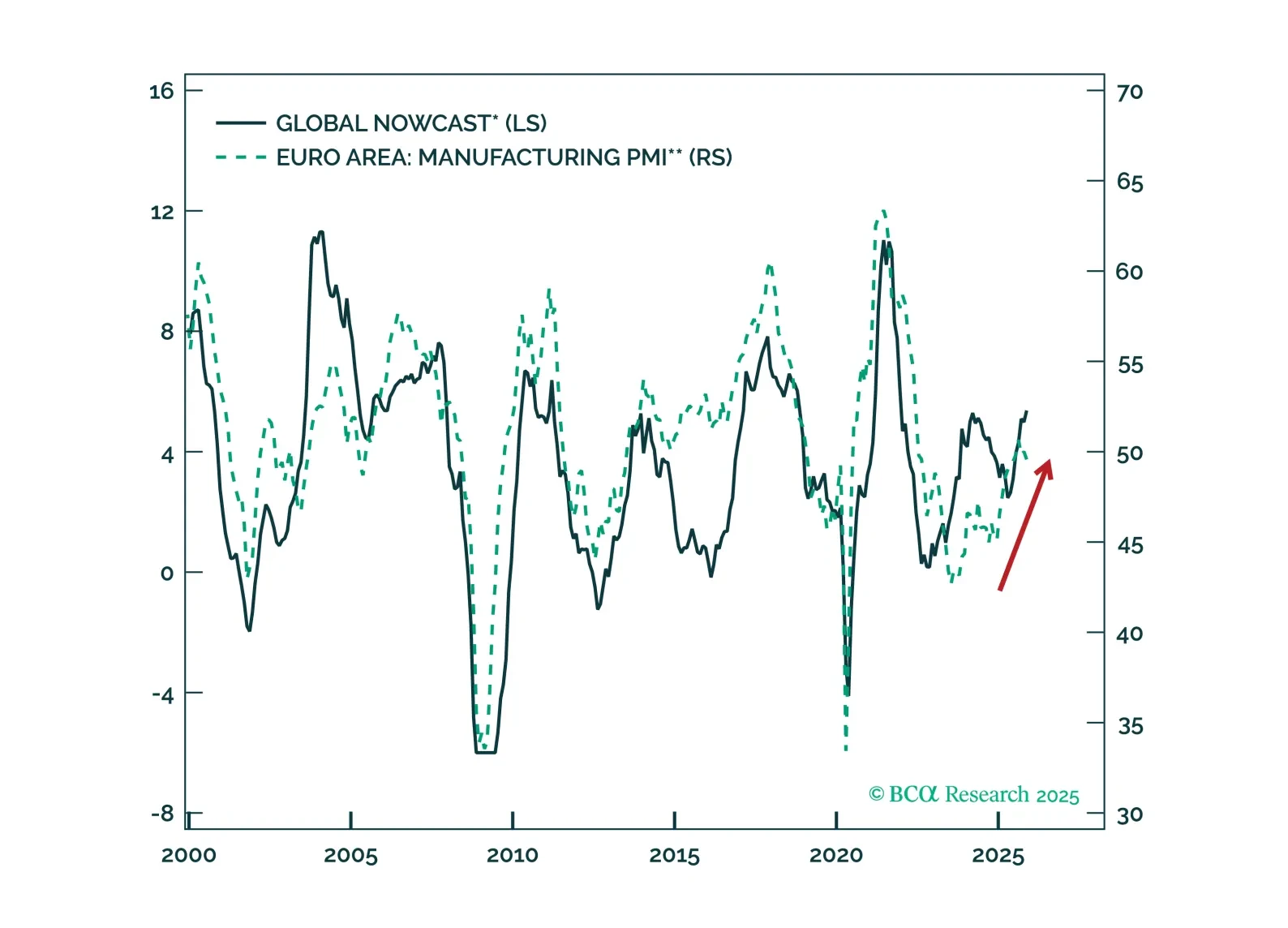

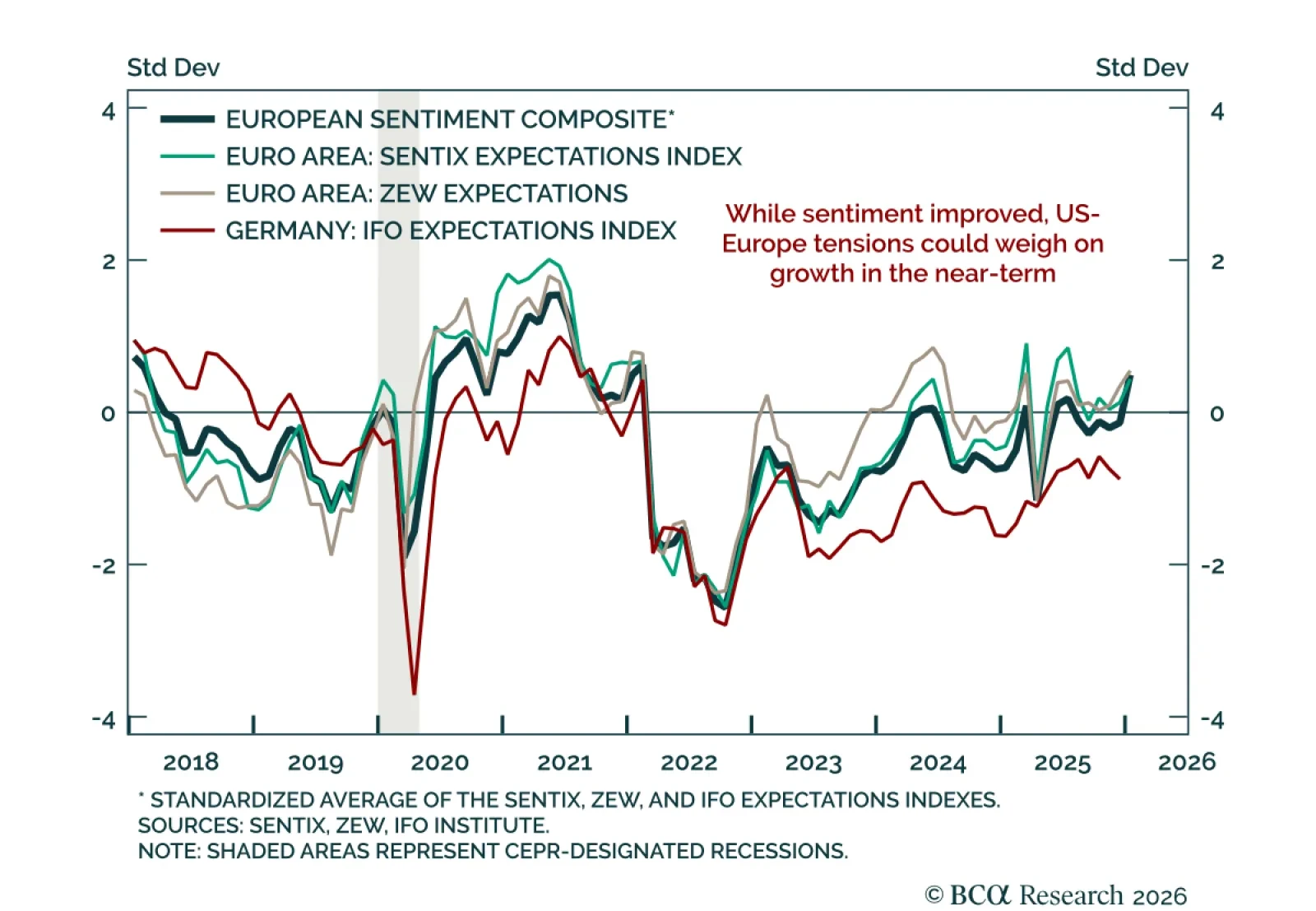

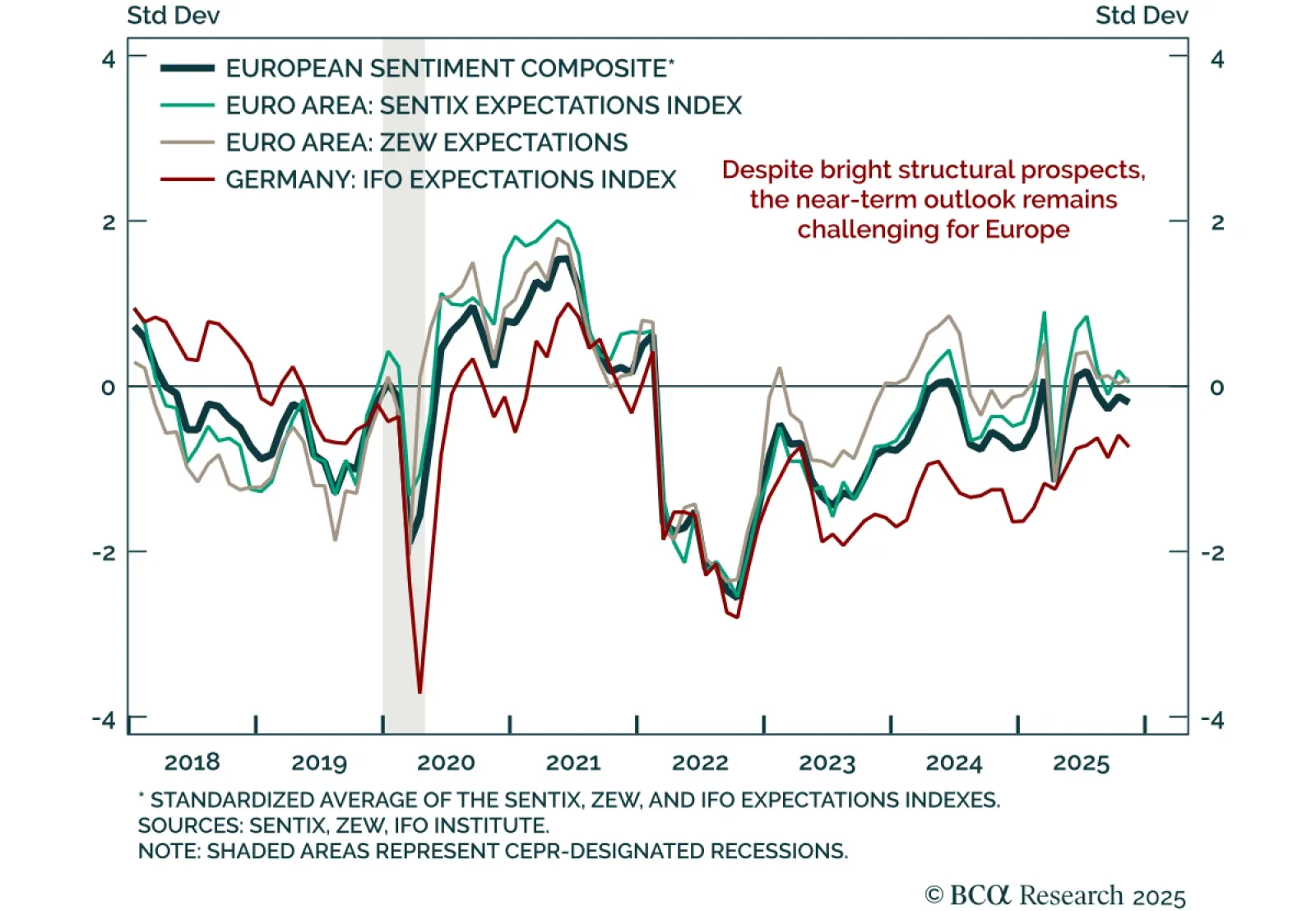

January Euro area sentiment improved, but growth momentum remains limited as tensions with the US rise and reflationary ECB cuts remain possible. January sentiment brightened in the Euro area. The ZEW survey beat expectations for…

Europe is in a geopolitical sweet spot. Exaggerated fears of Russian military aggression and abandonment by the United States, as well as increased competition from China, create a geopolitical imperative to stimulate, reflate, and…

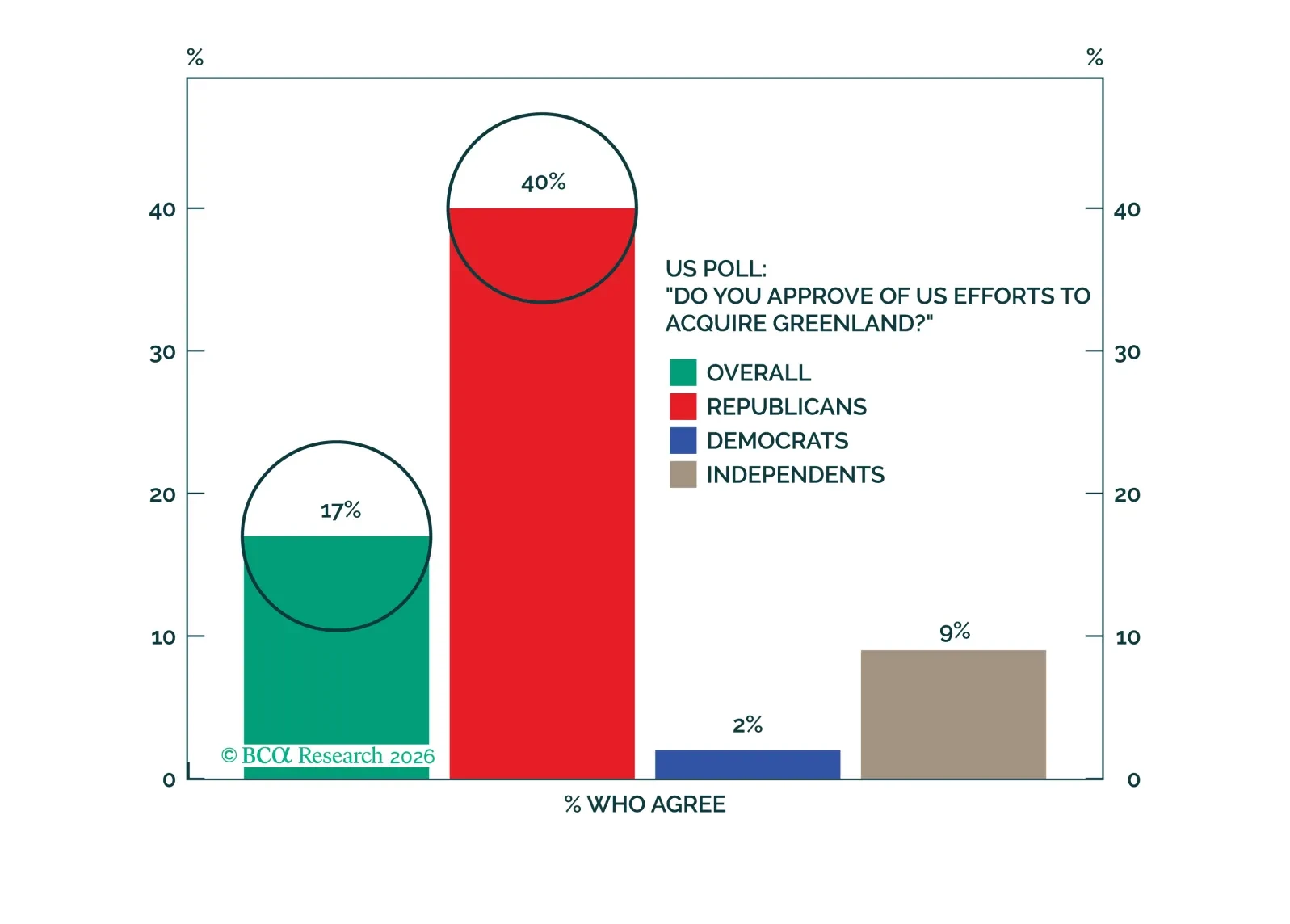

Investors should bet against the US seizing Greenland by force and collapsing NATO. But stay tactically defensive anyway.

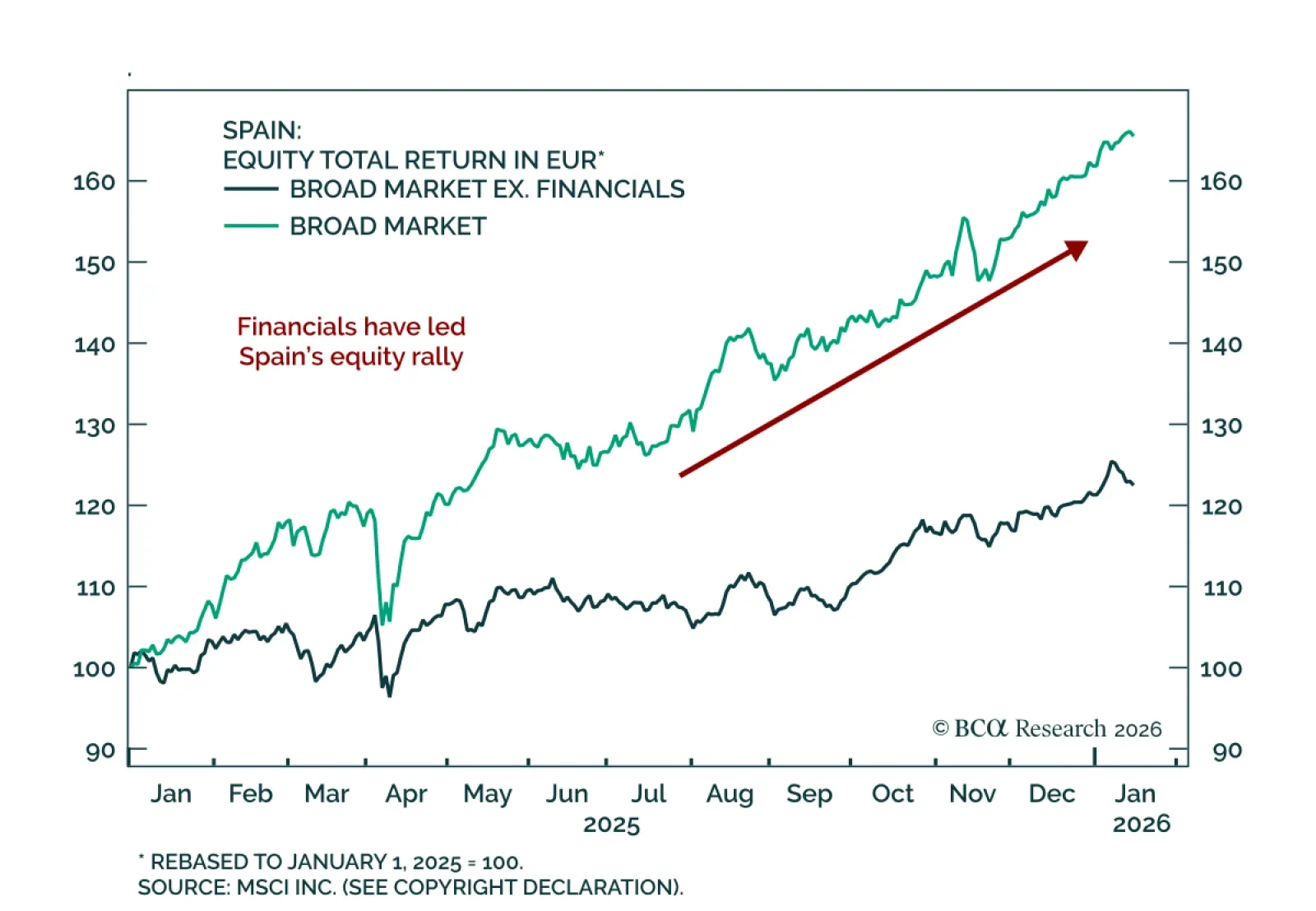

Our GeoMacro and European strategists highlight Spain’s equity and bond outperformance as fundamentally driven, supported by improving balance sheets, stronger profitability, and repeated earnings upgrades. Financials have led the…

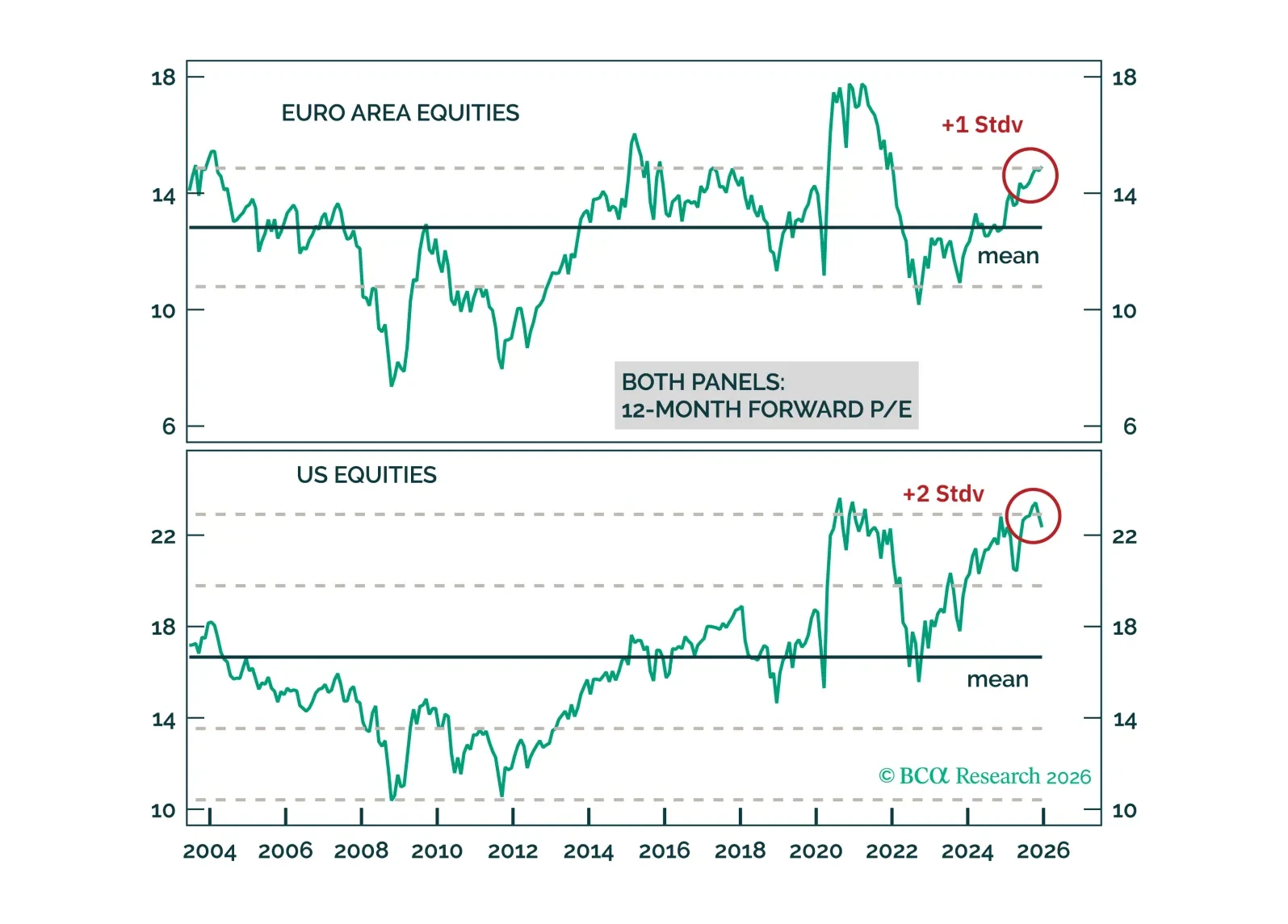

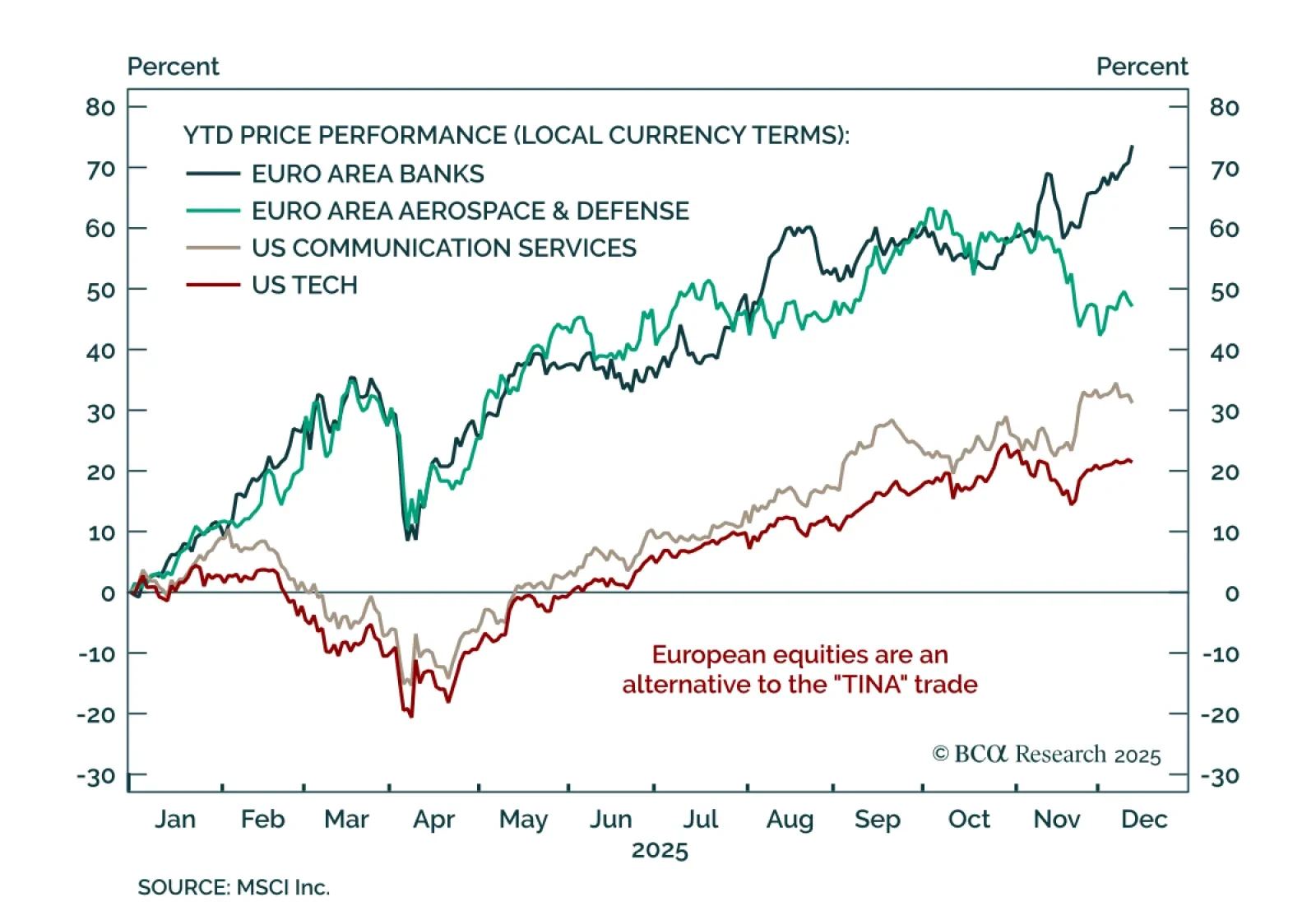

Europe’s equity outperformance is real, and even stronger once adjusted for FX. Our Chart Of The Week comes from Jeremie Peloso, Chief European Investment Strategist. Banks and defense stocks (not tech and communication services…

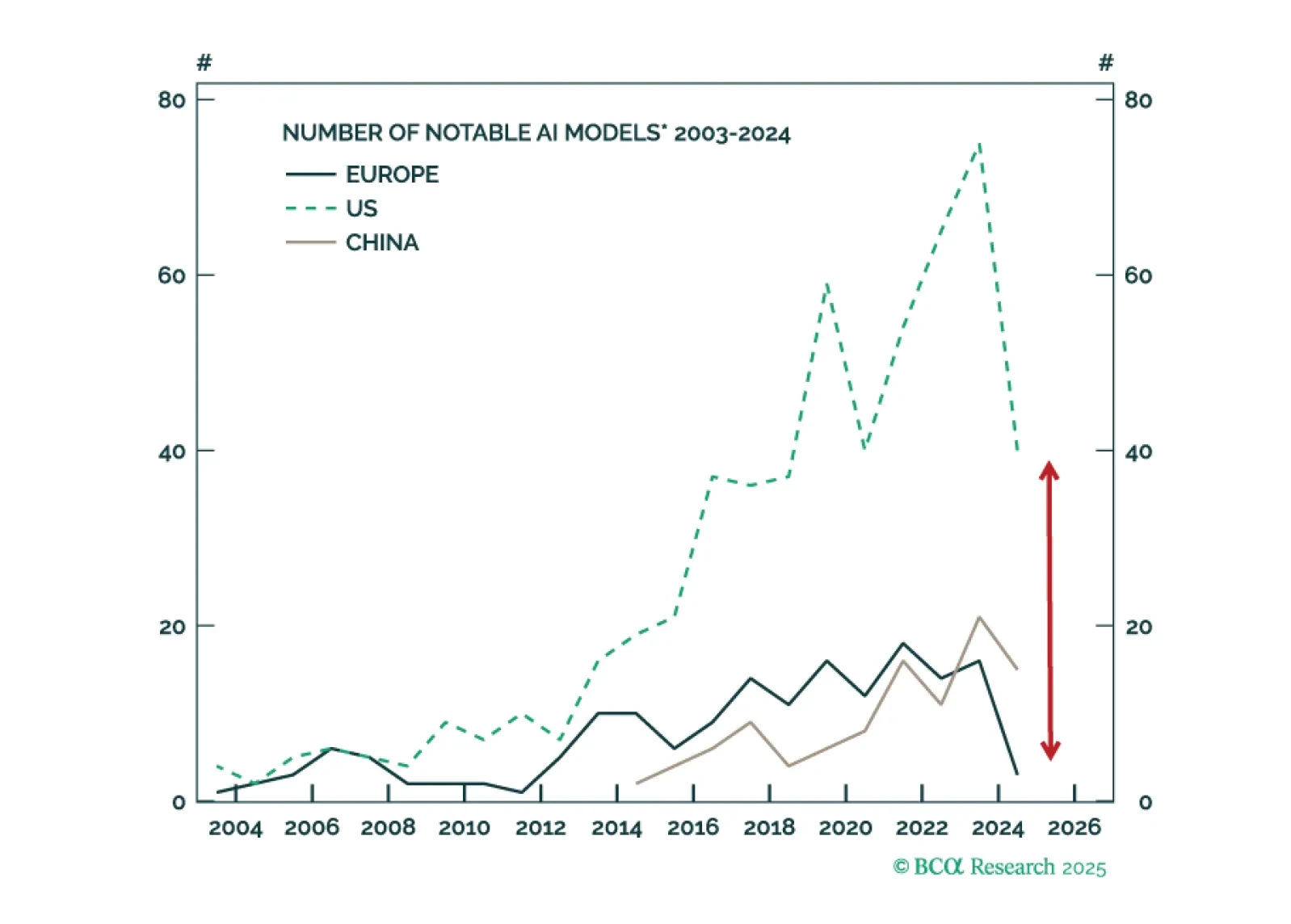

This year, we once again present our 2026 outlook as a retrospective from the future – a future in which the AI boom turned to bust.Next week, please join me for a Webcast on Wednesday, December 17 at 10:30 AM EST (3:30 PM GMT, 4:30…

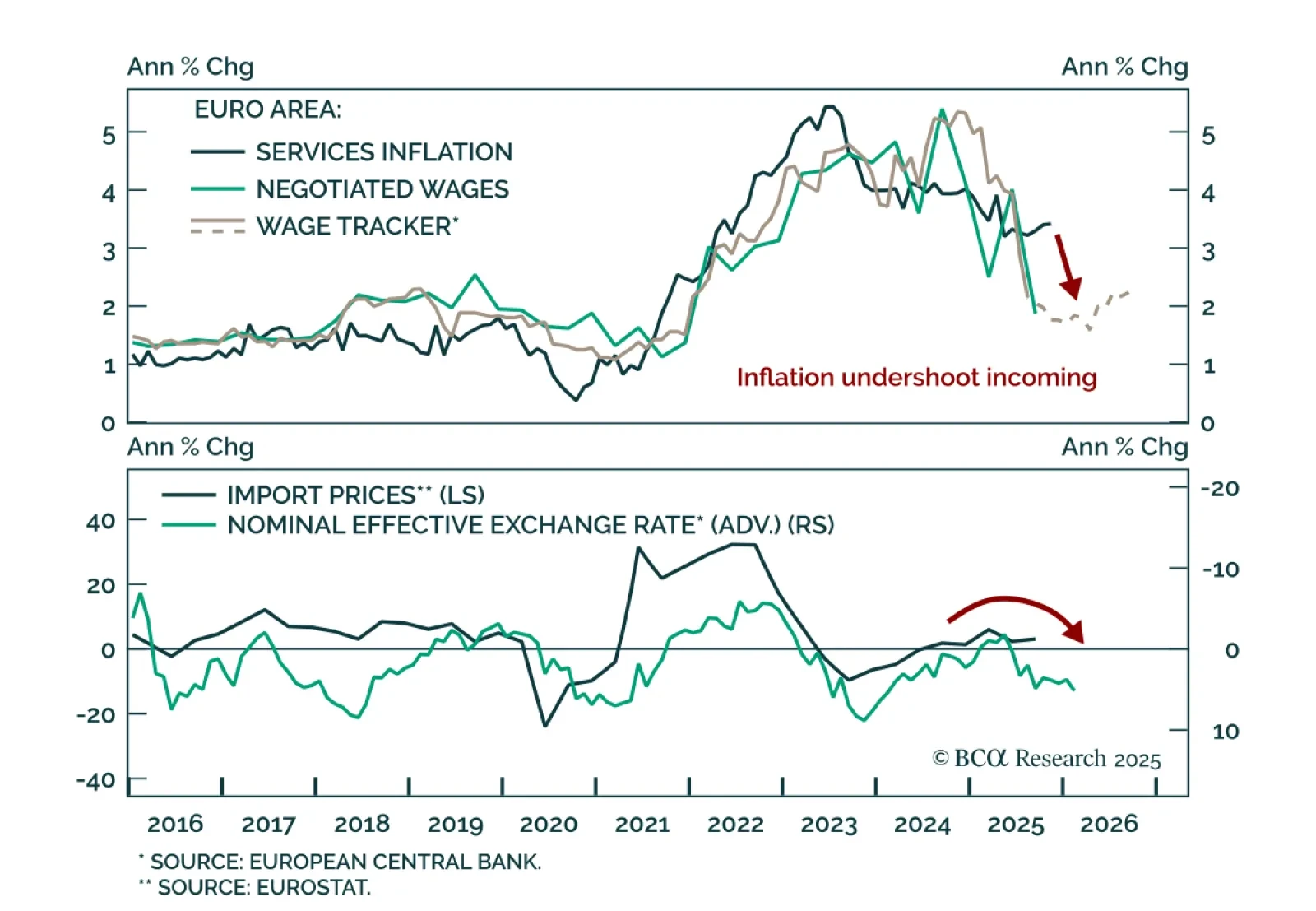

Our European strategists expect a return to growth in 2026, supported by AI-related investment, continued NGEU fund disbursements, and easier ECB policy. As inflation falls well below target in H1, the ECB is likely to deliver one to…

Europe is not left out of the AI race. Despite lagging US and China in LLMs and AI capex, Europe is quietly making progress where it matters, including industrial adoption. European capitals and the EU seem committed to not let that…

The November Ifo survey disappointed, highlighting weakening expectations for Germany and limited near-term upside for European growth. The Business Climate Index fell to 88.1 from 88.4, driven by expectations dropping to 90.6 from…