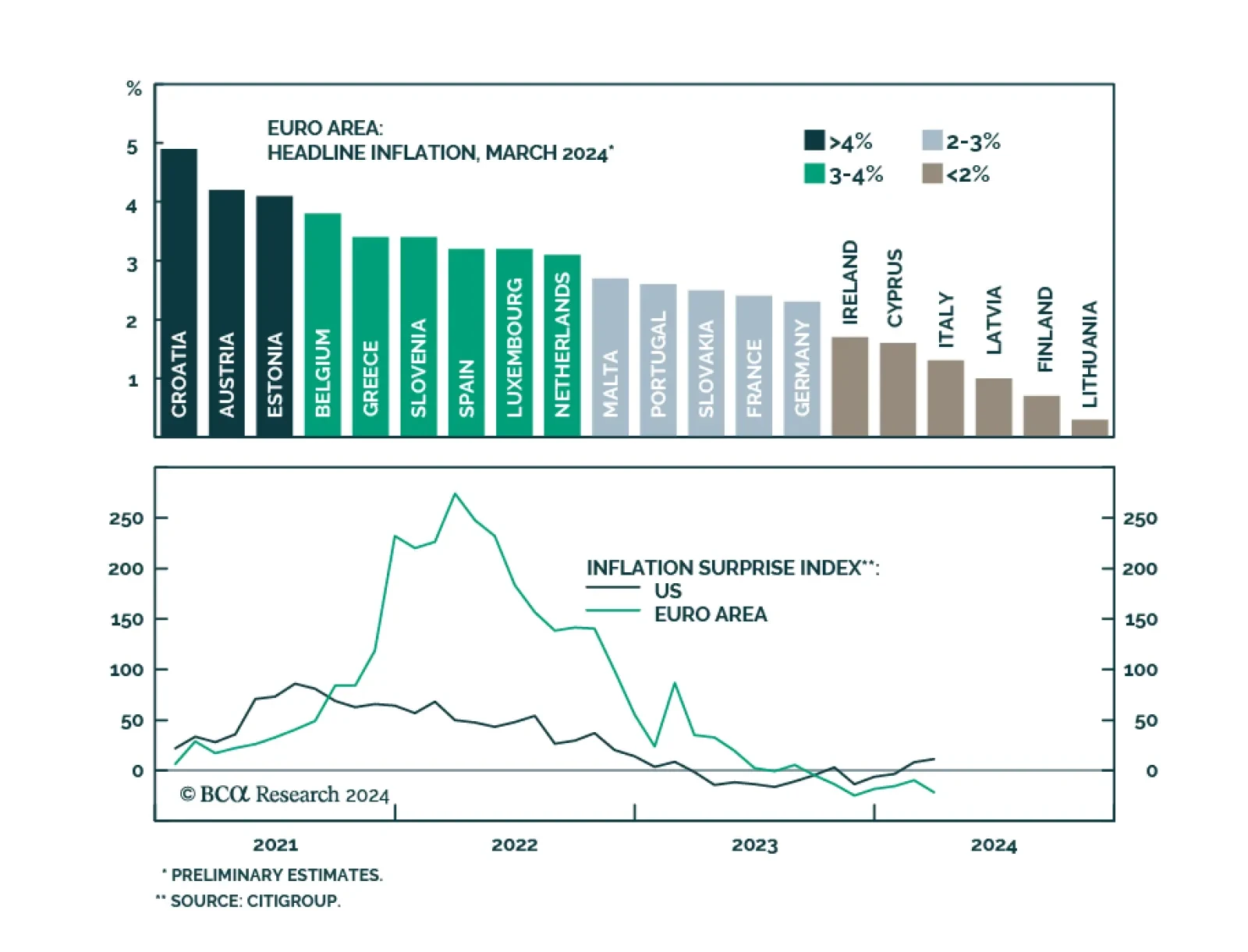

Flash estimates for Euro Area inflation in March surprised to the downside. Headline inflation slowed from 2.6% to 2.4% versus expectations of 2.5% and core inflation eased from 3.1% to 2.9% versus expectations of 3%. While the…

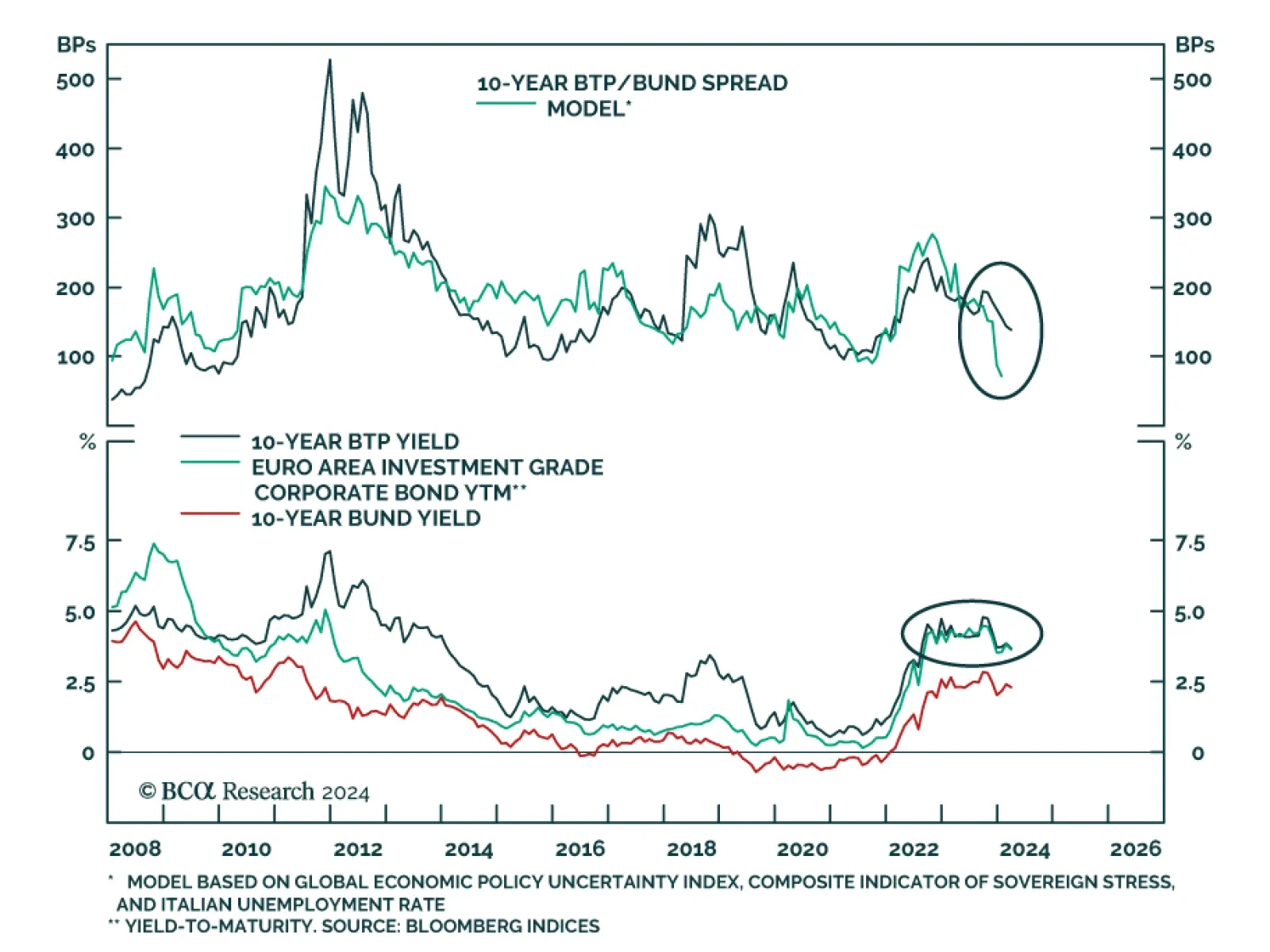

According to BCA Research’s European Investment Strategy service, investors should favor Italian BTPs over Euro Area IG until there is a better entry point to add exposure to BTP-bund spreads. The team’s latest…

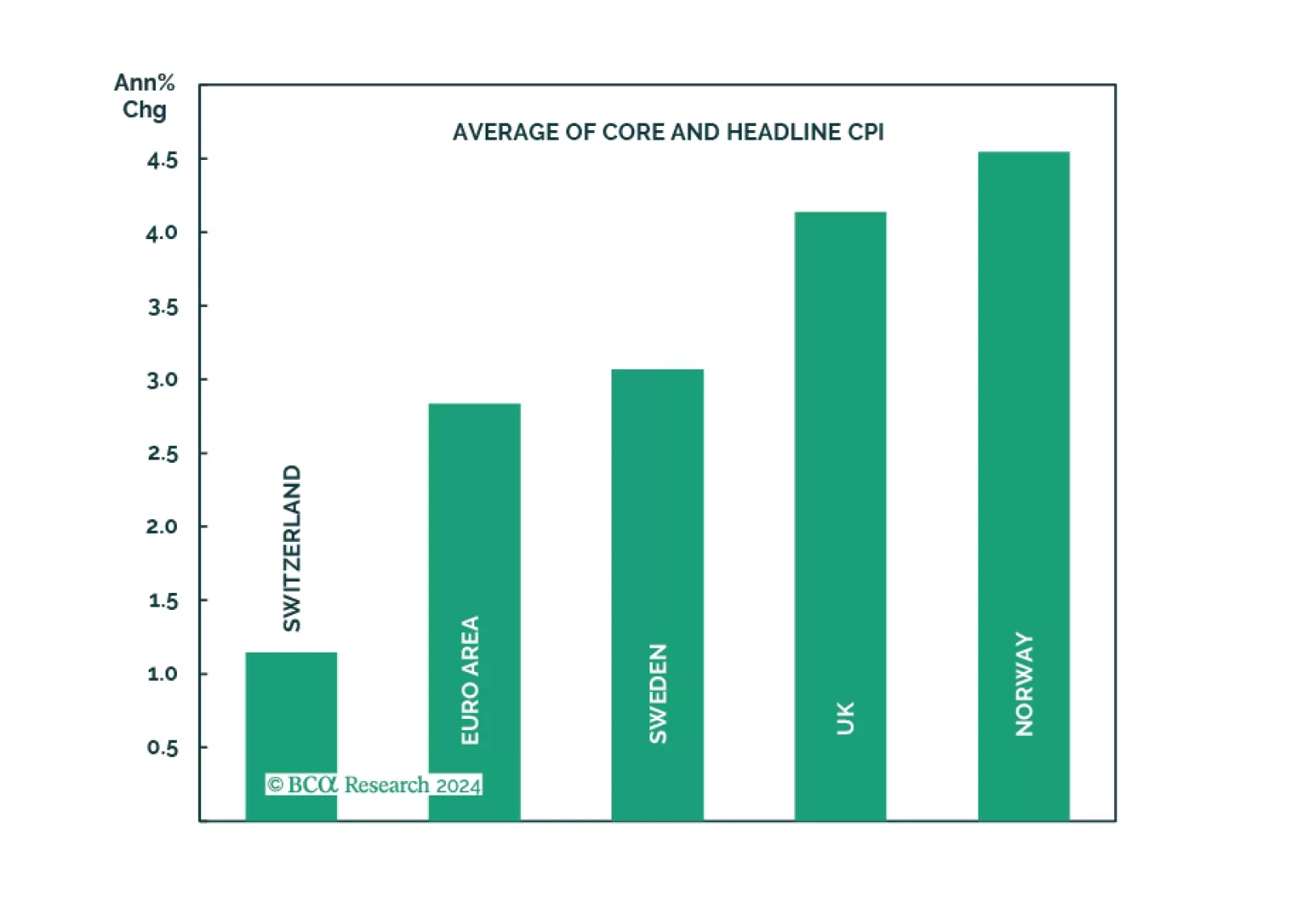

Does the recent surprise rate cut by the Swiss National Bank augur other dovish surprises among major central banks in Europe?

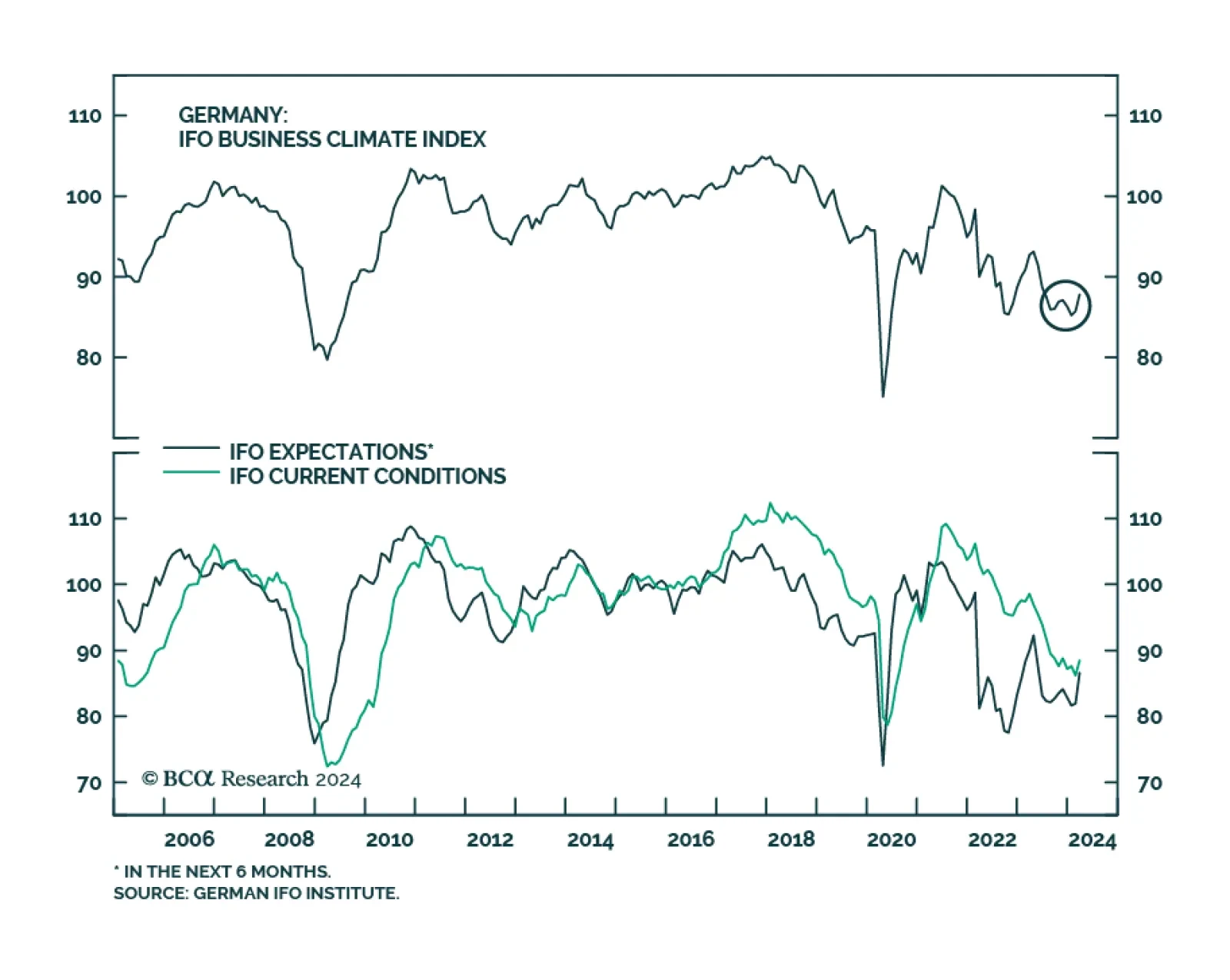

The 2.1-point increase in Germany’s Ifo Business Climate index in March brought it to a 9-month high of 87.8 and beat expectations of a more muted rise to 86.0. Both current economic conditions (+1.2 to 88.1) as well as…

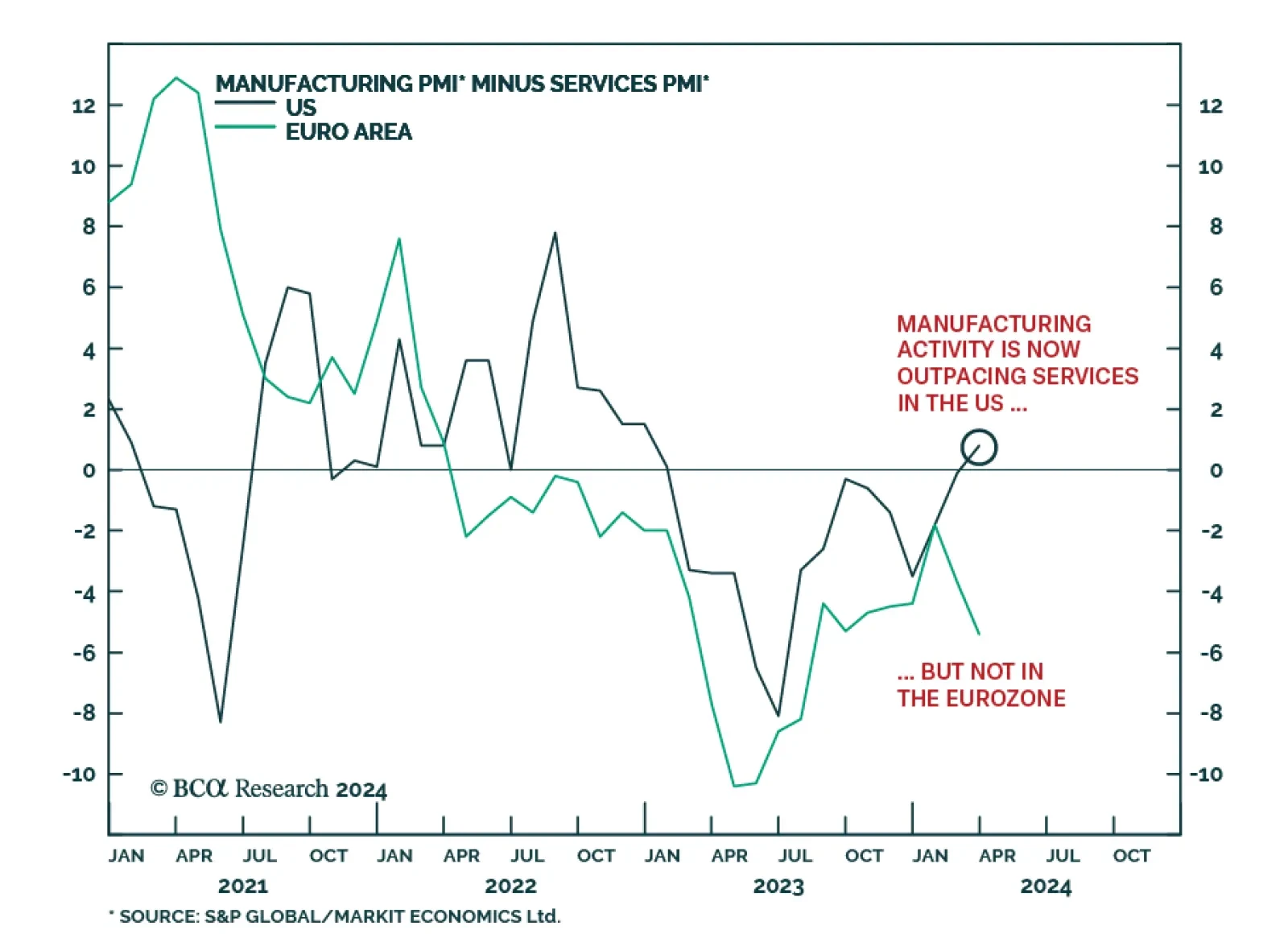

The flash PMI estimates for March produced a mixed update on manufacturing and service sector activity in the US and Eurozone. In the US, the results suggest that growth is more resilient in the manufacturing…

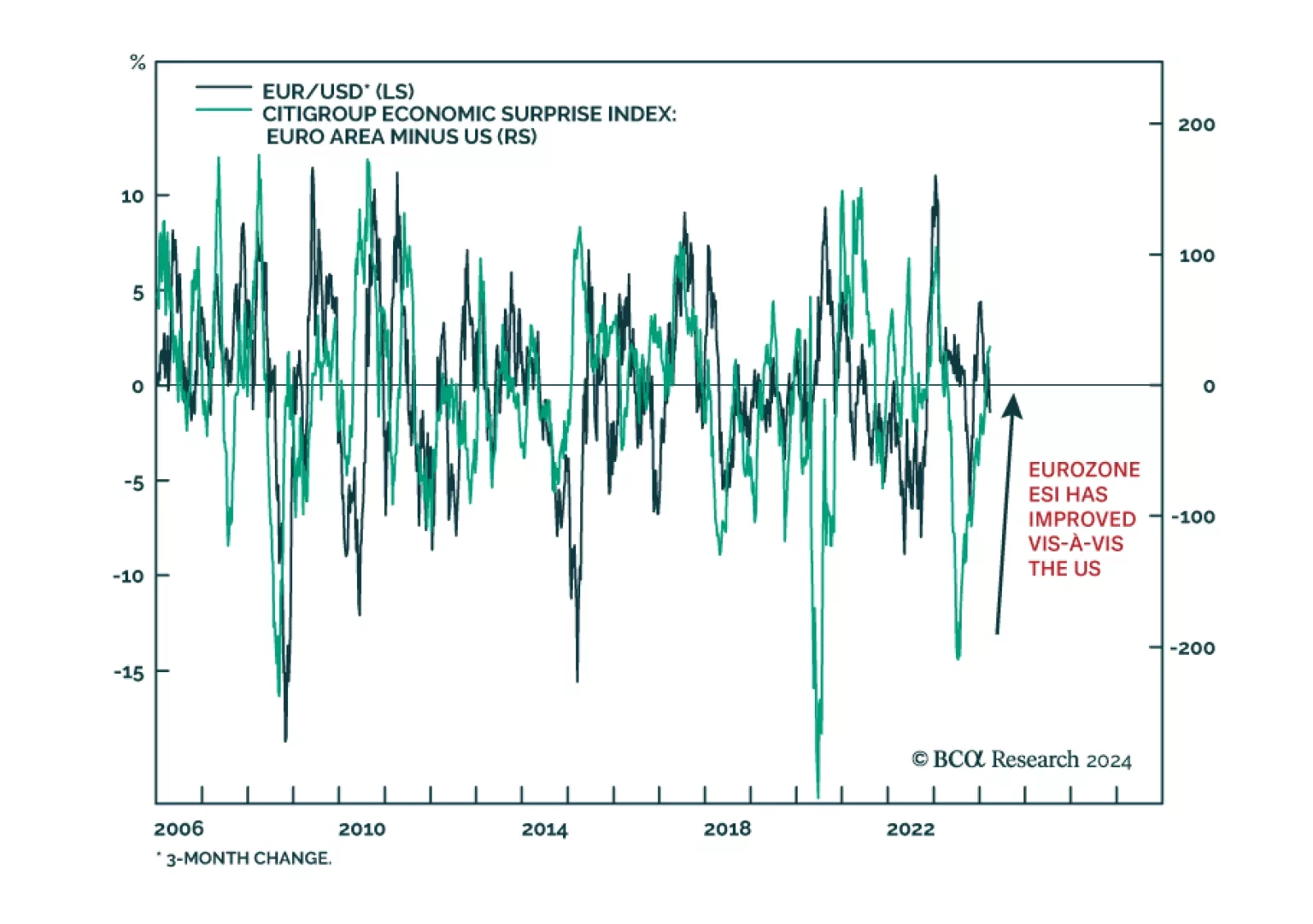

Citigroup’s economic surprise index for the Euro Area has been on a steady ascent since mid-2023. Its continued increase after breaking into positive territory at the start of February indicates that the region’s…

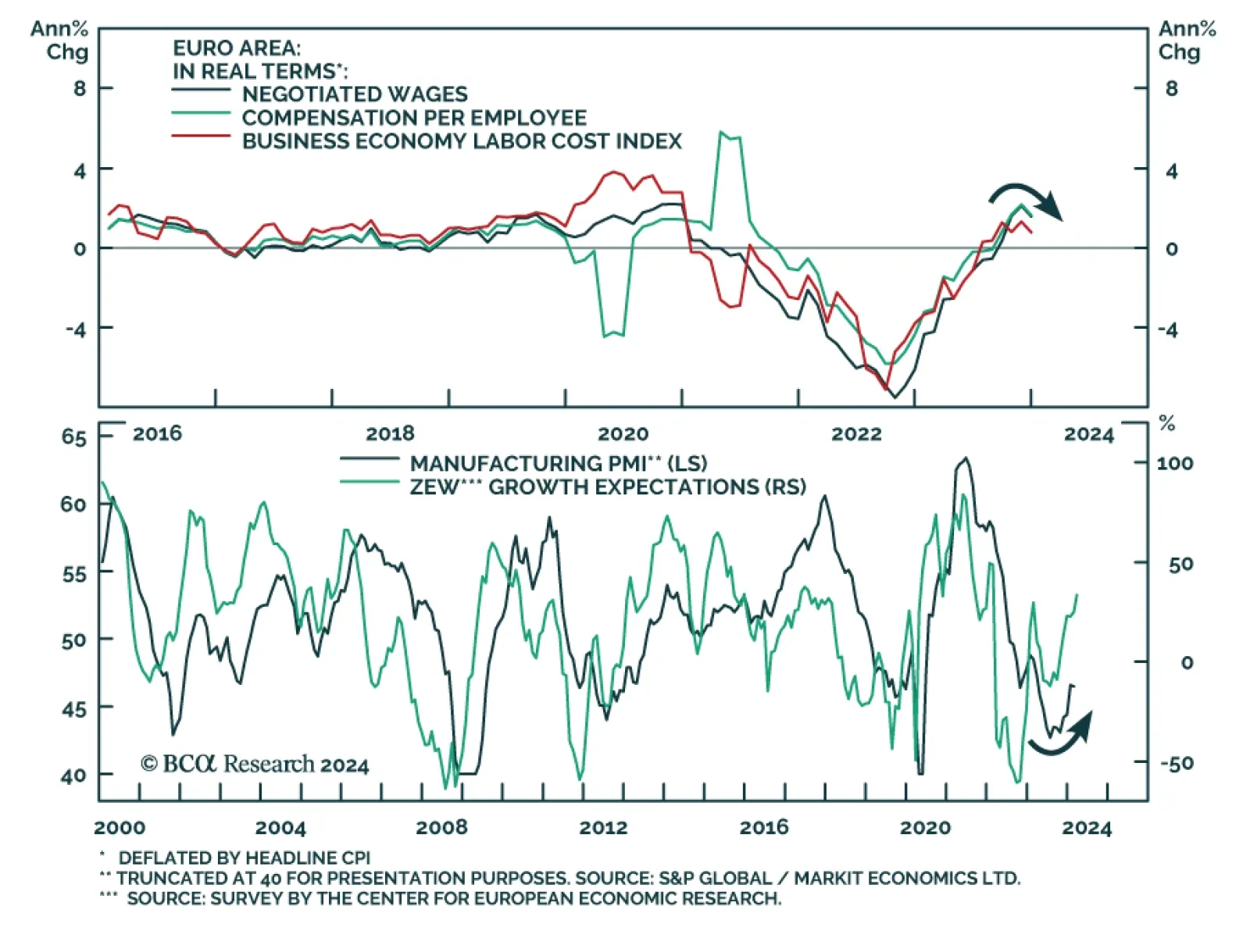

Various indicators of Eurozone wage growth have cooled off in recent months. Notably, the labor costs index eased sharply from a downwardly revised 5.2% y/y to 3.4% y/y in 2023Q4 – the slowest pace of increase since…

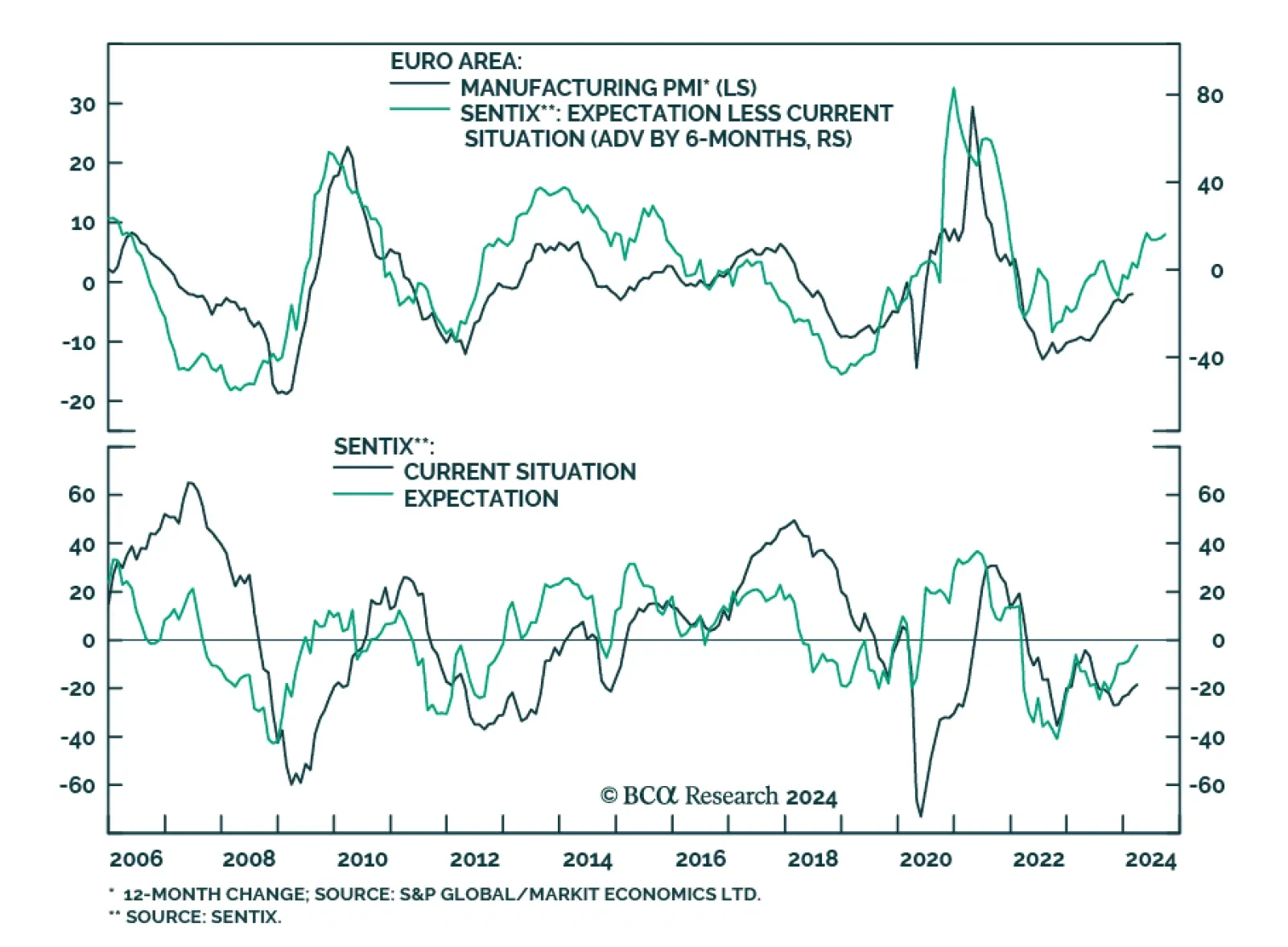

The Eurozone Sentix Economic index improved from -12.9 to -10.5 in March, marking a fifth month of improved sentiment amongst investors and economic agents. Notably, the Expectation subindex rose to a 25-month high of -2.3 from -…

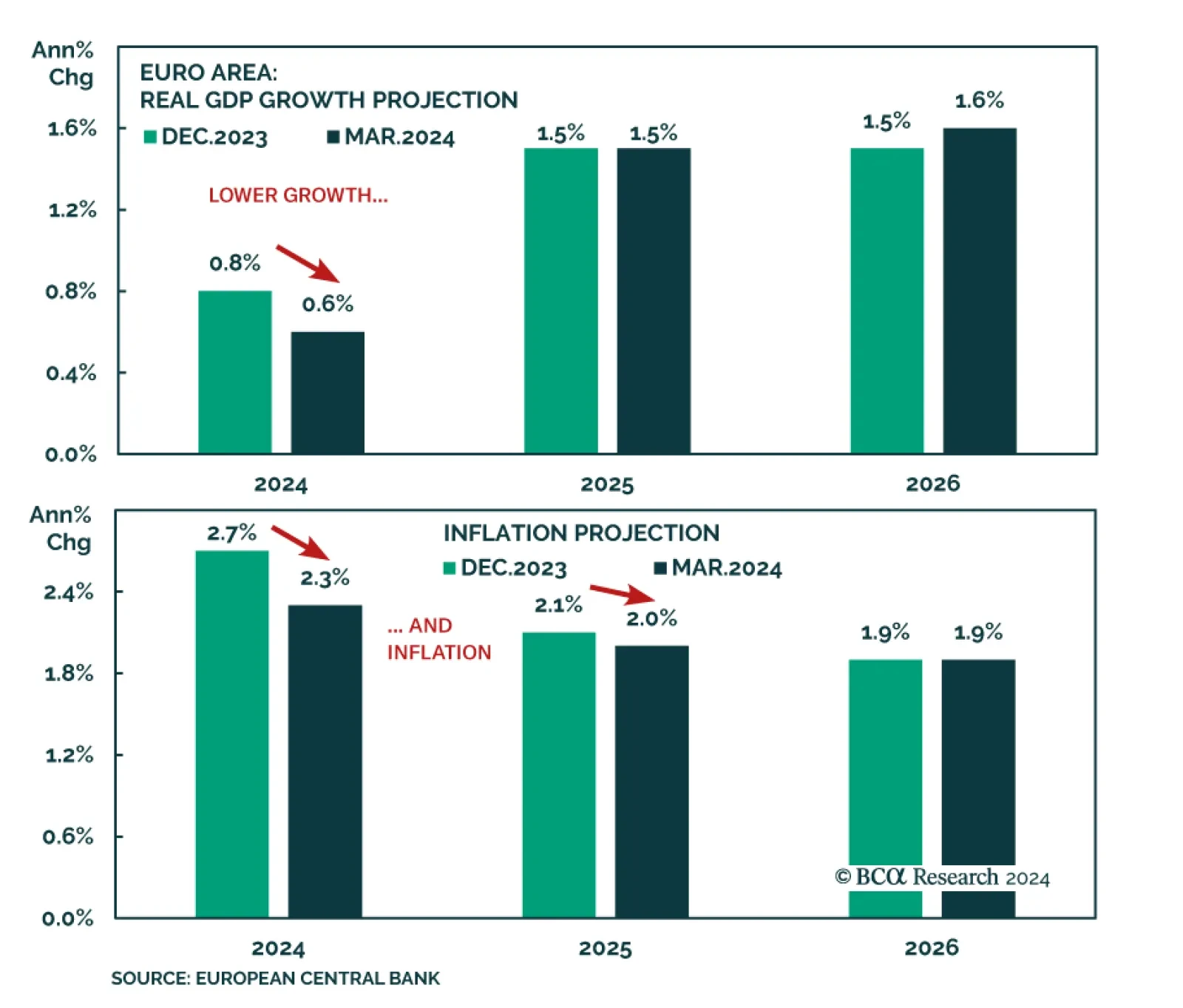

According to BCA Research’s European Investment Strategy service, last week’s ECB meeting confirmed their long-held view that the most likely date for the first ECB rate cut would be June. The ECB continues to…