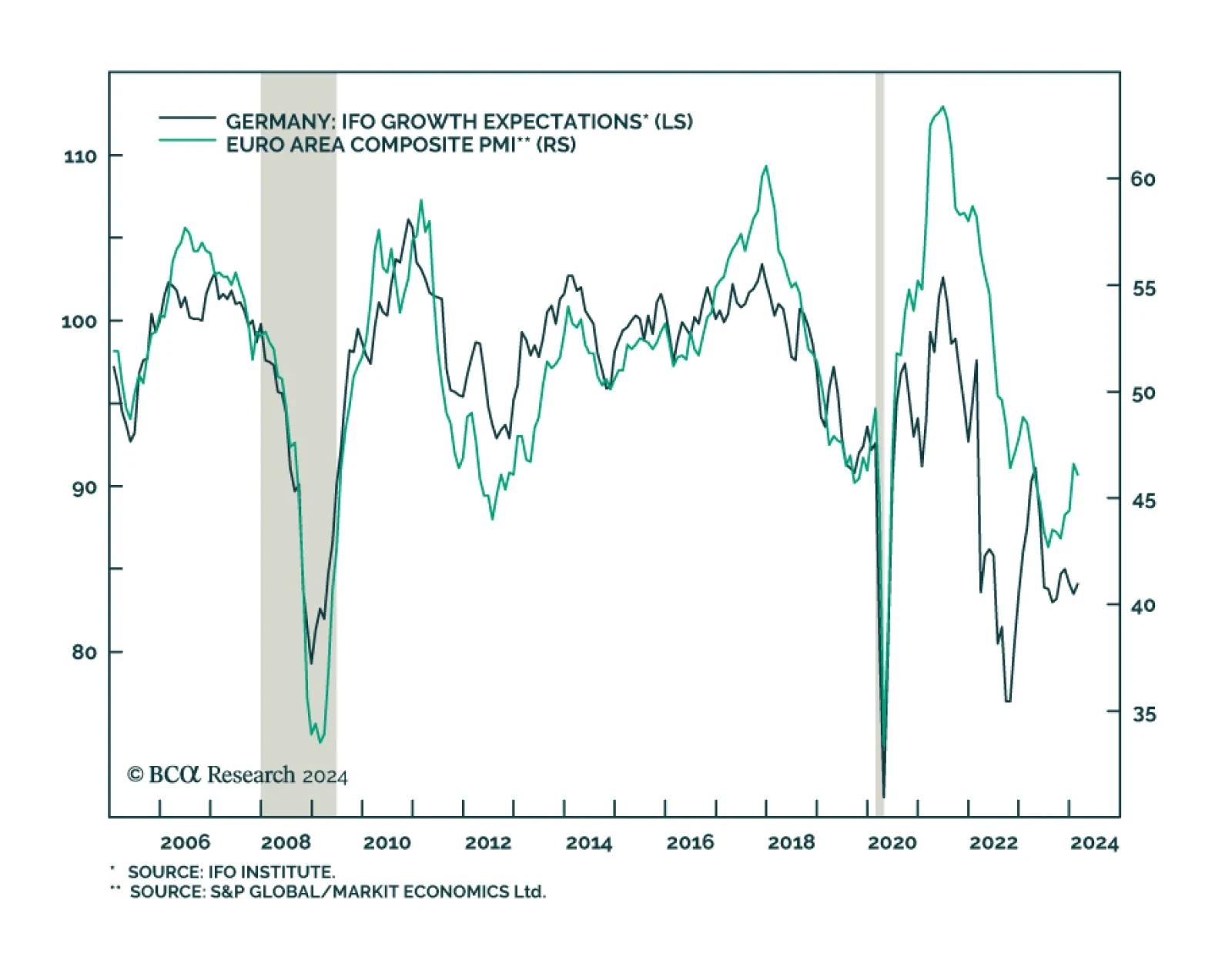

Germany’s IFO Business Climate index ticked up 0.3 points to 85.5 in February, in line with consensus estimates. Expectations for the next 6 months explain the improvement in sentiment among German companies (up 0.6 points…

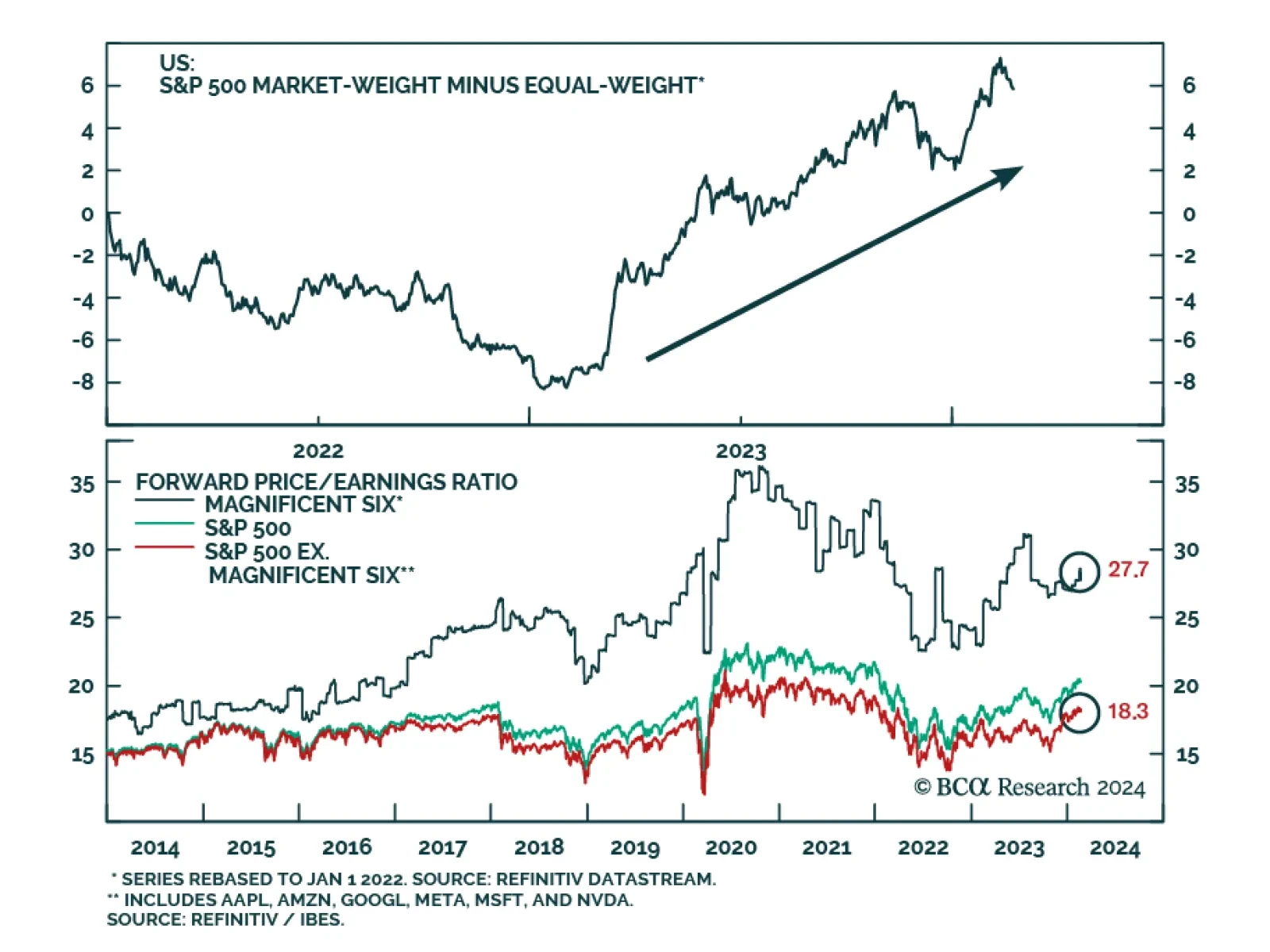

Nvidia’s blowout Q4 2023 earnings results and bullish guidance catalyzed a rally in global stocks that pushed the S&P 500, Europe’s Stoxx 600, and Japanese Nikkei to record highs on Thursday. The S&P 500 is…

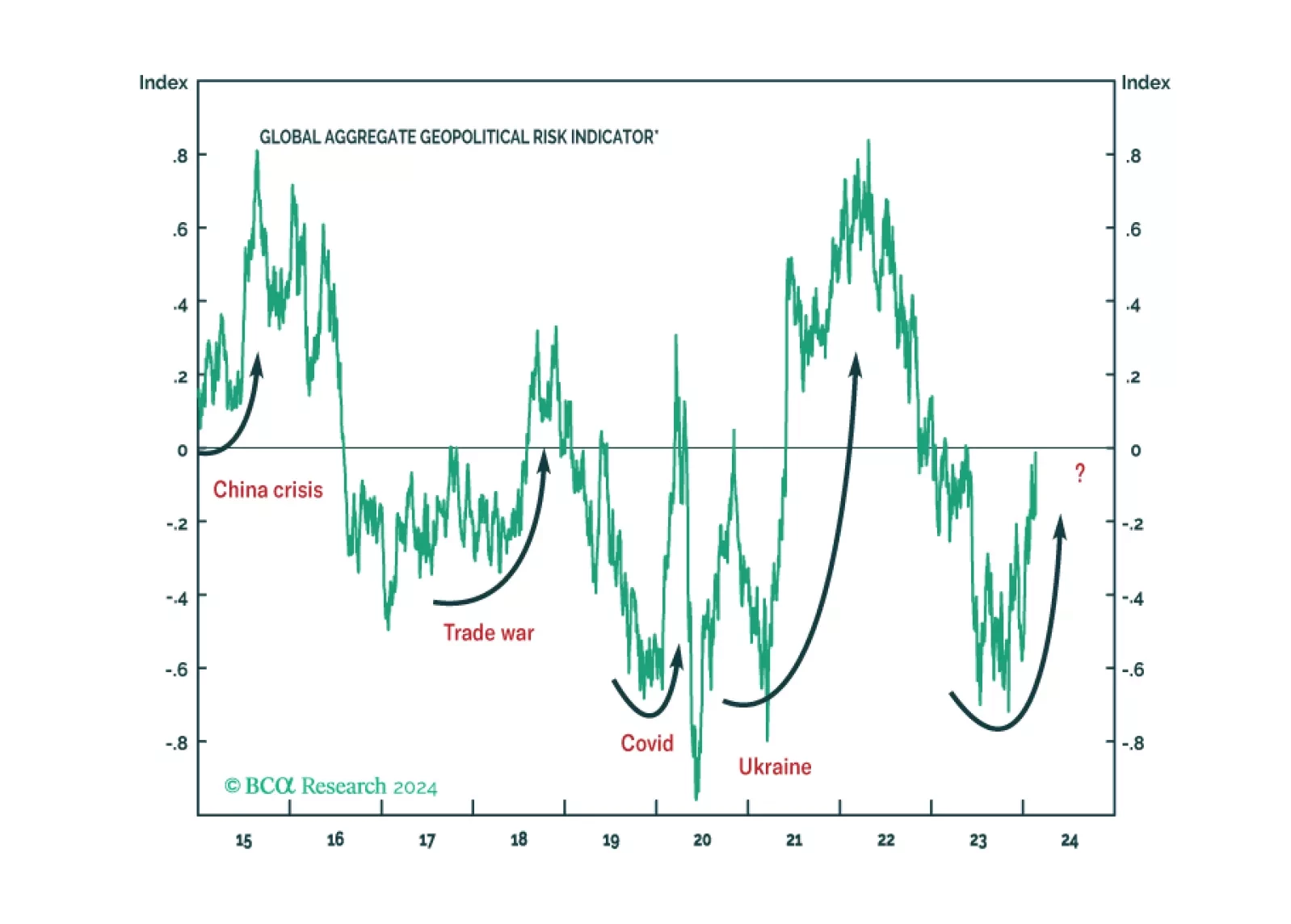

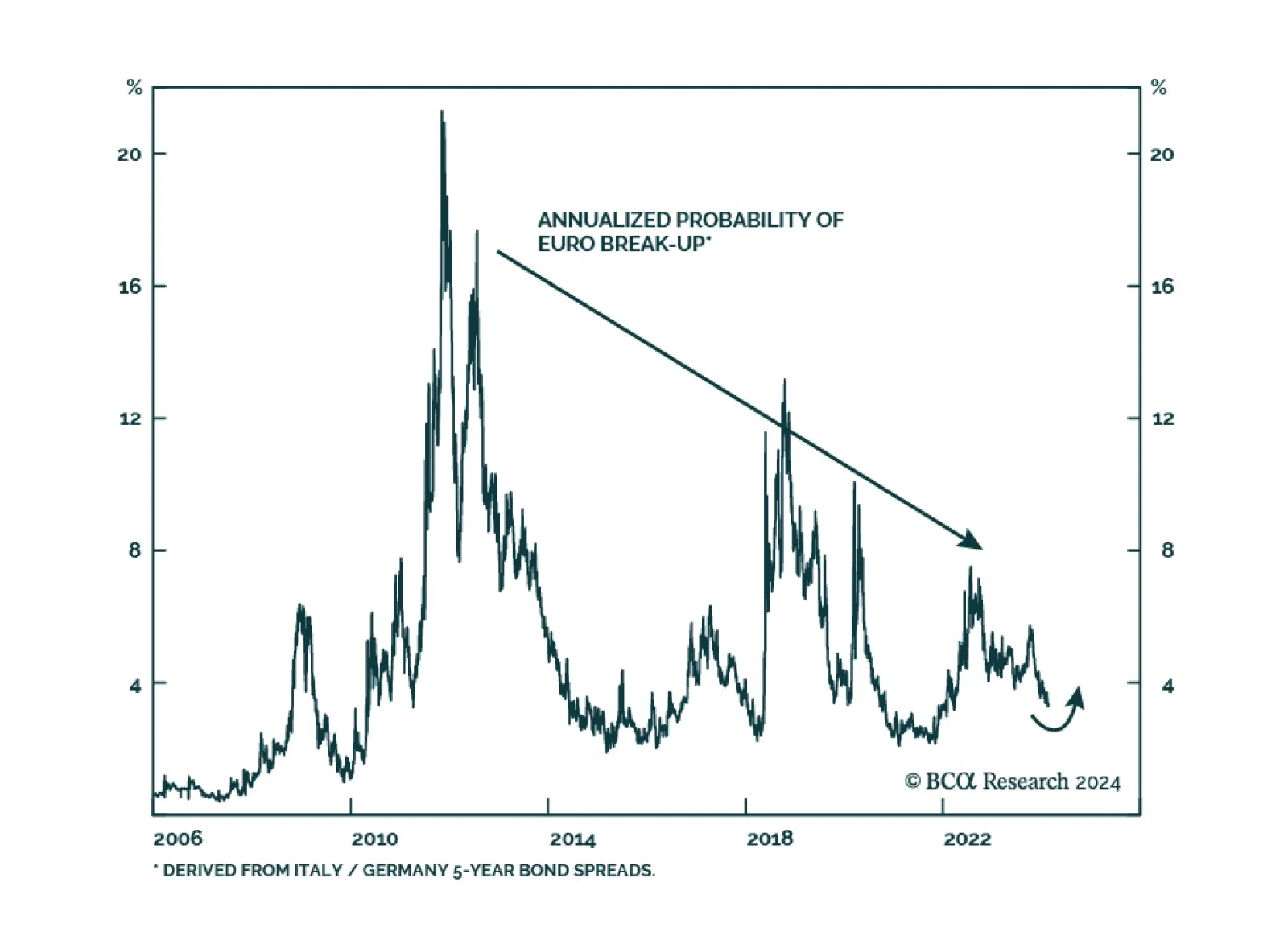

According to BCA Research’s Geopolitical Strategy service, European political risk is turning up again. Increased European political risk is not because of the European parliamentary elections, which will see right-wing…

While 2024 will see various election risks, global geopolitical uncertainty is driven by the US election and its struggle with Russia, China, and Iran. The stock market can manage local domestic political risk. But it will correct…

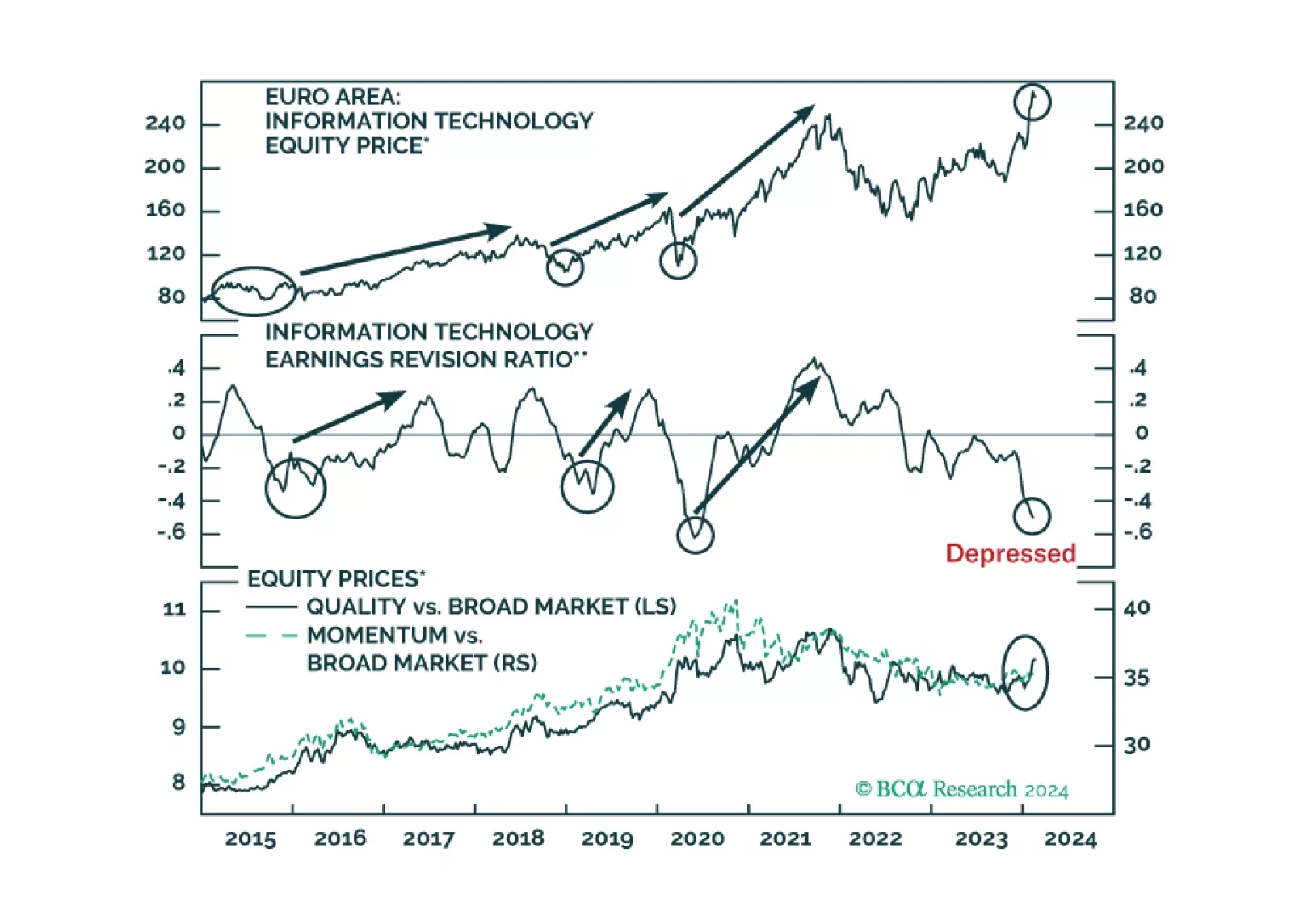

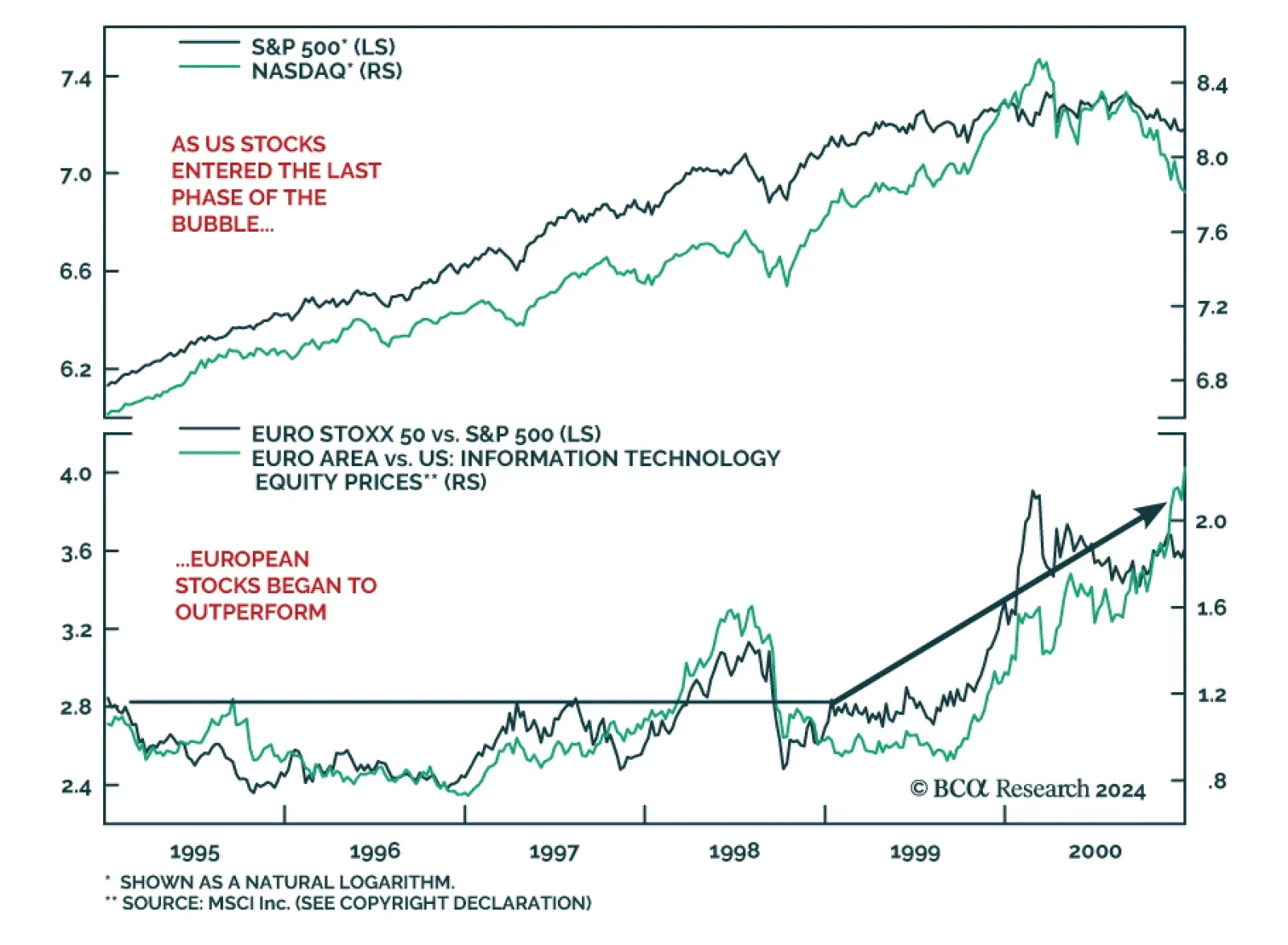

According to BCA Research’s European Investment Strategy service, European tech stocks could outperform their US counterparts in the last leg of the rally. The tech sector is in a bubble in advanced economies. While it…

Signs that we are entering the last phase of a bubble are building up. Can European equities benefit from a new tech mania?

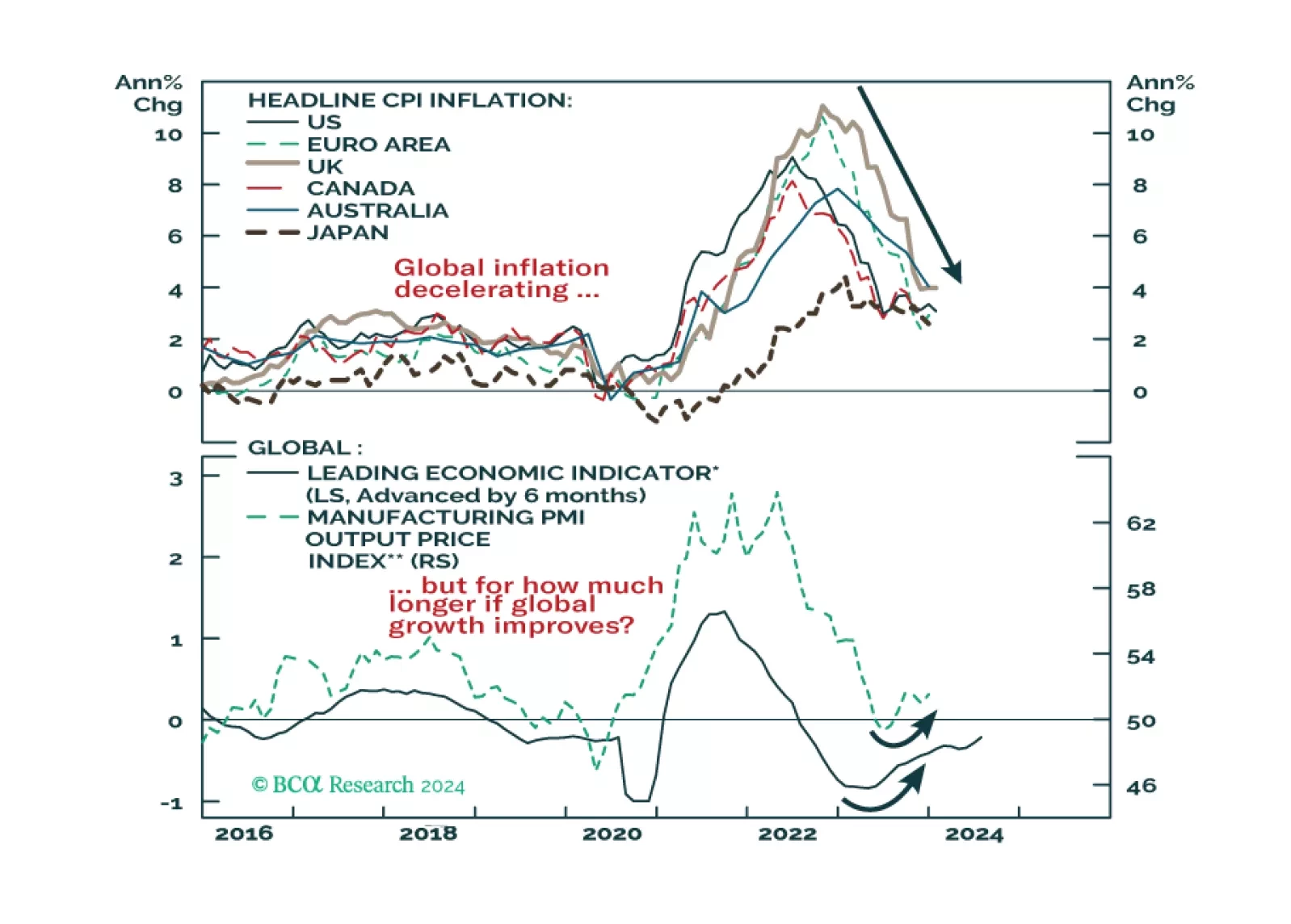

Could a second wave of global inflation be underway? The latest inflation prints in the US and UK showed upside surprises, while there is evidence of increased price pressures in global manufacturing. Combined with the improvements…

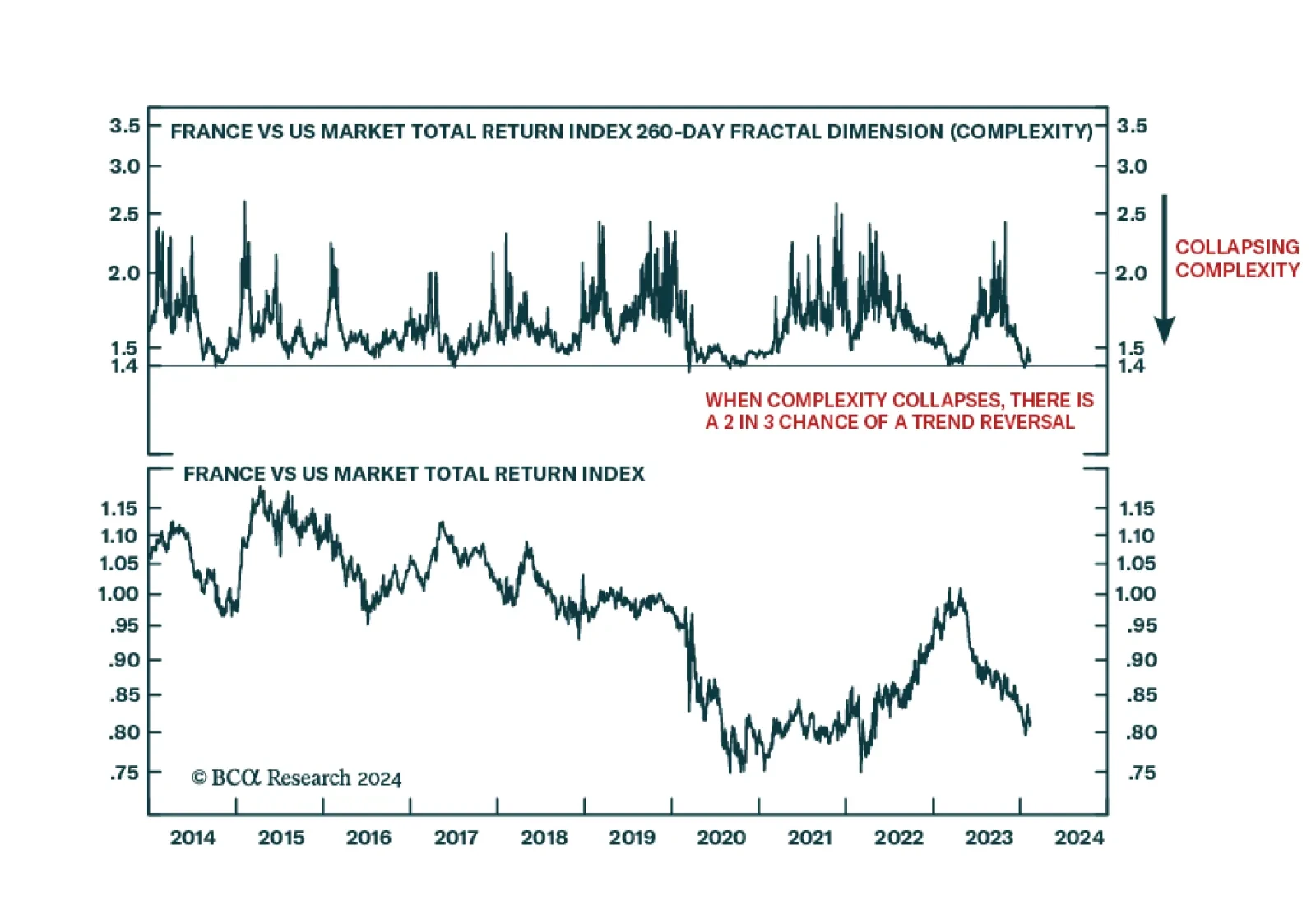

According to BCA Research’s Counterpoint service, European stocks will be the big winners of the 2020s. Every decade has a big loser and a big winner. Which stock market will be the winner through the remaining two-…

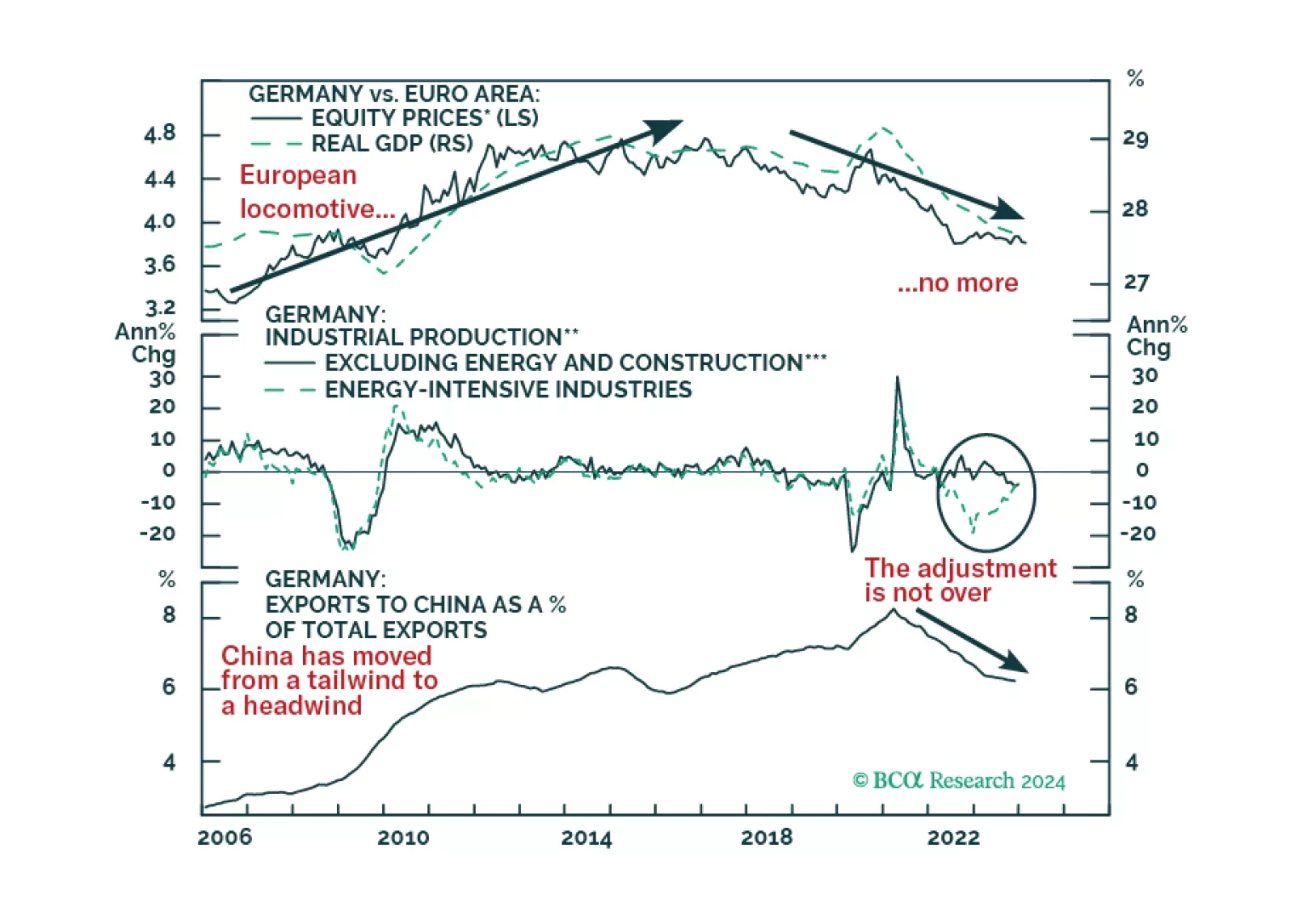

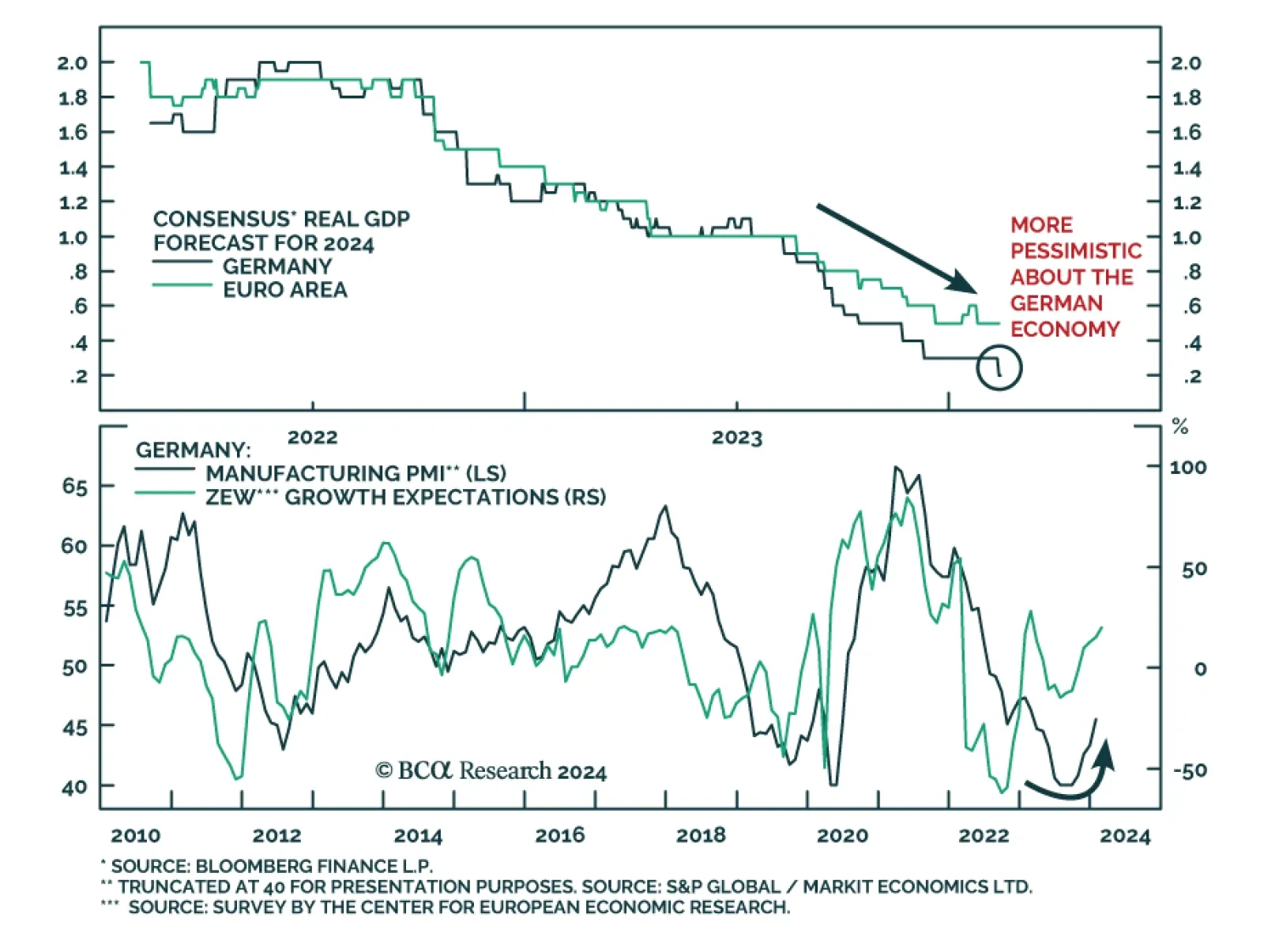

The German economy was a laggard at the end of last year, posting a 0.3% q/q real GDP contraction in Q4 2023 while the broader Eurozone economy stagnated. Importantly, while economists have been revising up their 2024 forecasts…