In this Second Quarter Strategy Outlook, we explore the major trends that are set to drive financial markets for the rest of 2025 and beyond.

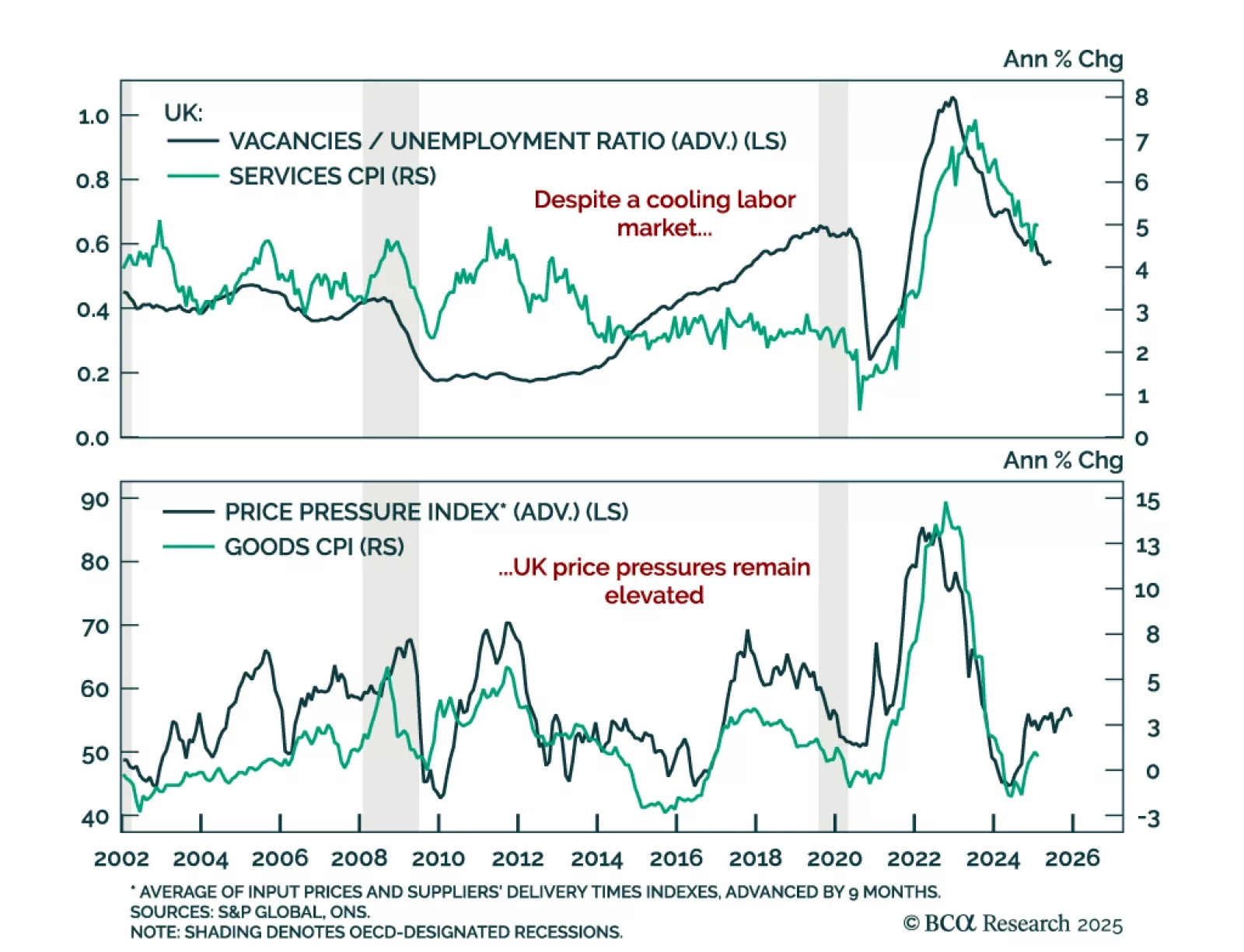

UK inflation came in cooler than expected in February, but lingering price pressures and a still-firm labor market keep the BoE sidelined, for now. Our Global Fixed-Income strategists view the BoE as the most likely DM central bank…

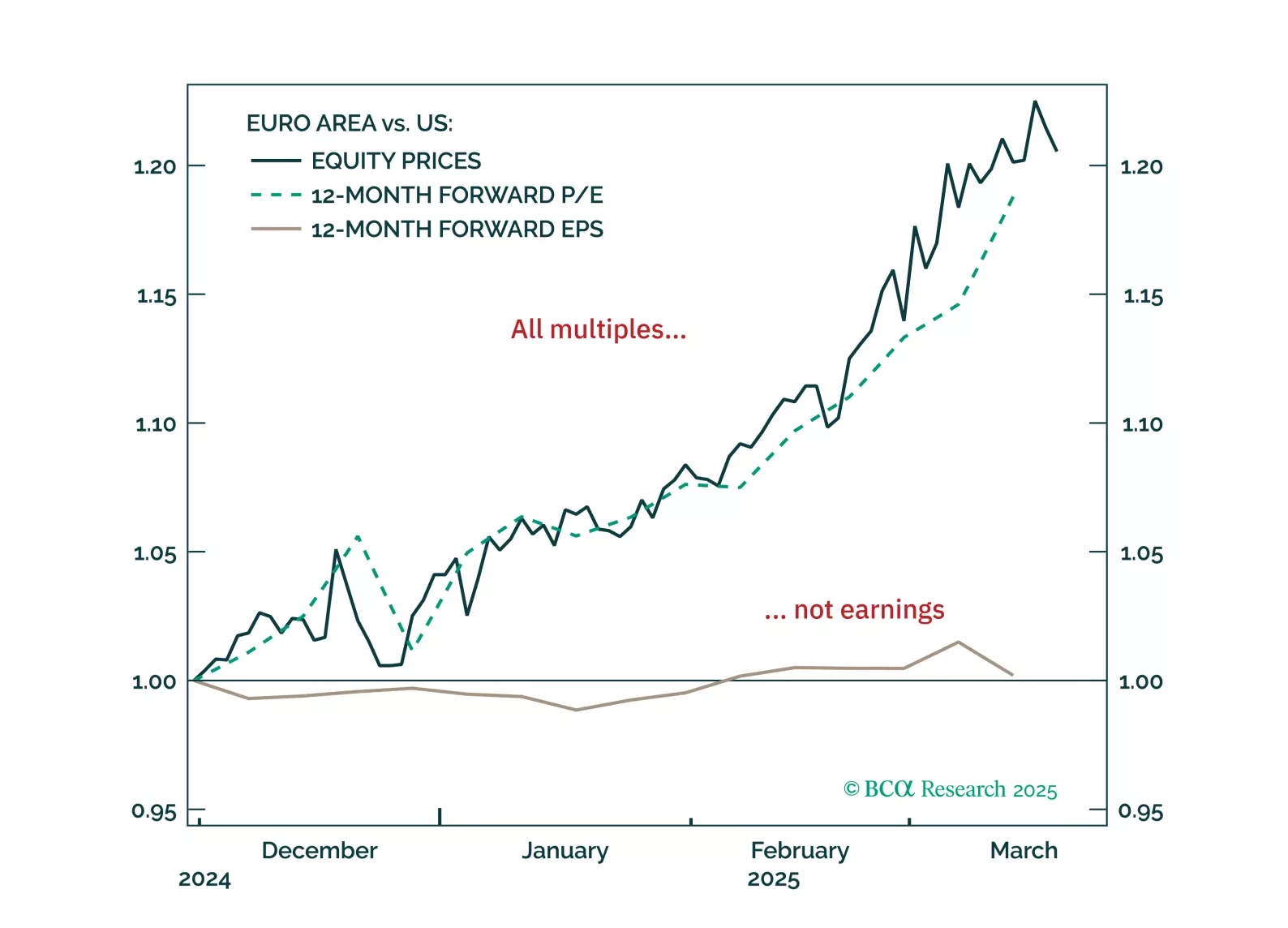

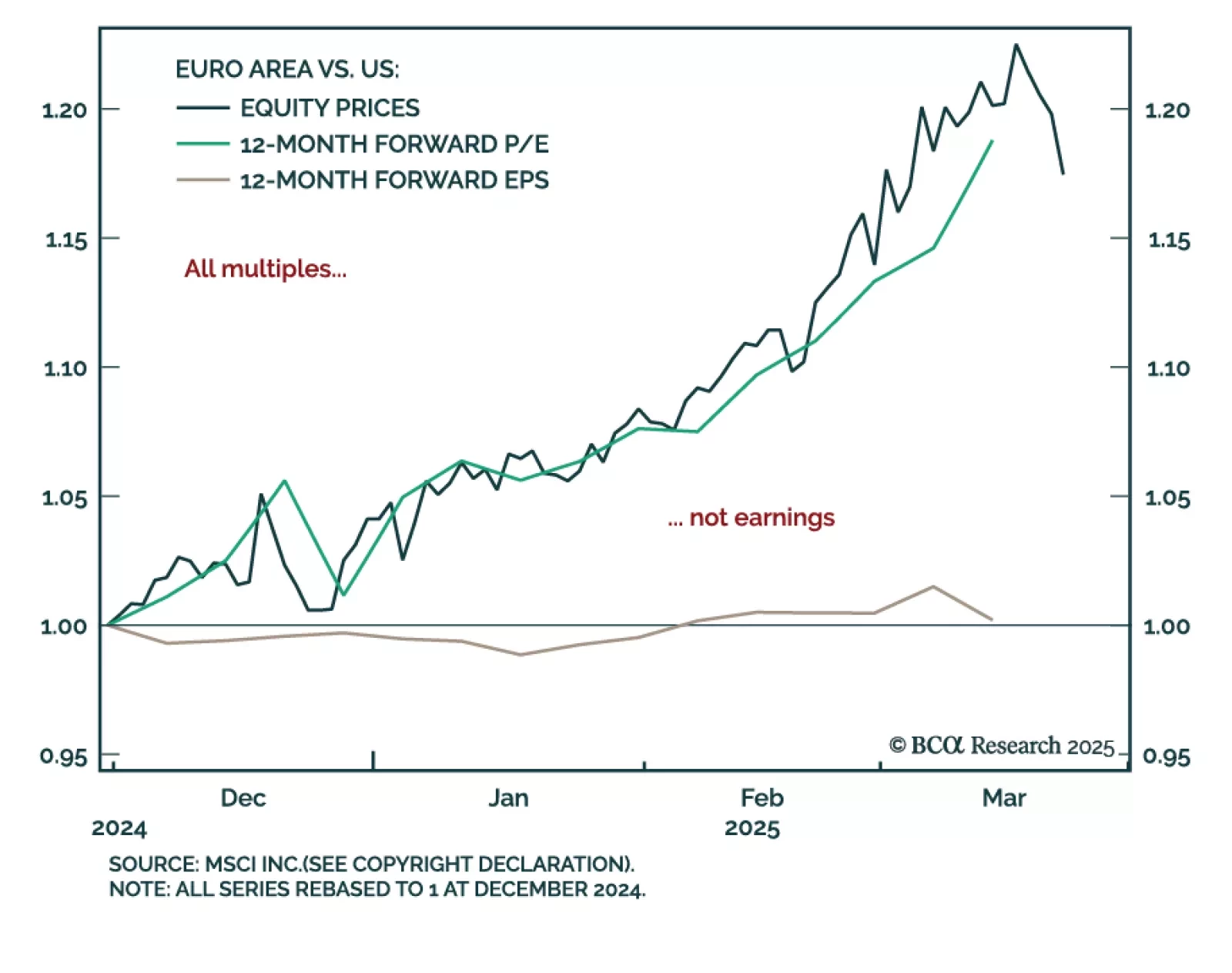

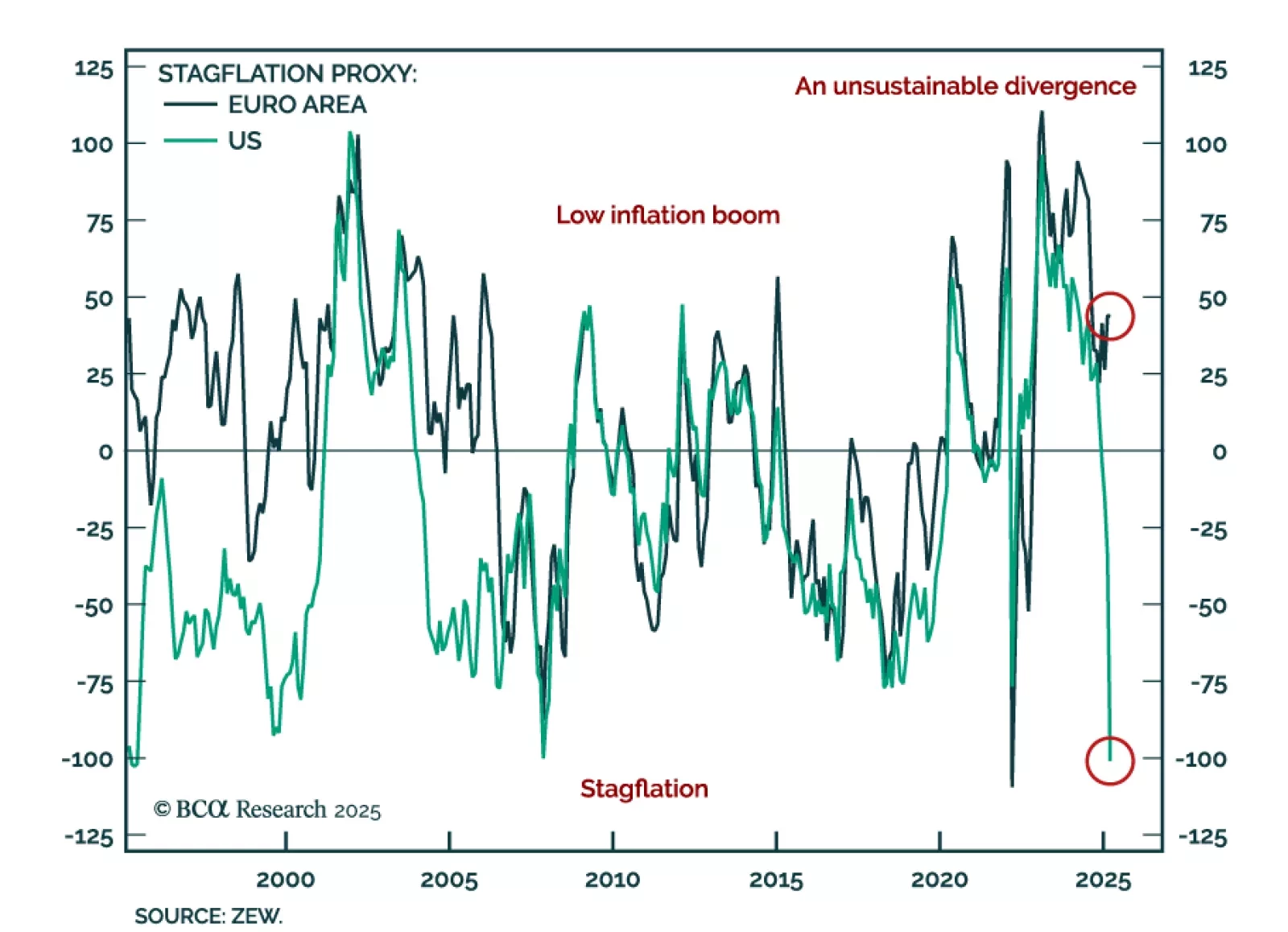

Our European investment strategists recommend underweighting European equities over the next three-to-six months, favoring defensives like telecoms, which may also benefit from reform potential. The rally in European equities…

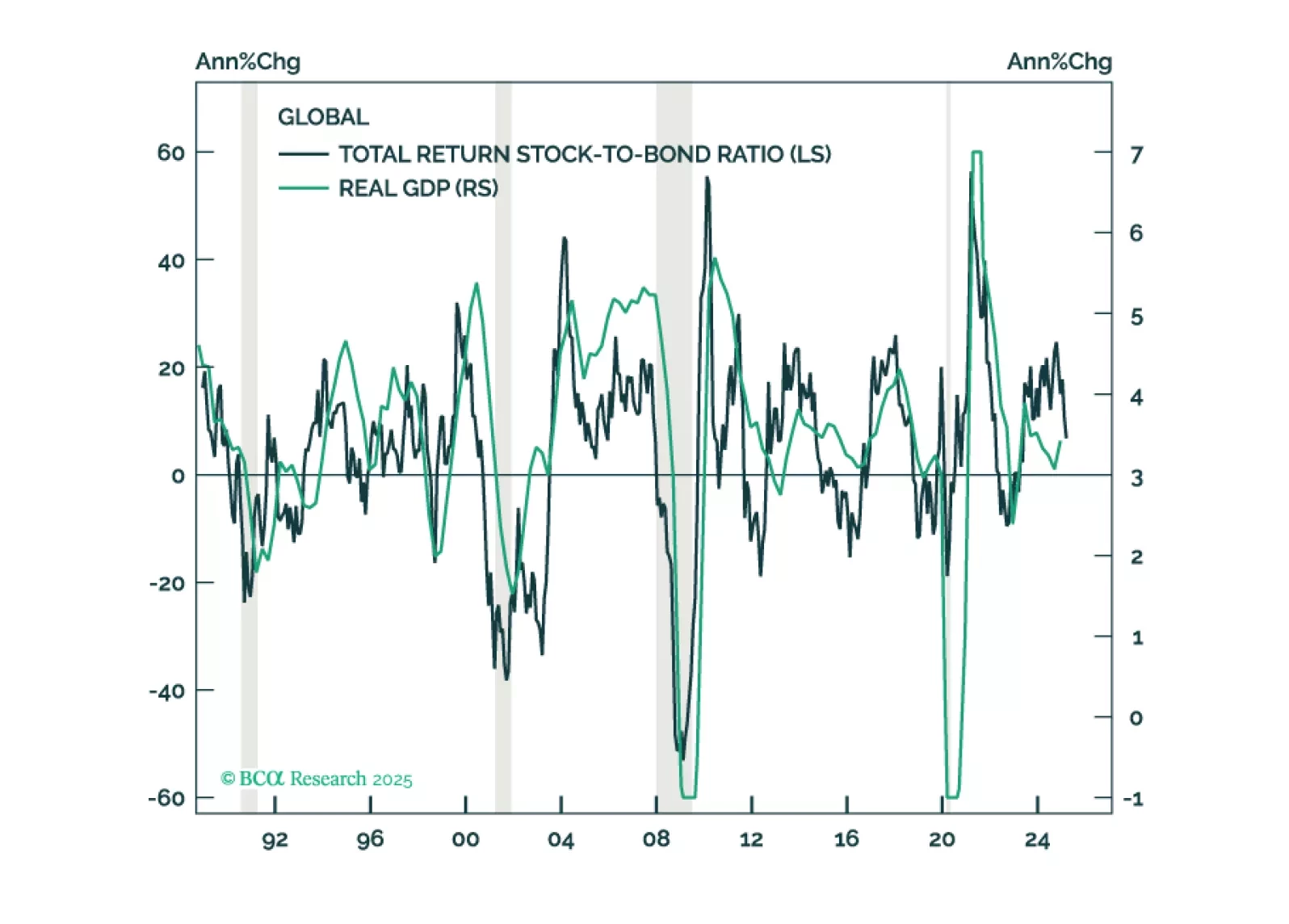

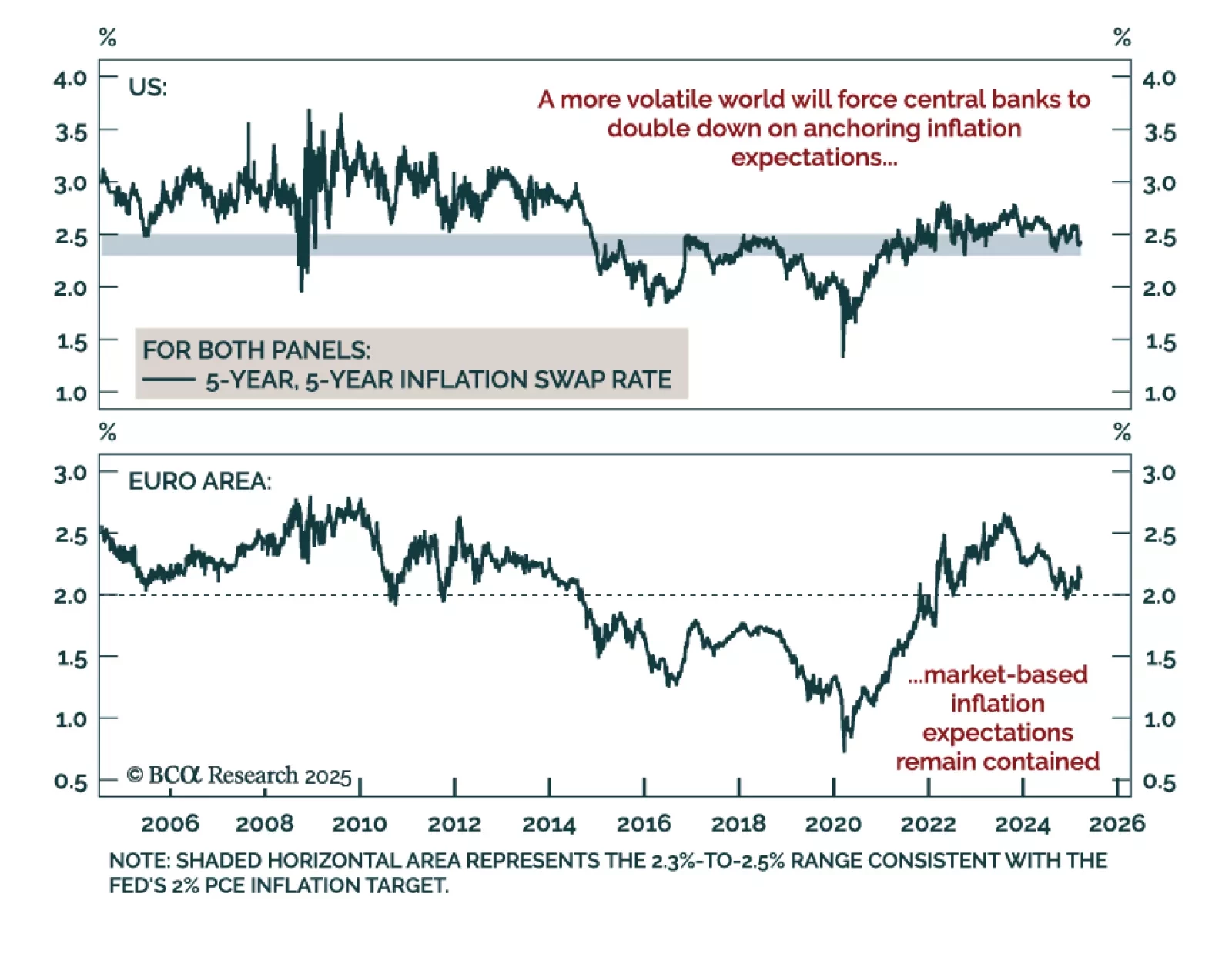

The years ahead will be more complex for investors. Inflation expectations and its leading indicators will matter as much as realized inflation, and rates volatility is likely to remain structurally higher. This calls for increasing…

European equities have surged on hopes of a low-inflation boom—but the rally has likely gone too far, too fast. With a pullback now likely, how should investors position themselves over the next 3–6 months?

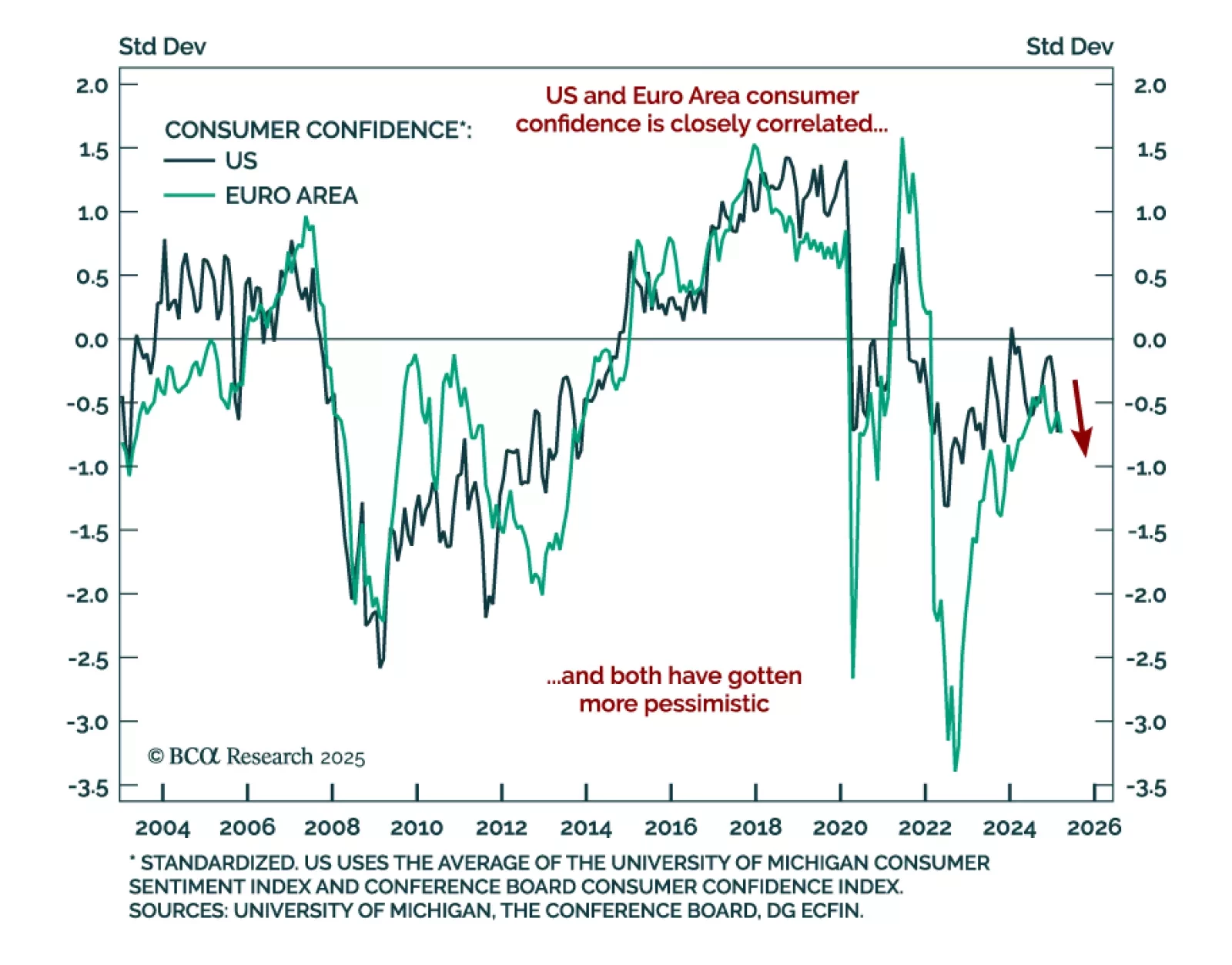

The March flash estimate for European Consumer Confidence missed estimates, and fell to -14.5 from -13.6 in February. This negative reading is the first European sentiment number missing expectations since January. The sentiment…

Our Chart Of The Week comes from Mathieu Savary, Chief Strategist of our European Investment Strategy service. Mathieu believes the recent outperformance of European over US risk assets is unlikely to last over the next 3-6 months.…

Our tactical framework highlights how financial conditions and economic surprises interact, where growth often sows the seeds of its own demise. Markets price expectations efficiently but lack perfect foresight, making data surprises…

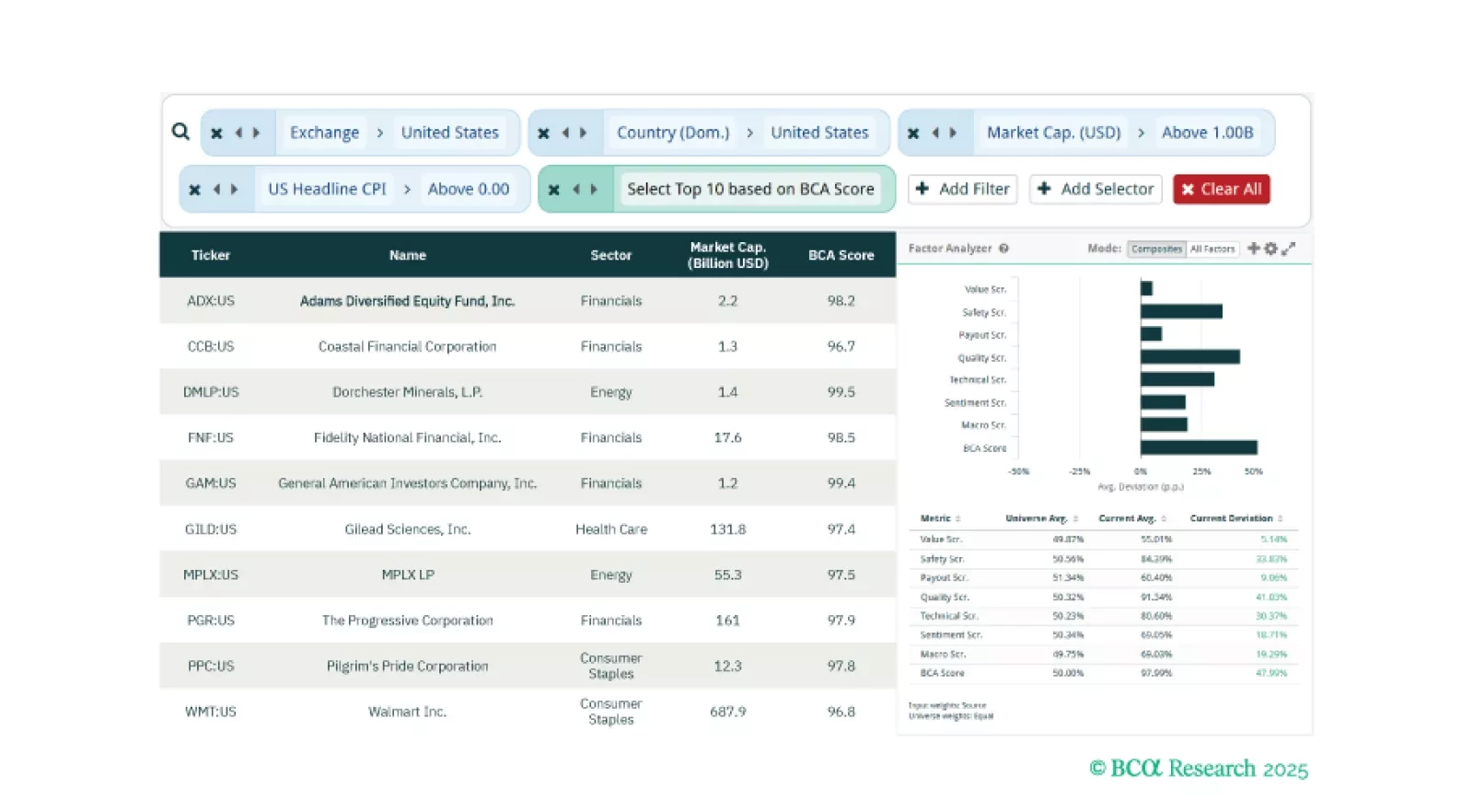

Weekly Screeners: “Transitory” Inflation 2.0, European Aerospace & Defense, And Buffett’s Philosophy

This week, our three screeners cover equity plays for “transitory” inflation impacts from US tariffs, a correction in sentiment within the European Aerospace and Defense industry, and Value Investor, Warren Buffett’s Philosophy.…

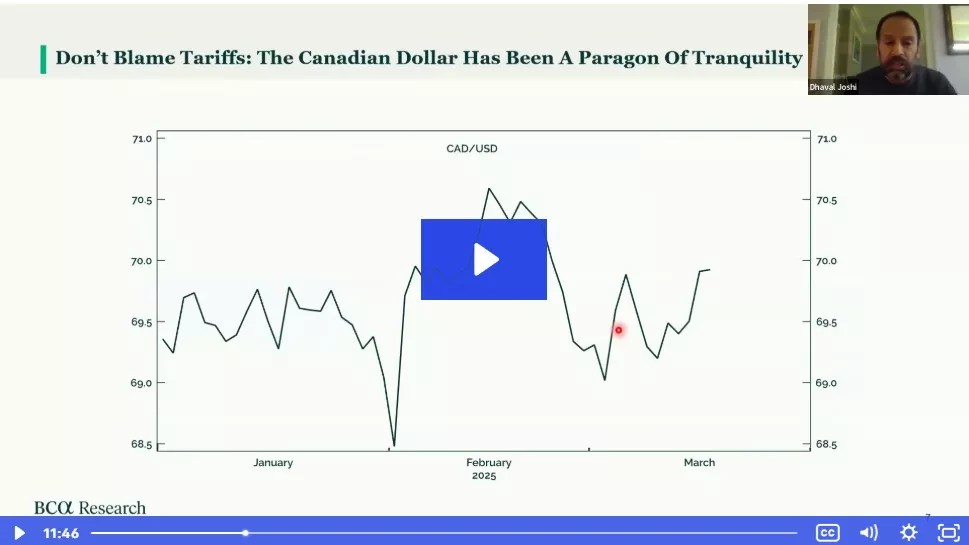

In this webcast, Dhaval discussed how investors should interpret, and react to, the recent selloff in stocks.