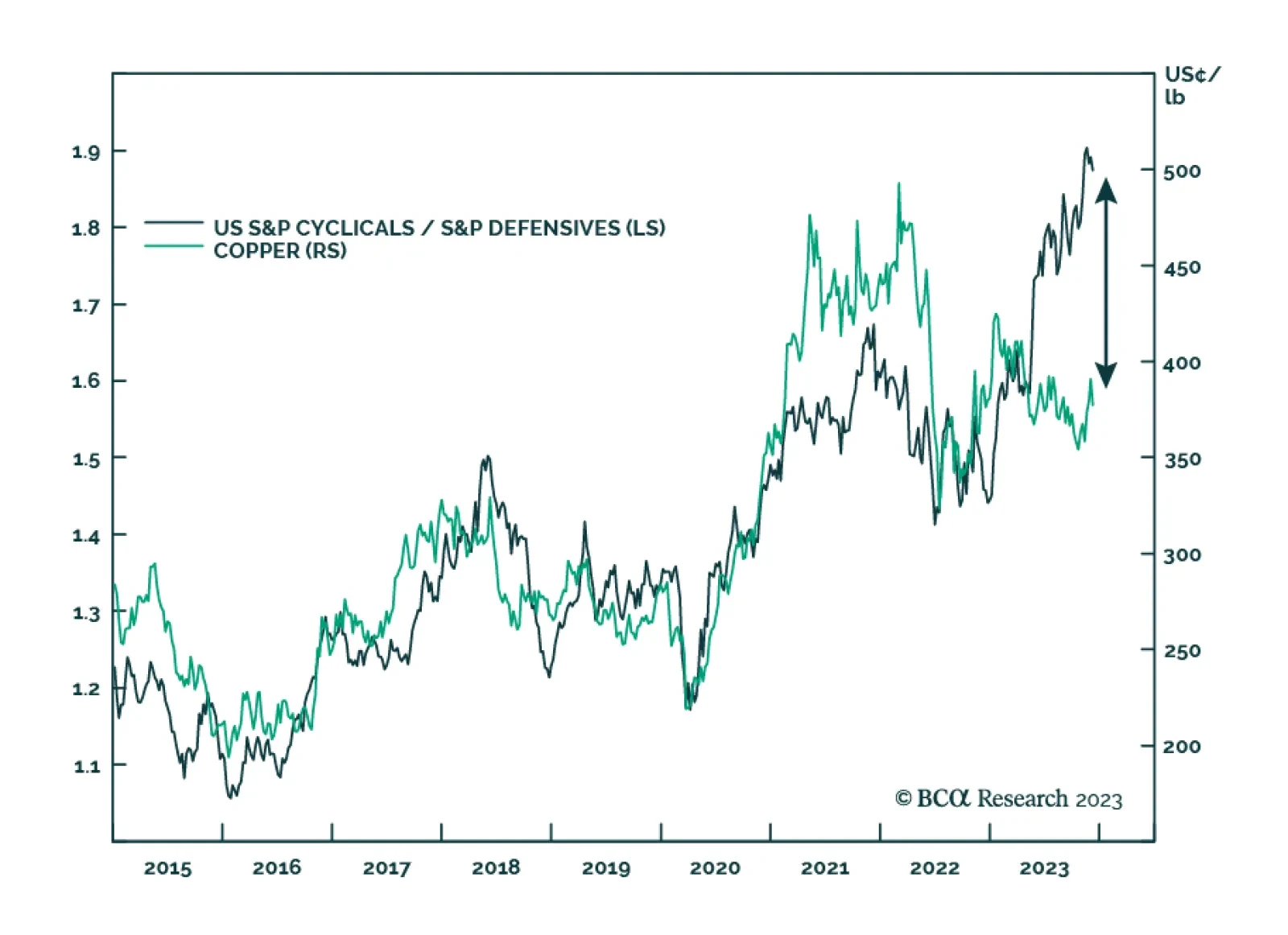

Copper benefited from the recent improvement in global risk sentiment, participating in the broad-based rally in November. To the extent that the red metal has vast applications across many economic sectors, it is…

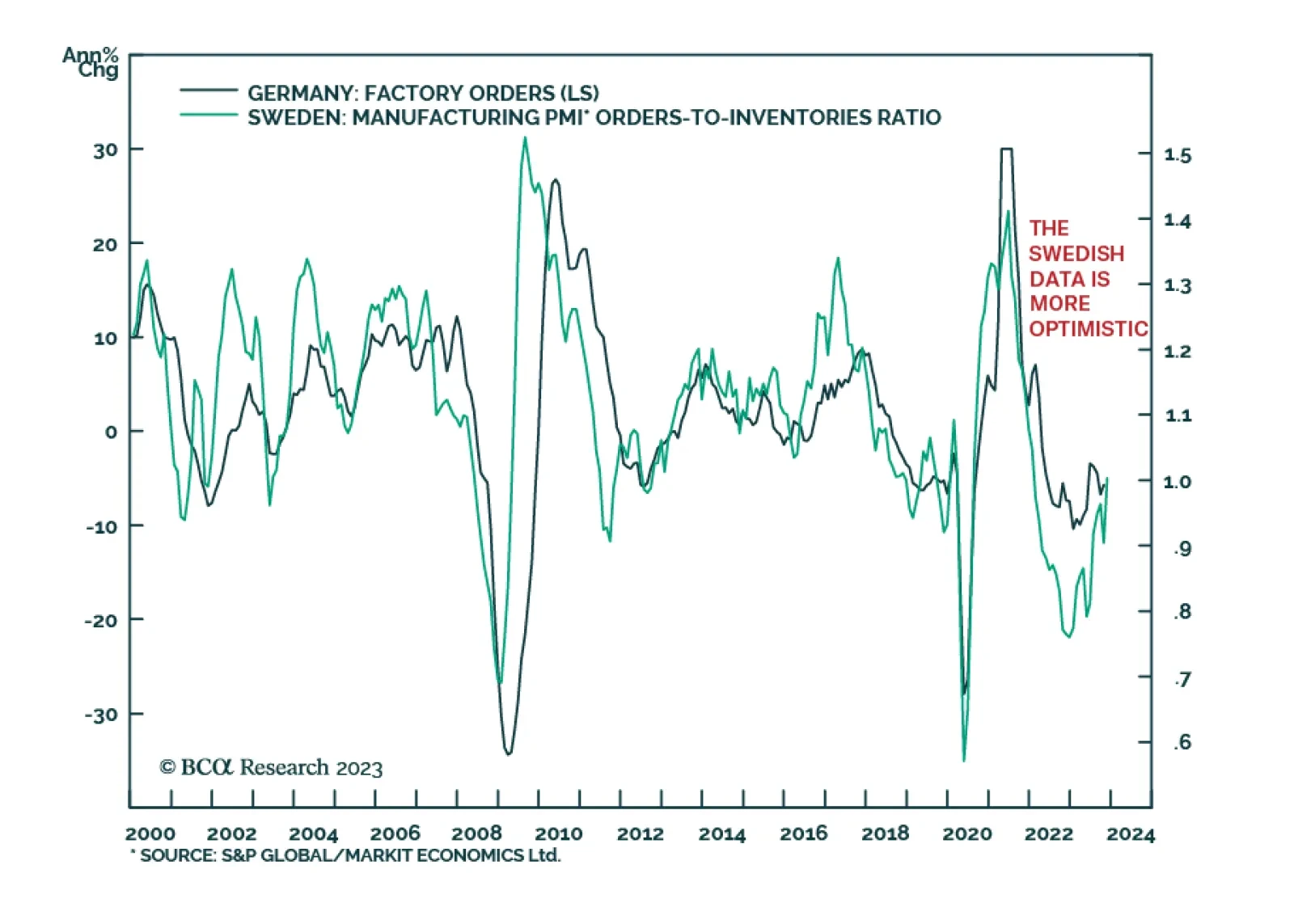

German factory orders sent a disappointing signal on Wednesday. New orders at German factories unexpectedly declined by 3.7% m/m in October, disappointing expectations of a 0.2% m/m rise following two consecutive months of…

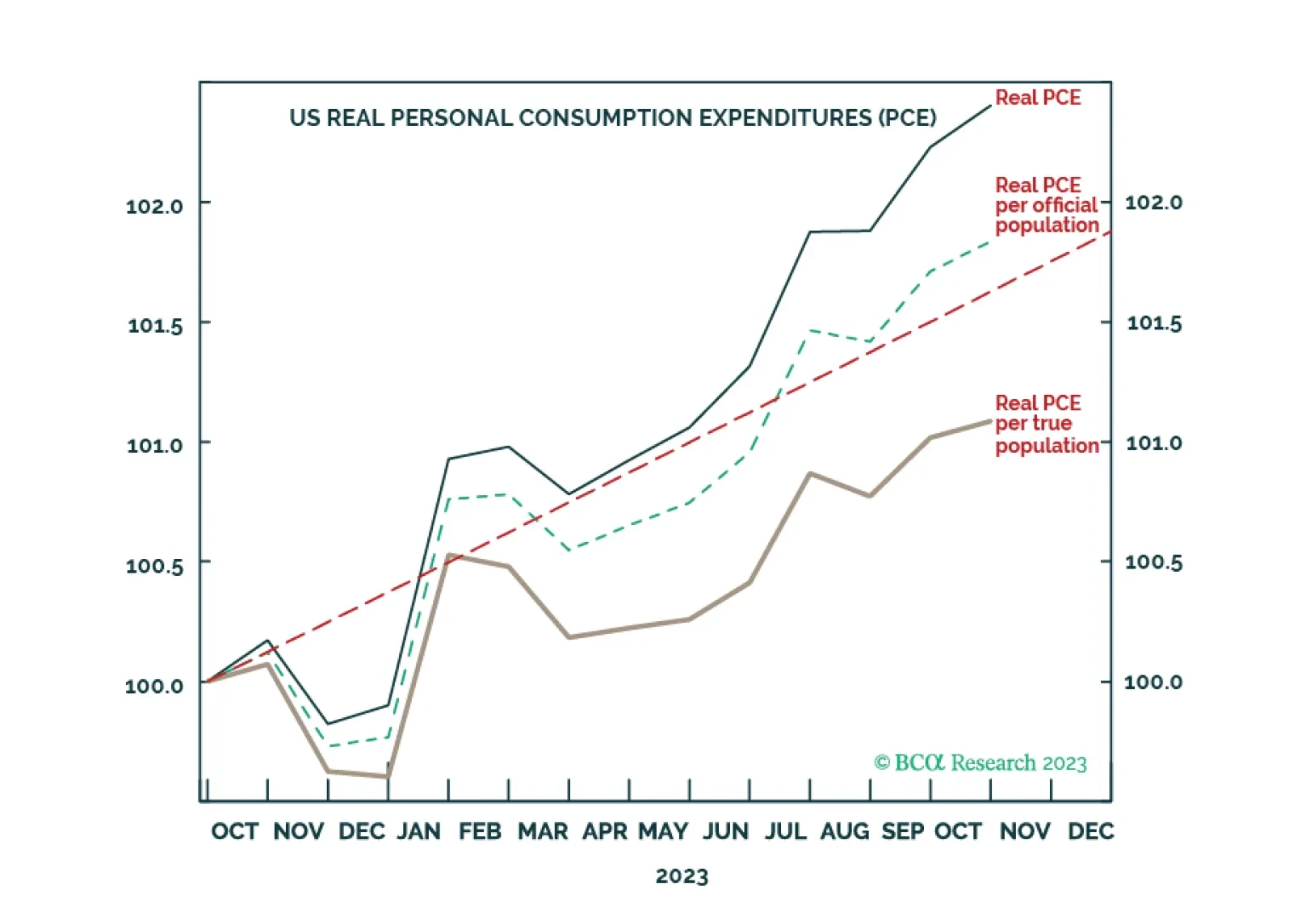

Illegal immigration into the US has skyrocketed to record levels. Correctly accounting for this, US real consumption growth on a per head basis is already fragile. Meanwhile, the real bond yield is only now approaching the pain point…

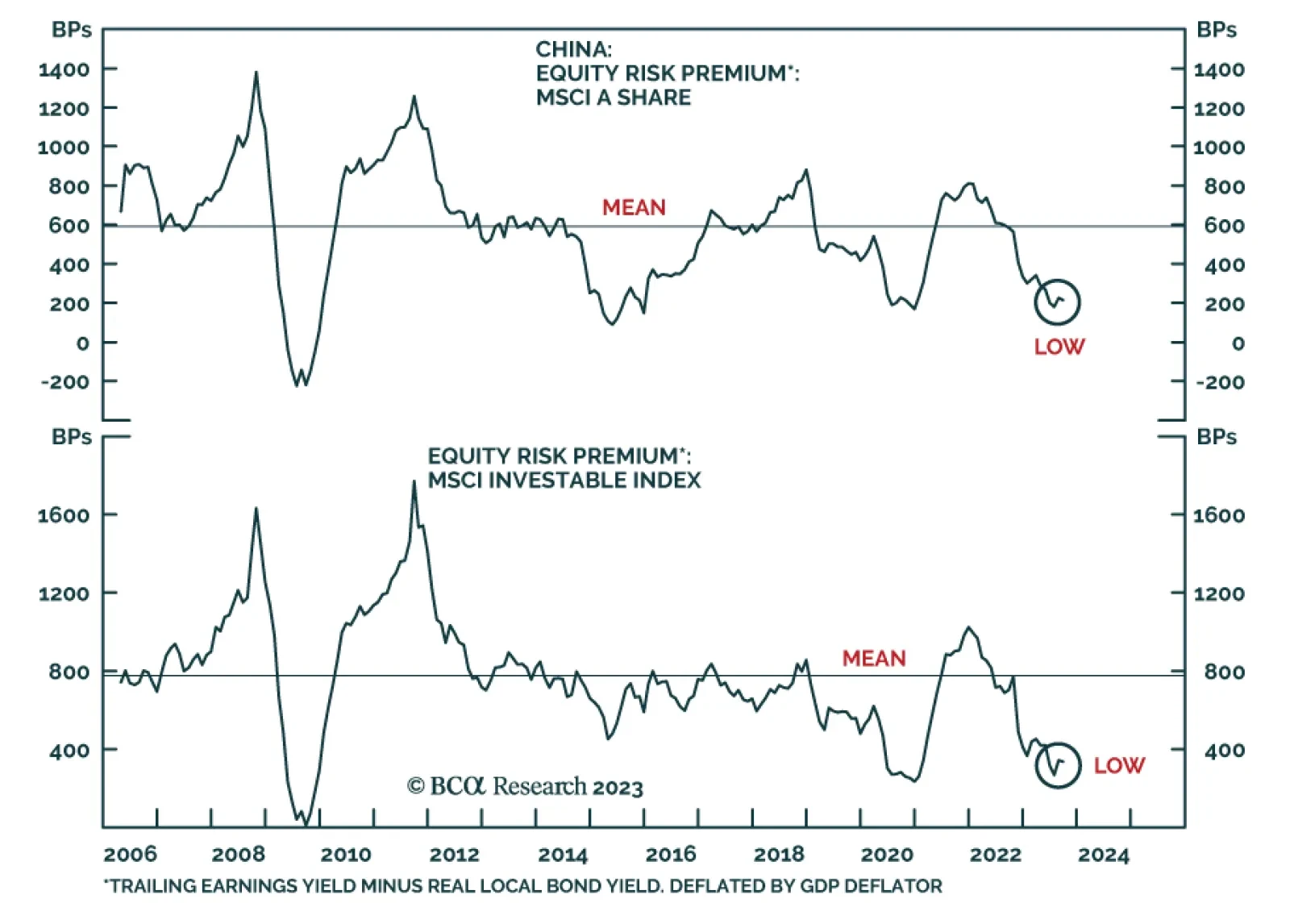

China’s CSI 300 equity index closed at its lowest level since early 2019 on Tuesday following news that Moody’s downgraded its outlook for China’s credit rating from stable to negative. The report cited the…

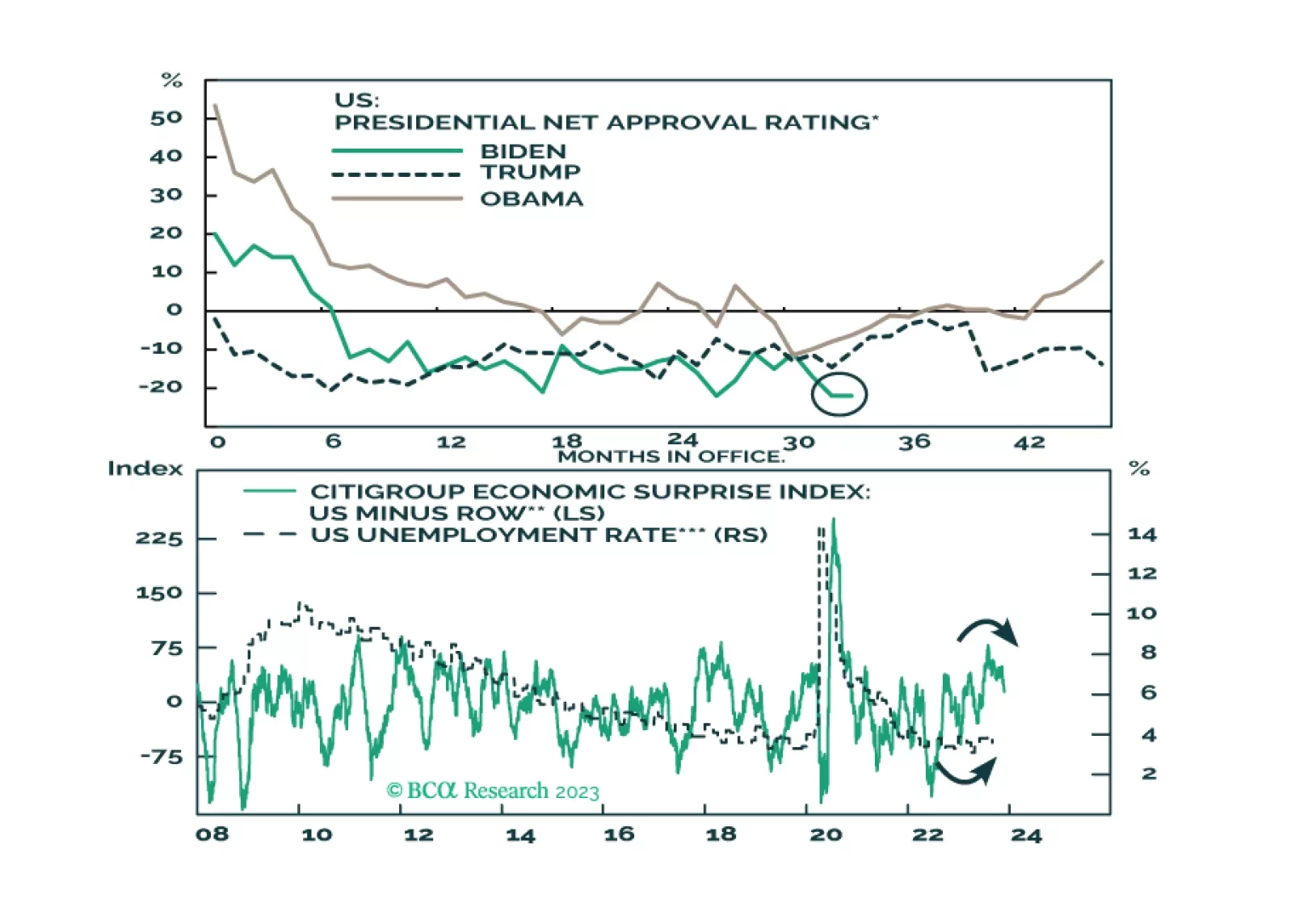

Global instability will continue in 2024 – whatever happens afterward. Slowing economies will exacerbate already high geopolitical risk and policy uncertainty stemming from the US election and foreign challenges to US leadership.…

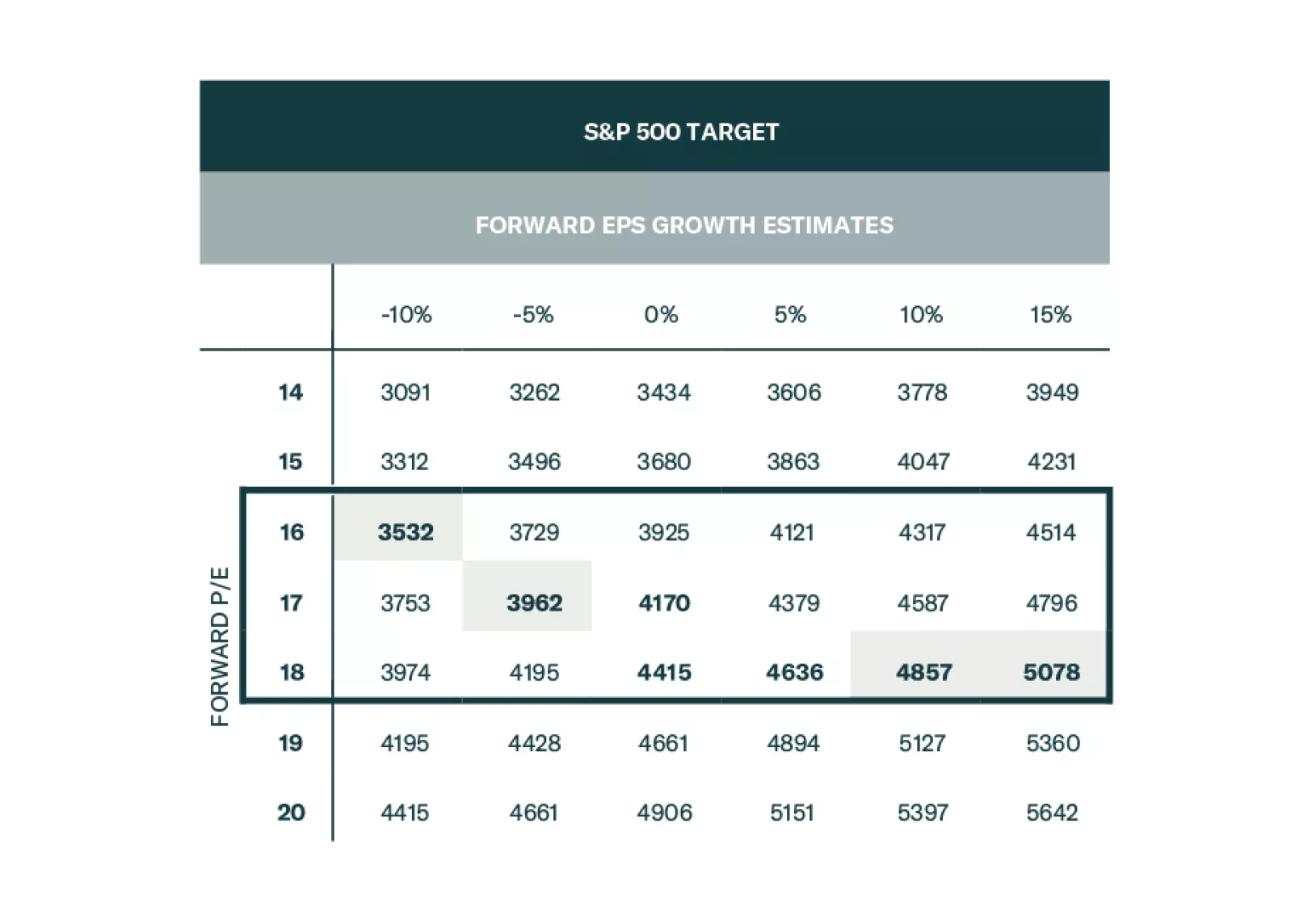

The S&P 500 closed at a fresh year-to-date high on Friday, breaking slightly above its late-July top. The brisk rally since late-October erased all the losses of the prior three months. However, the sector performance has…

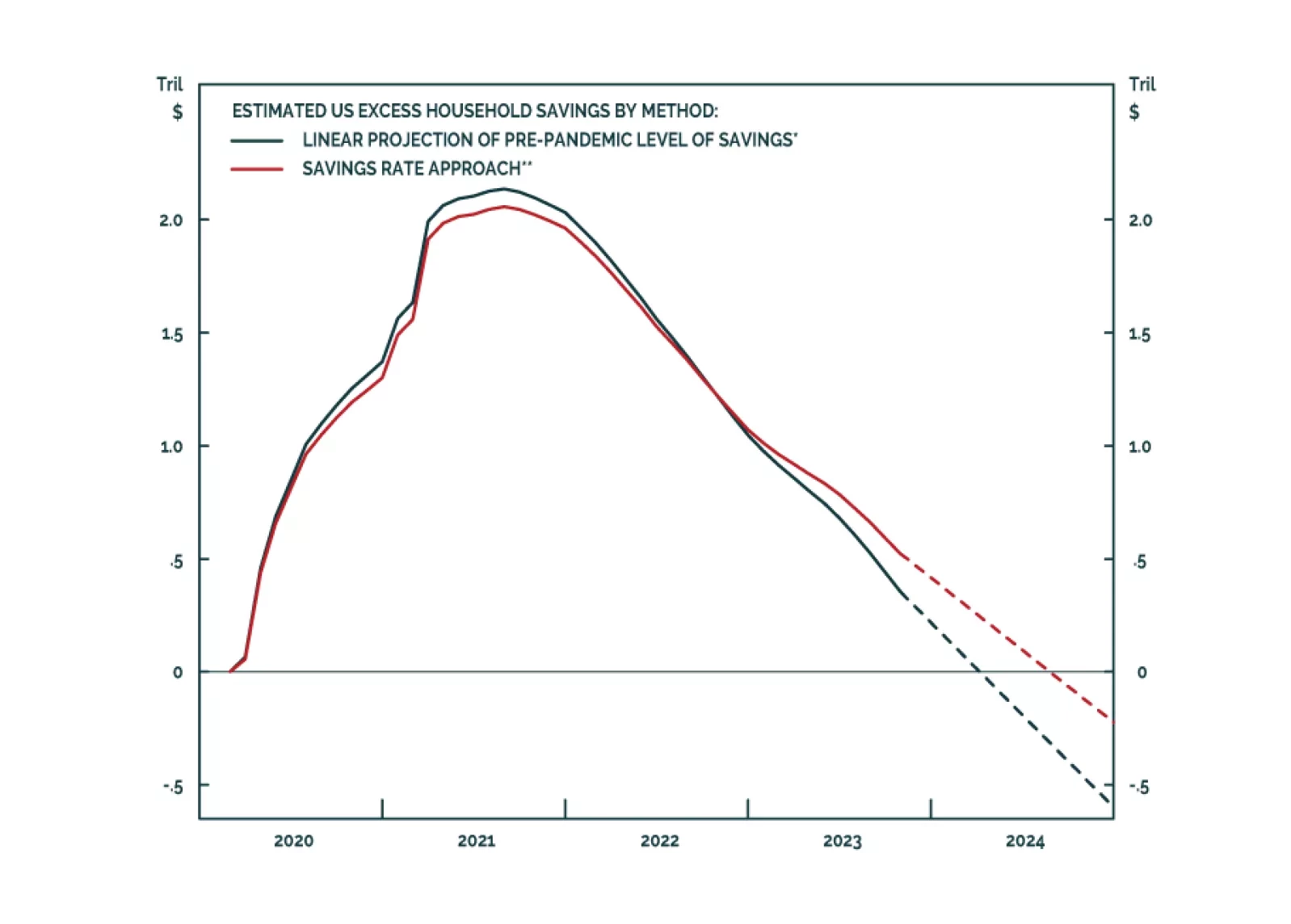

According to BCA Research’s Global Asset Allocation service, recession is still on track to begin in the first half of 2024. Is it the recession that never came? Certainly, the consensus thinks so. Soft landing is now…

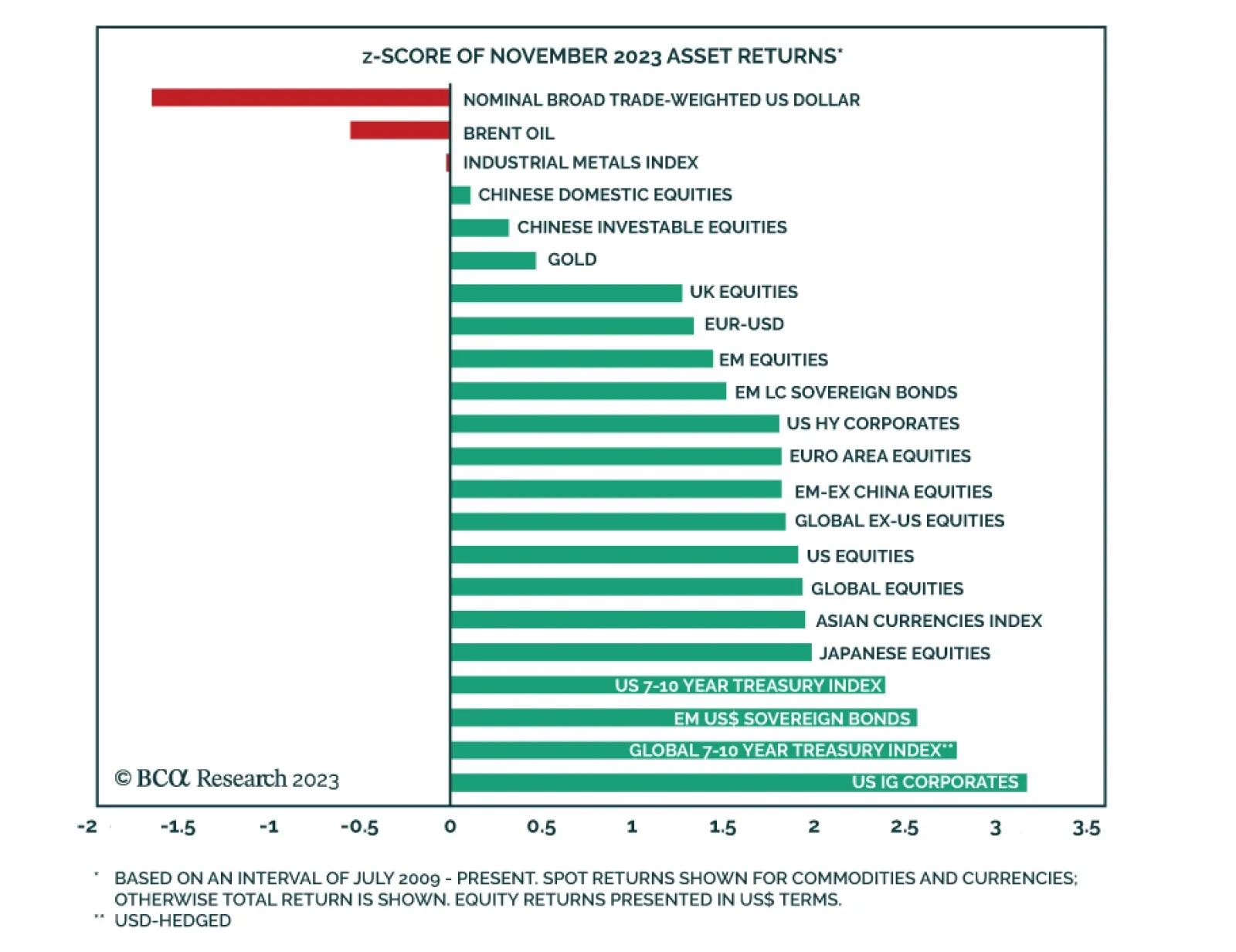

Global financial markets delivered exceptional gains in November. Fixed income led in terms of abnormally large returns amid a shift in the market narrative in favor of significant Fed rate cuts in 2024. Importantly, the…