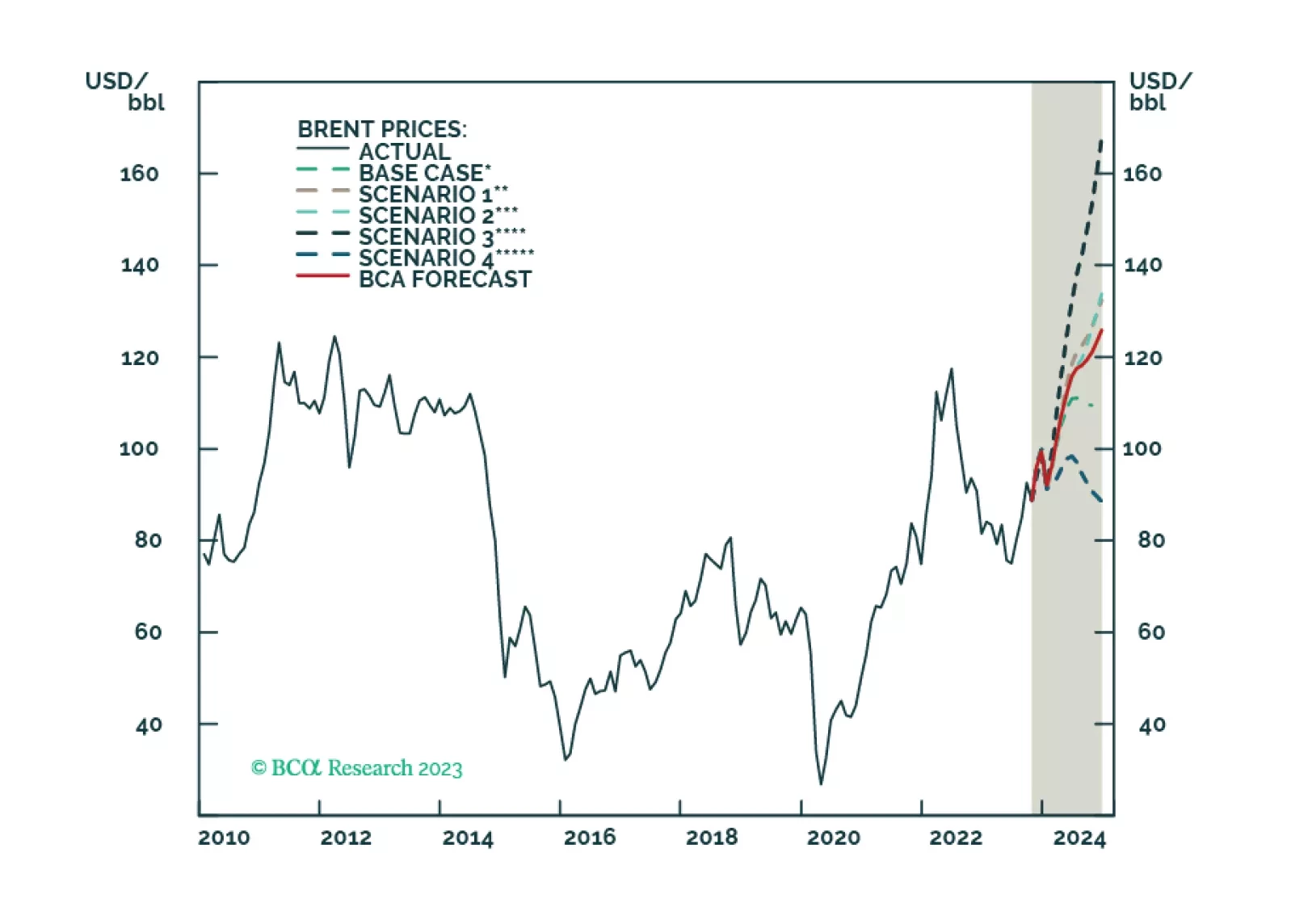

US and Chinese oil-demand strength will offset EU weakness next year. Incremental supply growth from non-OPEC 2.0 producers, coupled with a lower risk of the US enforcing its sanctions on Iranian oil exports, reduces our 2024 Brent…

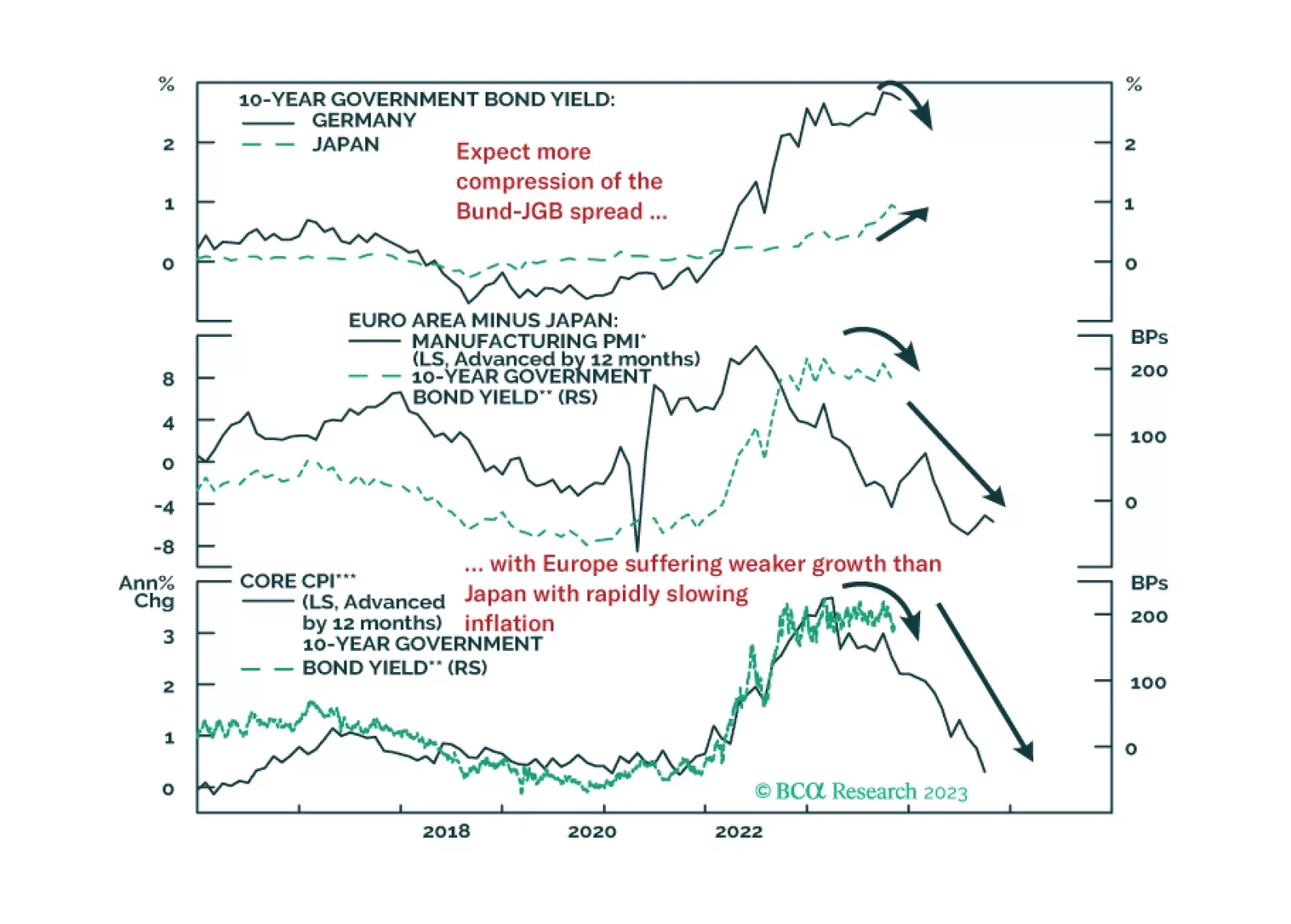

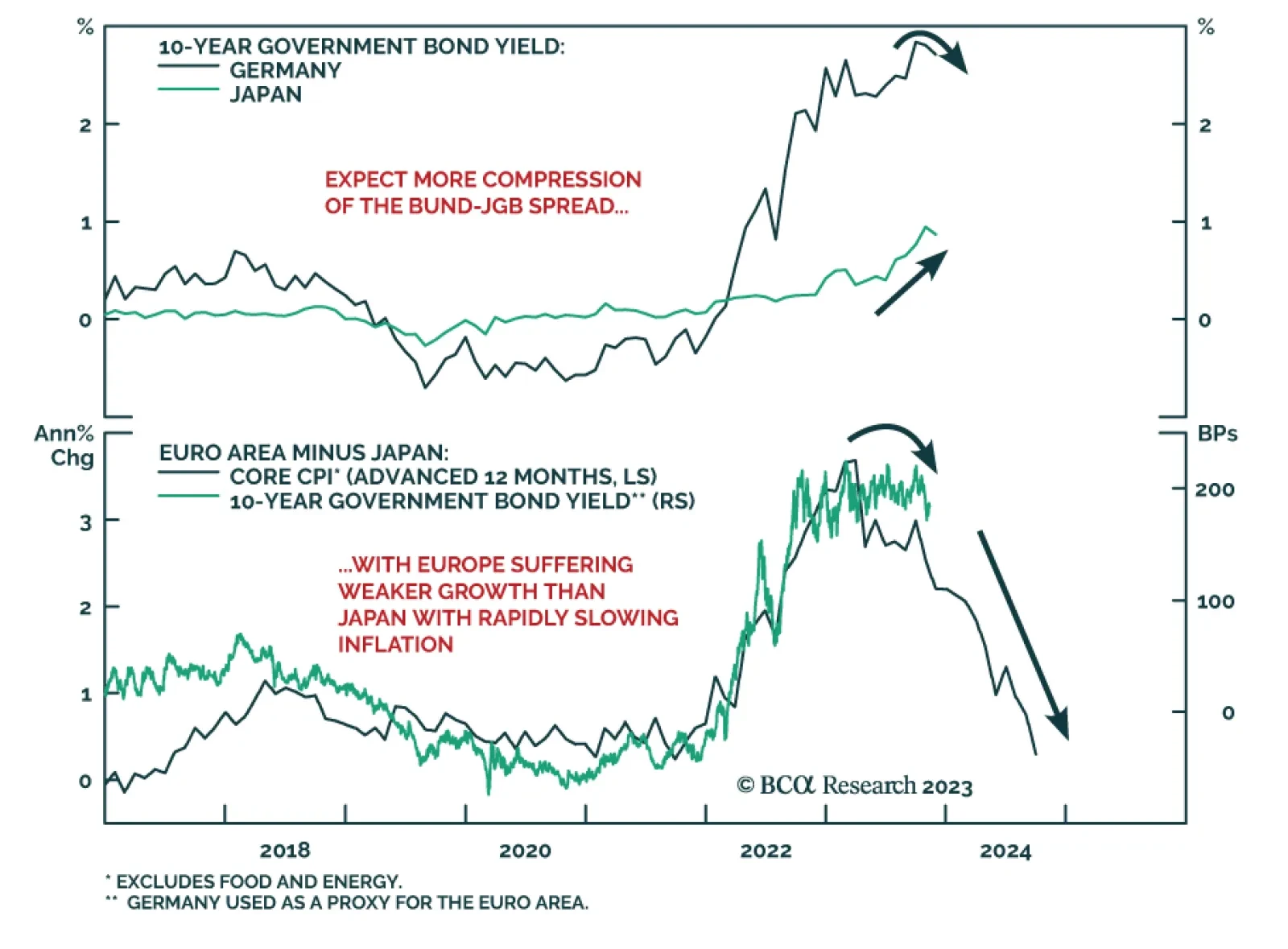

BCA Research’s Global Fixed Income Strategy service remains long 10-year German bunds vs short 10-year Japanese government bonds (JGBs) as a tactical trade. This trade mirrors the team's two highest conviction…

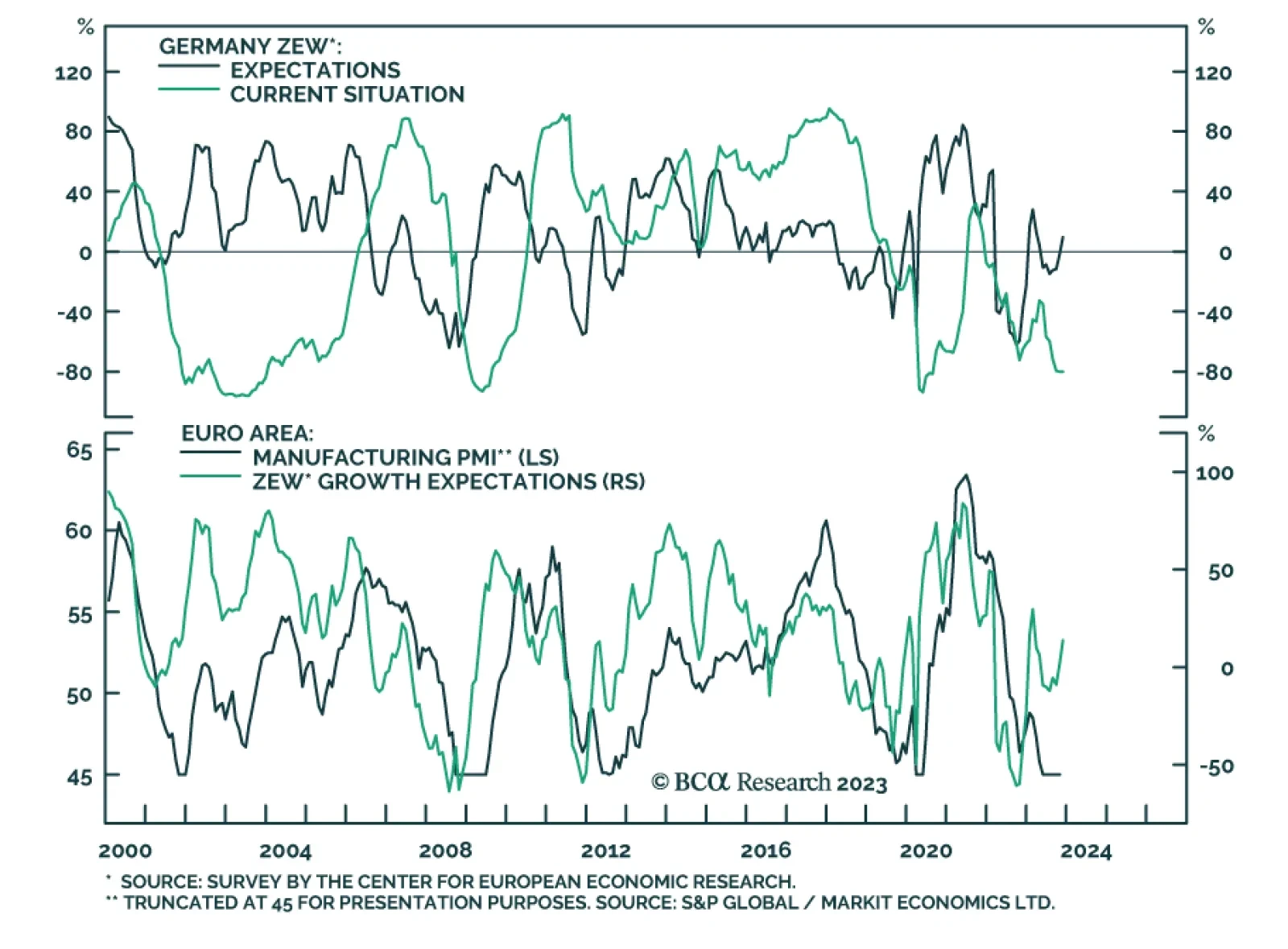

The ZEW survey of investor sentiment continues to send an optimistic signal. German sentiment jumped from -1.1 to +9.8 in November – its highest level since March and beating expectations of a smaller improvement to 5.0.…

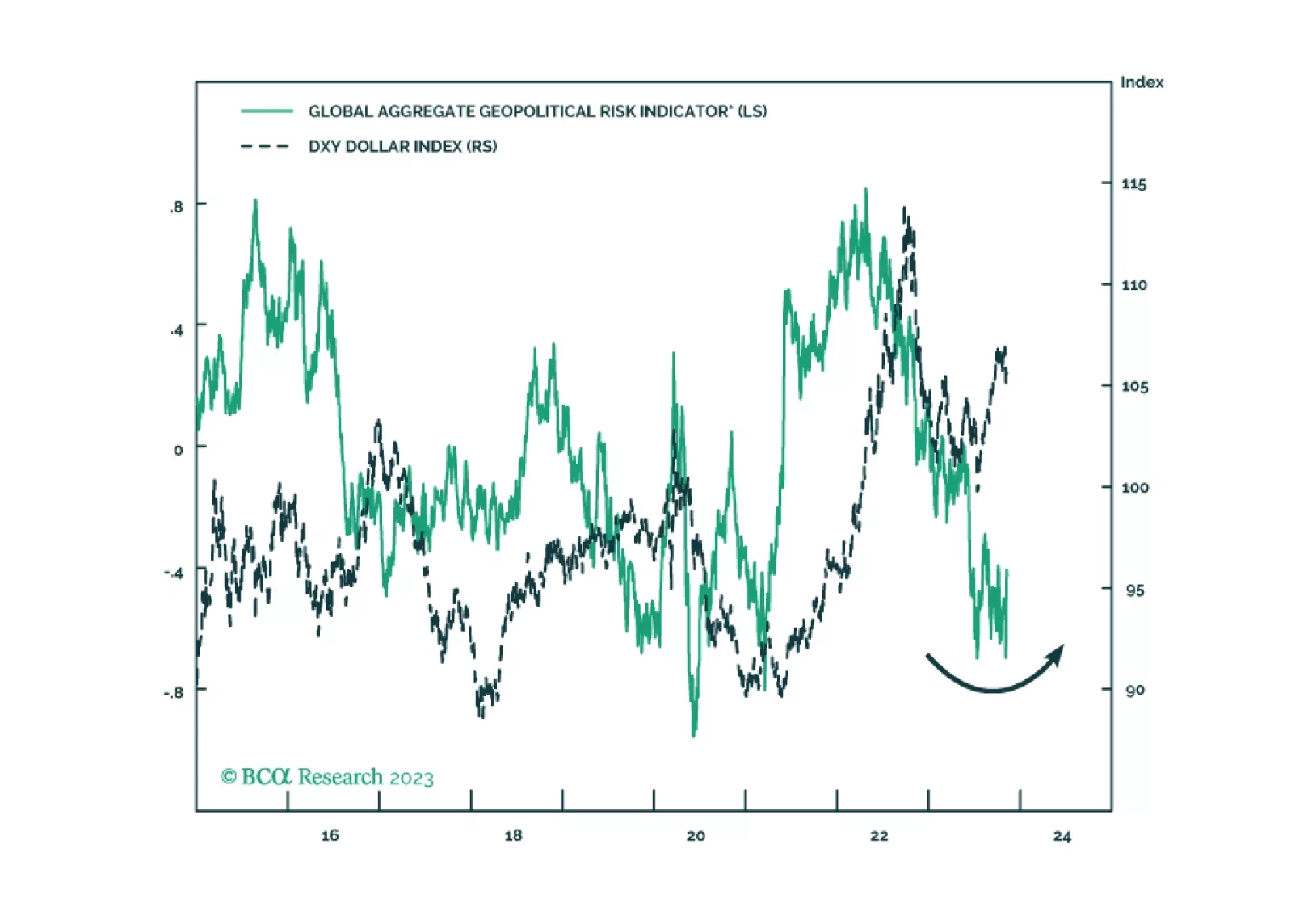

Amid a range of geopolitical narratives, what matters is that the US strategy of economic engagement with its rivals is failing, giving rise to a new strategy of containment that will reinforce the secular rise in geopolitical risk.…

In this Insight, we review the performance and rationale for our current set of tactical fixed income trade recommendations. Our highest conviction positions also happen to be our most successful trades: positioning for a narrowing…

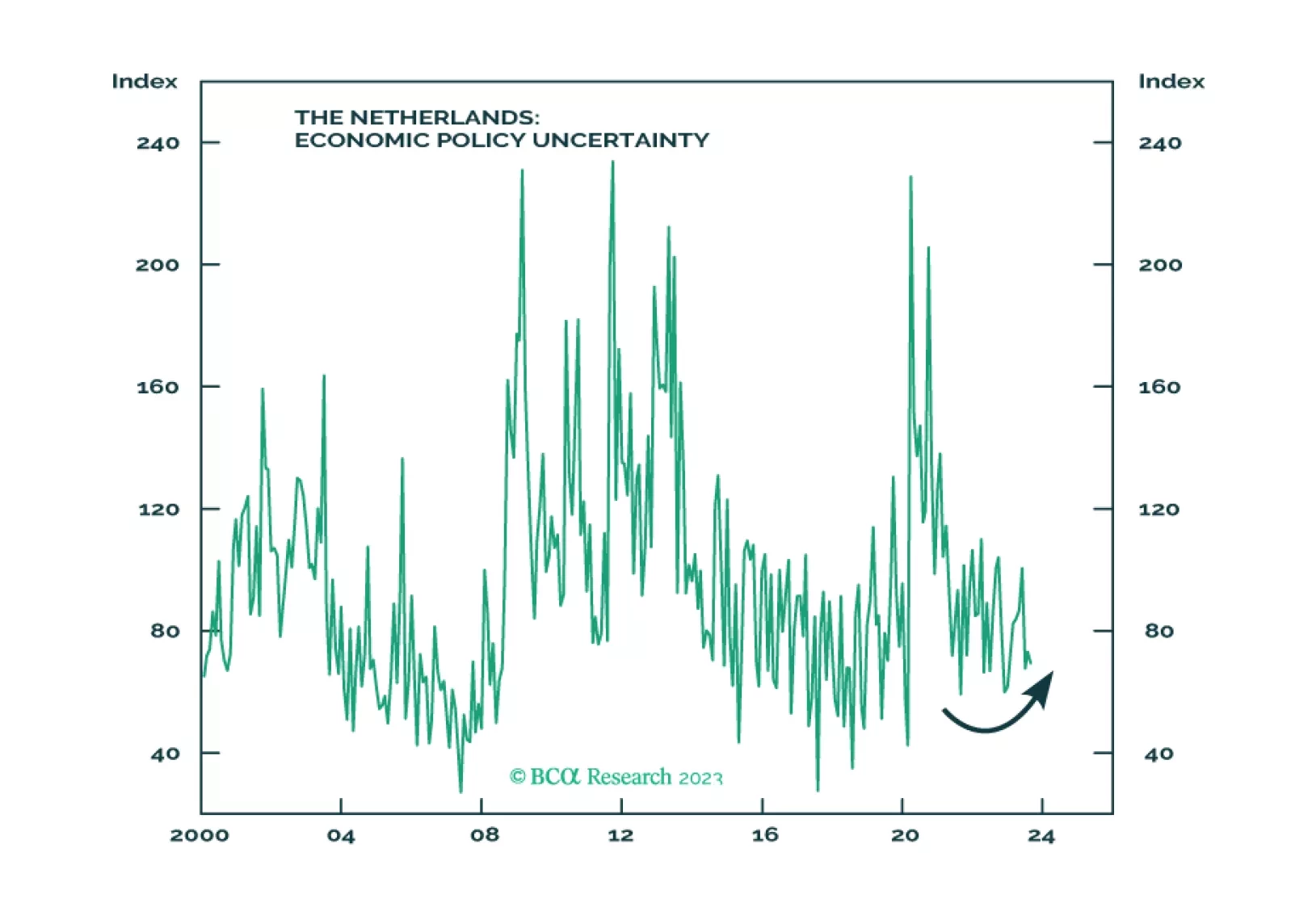

European markets have room to rebound in the coming weeks, however, a recession looms. What are the lessons from history that investors can use to position themselves under these conditions?

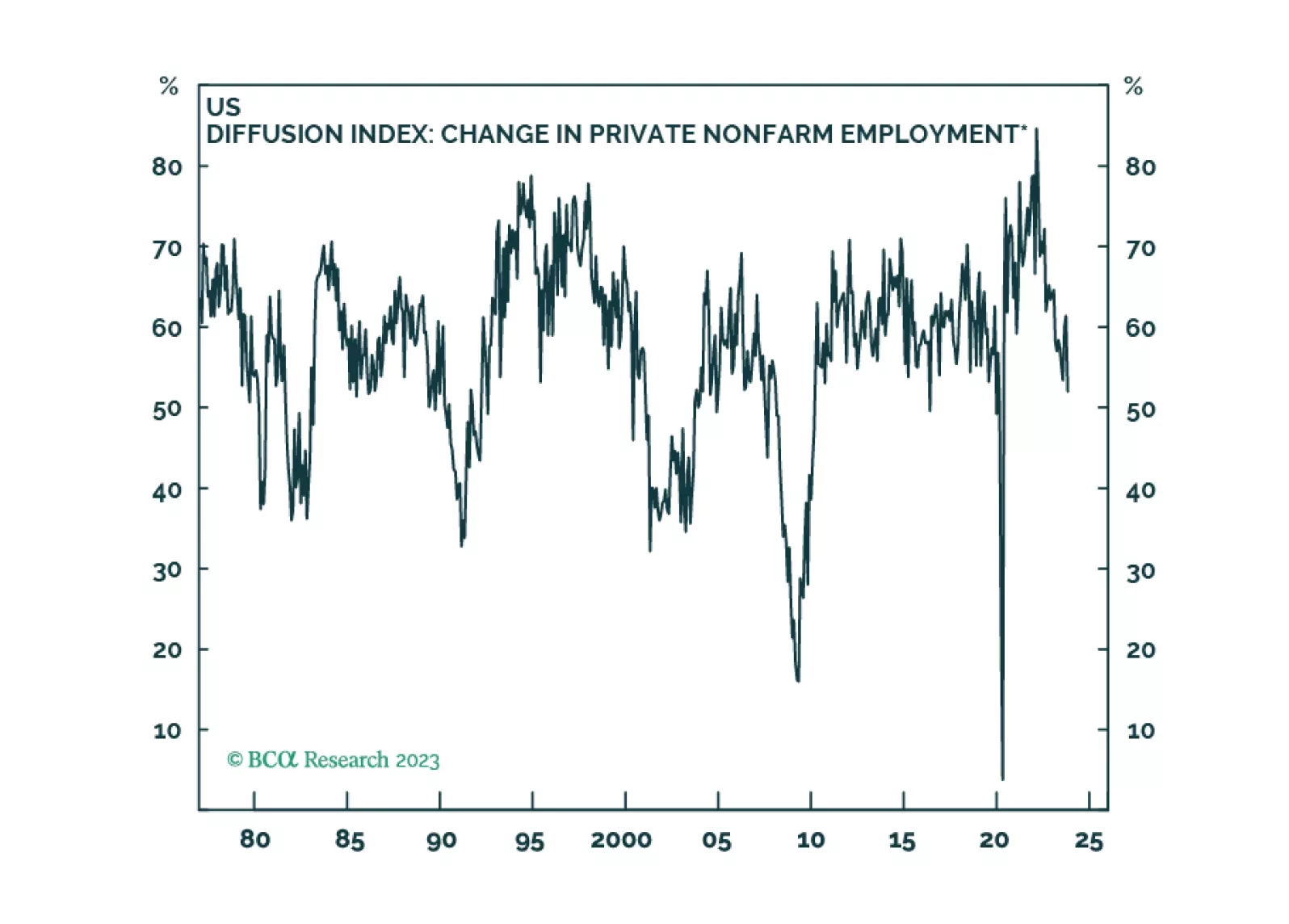

Labor markets are softening in most developed economies, as is usually the case in the lead-up to recessions. Our base case is that the global recession will begin in the second half of 2024, but we will be monitoring our MacroQuant…

According to BCA Research’s Counterpoint service, the ECB is the central bank that poses the lowest risk of repeating the mistakes of the 1970s and letting inflation expectations unanchor. One reason is the ECB’s…

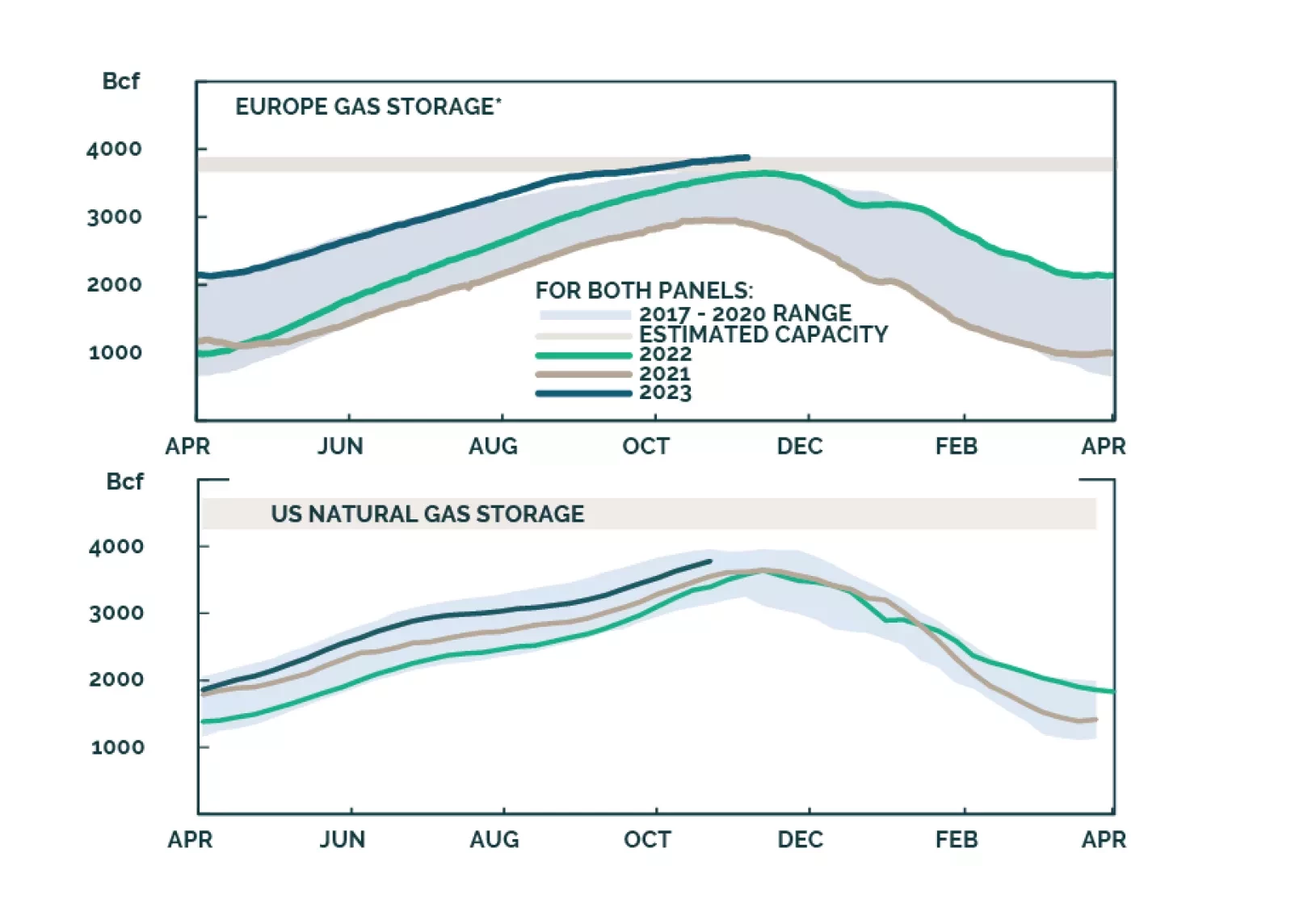

Natural gas storage levels in the US and EU are sufficient to balance flowing supply and demand this winter, assuming normal weather. China continues to invest in domestic production, and to diversify supply sources to compensate…