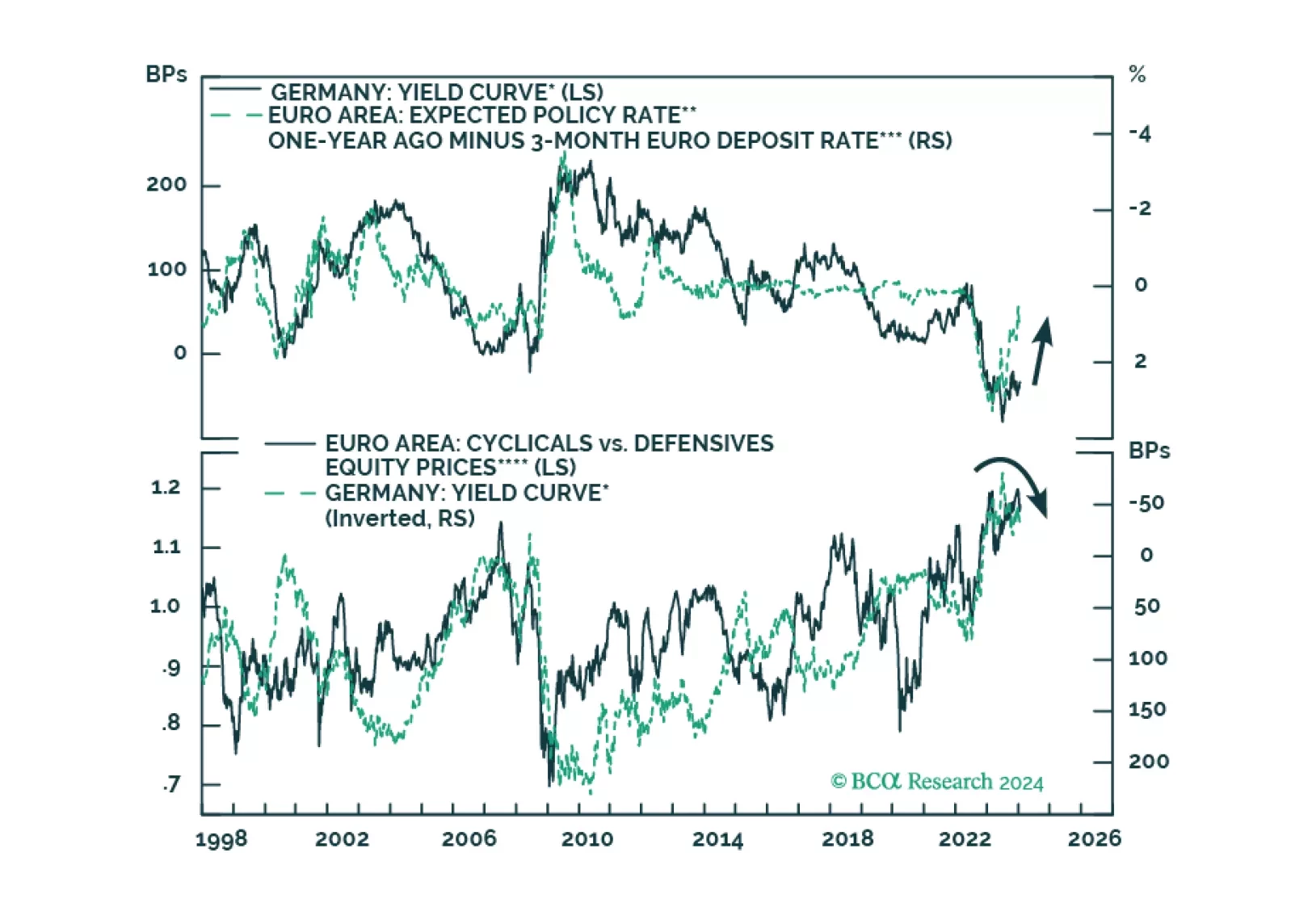

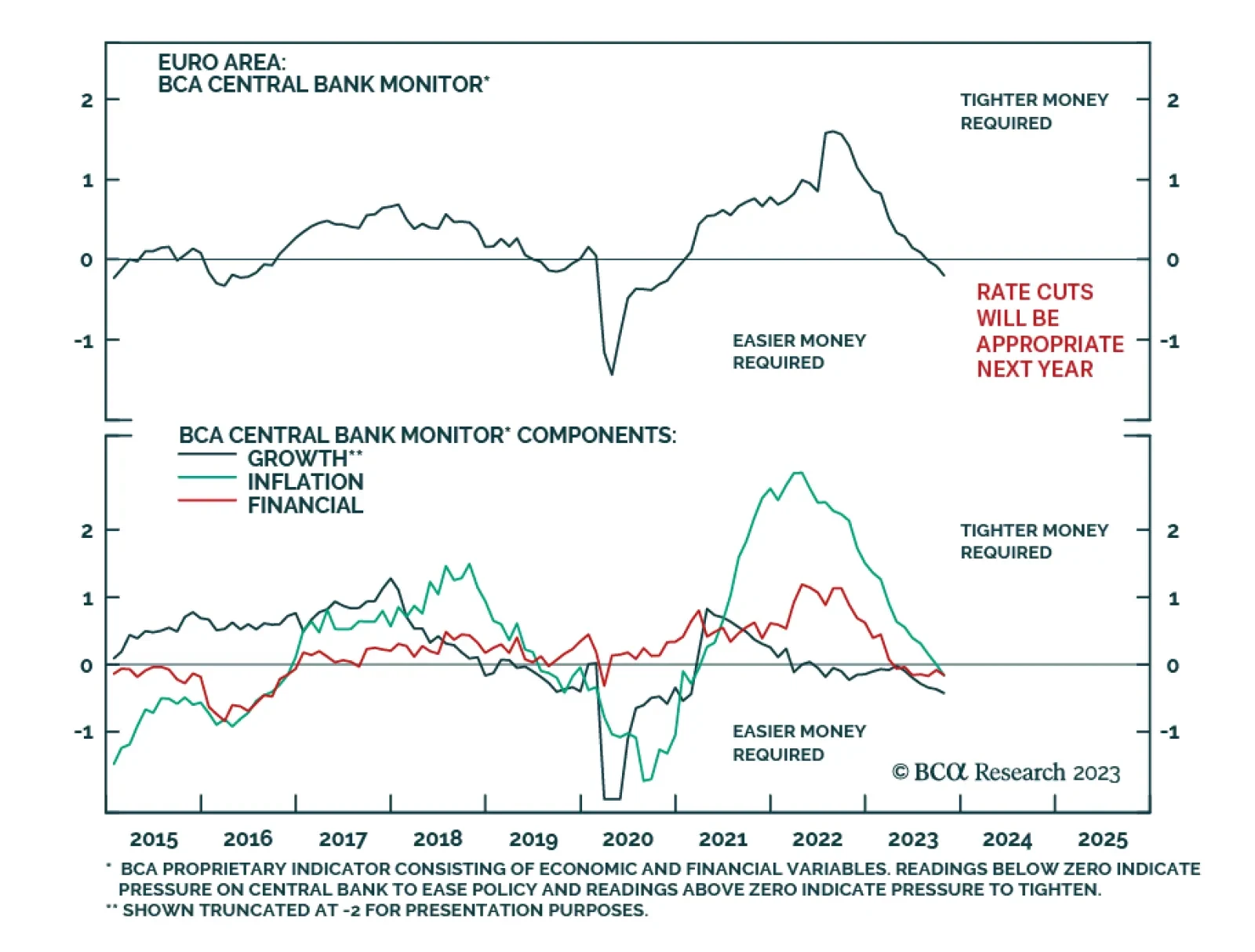

BCA Research’s European Investment Strategy service concludes that investors should go long German curve steepeners. Last week at Davos, European Central Bank (ECB) President Christine Lagarde leaned heavily against the…

The ECB will begin cutting rates in June, what does this start date imply for the yield curve and European cyclicals?

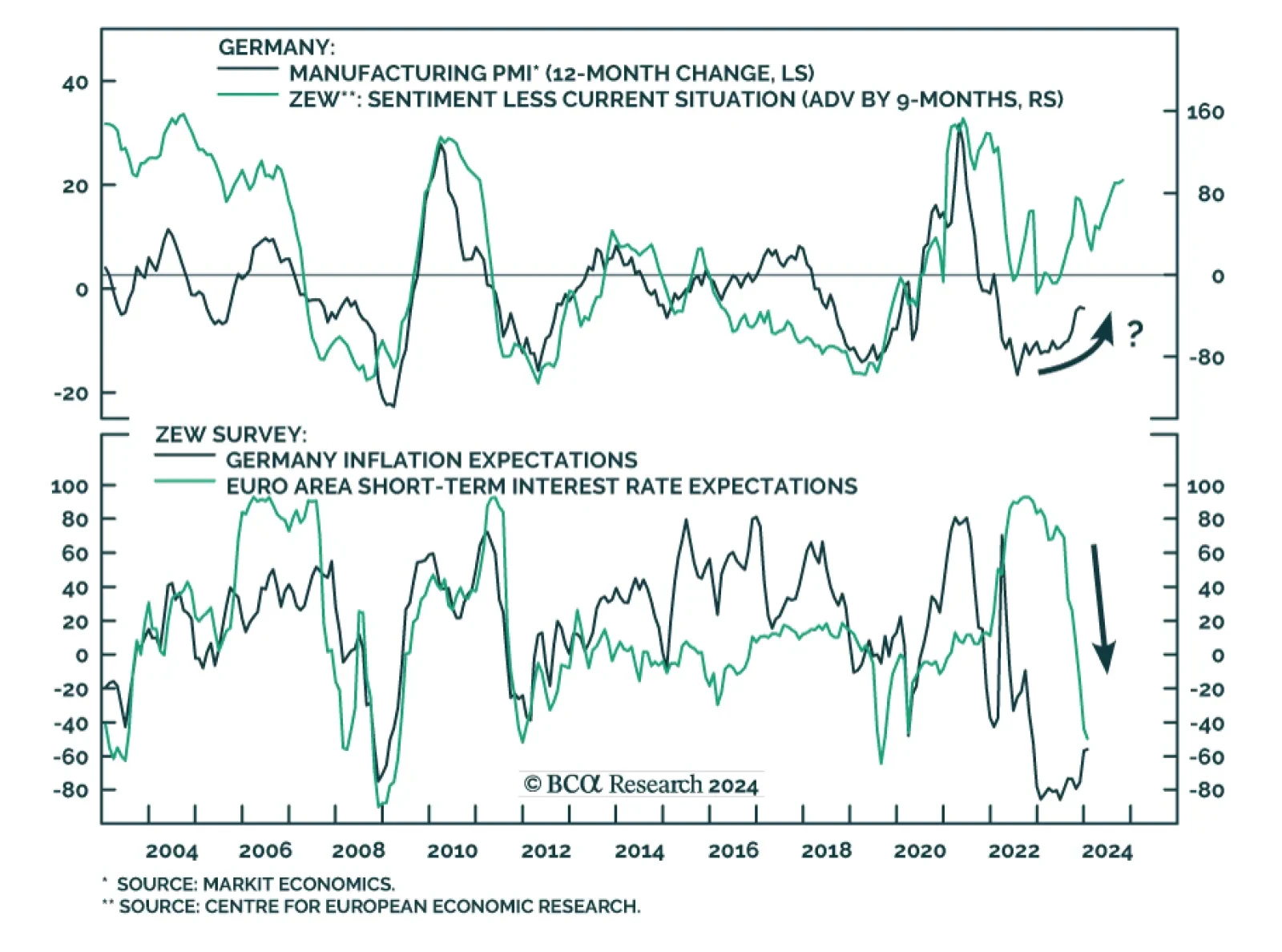

Results of the ZEW survey sent a slightly positive signal on German investor sentiment. The economic expectations indicator rose to an 11-month high in January – beating consensus estimates of a decline. This increased…

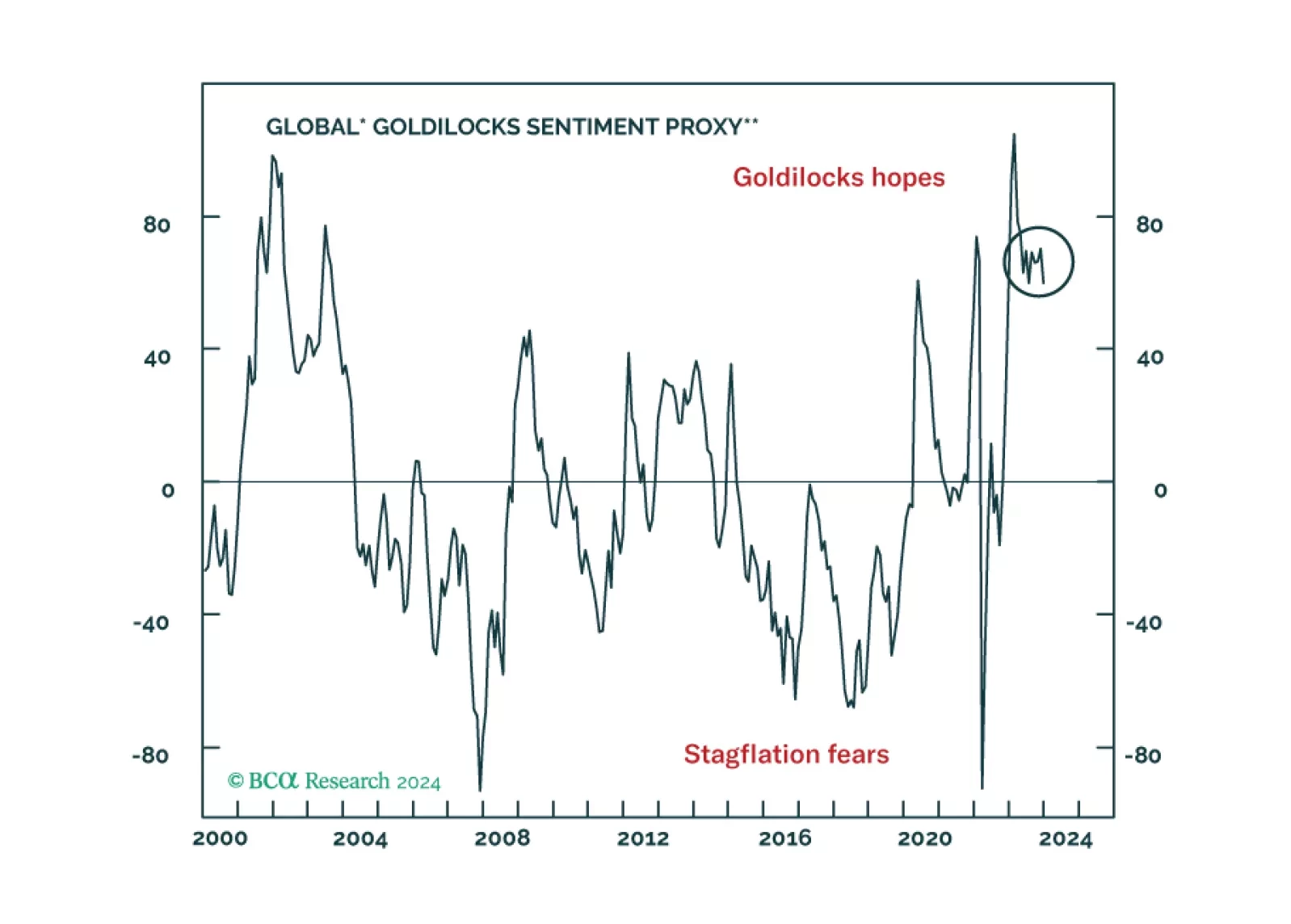

According to BCA Research’s European Investment Strategy service, investors should not chase European equities higher from current levels. The soft-landing narrative has captured the minds of investors. The expectations…

The soft-landing narrative has won, but is too much of a good thing now expected by investors?

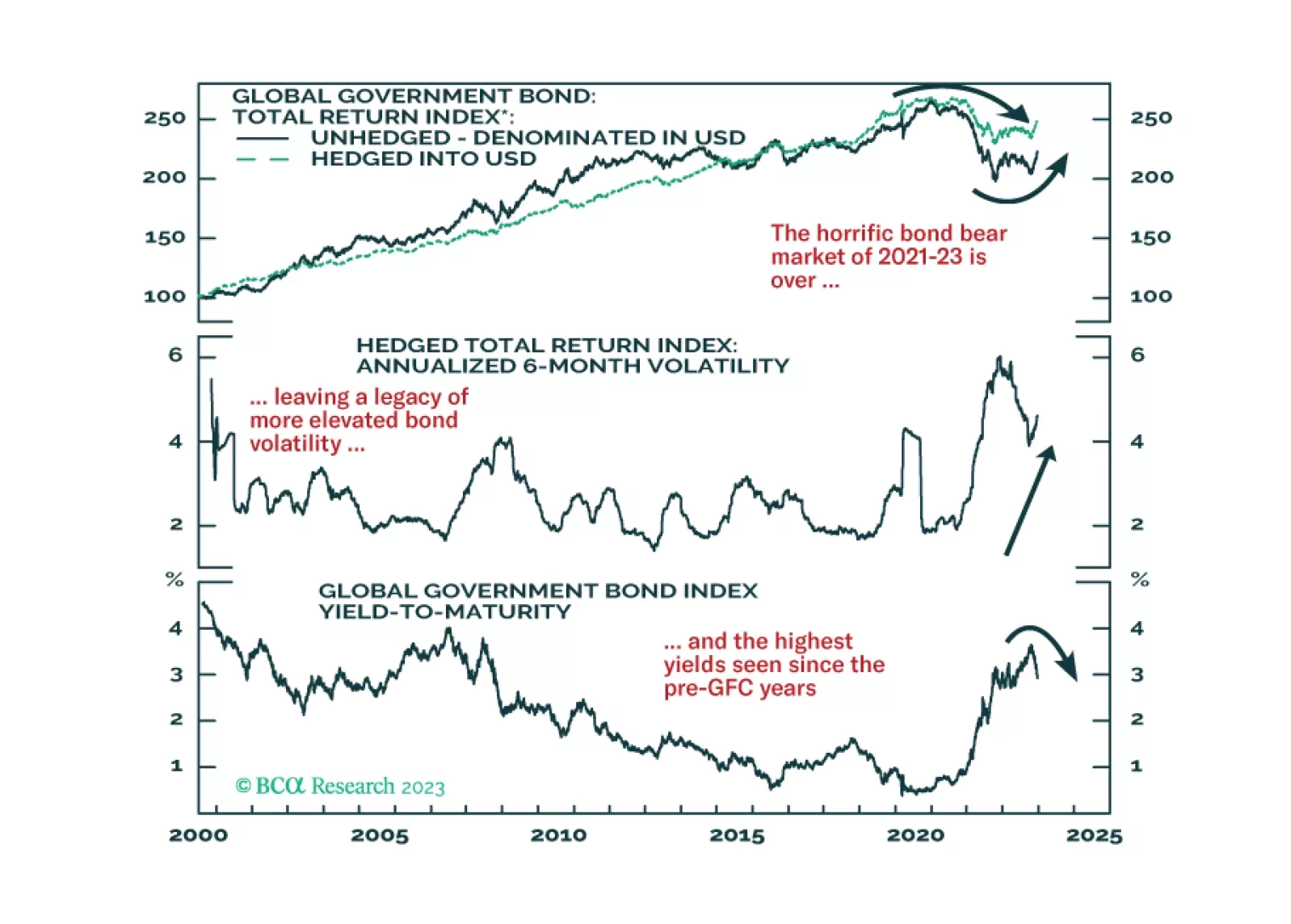

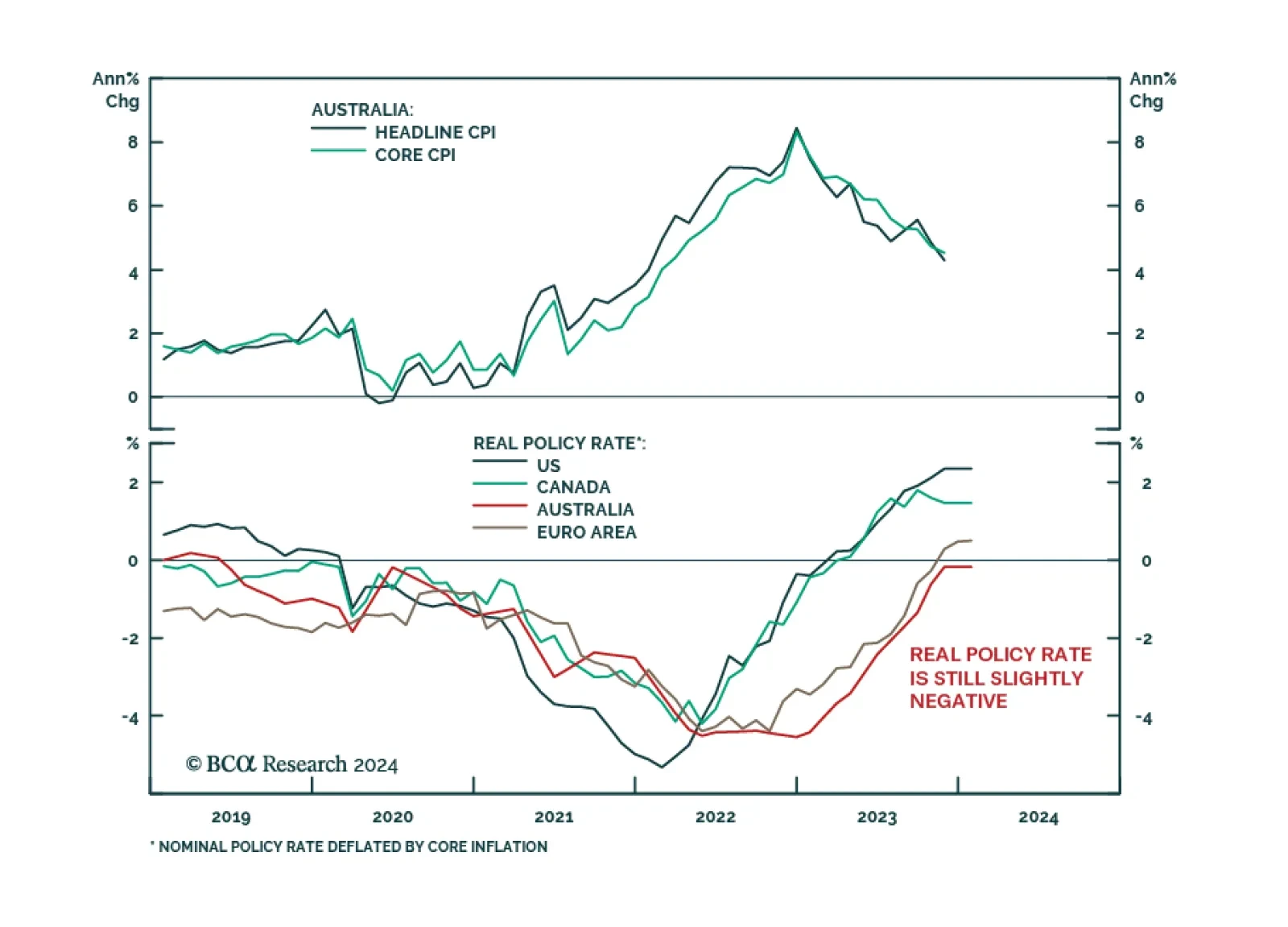

Australian CPI inflation fell from 4.9% y/y to a 22-month low of 4.3% y/y in November – slightly below expectations of 4.4%. Underlying measures of core inflation also indicate that price pressures eased in November. The…

As expected, the ECB kept its policy rate unchanged on Thursday. In the updated macroeconomic projections, the central bank revised down its inflation and growth forecasts for next year. It now expects inflation to ease to 2.7…