Executive Summary A Swedish Warning Stocks are oversold but downside risks persist. The Fed is on the verge of beginning a tightening cycle, which creates a process often linked to deeper and longer equity corrections…

Feature This week, we present the third edition of the BCA Research Global Fixed Income Strategy (GFIS) Global Credit Conditions Chartbook – a review of central bank surveys of bank lending standards and loan demand. The data from…

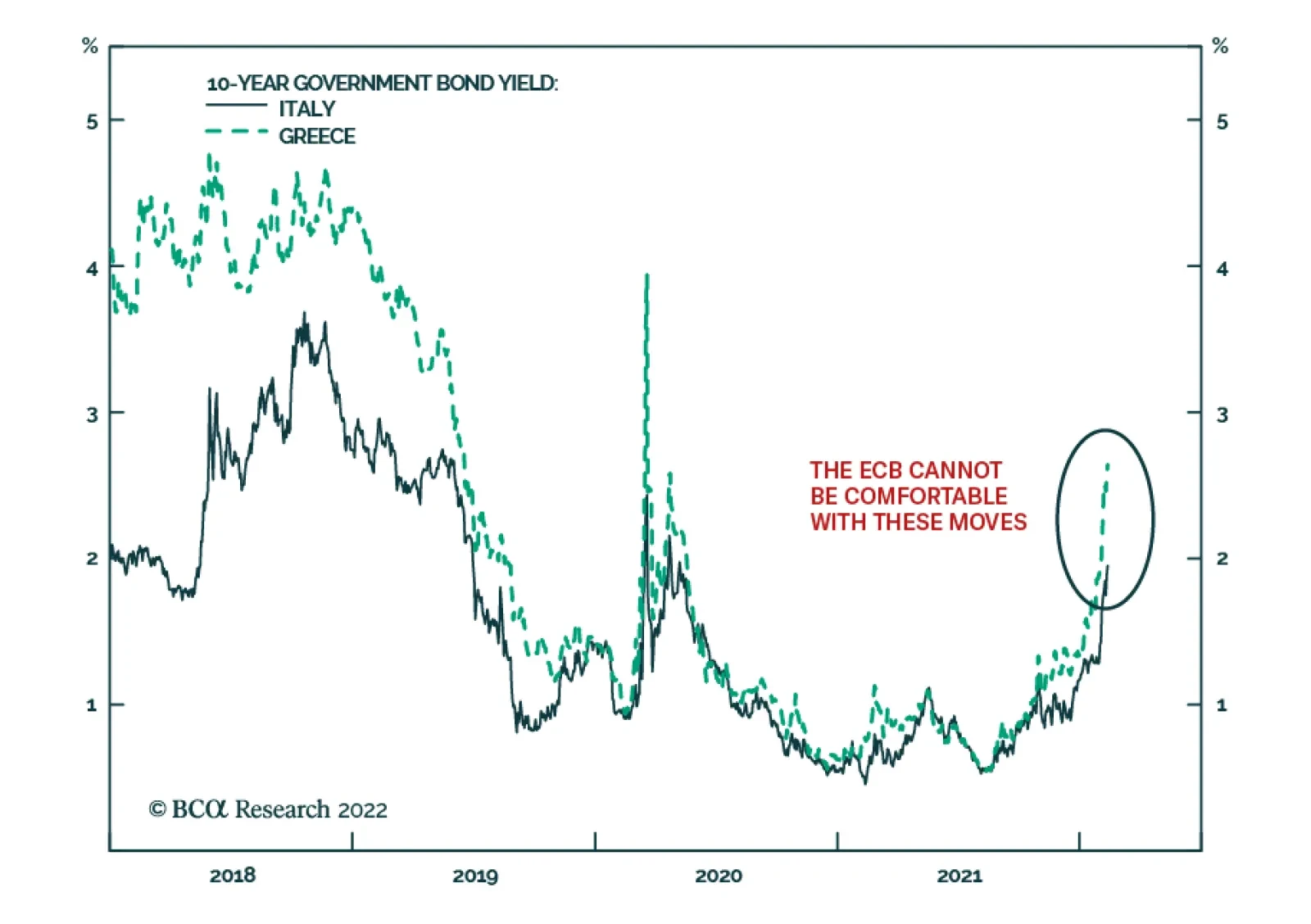

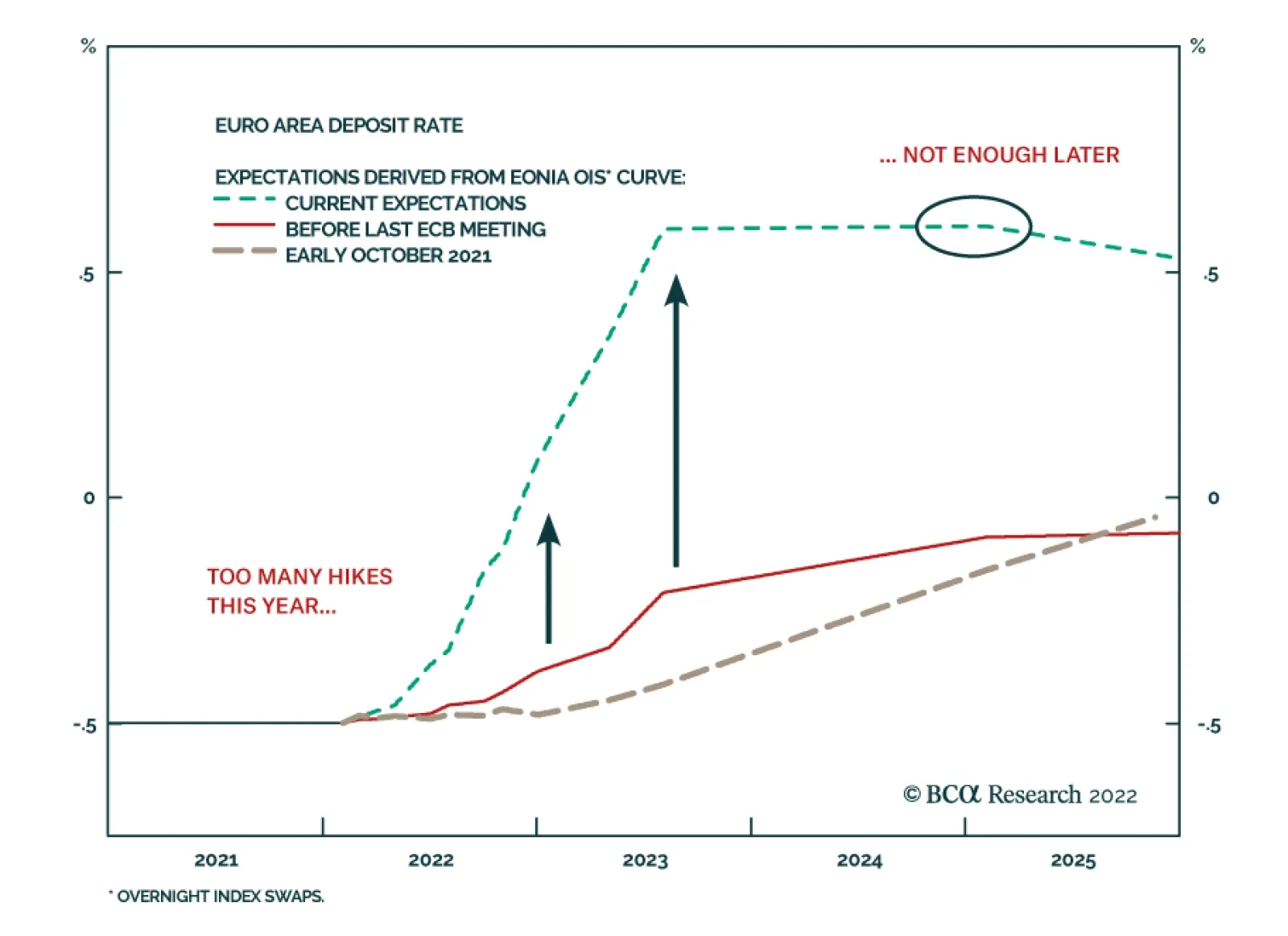

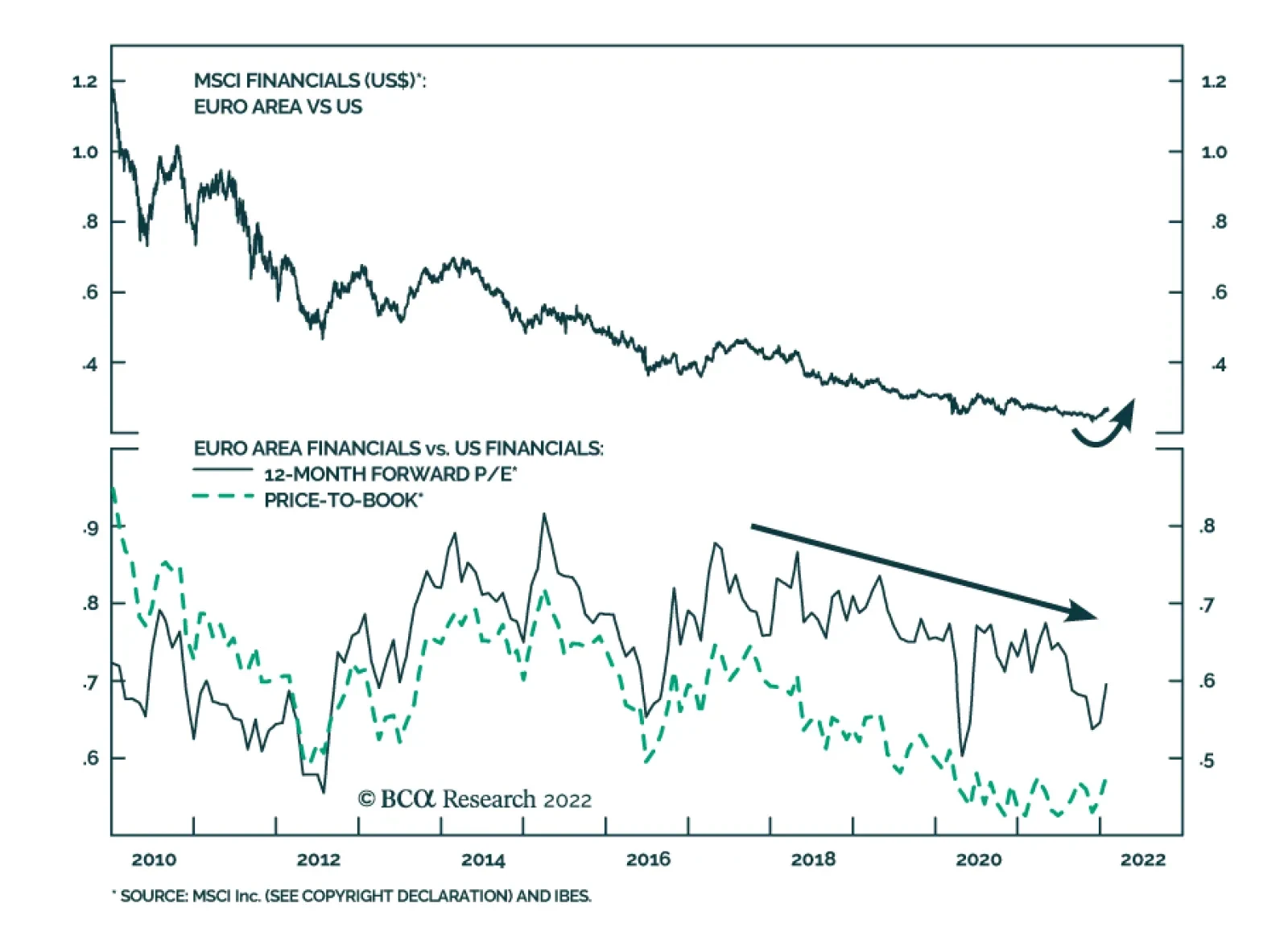

BCA Research’s European Investment Strategy service concludes that tightening financial conditions will preempt the European Central Bank from hiking rates as much as the money market is pricing in. First, the behavior…

Highlights A feedback loop has emerged in European markets. Tightening financial conditions will preempt the European Central Bank from hiking rates as much as the money market is pricing in. The widening in peripheral and credit…

Executive Summary The Euro And Relative Growth The euro is likely to appreciate over the course of 2022. But the path will be volatile, with a retest of recent EUR/USD lows within the central band of possible outcomes. Our…

Executive Summary The End Of The Negative Bond Yield Era Recent price action in developed market government bond markets confirms a backdrop that has been in place for the past several years - movements in US Treasuries…

According to BCA Research’s European Investment Strategy service, the €STR curve is pricing in the potential path of the ECB this year too aggressively. First, inflationary dynamics in Europe are much tamer than…

A dominant market theme this year is rising global government bond yields as central banks exit ultra-accommodative monetary policy and attempt to stymie inflationary pressures. The equity market implication of rising bond yields…

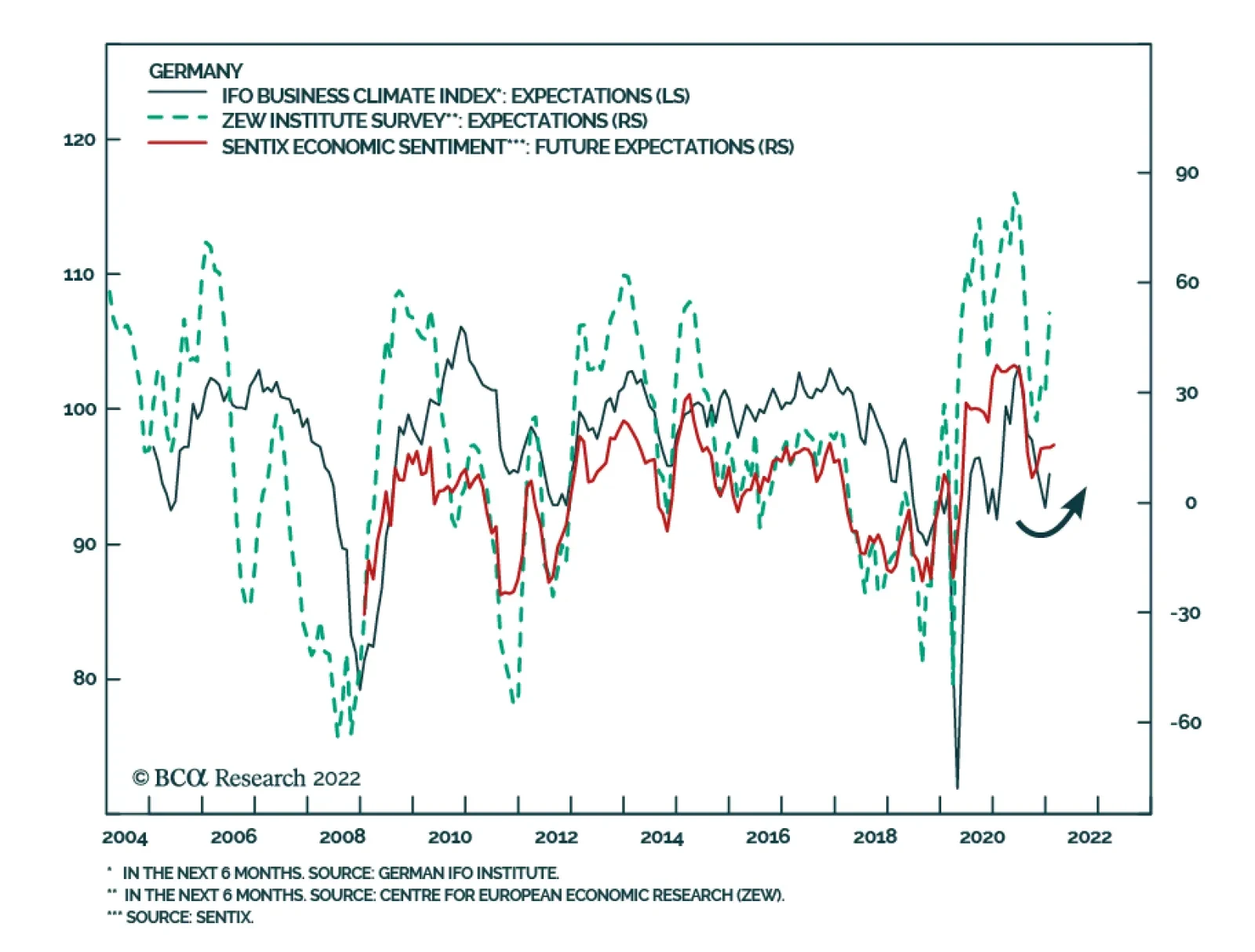

The Sentix Economic Index is sending a positive signal about investor morale in the Eurozone. The overall index increased by 1.7 points to 16.6 – above expectations of a more muted increase to 15.2. The higher headline…