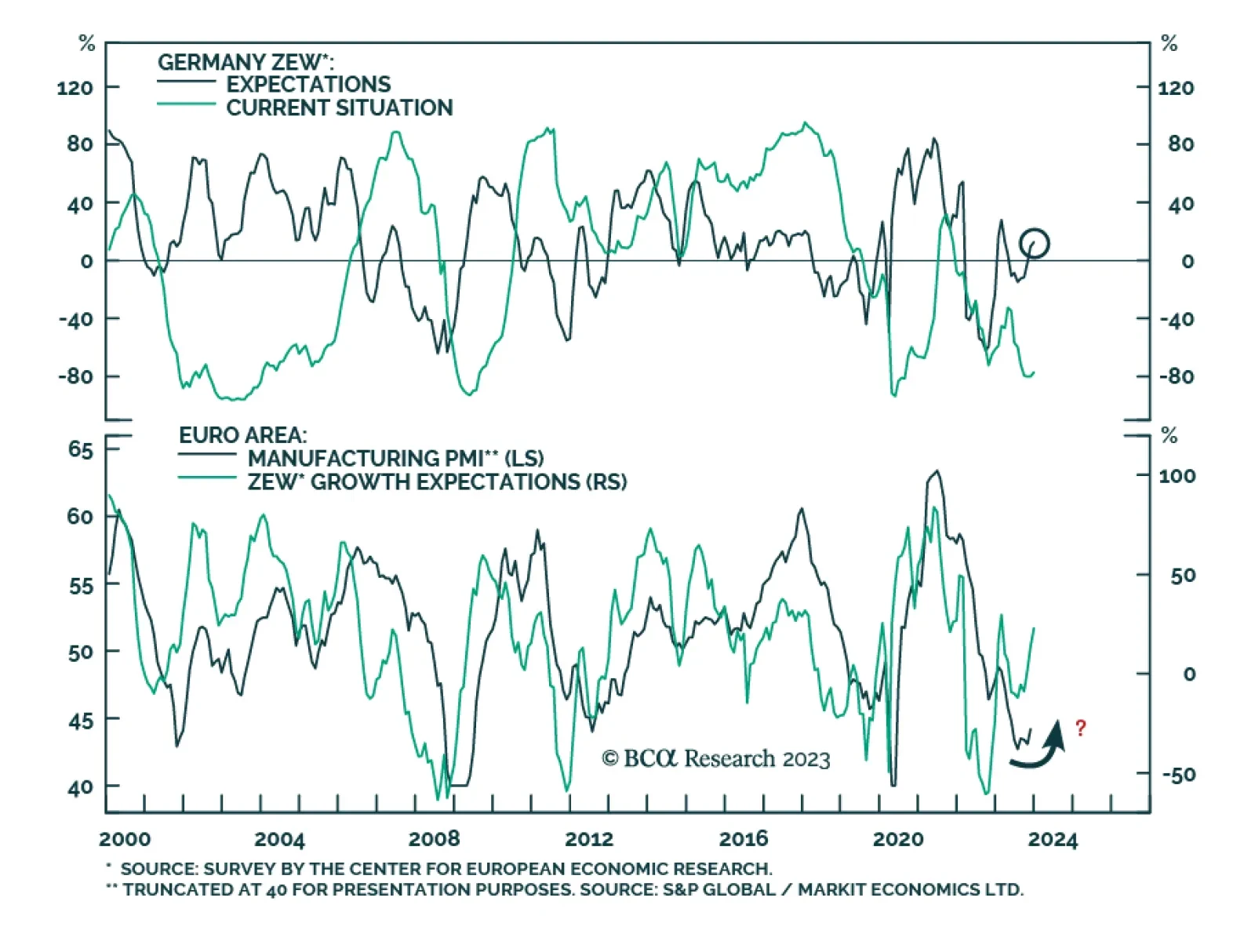

The continued improvement in German investor morale captured by the ZEW survey corroborates other indicators pointing to near-term support for Eurozone stocks. Economic sentiment jumped three points to a 9-month high of 12.8 in…

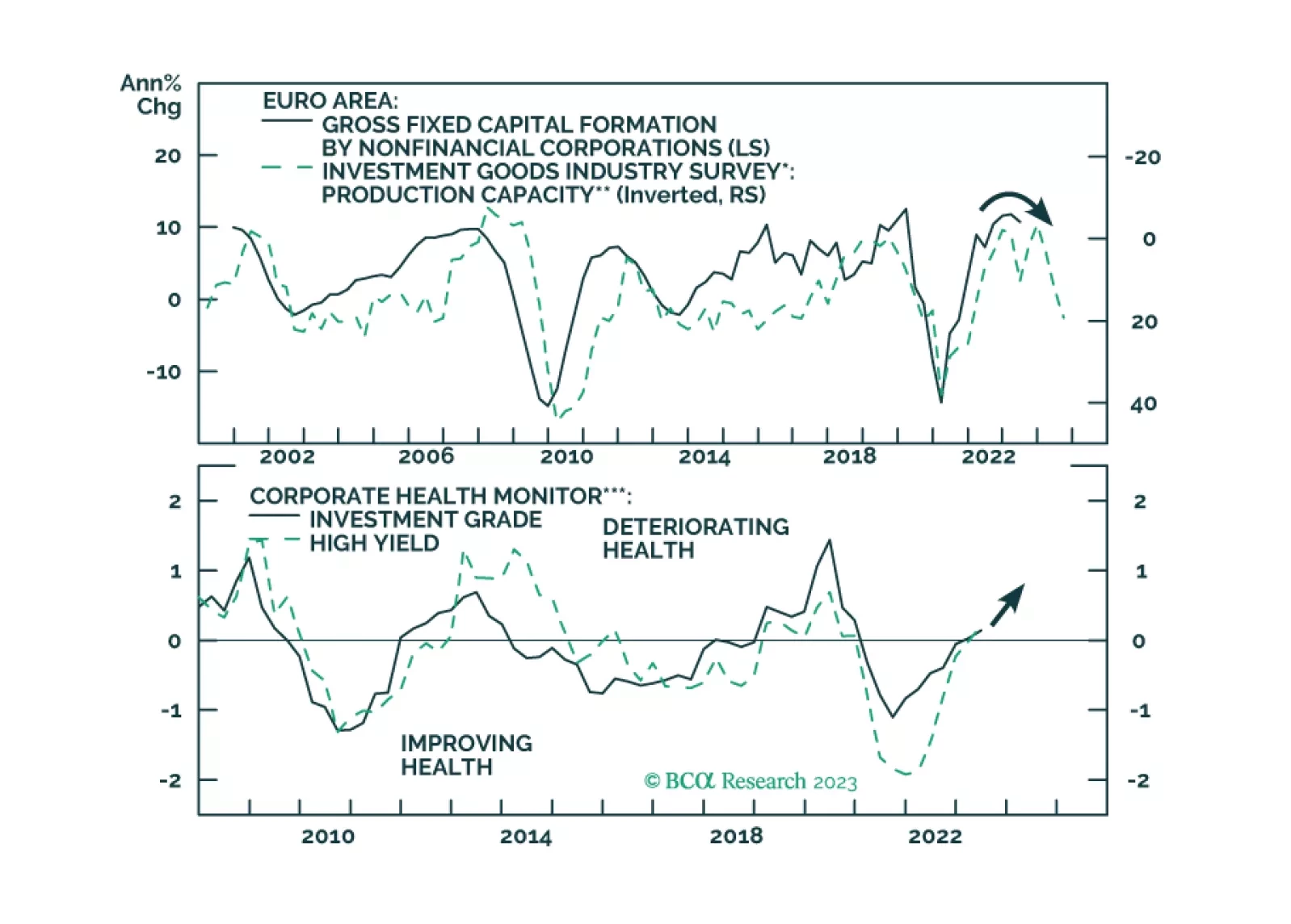

According to BCA Research’s European Investment Strategy service, European equities near cycle highs are vulnerable to weaker earnings. The team’s earnings model for Eurozone equities continues to point to a double…

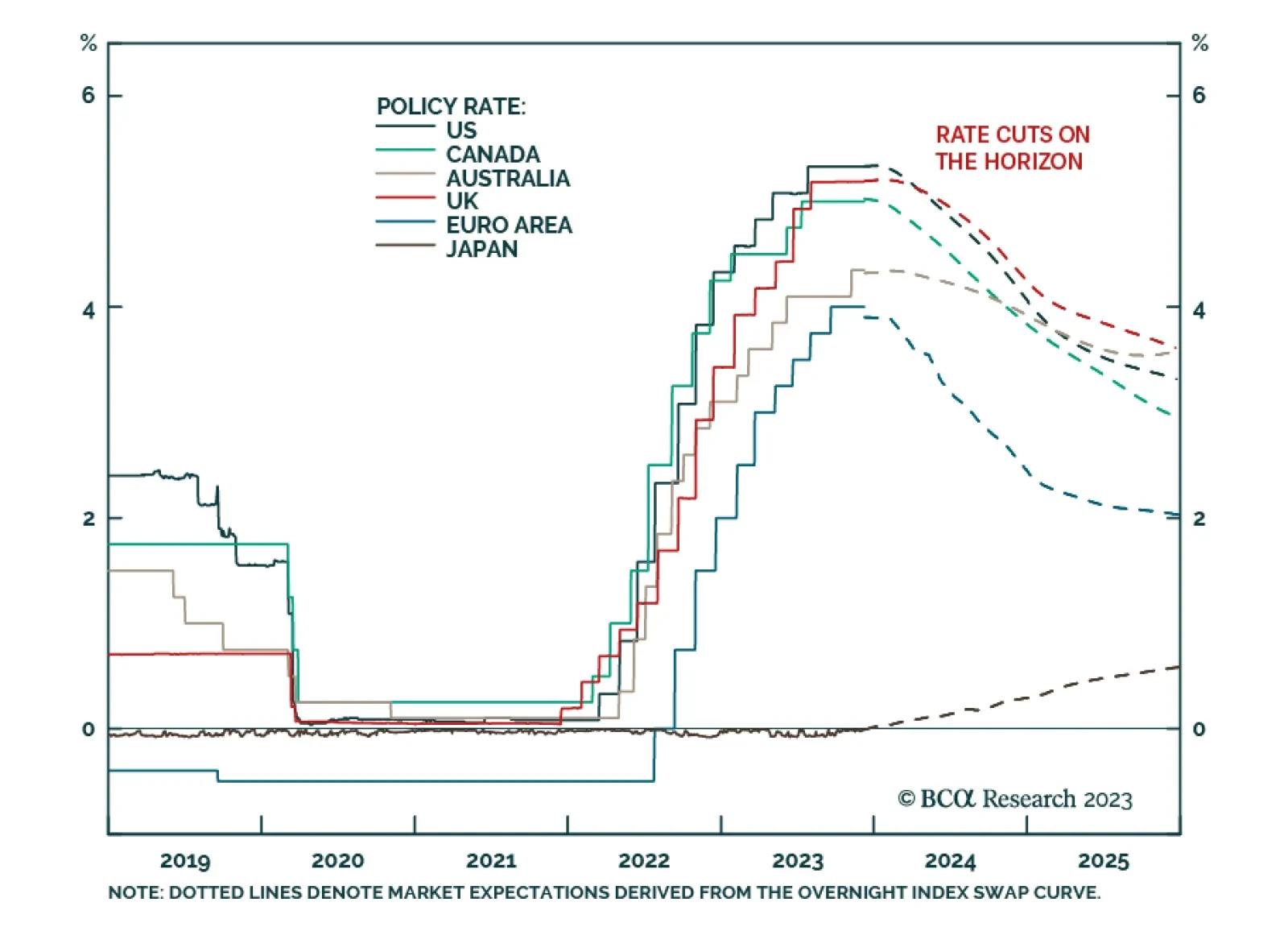

Multiple major DM central banks are scheduled to decide on monetary policy this week. The US Fed will meet on Wednesday, followed by the ECB, BoE, and Norges Bank on Thursday. It comes after the BoC and RBA both opted to keep…

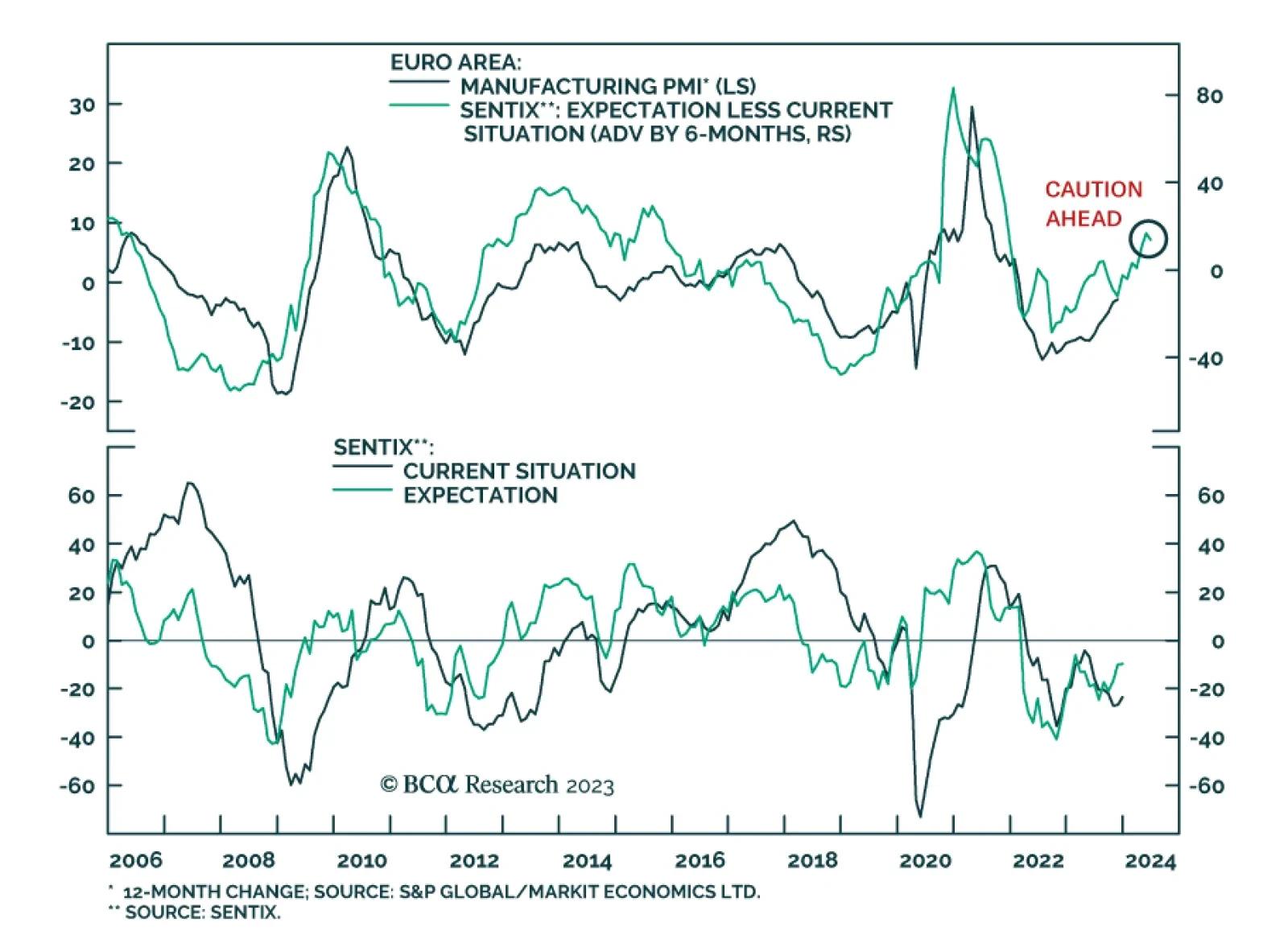

The recent decline in yields has powered European equities higher, however, this rally cannot last if earnings decline meaningfully. With this in mind, are our earnings models flagging risks for stocks next year?

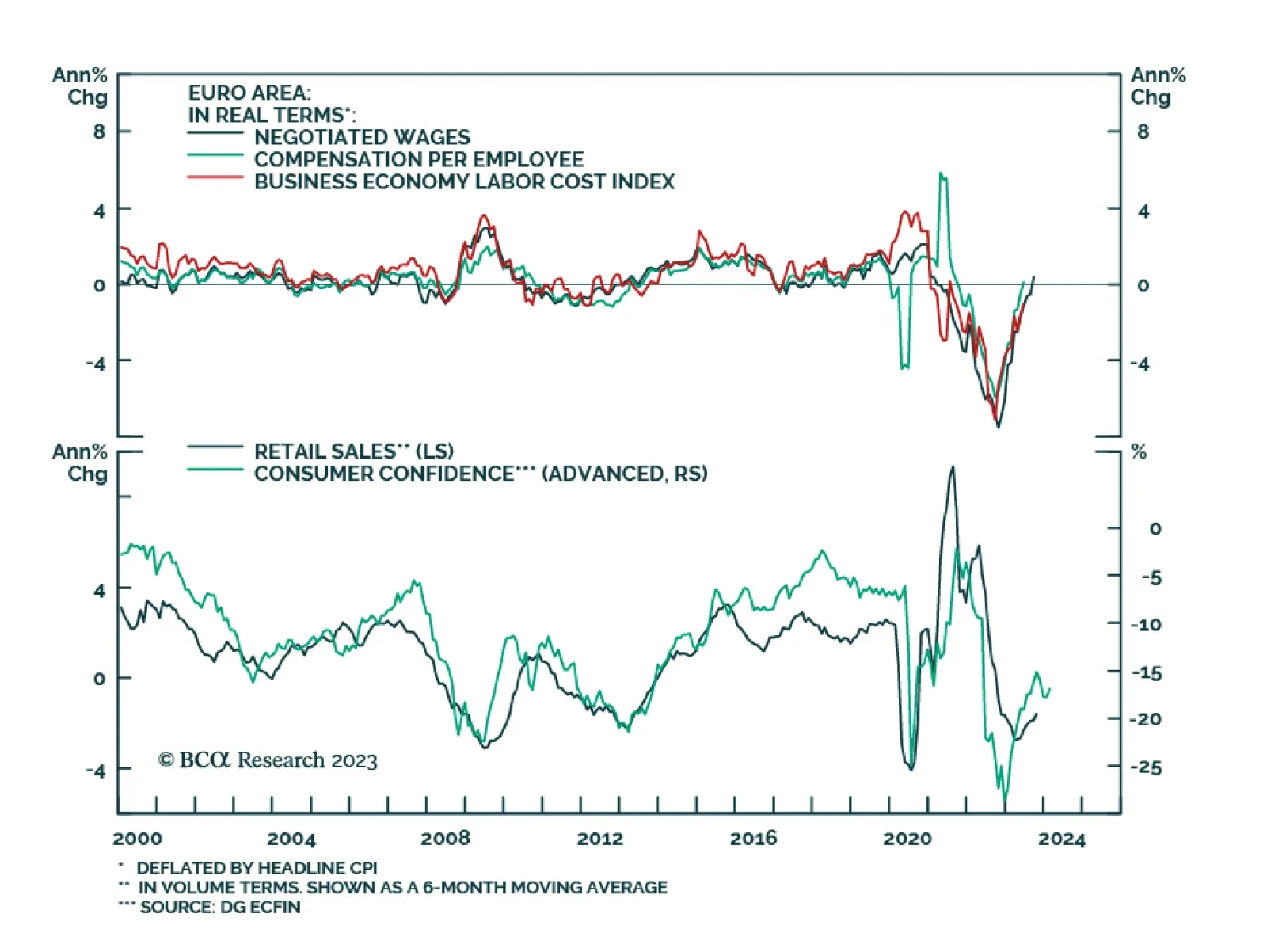

Retail sales volumes grew on a sequential basis for the first time in three months in October, rising by 0.1% m/m following an upwardly revised 0.1% m/m decline. On an annual basis, the pace of decline slowed from -2.9% y/y to -1…

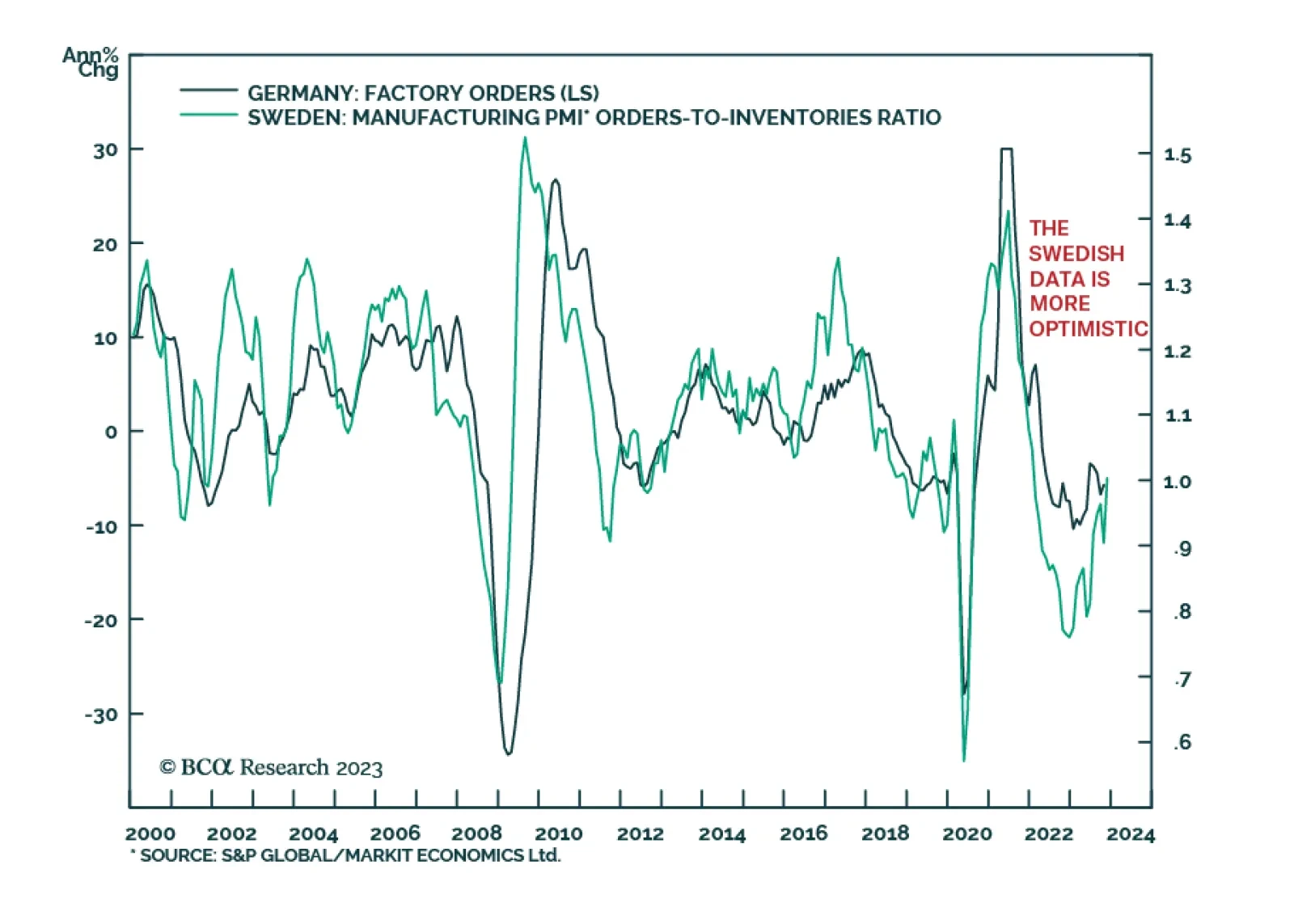

German factory orders sent a disappointing signal on Wednesday. New orders at German factories unexpectedly declined by 3.7% m/m in October, disappointing expectations of a 0.2% m/m rise following two consecutive months of…

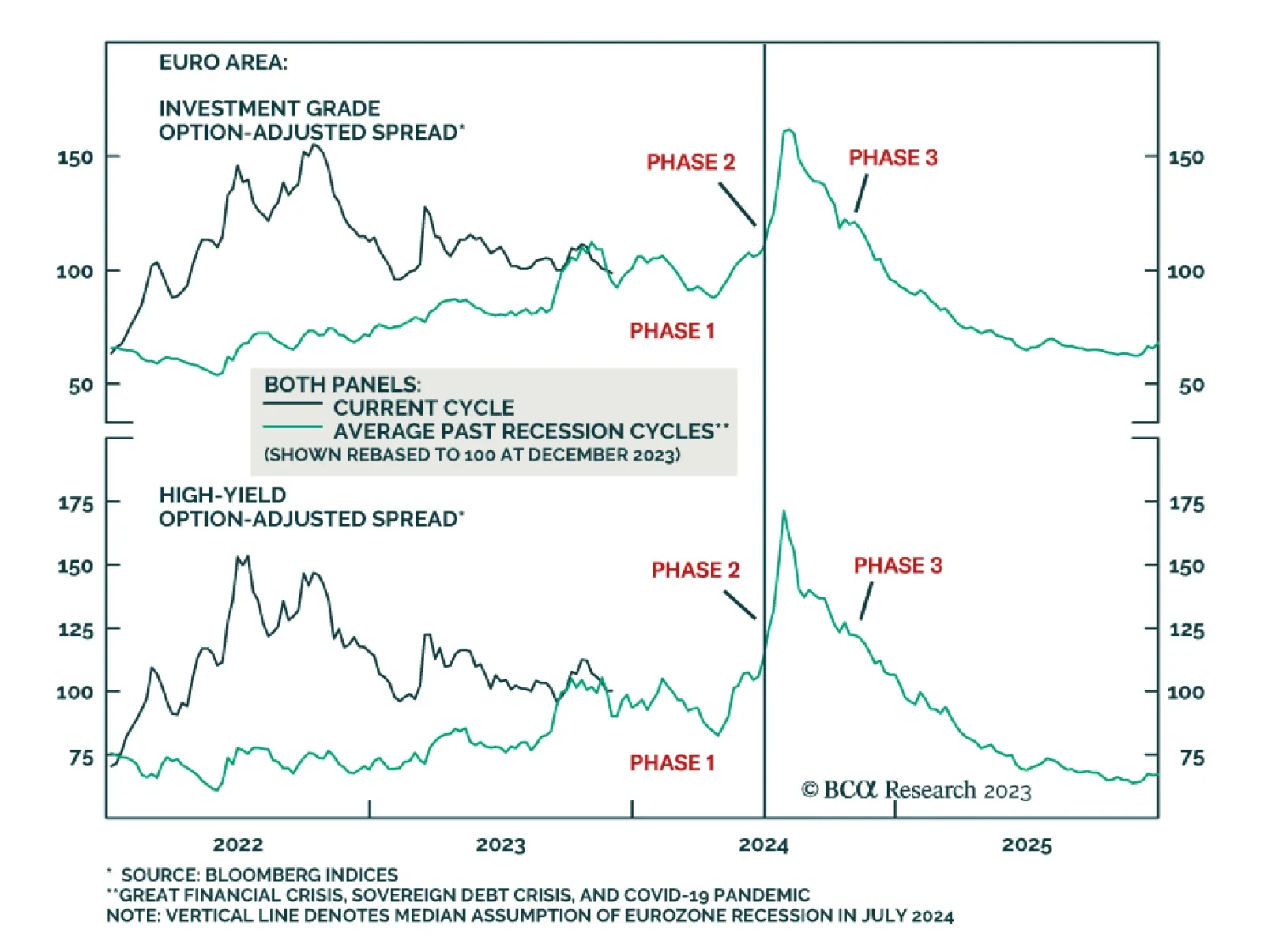

According to BCA Research’s European Investment Strategy service, European corporate spreads will widen over the coming six months before an attractive buying opportunity emerges in the second half of 2024. 2024 will…

The Sentix Economic Index for the Eurozone continues to send a marginally positive signal. Its 1.8-point increase to -16.8 in December brings it to its highest level since May, albeit below expectations of a slightly more…

The recent uptick in European economic data will not last beyond the next six months. How will European corporate credit perform in this context?

Inflation won’t fall fast enough for the Fed to cut rates preemptively before recession arrives. The risk/rewards balance is unfavorable for risk assets. Stay overweight bonds versus equities.