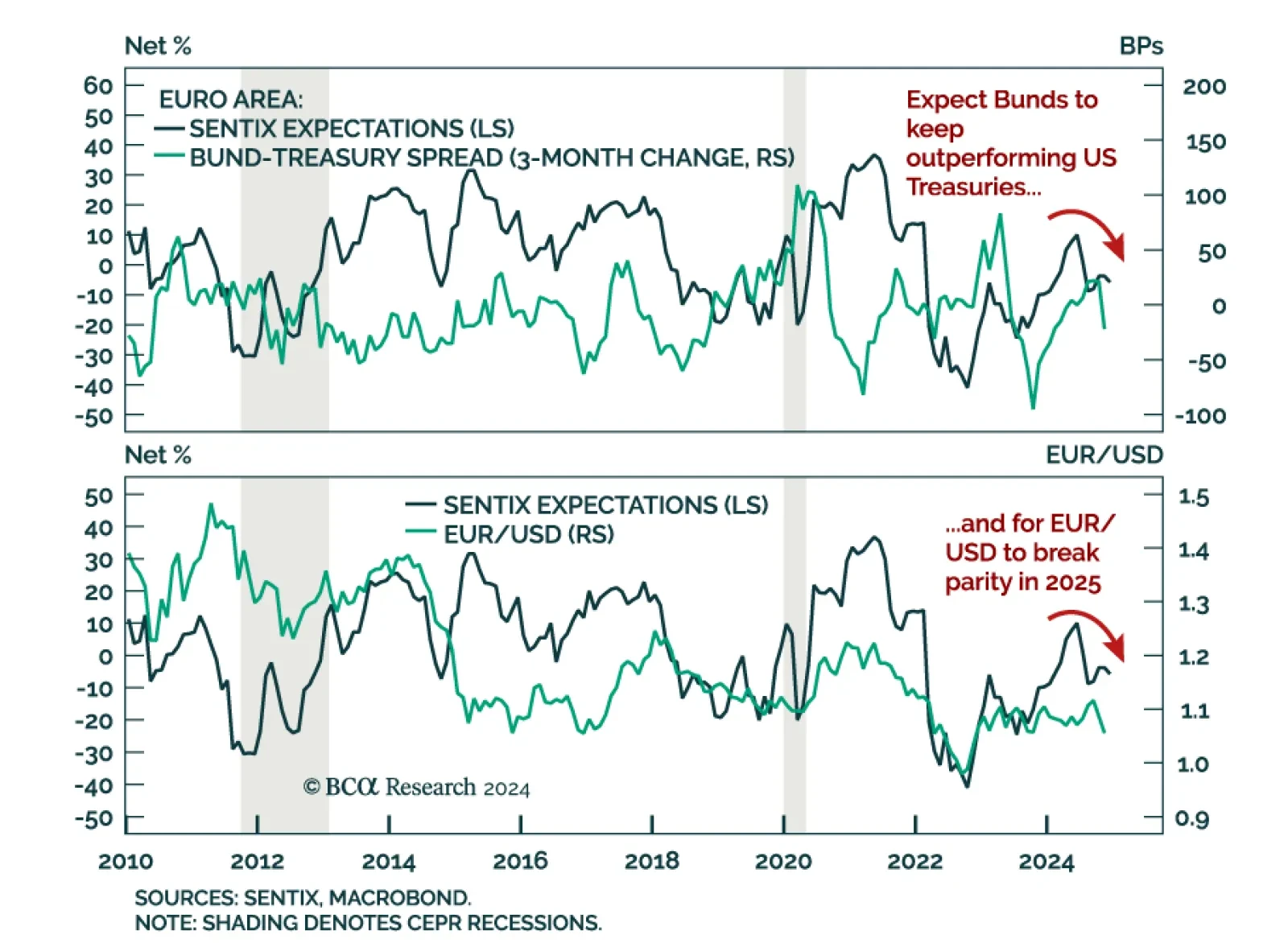

The December Sentix Economic Index for the Euro Area missed expectations, declining to -17.5 vs. -12.8 in November. Both the current situation and expectations components declined. As the first sentiment indicator for…

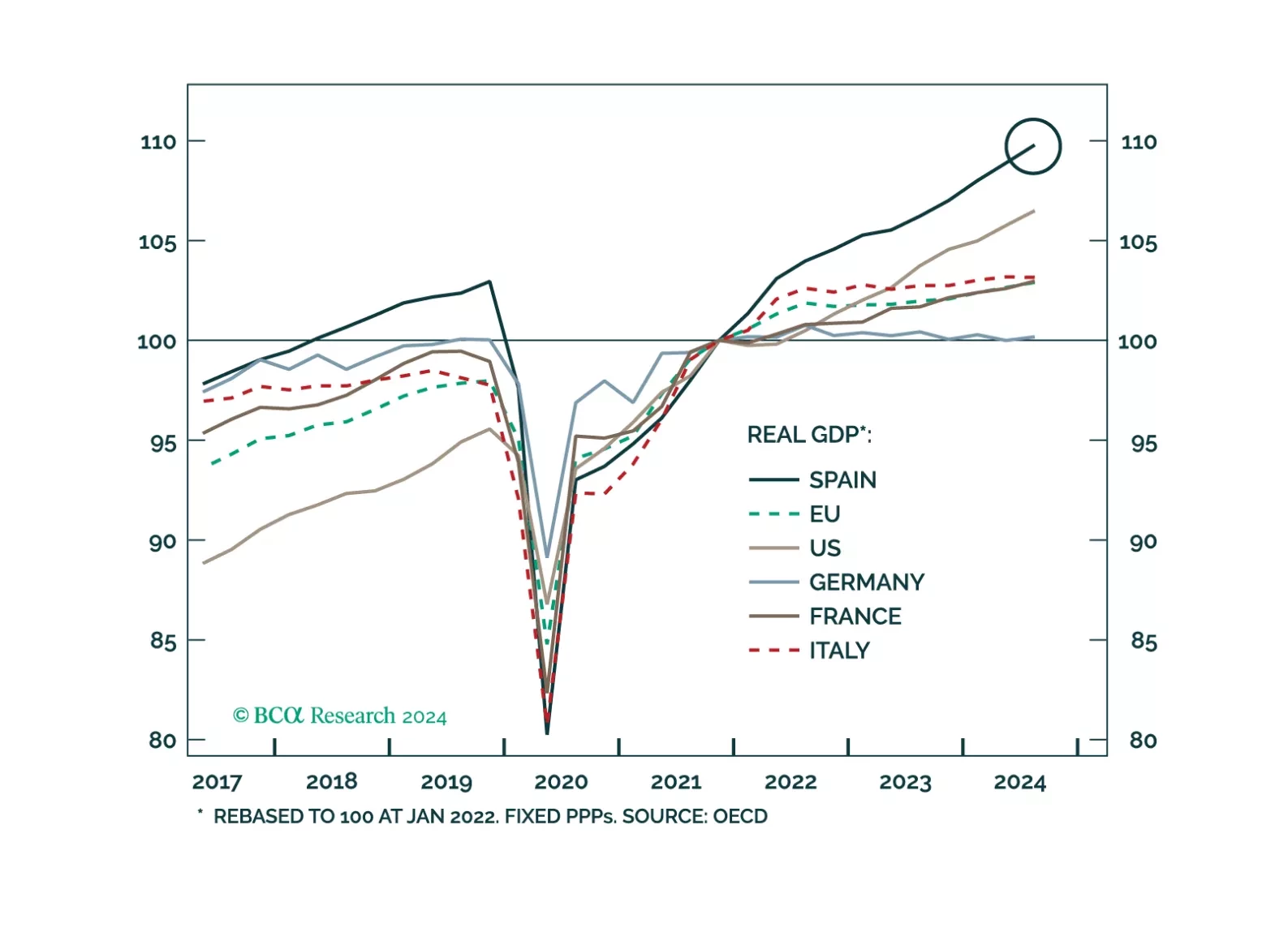

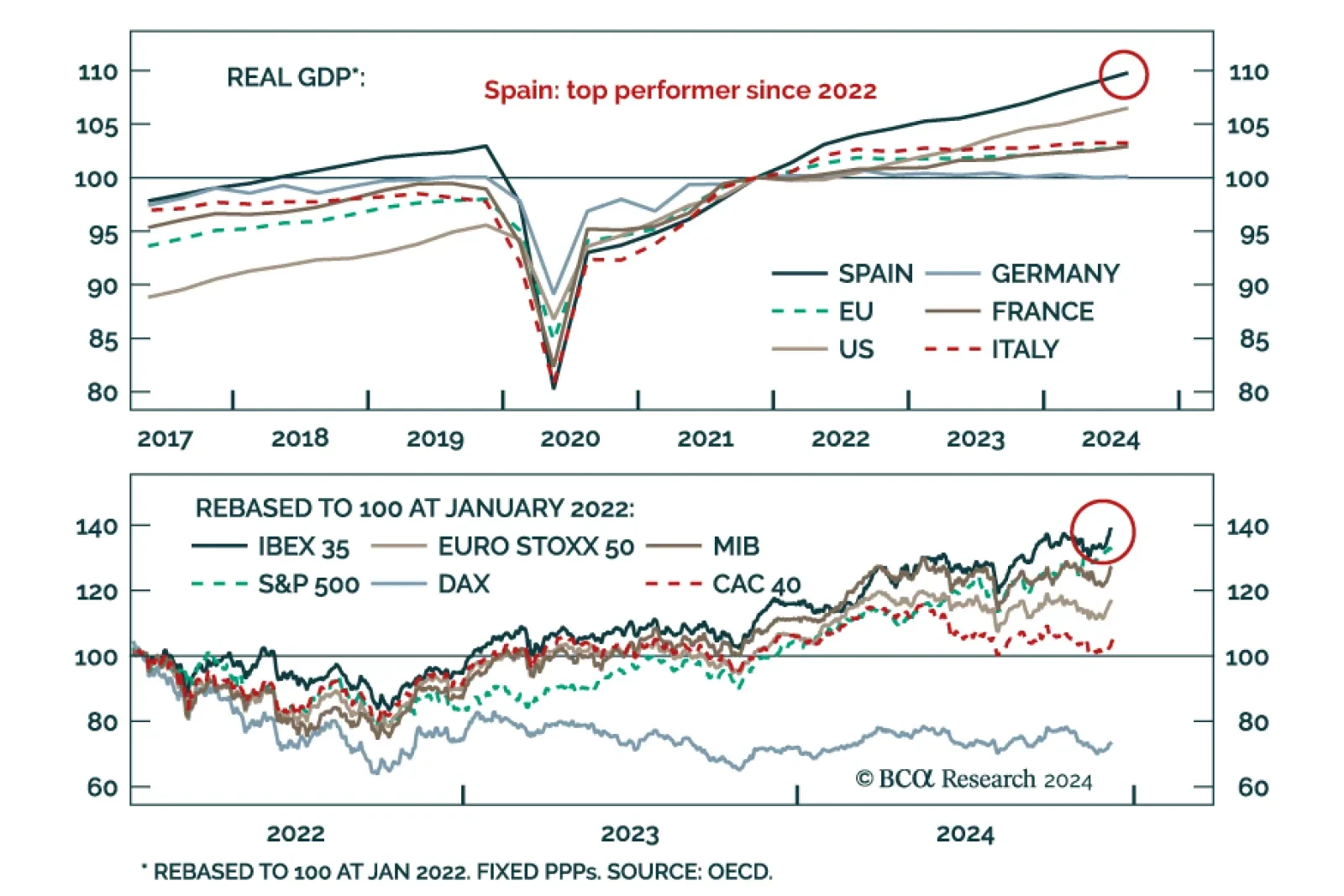

In the final installment of their “PIGS Have Wings” special series, our European investment strategists took a deep dive into the Spanish economy and financial assets. Spain outperformed most developed markets…

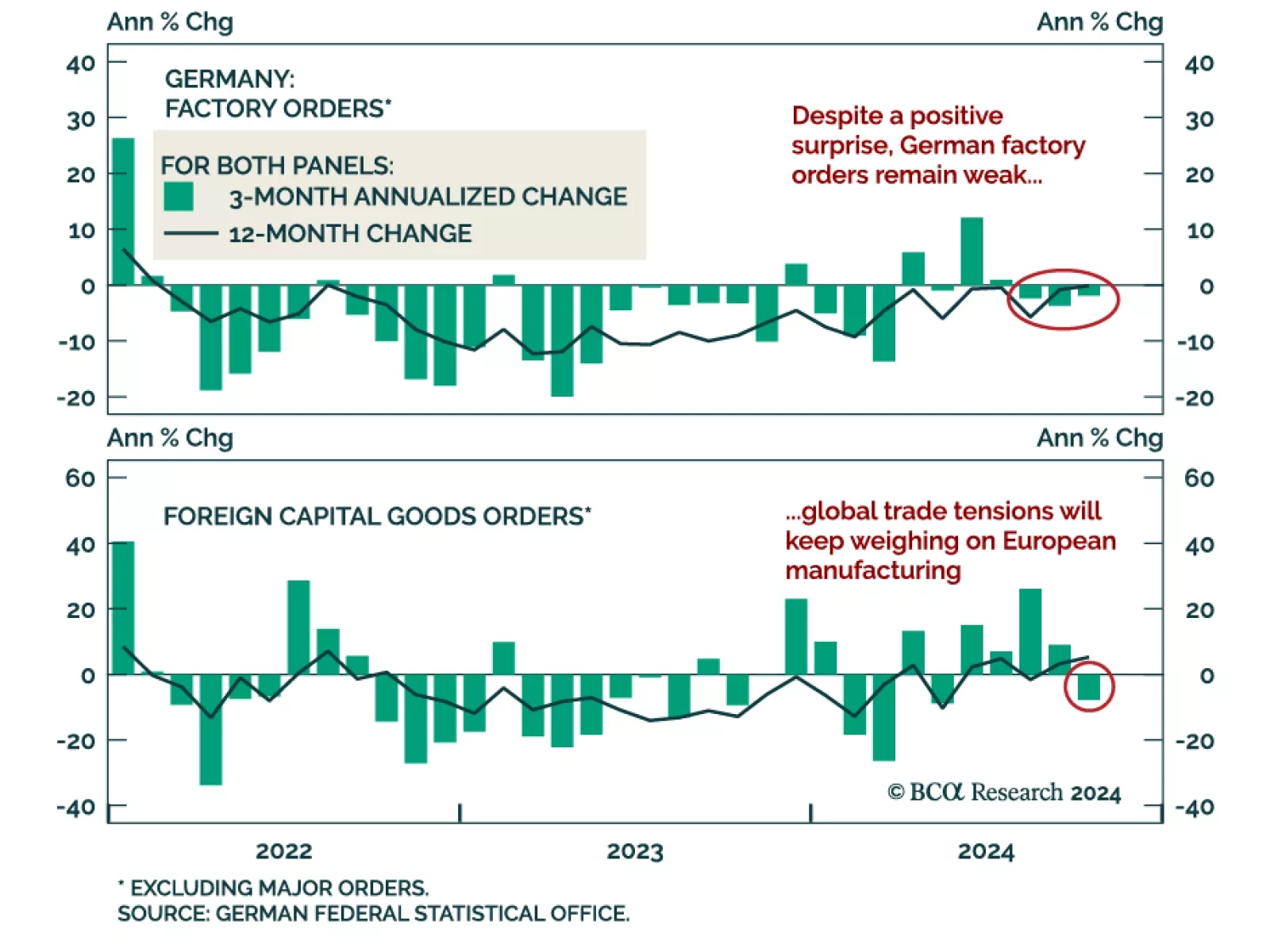

German factory orders decreased less than expected in October, falling 1.5% m/m after rising 7.2% in September. Excluding major orders, which often distort the overall picture, core new orders rose 0.1%, after rising 2.7% a month…

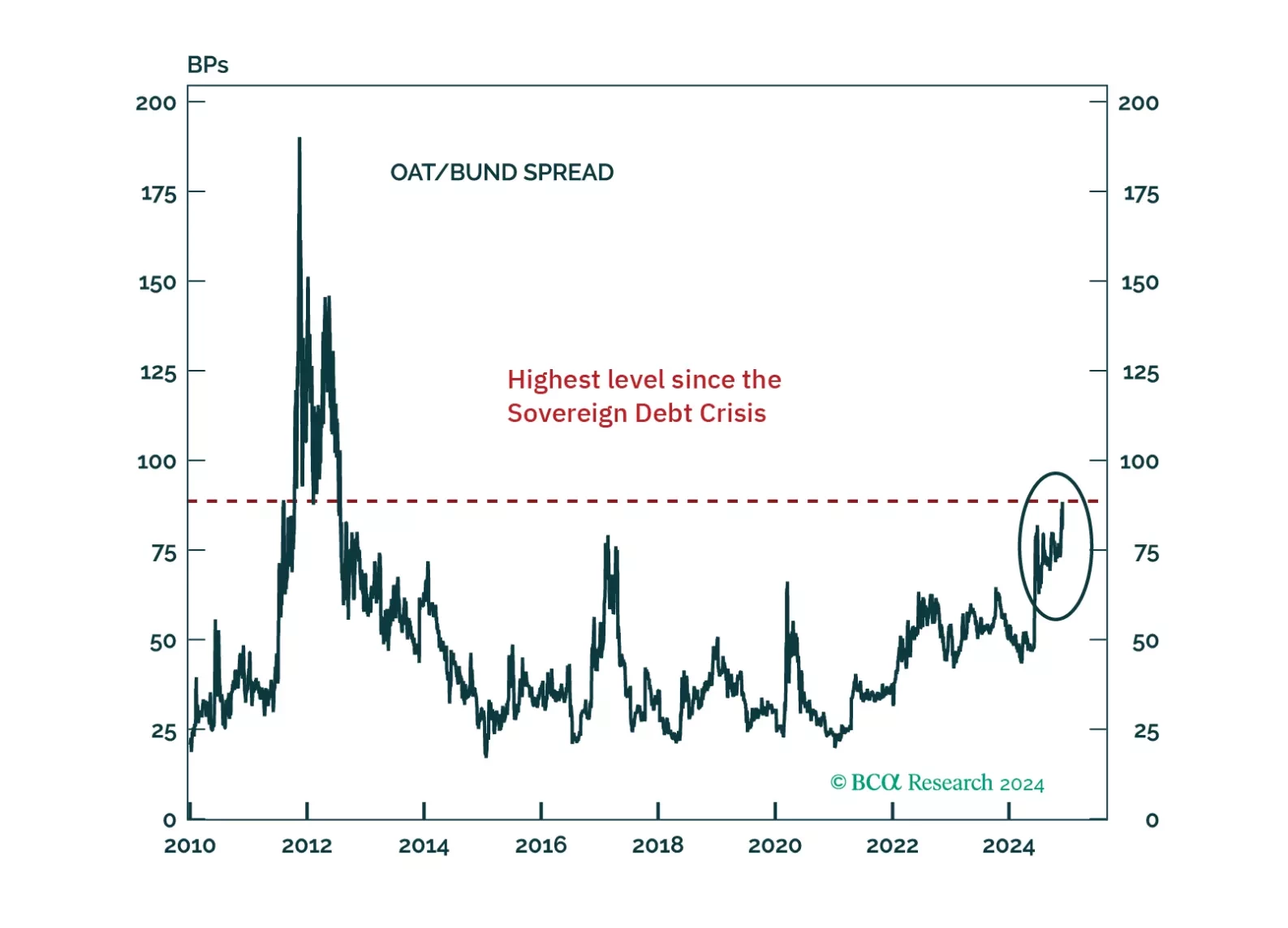

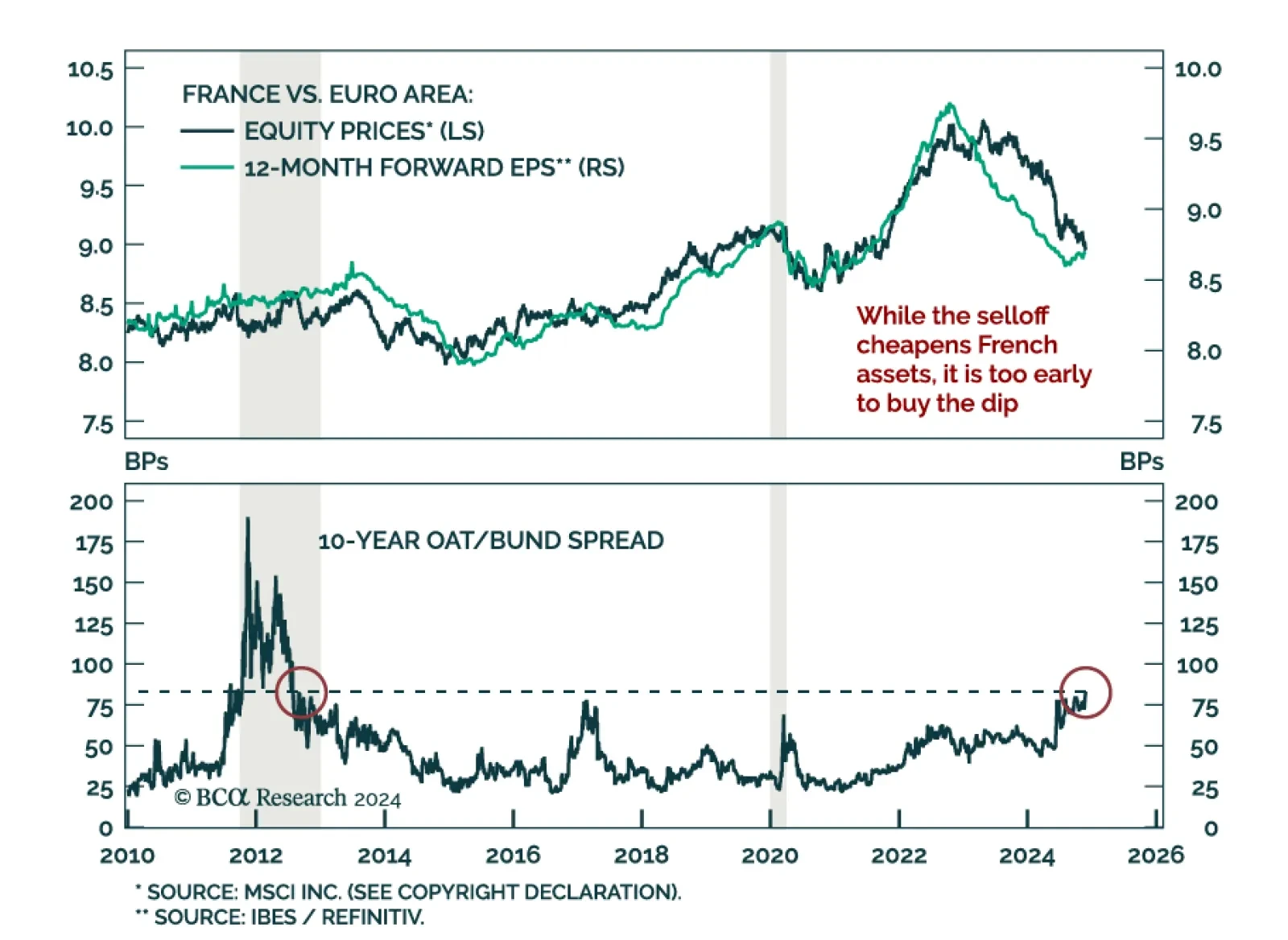

France finds itself in a unique, thorny situation. Can it heave itself out of it? And what does it mean for investors?

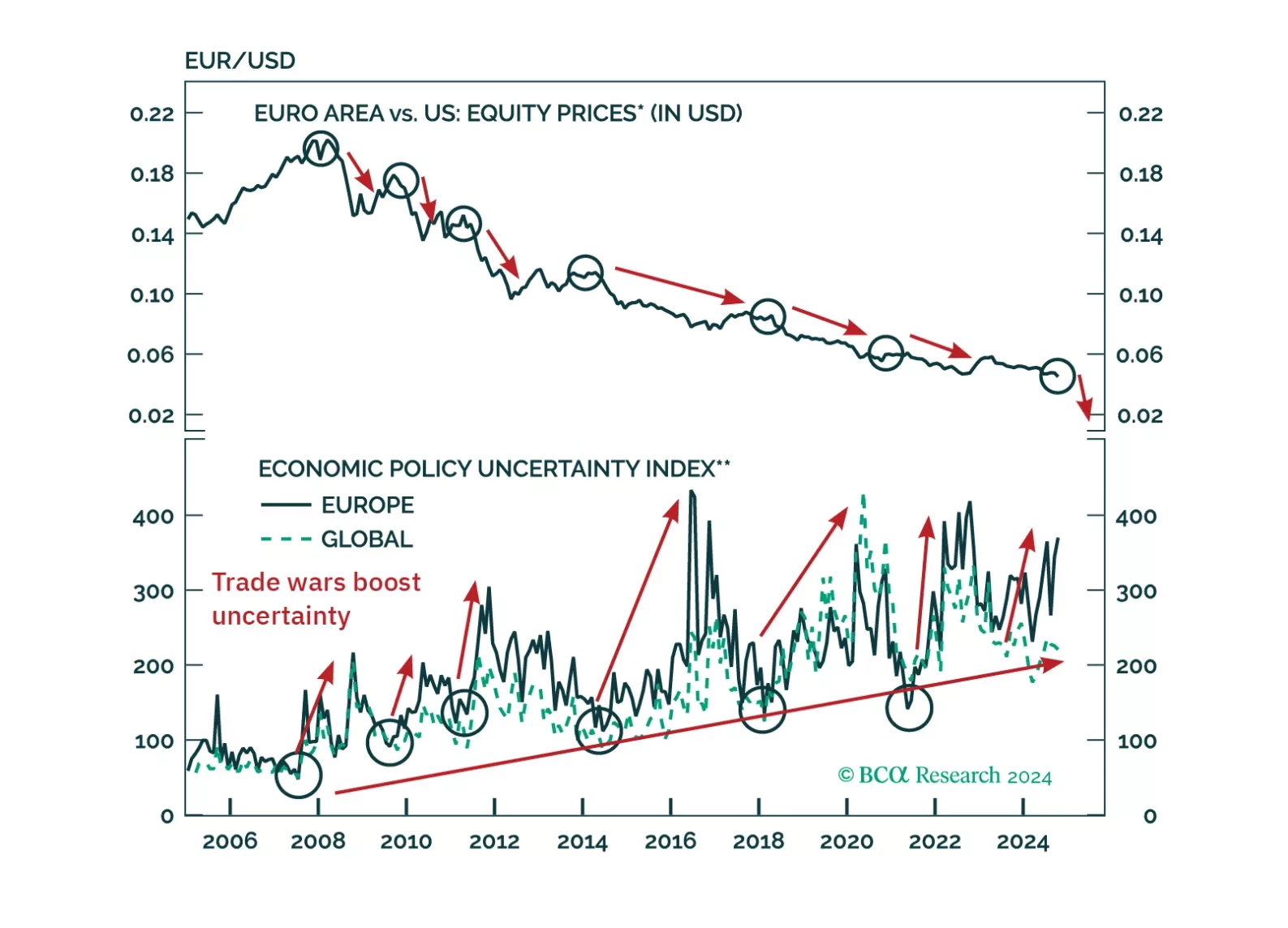

Investors have given up on European assets, which now suffer exceptional discounts to US ones. However, tighter US fiscal policy, the end of Europe’s austerity and deleveraging, the LNG Tsunami about to hit European shores, and the…

Investors focused on the flurry of cabinet nominations in the aftermath of the US election, but the US does not have a monopoly on political drama. France is going through turmoil of its own. This summer’s snap election…

European assets and the euro have become oversold and are likely to rebound. Will this move be nothing more than a dead cat bounce leading to more weakness?