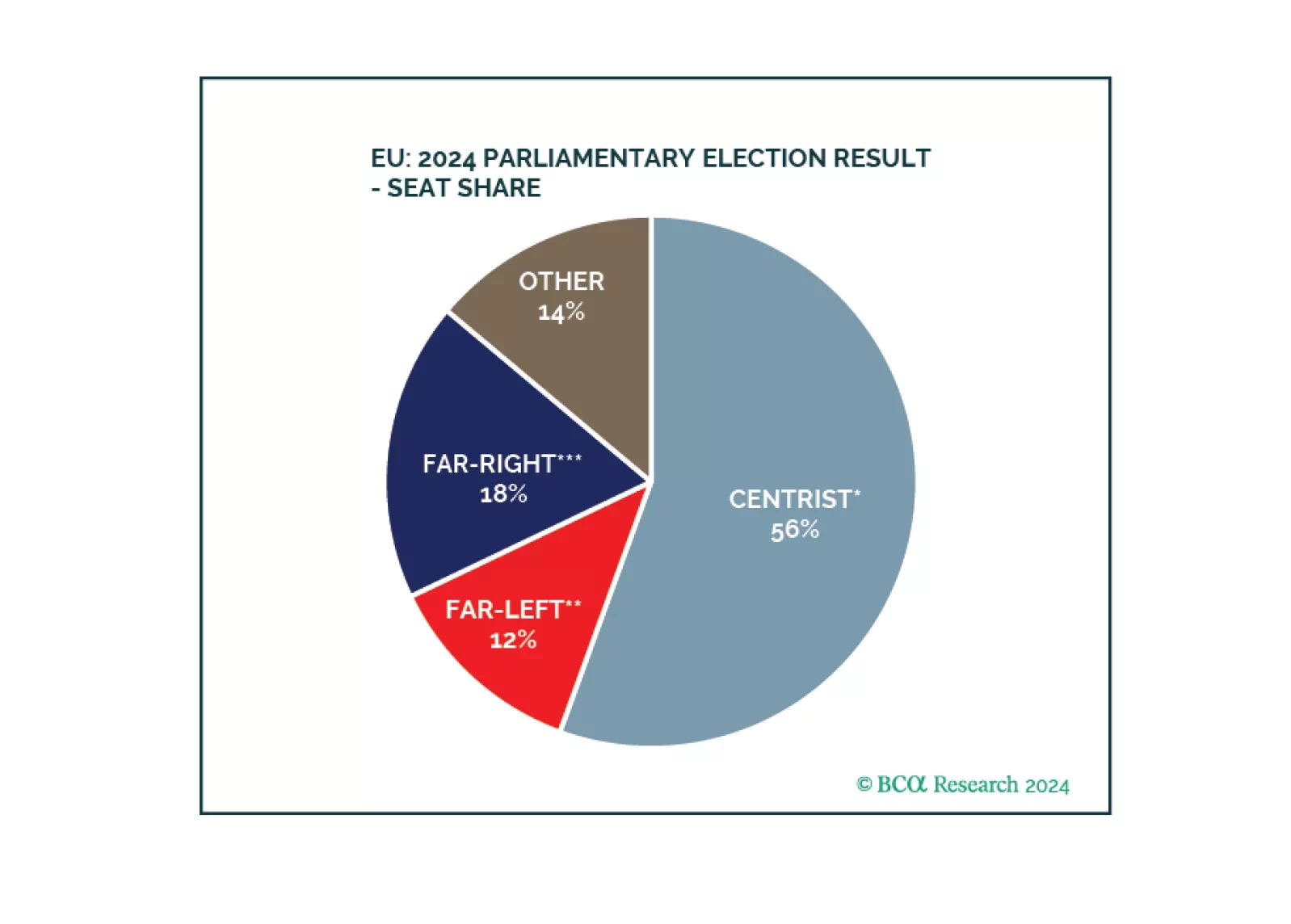

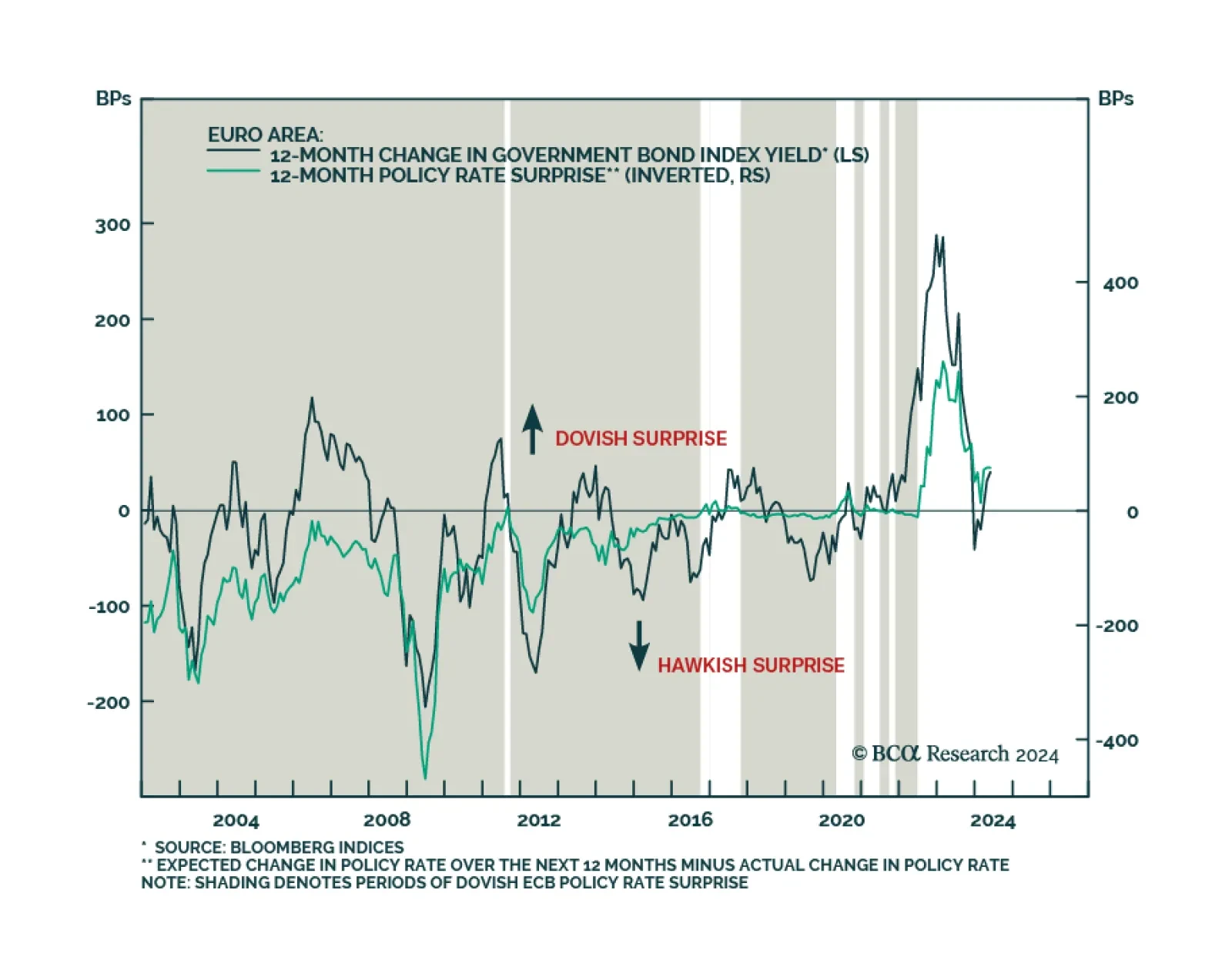

Europe did not witness a major policy reversal. Inflationary pressures are coming down, enabling the ECB to cut rates and European states to maintain soft budgets. Geopolitical challenges ensure that European parties continue to…

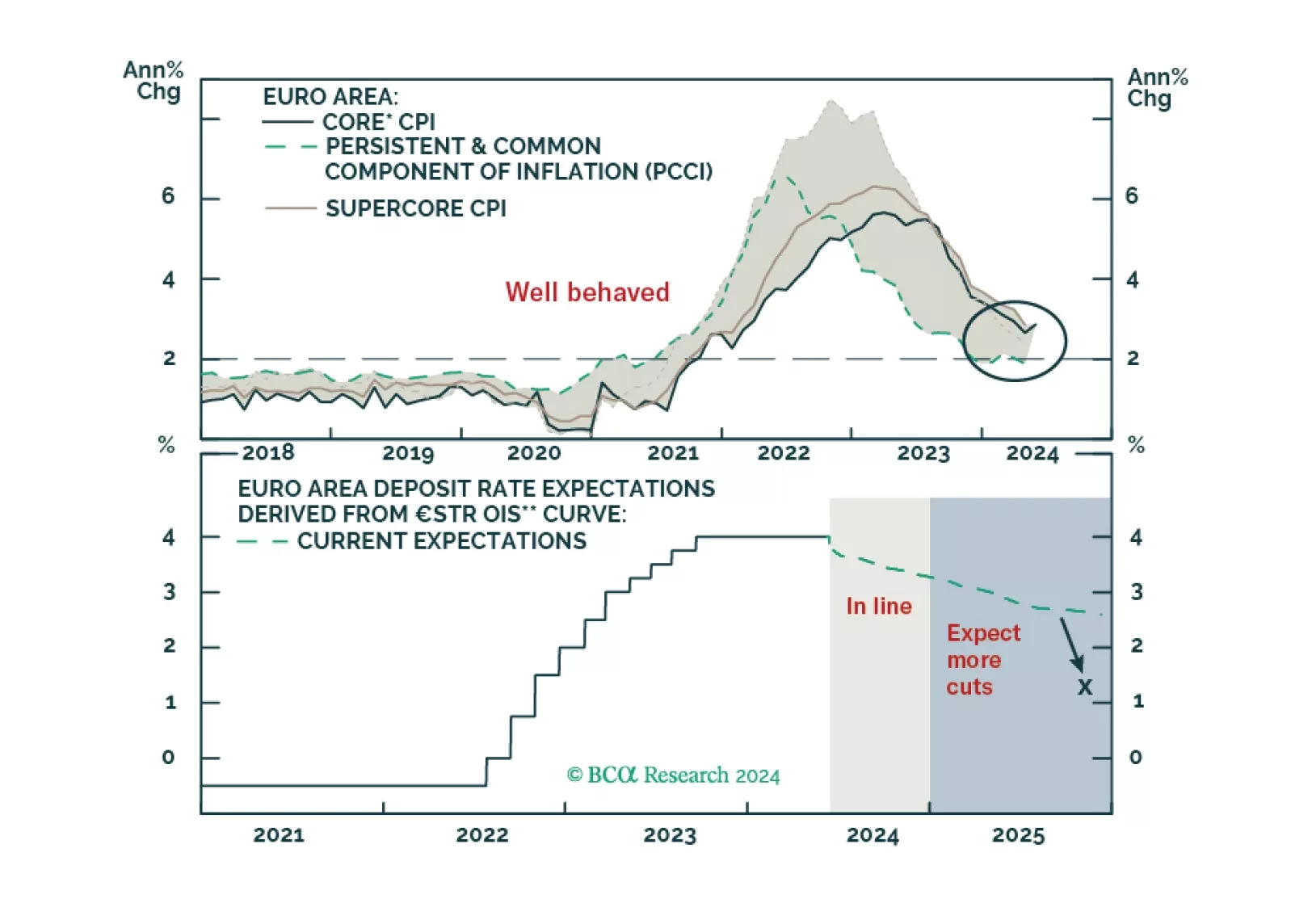

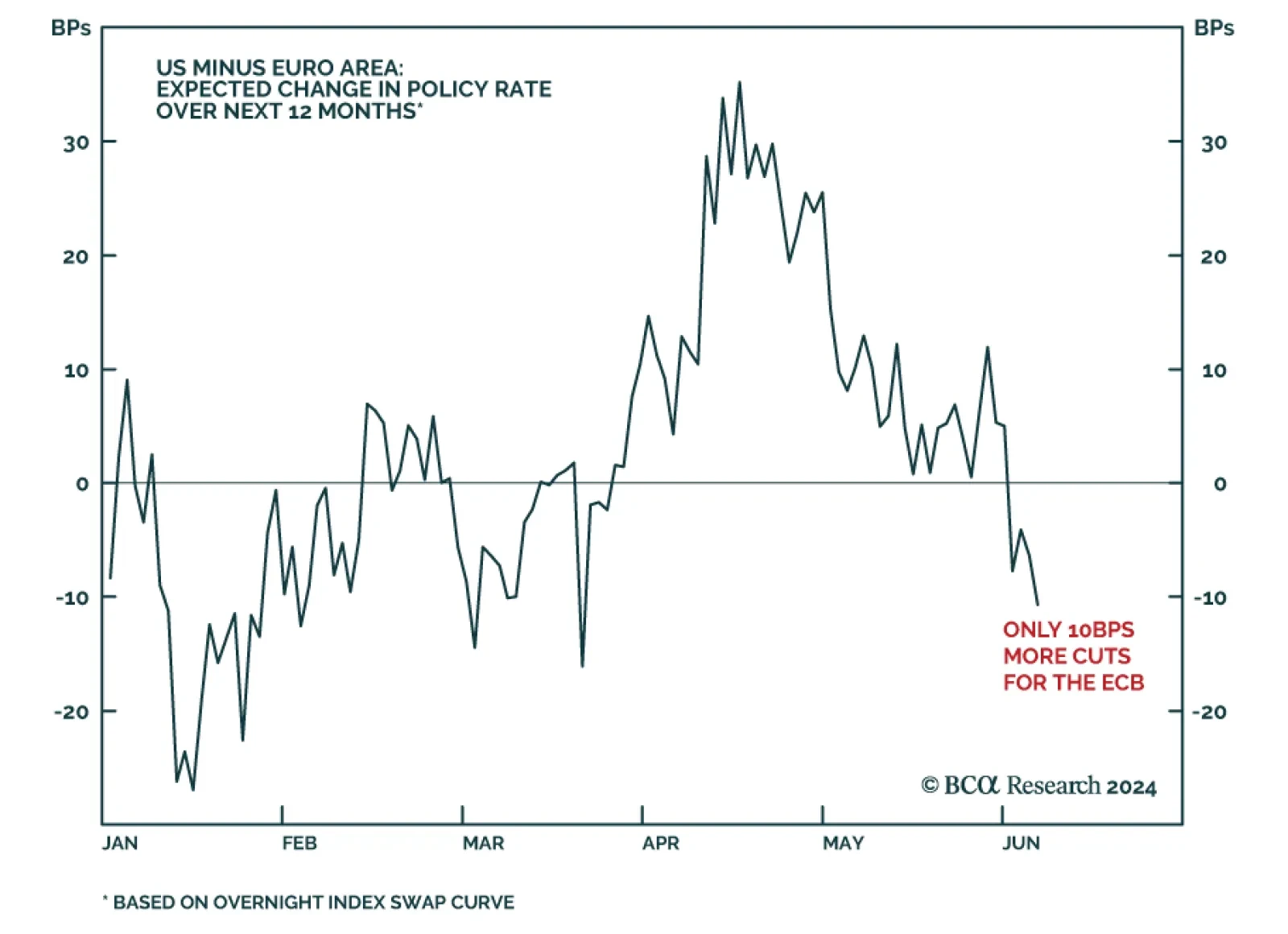

The ECB is now firmly in easing mode, even if it refuses to pre-commit to a specific rate path. What does this data dependency mean for the euro and European yields?

After holding rates steady over the past nine months, the ECB delivered on its widely expected rate cut on Thursday. The Governing Council lowered all three key ECB interest rates by 25 bps, bringing the refinancing, marginal…

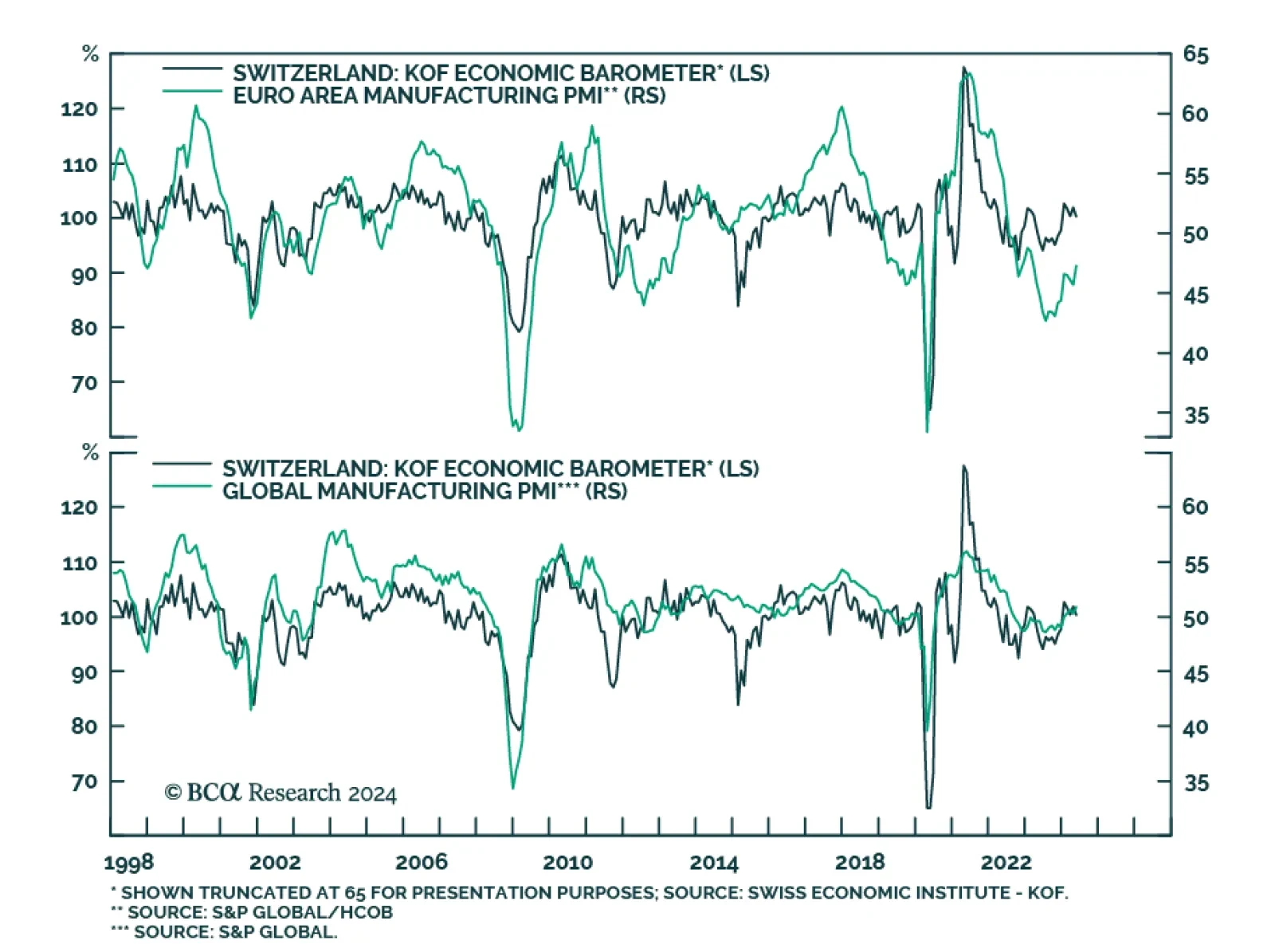

The Swiss KOF Barometer is a composite leading indicator of the Swiss economy. It surprised to the downside in May, coming in at 100.3 from 101.9, below expectation of an acceleration to 102.1. Switzerland’s economy is…

Euro Area CPI accelerated for the first time this year from 2.4% y/y to a faster-than-expected 2.6% y/y in May. Preliminary estimates also suggest that core CPI accelerated from 2.7% y/y to 2.9% y/y, against expectations of a…

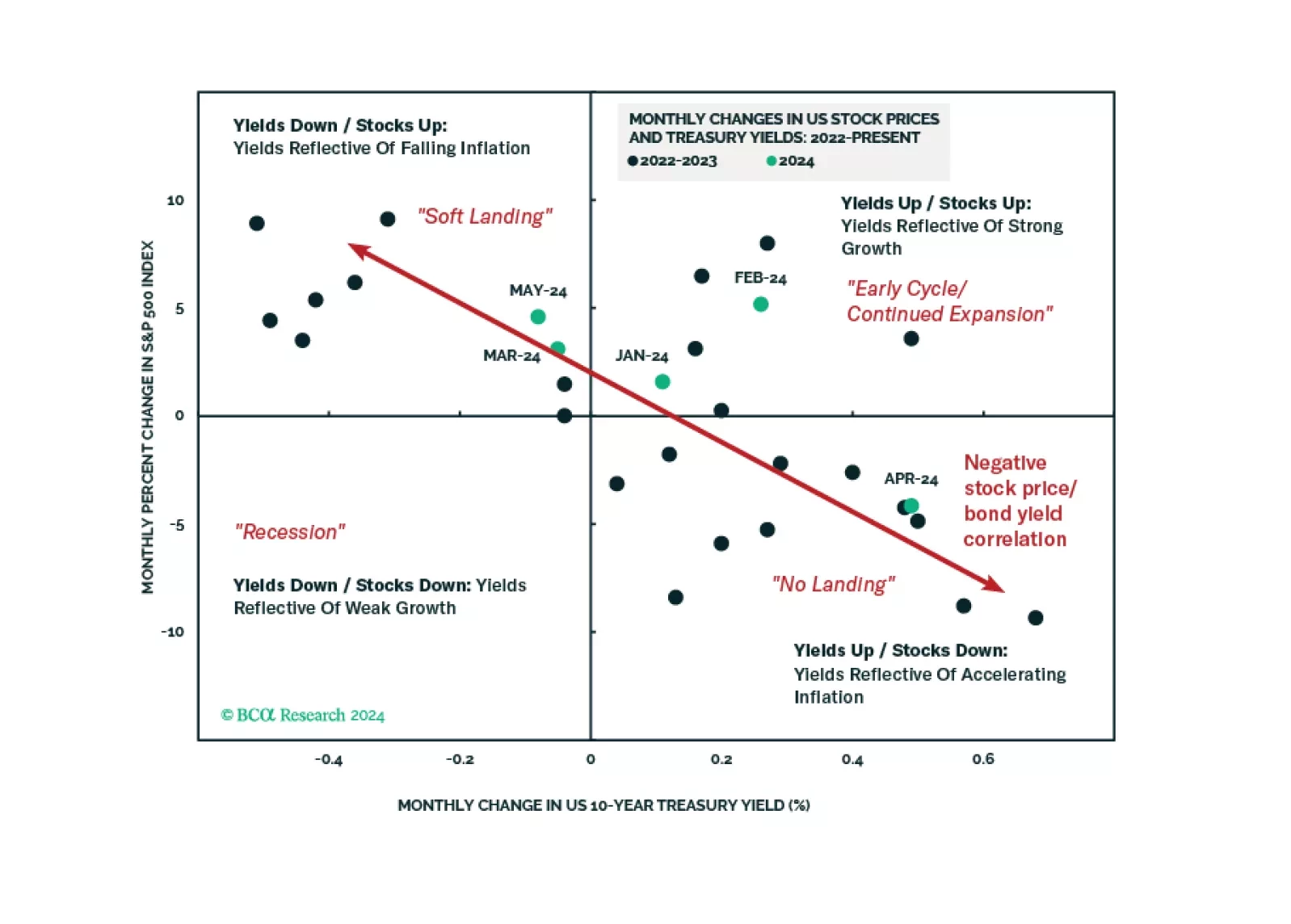

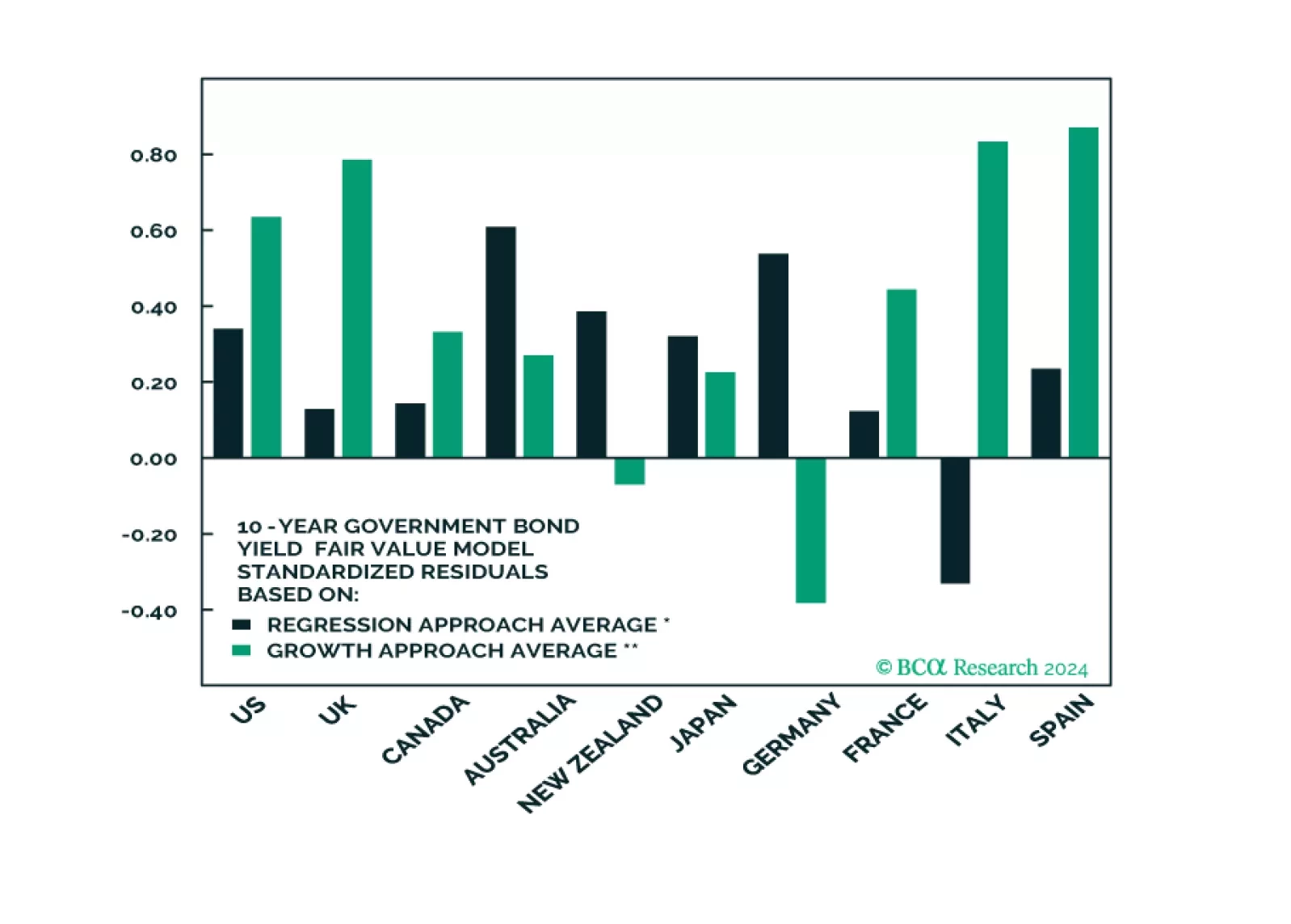

In Section I, we argue that global investors have been lulled into a false sense of security concerning the resiliency of the US economy. Tight monetary policy means that something must change for a recession to be avoided, and…

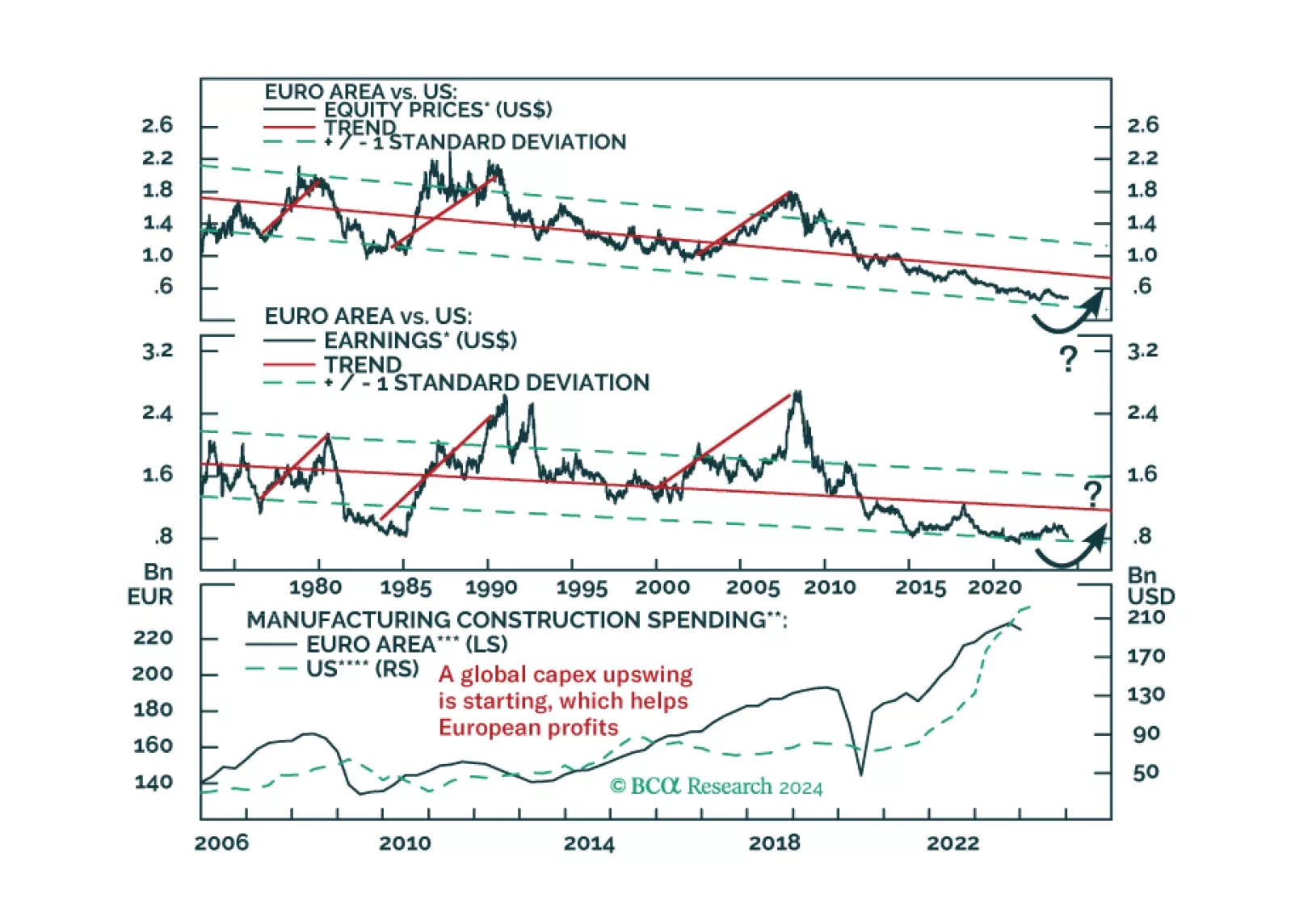

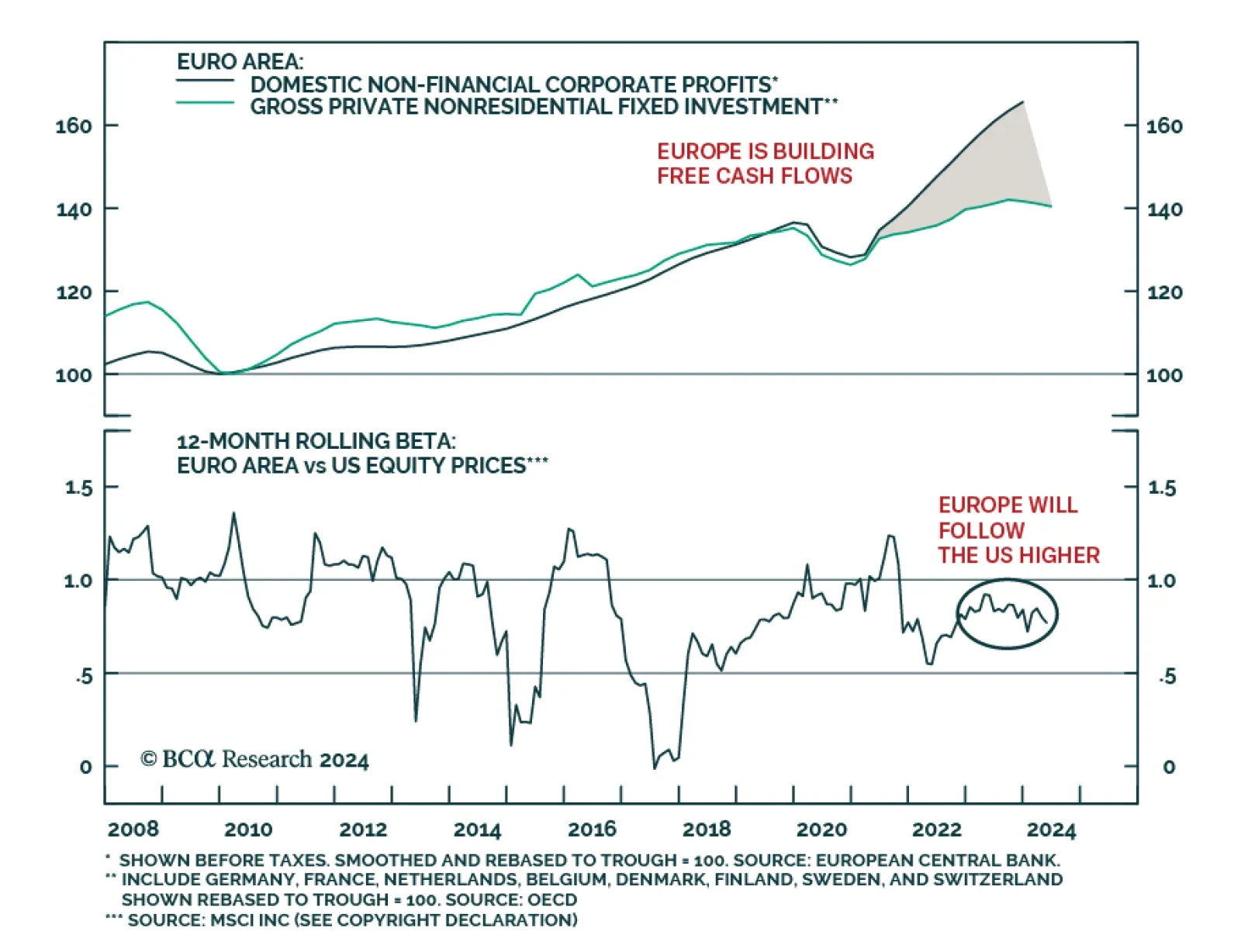

According to BCA Research’s European Investment Strategy service, the money sloshing around the financial system from pandemic-era stimulus measures disconnects near-term prospects for growth from risk asset prices. As a…

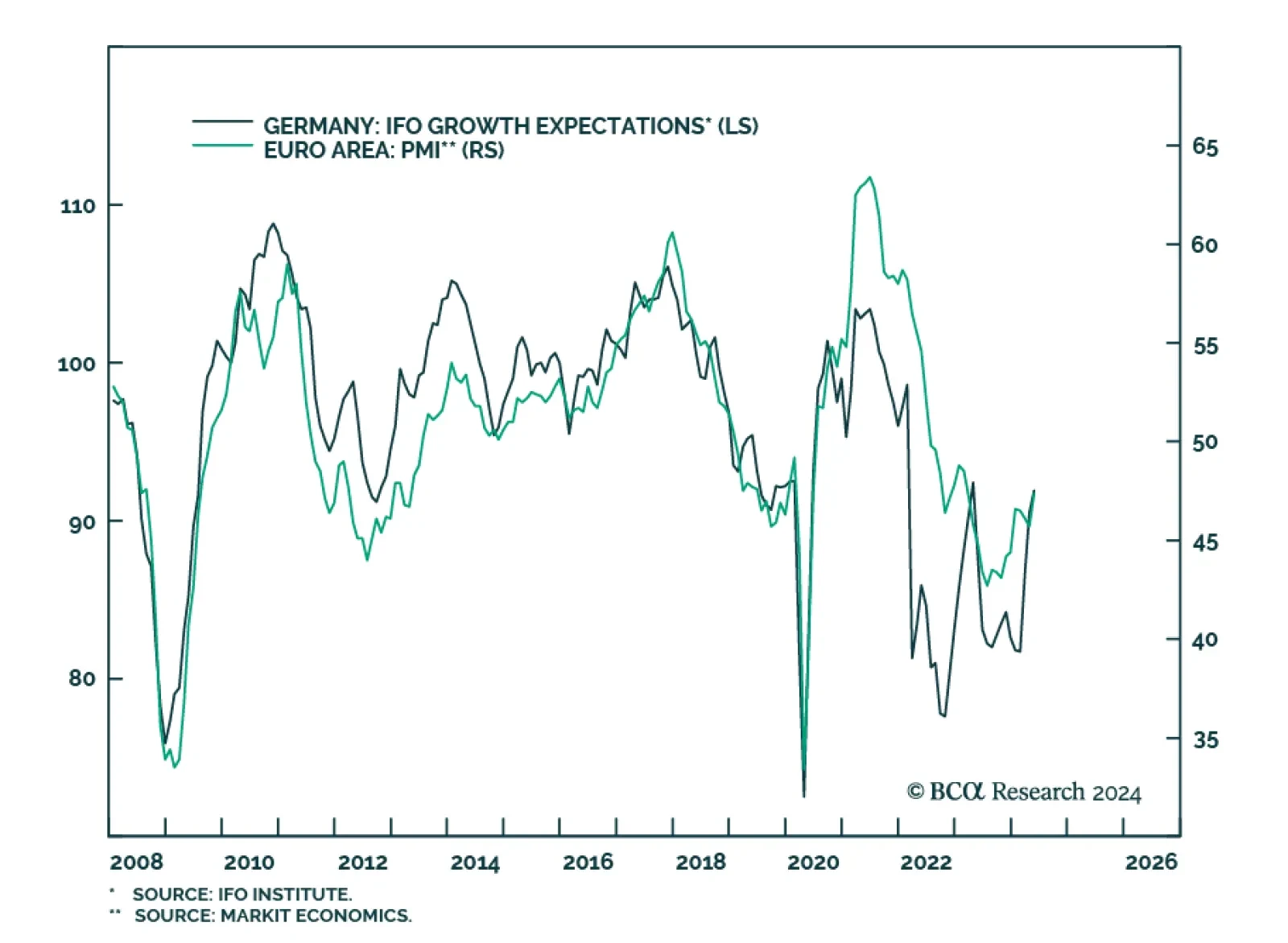

Sentiment among German companies stalled in May, after having firmed for 3 consecutive months. The IFO Business Climate came in at 89.3, unchanged from April, disappointing expectations of further strengthening to 90.4. Although…