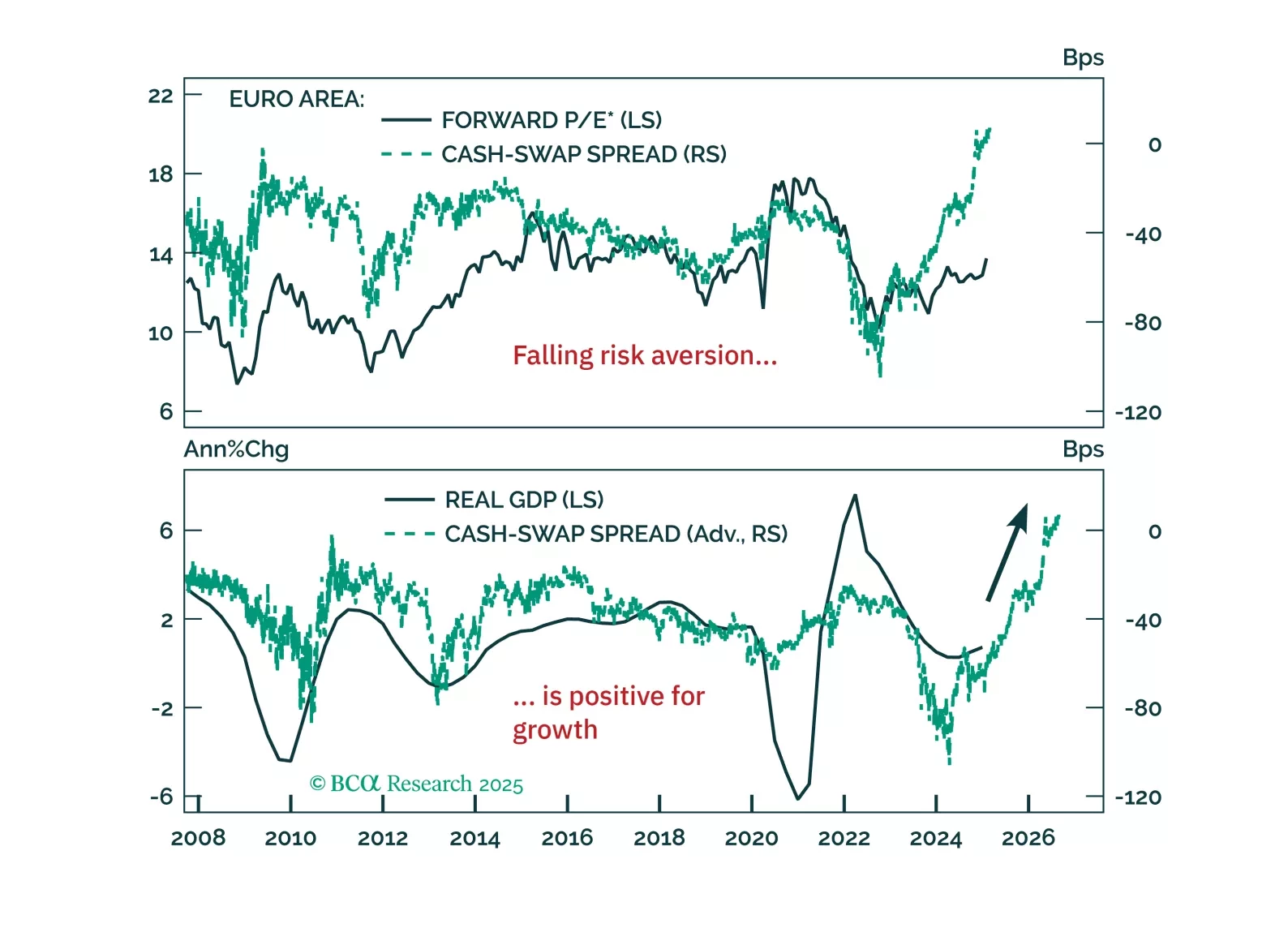

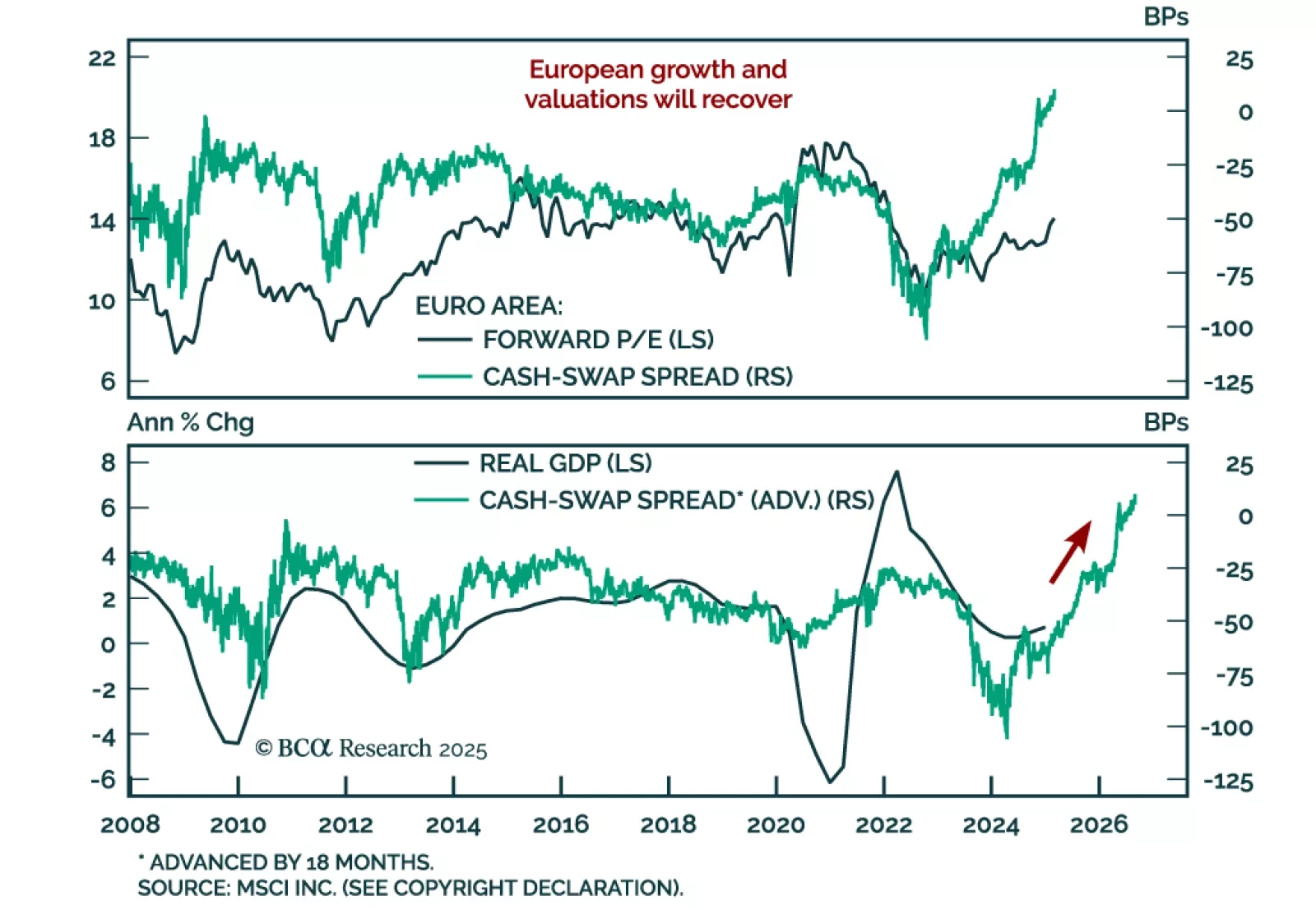

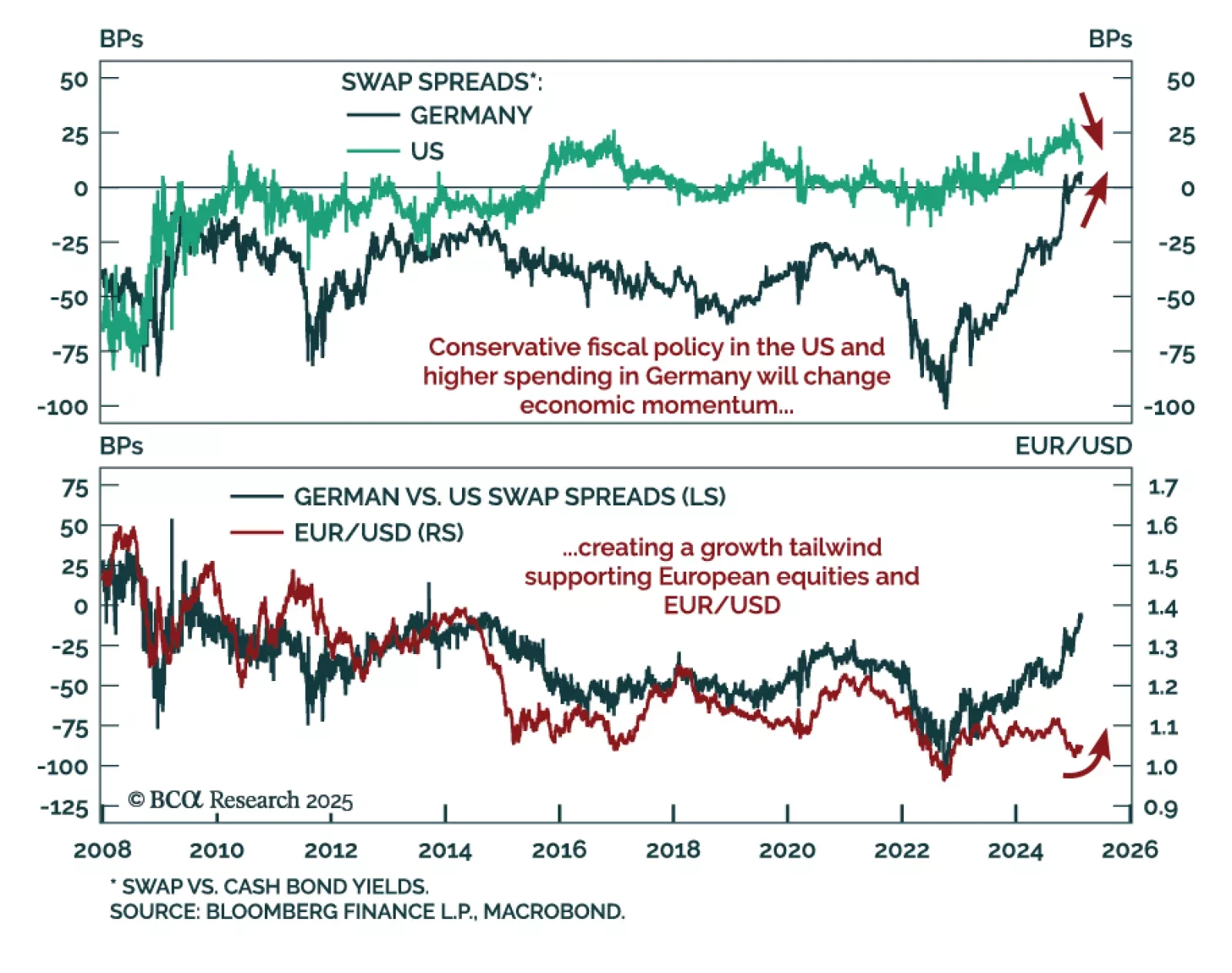

Our European strategists see Europe escaping its liquidity trap, which will create a structural tailwind for European assets. Europe’s resilience amid global shocks is supported by a shift away from precautionary money demand,…

Europe’s resilience to global liquidity deterioration isn’t a fluke—it signals a structural shift. Our latest report explains why the decline in precautionary money demand marks the end of Europe’s liquidity trap and what it means…

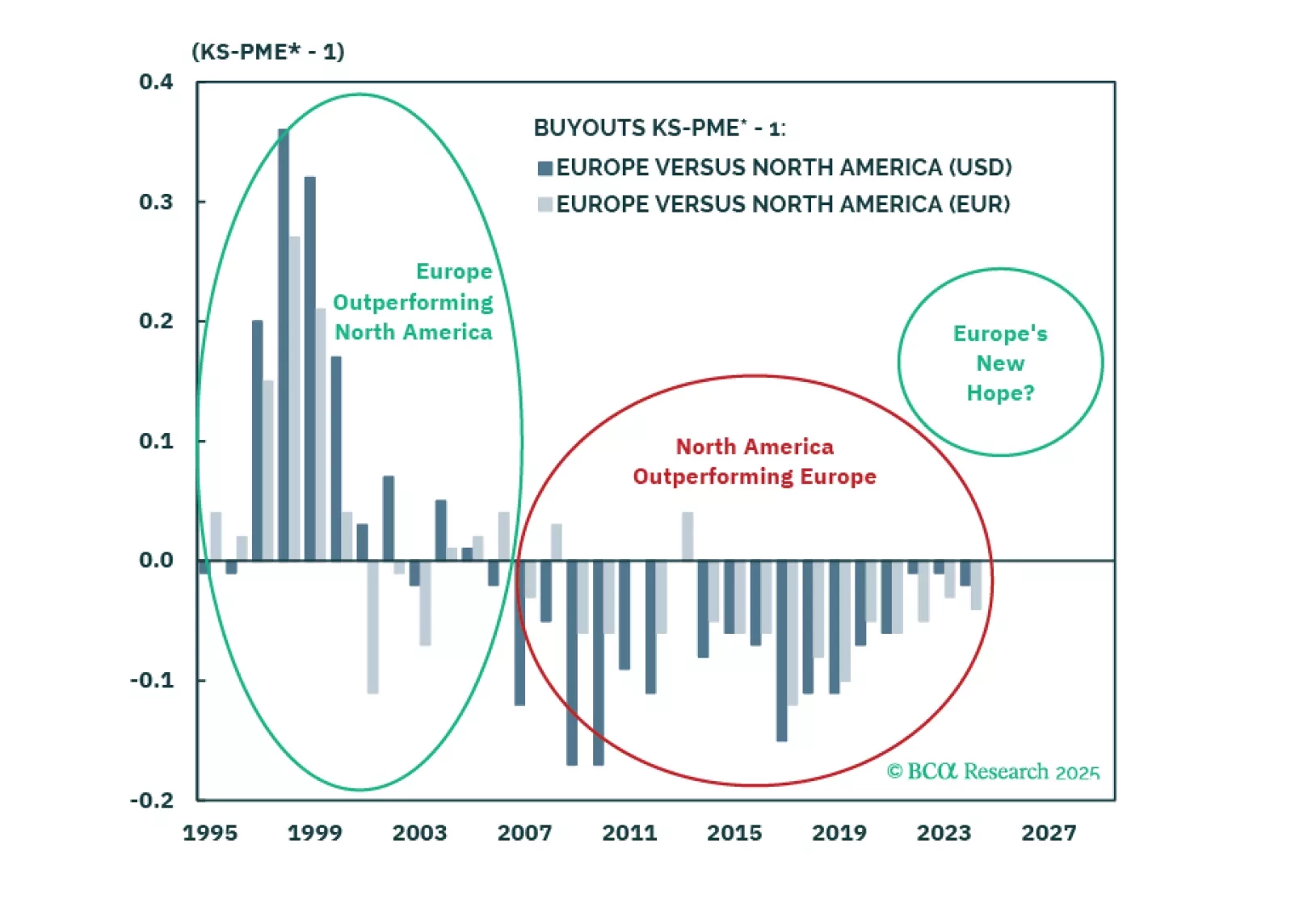

European equities have outperformed the US so far in 2025, especially after Euro Area economic surprises started outperforming as the US is starting to disappoint. The current leadership change between US and European assets reflects…

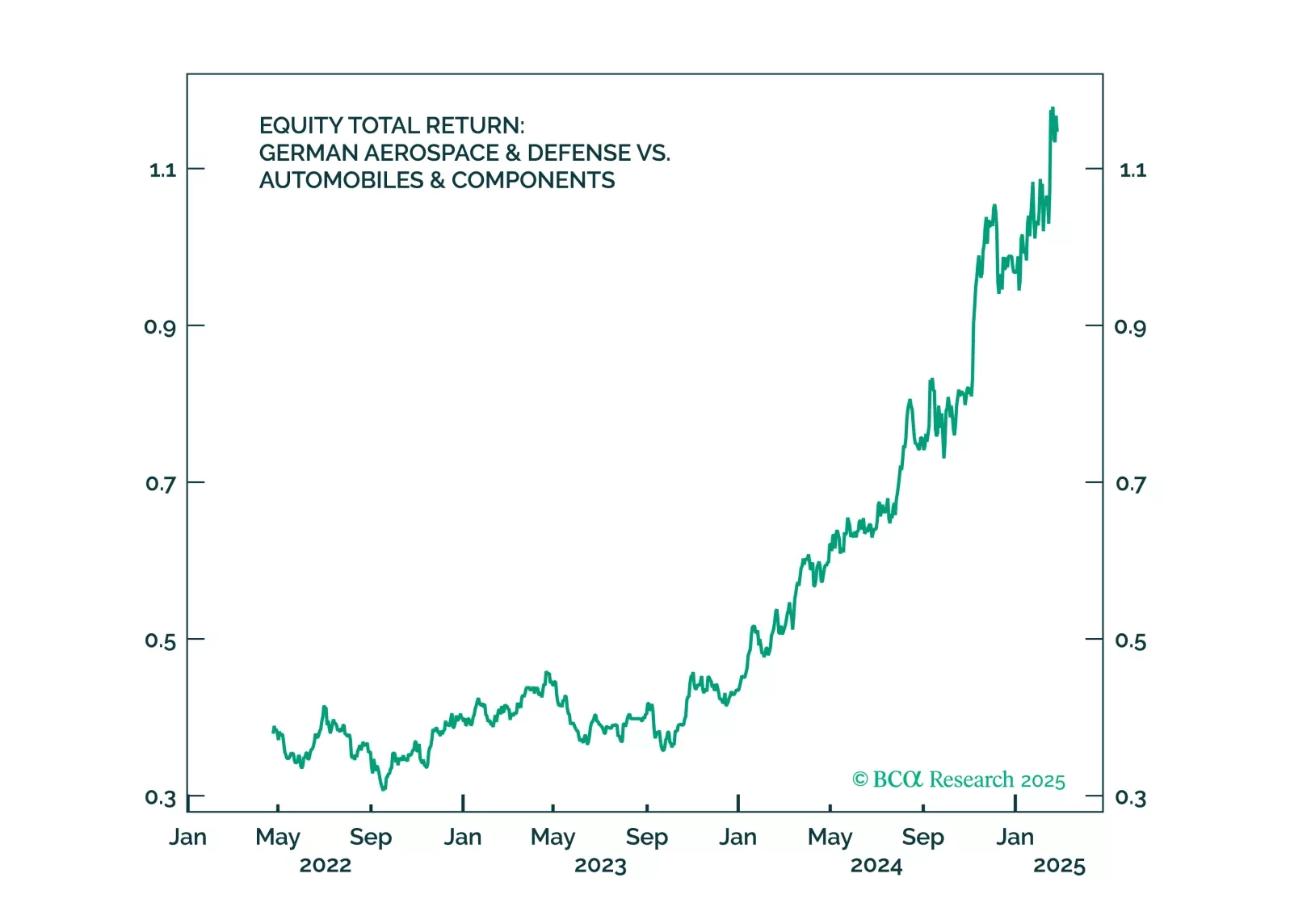

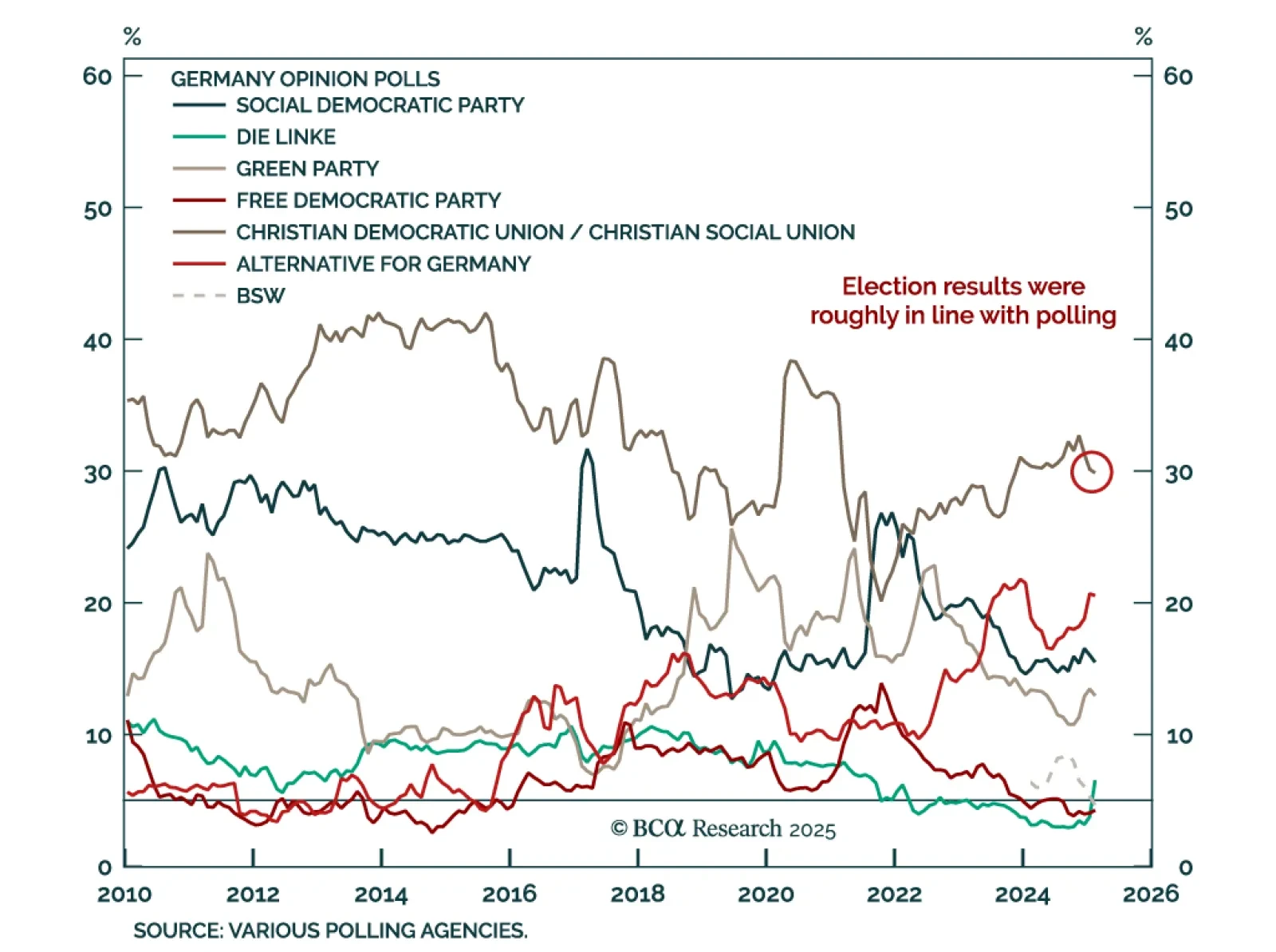

German election results were roughly as expected, but Europe’s biggest economy suddenly just got more interesting. While the details of the governing coalition have yet to be finalized, Chancellor Merz has floated options to ease the…

Trump’s ceasefire talks are positive for Germany – and so was the German election result. But Trump’s tariffs will hit Germany soon. Investors should use near-term volatility to increase exposure to Germany.

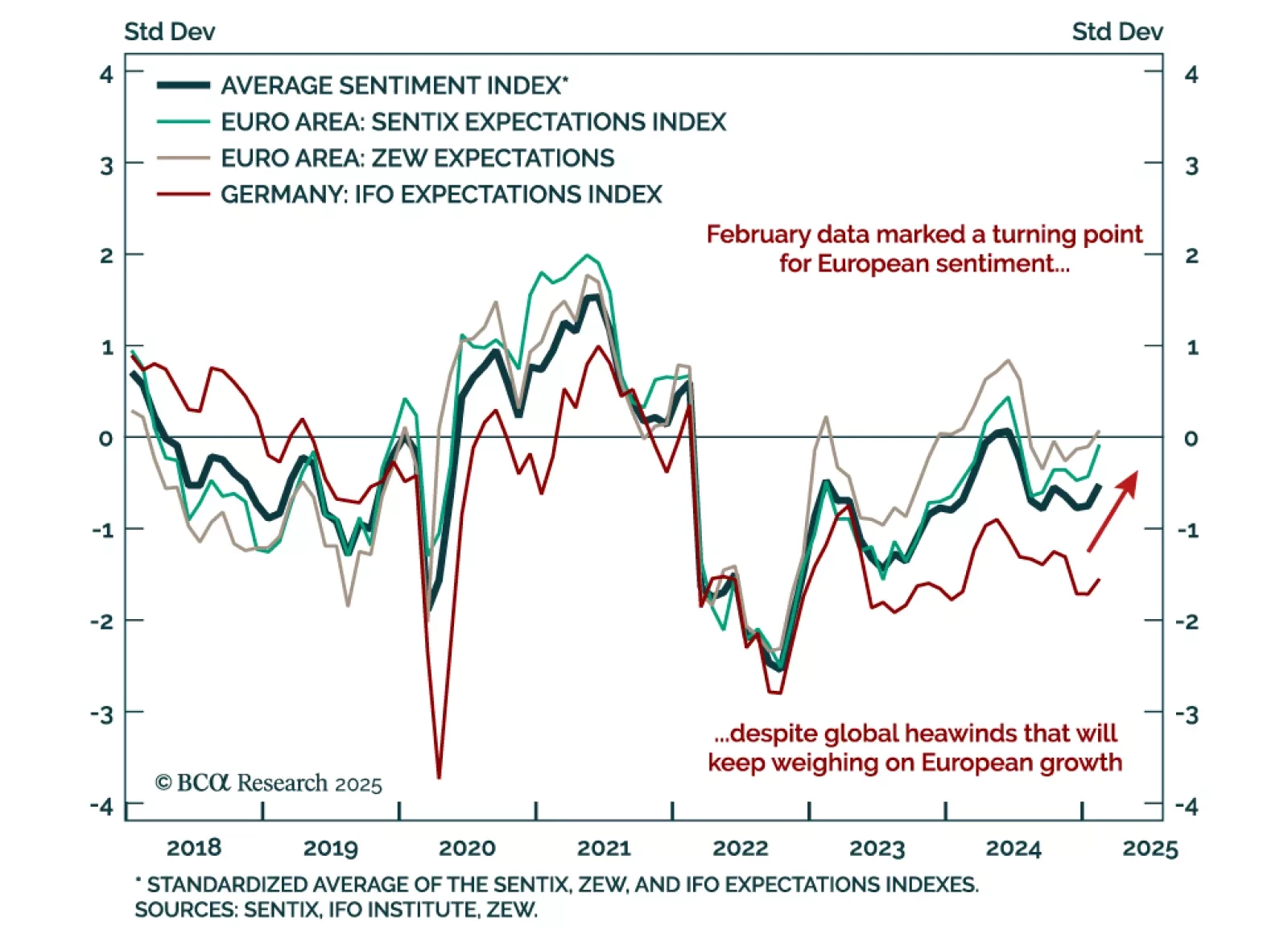

The February Ifo Business Climate index for Germany slightly missed estimates, staying unchanged from 85.2 in January. While respondents’ assessment of the current situation weakened, expectations rebounded to 85.4 from 84.3. …

Germany’s election delivered no major surprises but raised questions about whether Chancellor Friedrich Merz’s government will relax the “debt brake,” which caps budget deficits at 0.35% of GDP. The new coalition, comprising the…

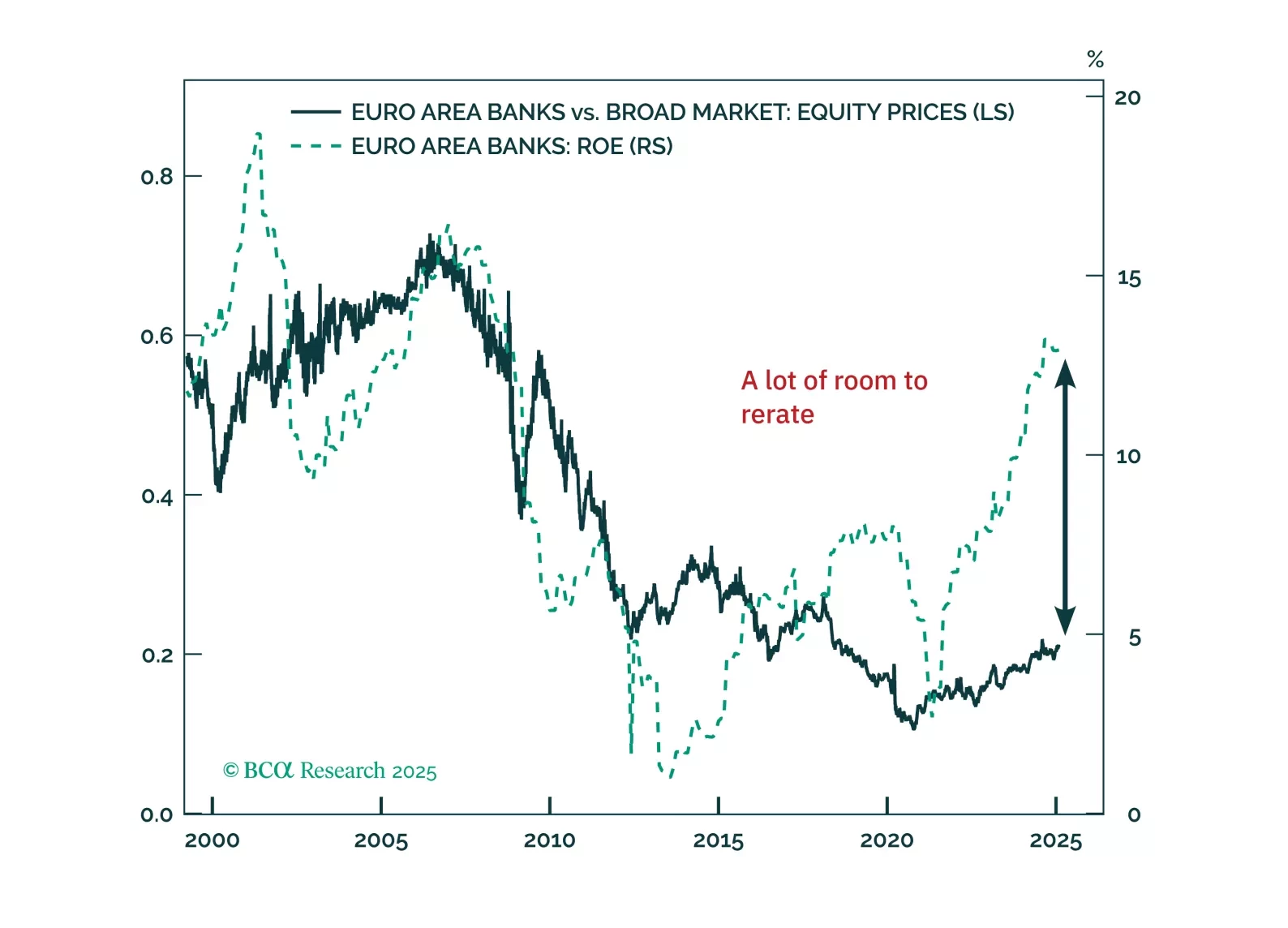

Eurozone banks have quietly outpaced the Magnificent 7—can they keep winning? With strong balance sheets, rising profitability, and structural tailwinds, European lenders still offer value despite short-term risks. Meanwhile, German…

A nascent theme in the latest data is the broad improvement in European sentiment. The February Sentix and ZEW surveys both improved, and flash estimates for European consumer confidence beat estimates, ticking up to -13.6%.…