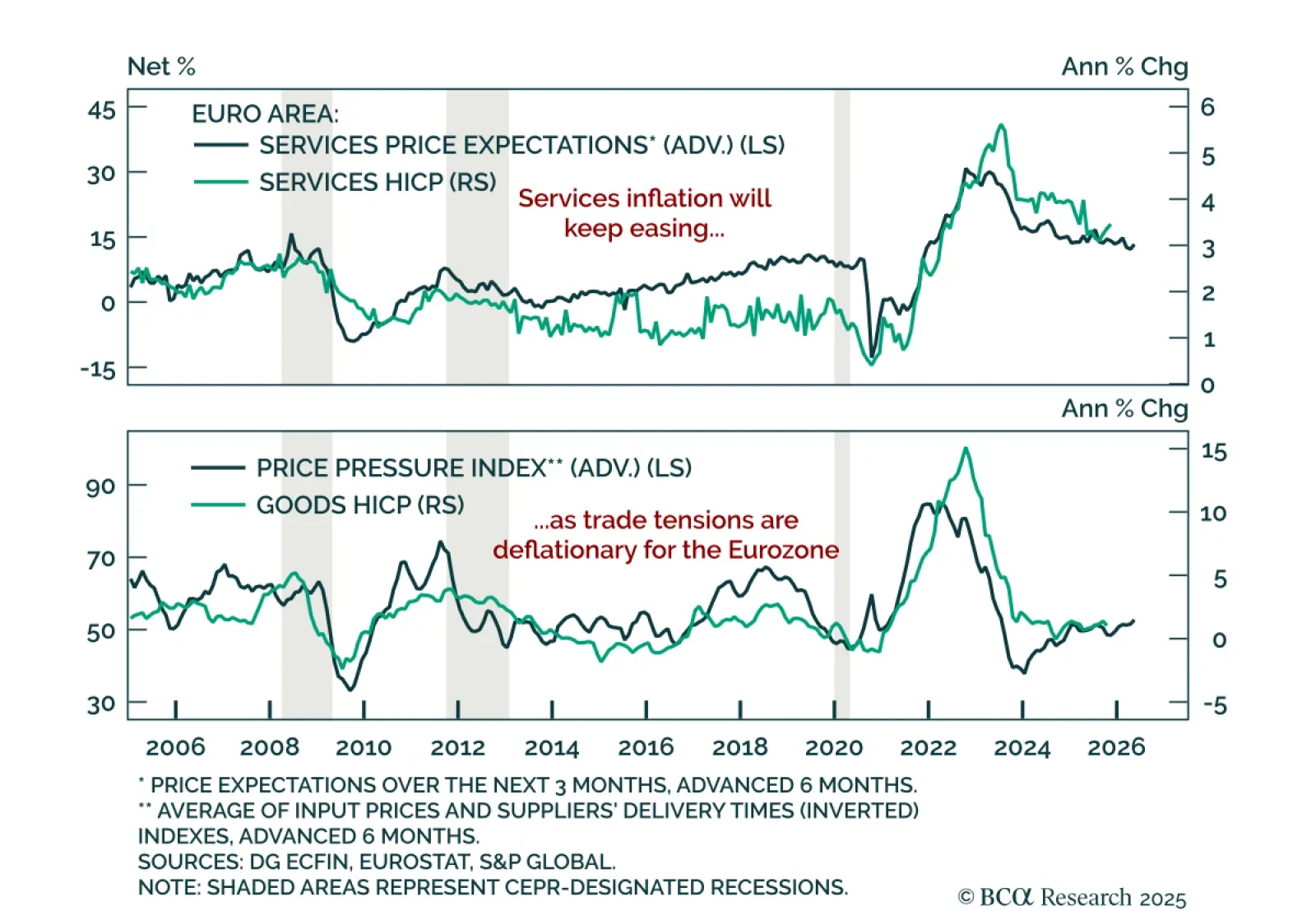

Favor US assets over European ones as weak Eurozone momentum and soft inflation keep tactical pressure on EUR. November Eurozone inflation came in slightly above estimates, with headline HICP at 2.2% y/y versus 2.1% in October and…

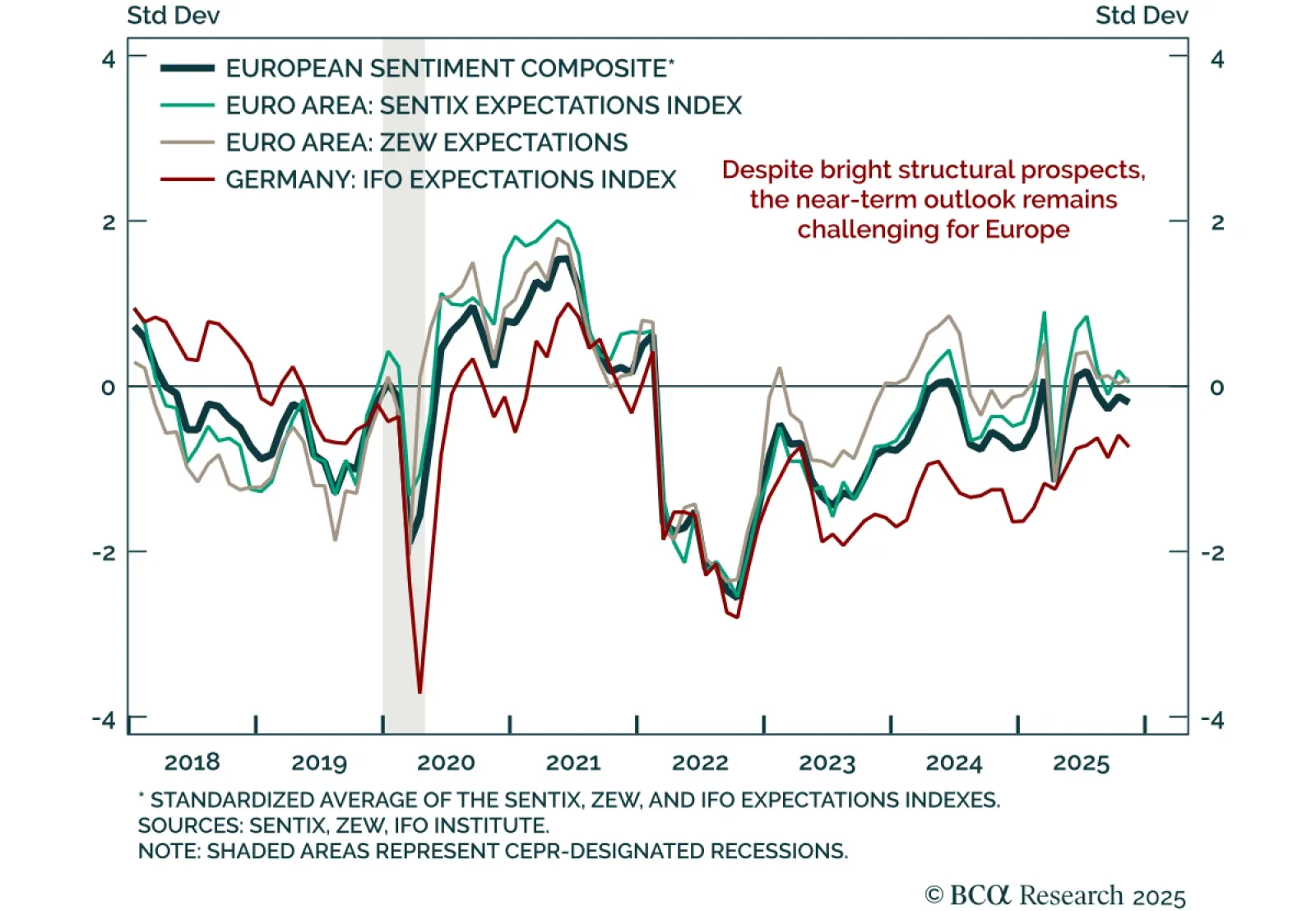

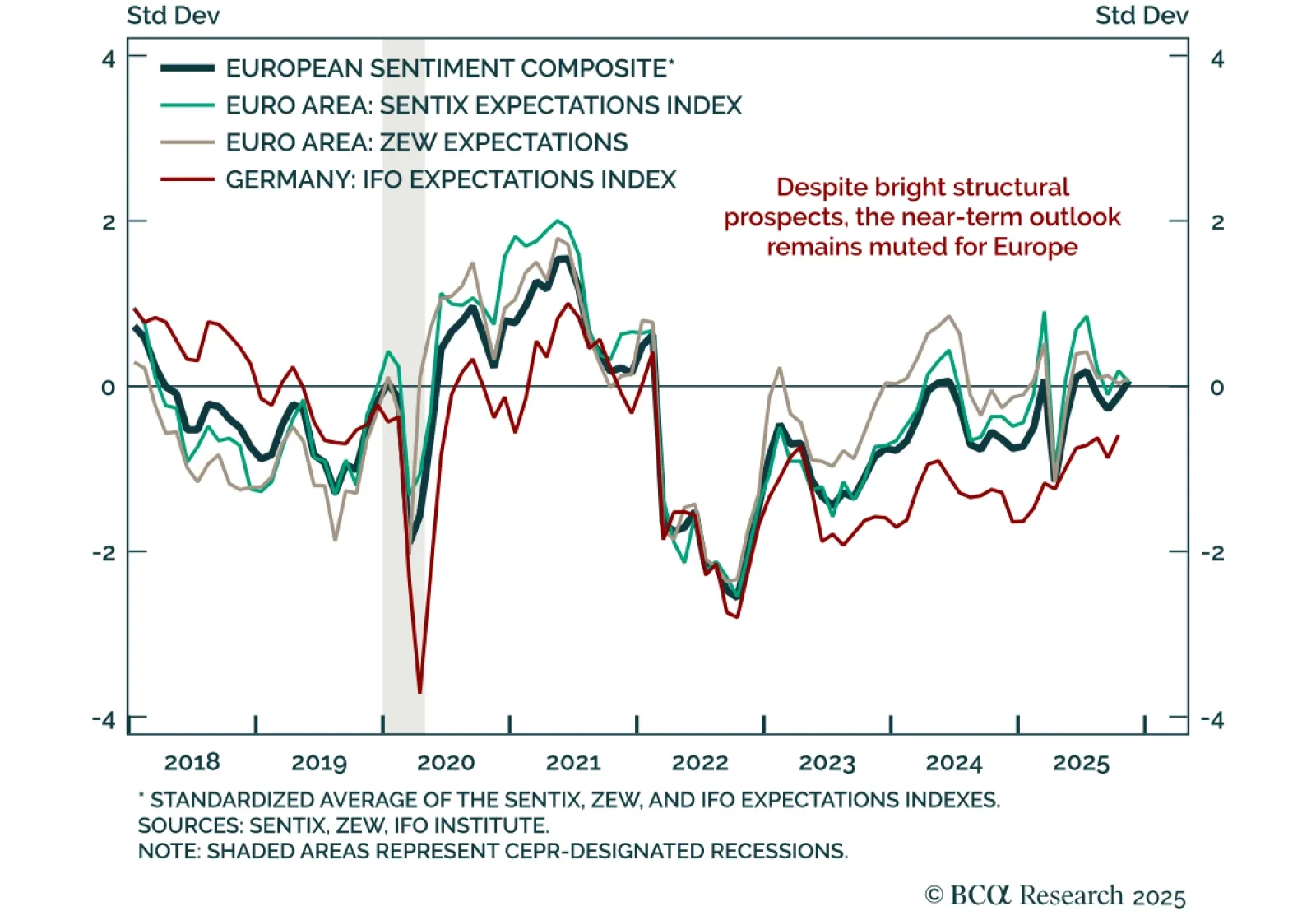

The November Ifo survey disappointed, highlighting weakening expectations for Germany and limited near-term upside for European growth. The Business Climate Index fell to 88.1 from 88.4, driven by expectations dropping to 90.6 from…

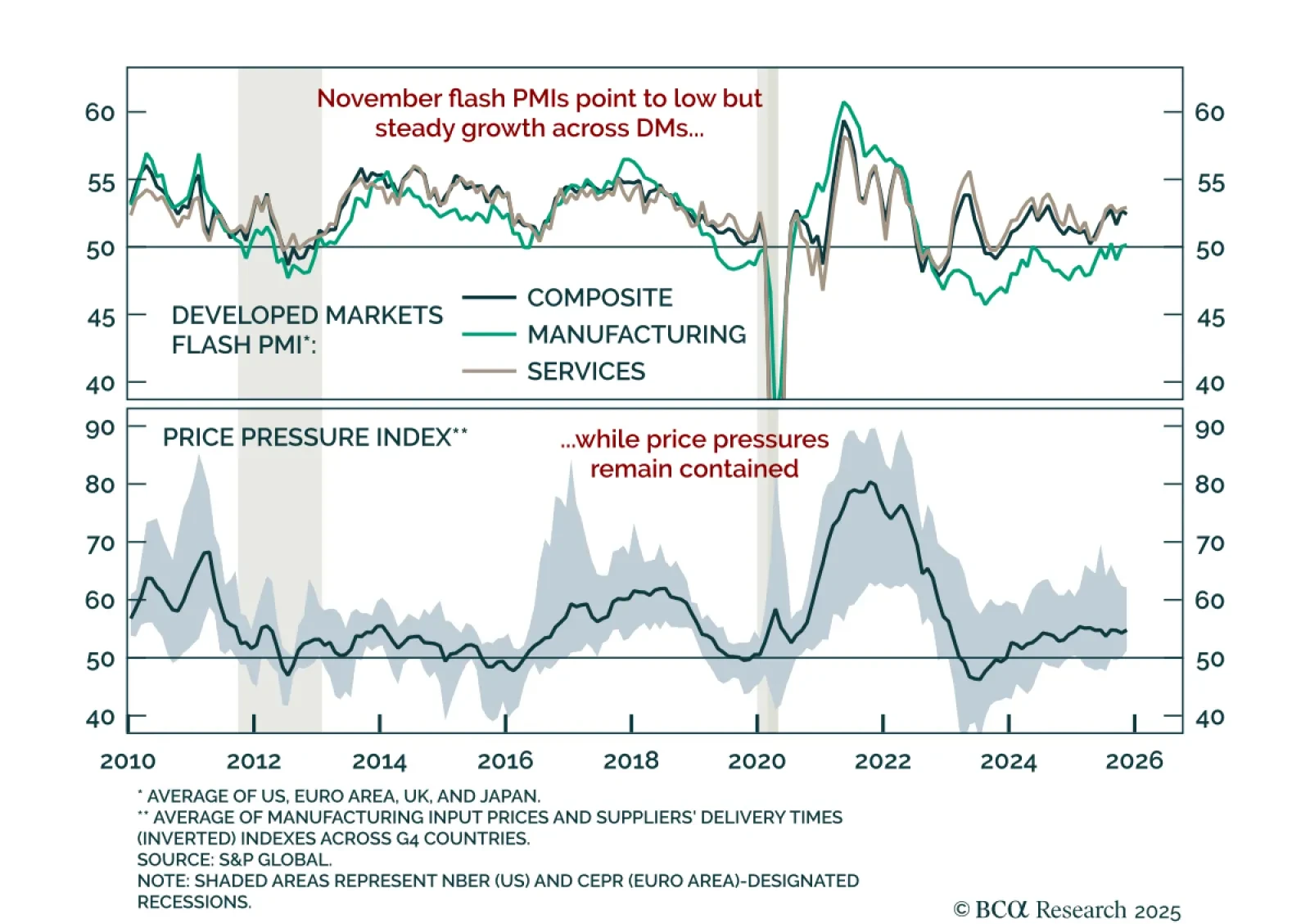

November flash PMIs confirmed sluggish global momentum, reinforcing a defensive stance with tactical support for the USD. The US composite PMI rose to 54.8, driven by stronger services but weaker manufacturing. The Euro area showed a…

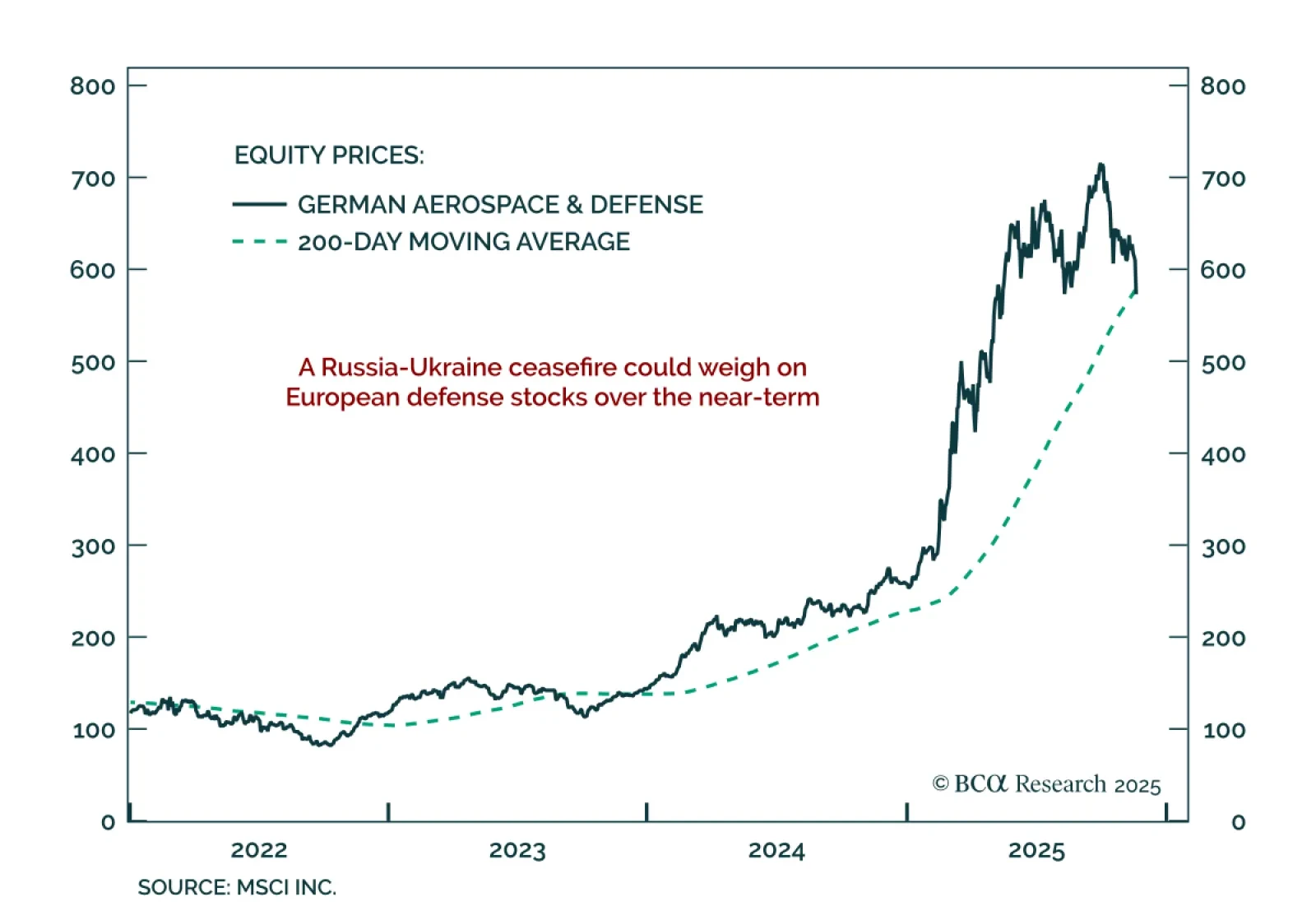

Reports of a potential US–Russia peace proposal revived speculation about a ceasefire, creating short-term downside risks for European defense equities. The 28-point framework, led by Trump’s negotiator, signals that both sides are…

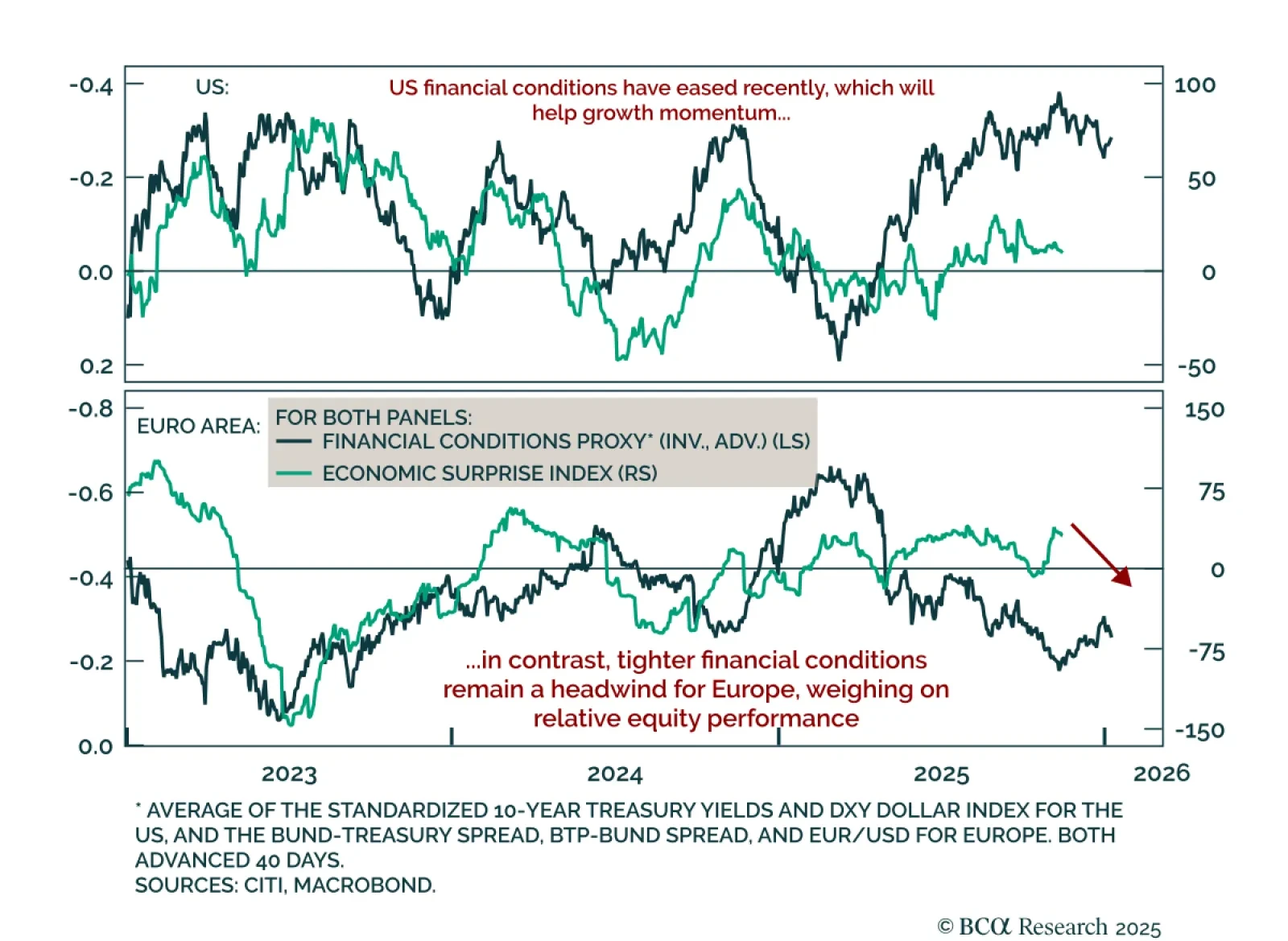

European sentiment remains mixed, with growth momentum failing to pick up despite brighter long-term prospects. Economic surprises have improved since mid-October, but tight financial conditions, driven by a strong euro and higher…

The November ZEW survey confirmed mixed sentiment in Europe, showing growth momentum is not taking off yet. Euro area growth expectations ticked up to 25.0 from 22.7, while German expectations missed estimates, edging down to 38.5…

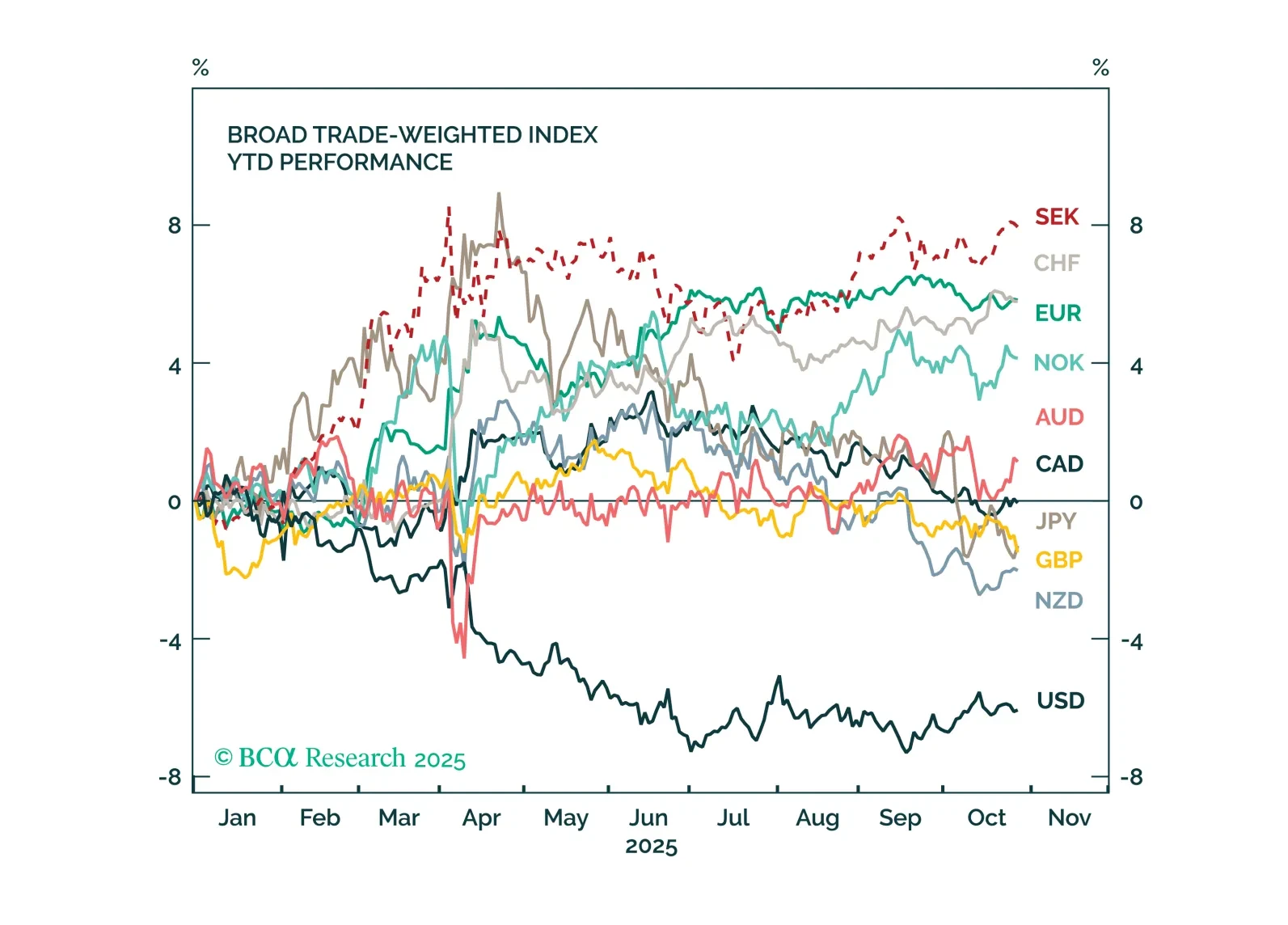

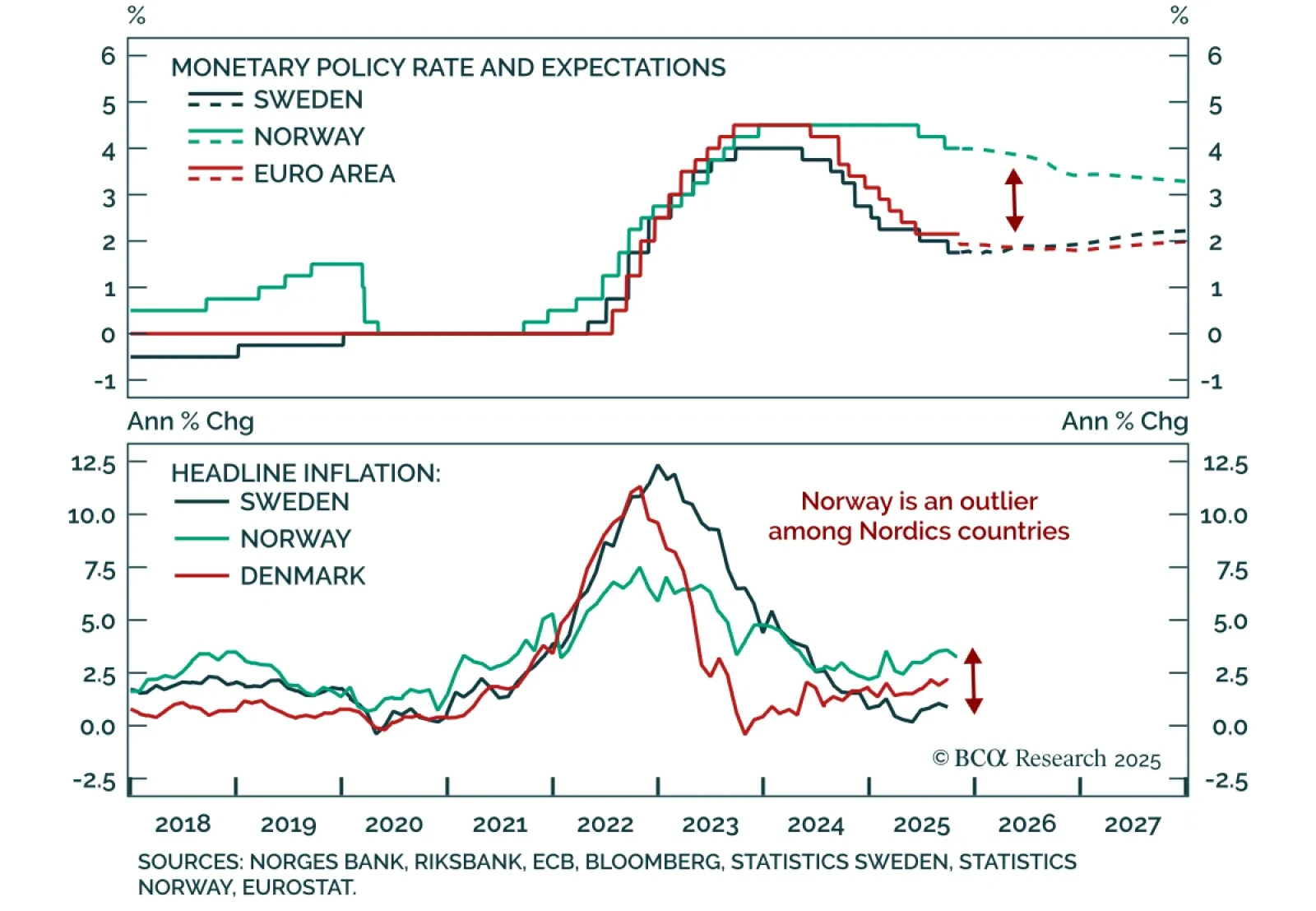

Our European strategists turn overweight Swedish equities and initiate a short NOK/SEK position as Nordic central banks pause but their economies diverge. Sweden’s recovery and stable inflation allow the Riksbank to join the “easing-…

Markets are increasingly pricing an end to the global easing cycle, with many central banks expected to remain on hold. But uncertainty remains high, and policy surprises are likely going into 2026. This Strategy Report breaks down…

Markets are increasingly pricing an end to the global easing cycle, with many central banks expected to remain on hold. But uncertainty remains high, and policy surprises are likely going into 2026. This Strategy Report breaks down…

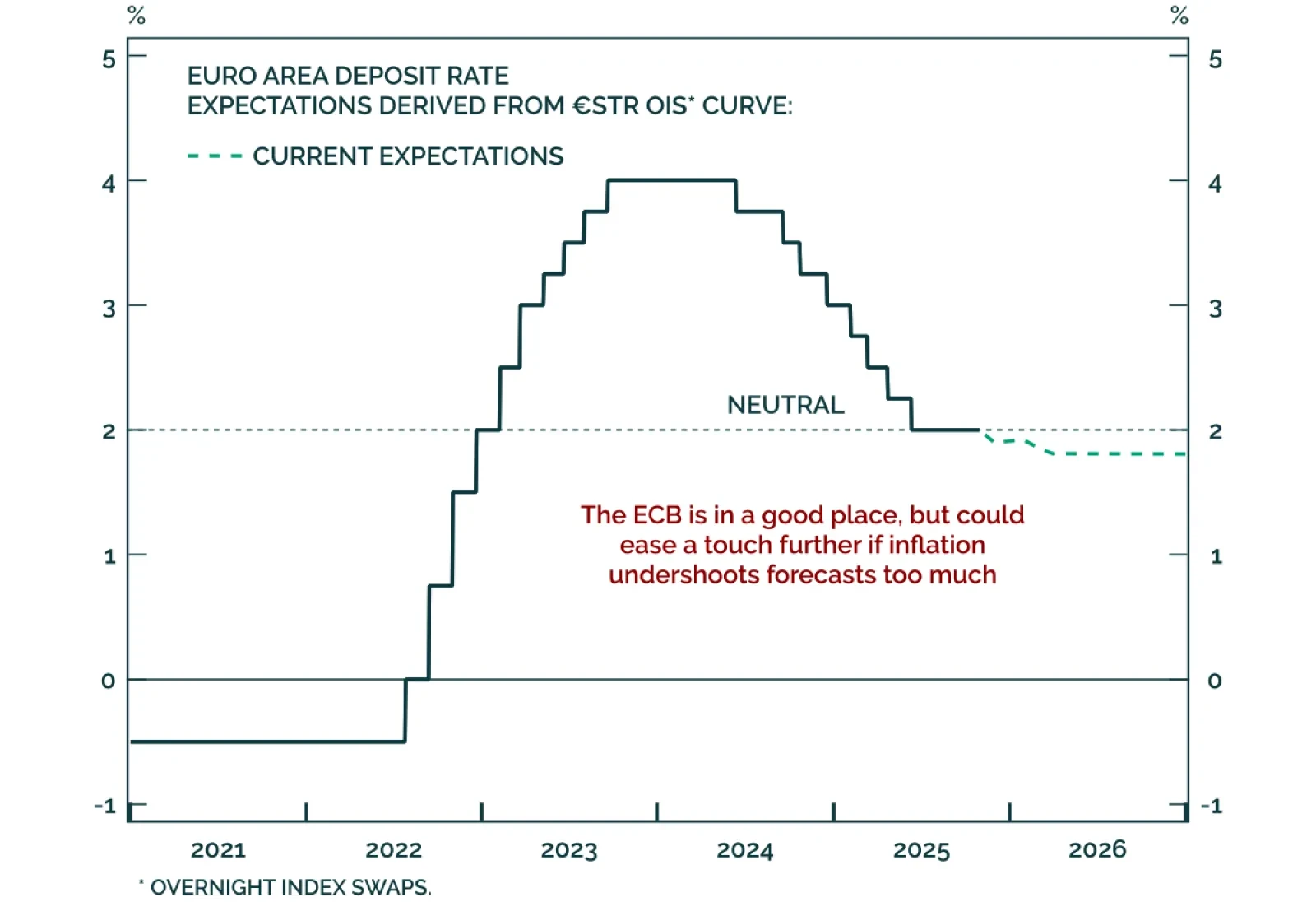

The ECB held rates at 2% for a third consecutive meeting, signaling policy stability as inflation sits at target and growth risks fade. The European central bank has cut a total of 200 bps since 2024, and while inflation could…