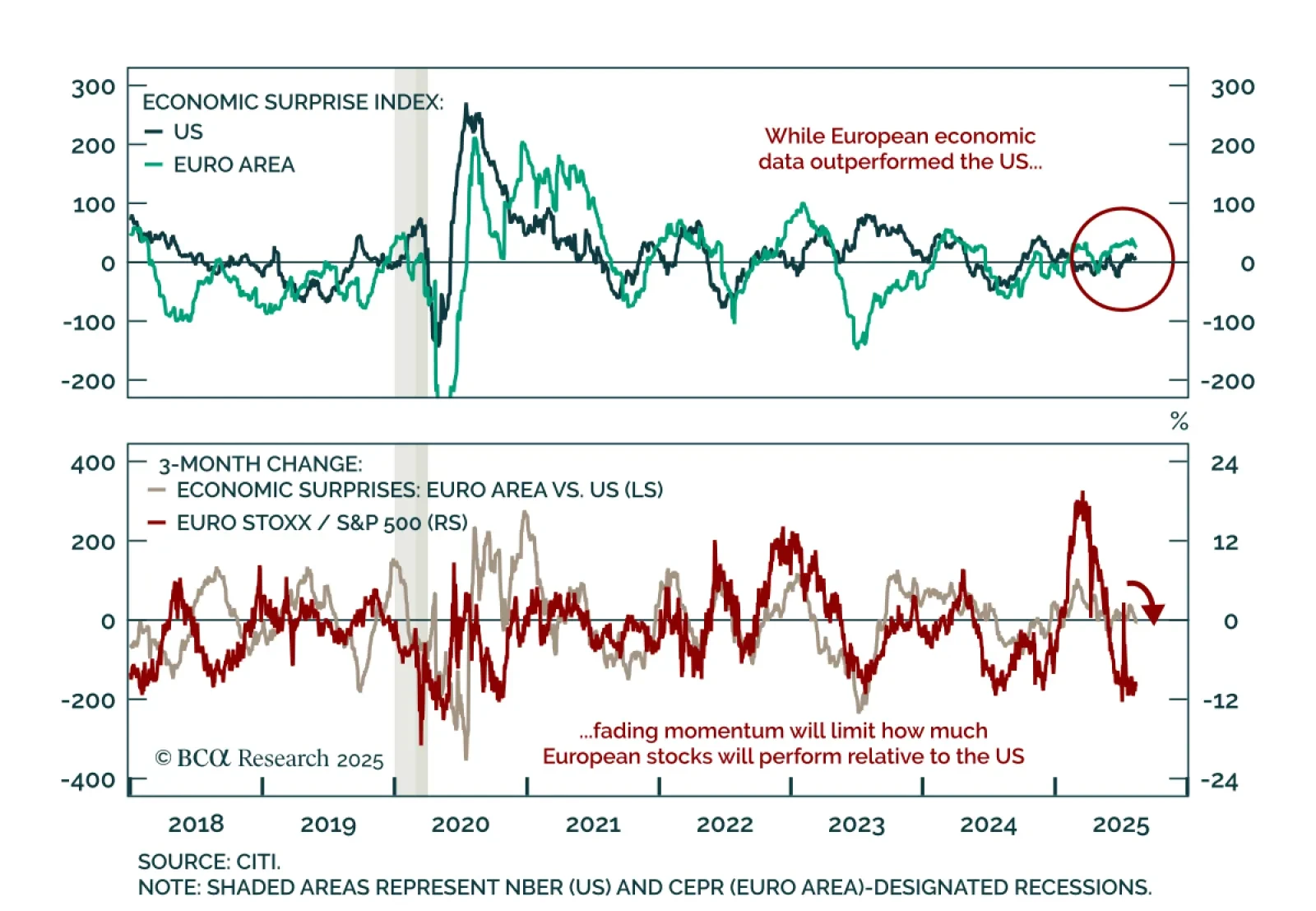

US equities are set for tactical outperformance versus Europe, but dips or underperformance in European assets remain entry points for long-term investors. European stocks have stalled below prior highs, while the S&P 500 has…

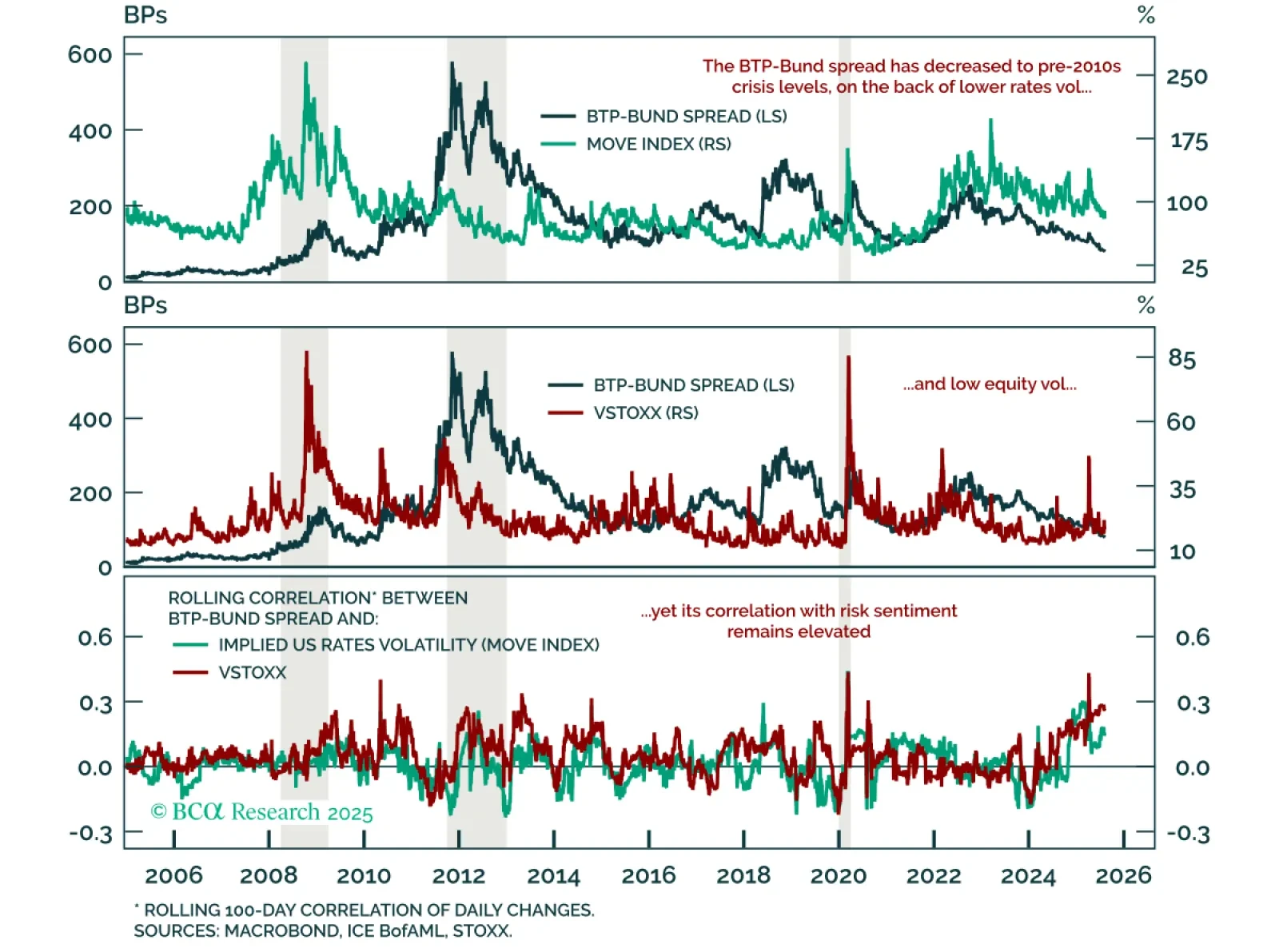

The BTP-Bund spread has tightened to pre-2010s levels, but with global growth risks we favor Gilts over Bunds and prefer BTPs over credit. While the EURO STOXX 50 remains rangebound since the Liberation Day recovery, European…

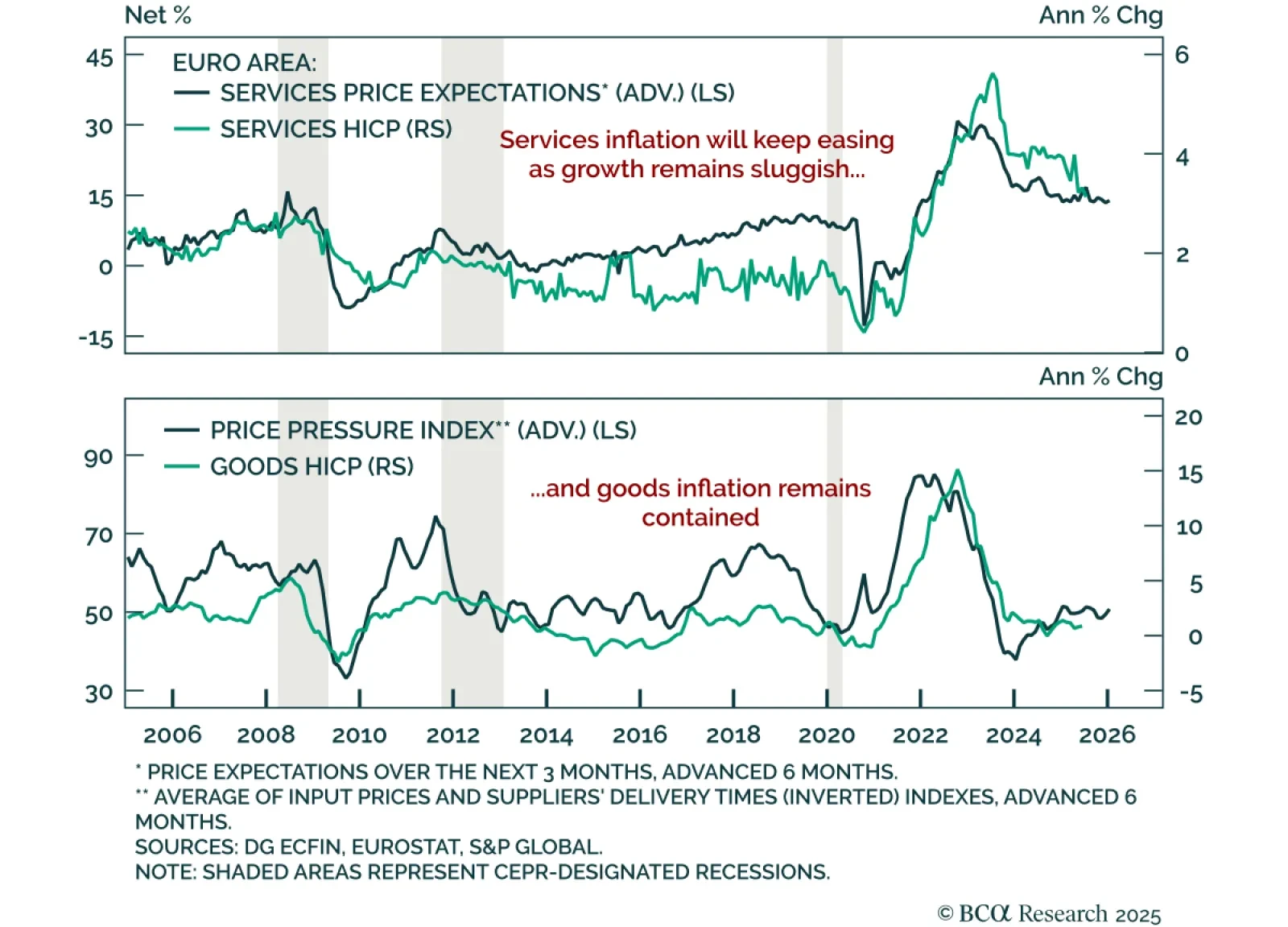

Euro area inflation held steady in July, but near-term risks remain. Long-term investors should buy on dips. Headline and core HICP came in at 2.0% and 2.3% y/y, roughly in line with expectations. The ECB held its deposit rate…

EUR/USD has broken below key support, and near-term risks justify a tactical bearish stance while longer-term investors should buy dips. The pair fell through its 50-day moving average, which, along with the 20-day, had provided…

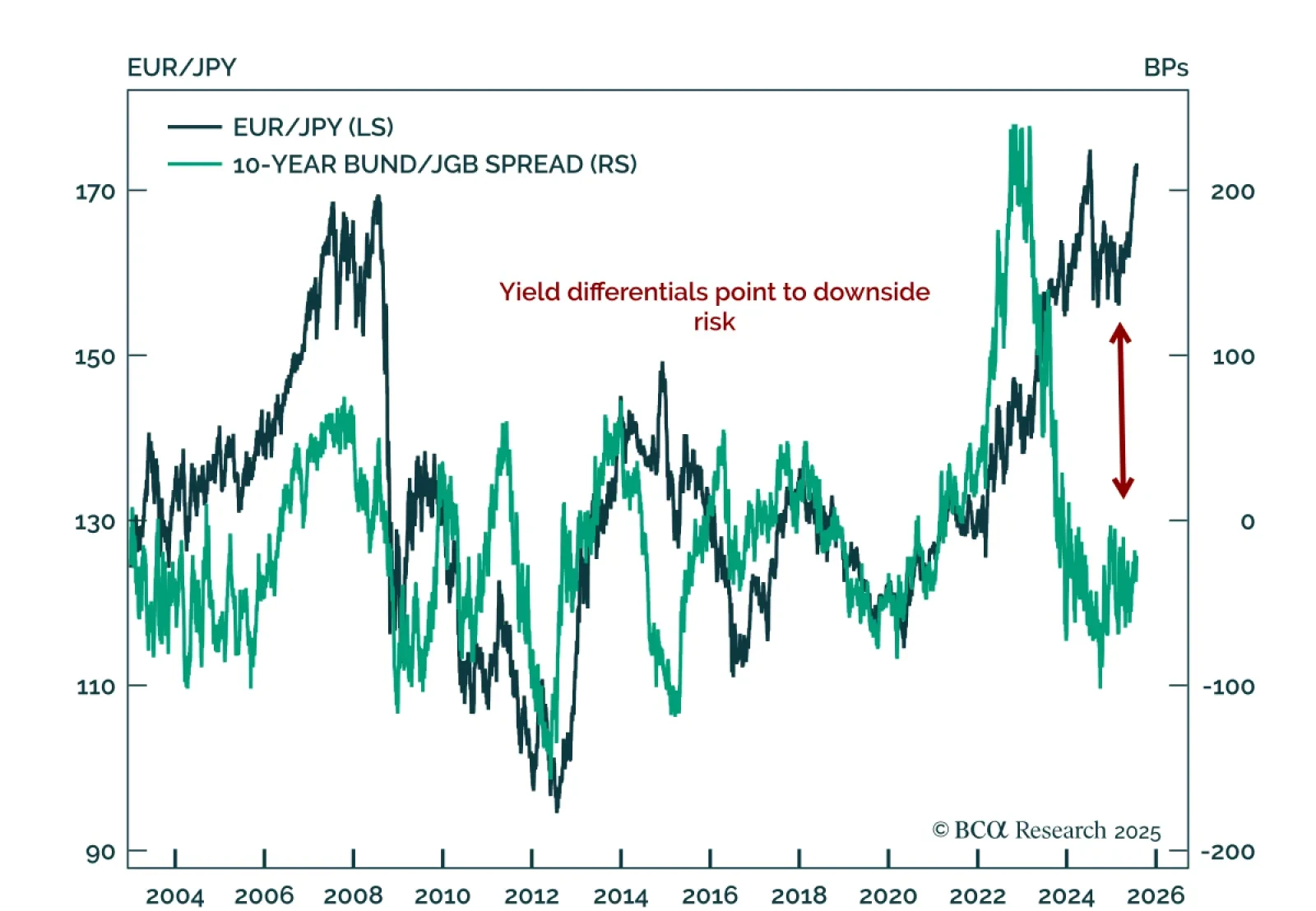

Our strategists recommend shorting EUR/JPY, citing stretched valuations and rising reversal risks. The cross has surged more than 6% since late May, triggering new short positions from the Counterpoint, European Investment Strategy,…

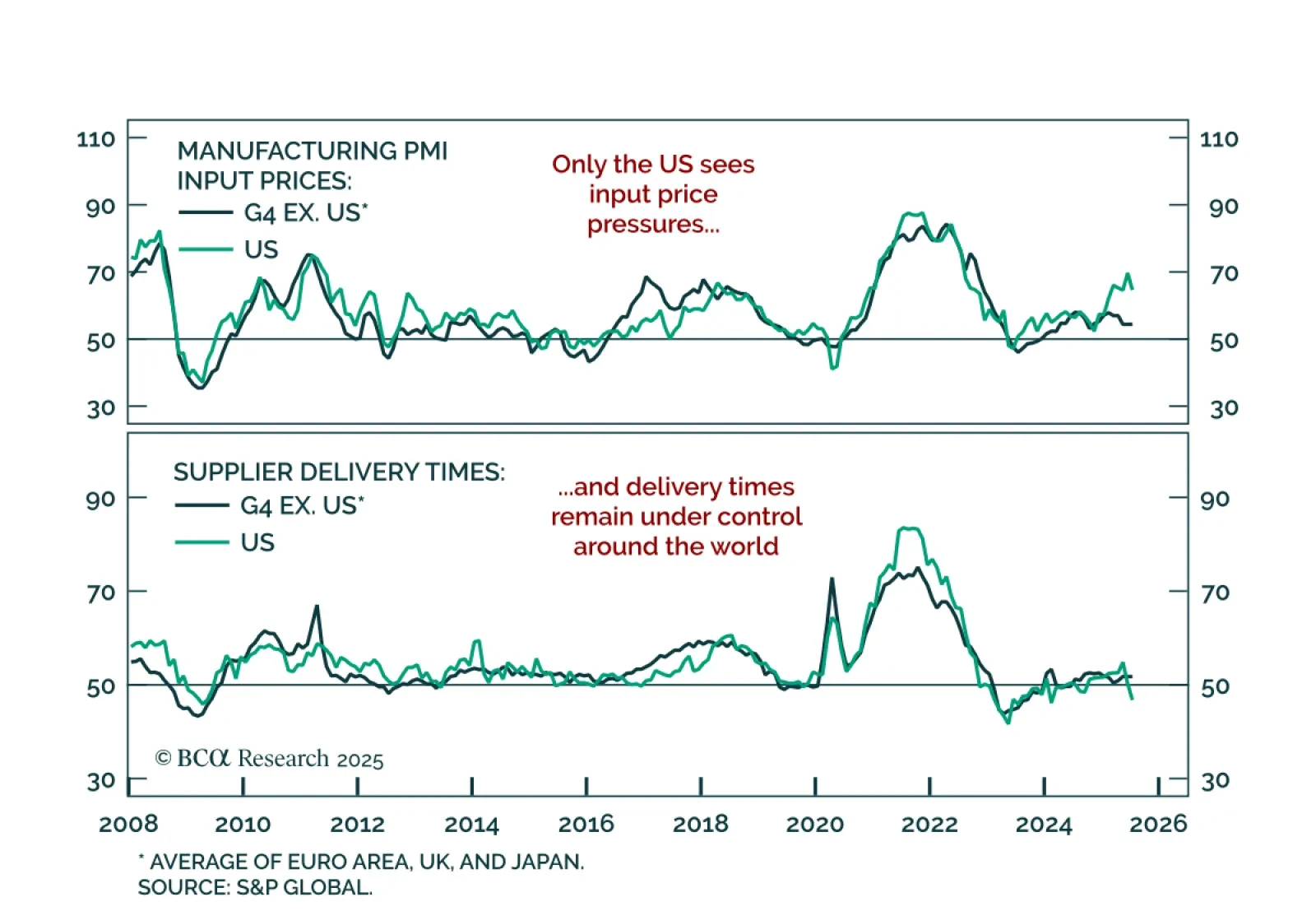

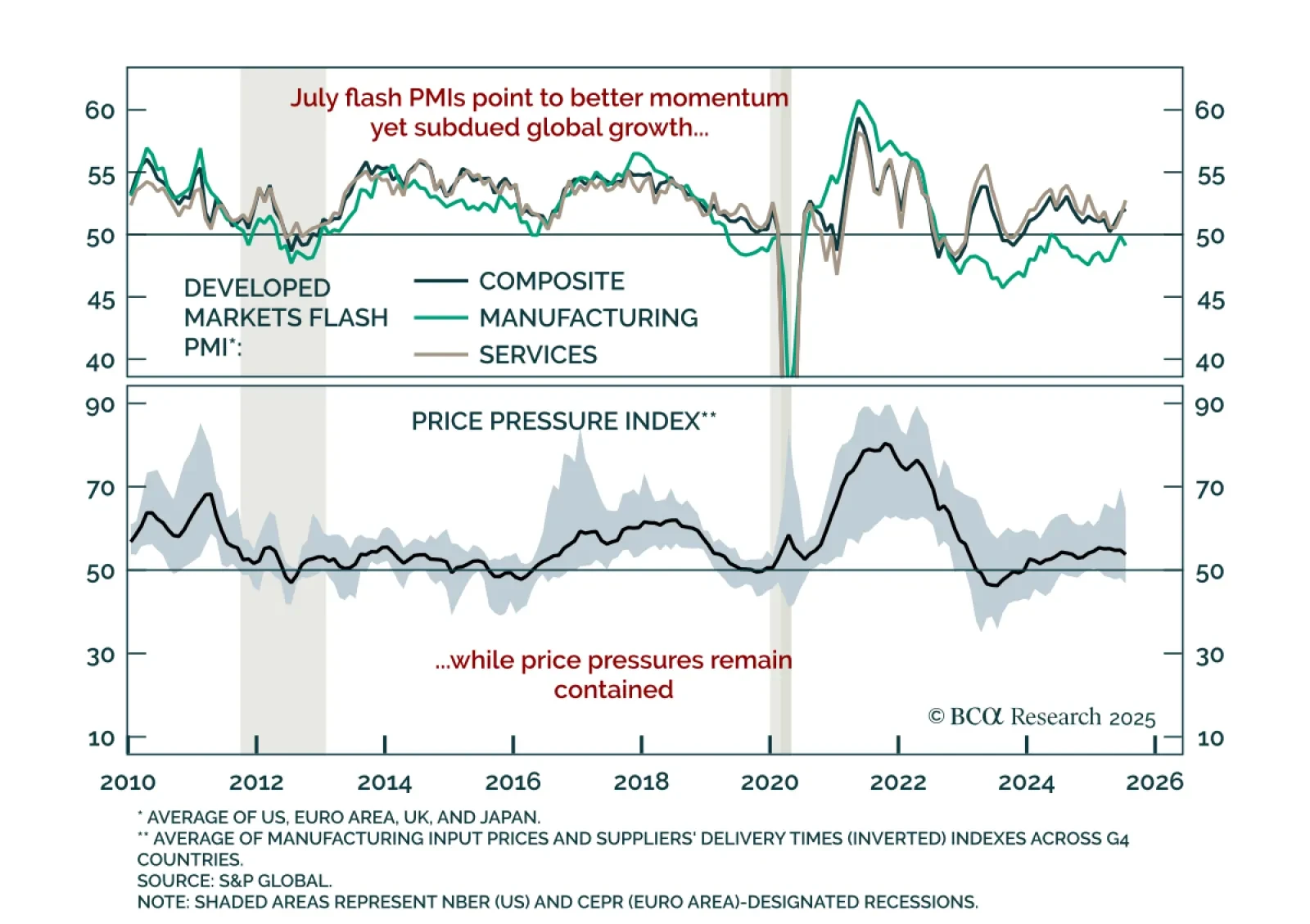

Cresting price pressures and weak global growth reinforce our long duration stance, with labor market slack limiting inflation upside across most major economies. Our price pressure indexes show moderate input inflation outside…

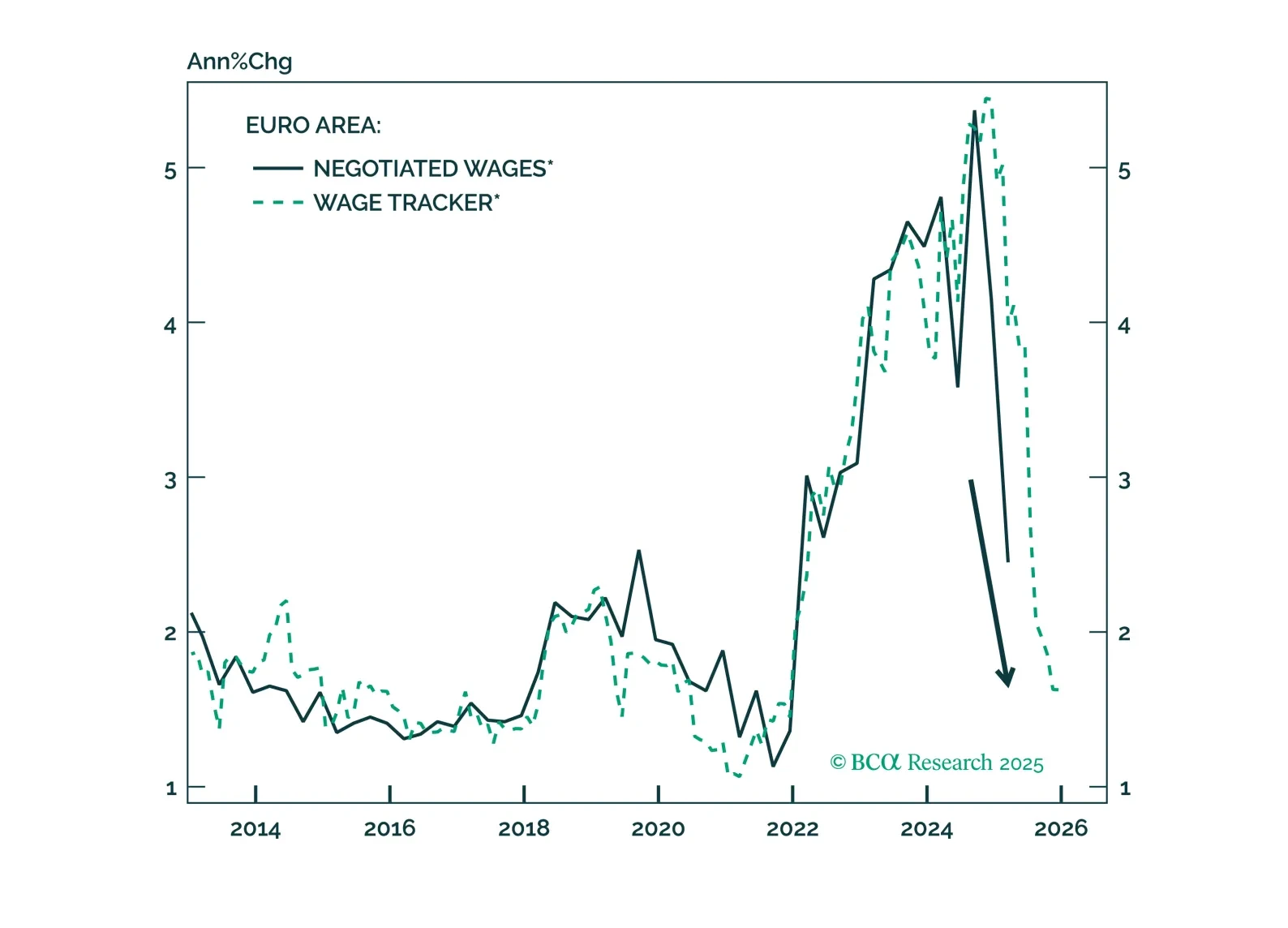

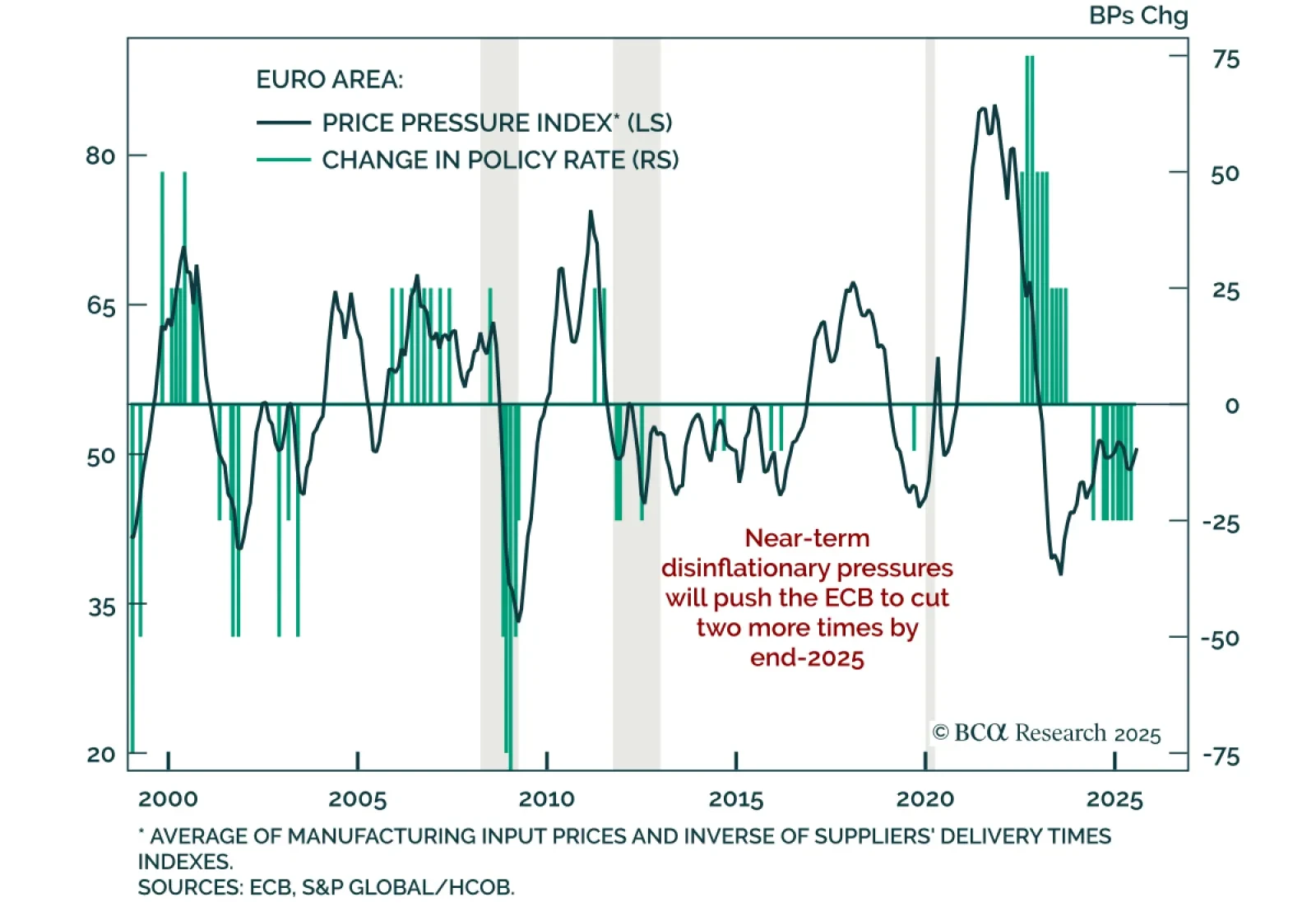

Consensus sees one final ECB cut; we argue two are coming as deflationary forces are building in Europe. Dive in for the trade map: falling Bund yields, tighter peripheral spreads, and a euro primed for a 2026 rebound.

The ECB held rates steady for the first time in eight meetings, signaling a slower pace of easing while downside risks and entrenched disinflation support positioning for further cuts. The deposit facility rate remains at 2.0%,…

July DM flash PMIs point to improving global growth momentum led by services, but manufacturing remains weak and upside is limited, reinforcing our defensive stance. Services PMIs improved in the US, Europe, and Japan, but…

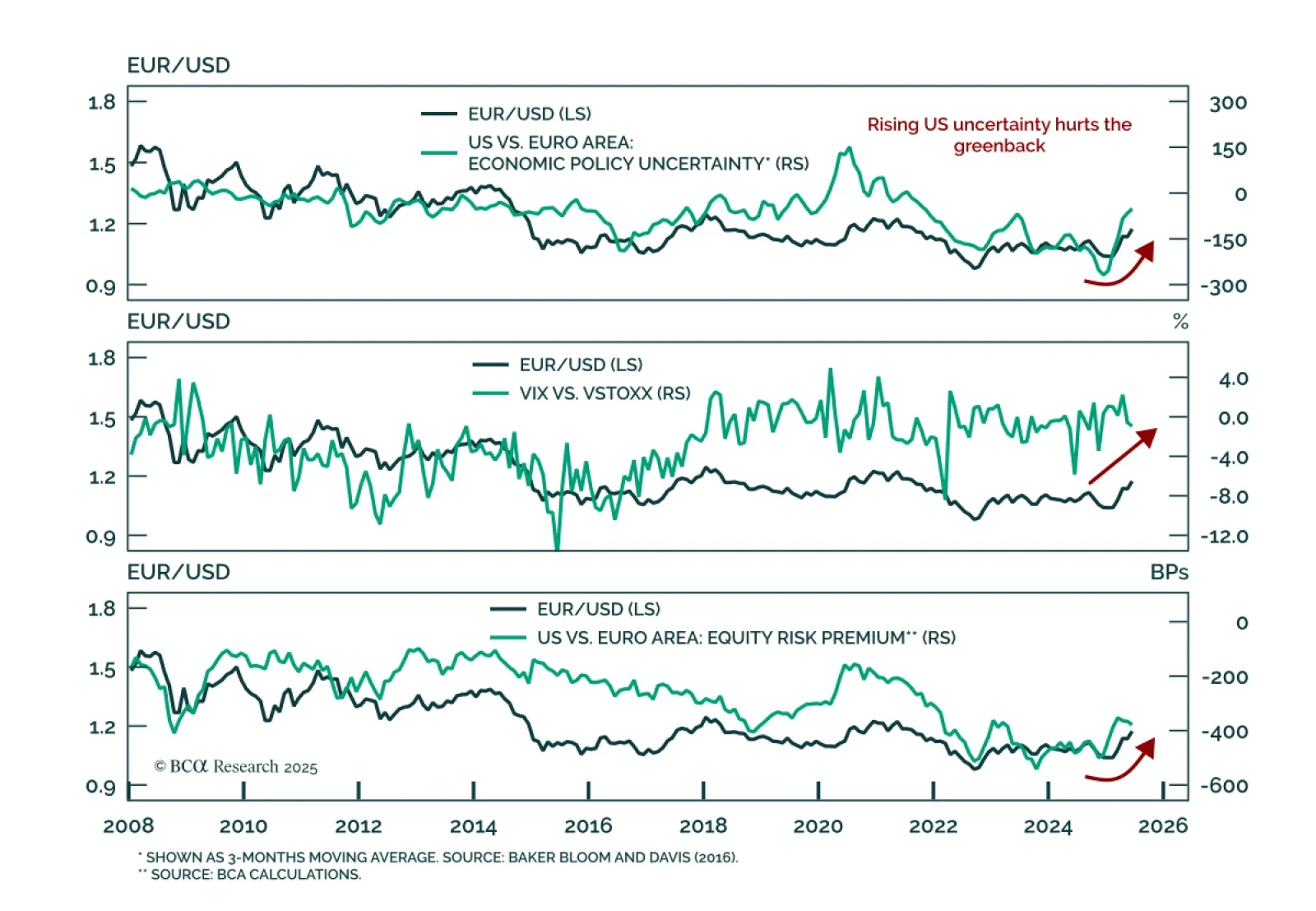

Rising US macro uncertainty and external imbalances are reinforcing euro strength and are supportive of a long-term bullish view on EUR/USD. Our Chart Of The Week comes from Mathieu Savary, Chief Strategist for Developed Markets ex…