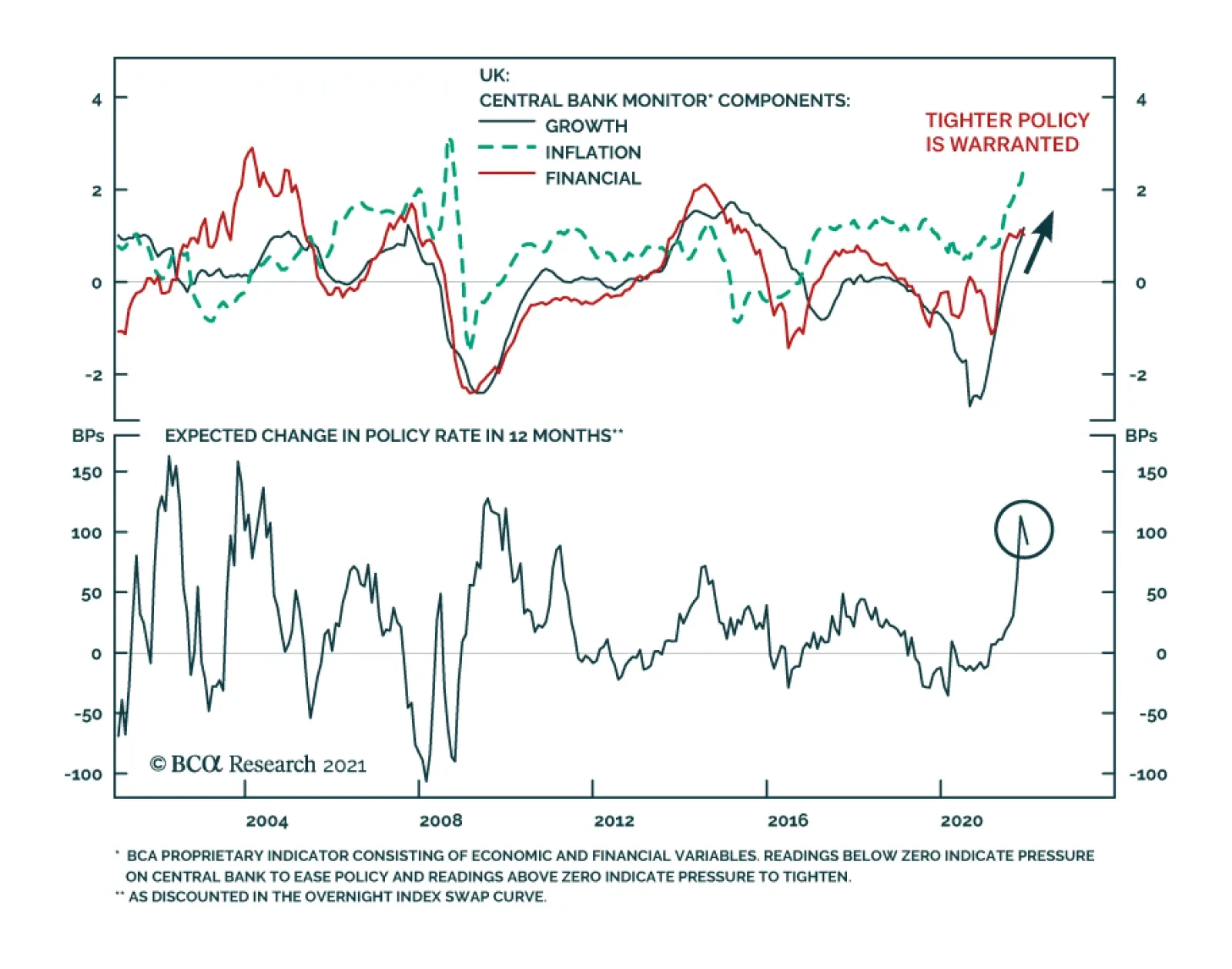

The flurry of monetary policy decisions announced over the past 48 hours highlight that central bankers globally are responding to inflationary risks to maintain their credibility. Following Wednesday’s hawkish FOMC outcome…

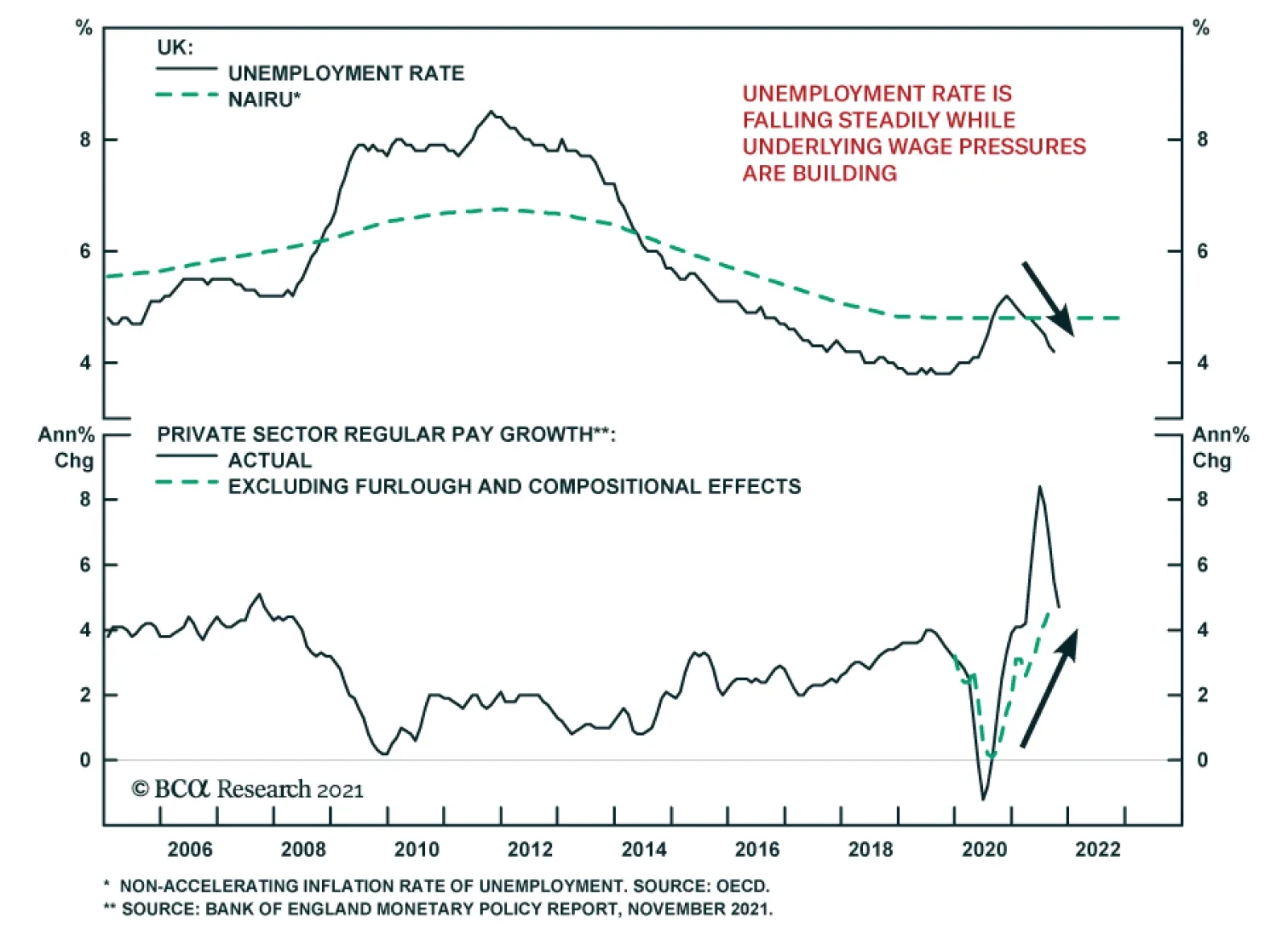

The UK labor market recovery appears to be withstanding the September expiry of the government’s Job Retention Scheme. The number of payrolled employees increased by 257 thousand in November to 29.4 million. This latest…

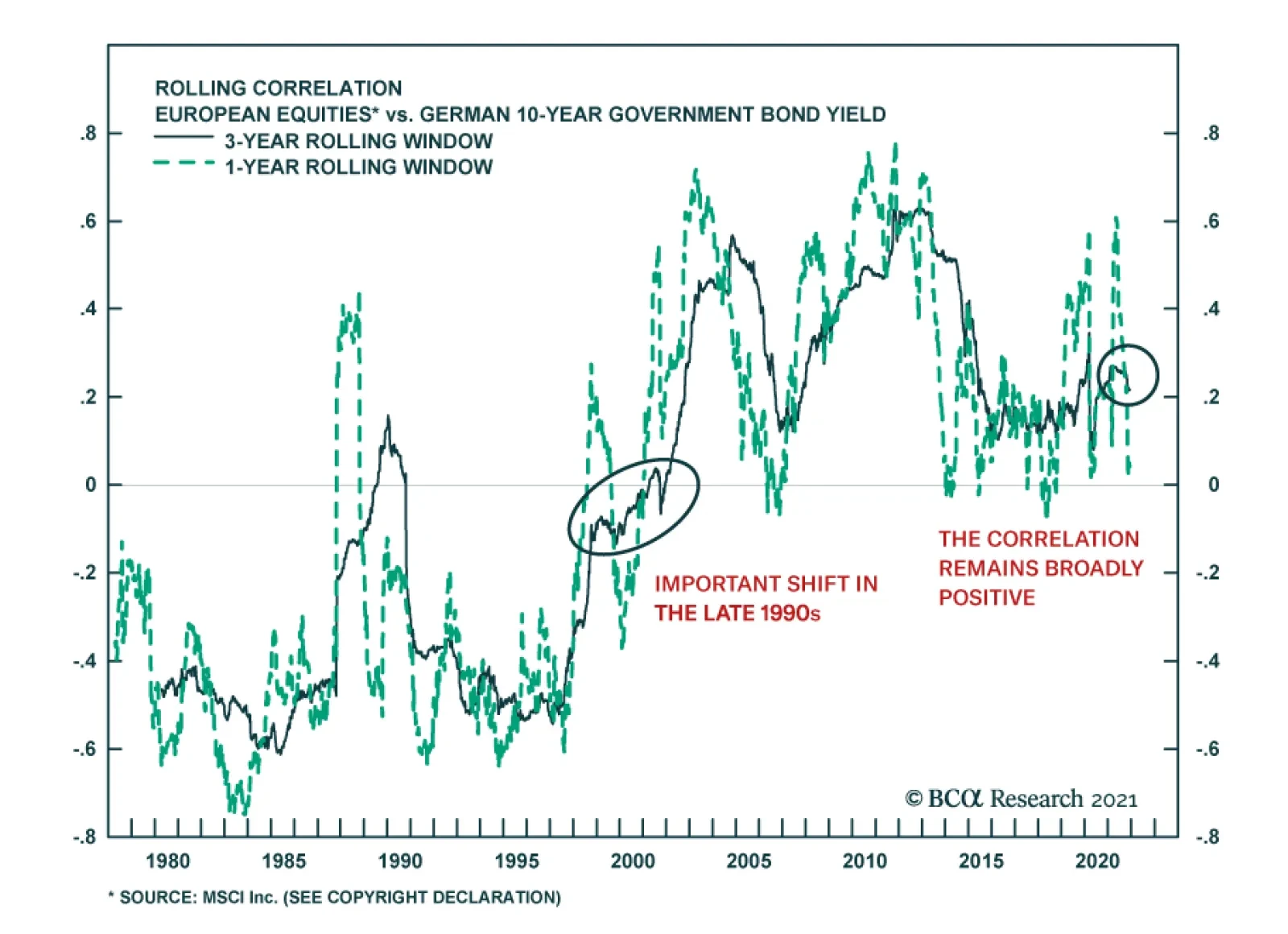

BCA Research’s European Investment Strategy service concludes that European equities are likely to withstand higher yields in 2022. To begin with, BCA Research’s US Bond strategists anticipate a modest…

Highlights The risk to European stocks from higher yields is overstated for 2022. Not only do equities possess a valuation cushion compared to bonds, but also the stock returns/bond yields correlation remains positive. This positive…

Market participants have been rolling back their rate hike expectations for the BoE. The emergence of the omicron variant and economic risks around tighter restrictions have only reinforced this trend. Meanwhile, UK Gilts have…

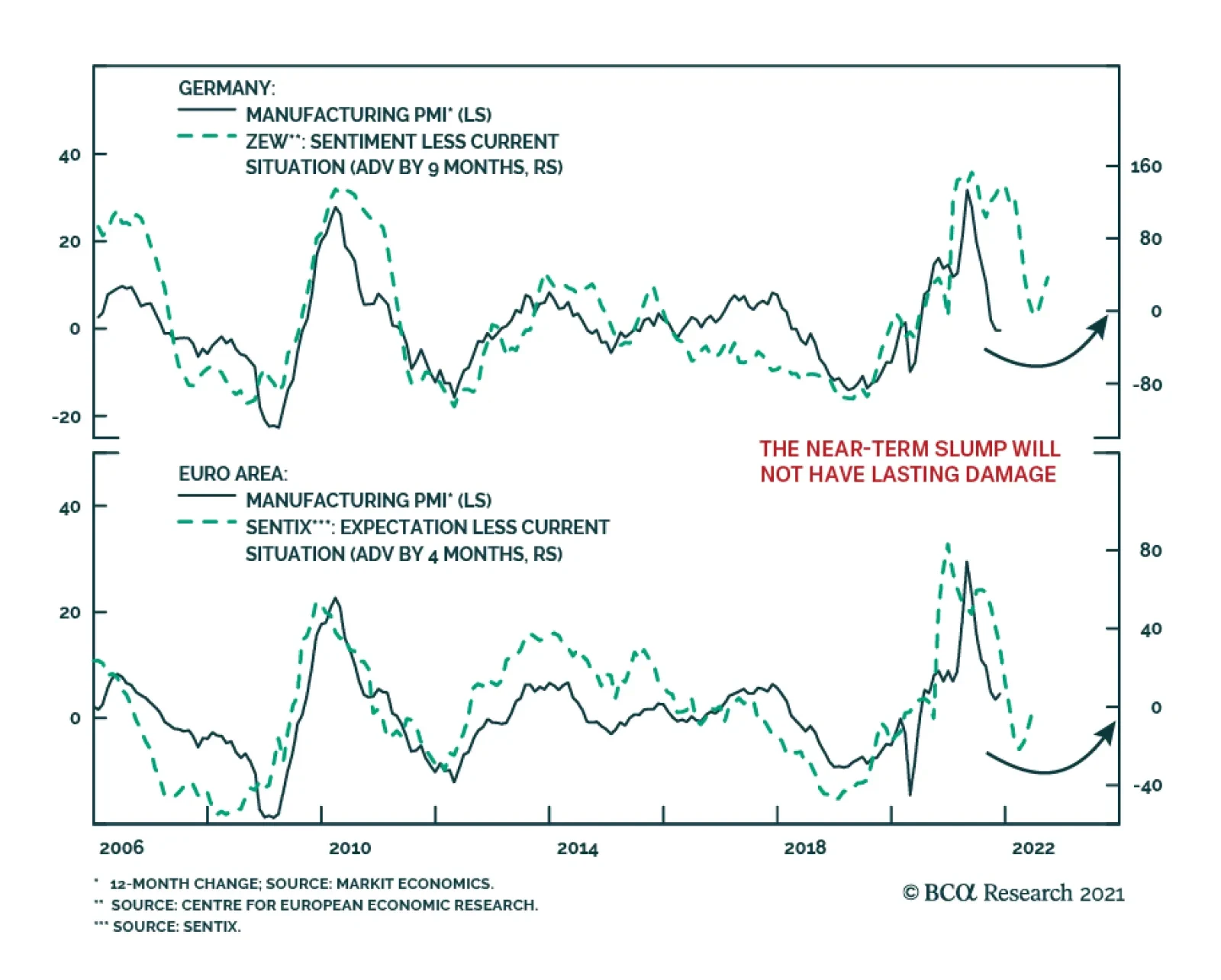

The Zew survey of investor sentiment reveals that confidence in Germany’s economic situation and outlook deteriorated in December. The current situation indicator lost 19.9 points and fell to a 6-month low of -7.4. A…