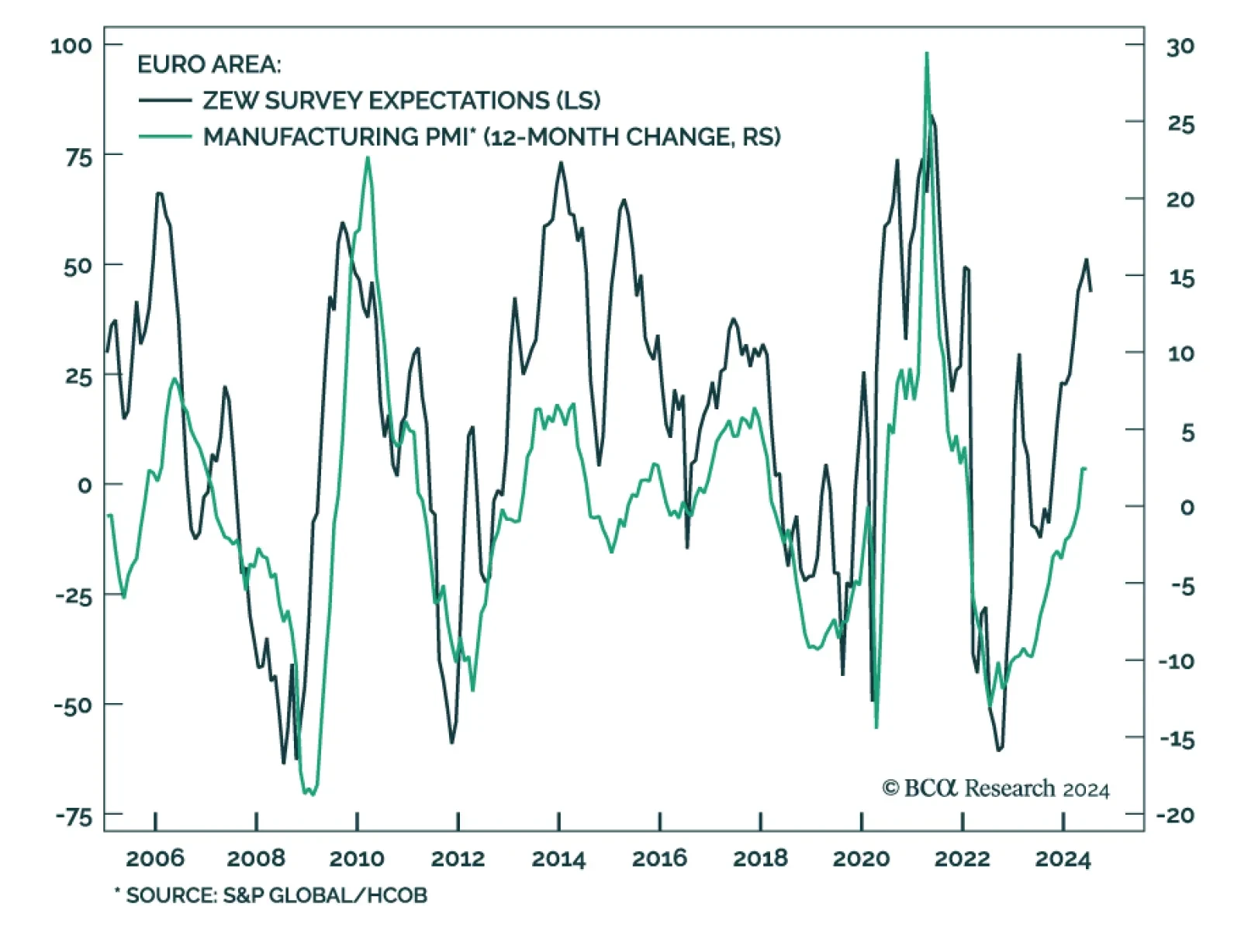

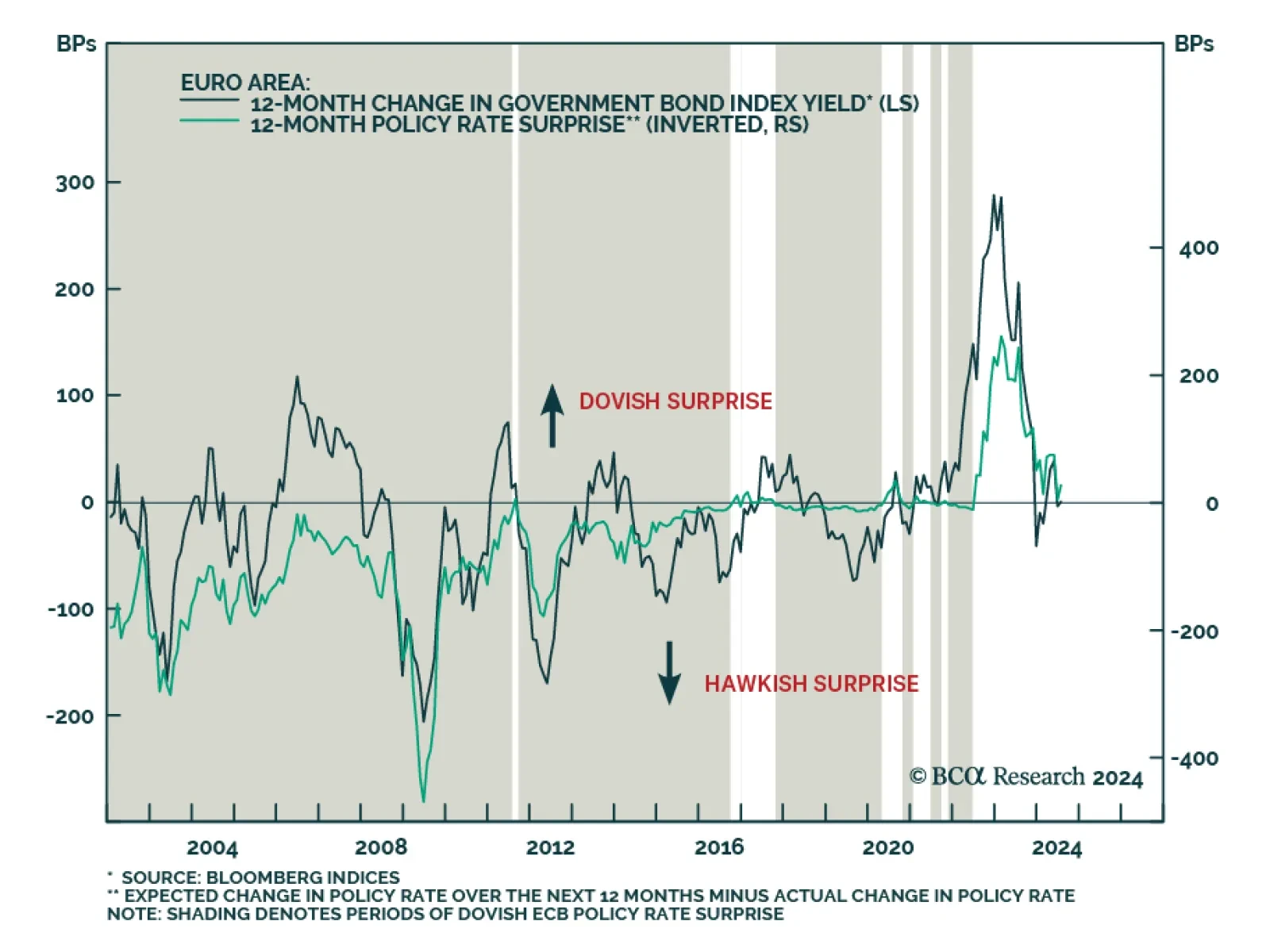

The Euro Area economy broadly surprised to the upside in the first half of 2024. Cooling inflation lifted real wages and the global late cycle amelioration benefitted the pro-cyclical Euro Area economy, but these tailwinds are…

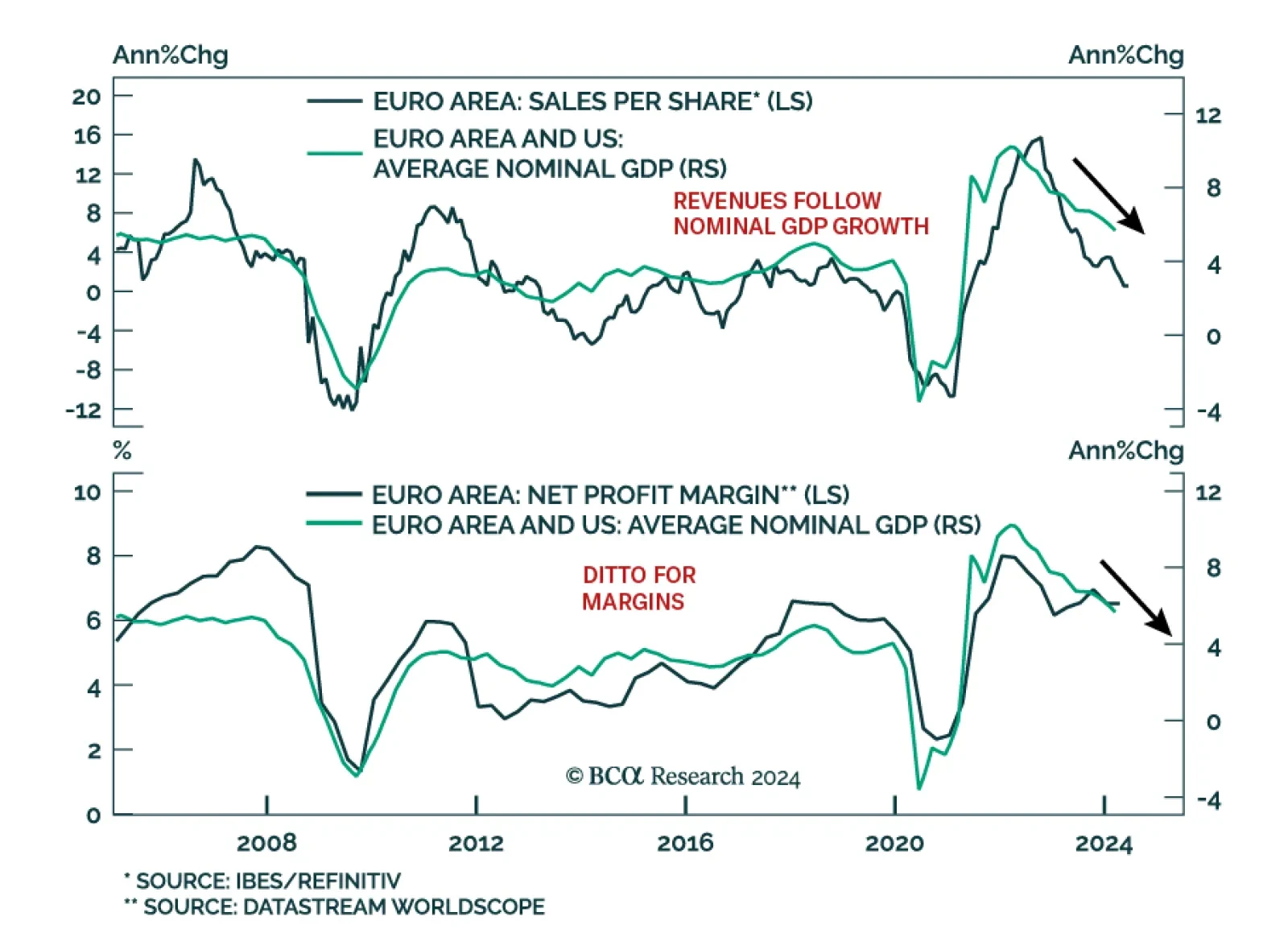

According to BCA Research’s European Investment Strategy service, the threat to European equities stems from growth, not French politics. After the dissolution of the French parliament on June 9th, investors sold…

The real threat to European equities is growth, not political risk. How low will Eurozone earnings fall during the coming recession and how much will equities decline in response?

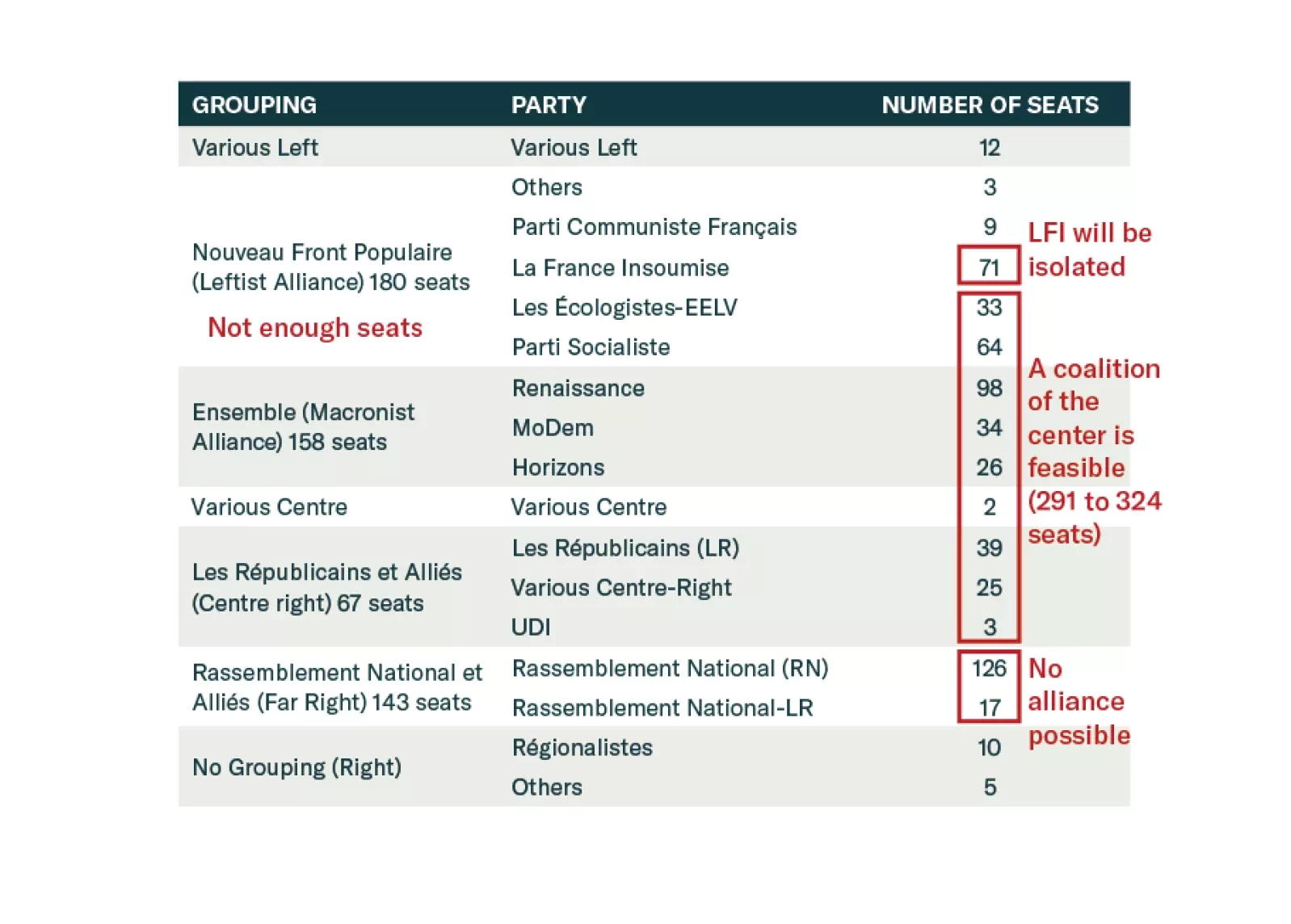

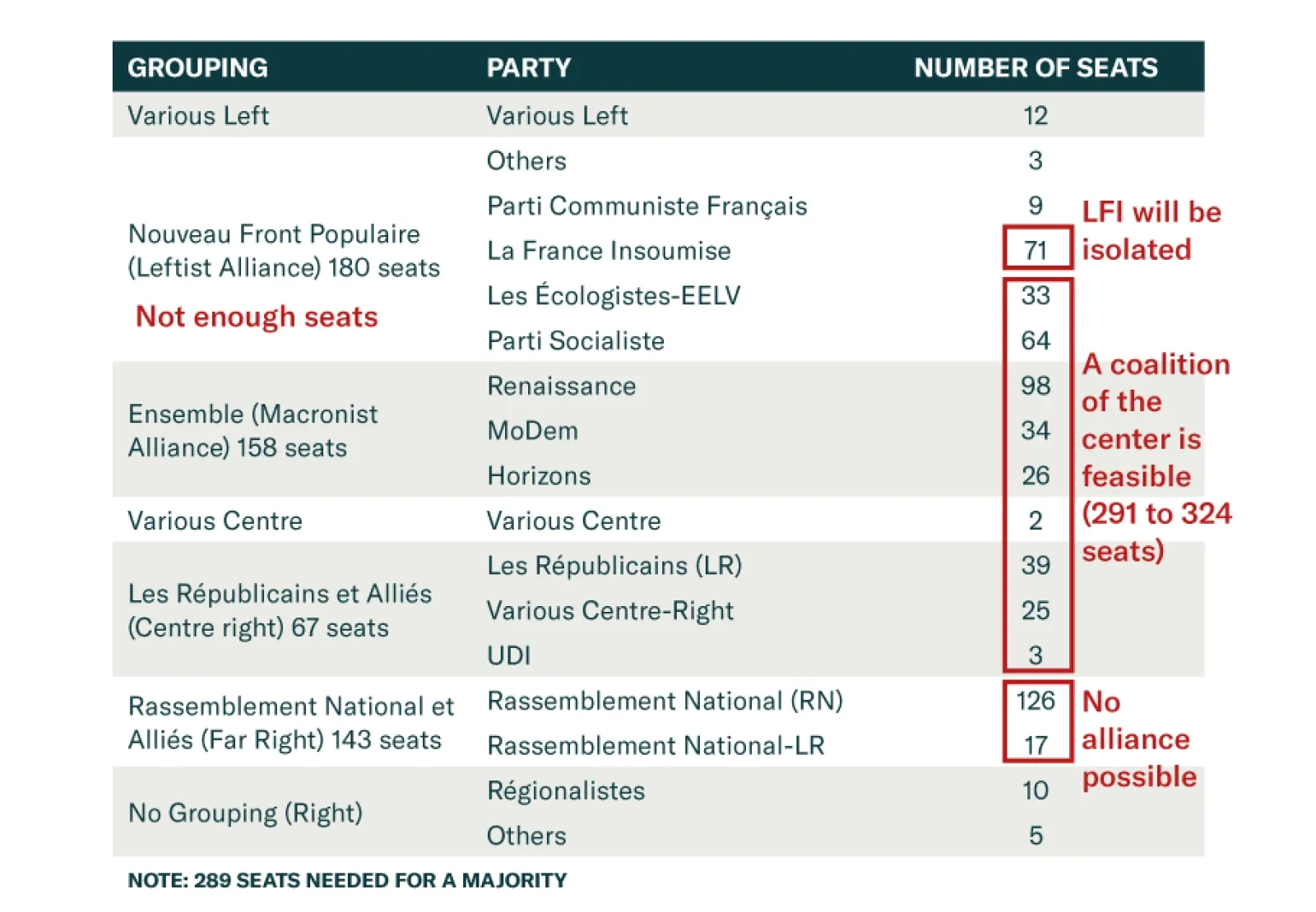

France’s snap election is over and, according to BCA Research’s European Investment Strategy service, President Emmanuel Macron’s gamble paid off in some ways: neither the far right nor the far left can form a…

At first glance, France has moved to the far left. However, this coalition is fragile, and Macron’s allies still hold the balance of power. What are the assets that will benefit from this new political setup, and those that will not…

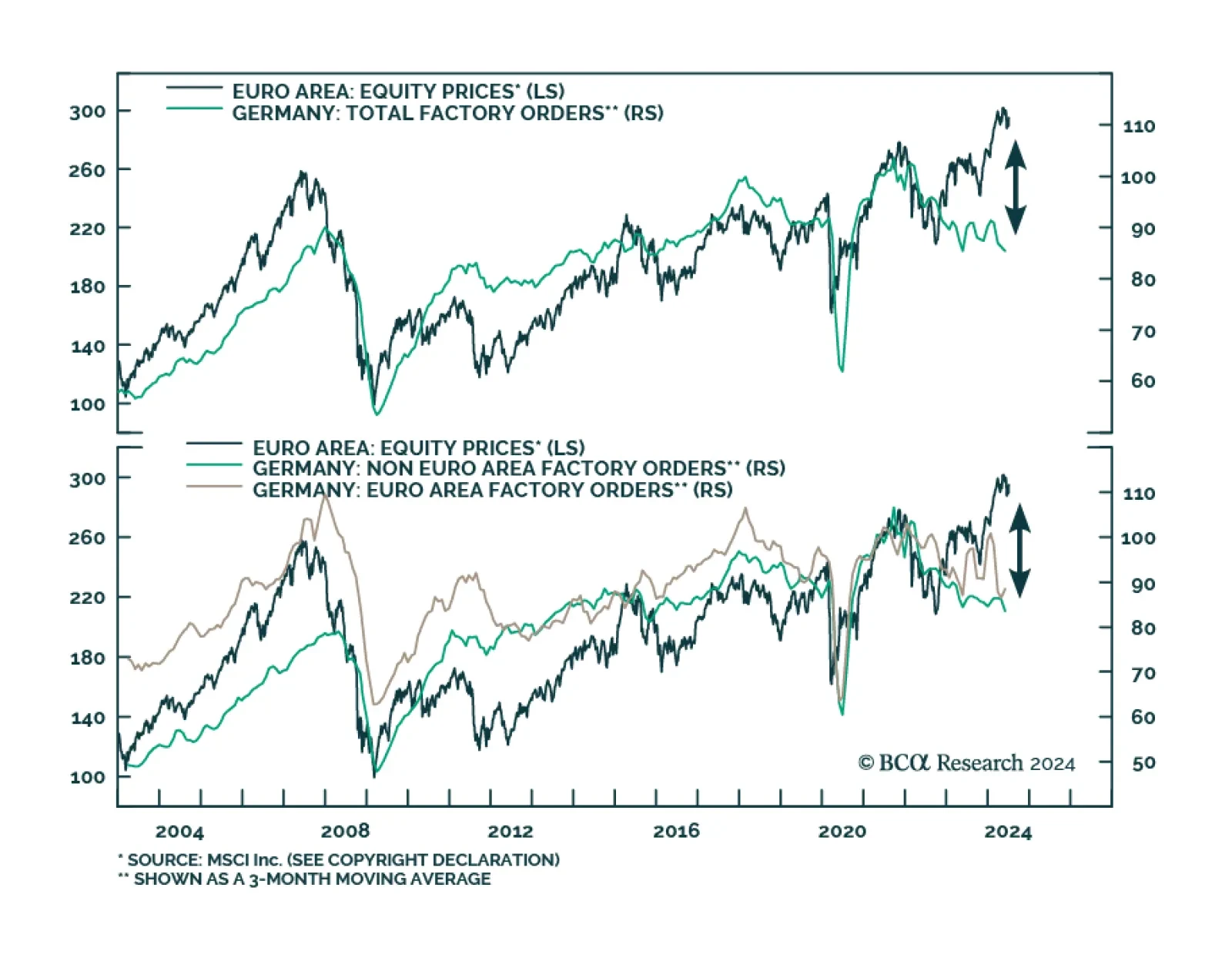

German Factory orders disappointed on Thursday. The month-on-month contraction deepened to 1.6% in June from a contraction of 0.6% in May, revised down from the previously reported 0.2%, well below expectations of a modest 0.5%…

Does the incipient slowdown in European data herald a soft landing and a goldilocks period for equities? We have our doubts.

Eurozone headline inflation slowed from 2.6% y/y to 2.5% in June. Germany, its largest economy, saw price pressures ease from 2.4% to 2.2%, below expectations of 2.3% (or from 2.8% to 2.5% on an EU-Harmonized basis). However,…

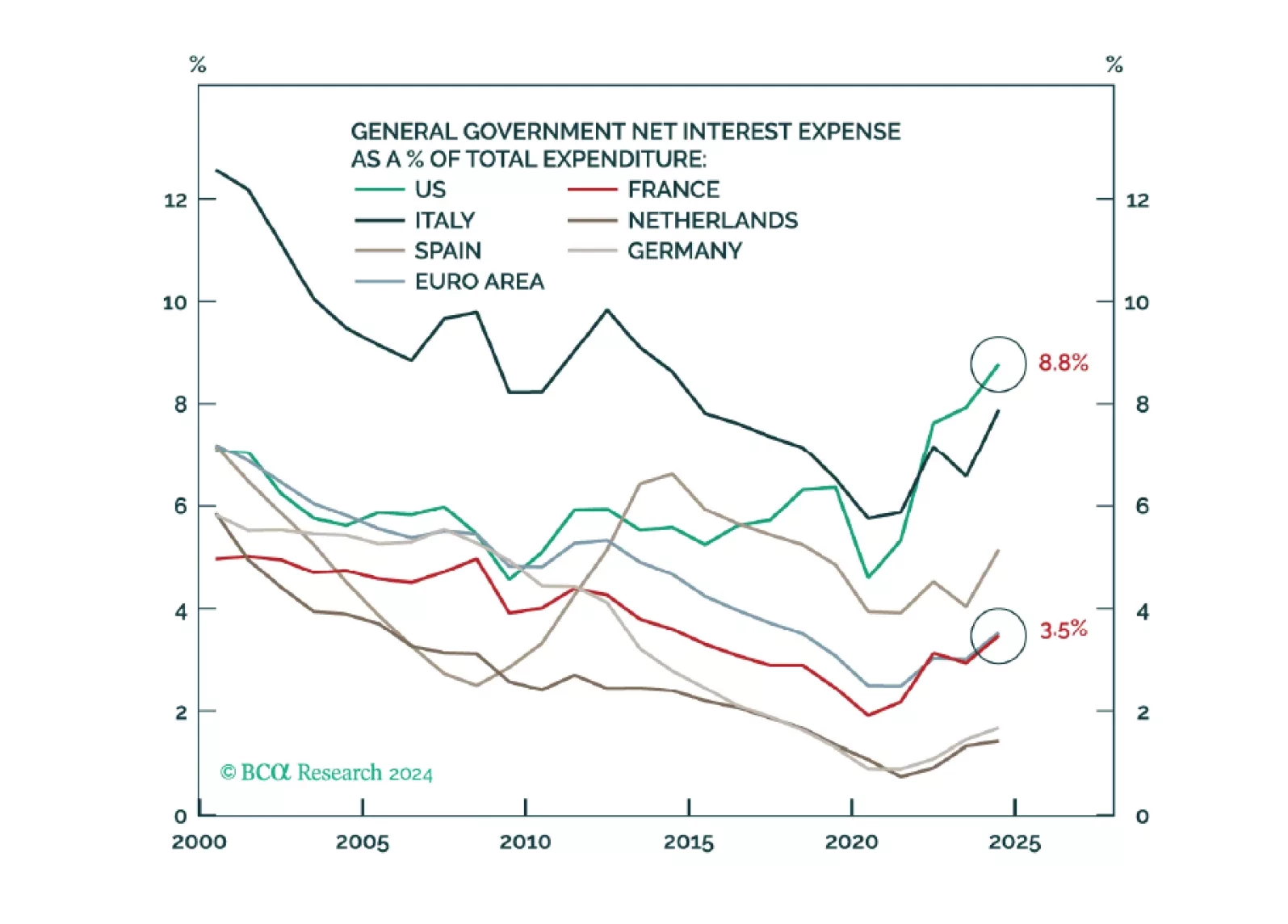

In our Volume I – The Alpha Report – we posit that the French bond market reaction is a mere amuse bouche for what is coming to the US. All year, we have warned investors that US politics could induce a bond market riot. This moment…

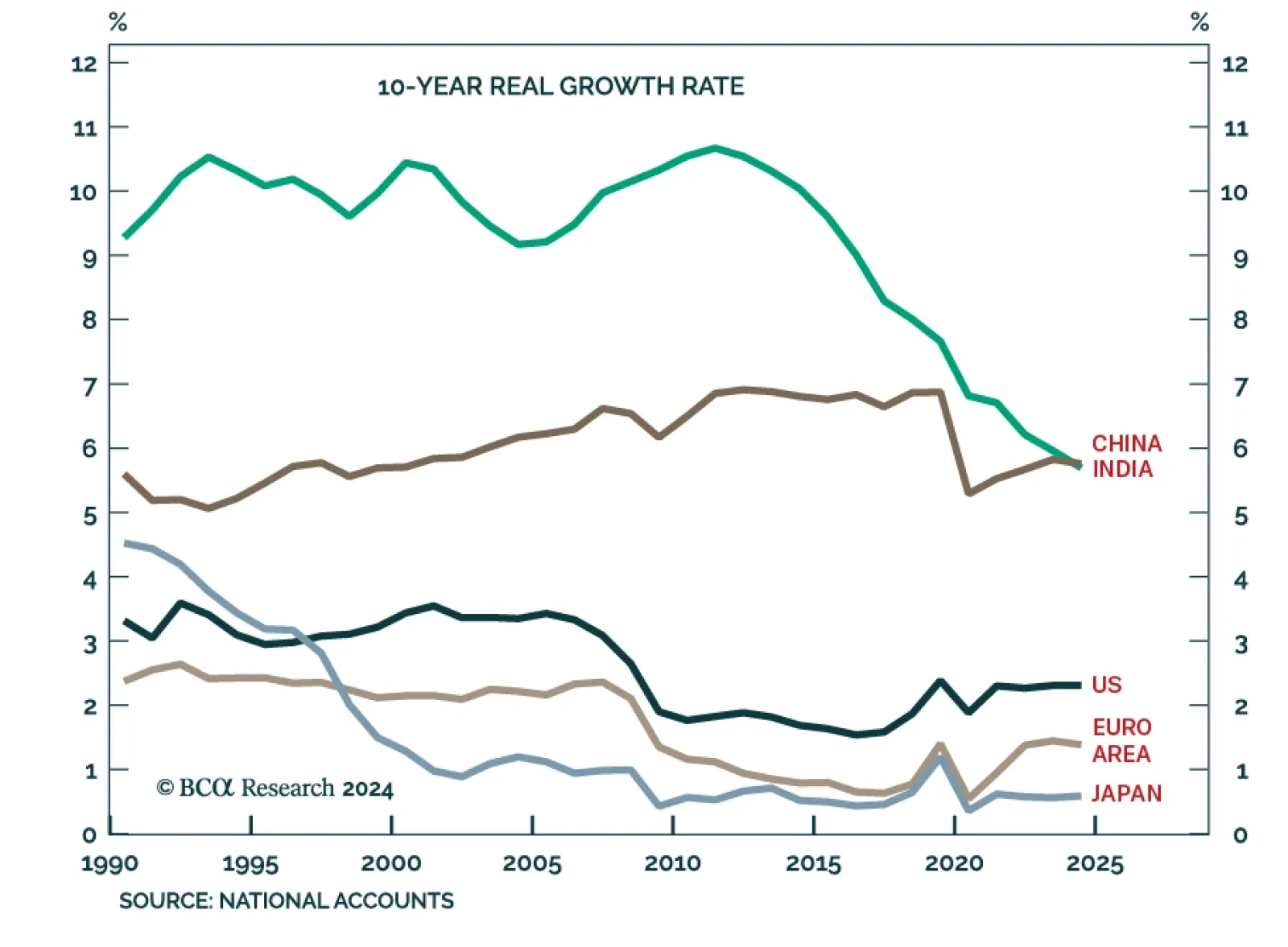

According to BCA Research’s Counterpoint service, absent China’s exponential credit growth, China’s trend growth rate will fall to 4 percent and the world’s trend growth rate will fall to sub-3 percent.…