European stocks and the euro continue to weaken; soon, they will test the bottom of their recent trading range. Which sectors can protect investors against this downdraft?

We continue to expect Brent crude to trade just above $101/bbl in 4Q23, and to average $118/bbl in 2024. Higher volatility looms. We expect Russia will cut oil production next year as part of a concerted effort to undermine Biden’s…

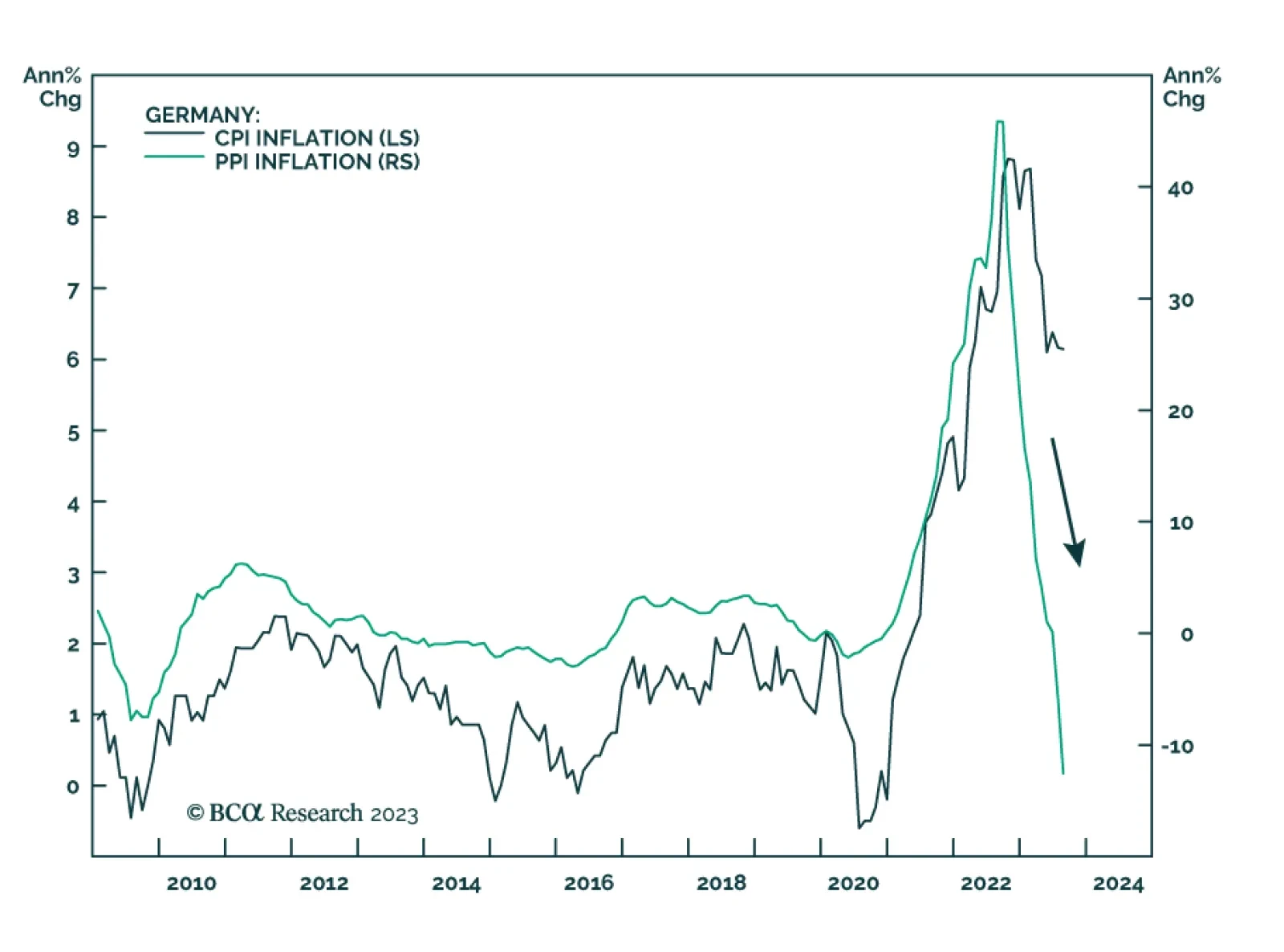

Collapsing German producer prices continue to indicate that inflationary pressures are moderating in the Eurozone. Total PPI declined by a record 12.6% y/y in August following a 6.0% y/y drop in July. While the annual decline…

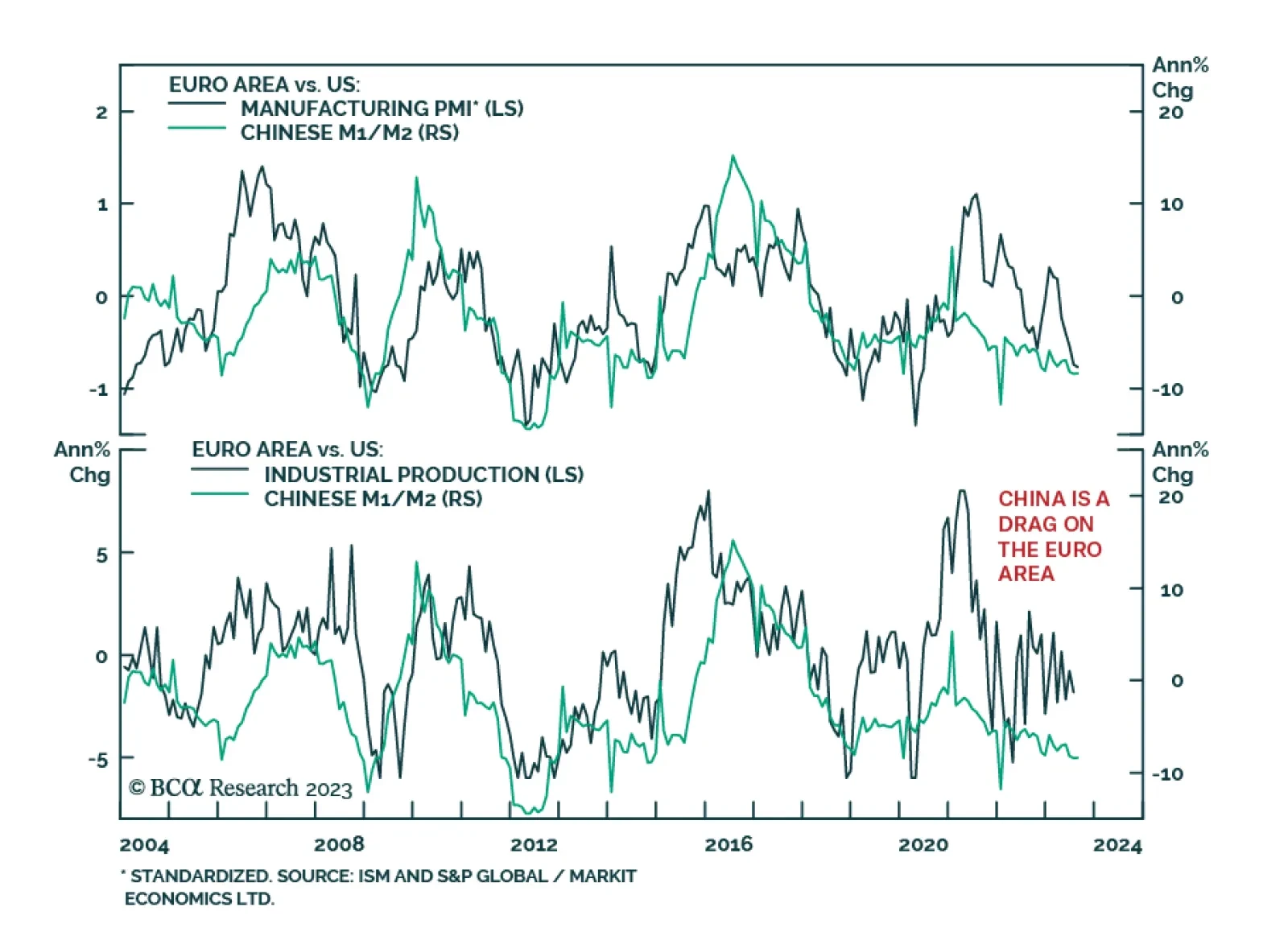

The German auto and components sector is under stress. Year-to-date, the sector’s equity prices have declined by 3.5% relative to the broader German market, and multiple indicators suggest that further challenges lie ahead…

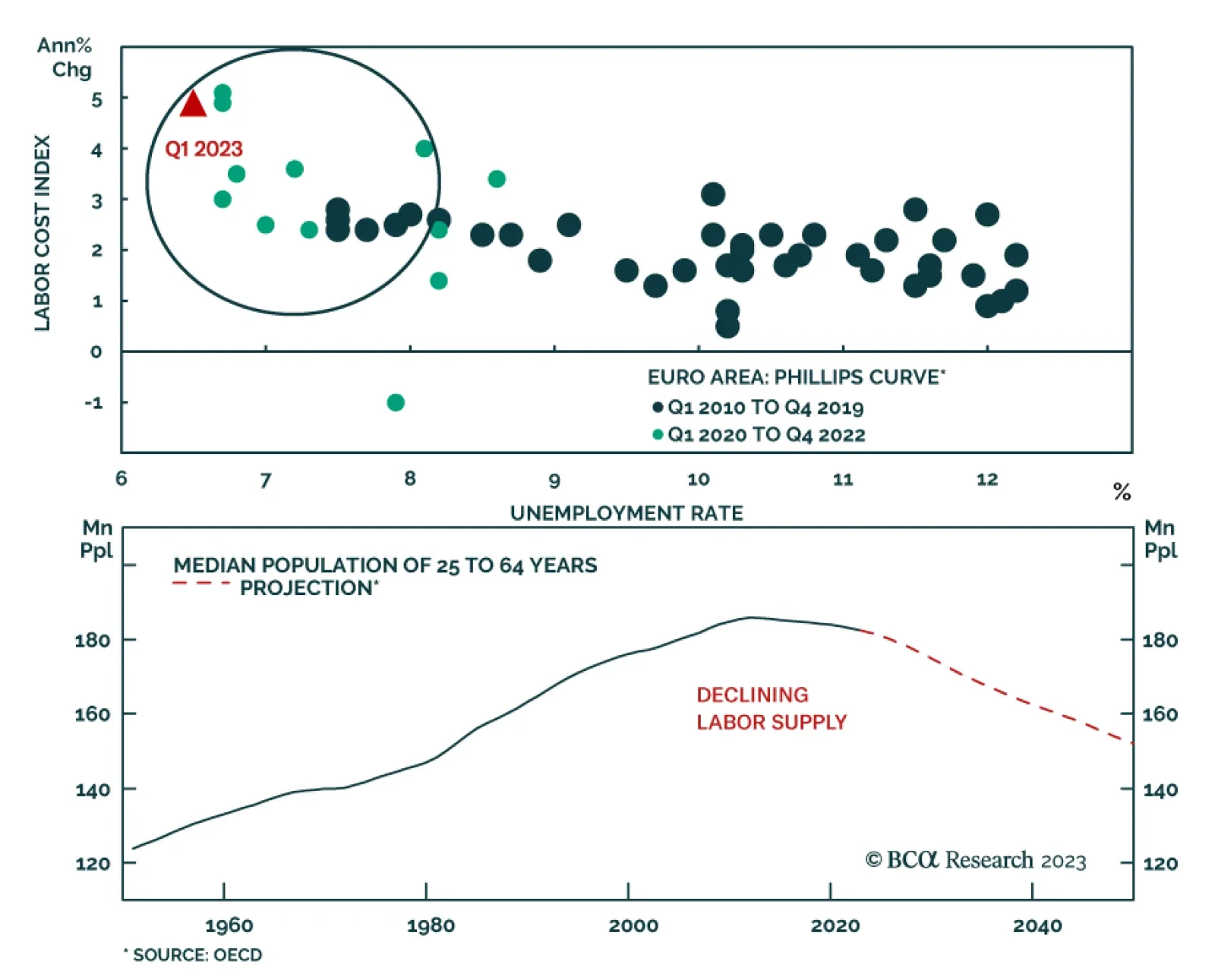

According to BCA Research’s European Investment Strategy service European inflation is likely to remain stubborn through the remainder of the decade, since the working-age population’s decline will keep the labor…

The ECB is done lifting interest rate for the cycle and its next move will be a cut next year. Yet, European rates will climb even higher in the second half of the decade.

The Euro Area’s industrial production figures for July sent a disappointing signal on Wednesday. The 1.1% m/m decline in output fell below expectations of a smaller 0.9% m/m decrease. On a year-over-year basis, IP…

In this report, we review our European fixed income strategy recommendations ahead of tomorrow’s critical ECB meeting

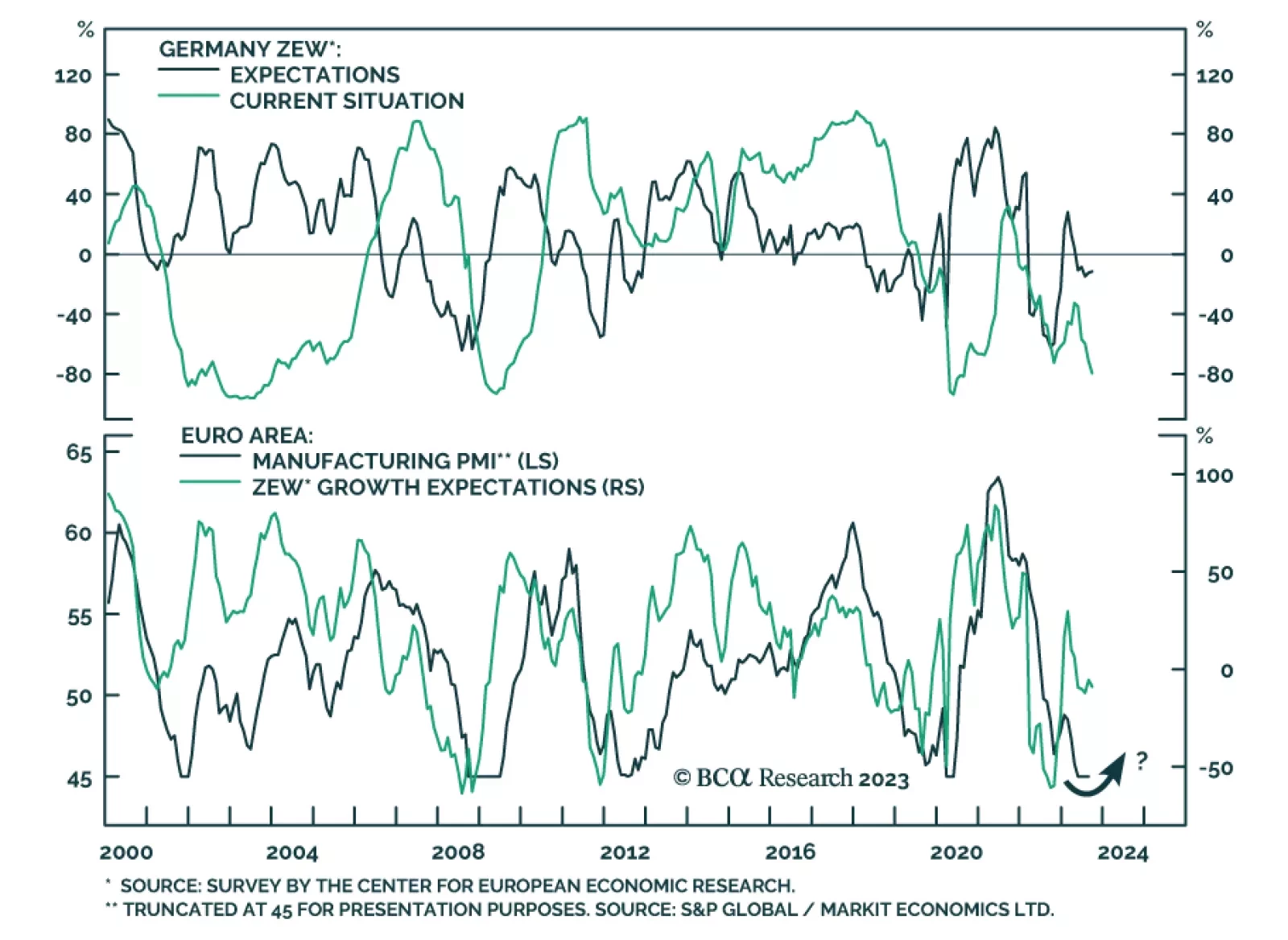

Results of the ZEW survey of investor sentiment delivered a mixed signal on Tuesday. On the positive side, the indicator of economic sentiment for Germany unexpectedly ticked up from -12.3 to -11.4, surprising expectation of a…