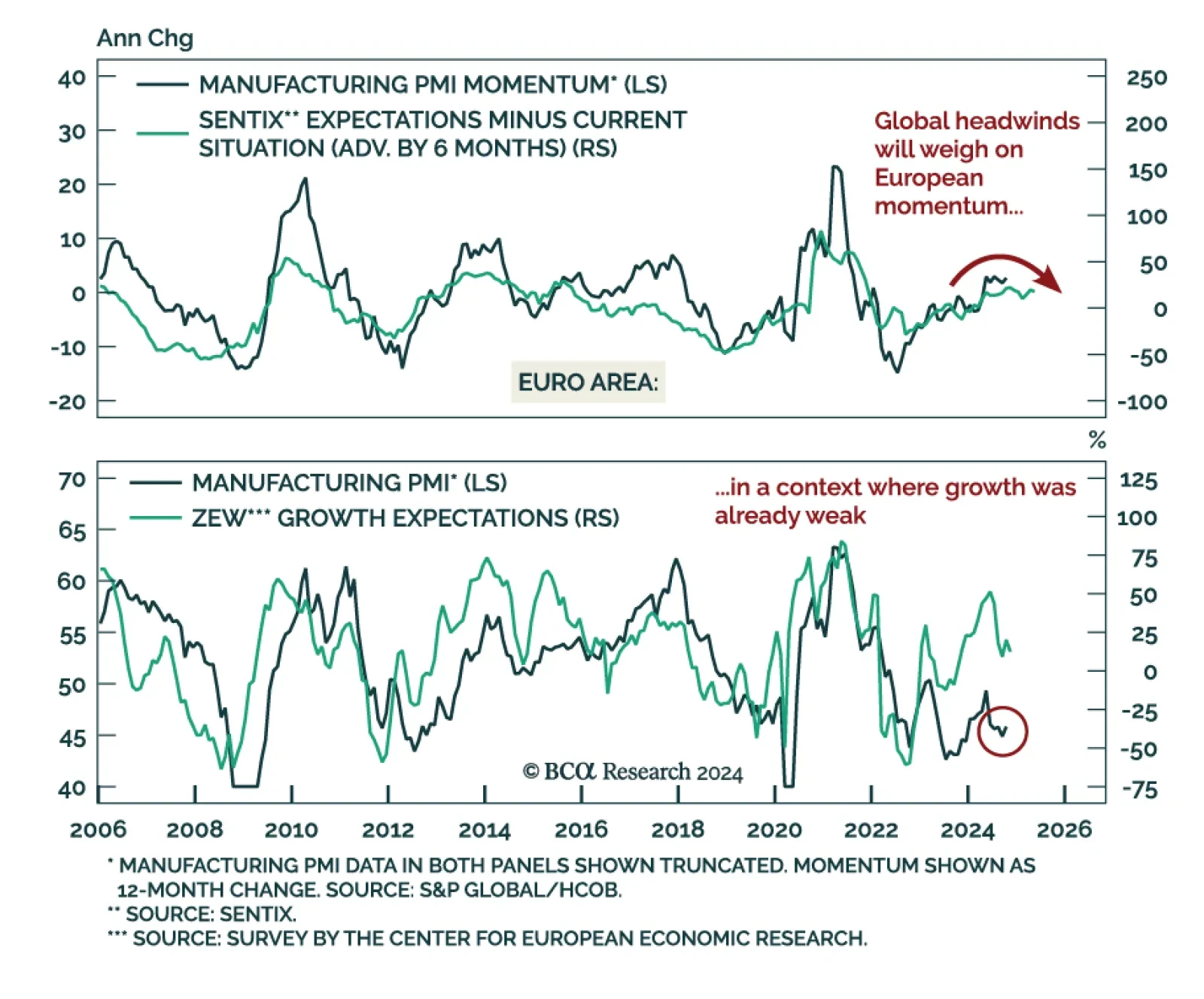

Economic expectations for Germany and the Eurozone disappointed, with the November ZEW decreasing to 12.5 from 20.1. The assessment of current conditions also worsened, implying the sentiment rebound from September will not be…

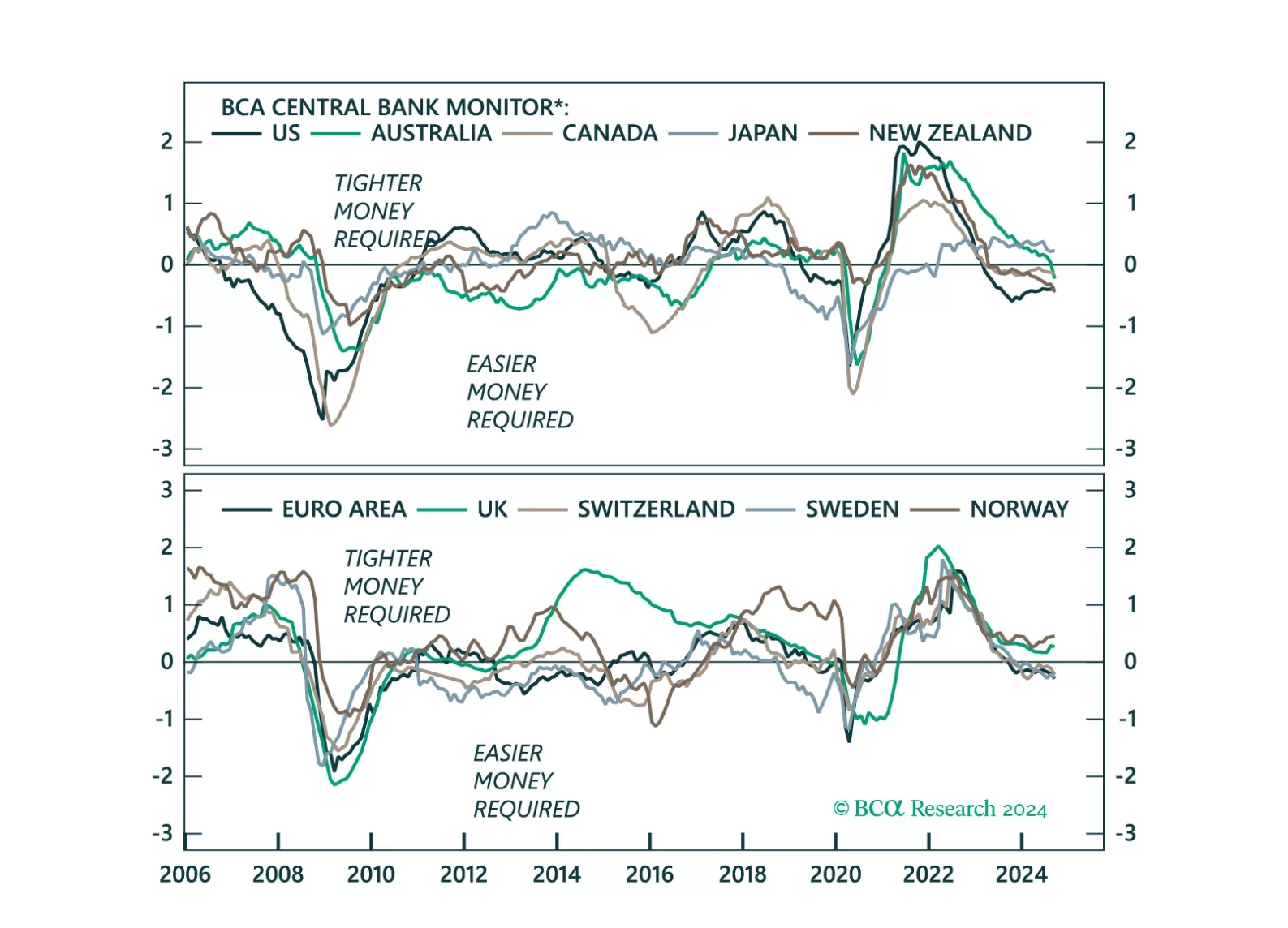

This week, we update our Central Bank Monitors (CBMs), that help us calibrate how monetary policy should be adjusted in developed-market economies. Our conclusion is that while overall, easier monetary settings are required, there a…

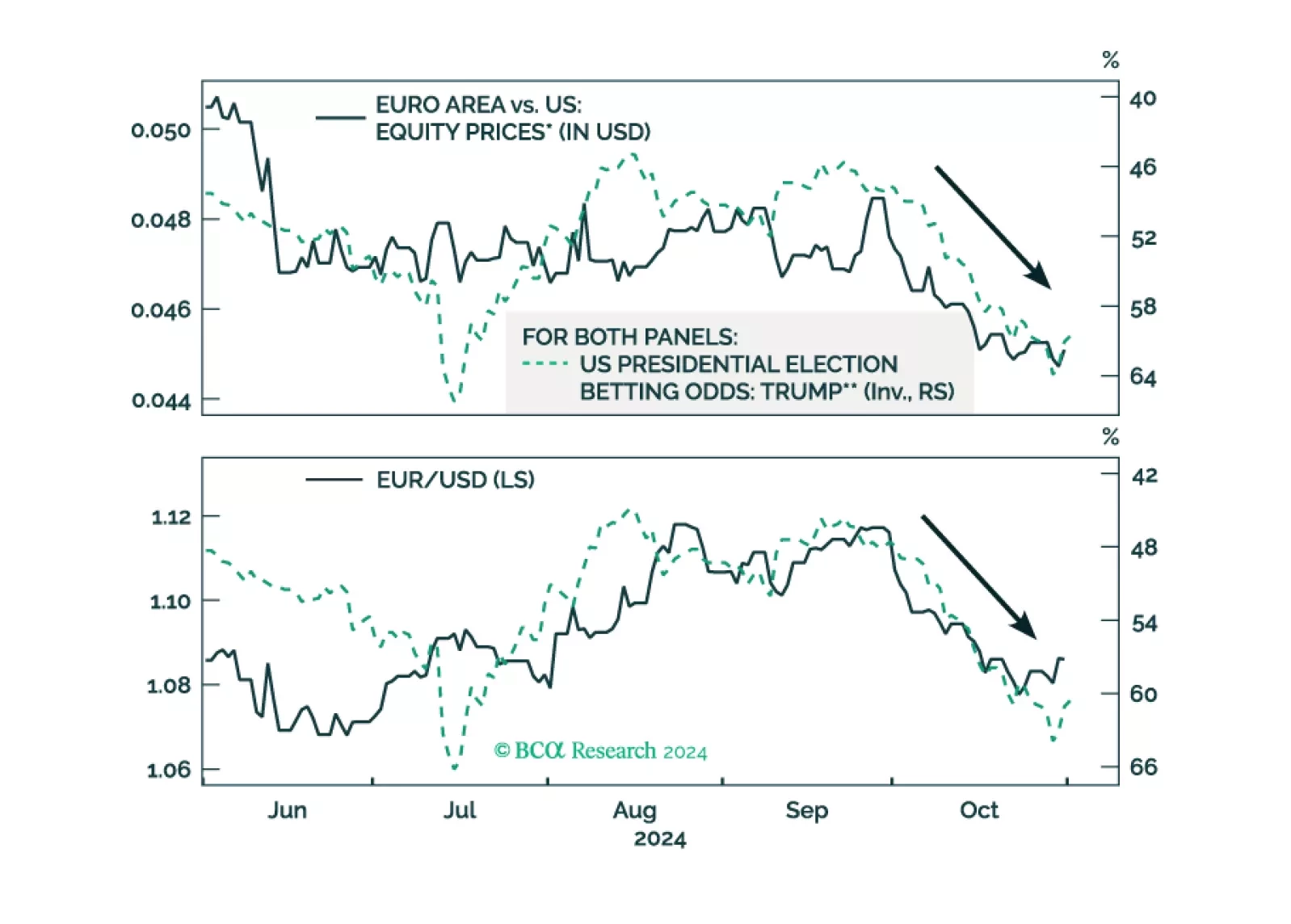

As the odds of a Trump victory rise, European assets underperform US ones. What would be the immediate impact of a Trump victory on European stocks?

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

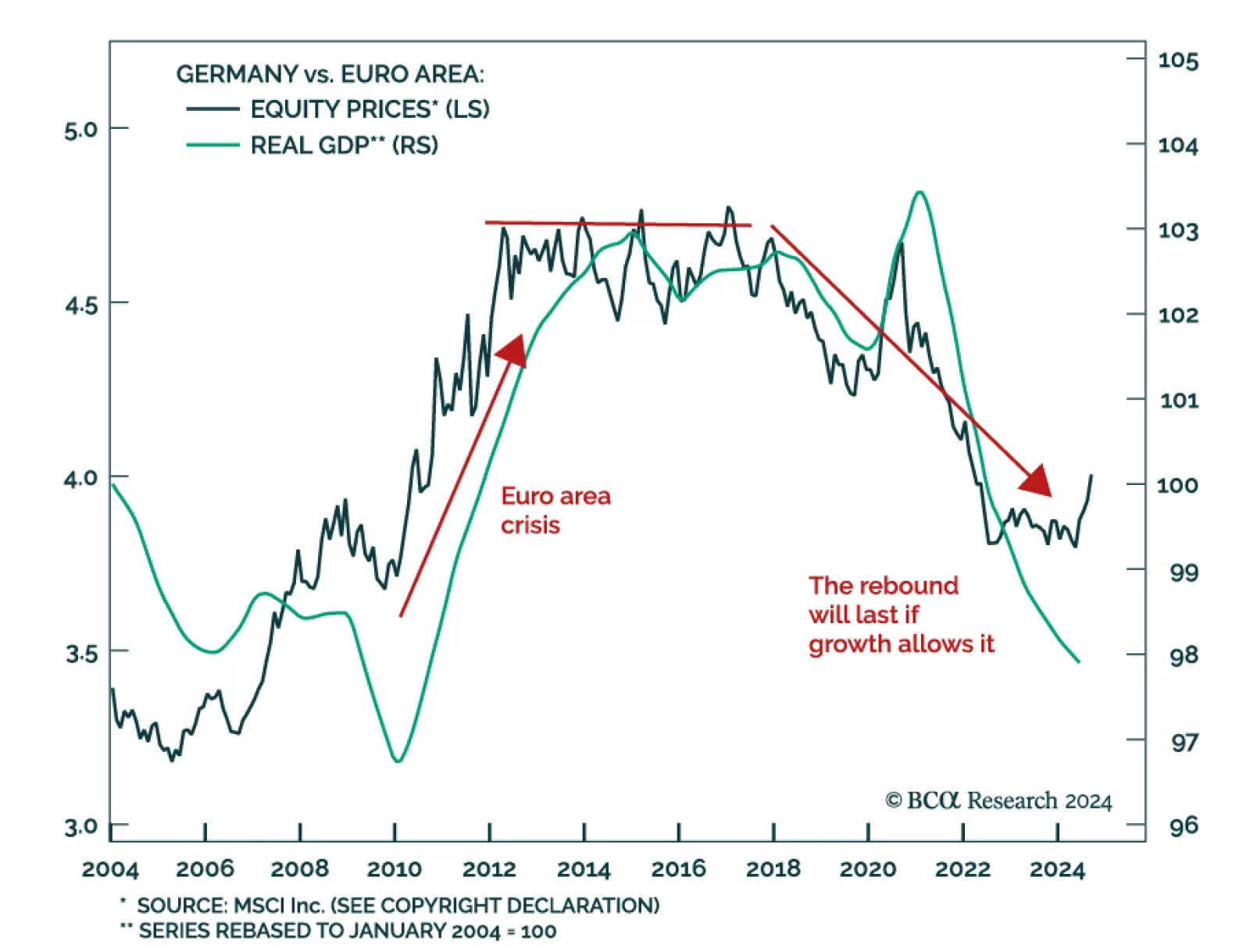

Germany’s problems are well known: Demographics, Chinese competition, underinvestment, energy dependence, and constrained fiscal policy. Our European Investment Strategy colleagues believe this bad news is priced in…

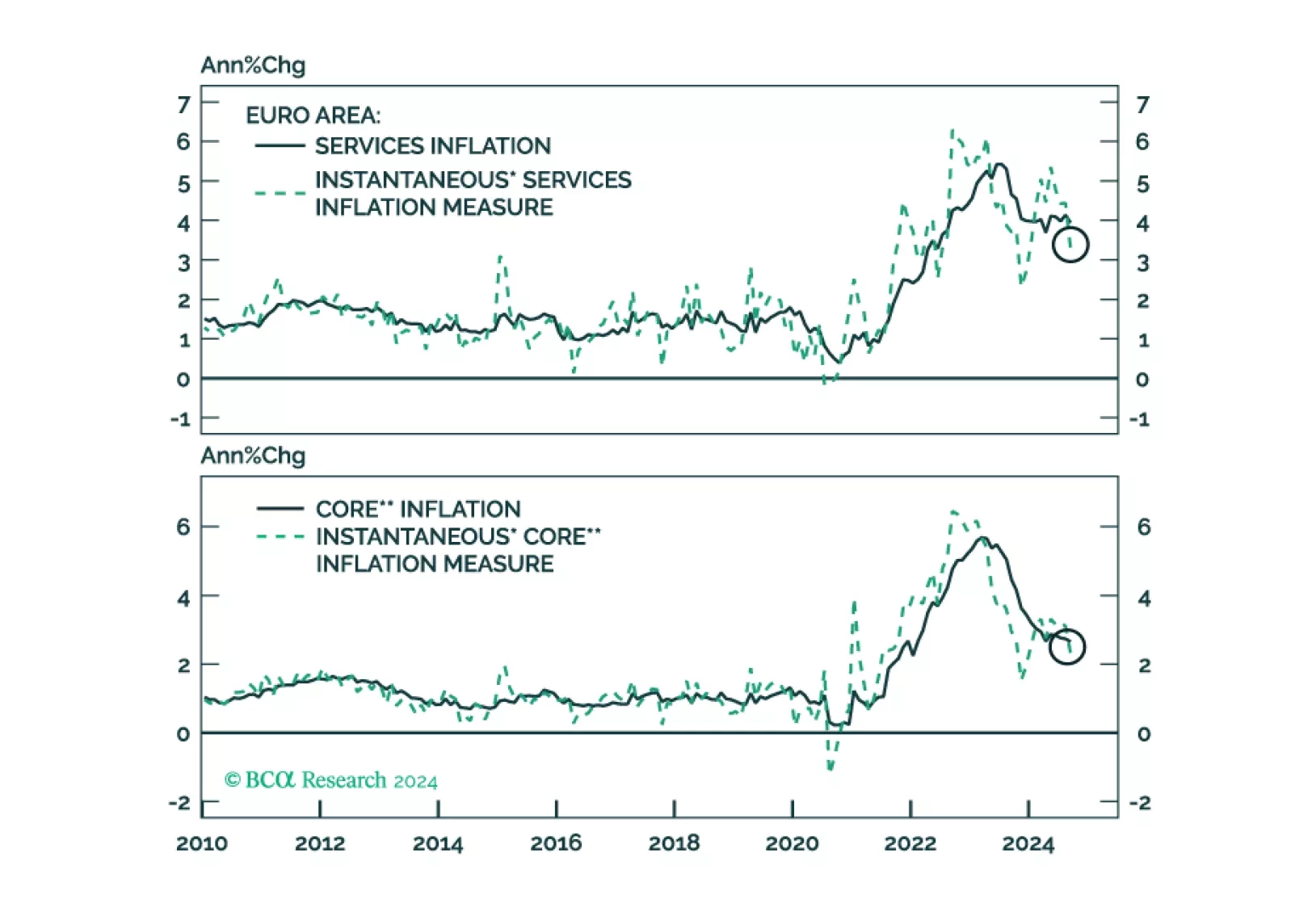

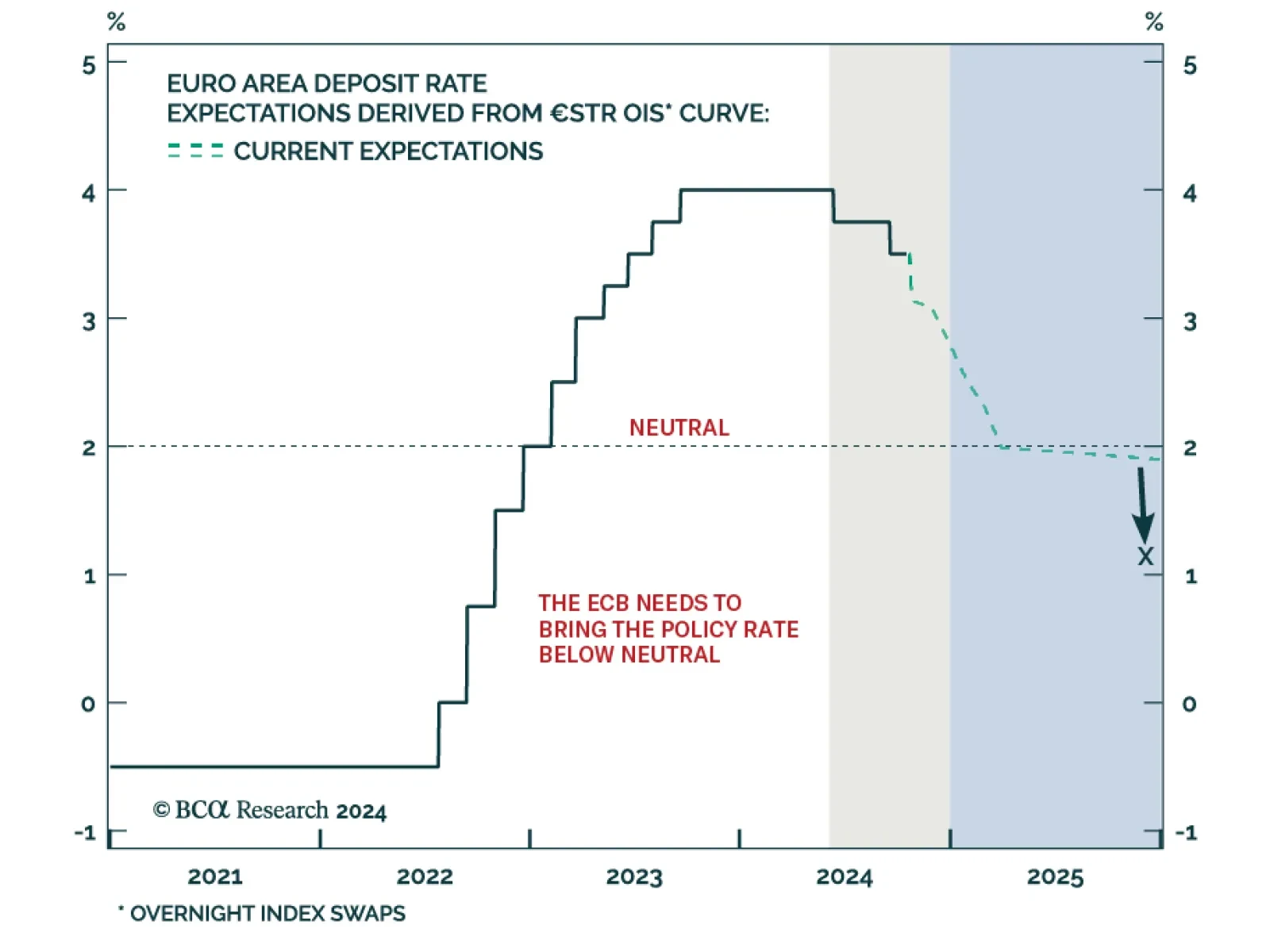

Yesterday, the ECB solidified its recent dovish tilt in response to weaker growth and decreasing inflationary pressures. It is now set to cut rates 25bps each meeting. How low will the ECB deposit rate ultimately go and what does…

The ECB cut interest rates by 25 bps for the third time this year, lowering the deposit facility rate from 3.5% to 3.25%. While the ECB is avoiding explicitly committing to a path for policy, President Lagarde’s repeated…

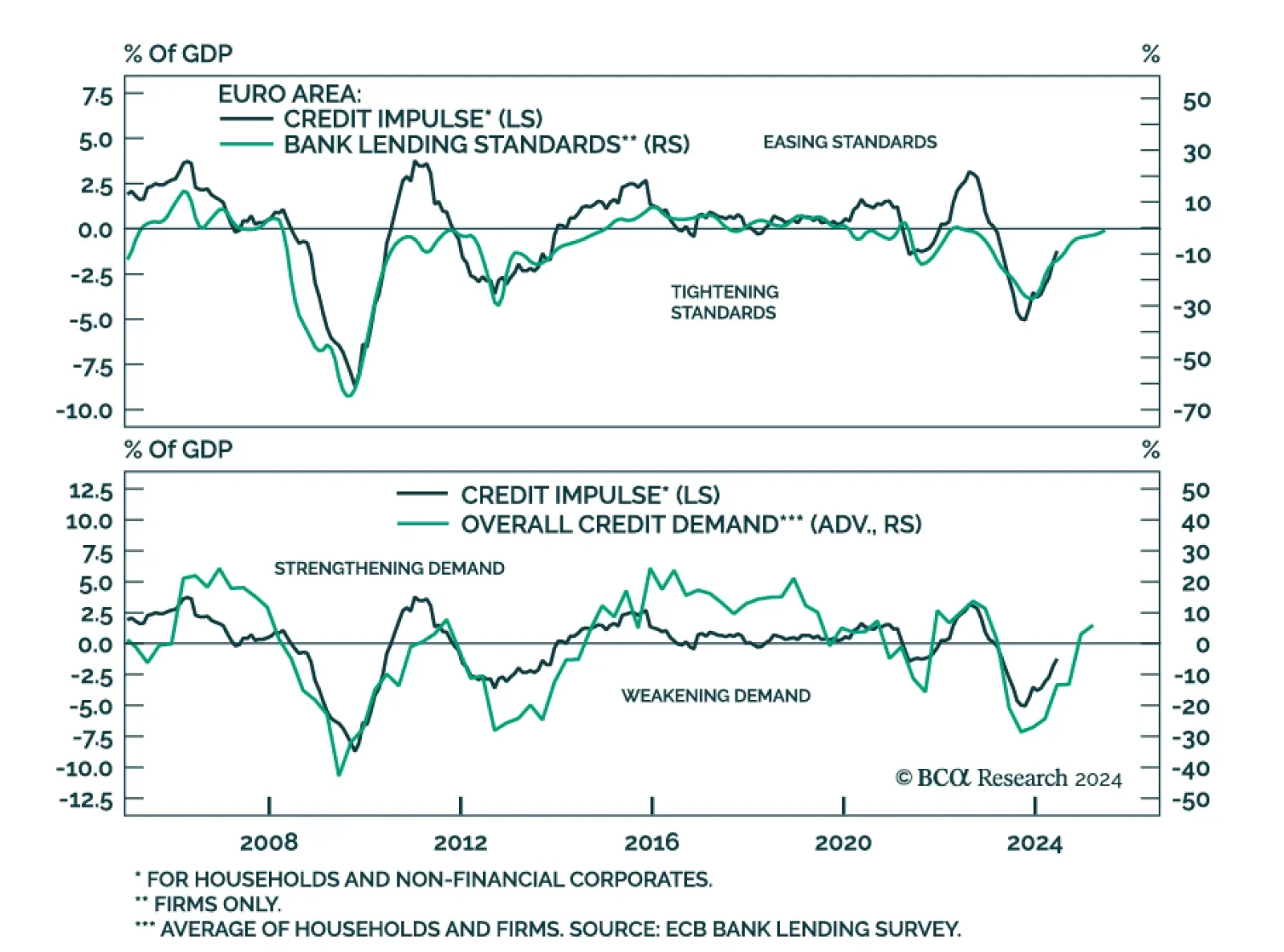

Banks reported an increase in loan demand from both firms and households in the European Central Bank’s Bank Lending Survey, marking the first rise since 2022. This demand increase occurred as lending standards for firms…

Japanese core machinery orders decreased by 1.9% in August and dropped 3.4% year-over-year, missing expectations for modest growth. This decline reversed July’s improvement, when machinery orders grew at an 8.7% annual pace…