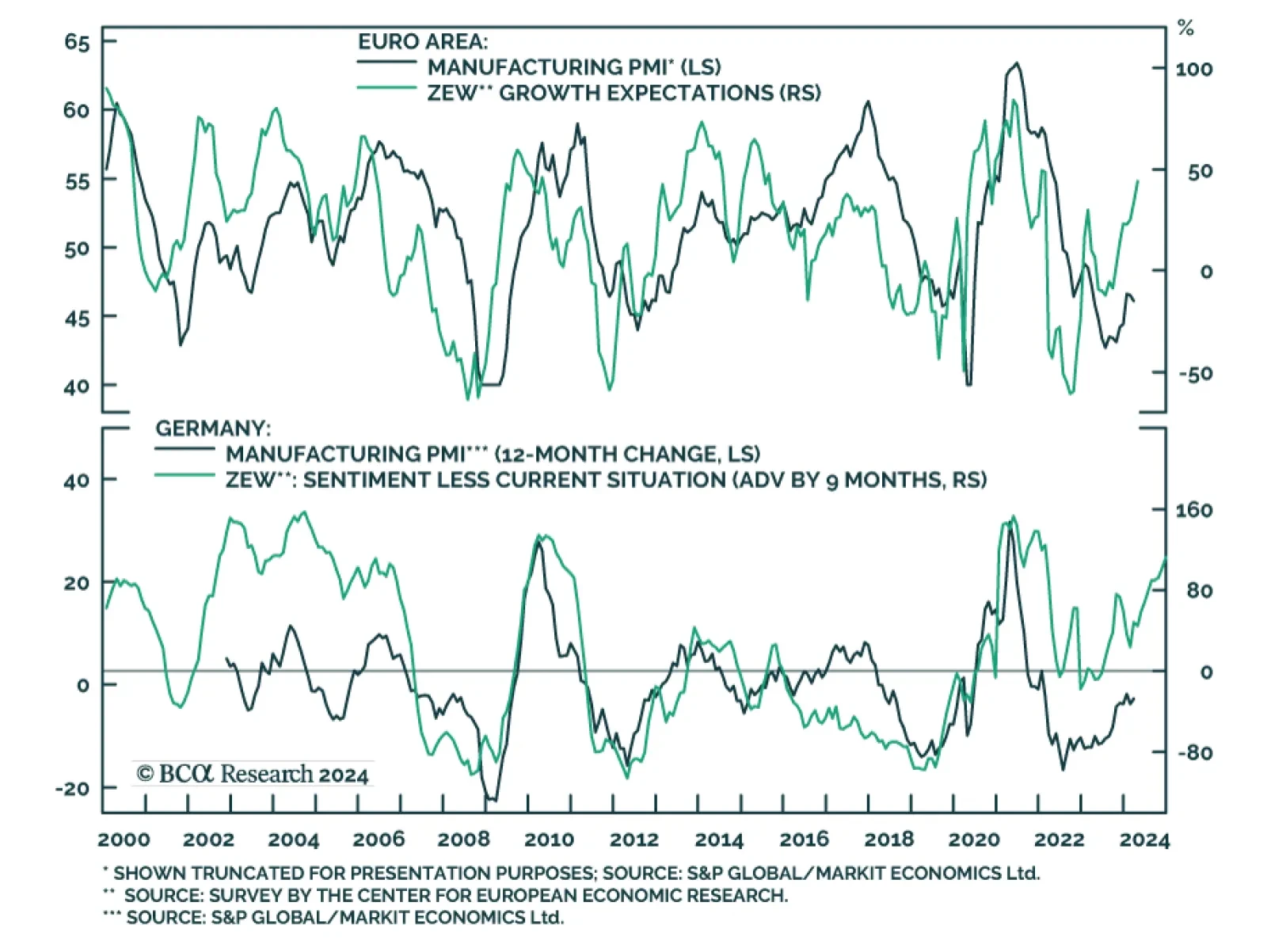

Optimism about the future continues to boost investor confidence in the Euro Area. The ZEW Expectations series for the Eurozone (+10.4 to 43.9) and Germany (+11.2 to 42.9) surged and are now both at their highest in 26…

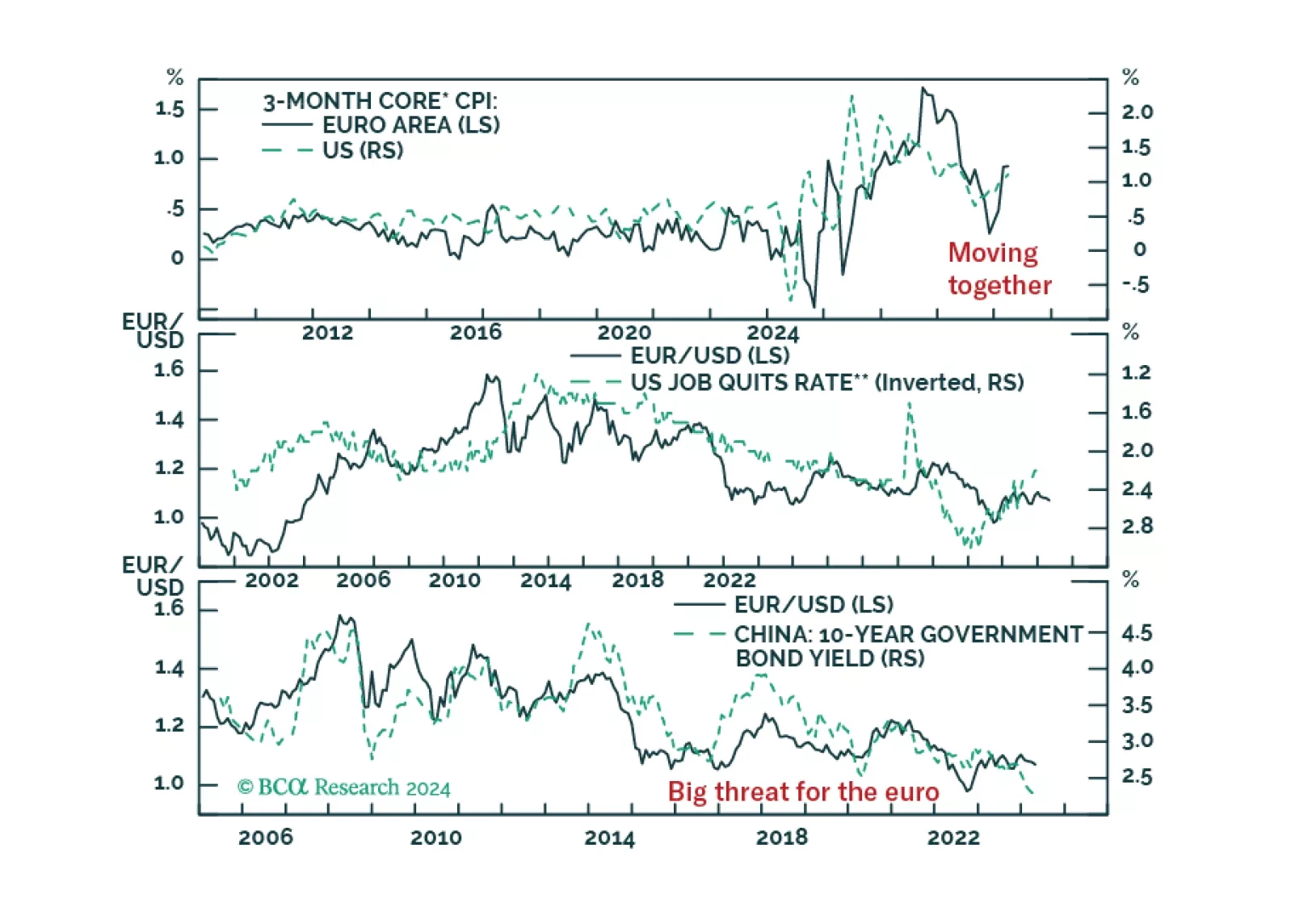

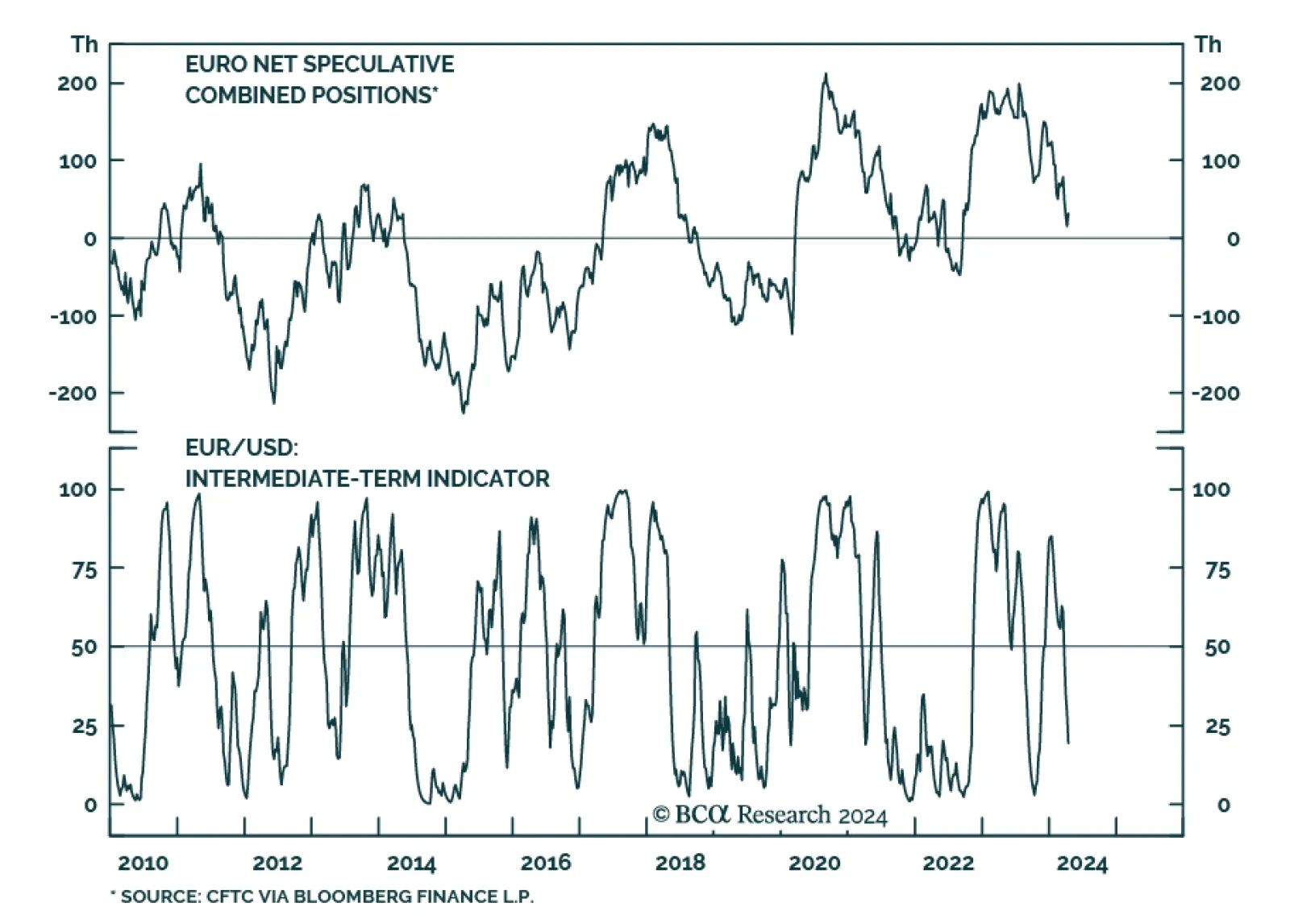

According to BCA Research’s European Investment Strategy service, a tactical buying opportunity for EUR/USD is approaching. However, this will not lead to a renewed bull market, only to a bounce toward 1.10-1.12. …

EUR/USD collapsed in the wake of last week’s hotter-than-expected US CPI report. Is this pessimism warranted and will the euro’s trading range that has prevailed since 2023 breakdown?

In this report, we present our quarterly review of our Model Bond Portfolio. The anti-growth bias of the portfolio allocations hurt the portfolio performance in Q1/2024 as global growth surprised to the upside. However, we anticipate…

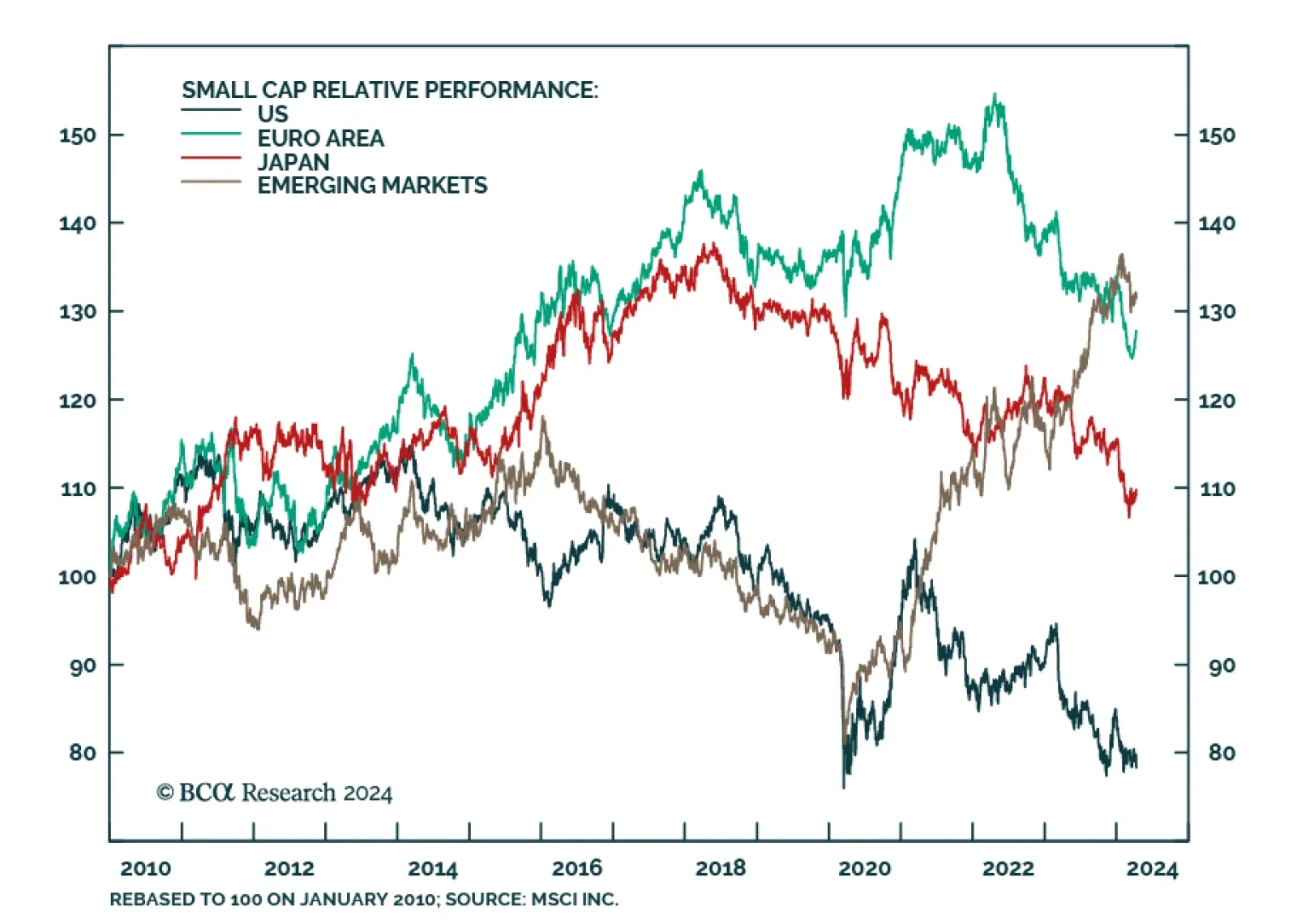

US, European and Japanese small caps have underperformed their large cap counterparts by 22.6%, 15.3% and 10.1% respectively since 2021. They now face conflicting forces. On the one hand, they are extremely beaten down and cheap…

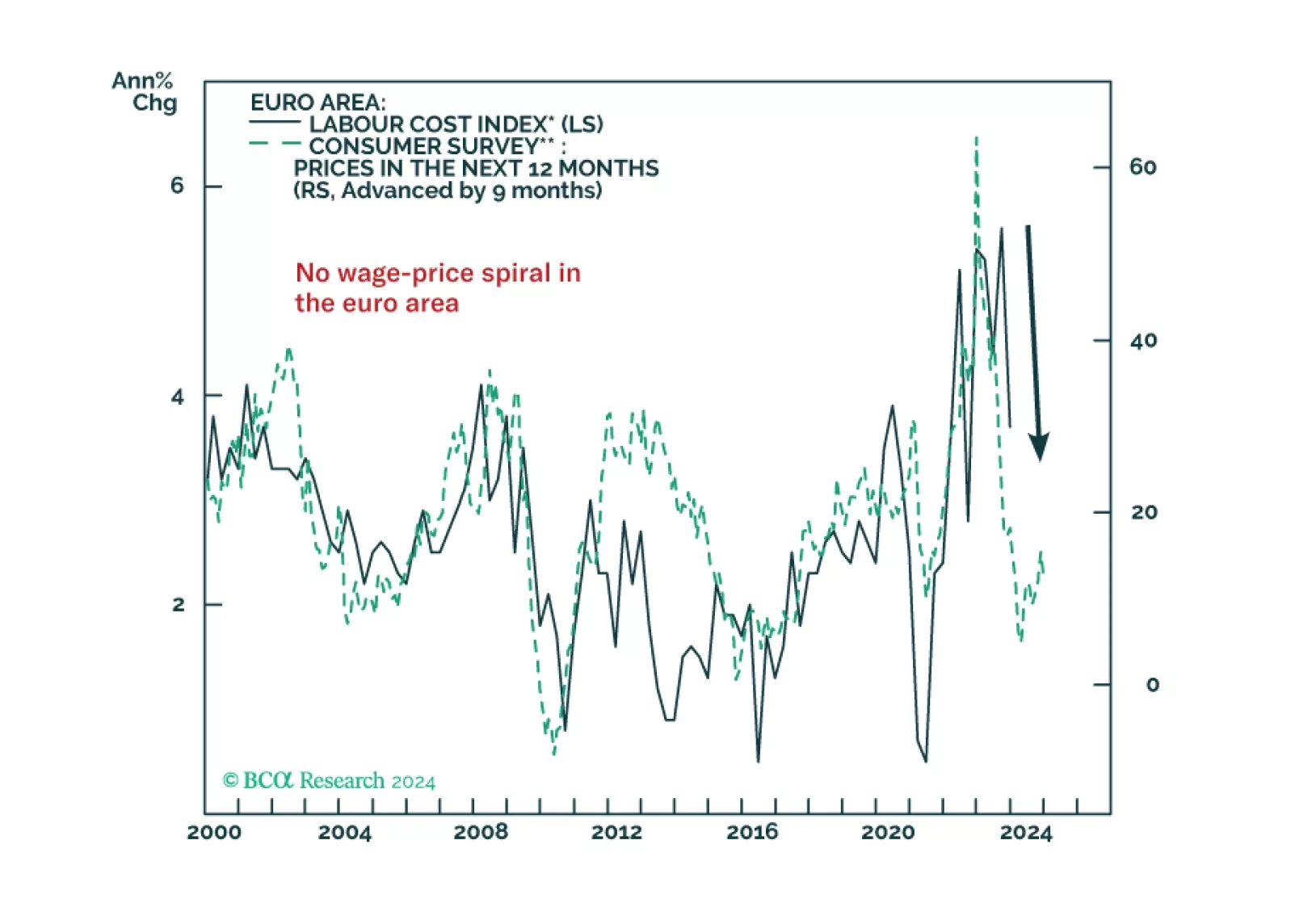

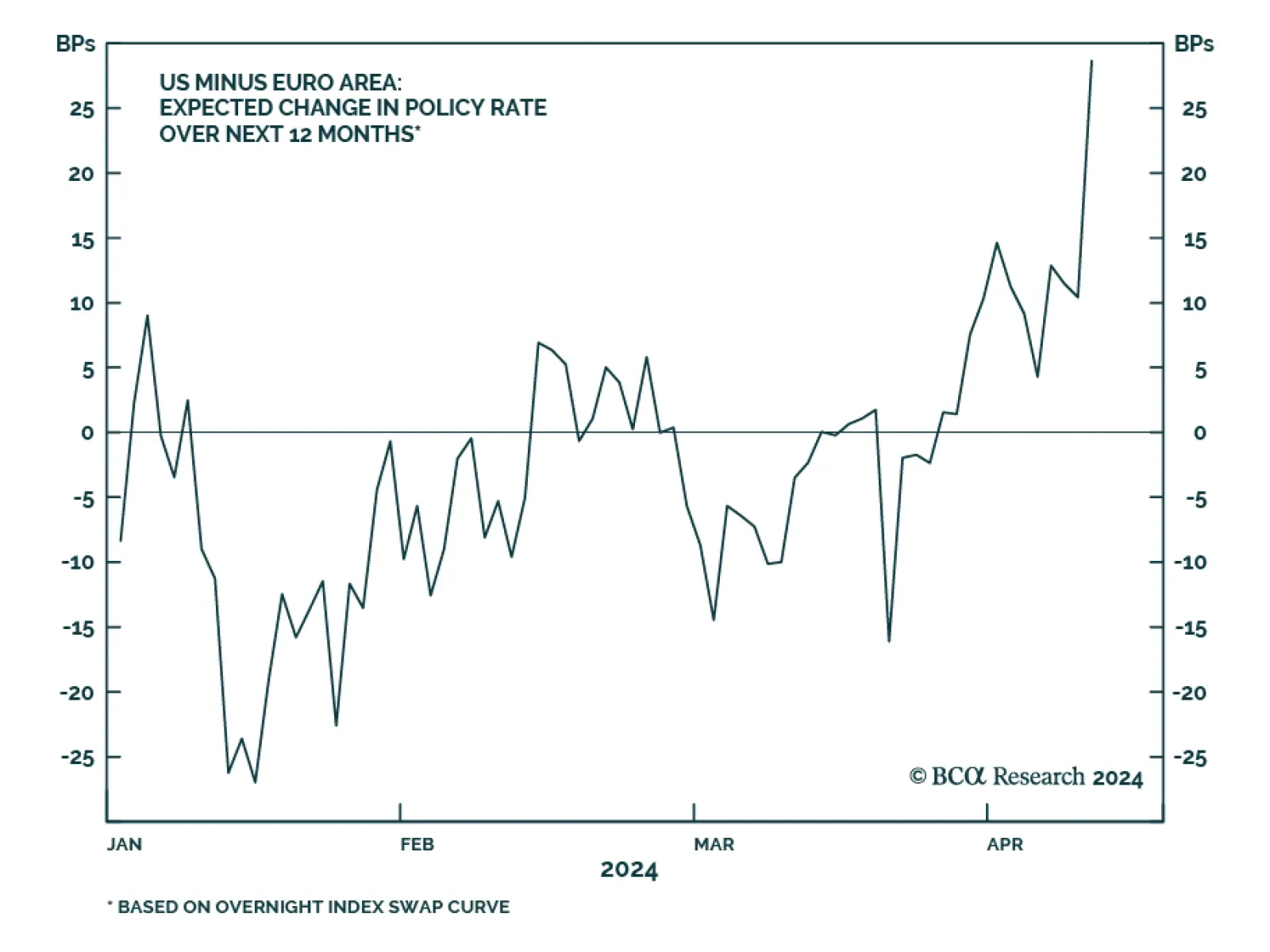

At today’s monetary policy meeting, the ECB gave strong hints that rate cuts will begin as soon as the next meeting in June. In this Insight, we share our thoughts on today’s meeting and discuss the implications for European bond…

As expected, the Governing Council of the ECB kept interest rates unchanged on Thursday. In its statement, the ECB reiterated that most measures of underlying inflation were easing, wage growth was moderating, and firms were…

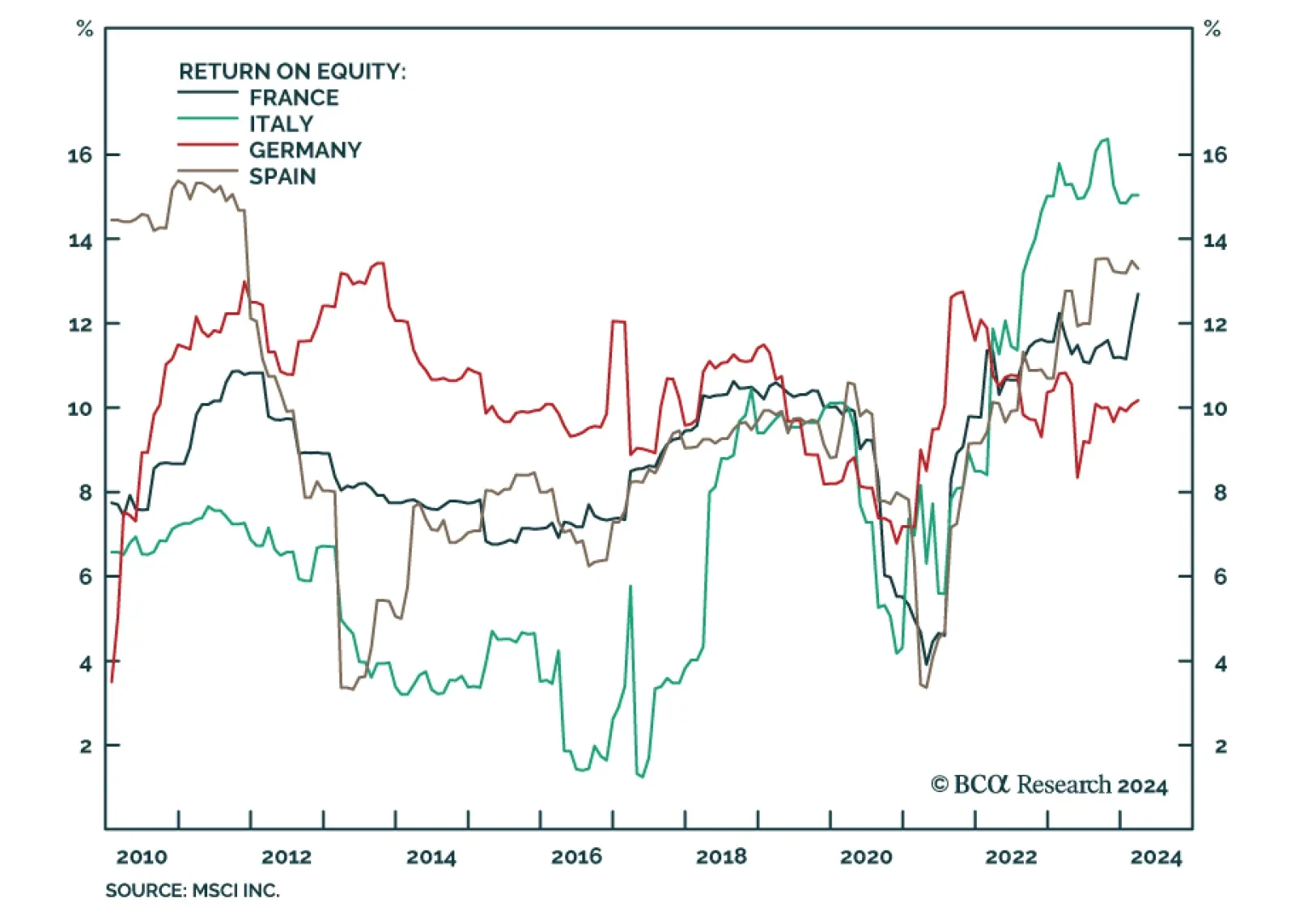

Italy and Spain have a poor reputation when it comes to their economies. The European debt crisis affected them more than other Euro Area countries. Their housing markets collapsed and debt cost soared. France and Germany, while…

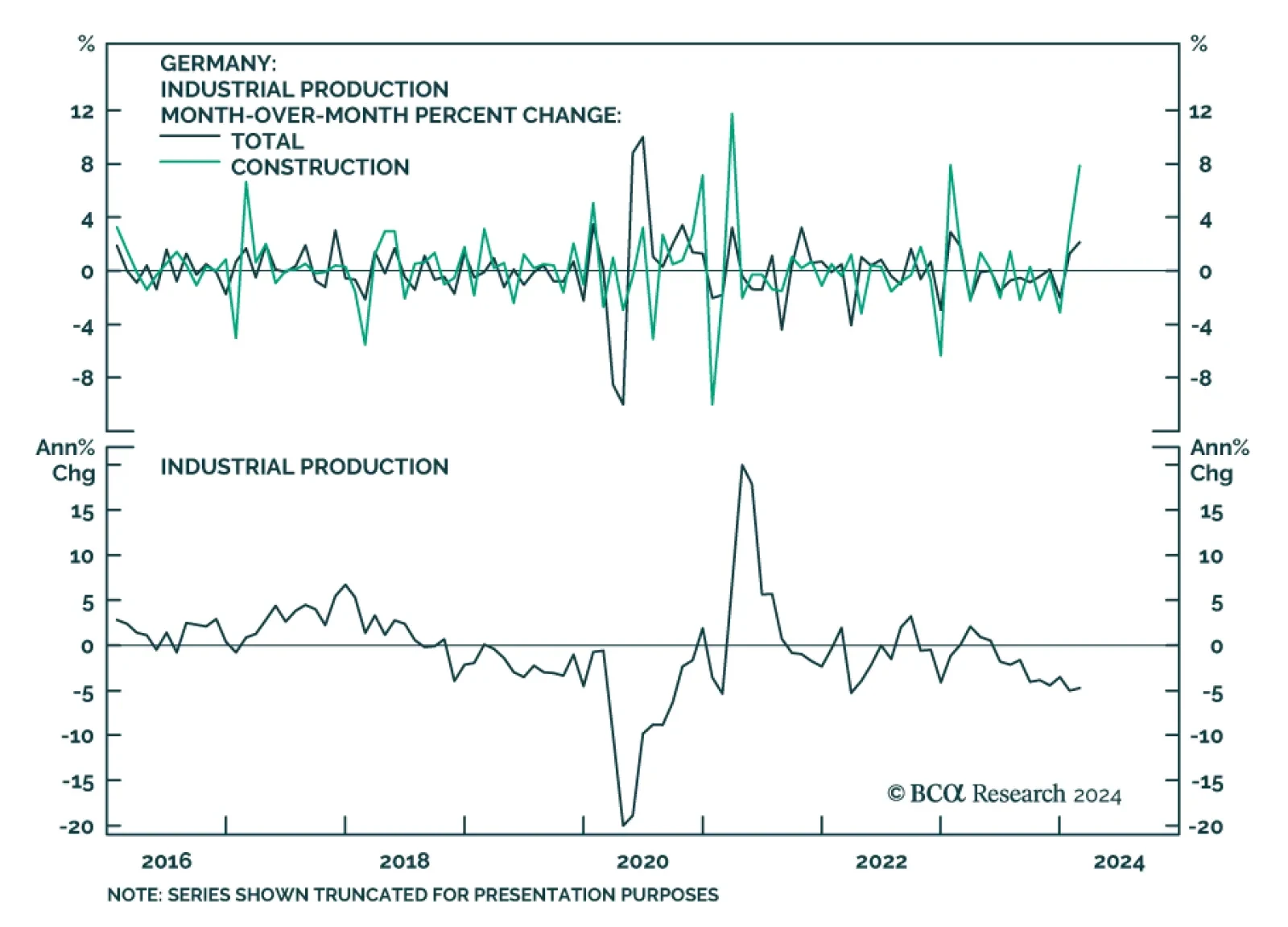

German industrial production growth accelerated from an upwardly revised 1.3% m/m to 2.1% m/m in February, registering the fastest pace in 13 months and largely beating expectations of a slowdown. A 7.9% m/m increase in the…

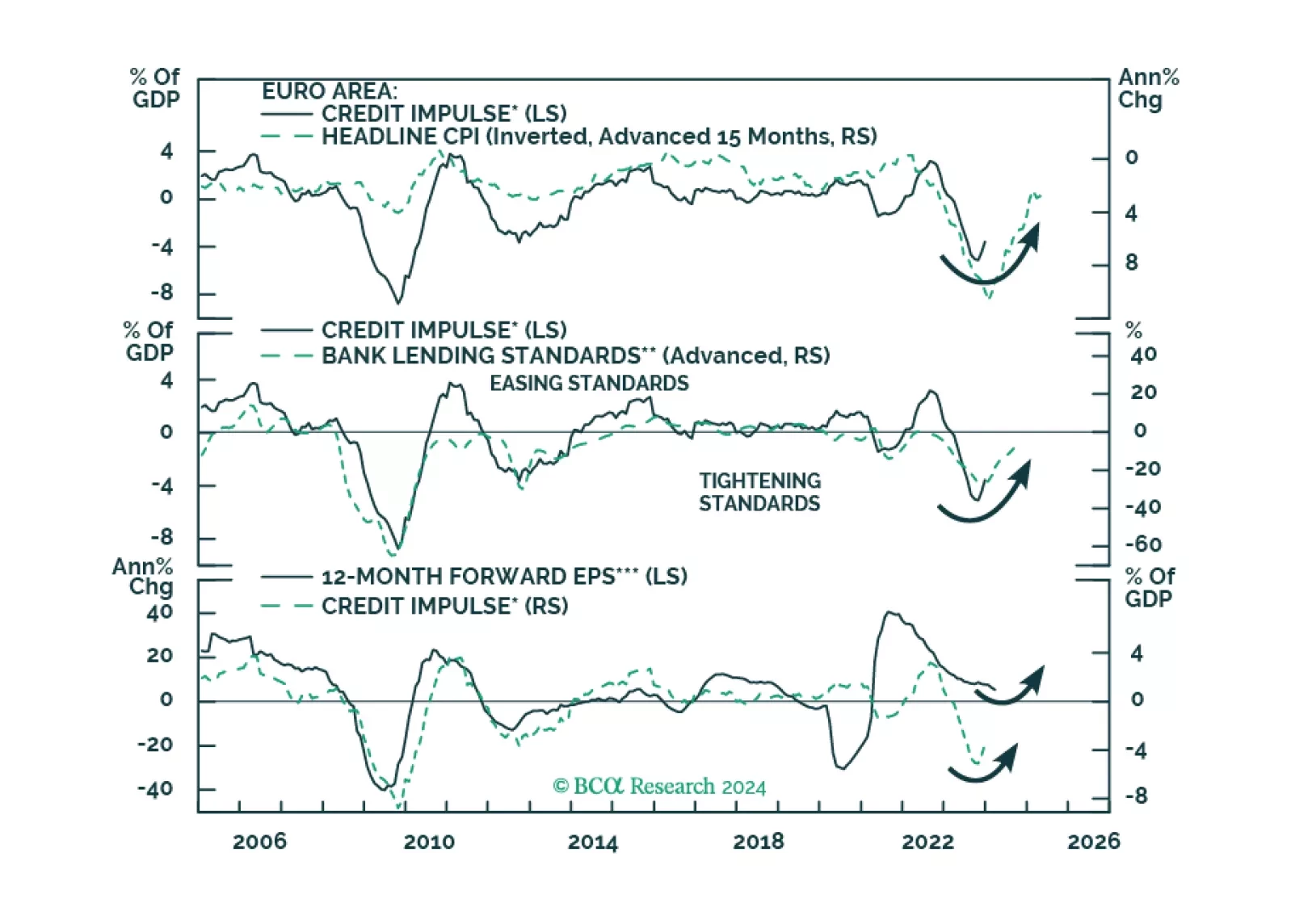

Europe credit flows are stabilizing, hence a major drag on the region’s growth will dissipate. What does this development imply for European equities?