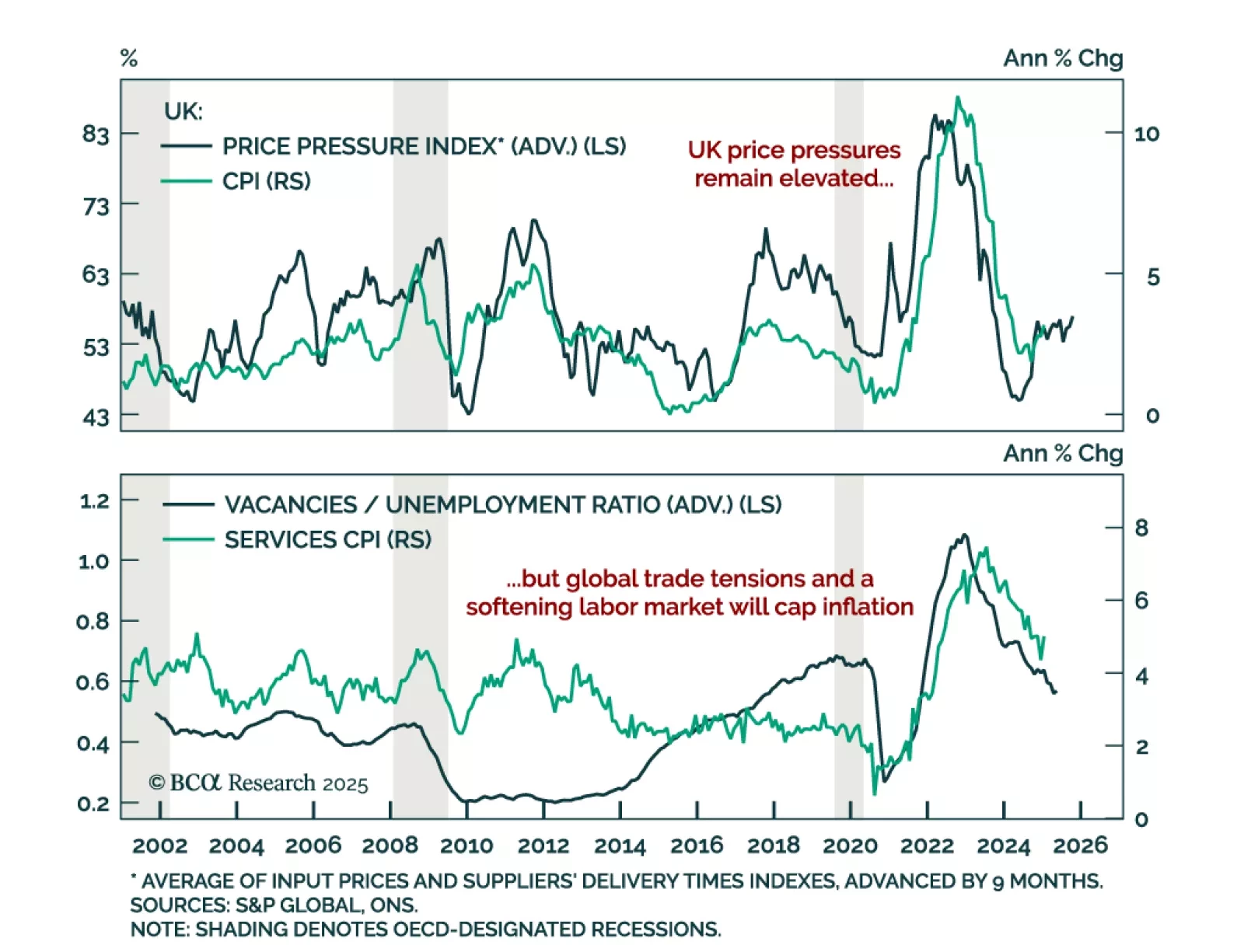

The January UK CPI was slightly hotter than expected. Headline inflation beat estimates, rising to 3.0% y/y from 2.5% in December. Core inflation also jumped but was in line with expectations at 3.7%. Services were strong, albeit…

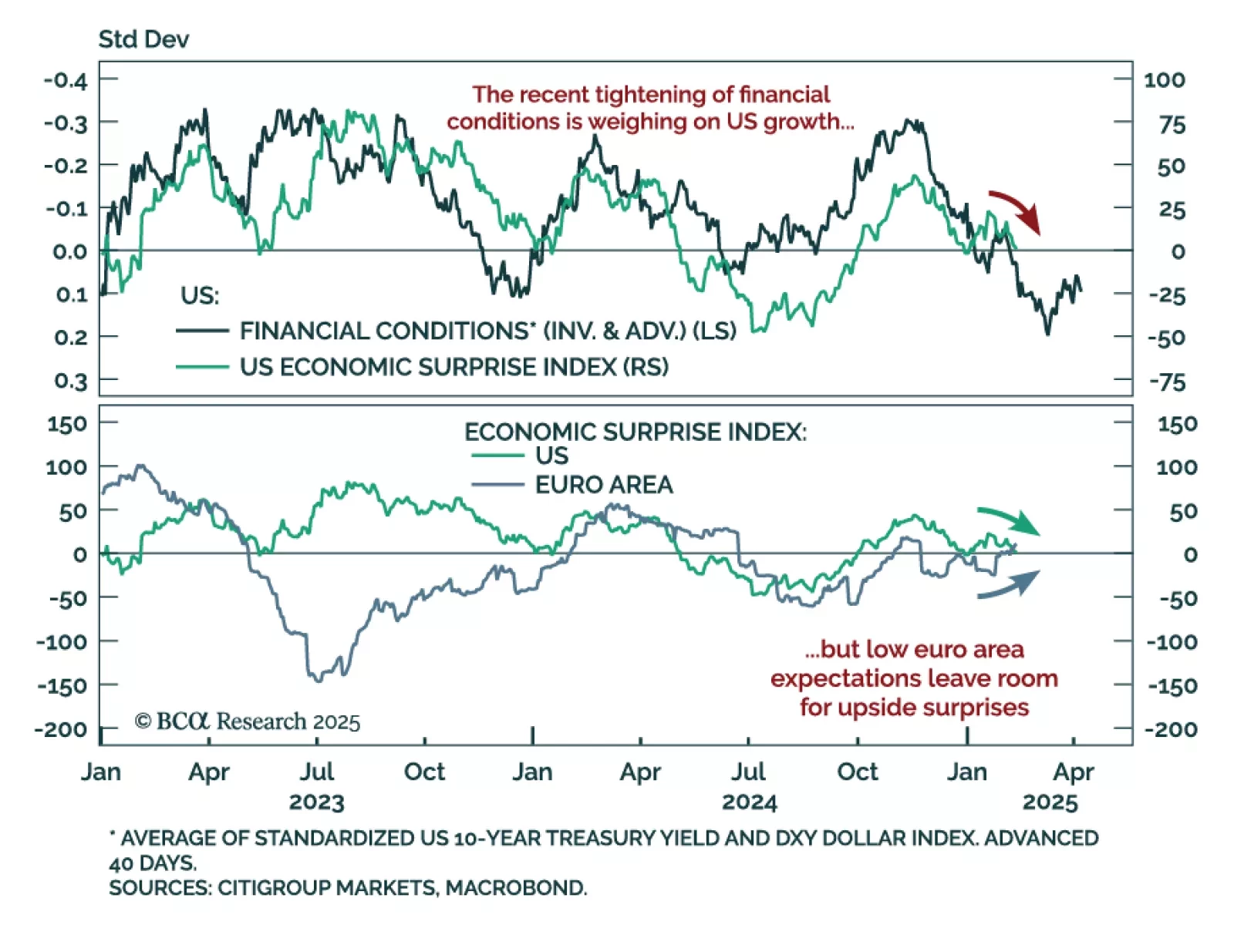

While geopolitics captured the latest headlines, Eurozone economic surprises have turned positive, while those in the US are on the verge of turning negative. Global economic surprises hinge on expectations and…

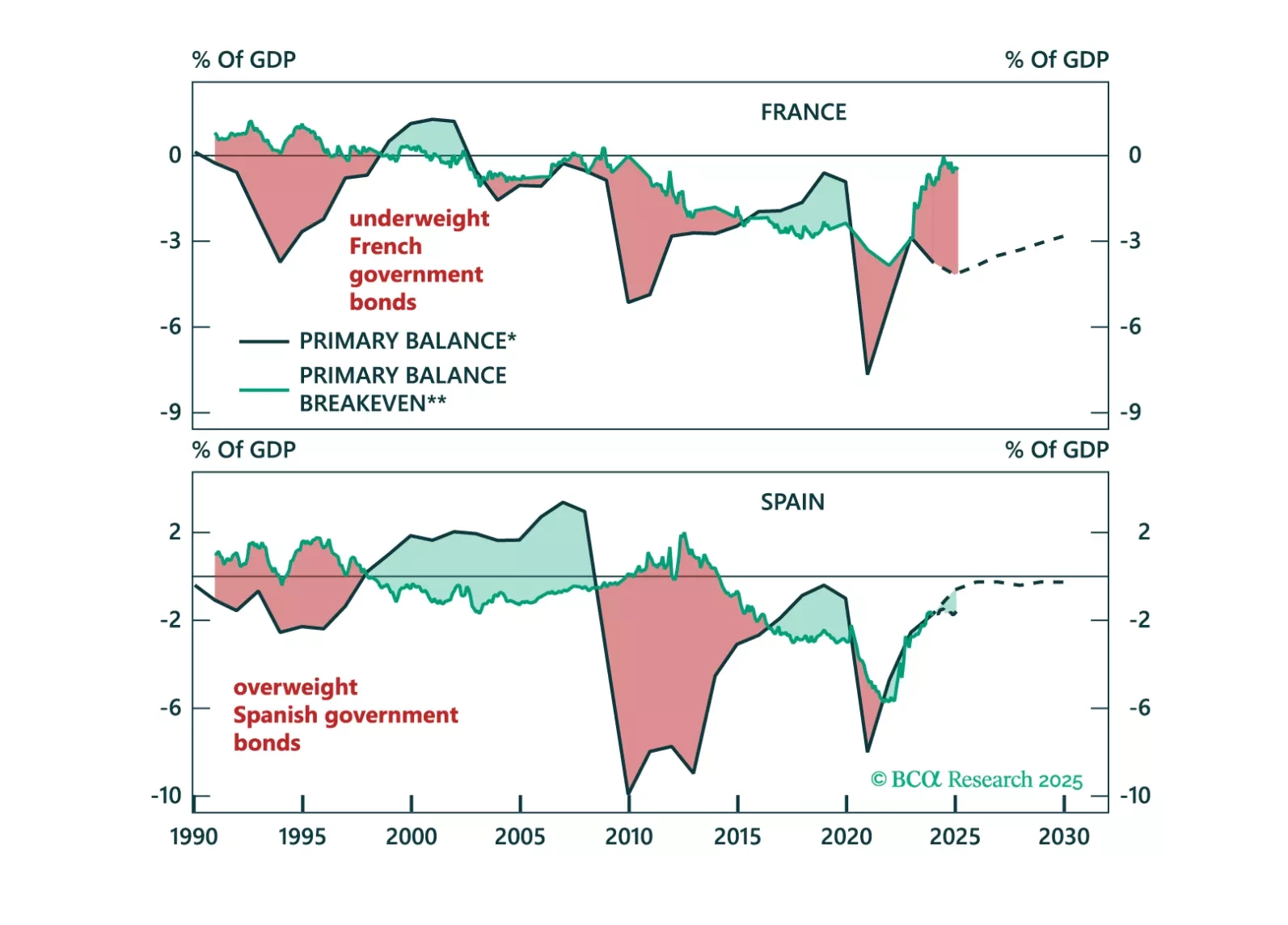

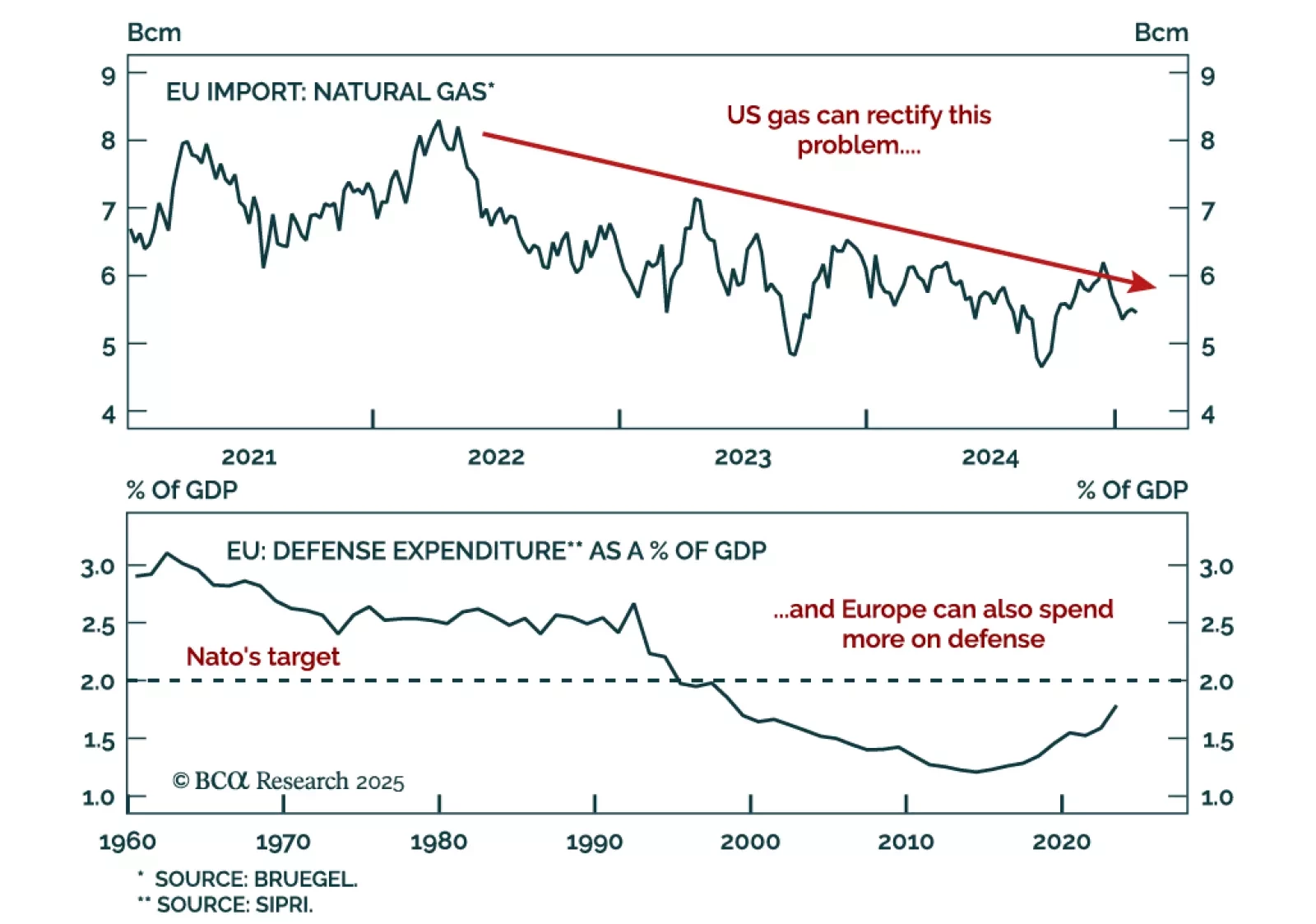

Our European strategists evaluate the looming threat of US tariffs on Europe, as it is President Trump’s next trade target after Canada, Mexico and China. While a deal centered on European energy imports and defense spending is…

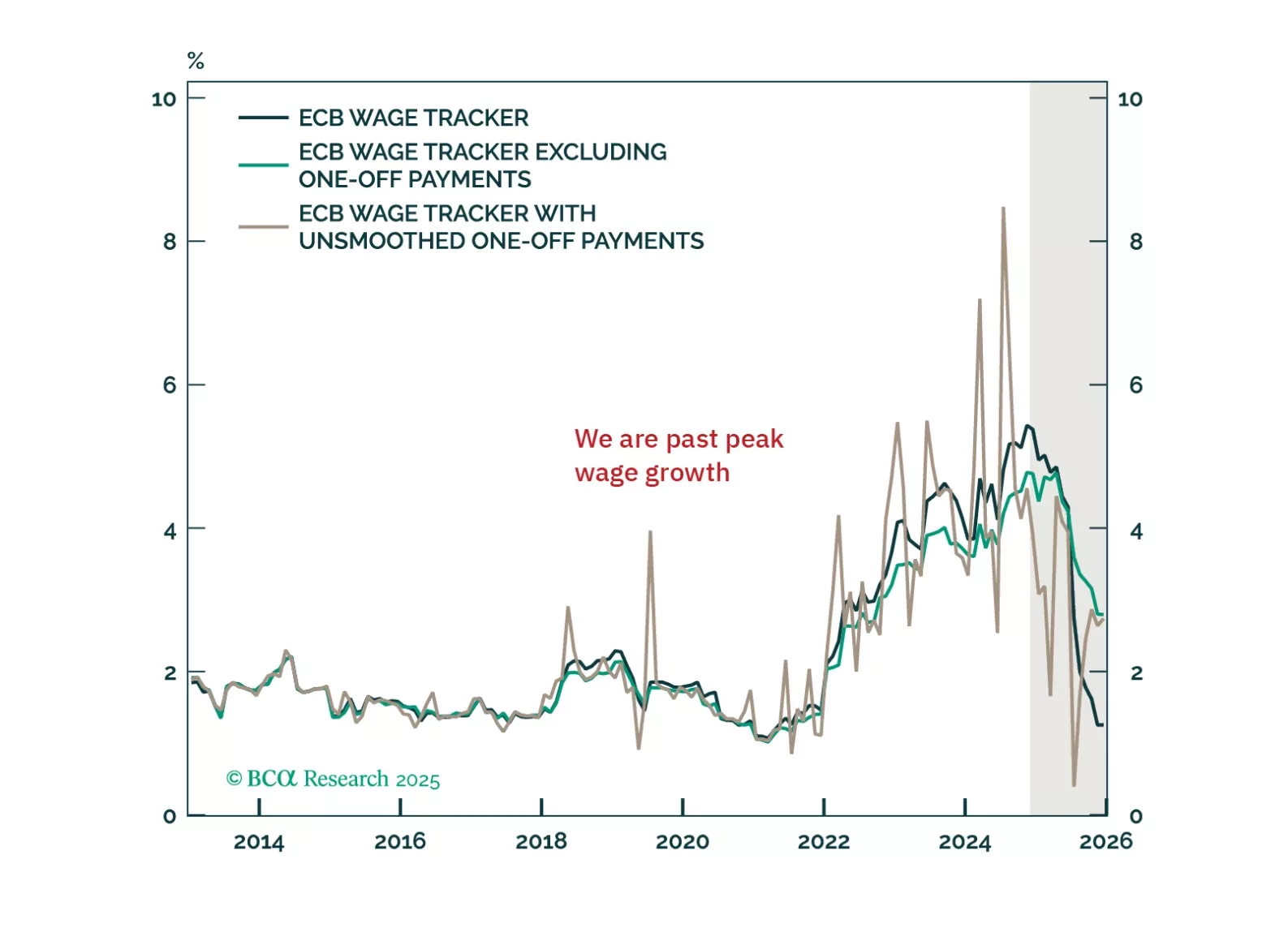

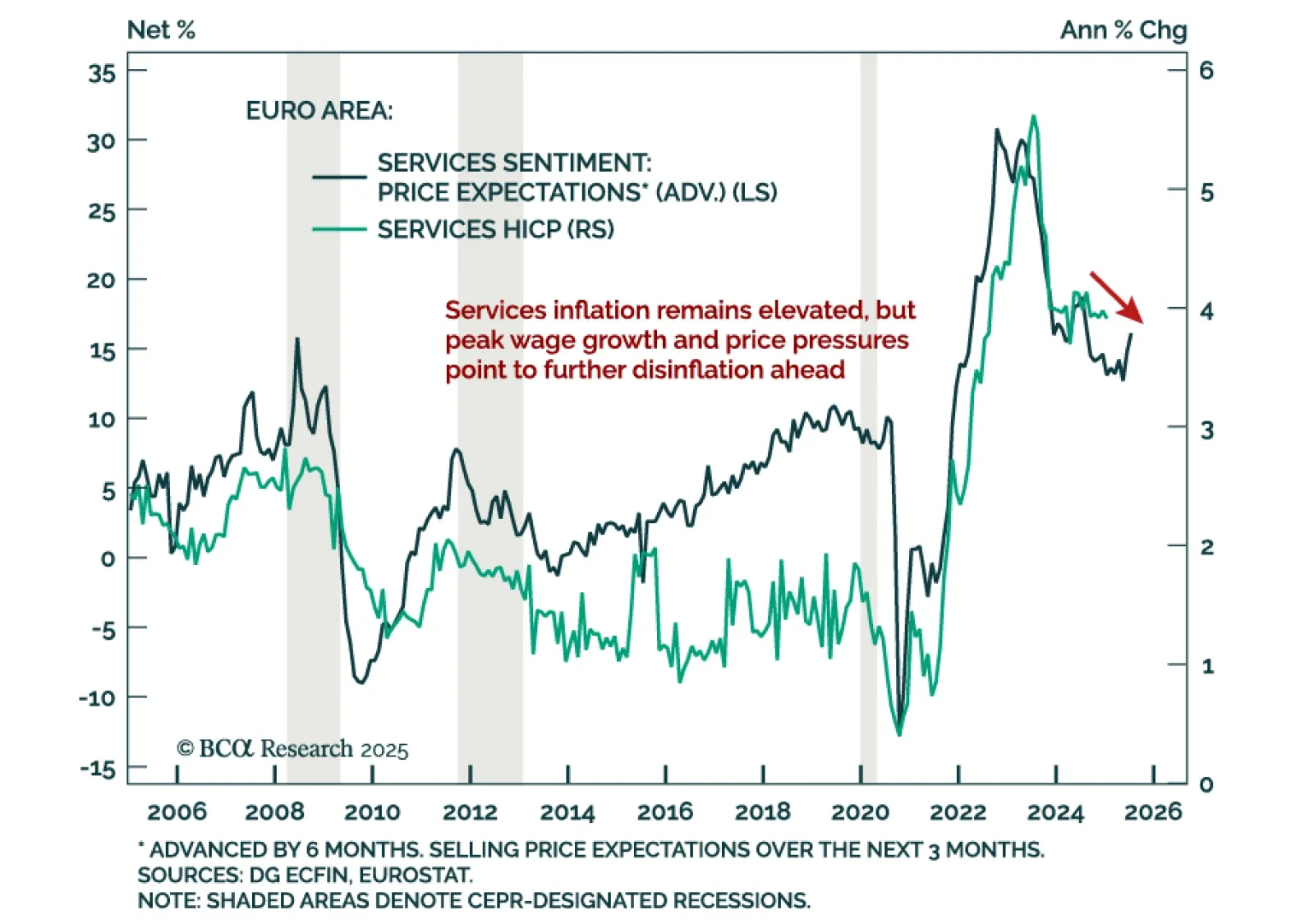

January flash inflation for the Eurozone slightly beat expectations, with headline HICP ticking up to 2.5% y/y from 2.4% in December, and core steady at 2.7%, above the ECB’s target. Services ticked down to 3.9% from 4.0%. The…

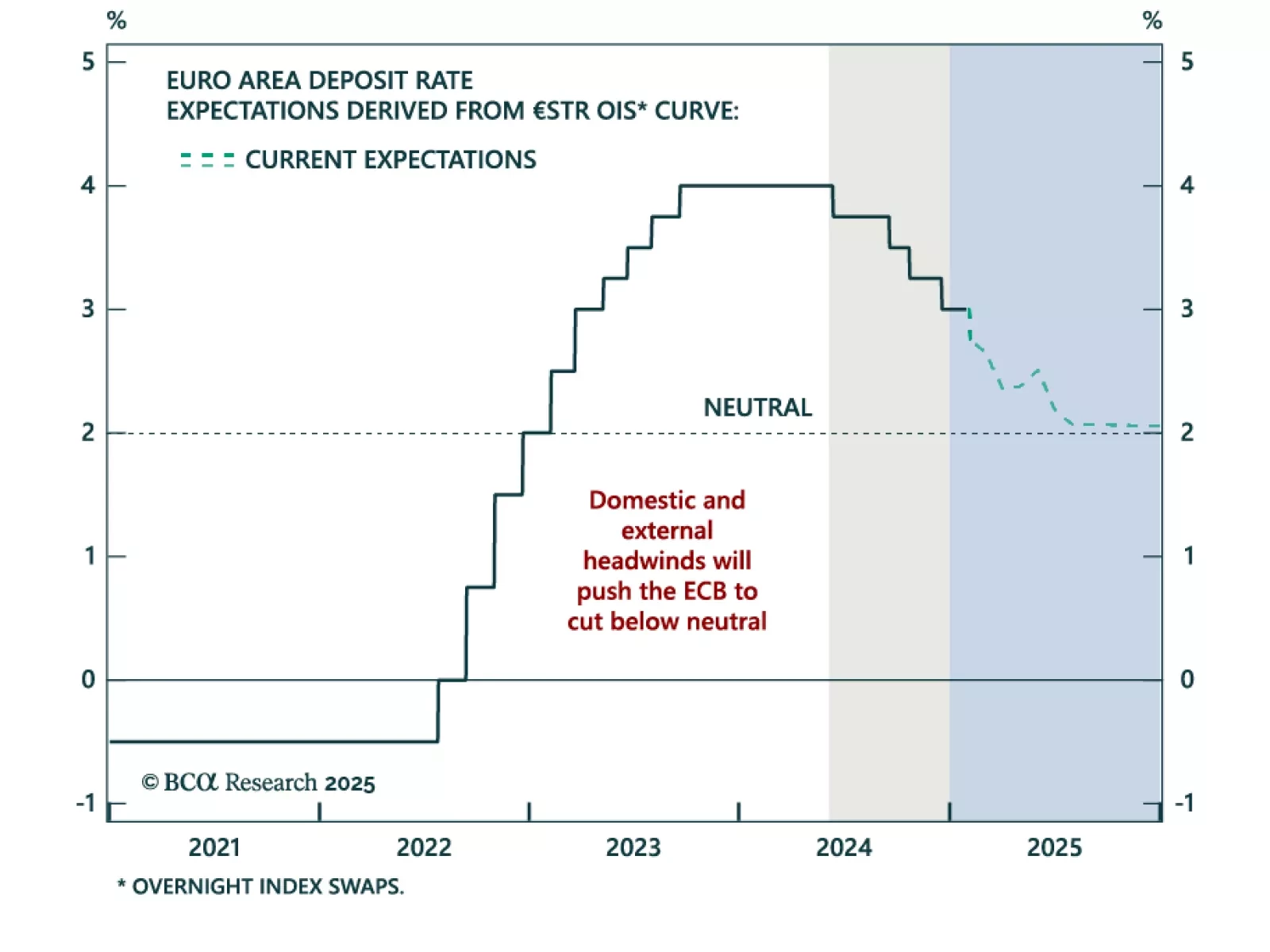

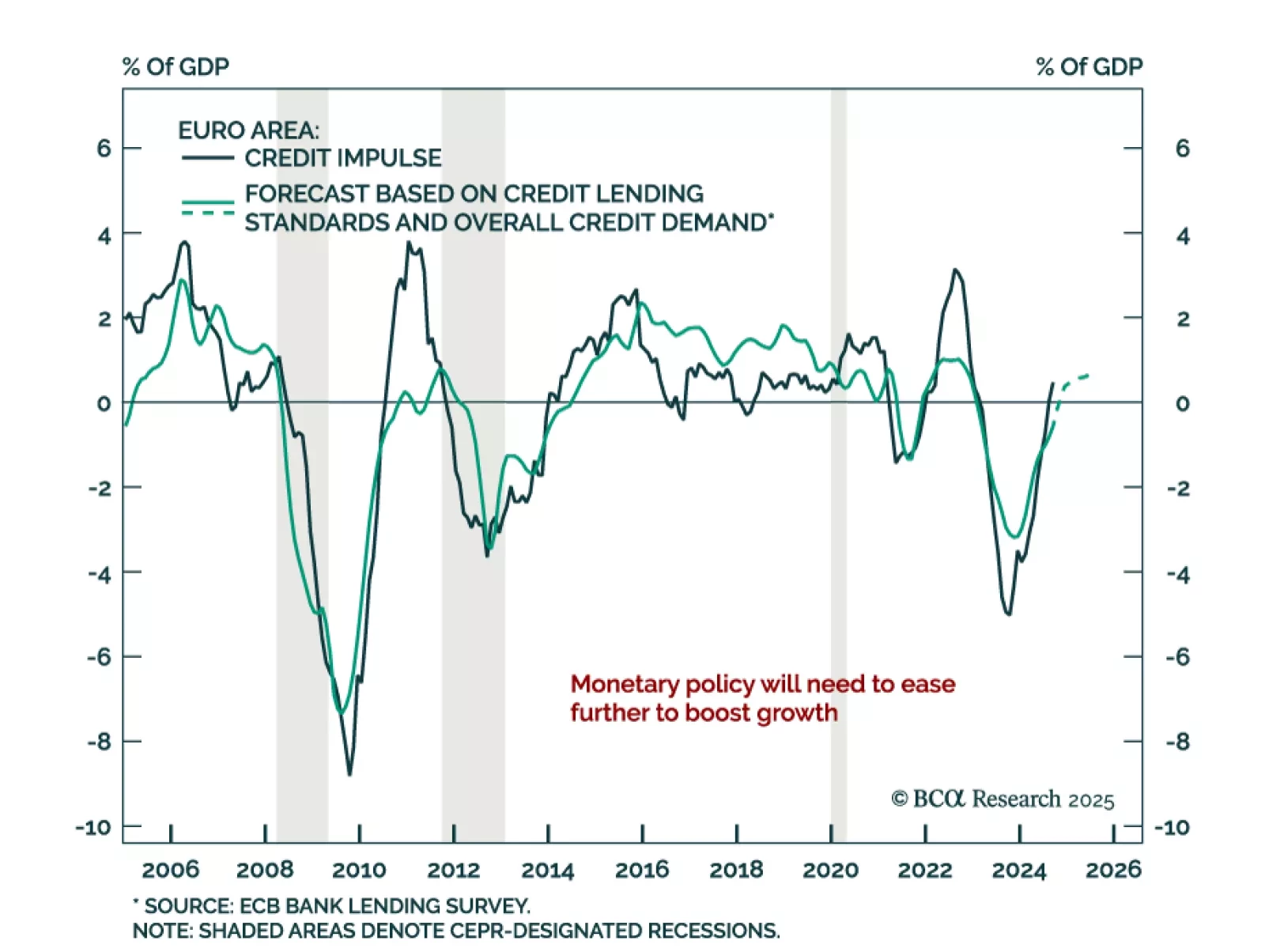

The ECB cut its deposit rate to 2.75%, as was widely anticipated. President Christine Lagarde did not provide any fireworks, but the Governing Council’s message was clear: Policy is restrictive, and inflation will fall further. As a…

The ECB cut by 25 bps as expected, bringing the deposit facility rate to 2.75%. Despite avoiding committing to a path for policy, President Lagarde reiterated the disinflationary process is “well on track”, and did not push against…

The January 2025 ECB bank lending survey saw a net tightening of credit standards in Q4 2024. Credit standards were tightened for business and consumer lending, and were roughly unchanged for home mortgage loans. Banks expect further…

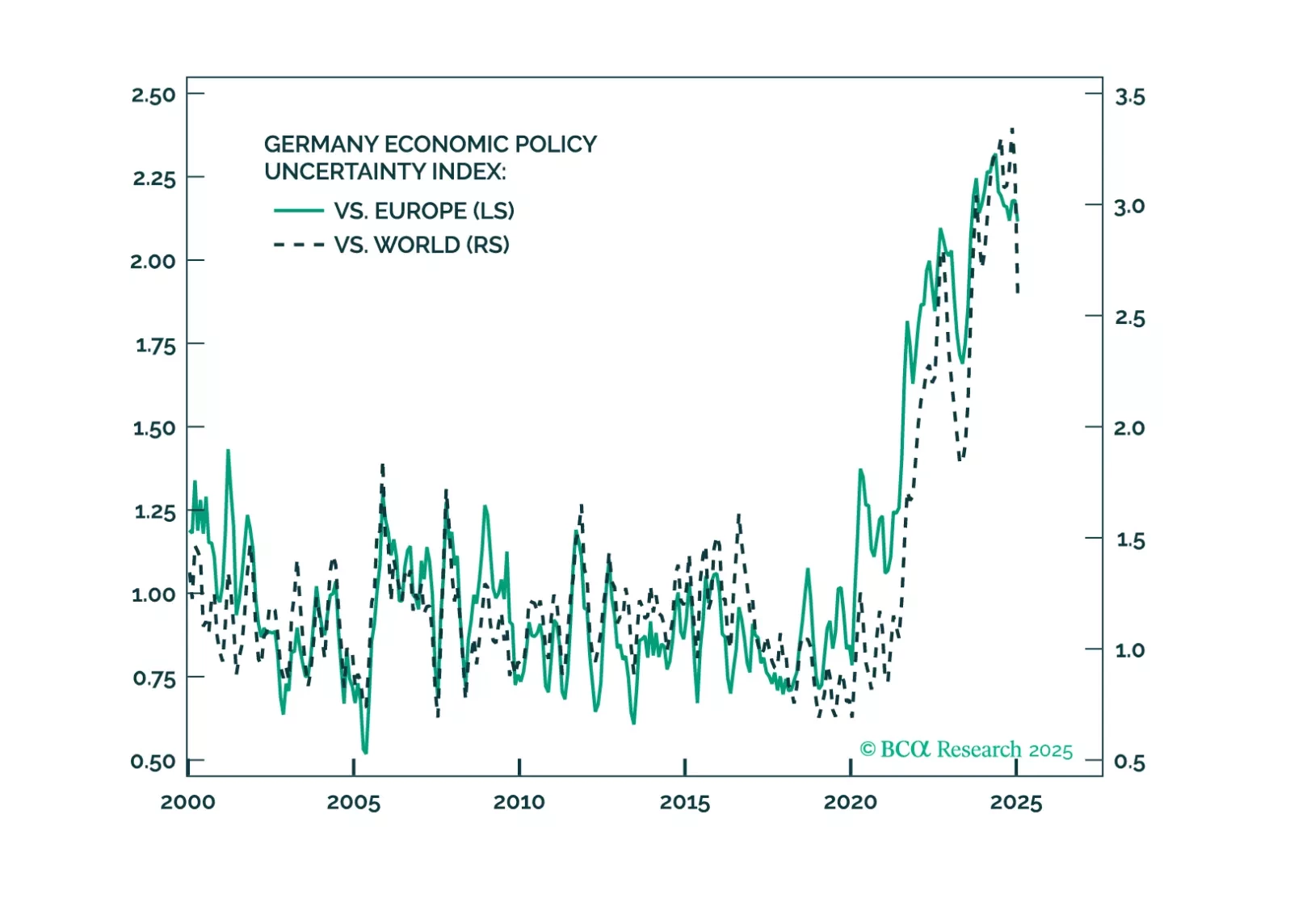

The January Ifo Business Climate index for Germany beat estimates, increasing to 85.1 vs. 84.7 in December. The increase came from the survey’s current assessment component, which increased a full point, as the expectations component…