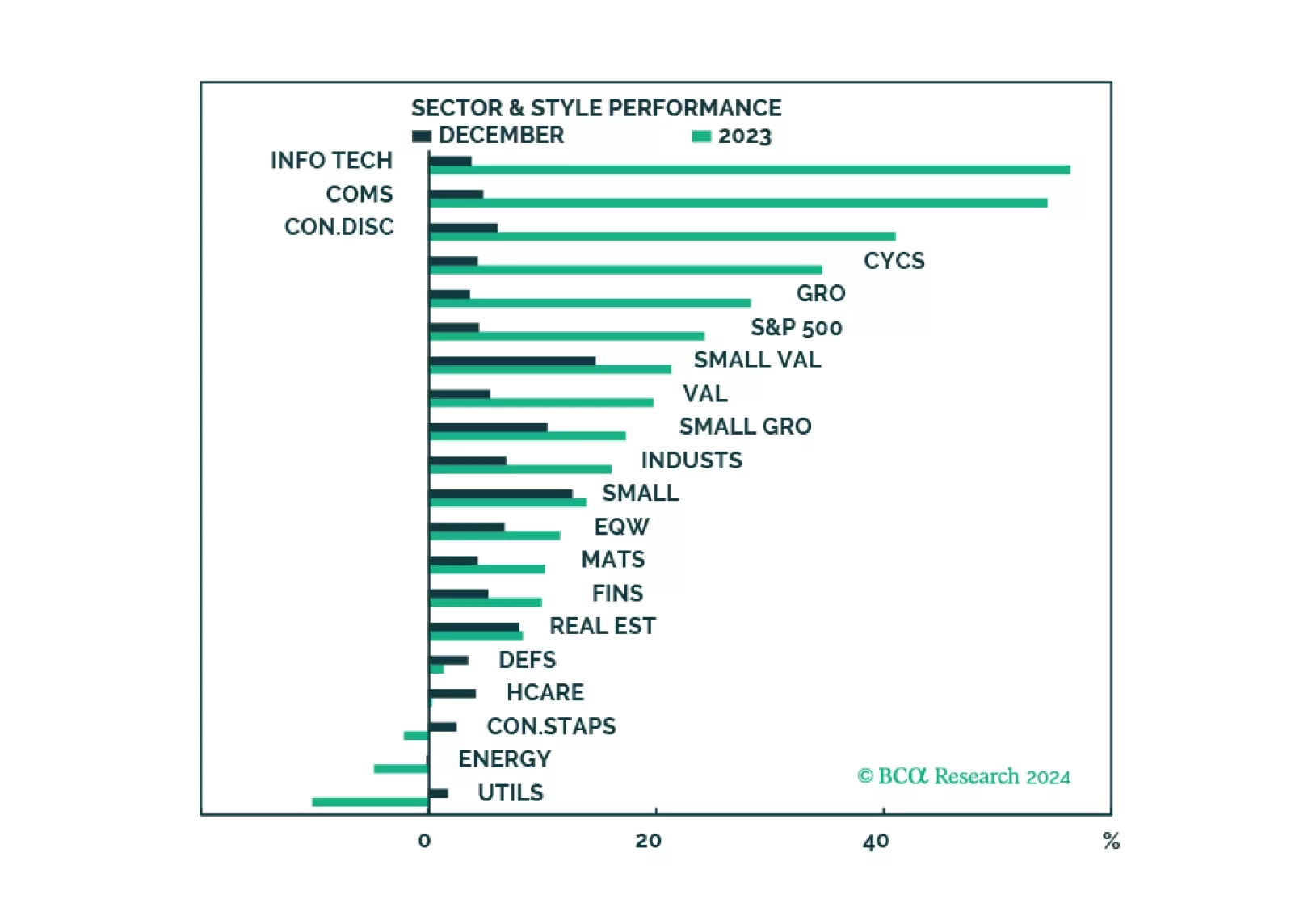

After sinking to a low in October last year, the S&P 500 rallied by 15.84 % by year end, but that rally has faded in the new year. Against the backdrop of increasing belief in the soft-landing narrative, this correction has…

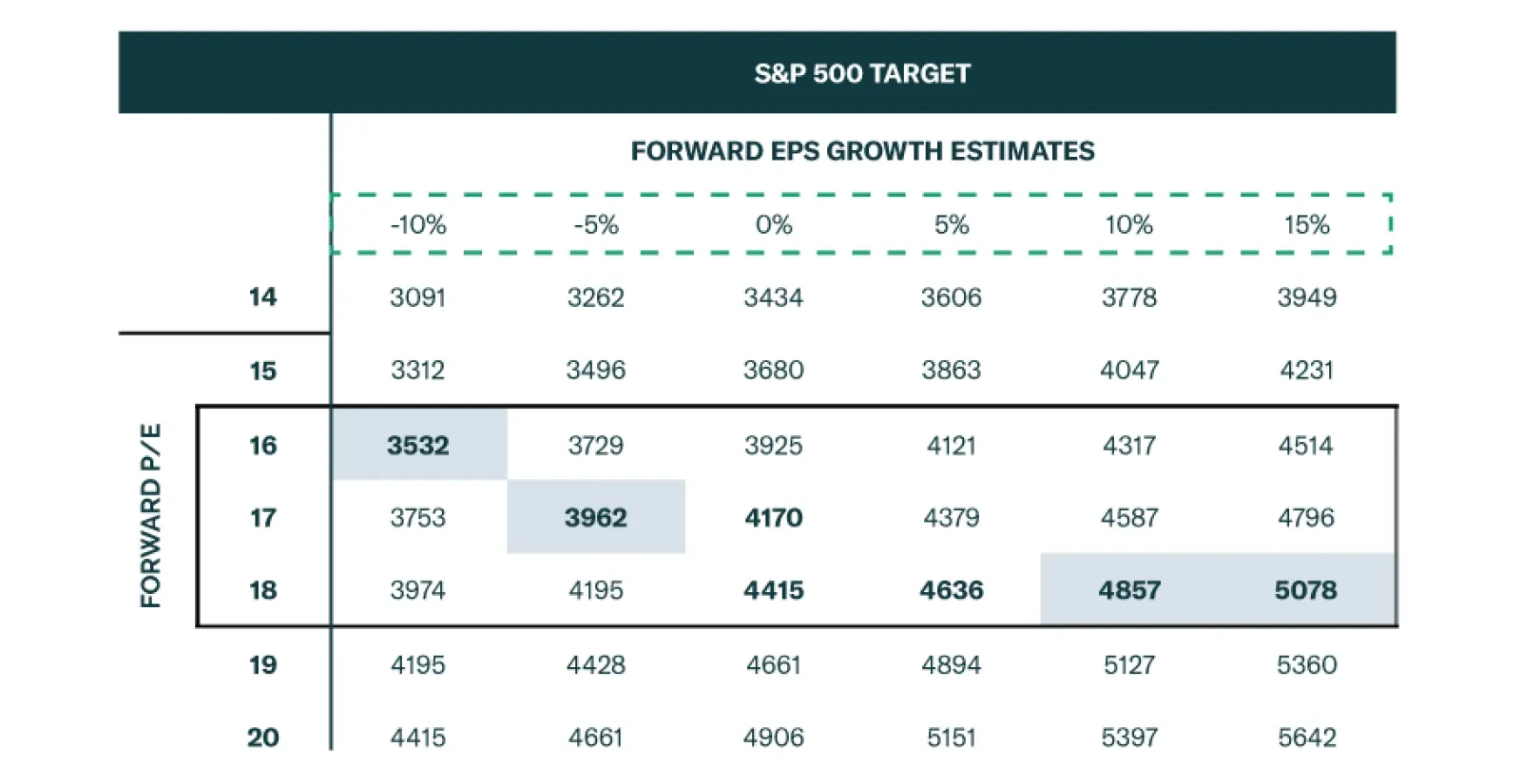

The Santa Claus rally started in late October lifting the S&P 500 by 15.8%. However, there are signs that the rally is getting tired. Consider the following: The S&P 500 has been trading at around 4,750 since the…

The market’s pricing of a soft landing means that geopolitical risks are becoming more, not less, relevant in 2024. US domestic divisions will invite challenges as foreign powers rightly fear that US policy will turn more hawkish…

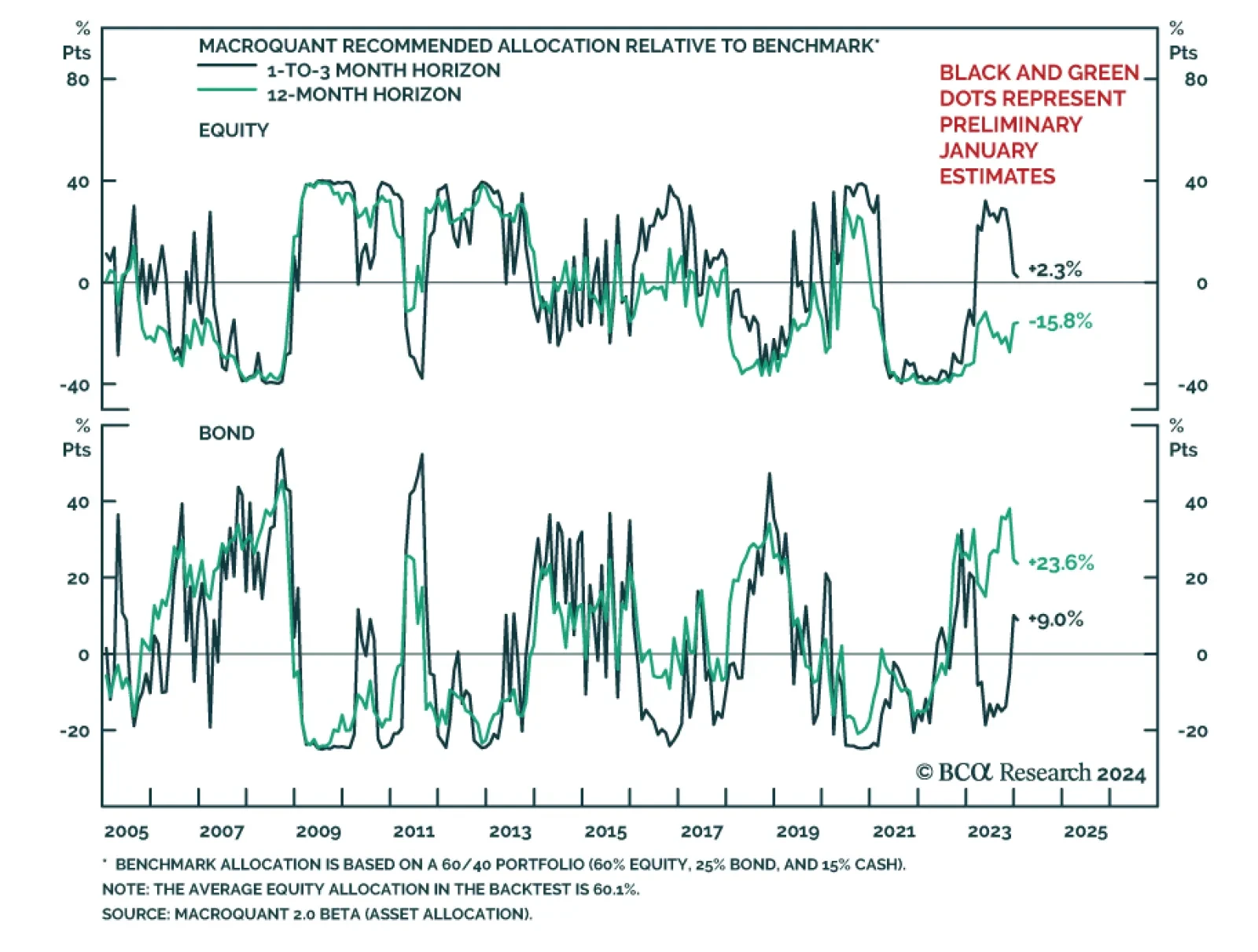

The S&P 500 has started off the new year on a weak footing, dropping by 1.5% in the first week of January. Indeed, by the end of 2023, several indicators were warning that conditions were becoming bearish. In…

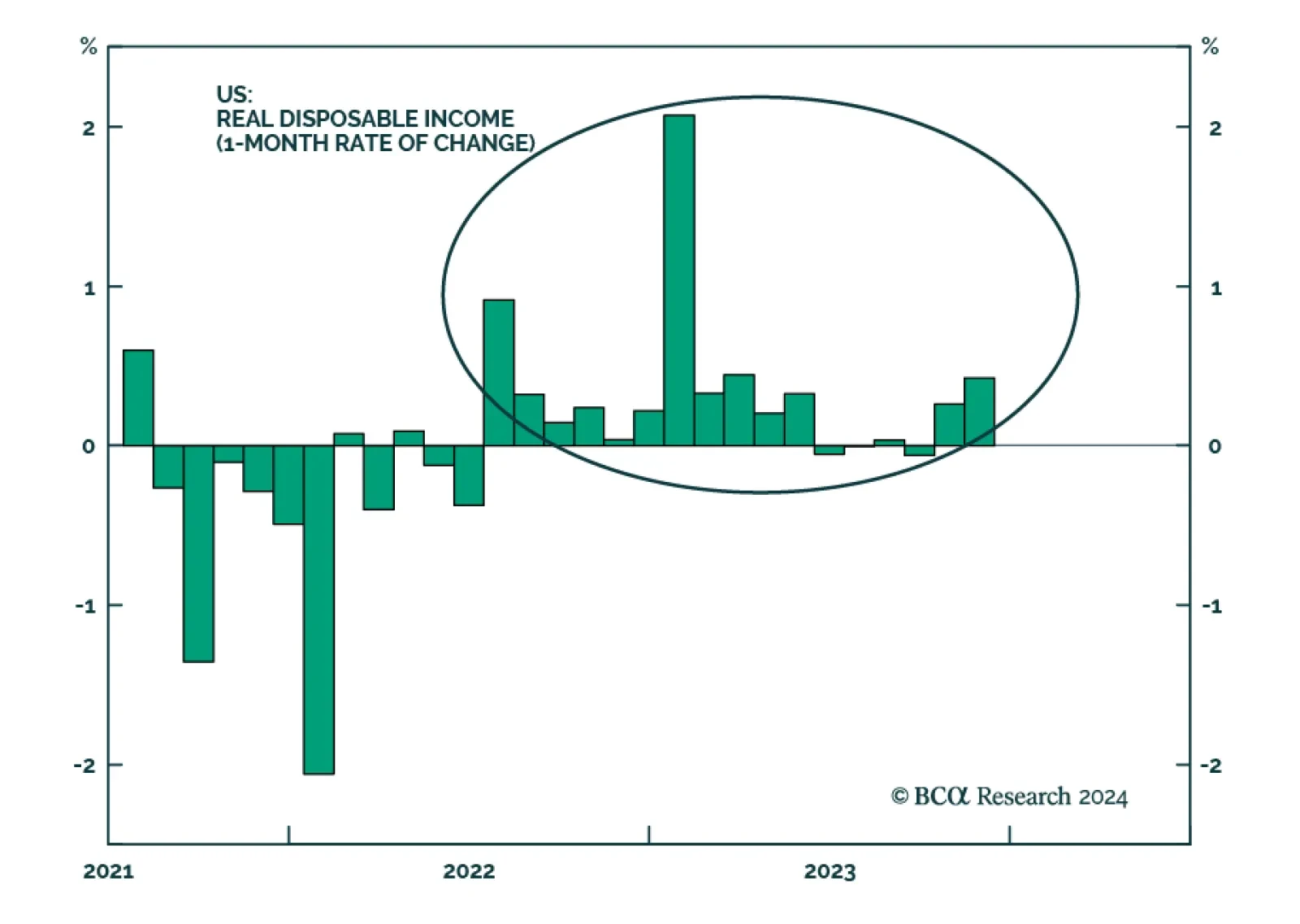

Growth in US disposable income has outpaced inflation nearly every month since mid-2022. Consumption is principally driven by income, but in the US it has gotten a meaningful assist the last two years from the drawdown of excess…

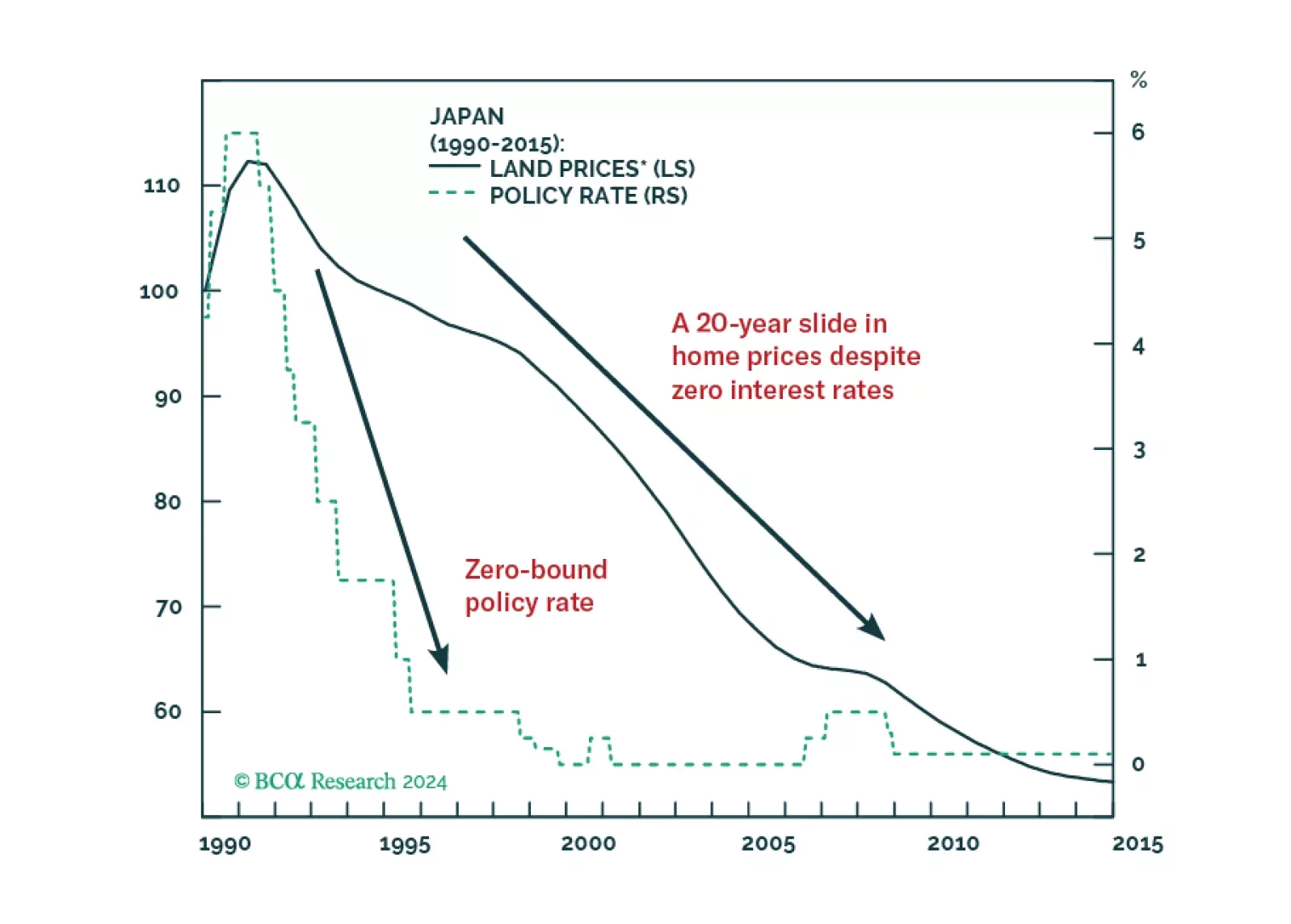

A low multiplier effect of stimulus will reduce the magnitude of the rebound in China's business activities in 2024. The housing market downturn will likely persist, and the ongoing household deleveraging also poses a significant…

Despite the blah opening to the year, we do not think stocks have reached an inflection point. We expect that incoming data will continue to flatter the soft-landing narrative for another couple of months, helping the S&P 500 to…

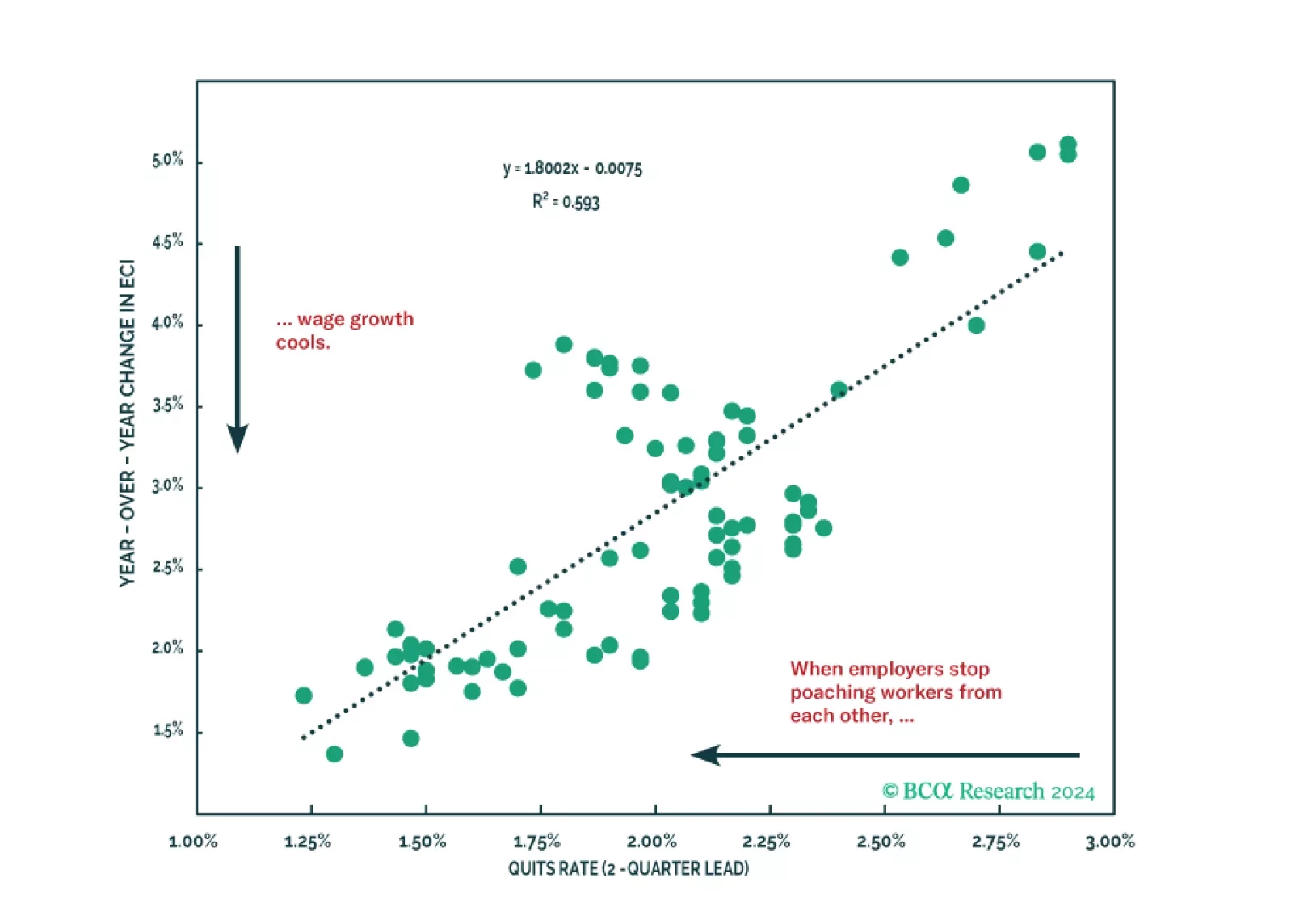

The Santa Claus rally has been fueled by investors optimism about a soft landing which is the least likely macro outcome in 2024. A pullback in the market is imminent as the probability of "too hot" or "too cold" will get priced in.…

After rallying by 11.2% between October 5 and December 27, the price of copper has since been on a losing streak, falling in each of the subsequent six trading sessions. Notably, this decline has coincided with weakness among…

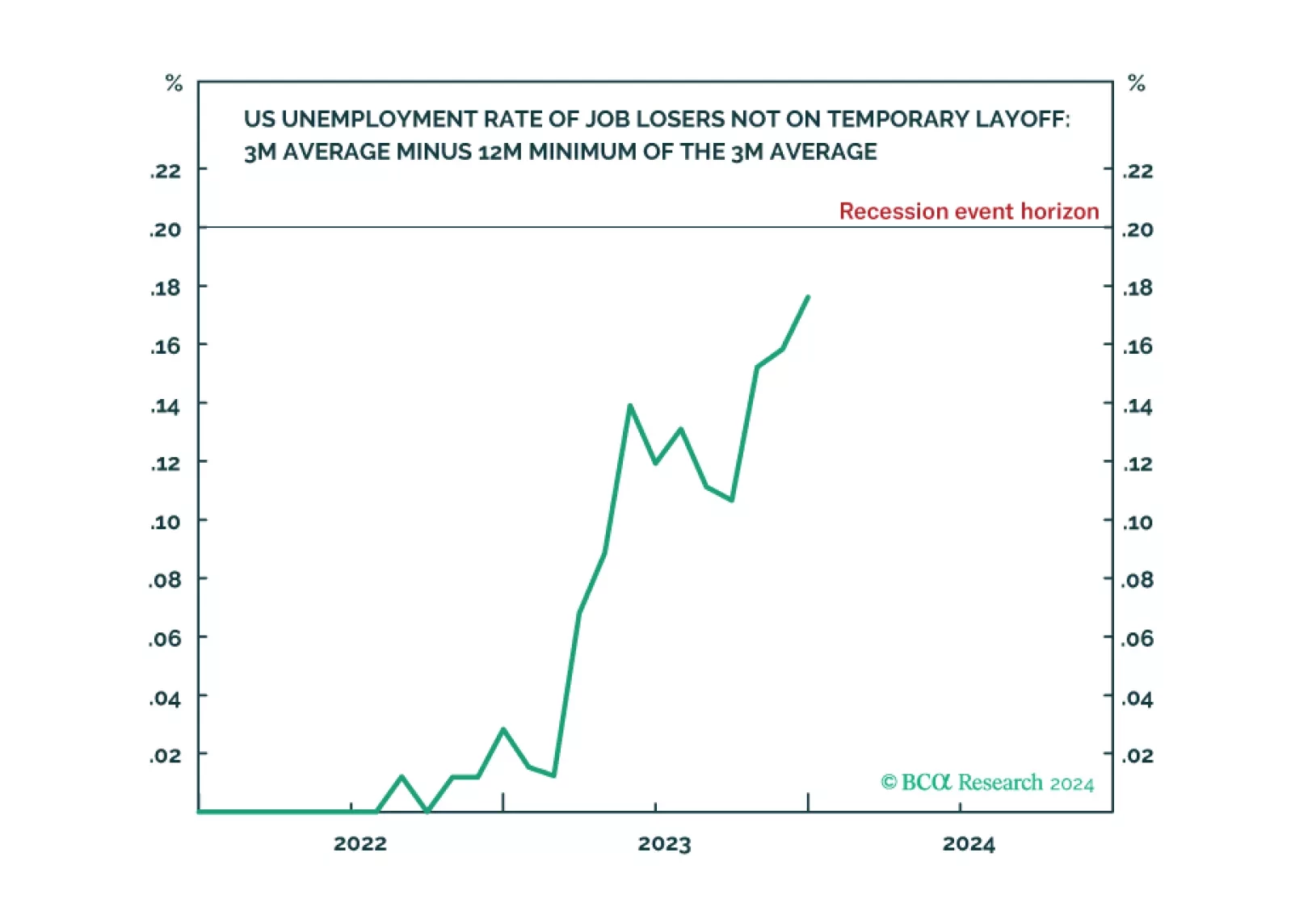

Following today’s US jobs data release, the Joshi rule real-time US recession indicator inched up to 0.18 and is now just a whisker from its recession event-horizon of 0.20.