Euro area and Chinese interest rates must fall much further to prevent monetary policy from becoming ultra-restrictive. But Trump’s attempts to force unwarranted rate cuts from the Fed risks a vicious backlash from the bond…

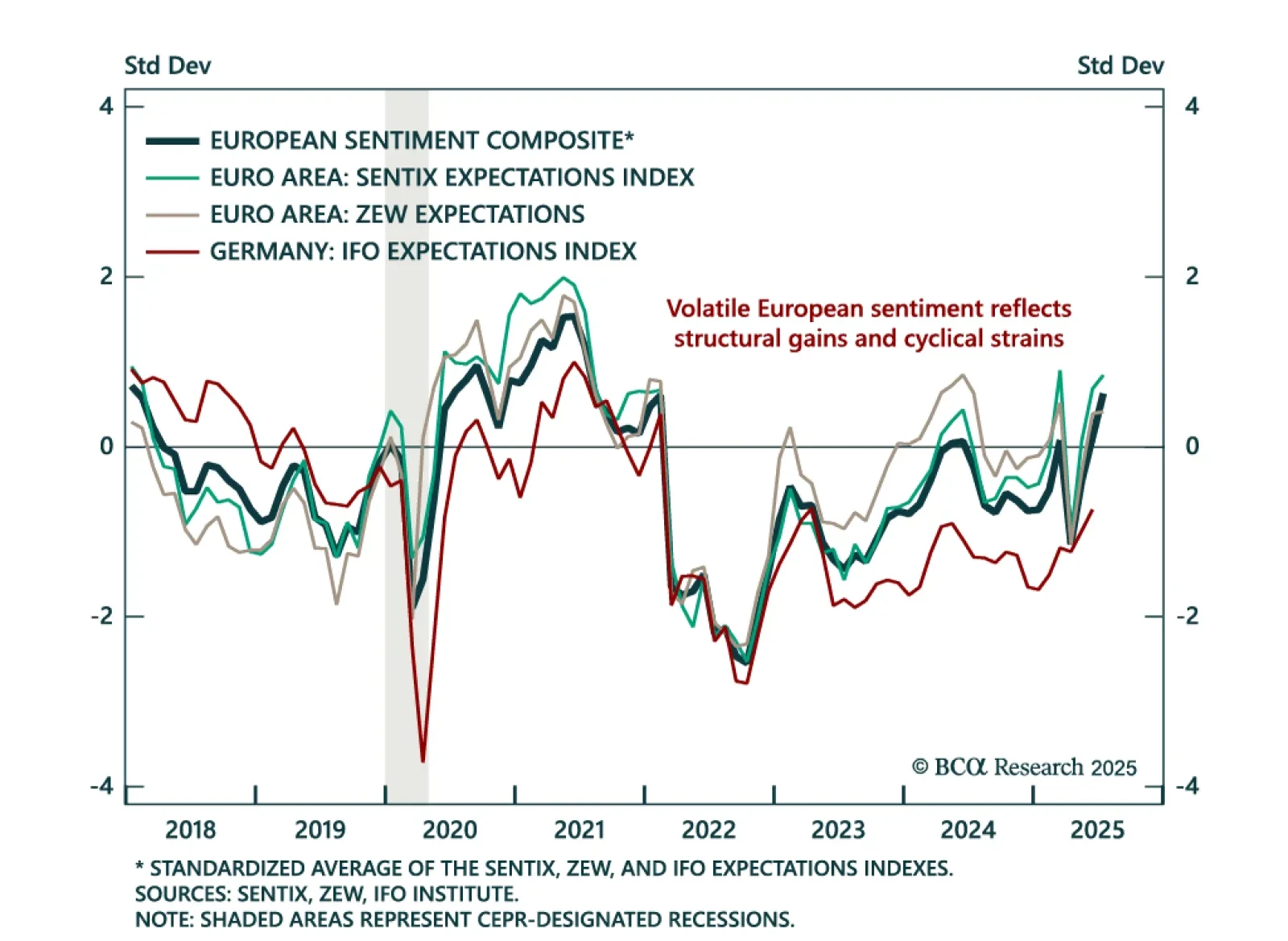

July’s ZEW data confirmed improving sentiment in Europe, but near-term conditions remain fragile, reinforcing a buy-on-dips stance for long-term investors. Euro area expectations rose to 36.1 from 35.3, with Germany also improving to…

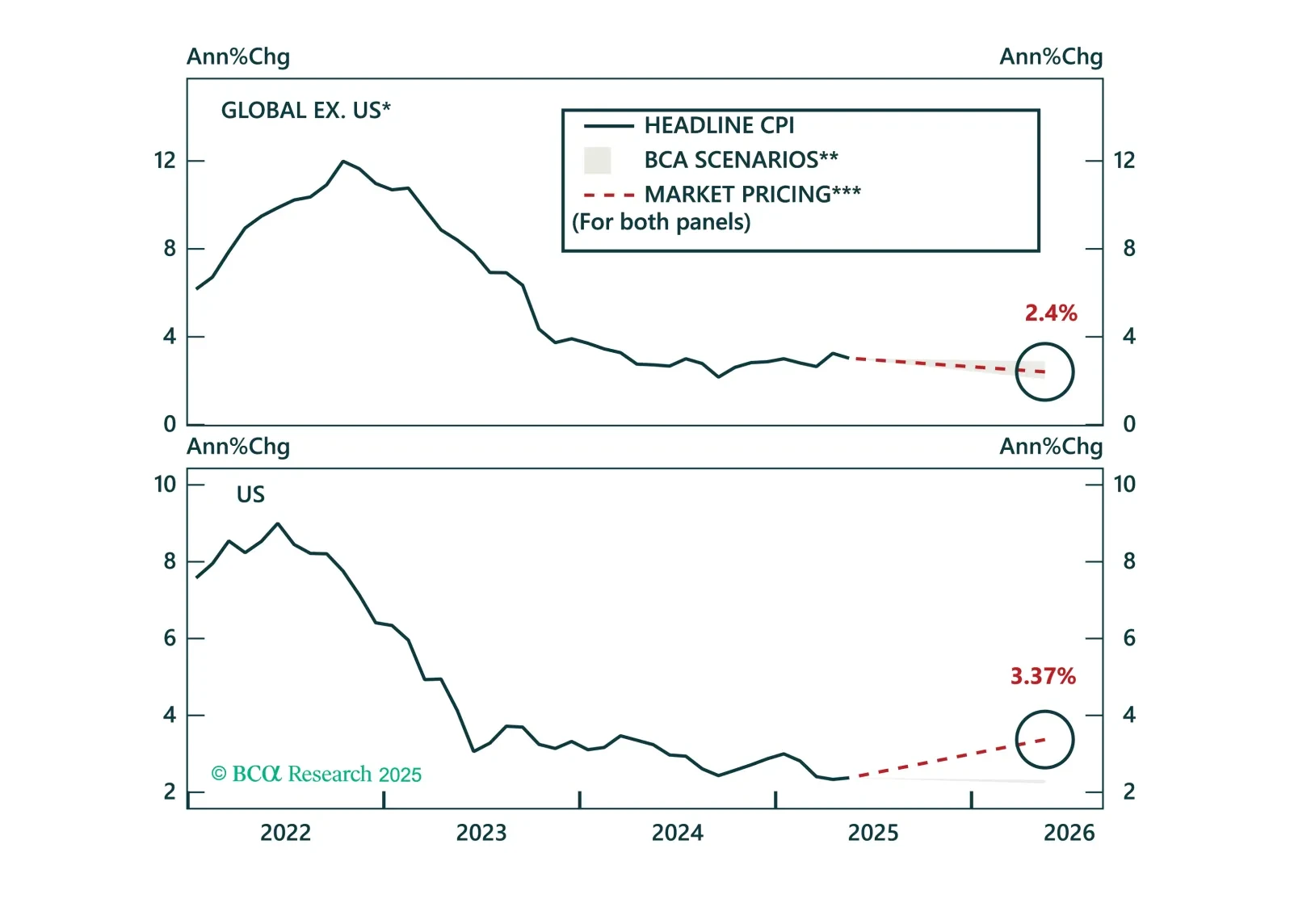

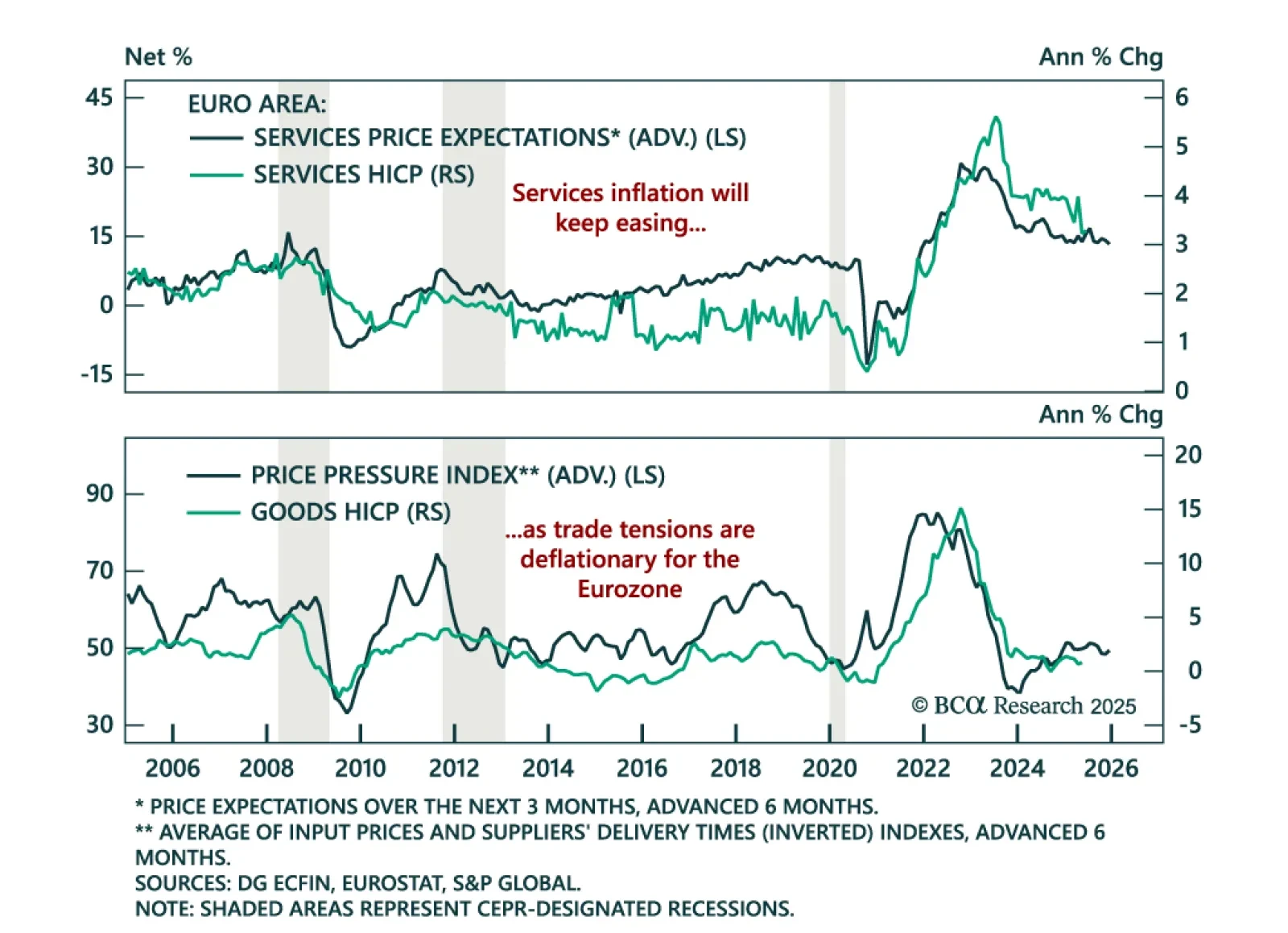

Disinflation continues to unfold globally, and markets are finally catching up. Inflation expectations have broadly realigned with fundamentals, prompting us to shift our global ILB allocation to neutral. While tariff risks are…

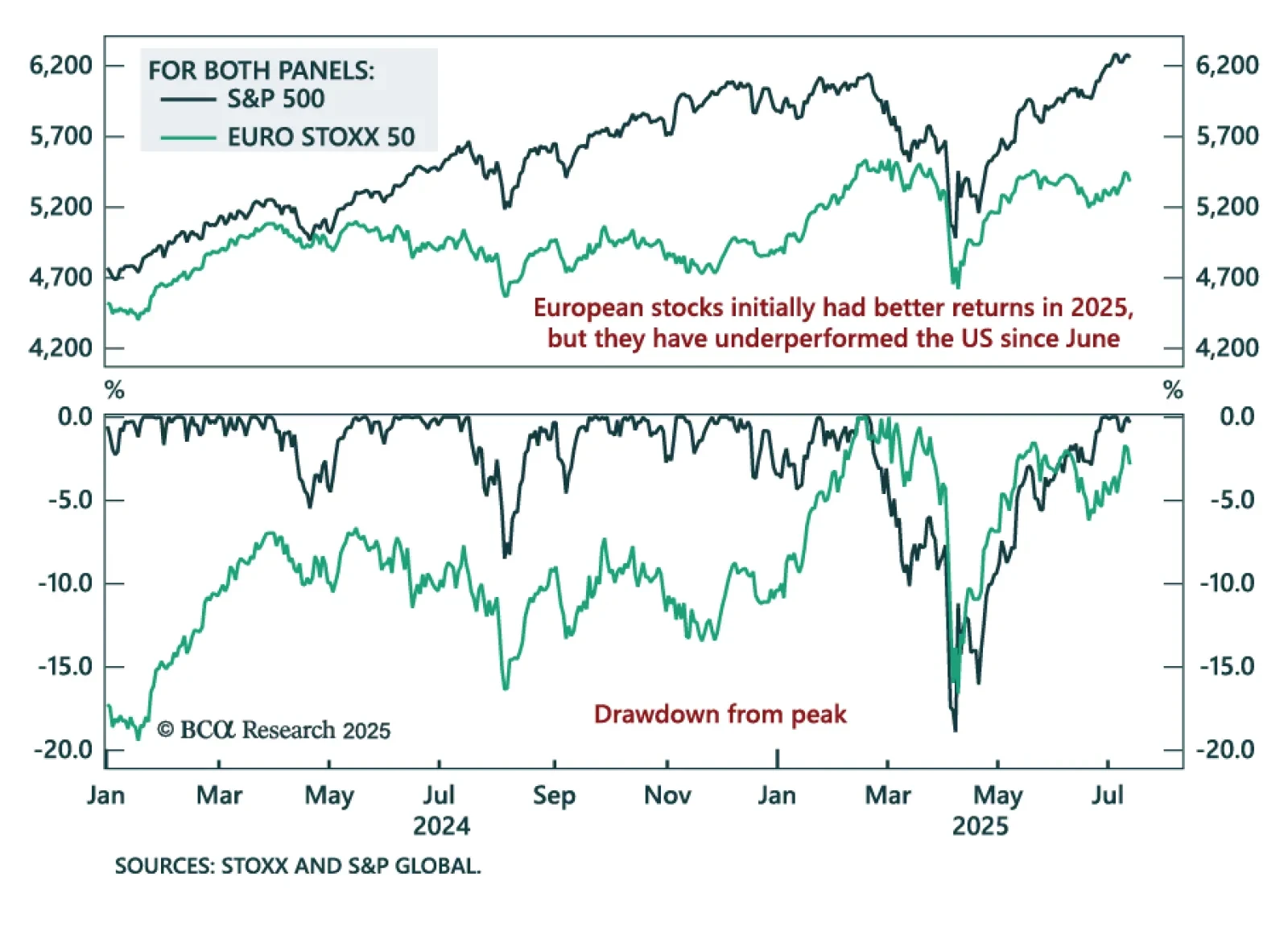

European equities have recently lagged the S&P 500, with short-term risks building despite a constructive long-term outlook. After reaching all-time highs in February, the EURO STOXX 50 began to stall as US markets sold off on…

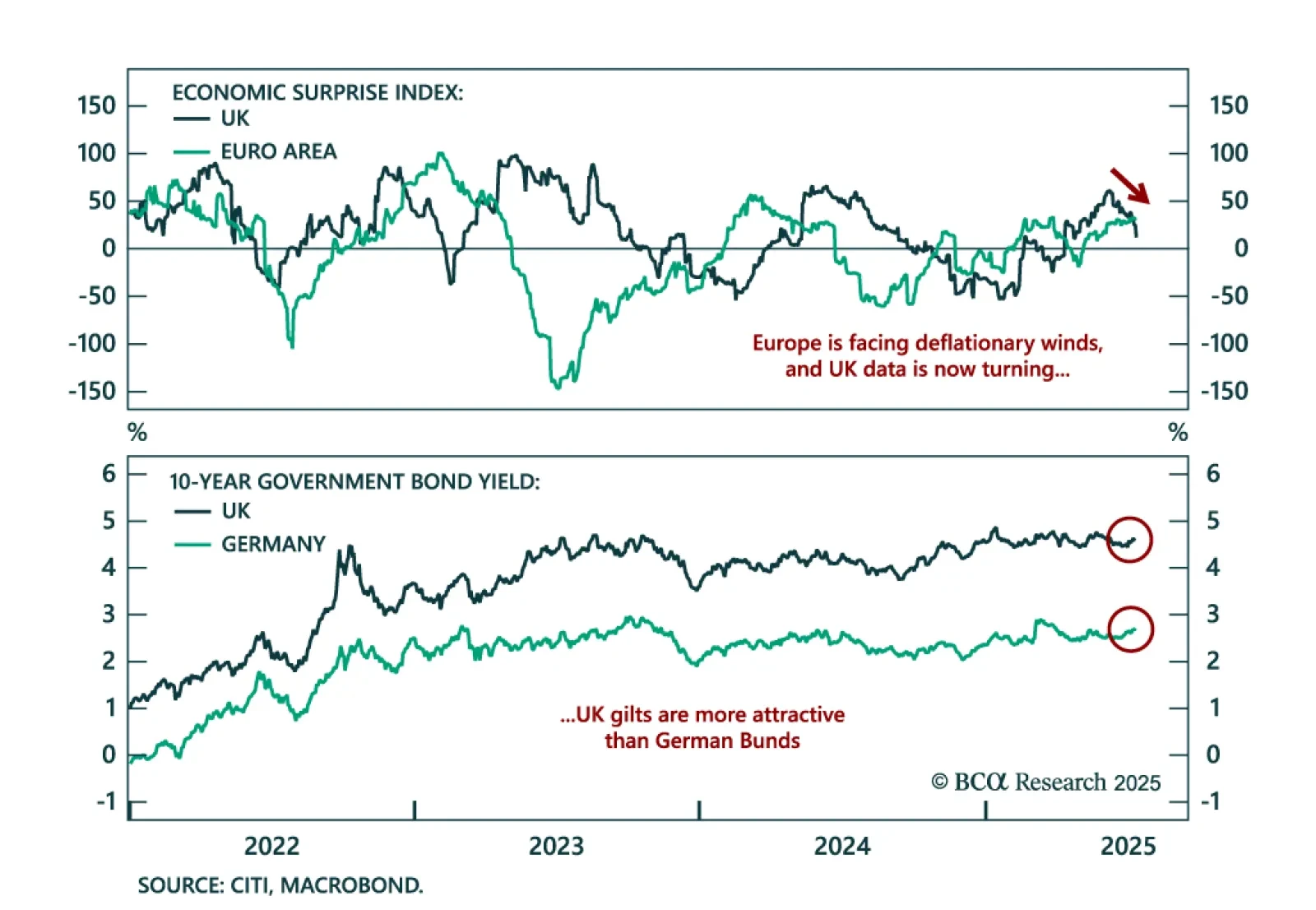

UK growth data continues to disappoint, making the case for a Gilts overweight and a dovish BoE. May GDP fell 0.1% m/m, missing estimates and marking a consecutive monthly contraction after April’s 0.3% decline. Industrial and…

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

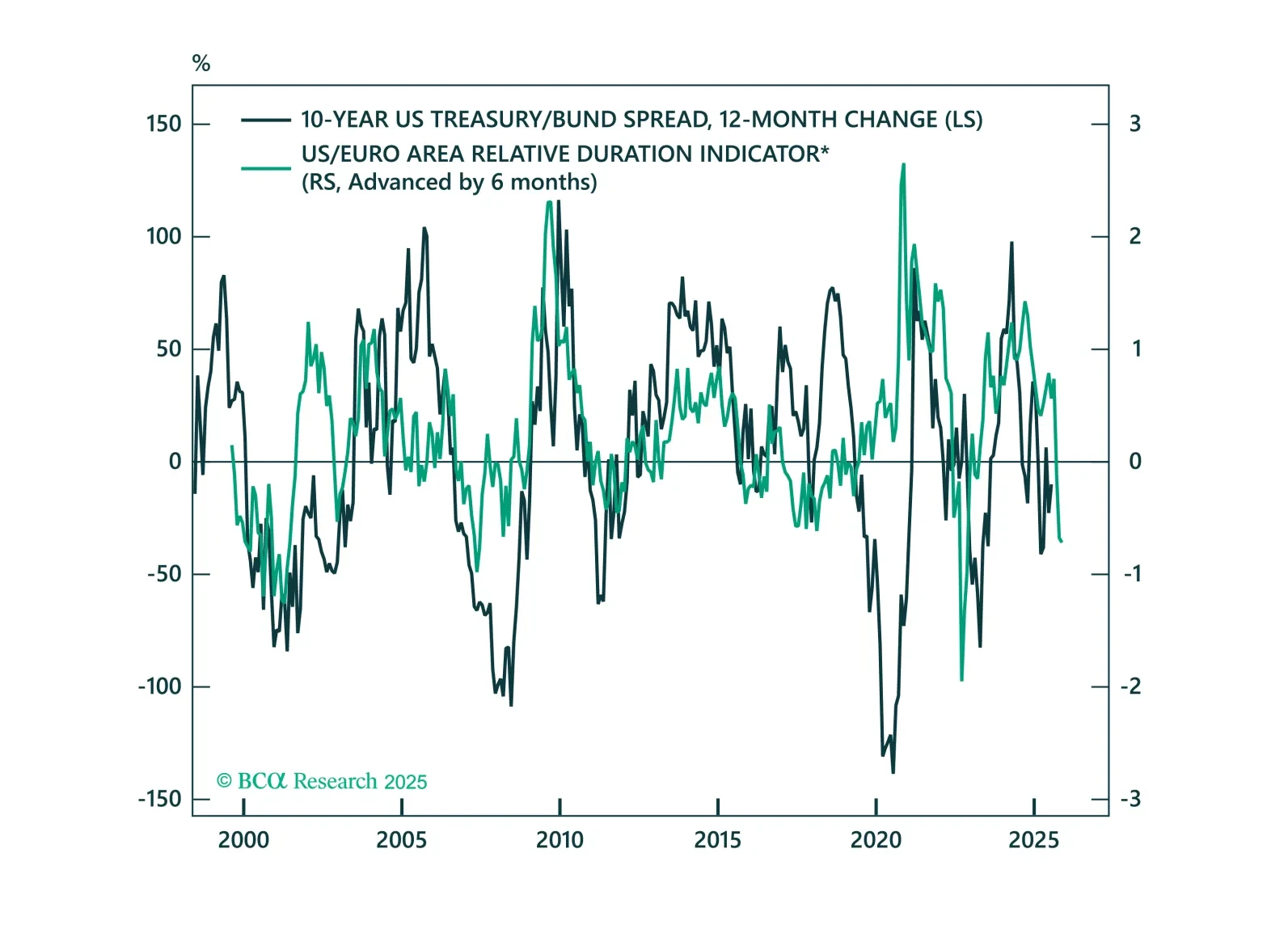

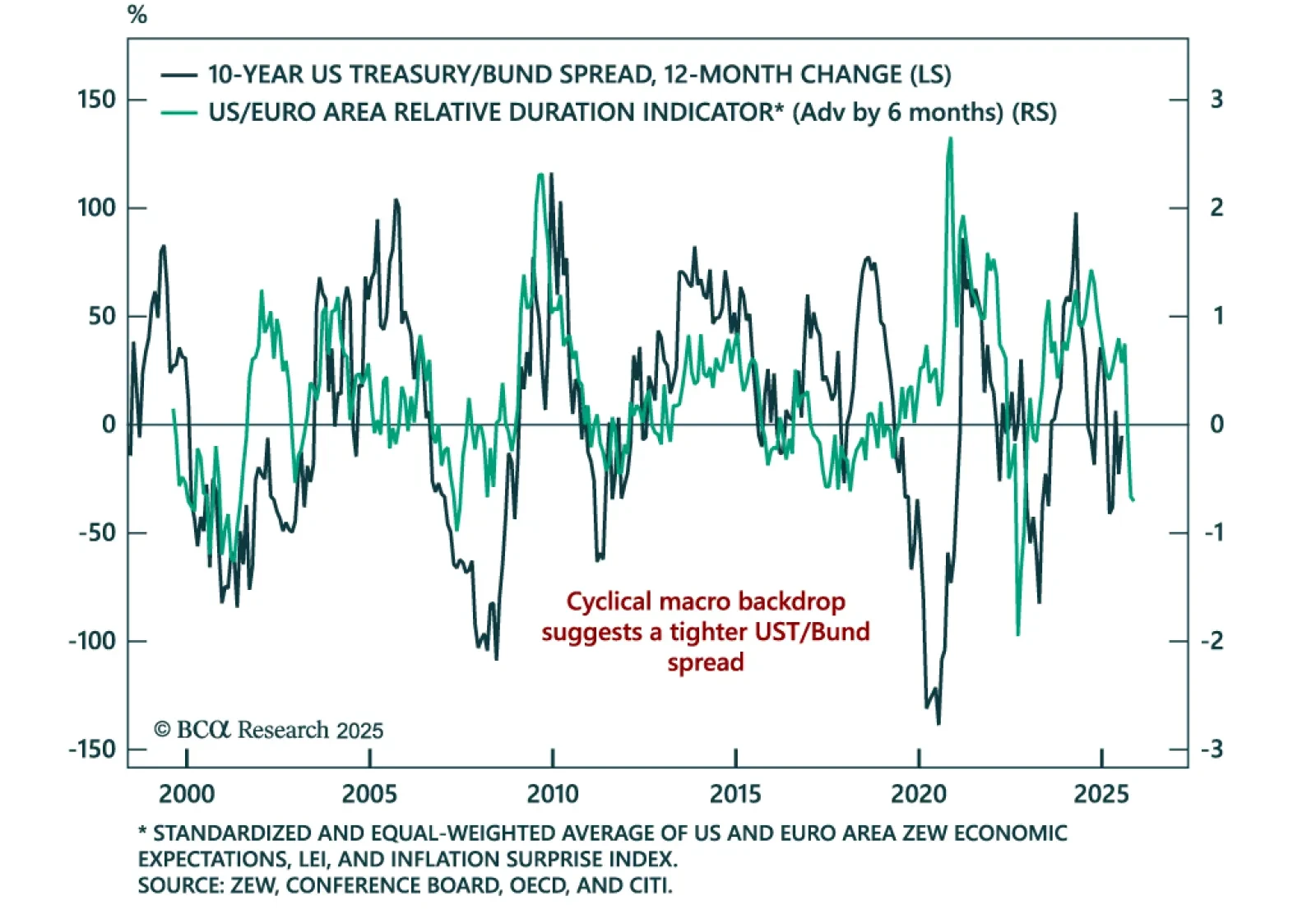

Relative growth and inflation trends point to a narrower UST/Bund spread. Our Chart Of The Week comes from Robert Timper, Global Fixed Income Strategist. This week, our rates strategists introduced a new US/Euro Area Relative…

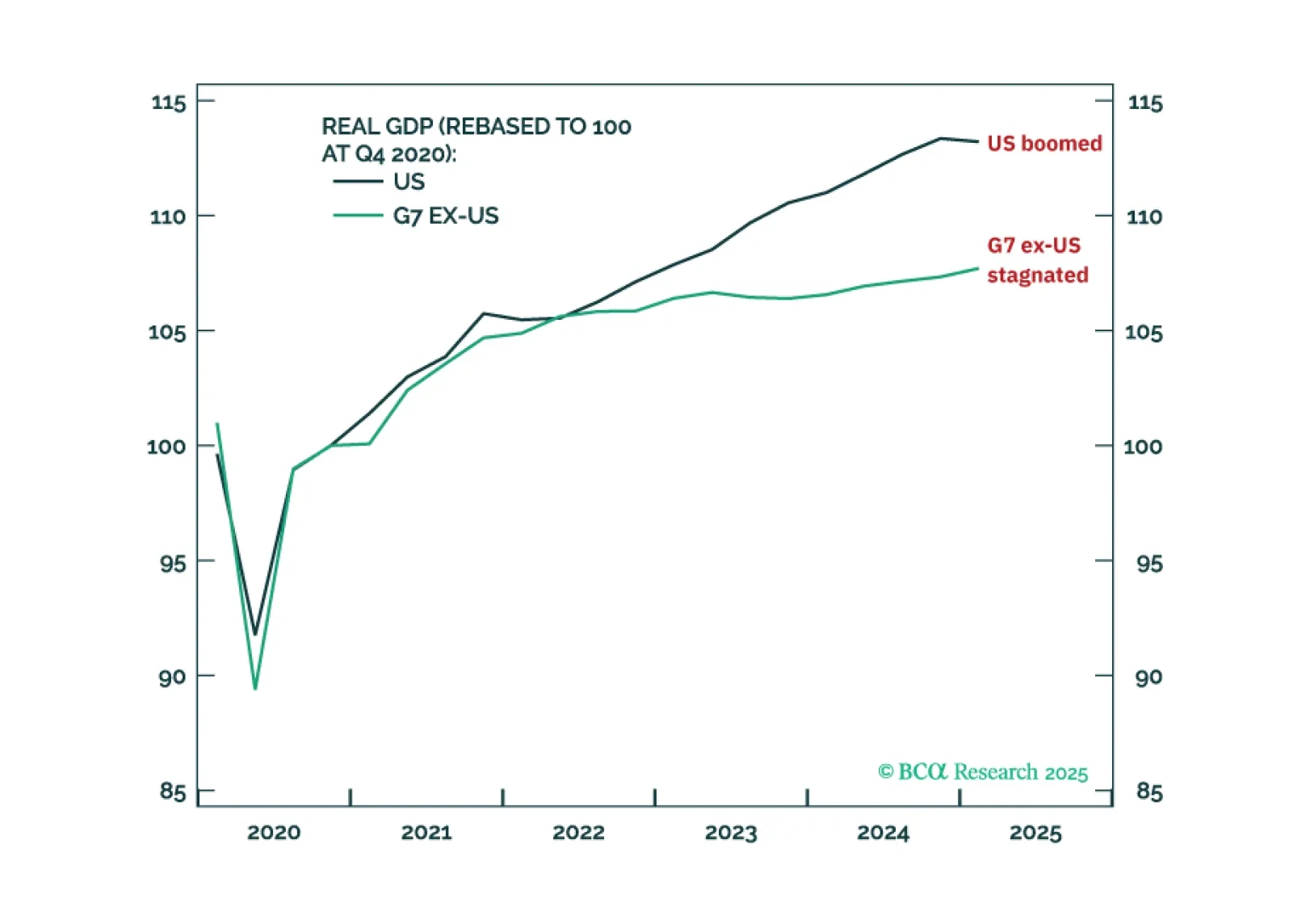

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…

Volatility is back in UST/Bund spreads. We unpack what’s driving the moves and explain what we are watching for tactical opportunities in the UST/Bund spread.

June Eurozone inflation data and soft growth backdrop support further ECB easing and reinforce the case for long European bond exposure. Flash HICP inflation ticked up to 2.0% y/y from 1.9%, while core inflation held steady at 2.3%,…