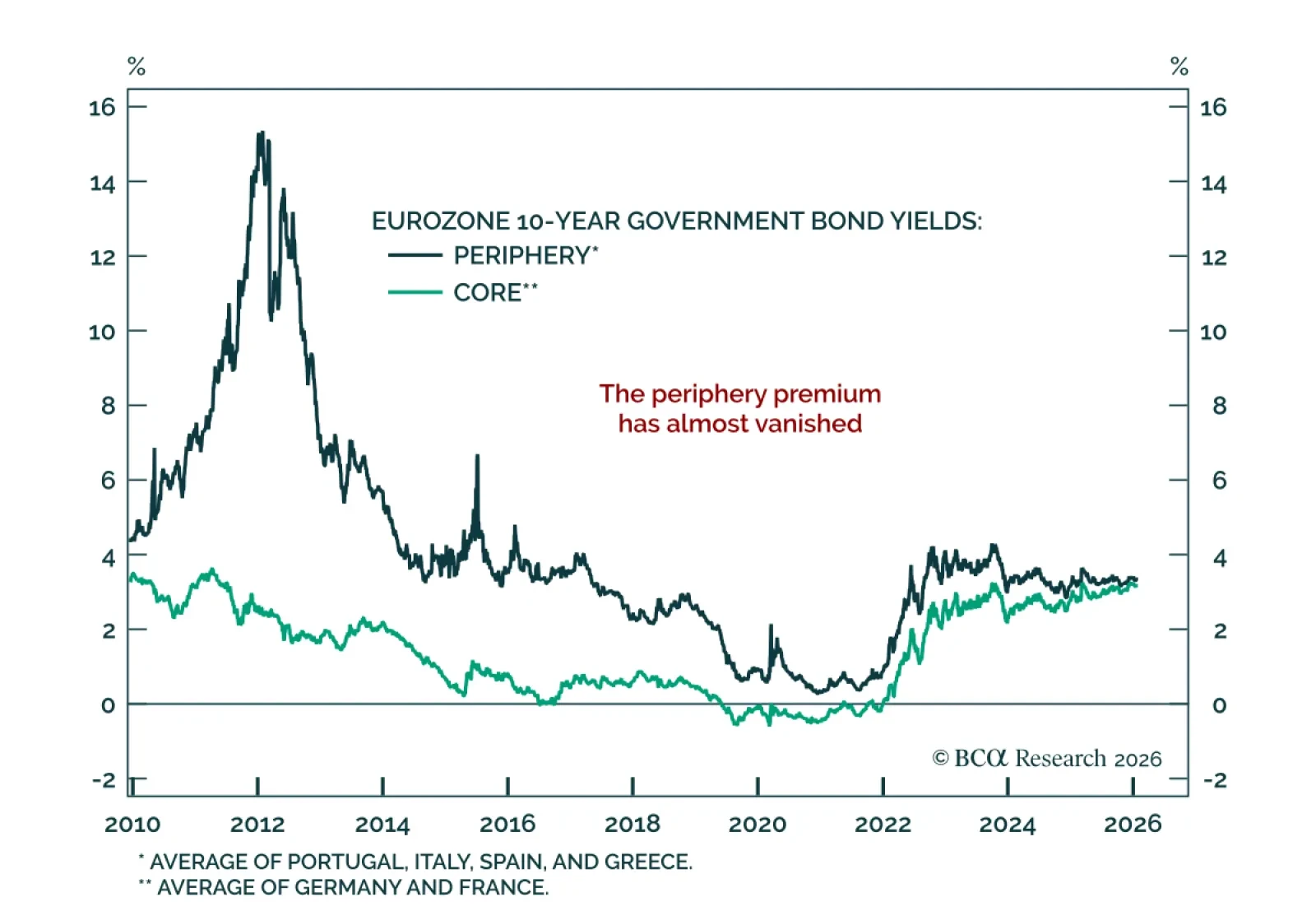

Peripheral Europe is driving the region’s resilience, and finally closing the gap with the core. Our Chart Of The Week comes from Jeremie Peloso, Chief European Investment Strategist. The resilience of the European economy and strong…

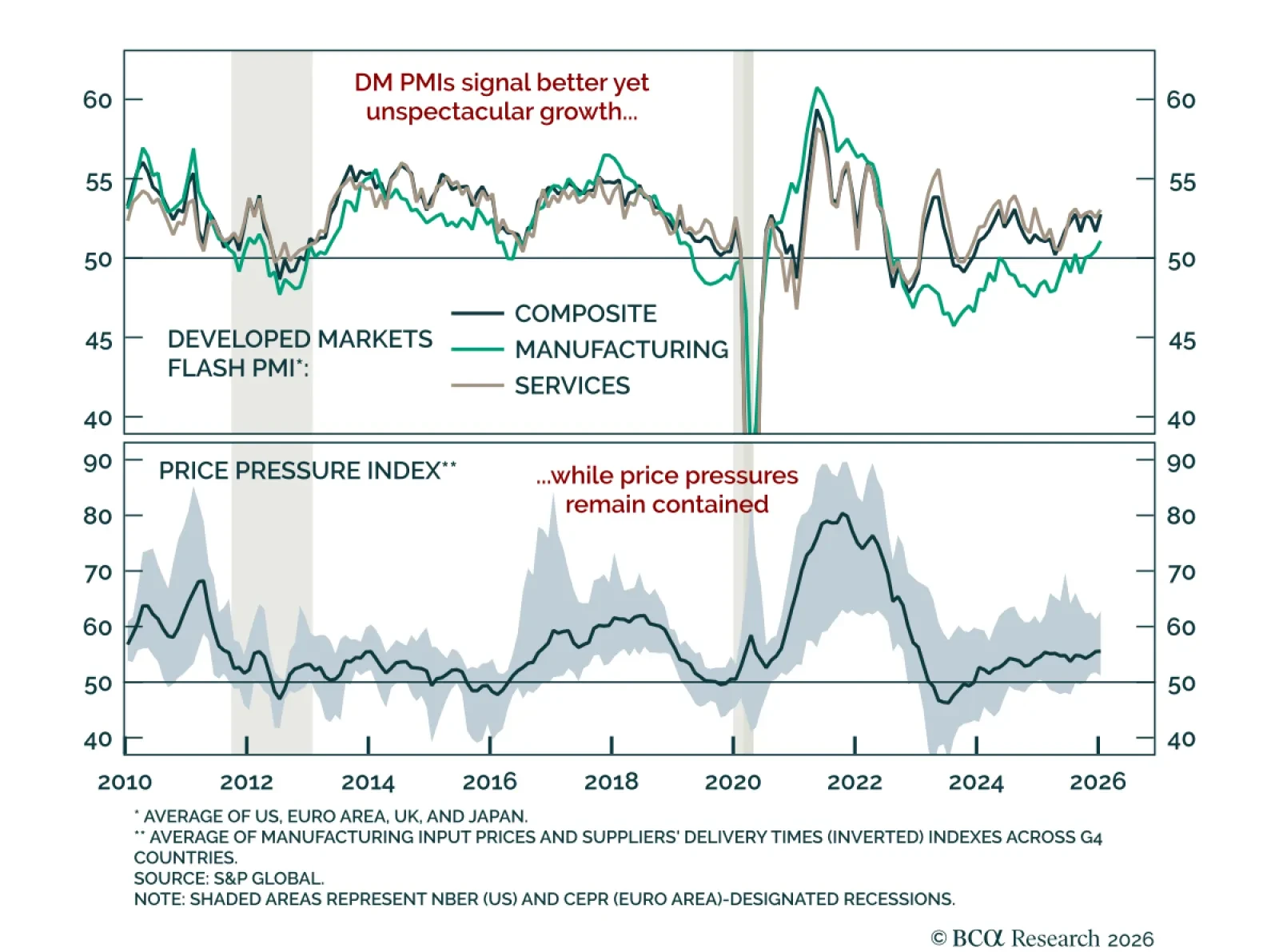

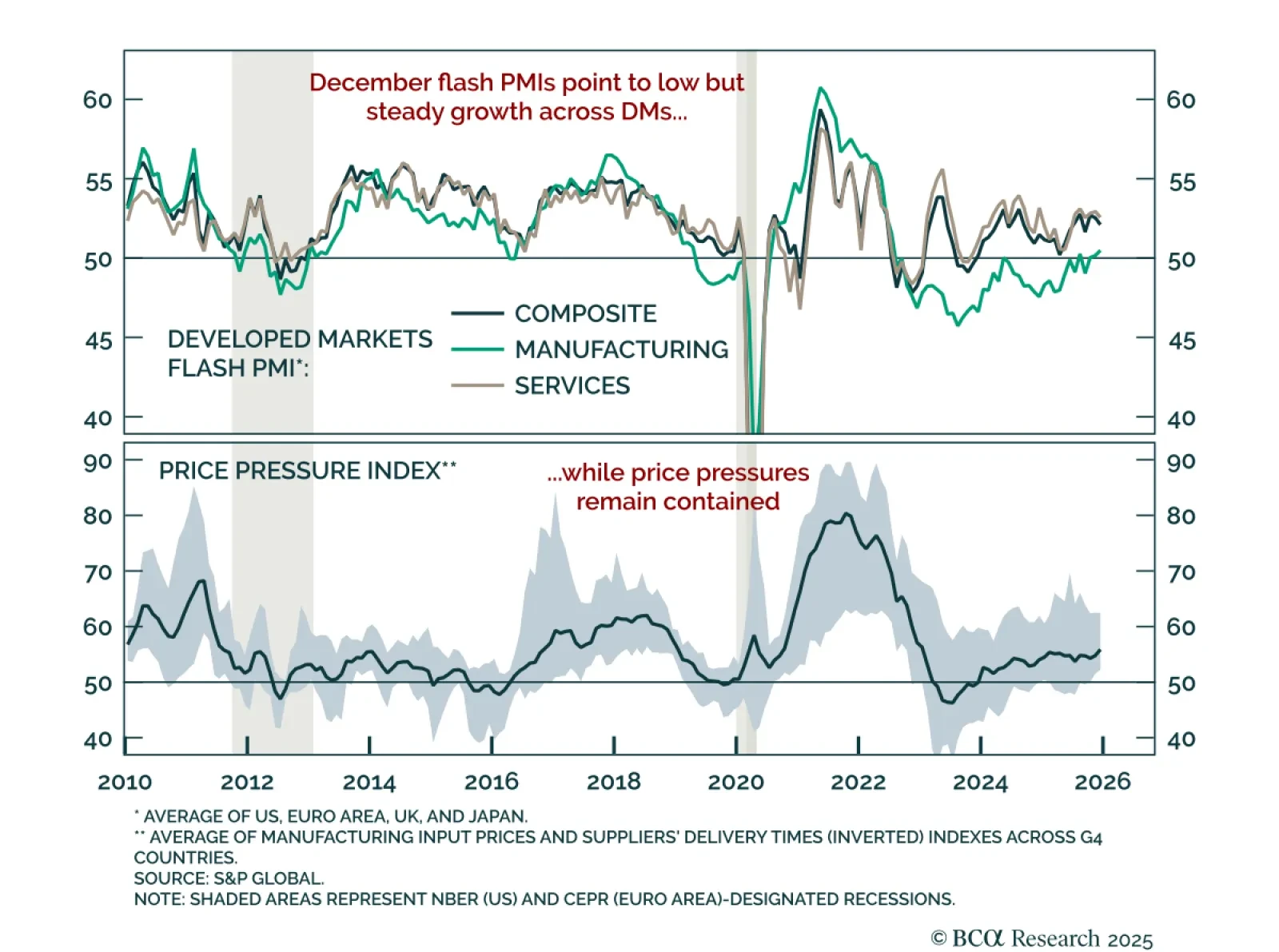

January flash PMIs point to better, though unspectacular, global growth momentum. Developed markets PMIs showed improvement in global growth momentum. PMIs have largely moved sideways through 2025, with manufacturing now recovering…

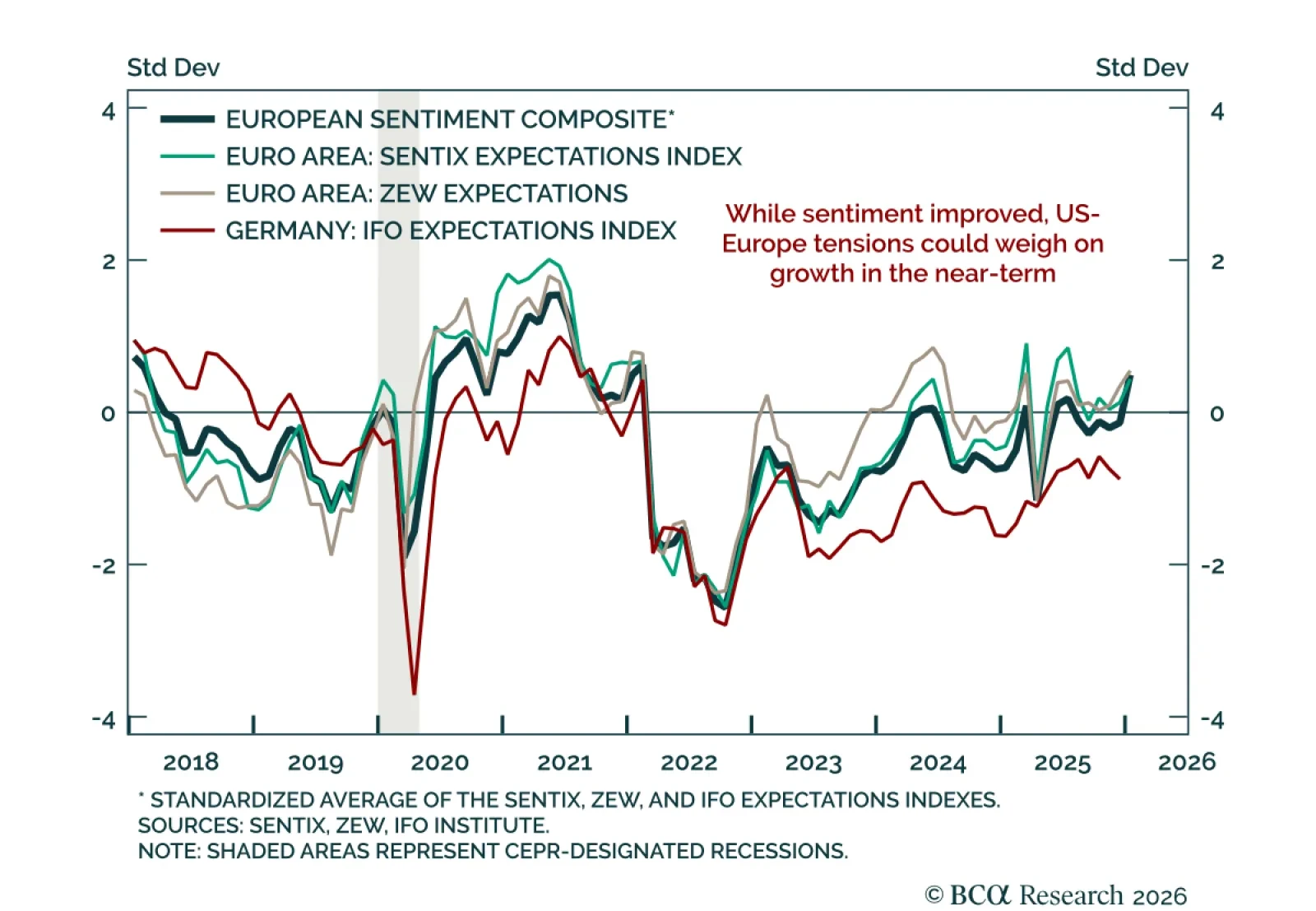

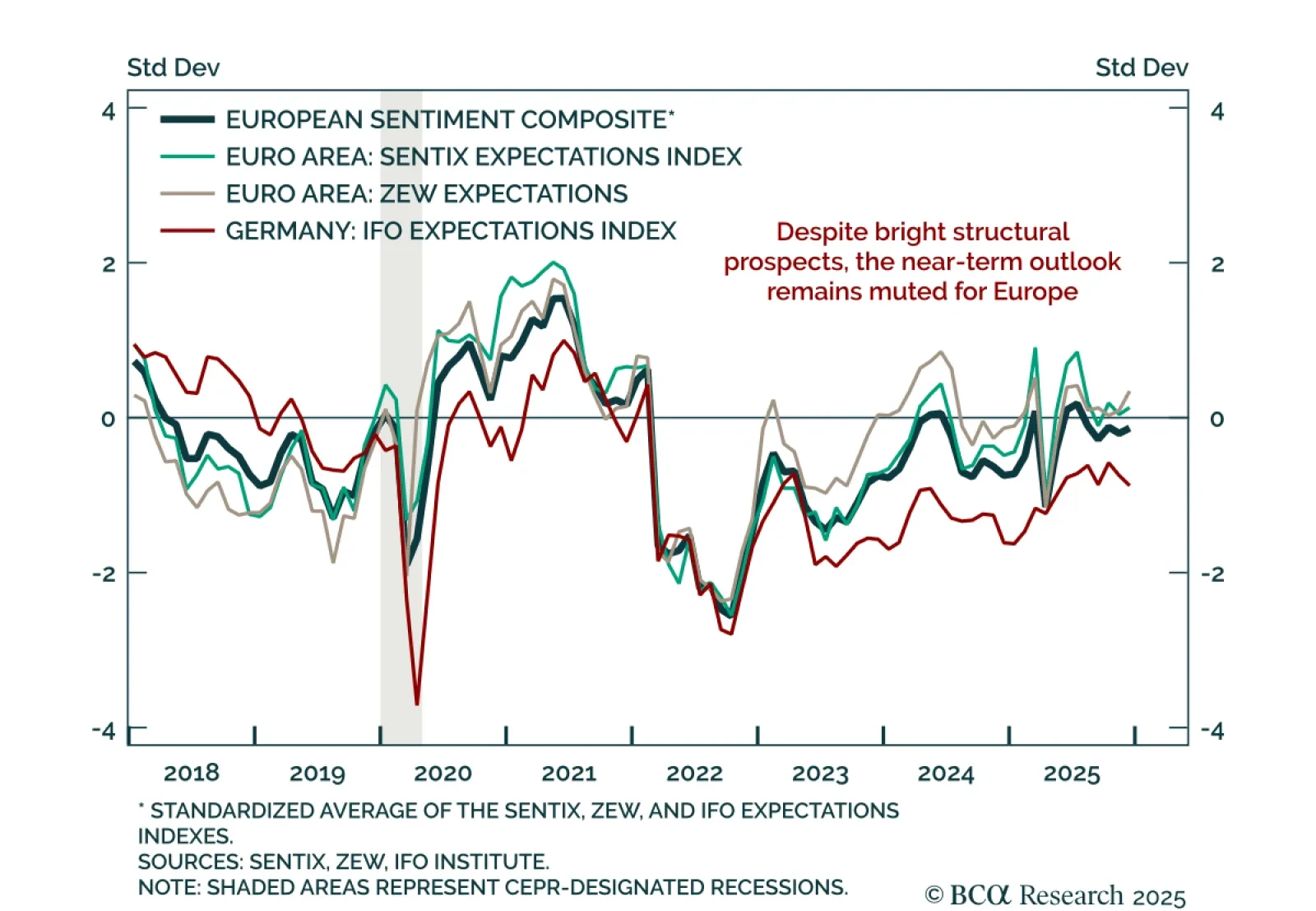

January Euro area sentiment improved, but growth momentum remains limited as tensions with the US rise and reflationary ECB cuts remain possible. January sentiment brightened in the Euro area. The ZEW survey beat expectations for…

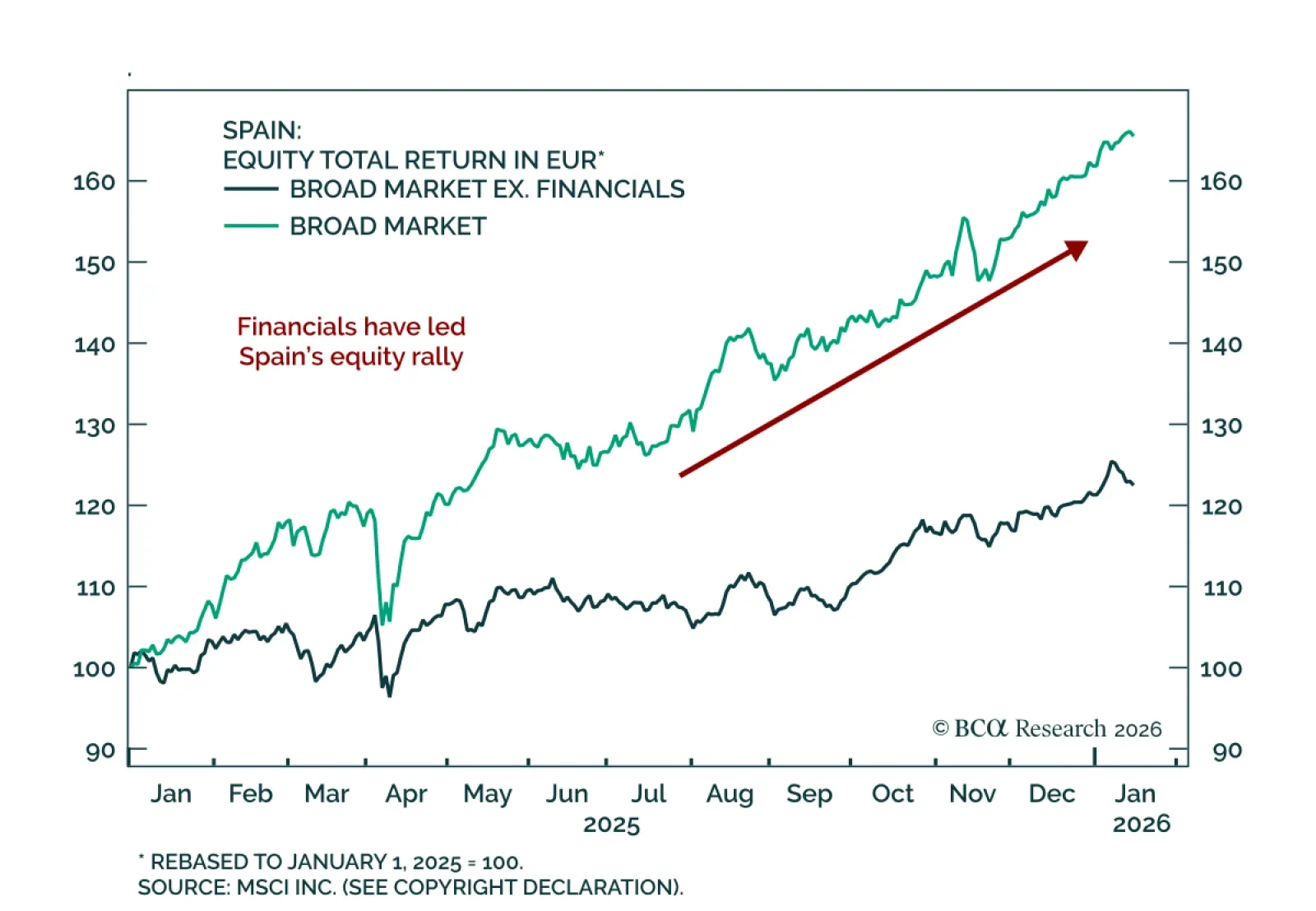

Our GeoMacro and European strategists highlight Spain’s equity and bond outperformance as fundamentally driven, supported by improving balance sheets, stronger profitability, and repeated earnings upgrades. Financials have led the…

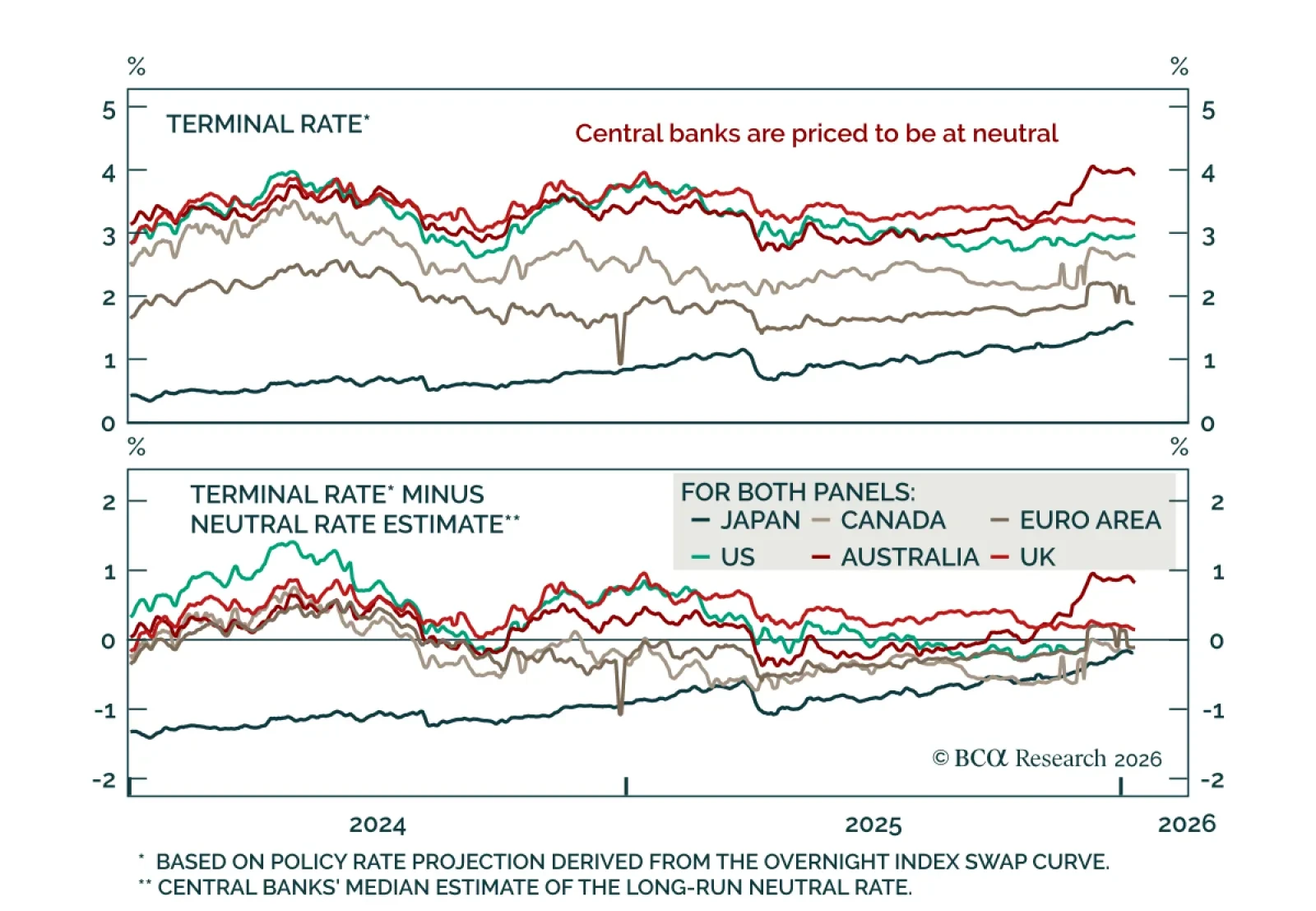

Our Global Fixed Income strategists maintain an above-benchmark duration stance as labor market risks continue to support downside yield potential, even as the global easing cycle winds down. With policy normalization largely…

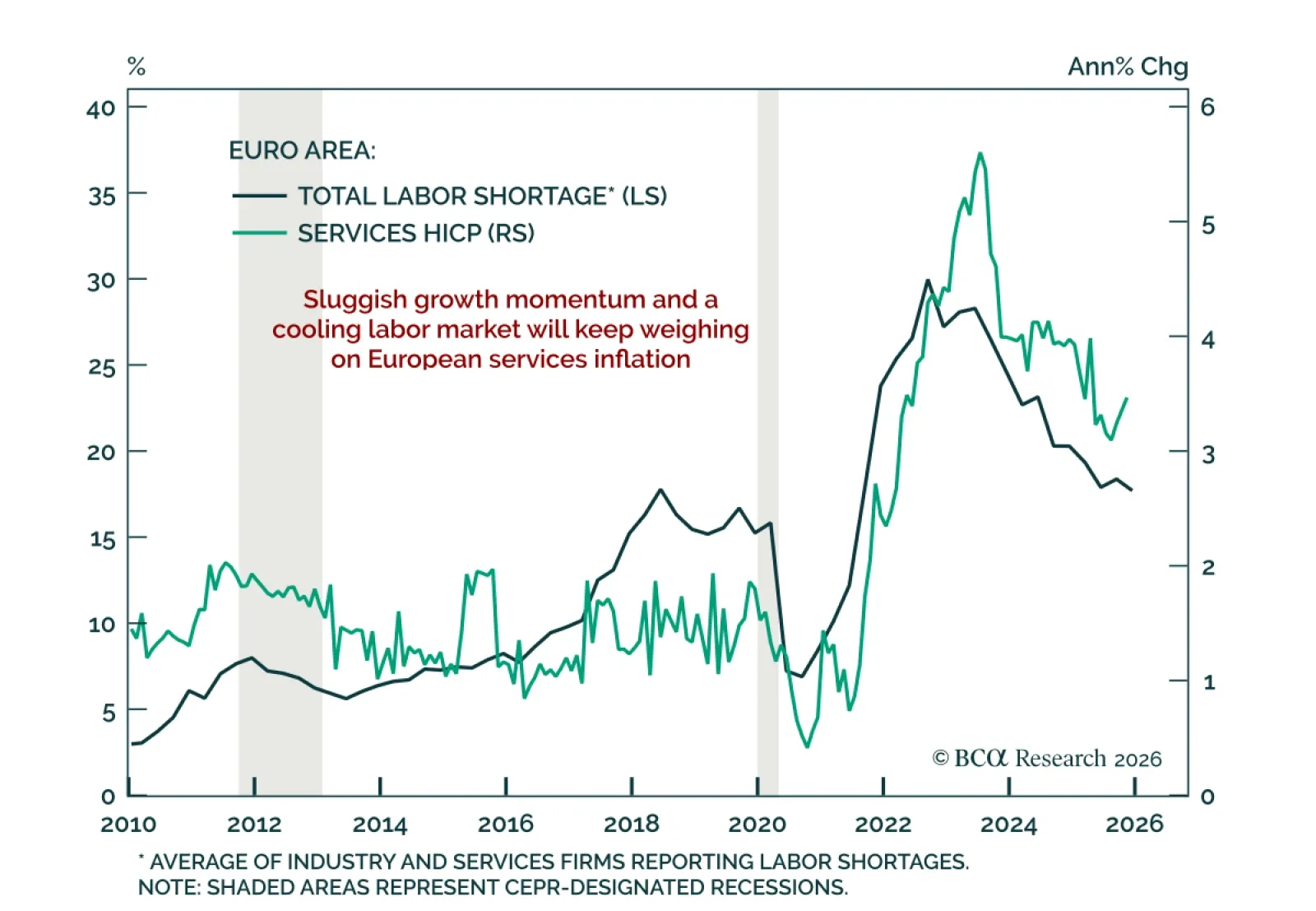

Remain tactically cautious on European assets as persistently weak sentiment keeps growth momentum subdued. European economic sentiment remains soft with little sign of acceleration. The European Commission’s Economic Sentiment Index…

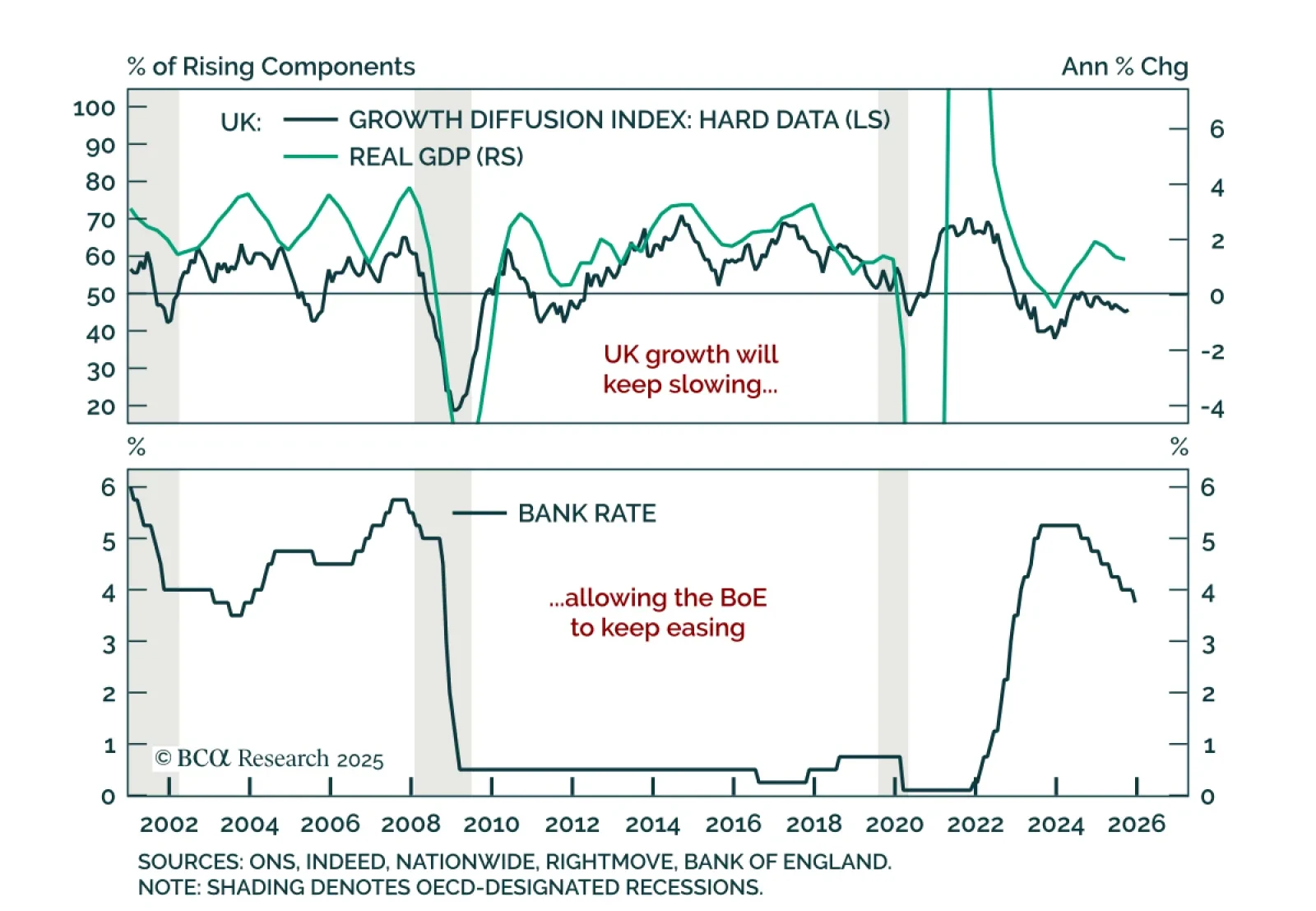

Stay long September 2026 Euribor futures and overweight UK gilts, as Europe could see reflationary cuts while the UK slowdown argues for deeper easing. The ECB left rates unchanged at 2% in a routine meeting and revised its growth…

Remain tactically cautious on European assets as sentiment stays mixed and leading indicators show no acceleration. Euro area sentiment data for December continued to send conflicting signals. The Sentix index slightly beat…

Maintain an underweight in industrial commodities as flash PMIs confirm weak global growth momentum. December flash PMIs for developed markets pointed to subdued activity. The US composite slowed to 53 from 54.2, a six-month low,…

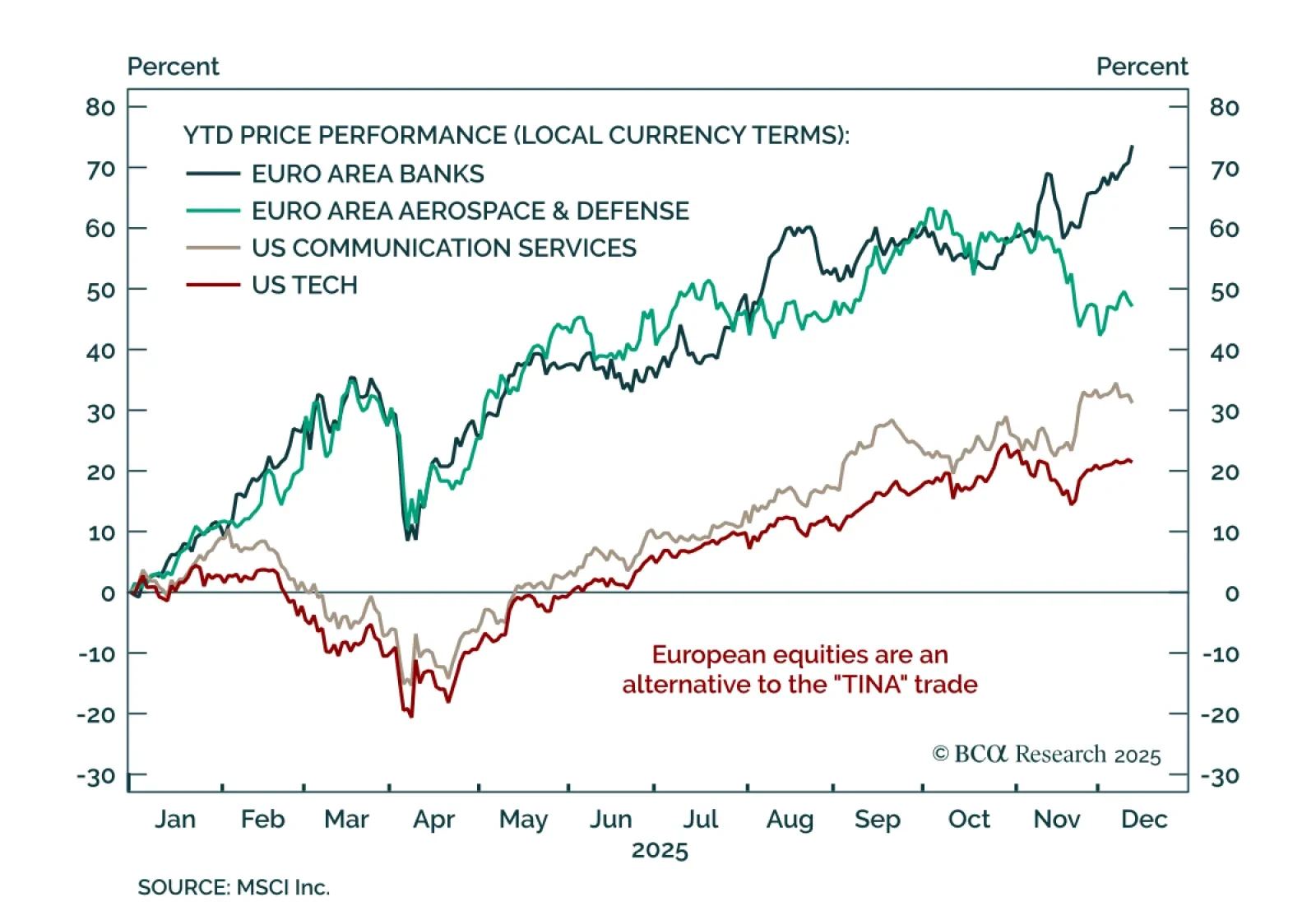

Europe’s equity outperformance is real, and even stronger once adjusted for FX. Our Chart Of The Week comes from Jeremie Peloso, Chief European Investment Strategist. Banks and defense stocks (not tech and communication services…