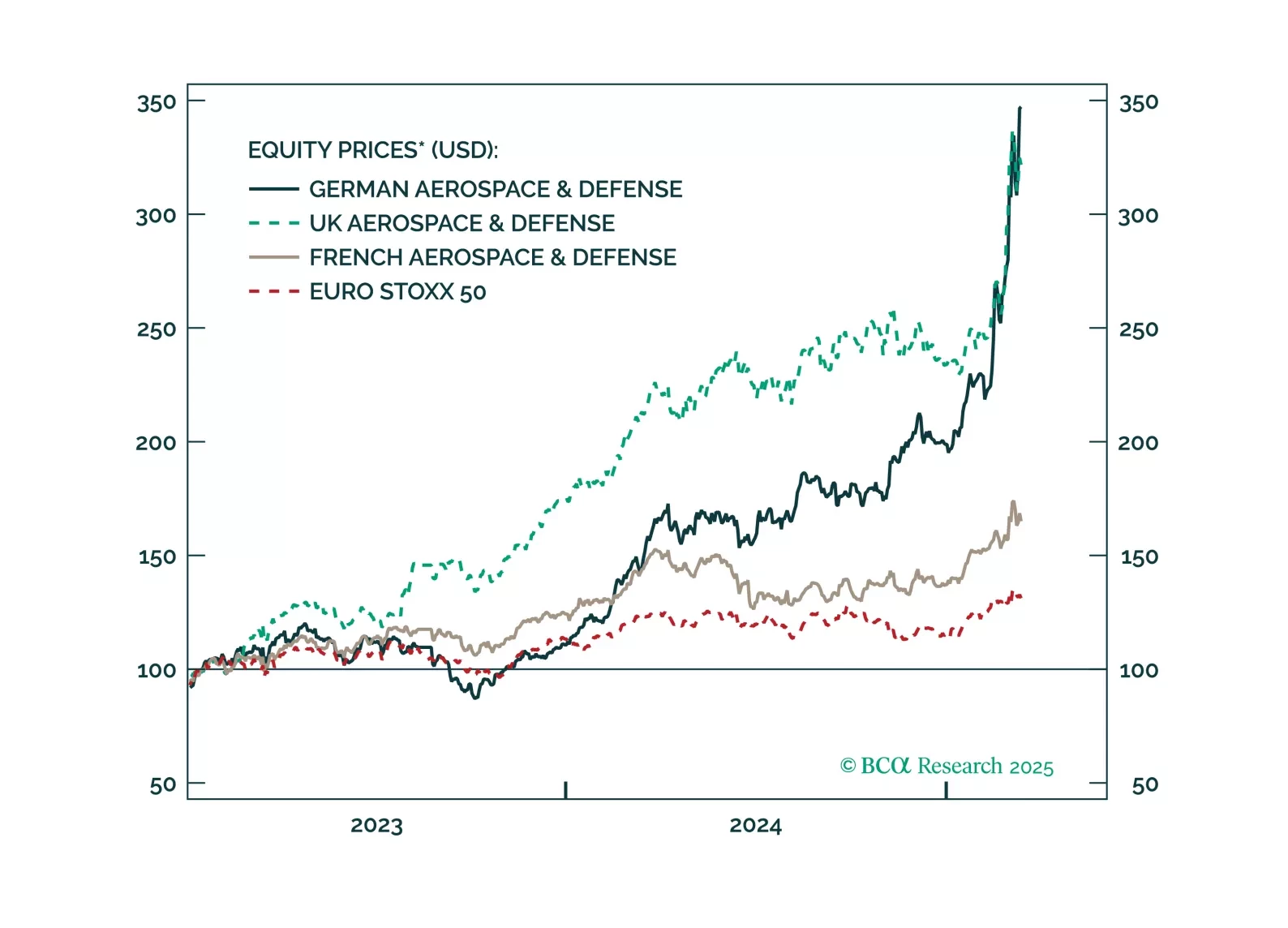

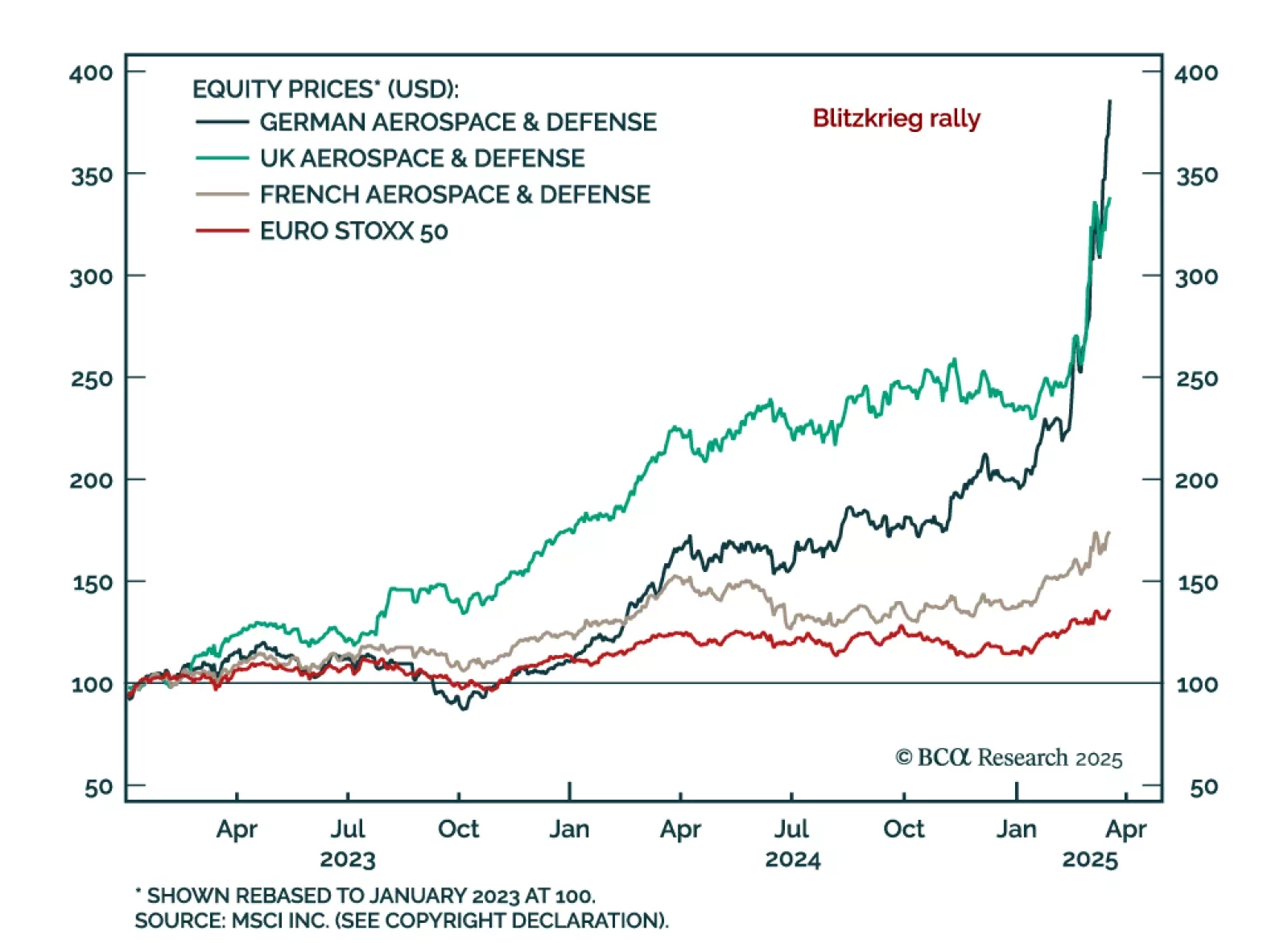

Our European strategists looked at the European defense sector after the massive rally following Germany’s fiscal turnaround. The rally in European defense stocks, up over 100% since their March 2023 recommendation, is…

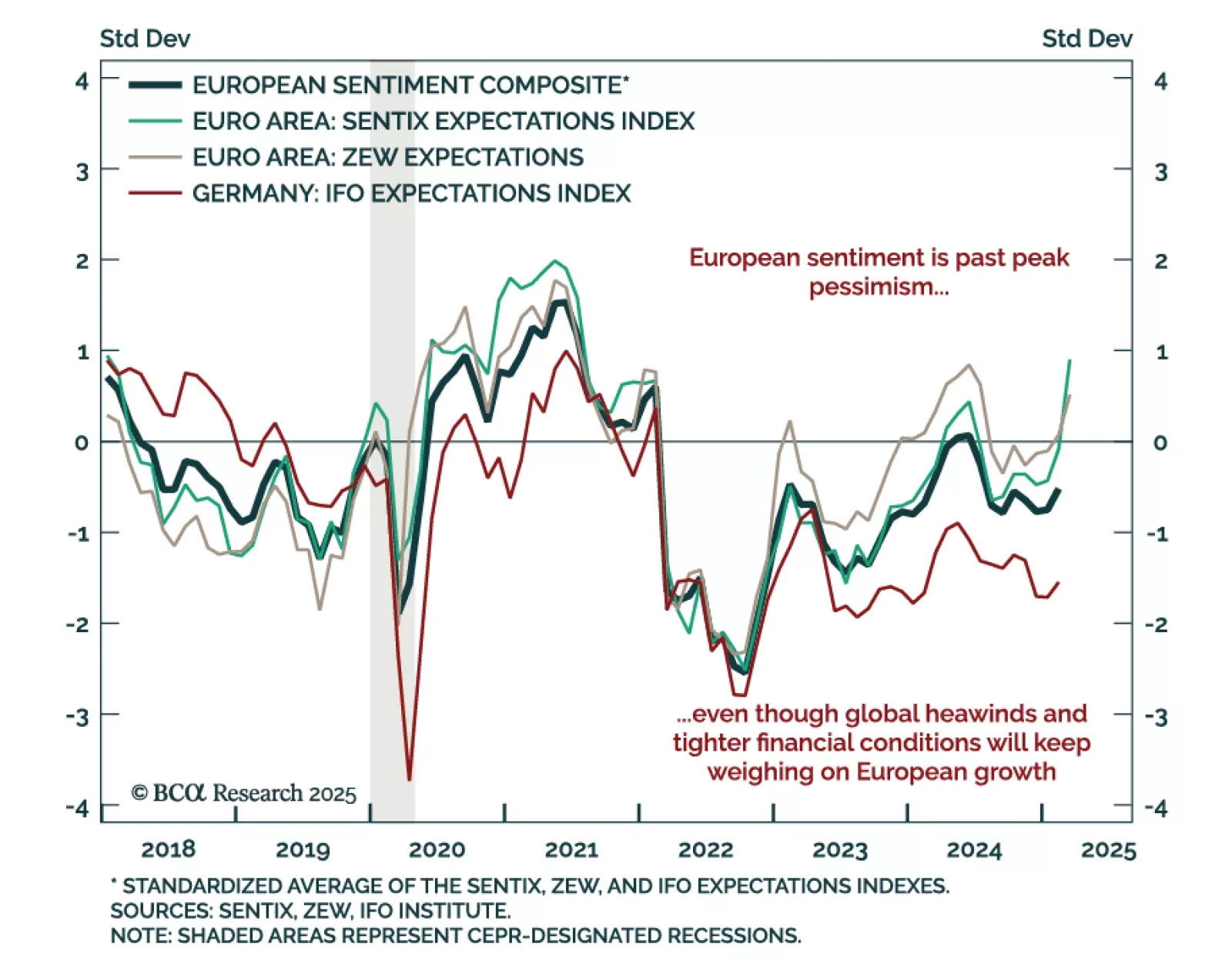

The March ZEW index for Germany and the eurozone beat estimates, with the expectations component rising to 51.6 from 26.0 in February. The current situation assessment only marginally improved yet remains deeply negative at -87.6.…

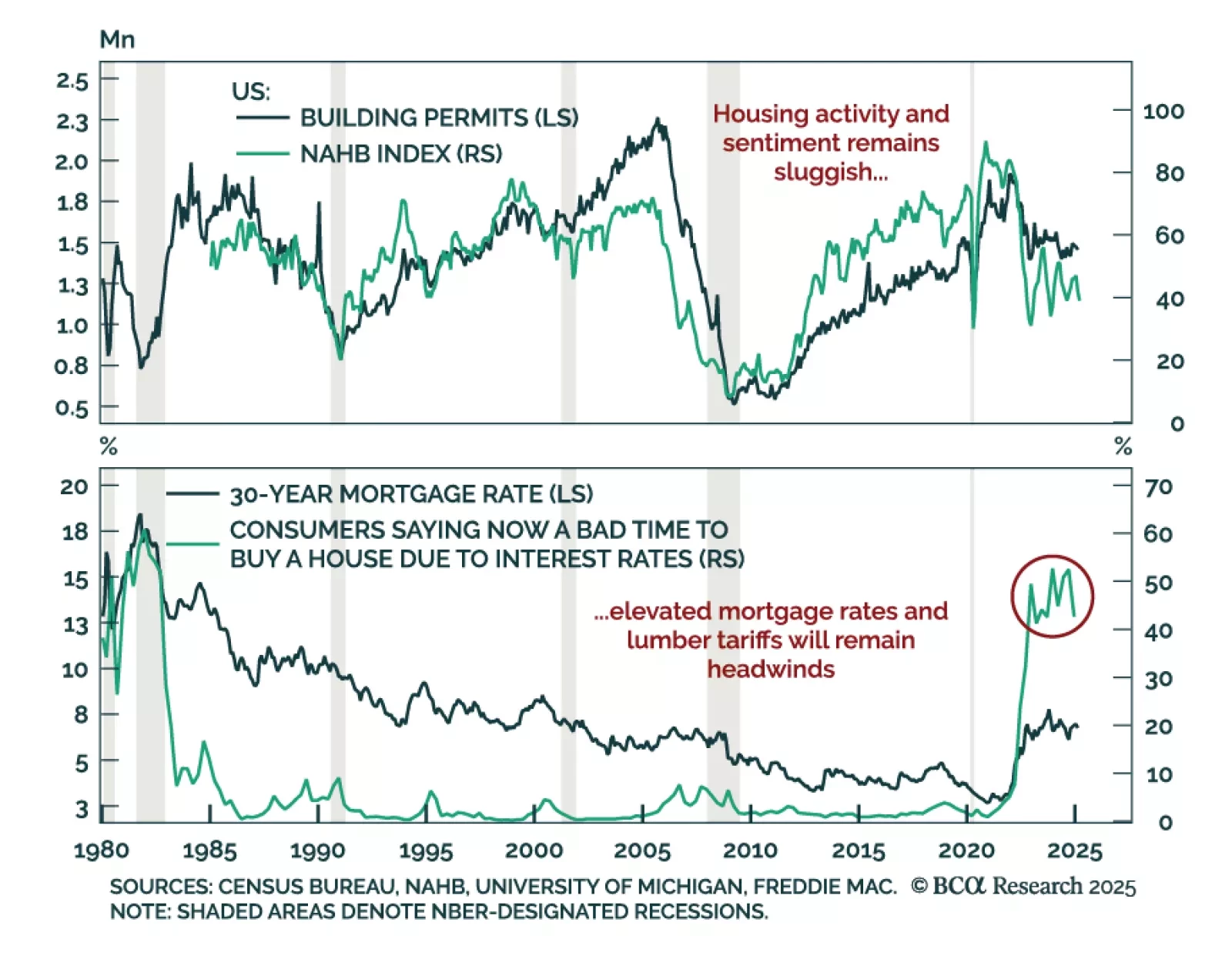

US February housing data was relatively strong, with housing starts rising 11.2% m/m after falling 9.8% in January. While they fell less than expected, building permits still declined at a faster pace than in January. The March NAHB…

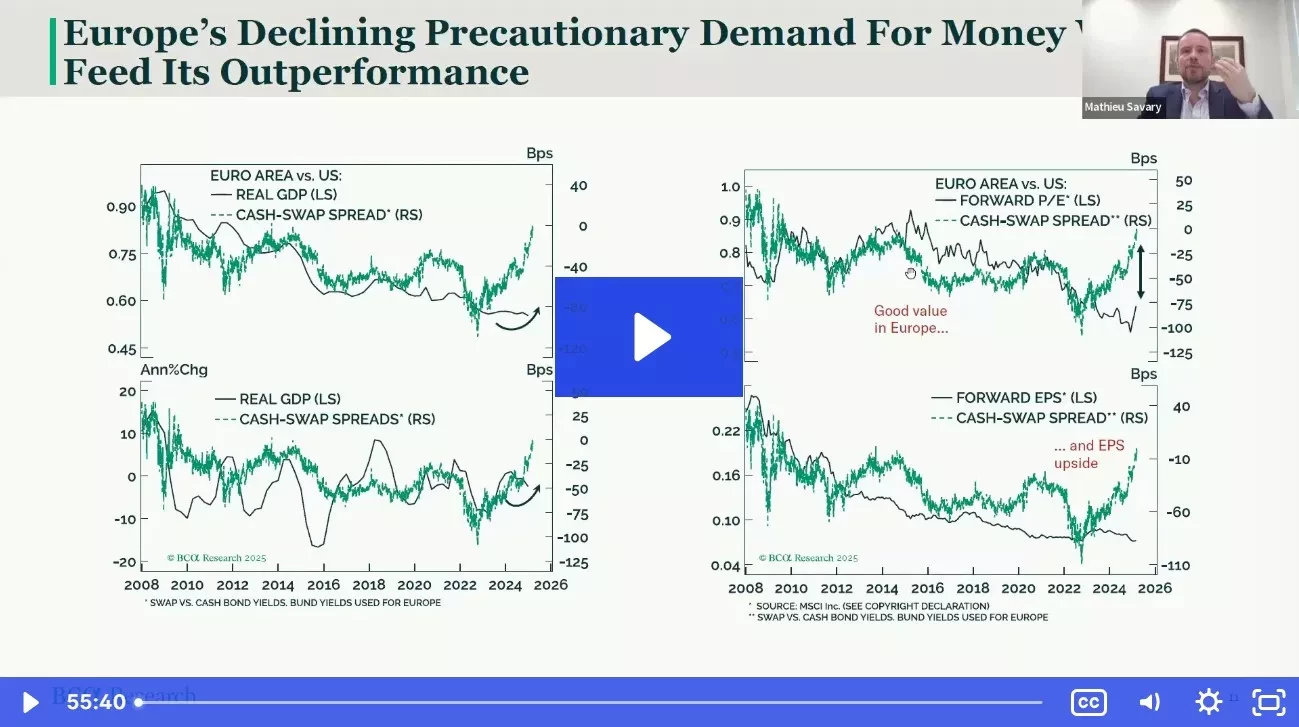

Join our webcast as we break down what’s next for European vs. U.S. equities—and where the best opportunities lie.

Investors should not chase the rally in European defense names any further. Too much good news has been priced in too quickly.

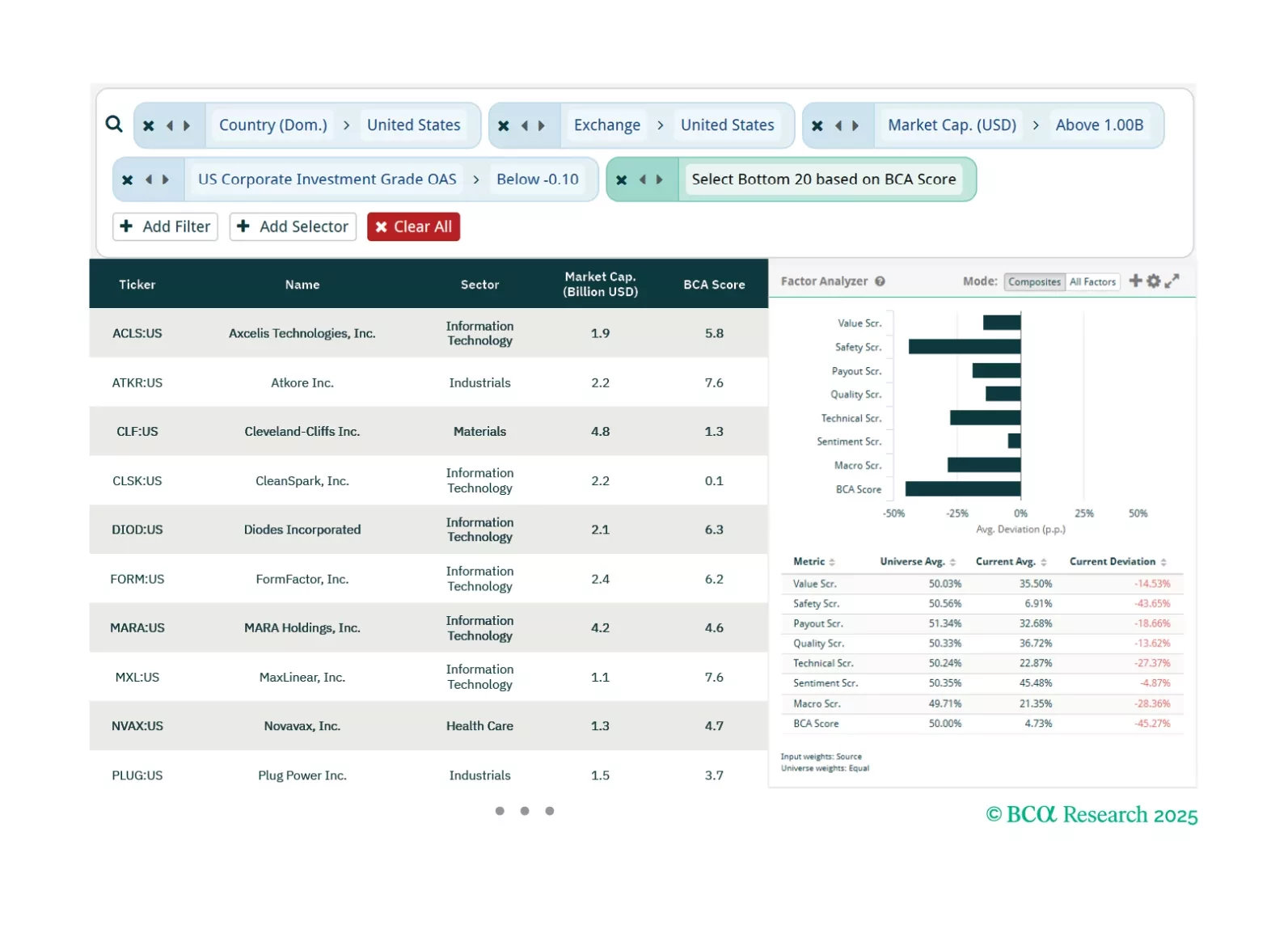

This week, our three screeners cover equity plays in US OAS Spreads, US Exceptionalism, and “DIVE”.

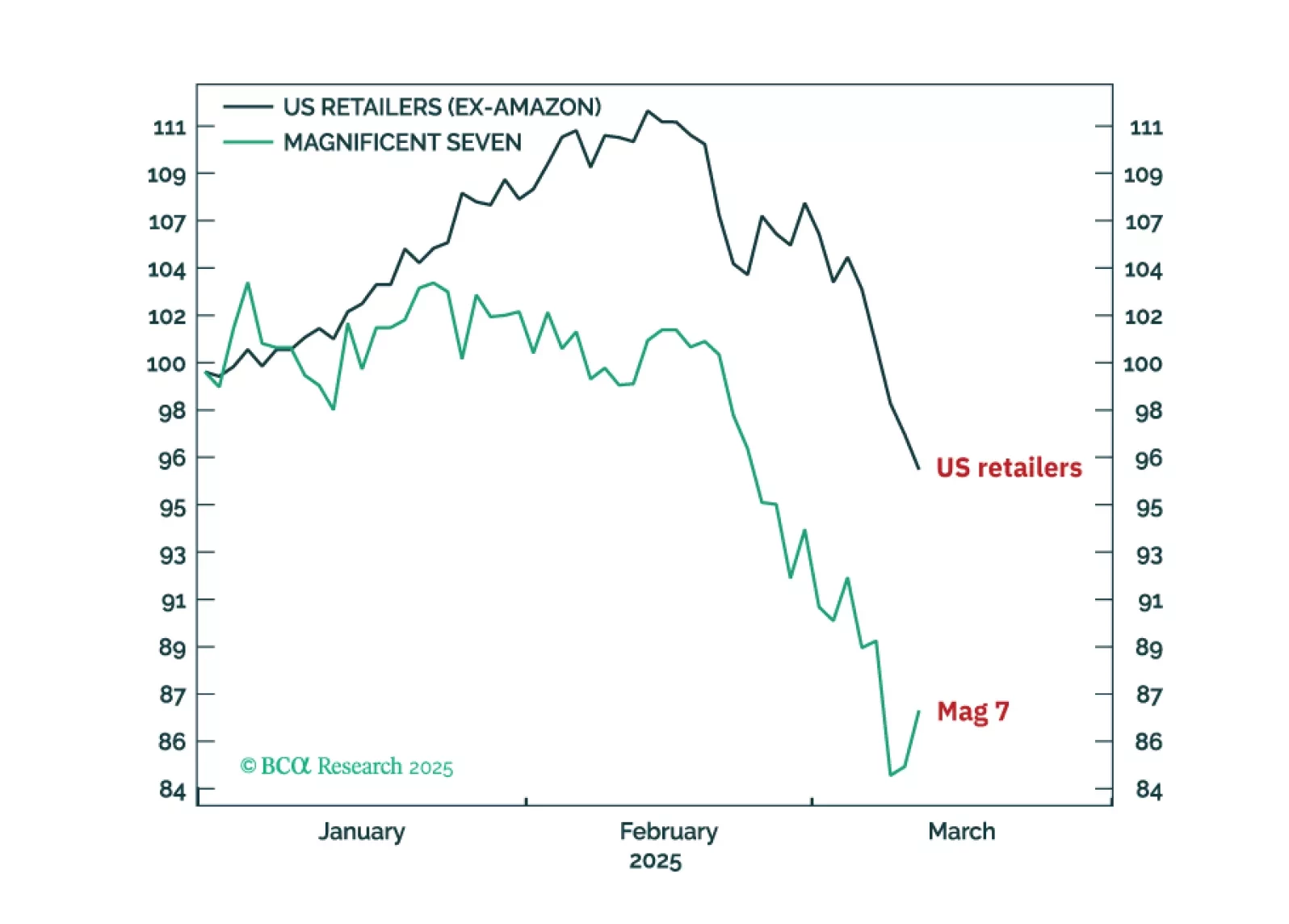

The Trump slump is nearing a temporary reprieve, with a playable countertrend rally in stocks and a tactical rebound in the dollar. Go tactically long USD/SEK. For long-term investors though, the AI bubble still has a lot of air to…

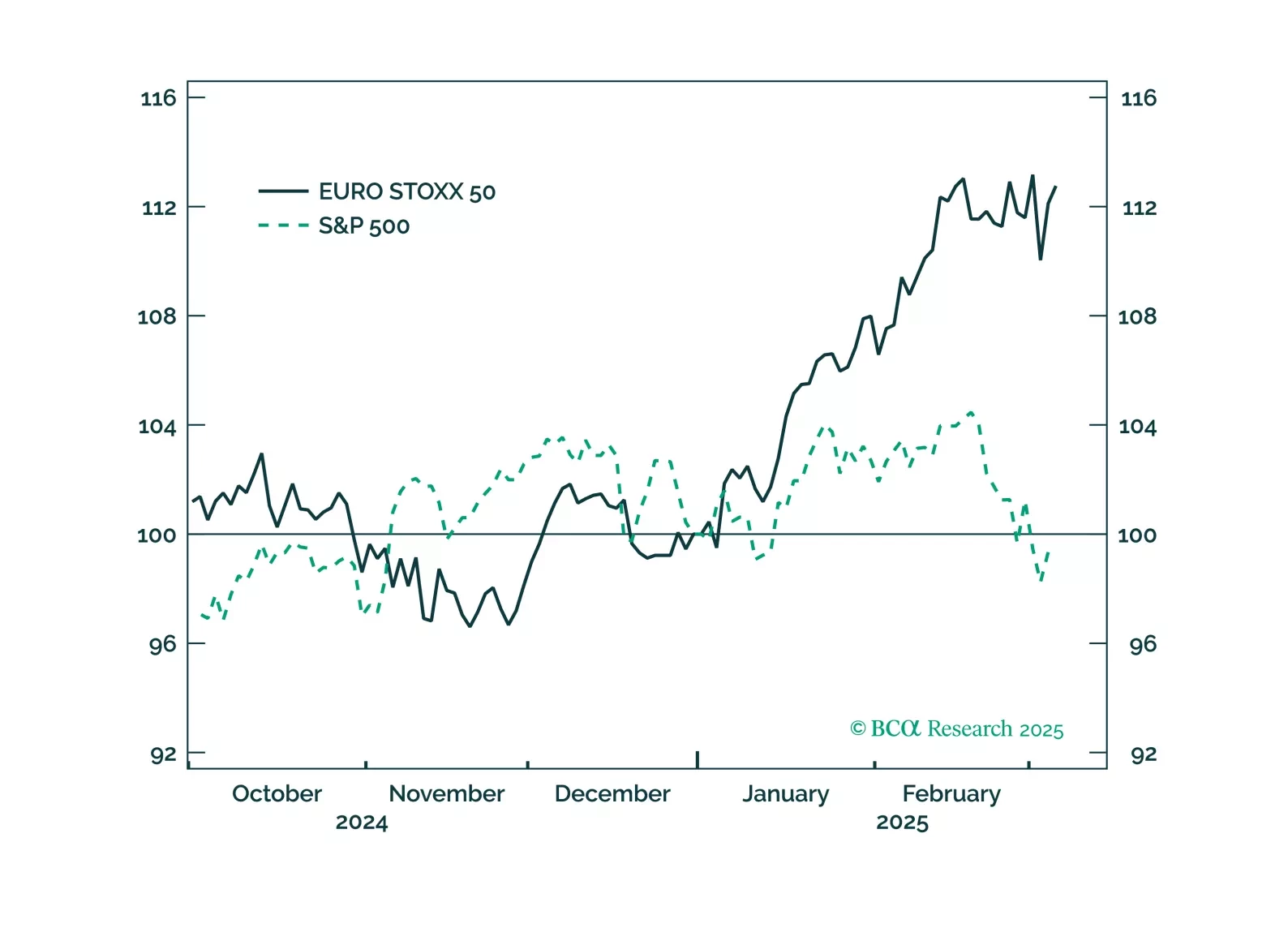

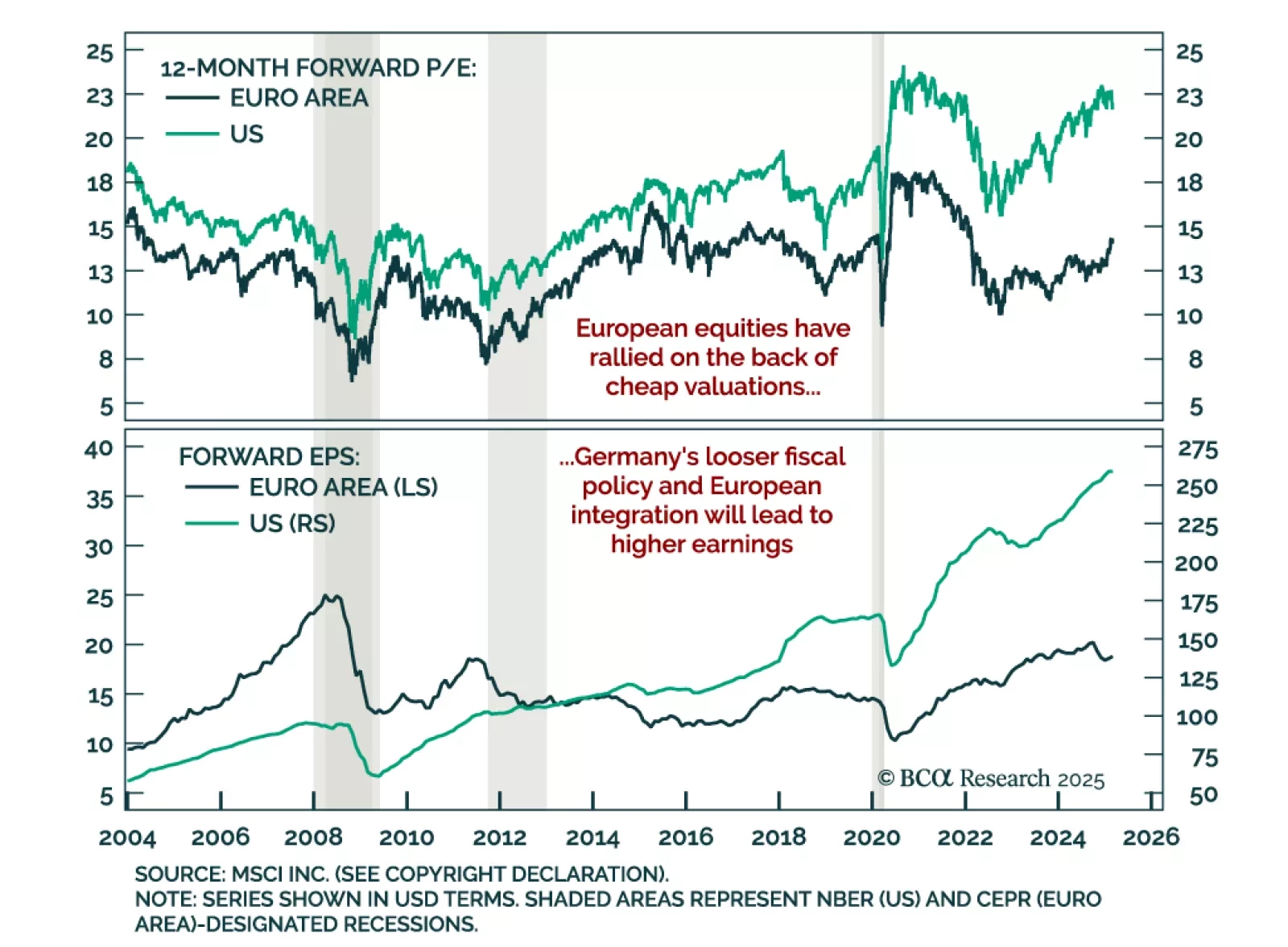

After entering 2025 with depressed growth expectations, measures of European sentiment have seemingly bottomed, and European assets rallied. However, given the changing geopolitical order and Europe’s forceful response thus far, are…

There is an alternative to investing in US stocks: Do it via Europe (DIVE). Allocate to European sectors or stocks that are highly and positively correlated with the Magnificent 7 but do not suffer stretched valuations.

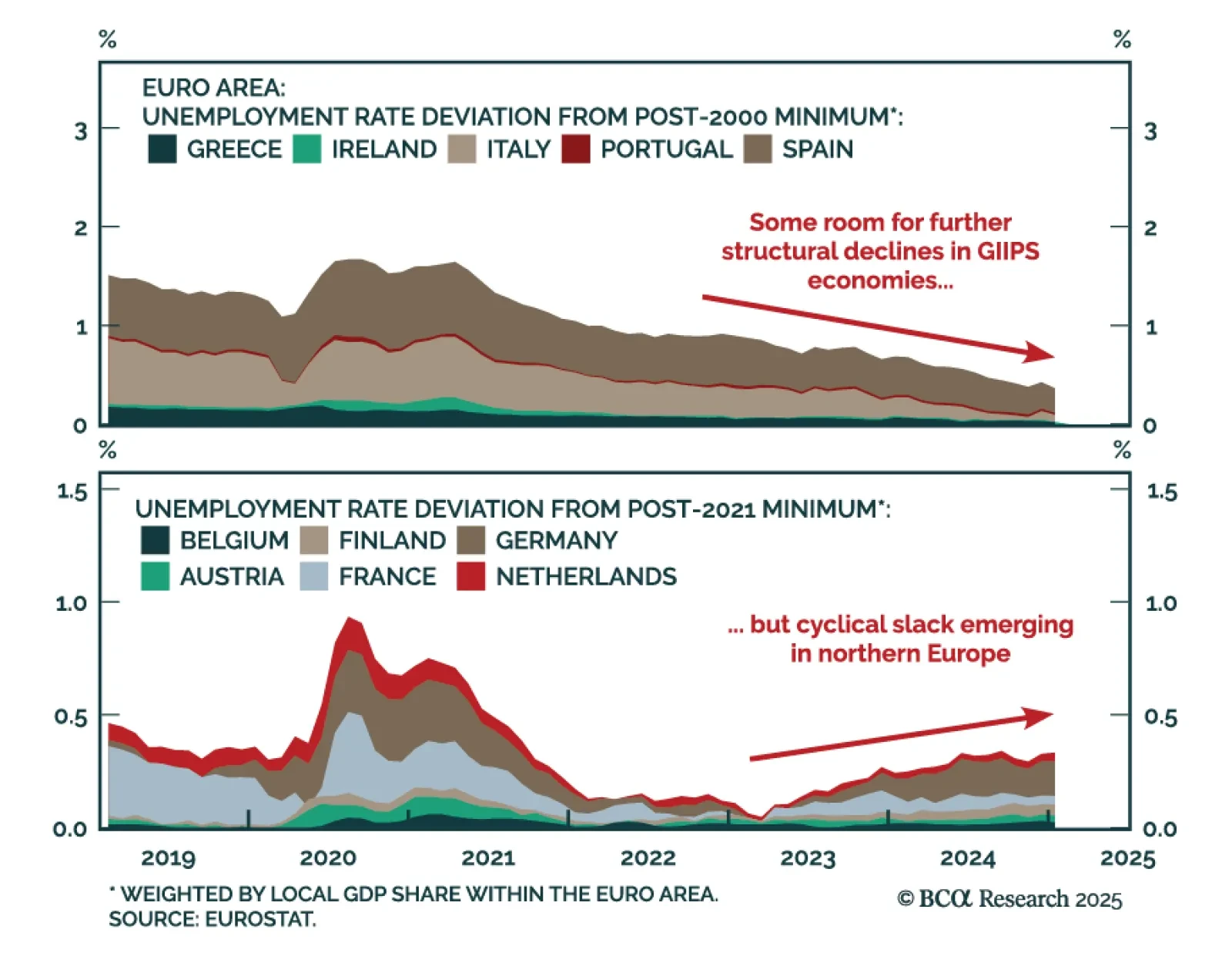

Our Chart Of The Week comes from Robert Timper, strategist in our Global Fixed Income strategy team. Robert digs into Eurozone employment dynamics. January data showed that unemployment remains at record lows, but regional…