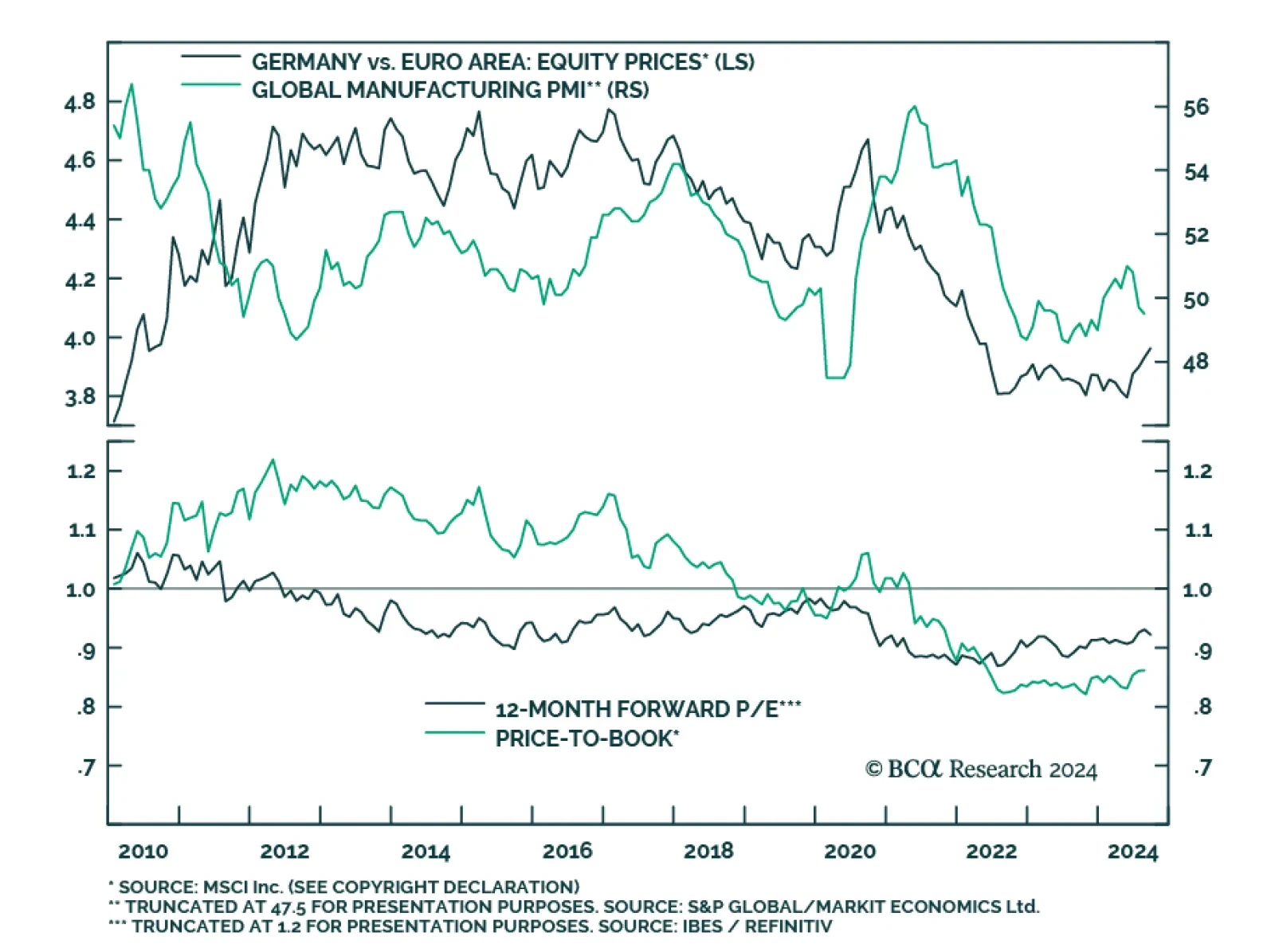

German equities have outperformed their Euro Area peers on a year-to-date basis, with the gap widening since May. The MSCI Germany Index returned nearly 4.5 percentage points more than the MSCI Eurozone index over the latter…

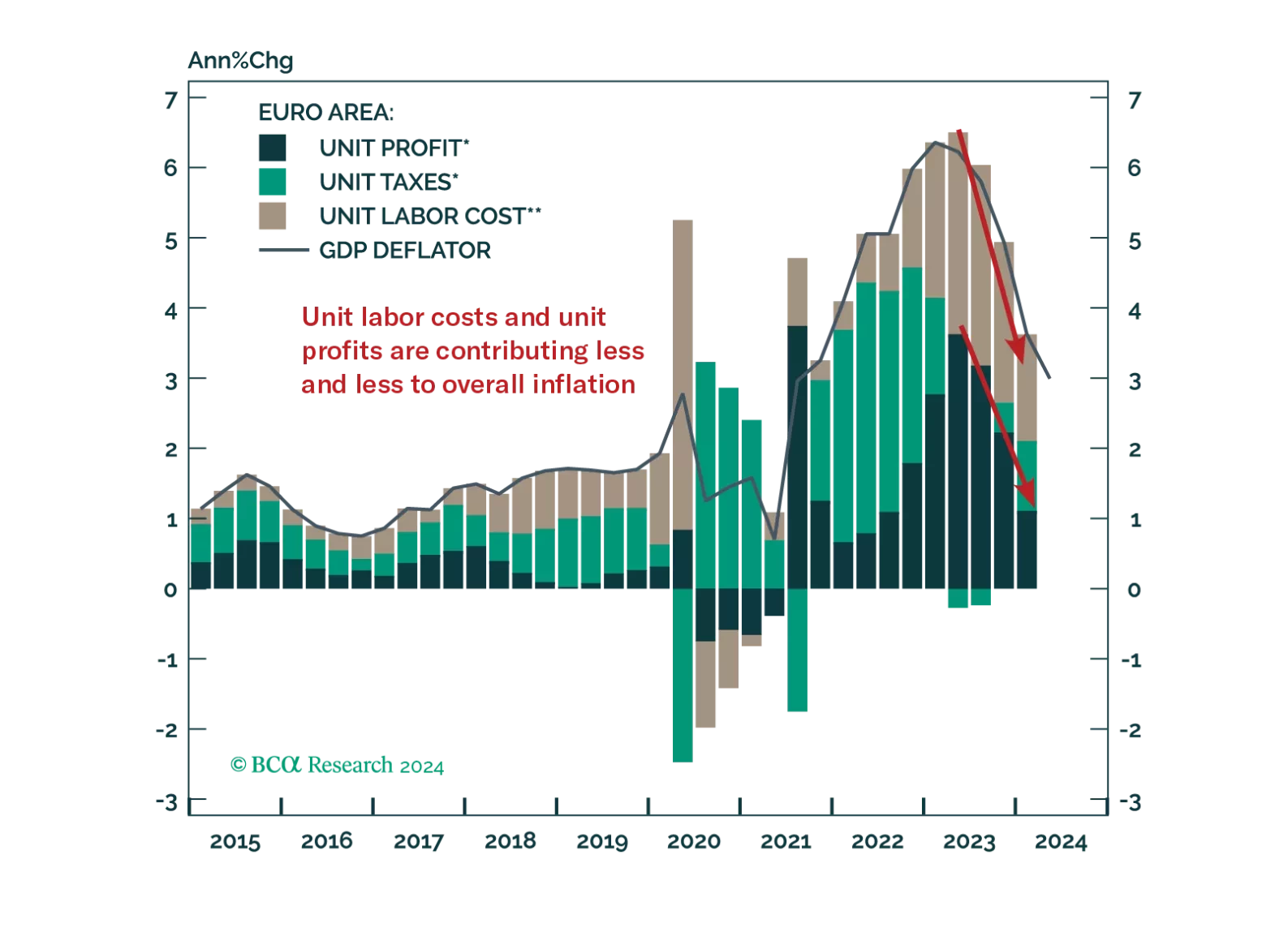

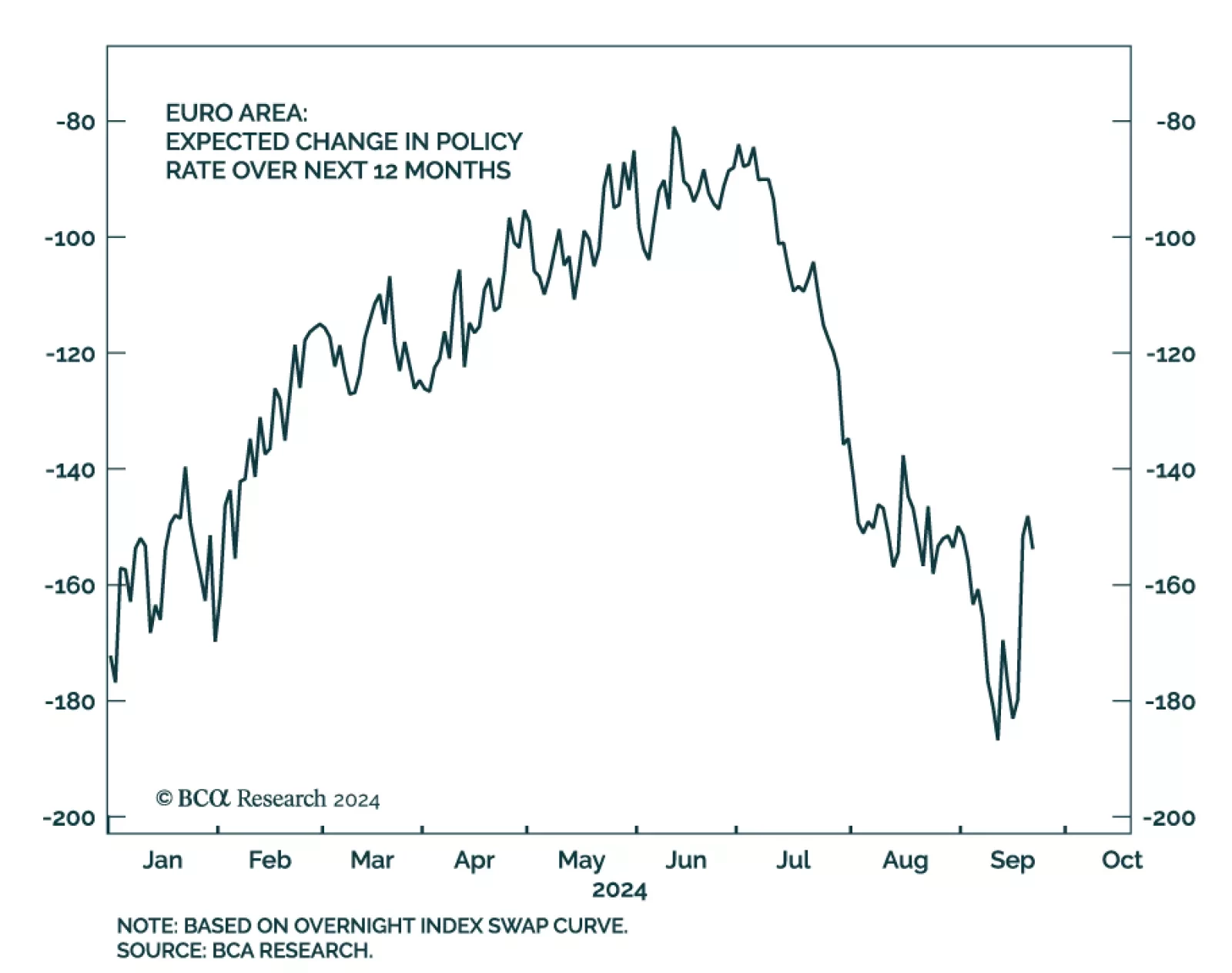

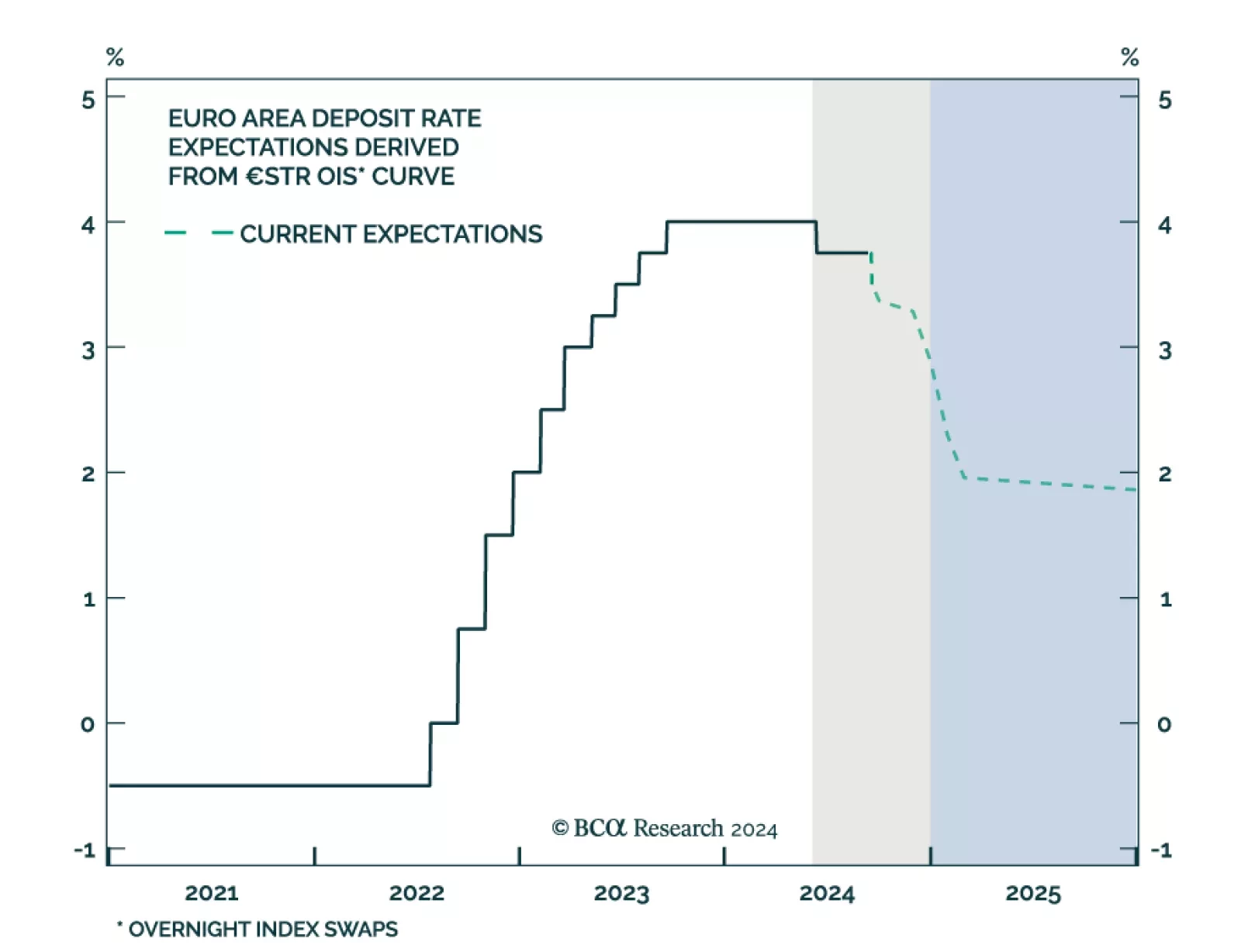

The European Central Bank (ECB) cut rates by 25 bps in September. It did not signal consecutive rate cuts and we highlighted that the short inter-meeting timeframe between September and October provides little scope for ongoing…

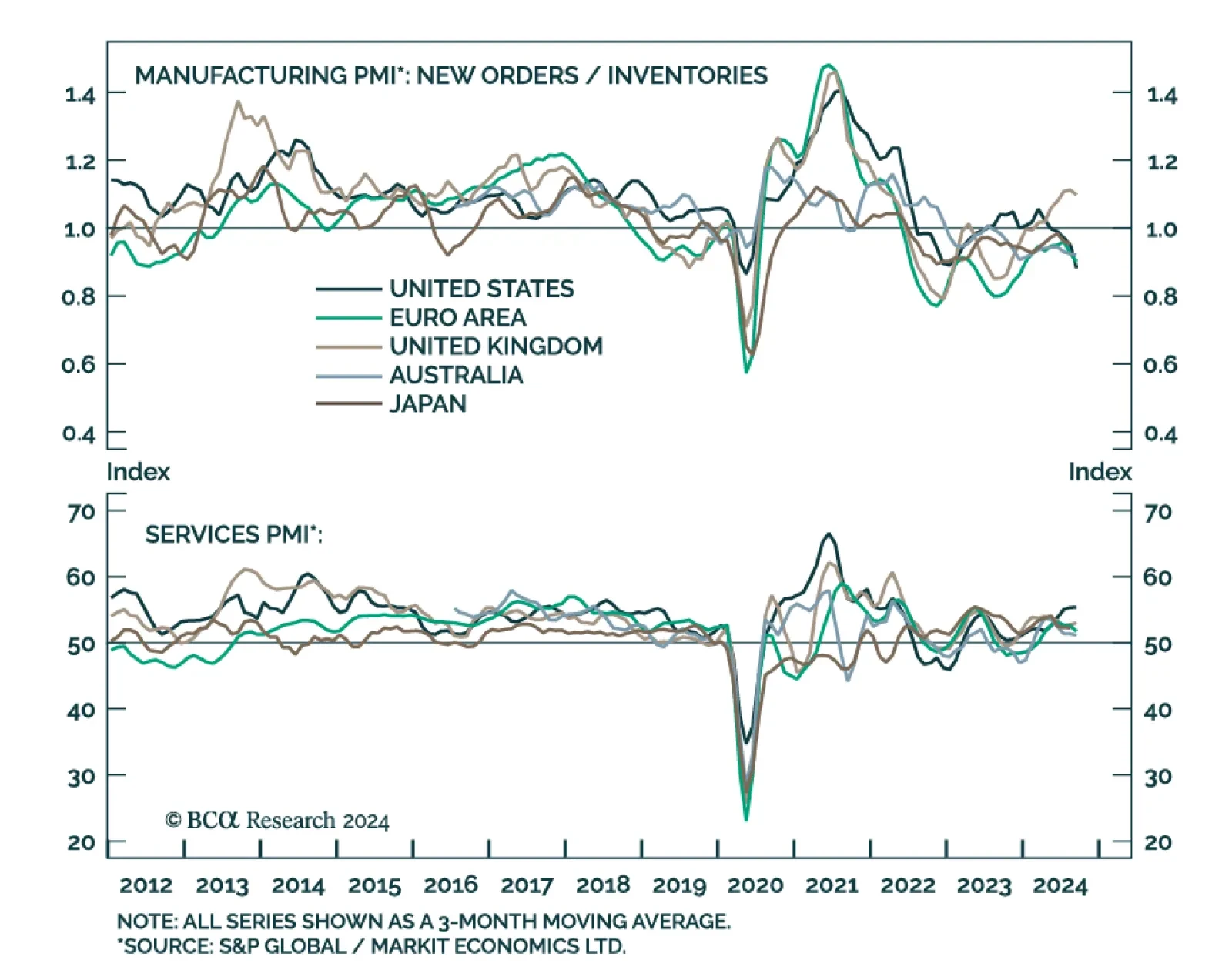

Preliminary estimates suggest that activity continued to slow across DM economies in September. Manufacturing PMIs contracted at a faster pace in the US, Eurozone, Germany, France and Australia, and grew at a slower pace in…

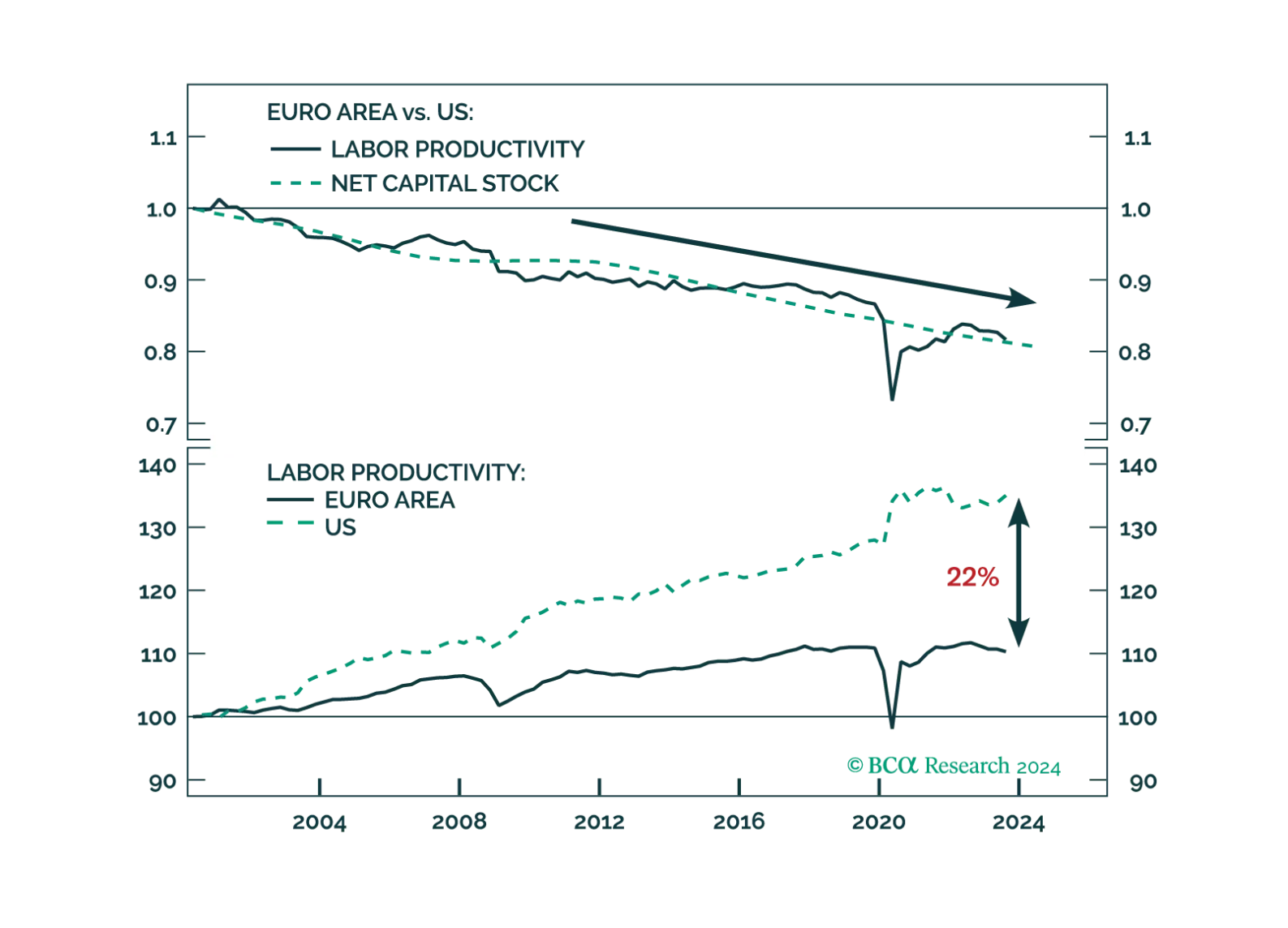

The Draghi report highlights sensible reforms that would address many of Europe’s productivity shortcomings. Whether European capitals heed Mario Draghi’s advices remains to be seen.

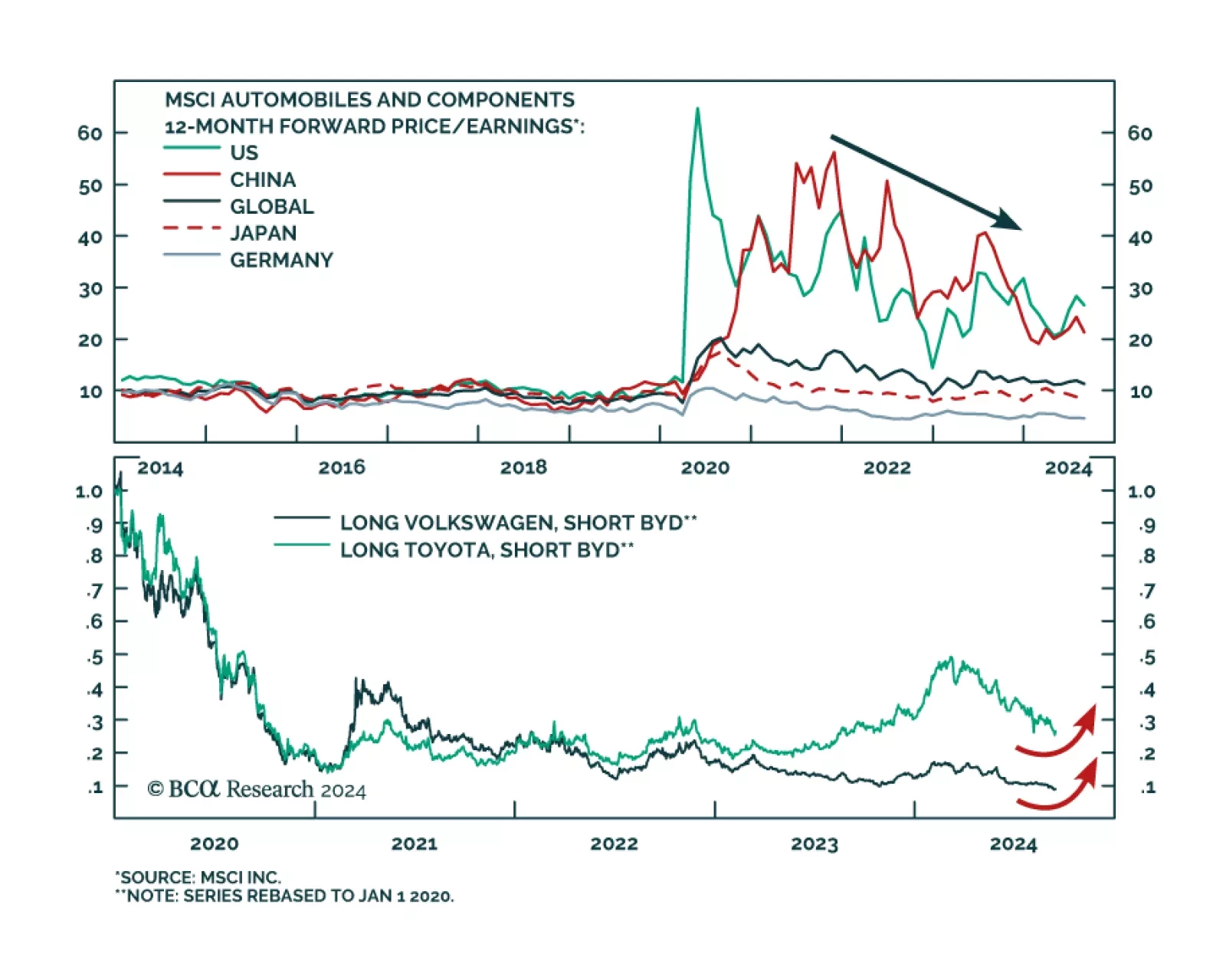

Volkswagen’s CEO has been making the point that the market for European carmakers has been deteriorating. Earlier last week, he went on to make a rather pointed reference at Chinese EV manufacturers. He was quoted…

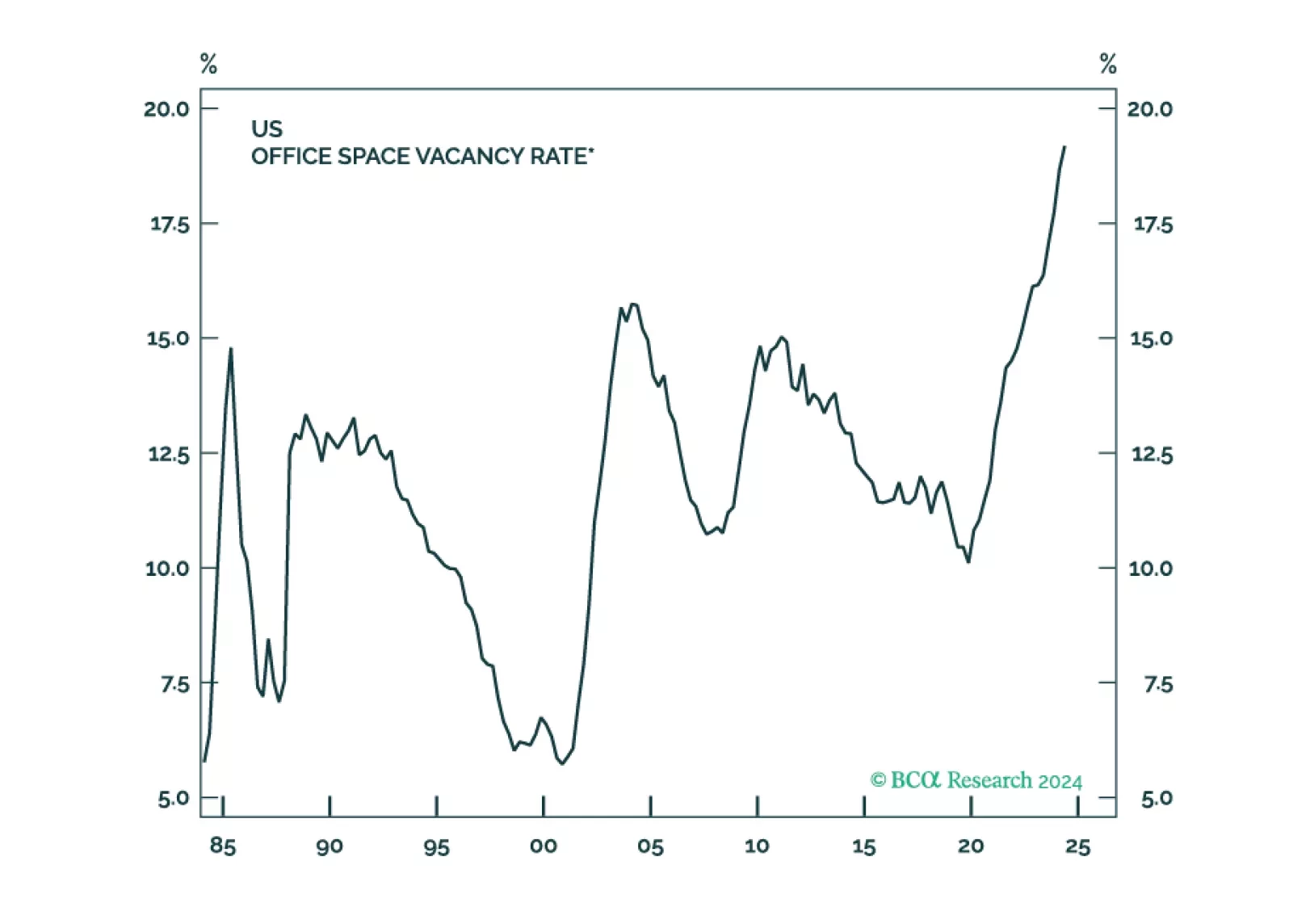

The US suffers from enough imbalances to produce a mild recession. Unfortunately, such a recession could lead to a significant bear market in stocks, just as it did during the very mild 2001 recession.

The ECB will cut rates once more this year; however, markets underprice how far it will ease next year.

ECB Governing Council members unanimously voted in favor of lowering the deposit facility rate by 25 bps to 3.50% in September, marking the second cut this year. Moreover, expectations for weaker domestic demand led the ECB to…

Following a 12-year-long bear market, Greek equities have returned a whopping 186% in EUR terms from their 2016 lows. The Greek macroeconomic backdrop has indeed improved. Since 2021, Greece’s nominal GDP growth has…

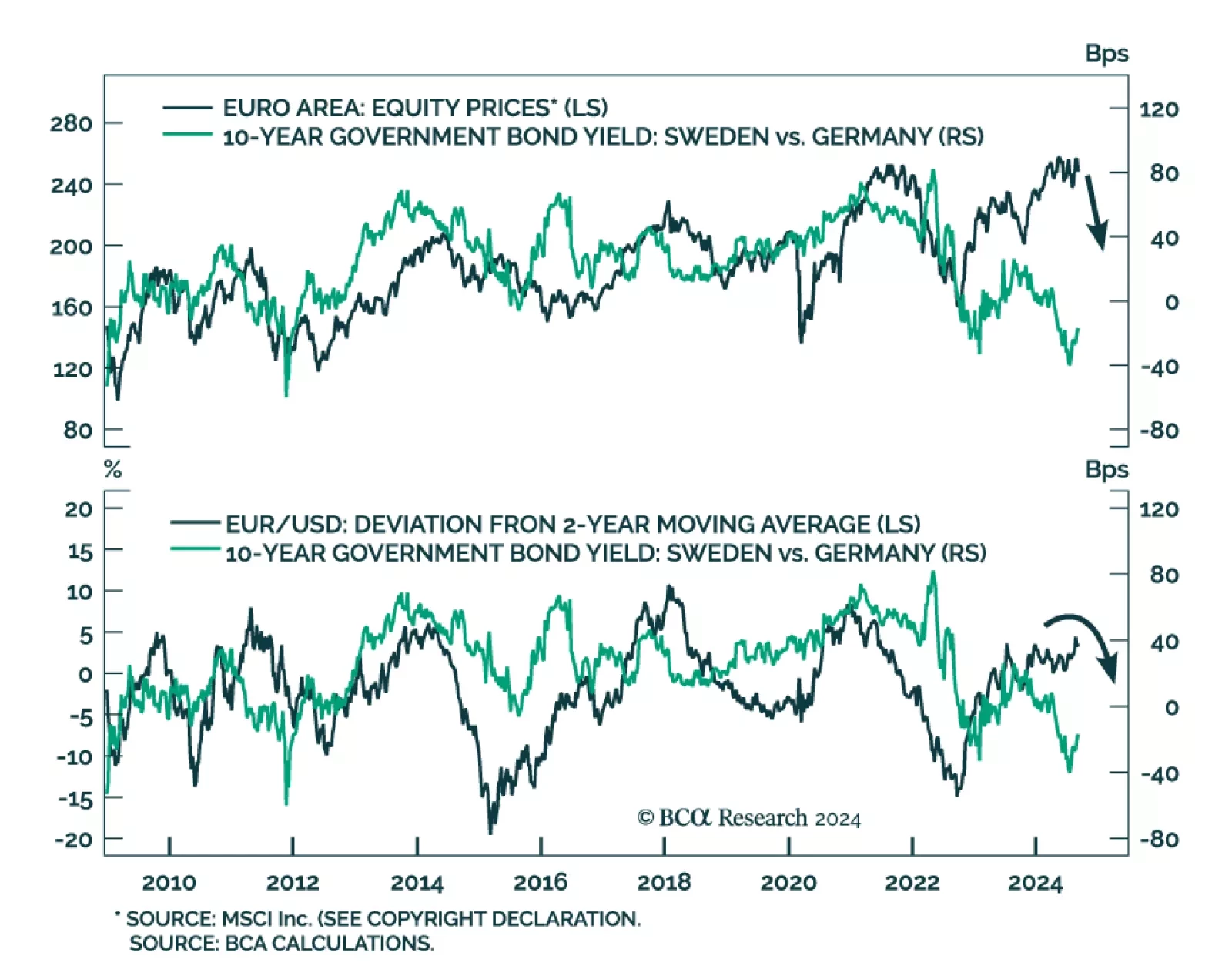

The Swedish economy’s cyclicality and sensitivity to global trade make it a reliable bellwether for global growth. Sweden is facing significant domestic weakness. Employment growth declined by 0.14% y/y in July and…