Highlights Several factors point to both an improvement and a deterioration in economic and financial market conditions, underscoring that the 6- to 12-month investment outlook is unavoidably uncertain. On the one hand, the US will…

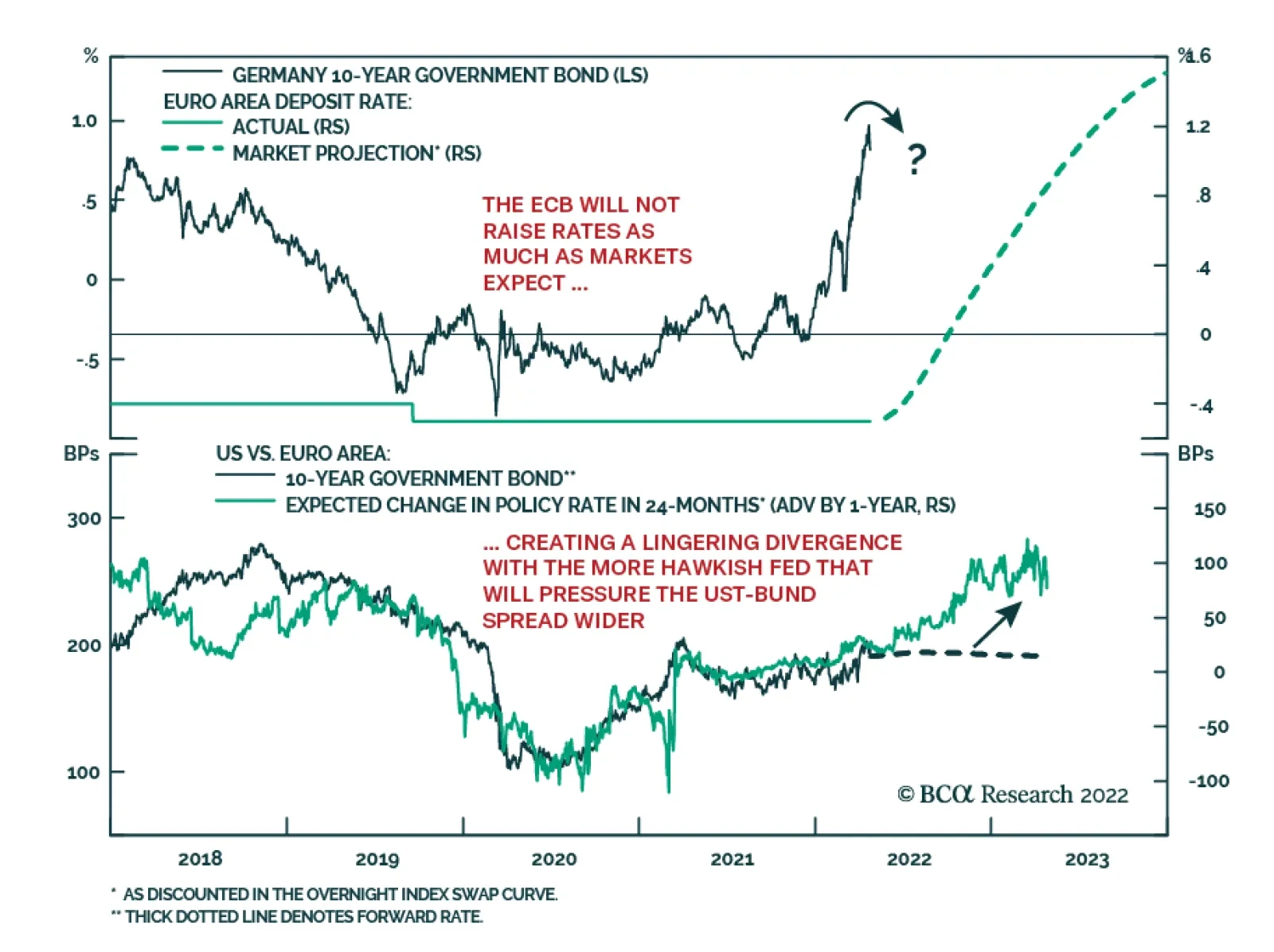

According to BCA Research’s Global Fixed Income Strategy service, a sluggish economy will handcuff the ECB’s ability to raise rates as fast as markets are discounting over the next year. Markets are now pricing in…

Executive Summary Summarizing Our Main Investment Themes In One Chart Our current strategic recommendations are centered around four key themes: global inflation will slow over the rest of 2022, Europe remains too weak to…

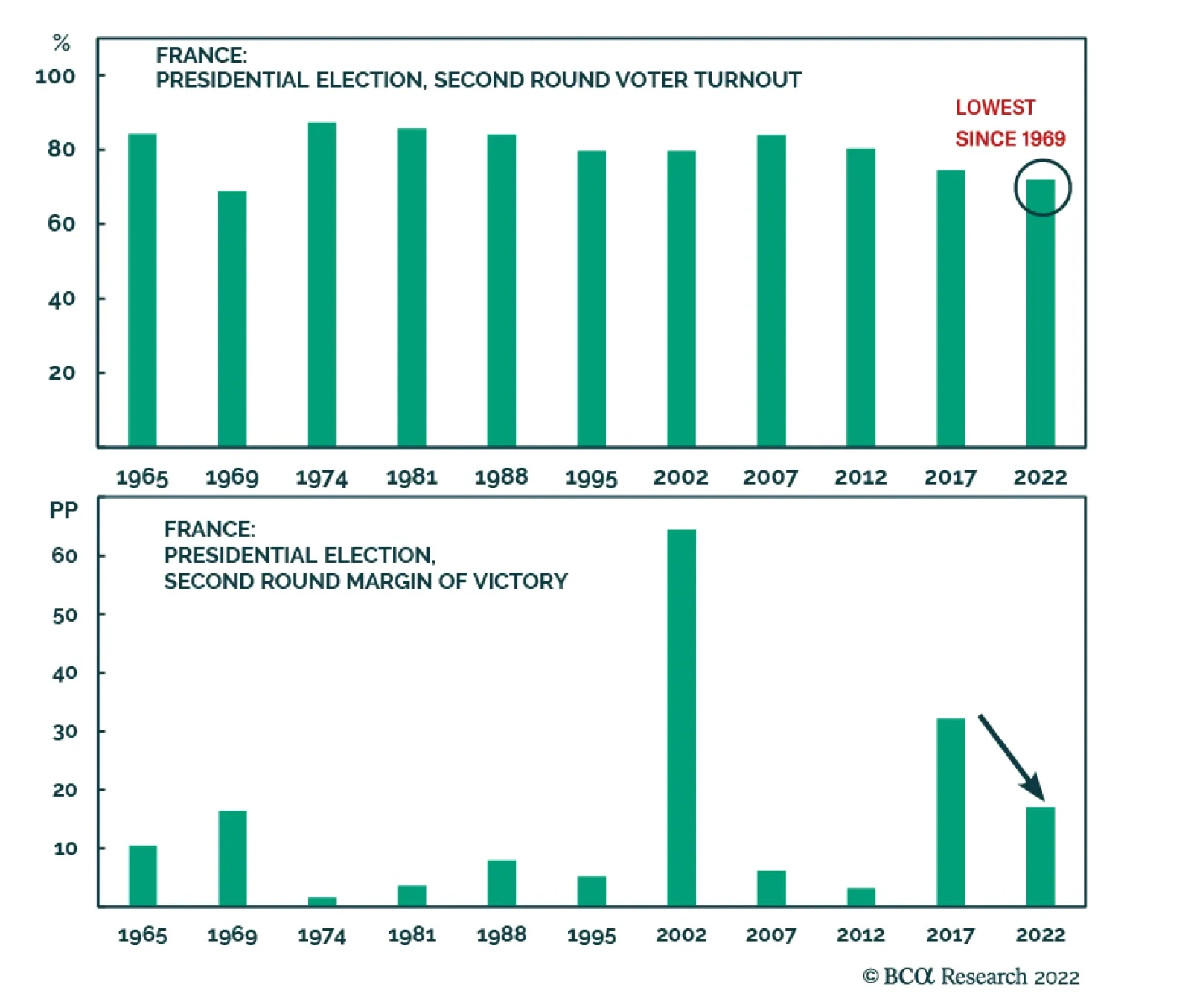

As expected, French President Emmanuel Macron secured a second term in the final round of the French presidential elections on Sunday, beating far-right rival Marine Le Pen by 58.5% to 41.5%. EUR/USD benefitted from a brief…

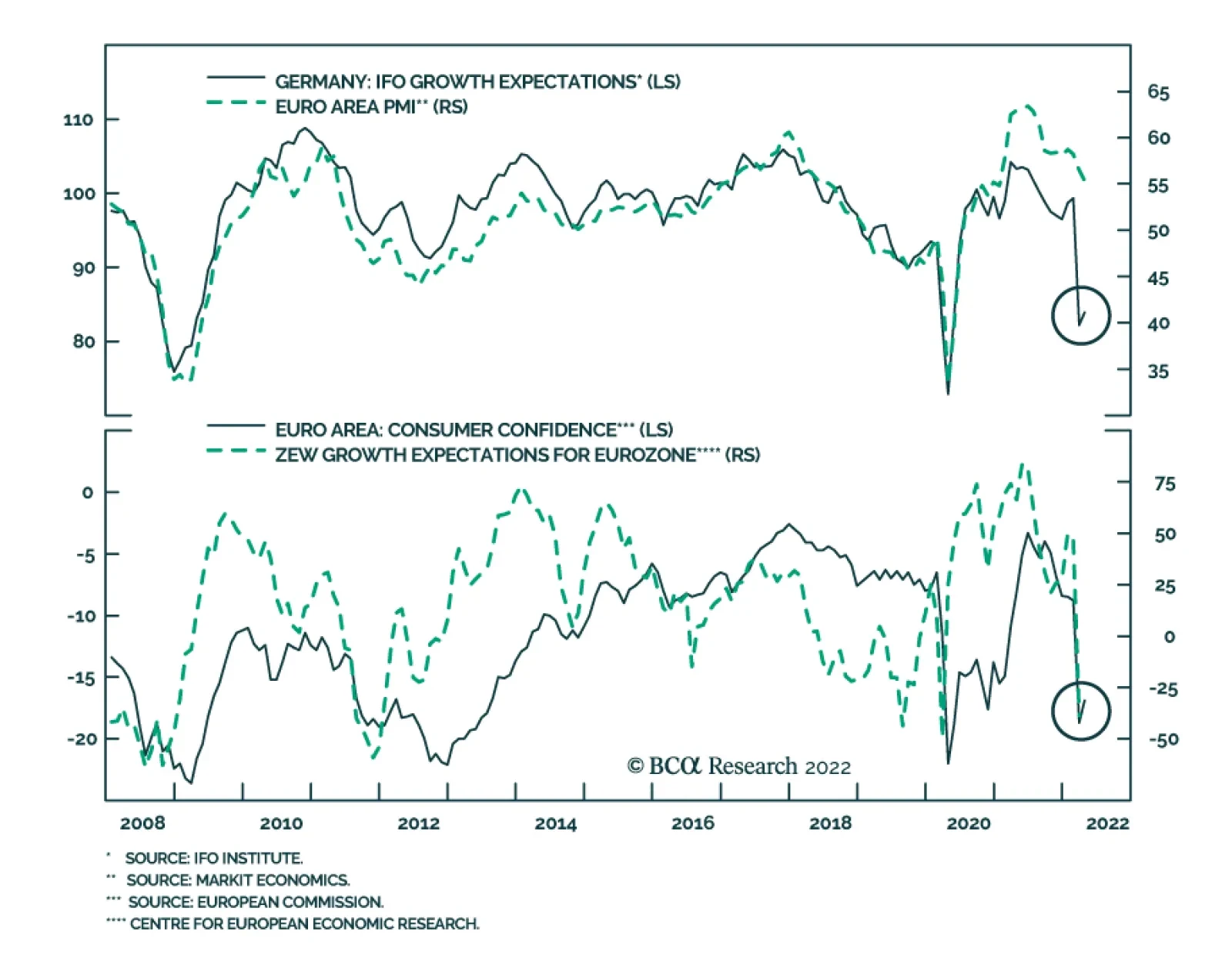

April’s release of the Ifo Business Climate Index for Germany surprised positively by edging up to 91.8 from last month’s 90.8 level, beating expectations of further deterioration. A pickup in German businesses…

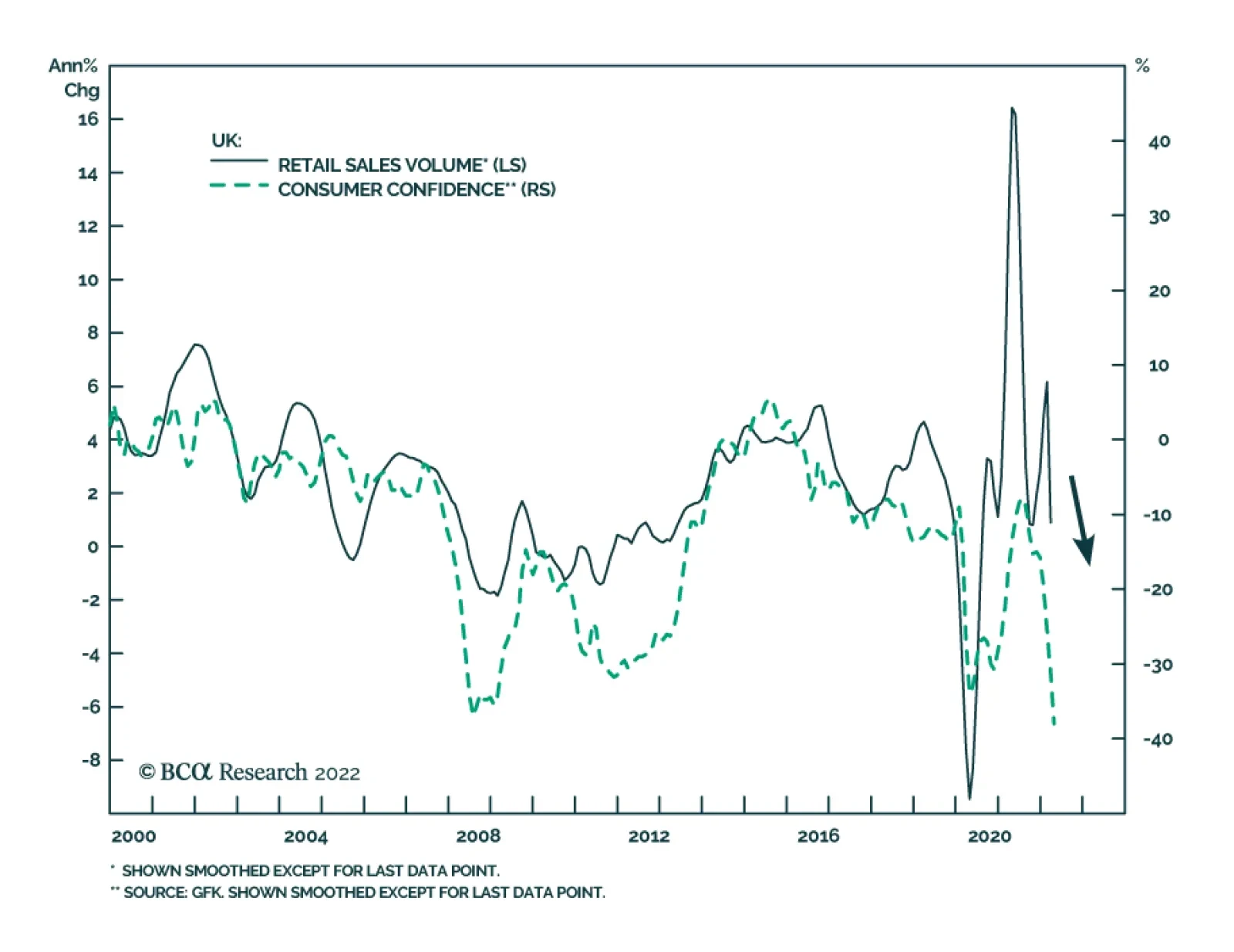

The UK economy faces multiple headwinds this year from tighter monetary and fiscal policies amid surging inflation. CPI inflation soared to a fresh 30-year high of 7% in March and the Bank of England raised interest rates at all…

Several ECB Governing Council members spoke out in favor of a more hawkish policy stance in recent days. On Wednesday, Joachim Nagel noted that there is a possibility that net purchases are concluded at the end of the second…

Executive Summary Brent Stable As Demand + Supply Fall Oil demand growth will slow this year and next by 1.6mm b/d and 1mm b/d, respectively. These expectations are in line with sharp downgrades in World Bank and IMF…

Executive Summary A Good Time For A Pause In The Bond Bear Market The global government bond selloff looks stretched from a technical perspective, and a consolidation phase is likely over the next few months as global…