Markets are increasingly pricing an end to the global easing cycle, with many central banks expected to remain on hold. But uncertainty remains high, and policy surprises are likely going into 2026. This Strategy Report breaks down…

Markets are increasingly pricing an end to the global easing cycle, with many central banks expected to remain on hold. But uncertainty remains high, and policy surprises are likely going into 2026. This Strategy Report breaks down…

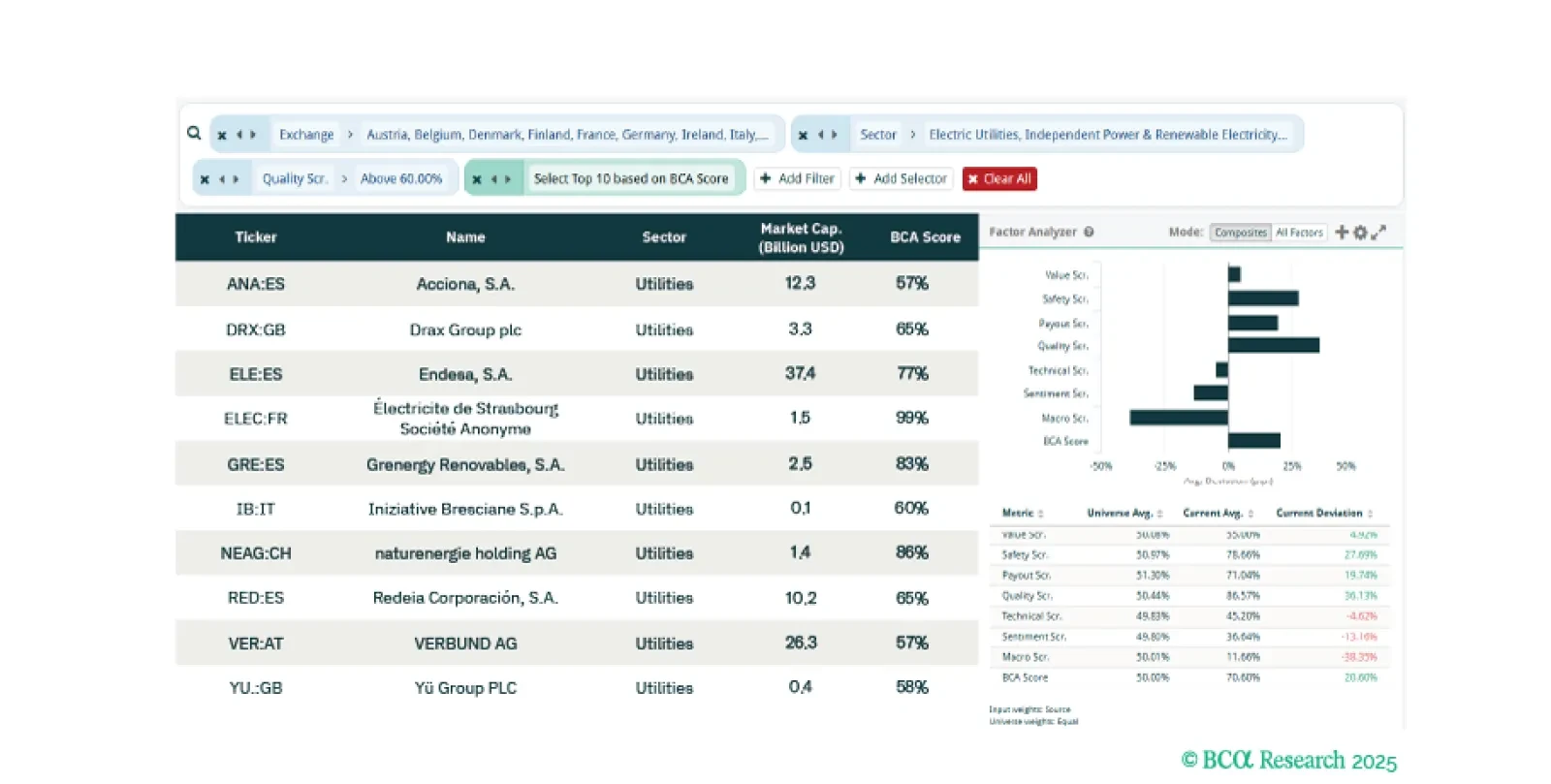

This week, our screeners explore opportunities arising from Europe’s electrification, identify high-quality Rare Earth plays, and propose a portfolio to hedge against a major global conflict.

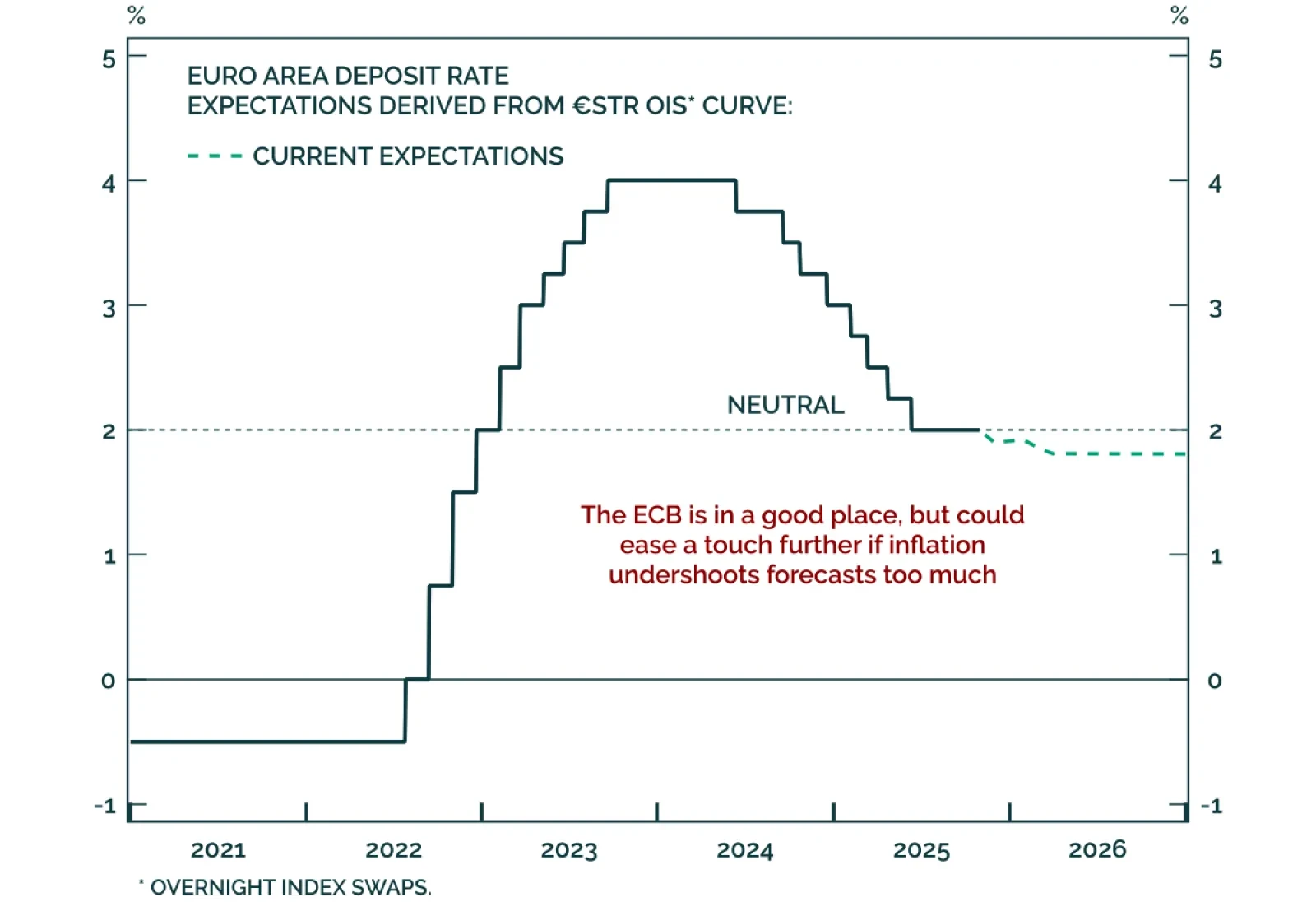

The ECB held rates at 2% for a third consecutive meeting, signaling policy stability as inflation sits at target and growth risks fade. The European central bank has cut a total of 200 bps since 2024, and while inflation could…

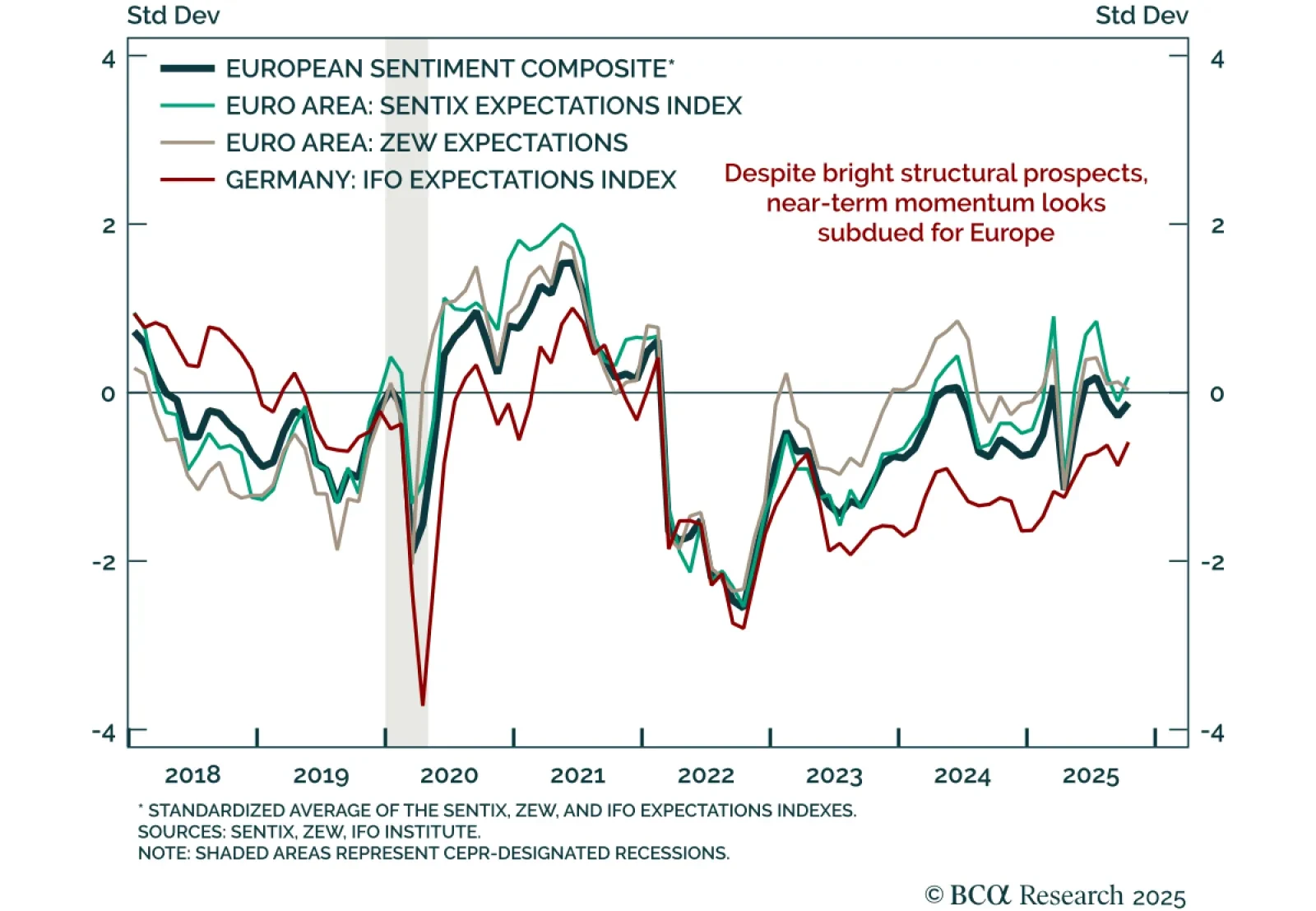

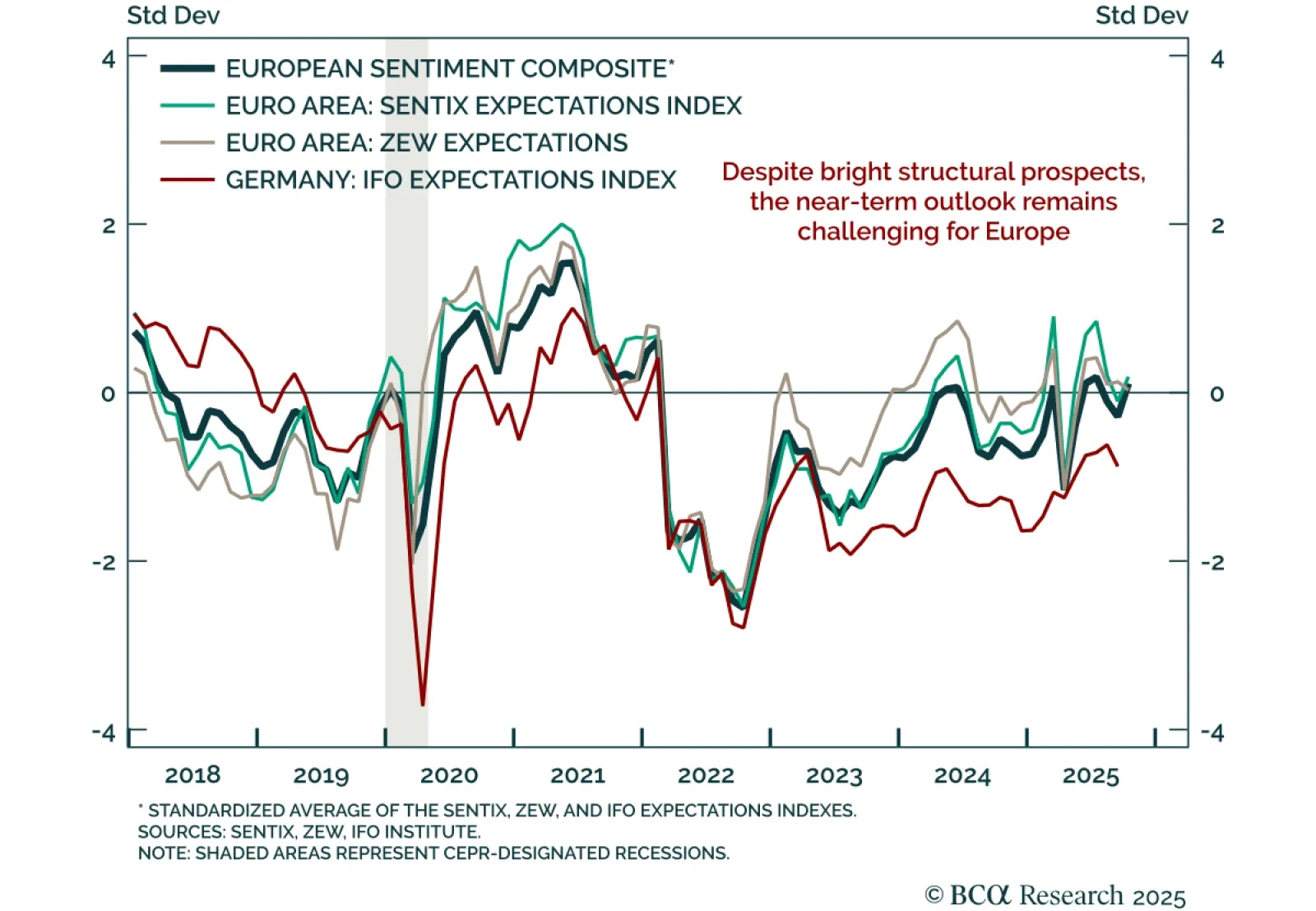

Germany’s October Ifo survey was mixed, with better expectations but weaker current conditions, underscoring a fragile European outlook. The headline Business Climate index rose above estimates to 88.4 from 87.7. The improvement came…

In this week’s note, we share the main implications for European investors from what was discussed at the BCA Conference in New York and provide a short list of the questions most frequently asked by investors we met recently in…

The October ZEW survey sent a mixed signal on near-term European growth, confirming limited growth momentum. Euro area growth expectations fell to 22.7 from 26.1, while German expectations missed estimates but rose slightly to 39.3…

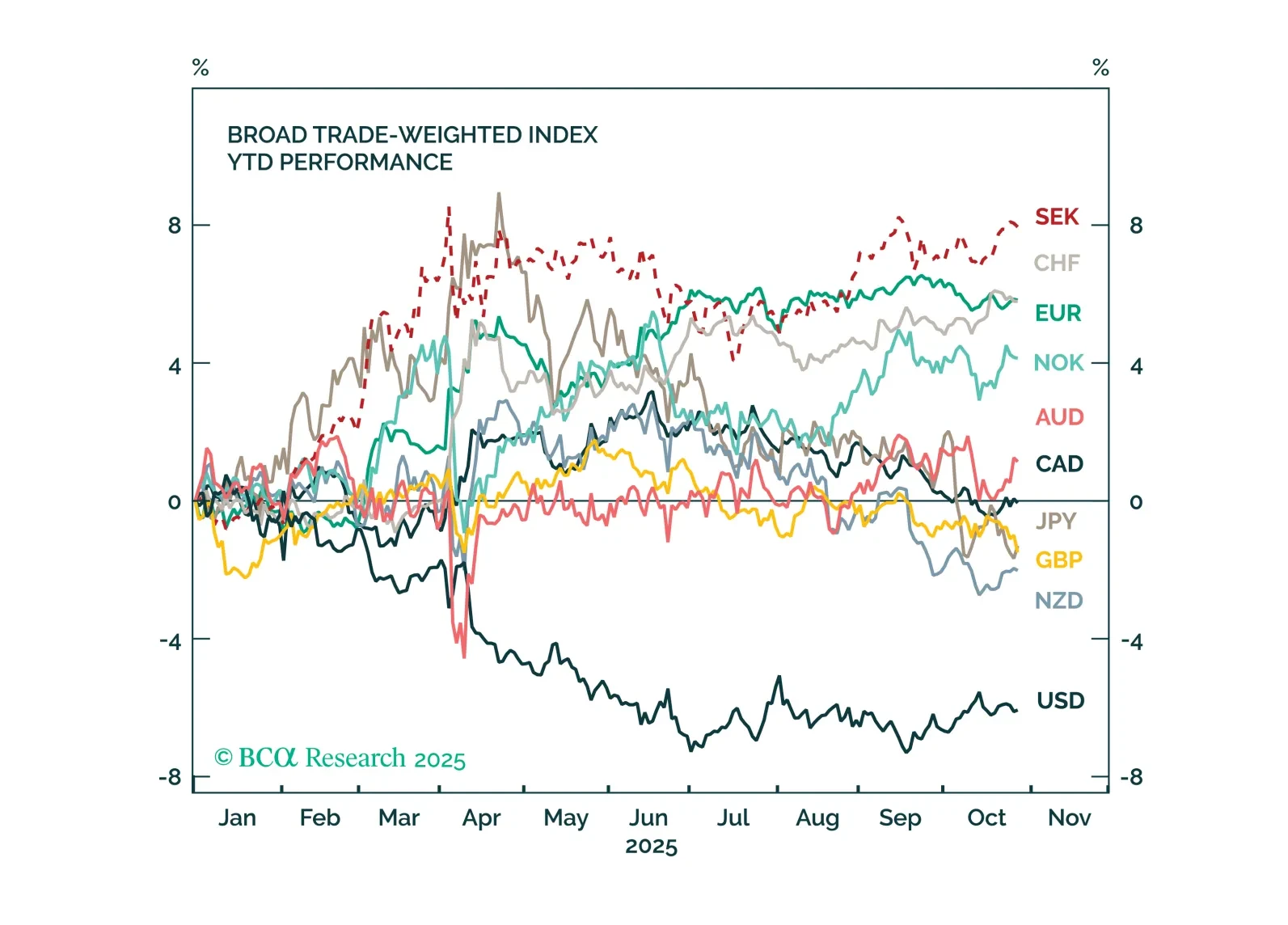

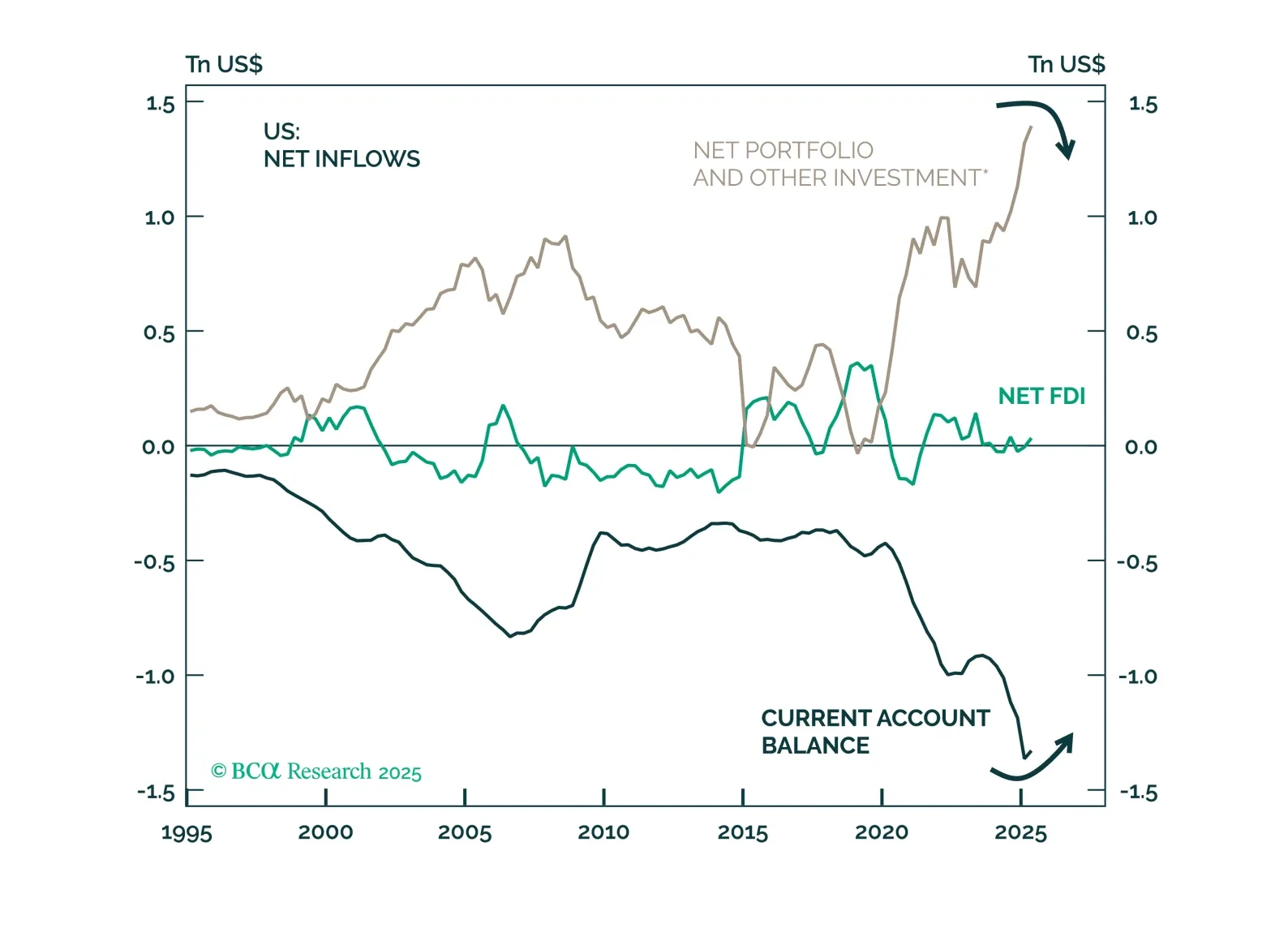

In this Q4 Strategy Outlook, we discuss where we stand on our recession call, the outlook for stocks and bonds in various scenarios, why investors are misunderstanding the impact of AI on corporate profits, whether the US dollar has…

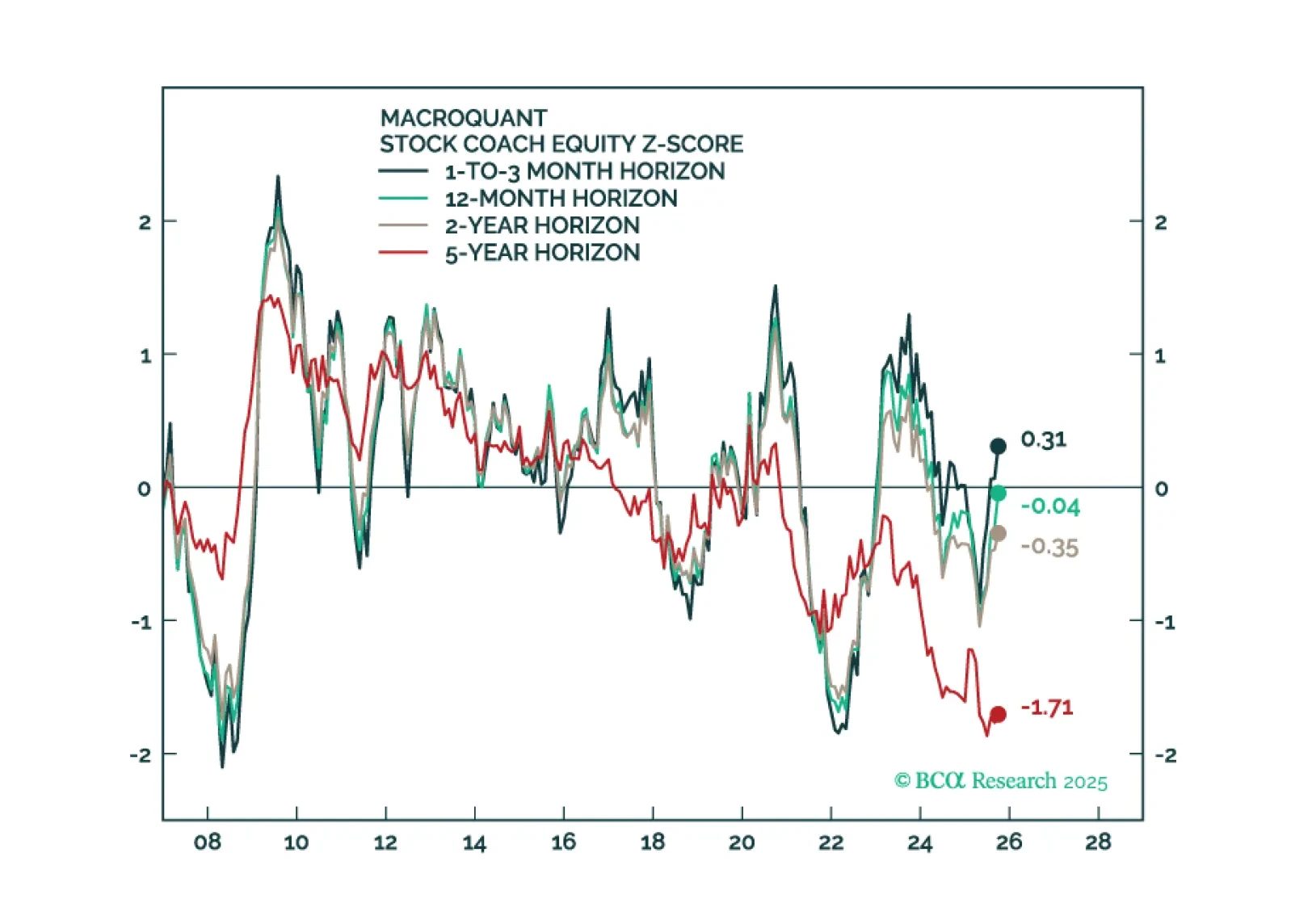

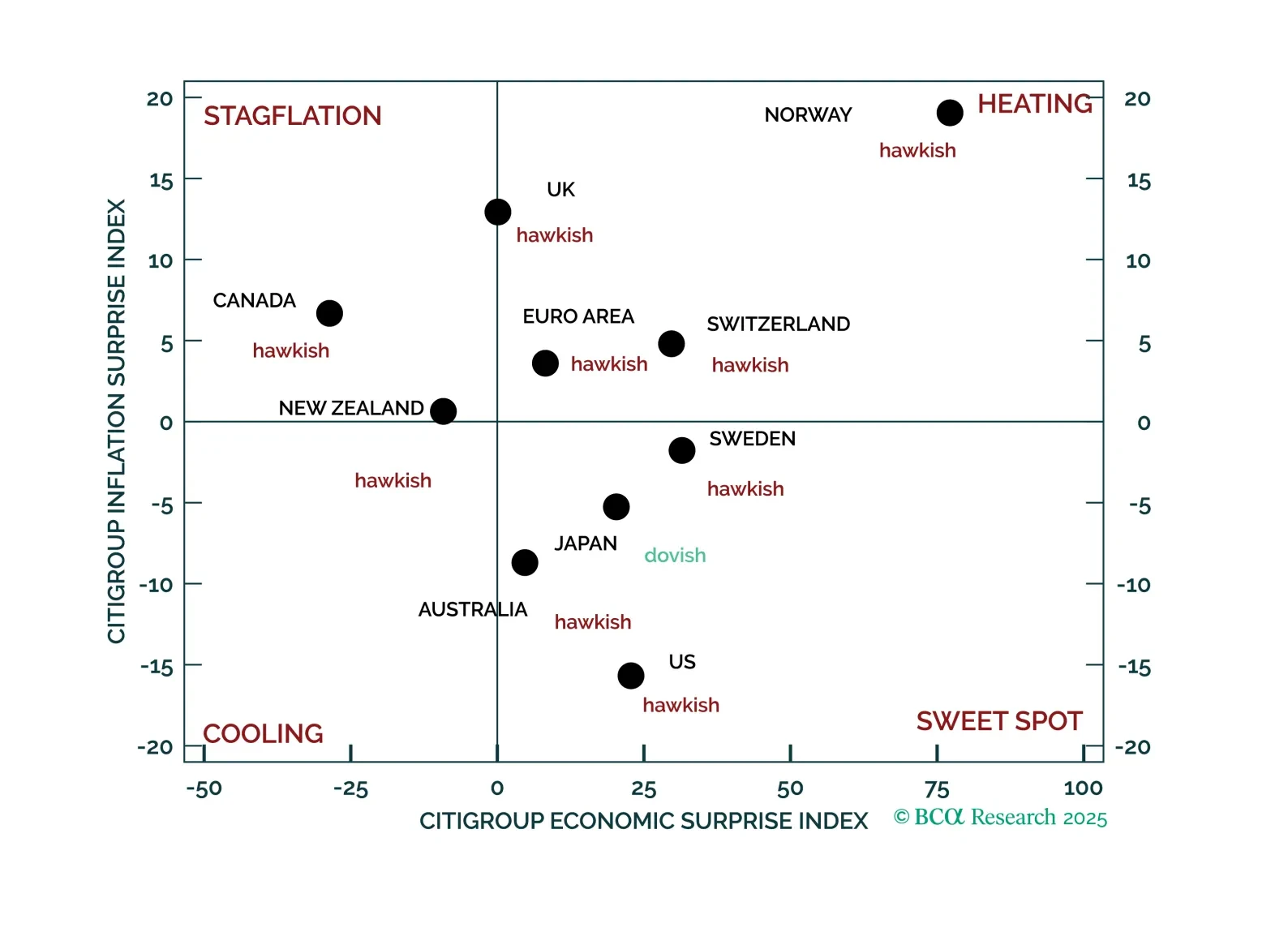

In this update, we apply our Macro Surprises framework to equities for the first time. Overall, the message is broadly consistent with our current equity views: Investors should favor Eurozone equities and continue to overweight…

The ECB stood pat today, yet the policy path remains fraught with uncertainty as domestic resilience collides with global headwinds. This dichotomy continues to hold important implications for European assets over the coming months.…