A recent slew of macroeconomic data has reassured us that the runway to a recession is longer than many thought. However, that positive realization comes with two caveats. First, the Fed pivot is not imminent, and the magnitude of…

According to BCA Research’s Geopolitical Strategy service there is more downside than upside for stocks and yields. Every year the team chooses their top five low-probability, high-impact events that could roil markets.…

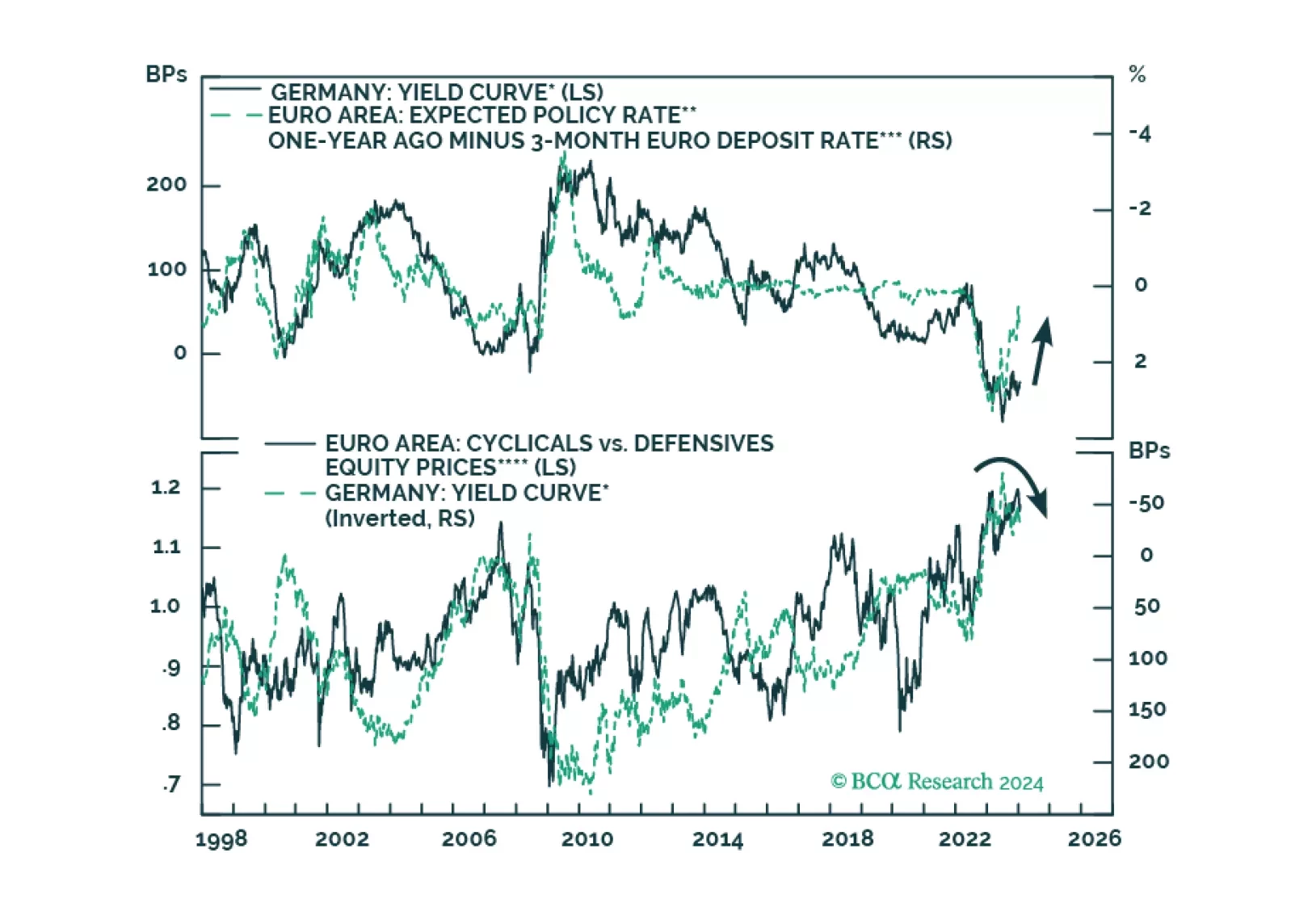

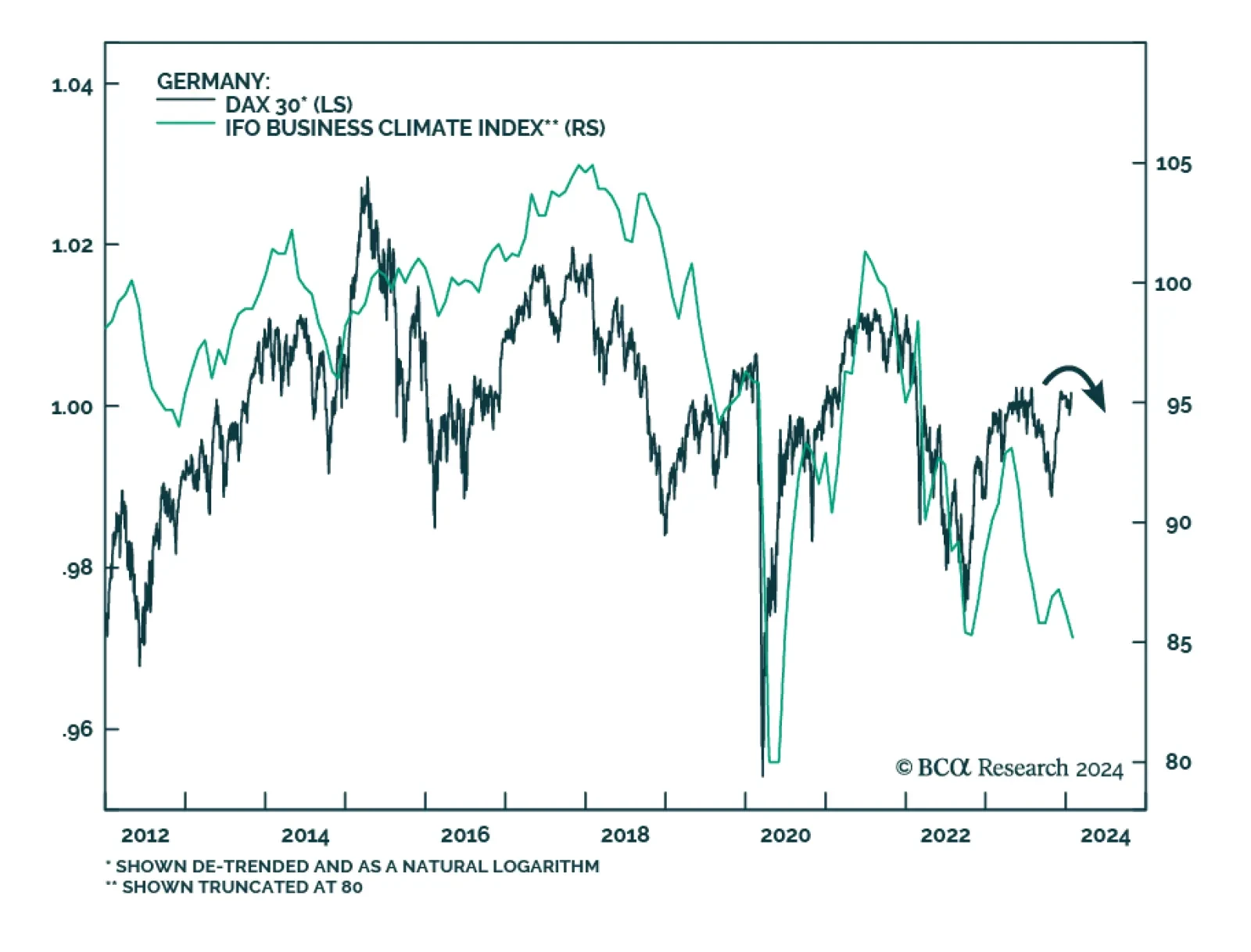

Germany’s IFO survey is sending a warning. The Business Climate Index unexpectedly fell for the second month in a row in January. Importantly, increased pessimism about the current situation and the outlook are driving this…

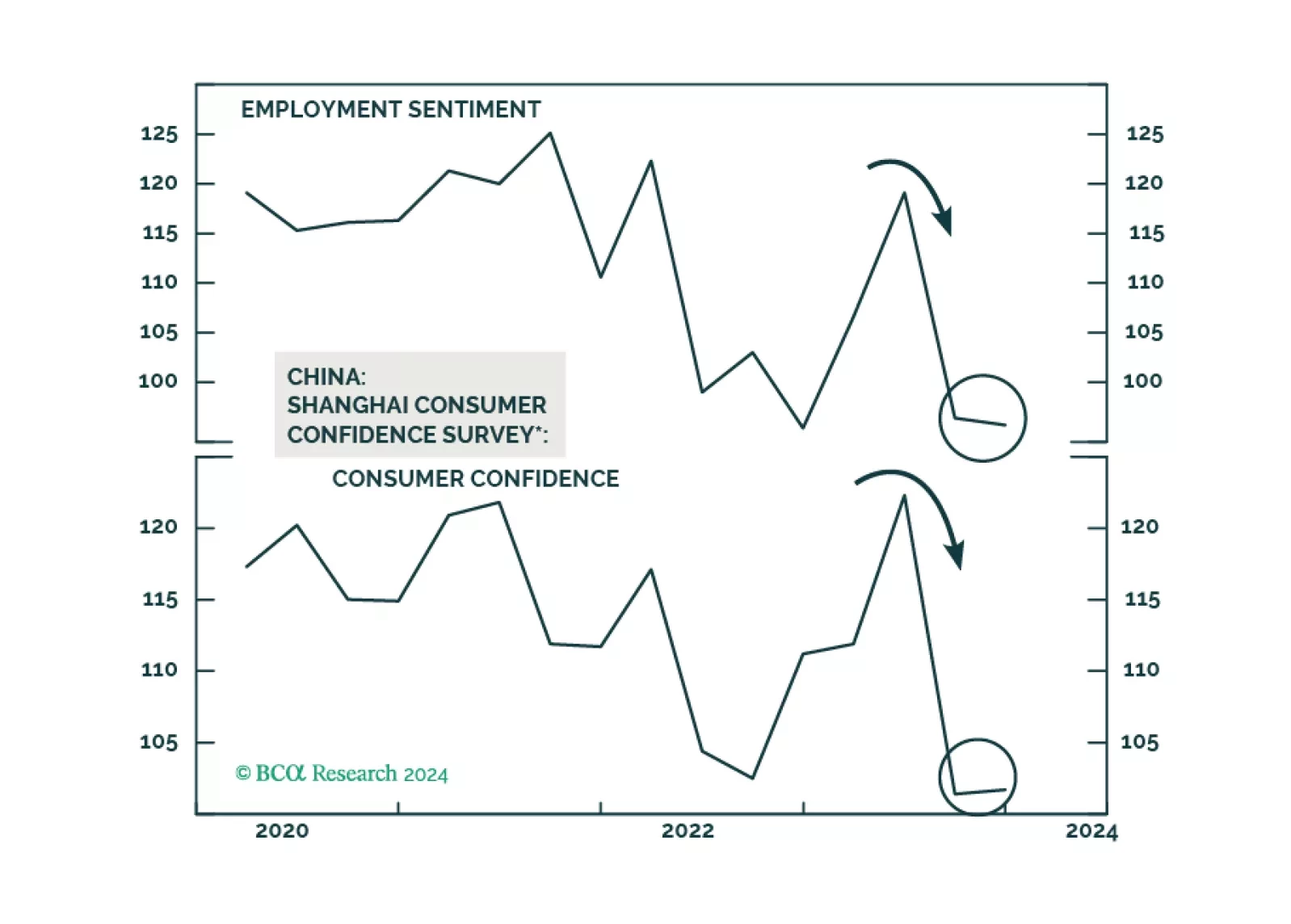

There is no easy way for China to forestall deflation. Provided policymakers are still reluctant to unleash large-size stimulus, more economic disappointments are likely in the coming months, and Chinese stocks will continue to sell…

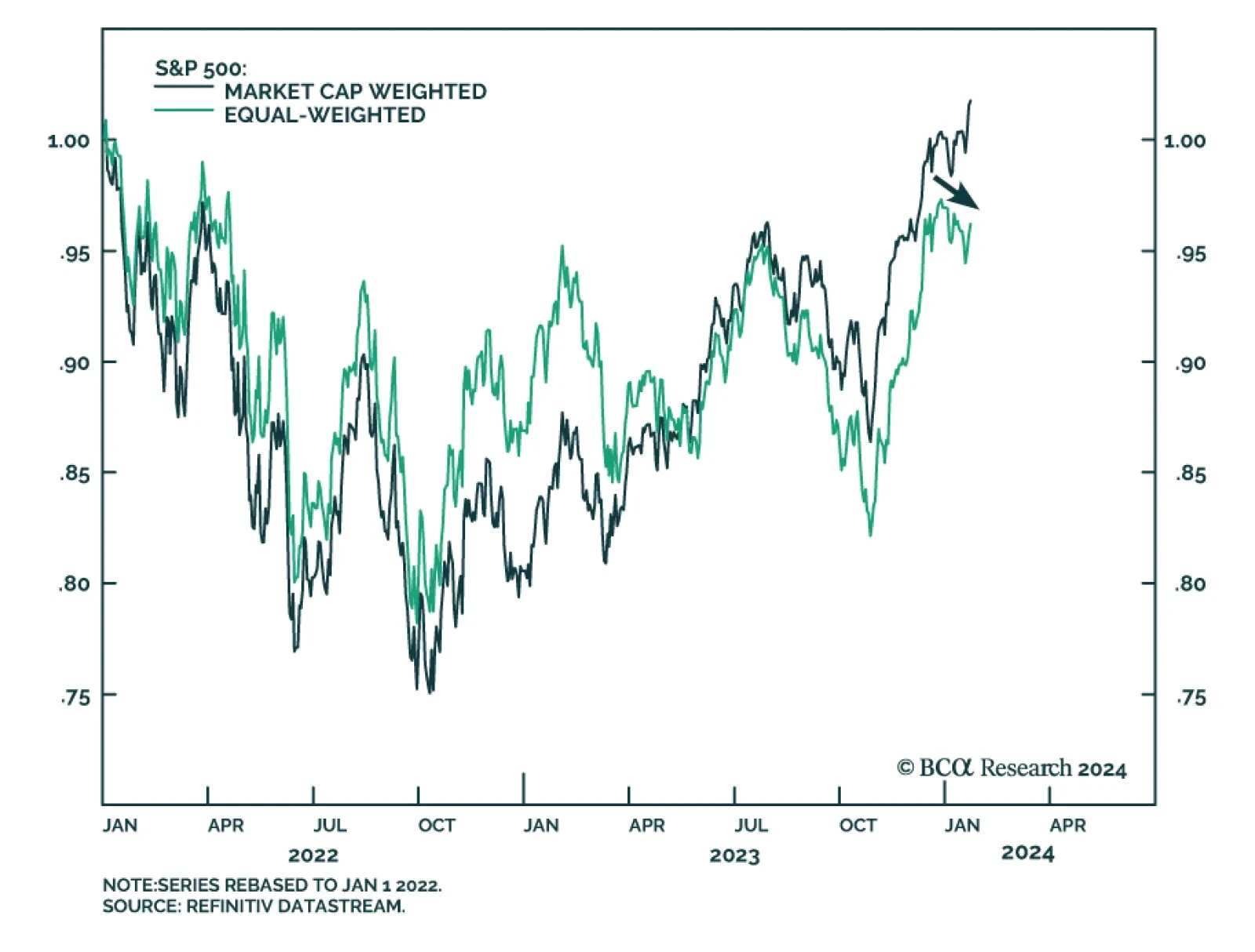

The S&P 500 notched a fresh record high on Tuesday for the third session in a row, bringing its year-to-date gains to 2.0%. Yet as we highlighted in a recent Insight, the lack of a broad-based rally across all S&P 500…

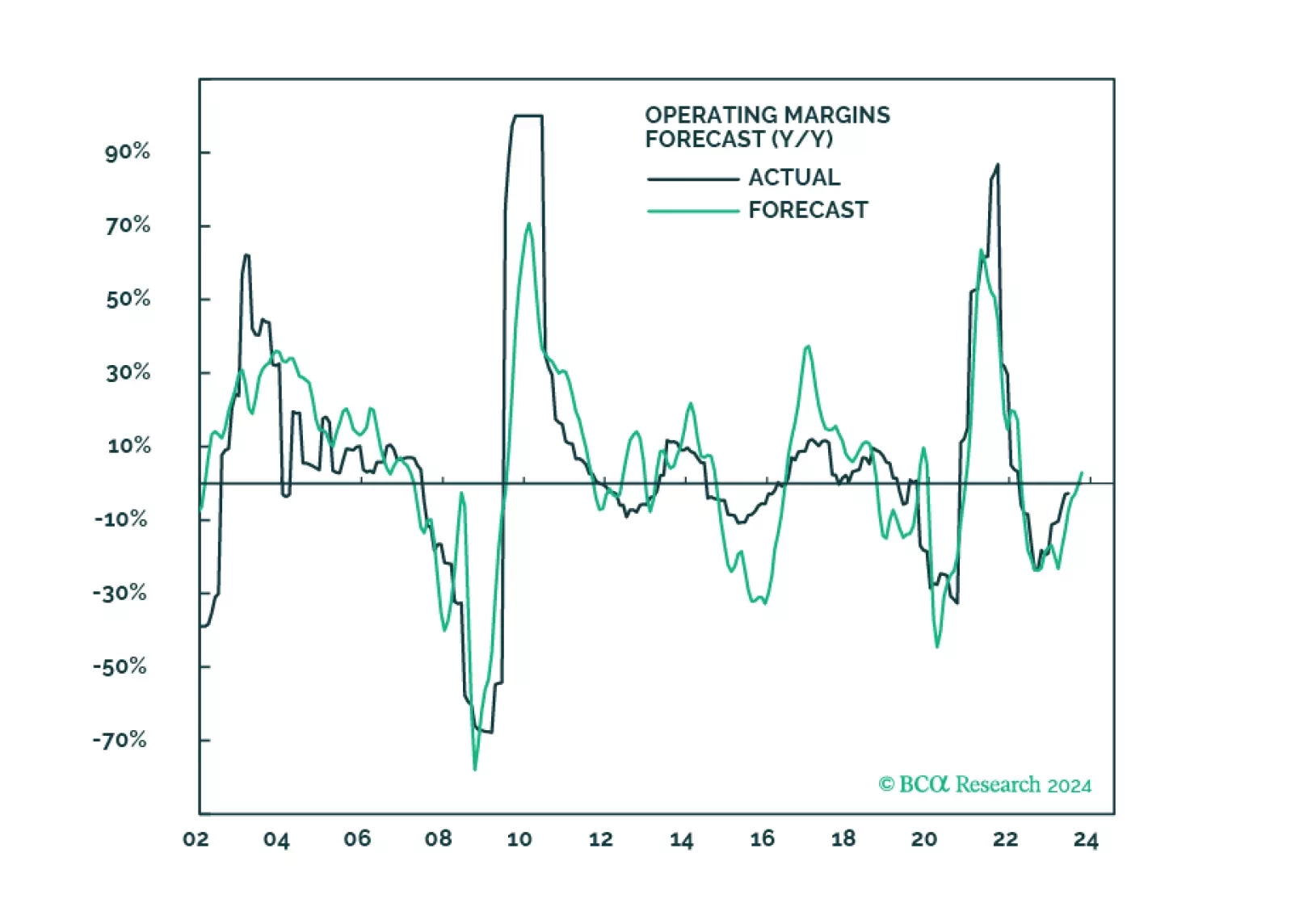

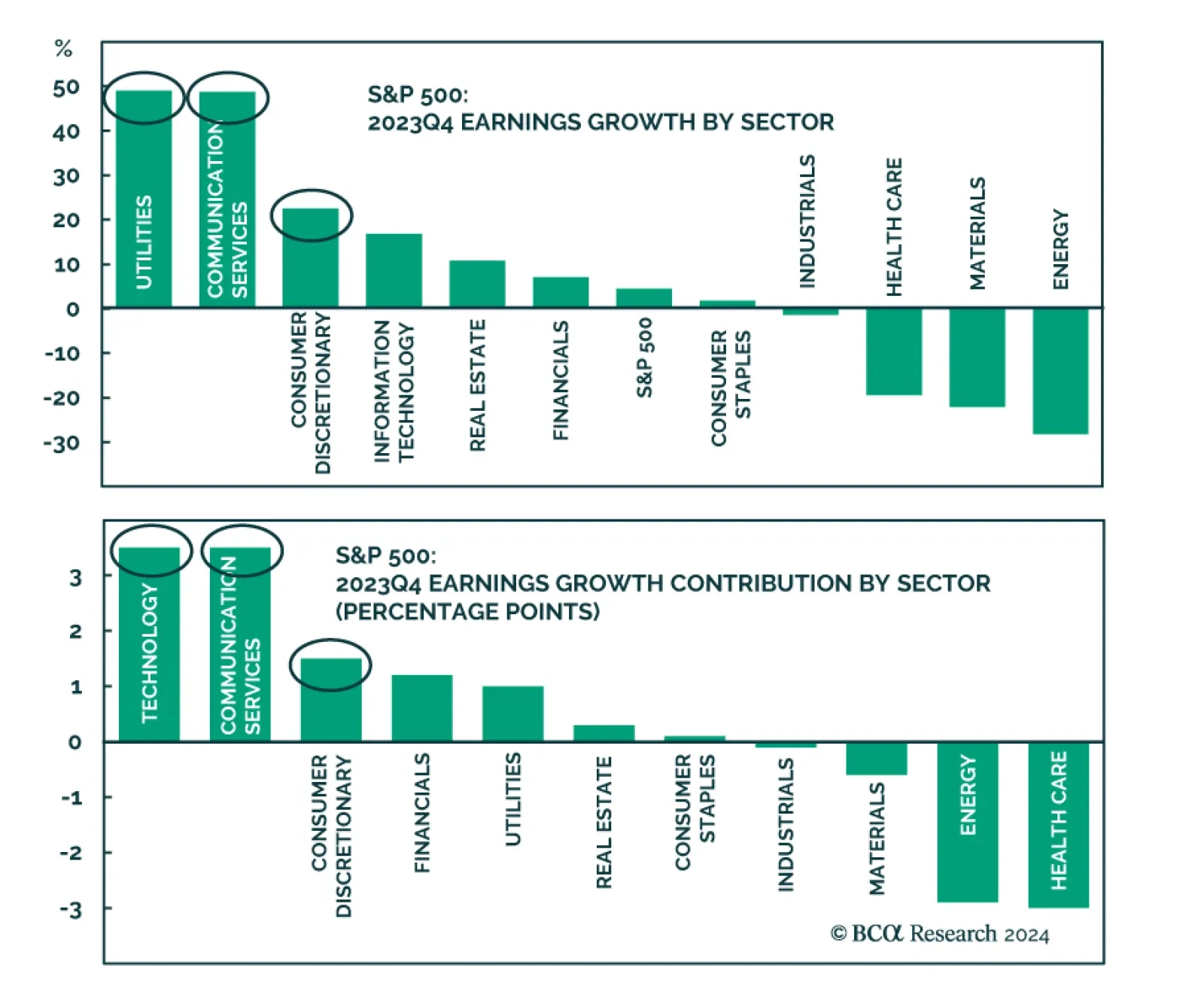

With US equity indices forging new highs, a key dynamic to watch to gauge the sustainability of the rally is earnings releases and forward guidance. With 52 S&P 500 companies having already reported their results, the Q4…

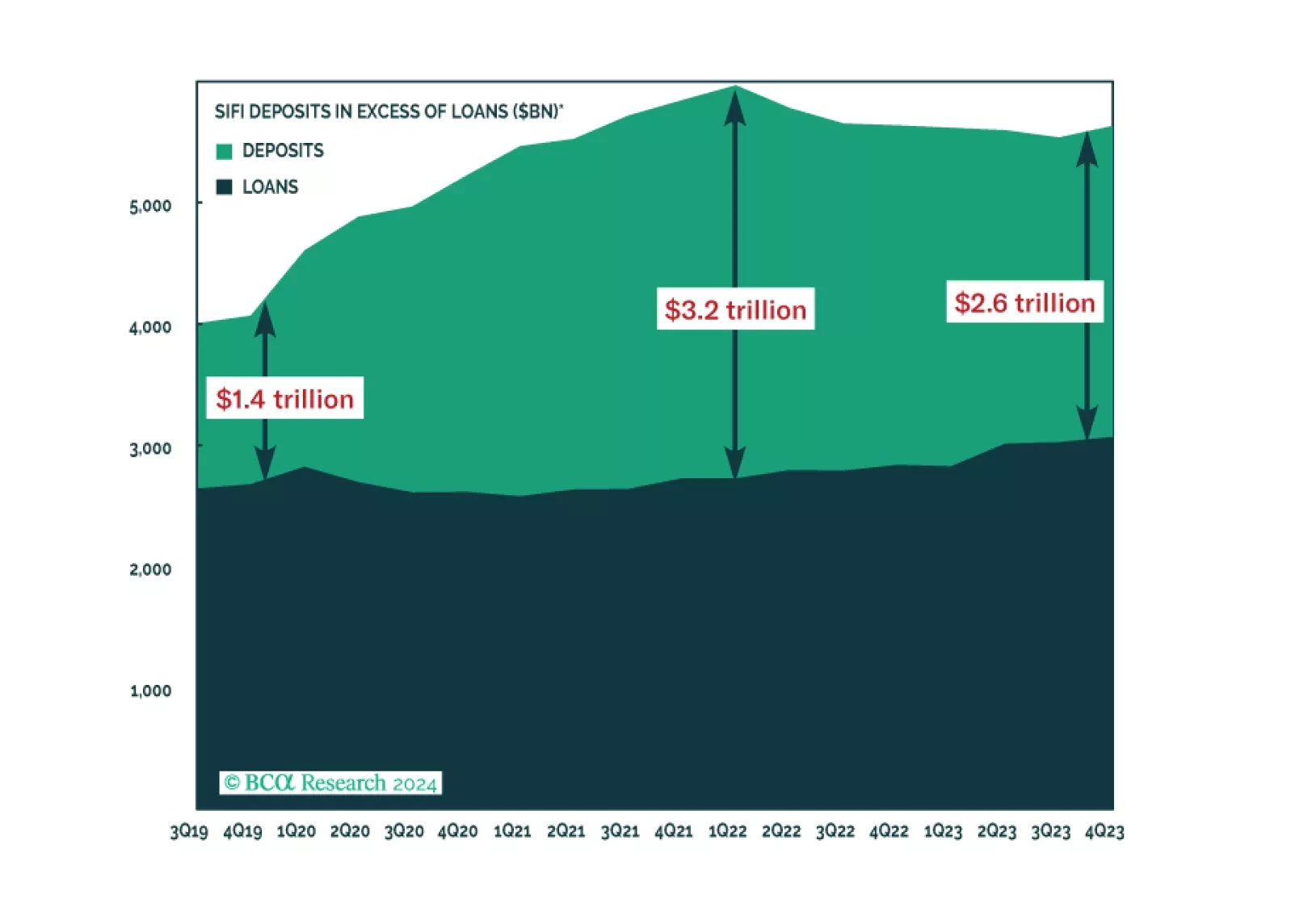

The SIFI banks expressed confidence in their credit outlook for 2024 and expect that credit losses will crest soon, given the reserves they’ve already set aside. Their implicit embrace of the soft-landing narrative suggests to us…

Disinflation coupled with sticky wage growth is likely to result in either a second wave of inflation or layoffs and a recession. In the meantime, market expectations for sales, growth, and margins are overly optimistic and are…

The ECB will begin cutting rates in June, what does this start date imply for the yield curve and European cyclicals?