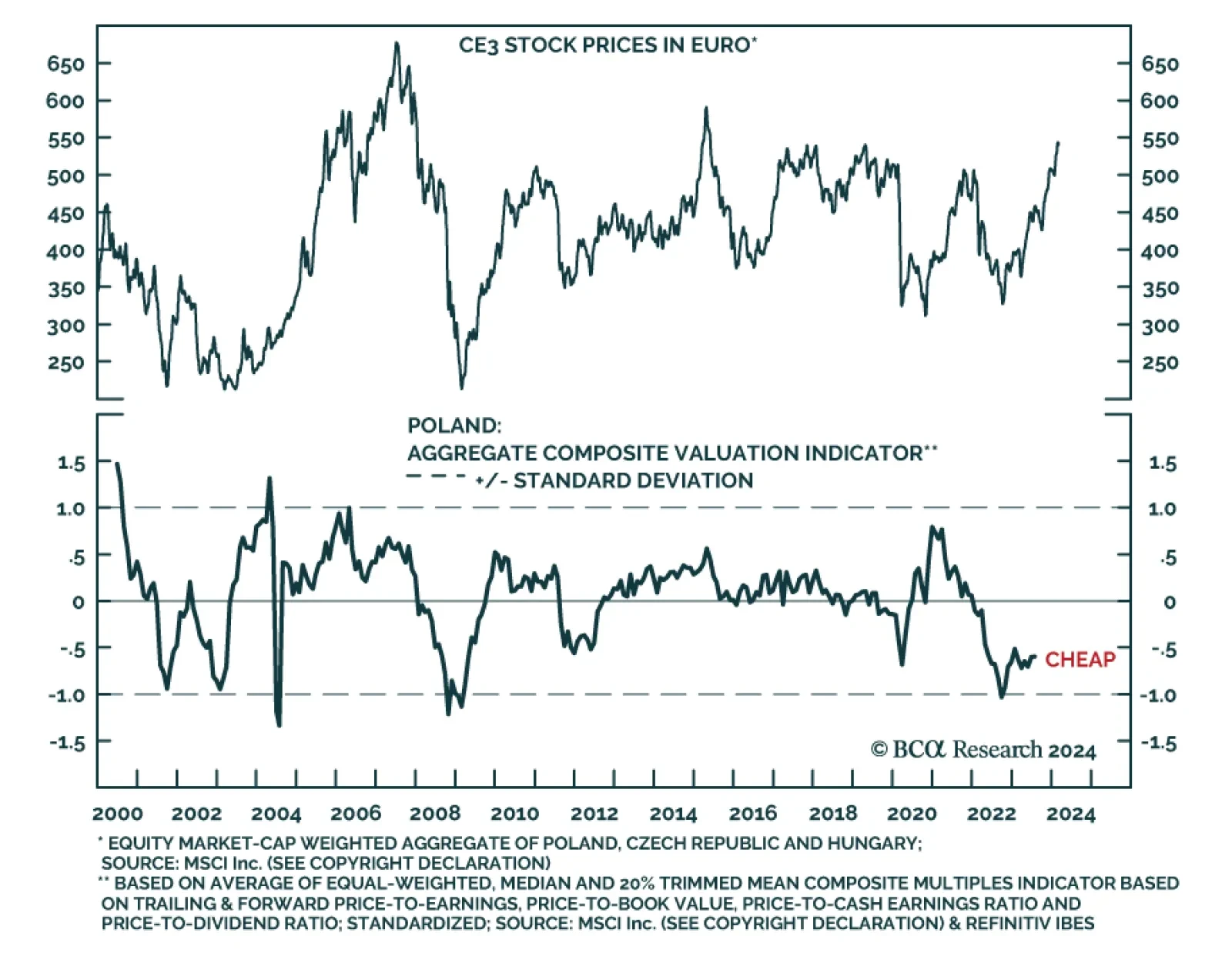

A market-cap weighted index of CE3 economies (Poland, Hungary and Czechia) returned a whopping 64% in common currency terms since its 2022 low. Polish and Hungarian equities led the rally, advancing by a respective 86% and 78% in…

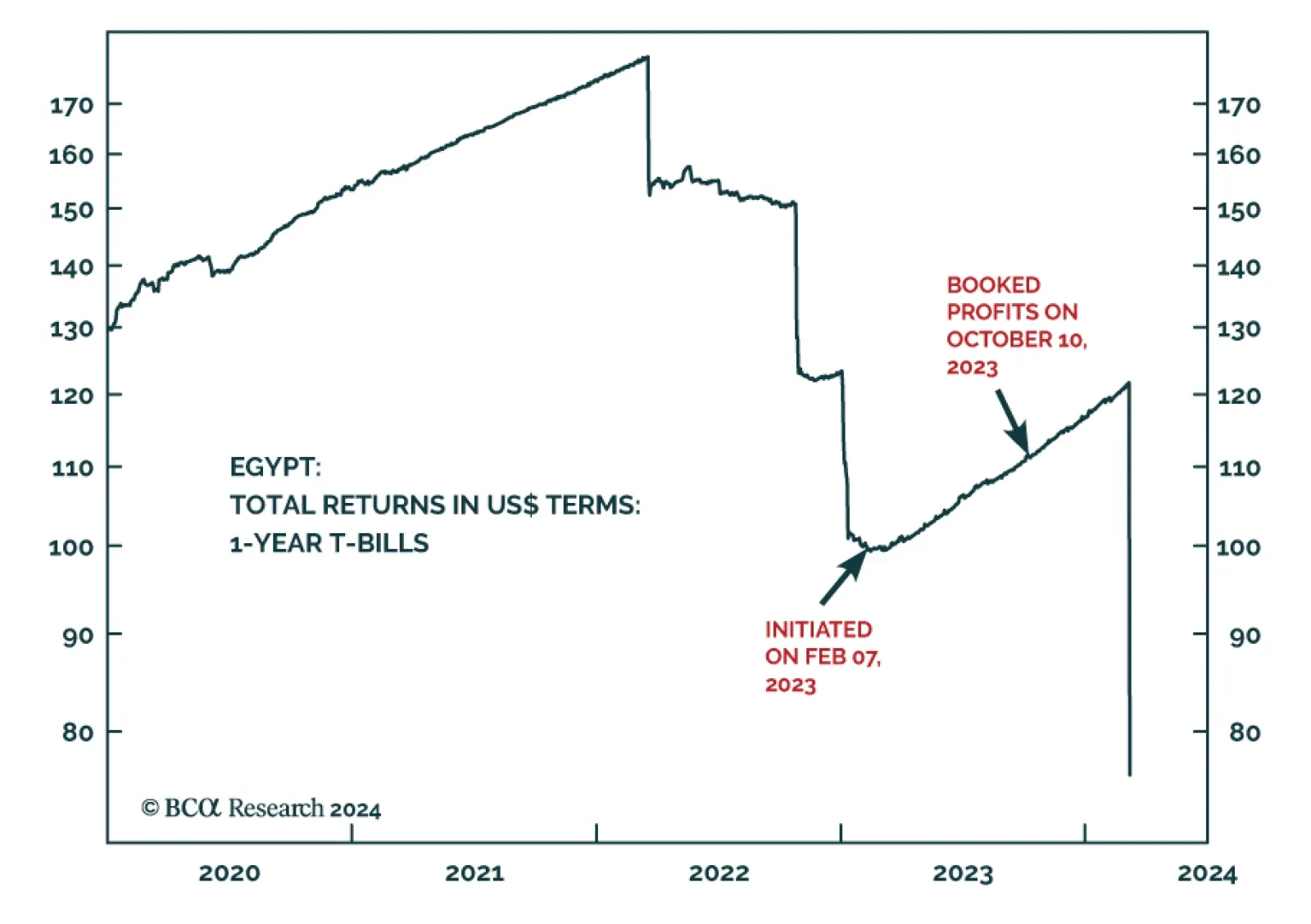

Our Emerging Market Strategy (EMS) colleagues recommended booking an 11.4% gain on their Egyptian T-bill trade initiated earlier in the year. Now that currency-devaluation risk has been removed from the picture for the…

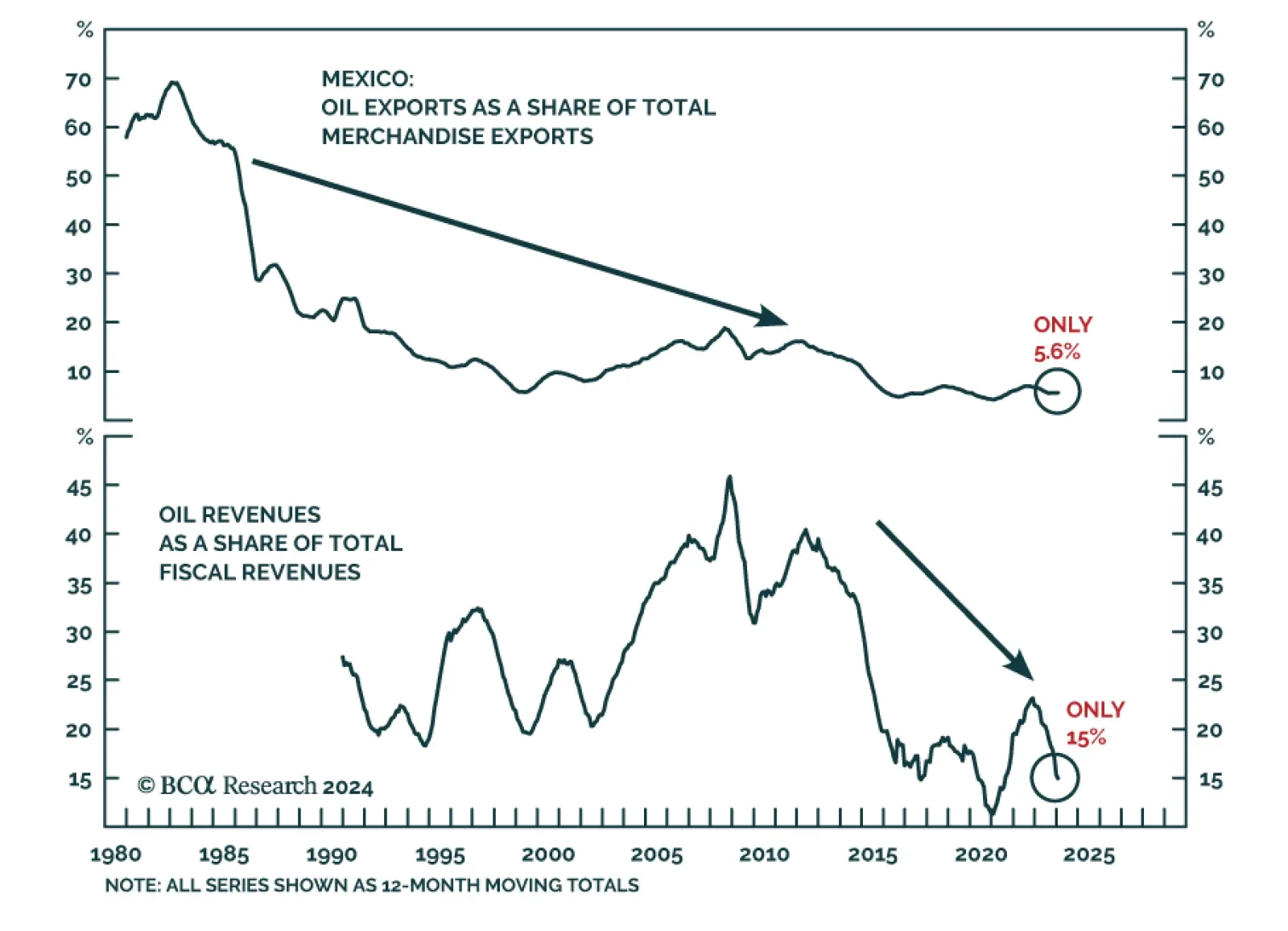

In the past couple of years, Mexico has been among the favorite markets for investors within the EM space. As our Emerging Markets Strategy team argued in a recent report, the cyclical and structural outlook for Mexican risk…

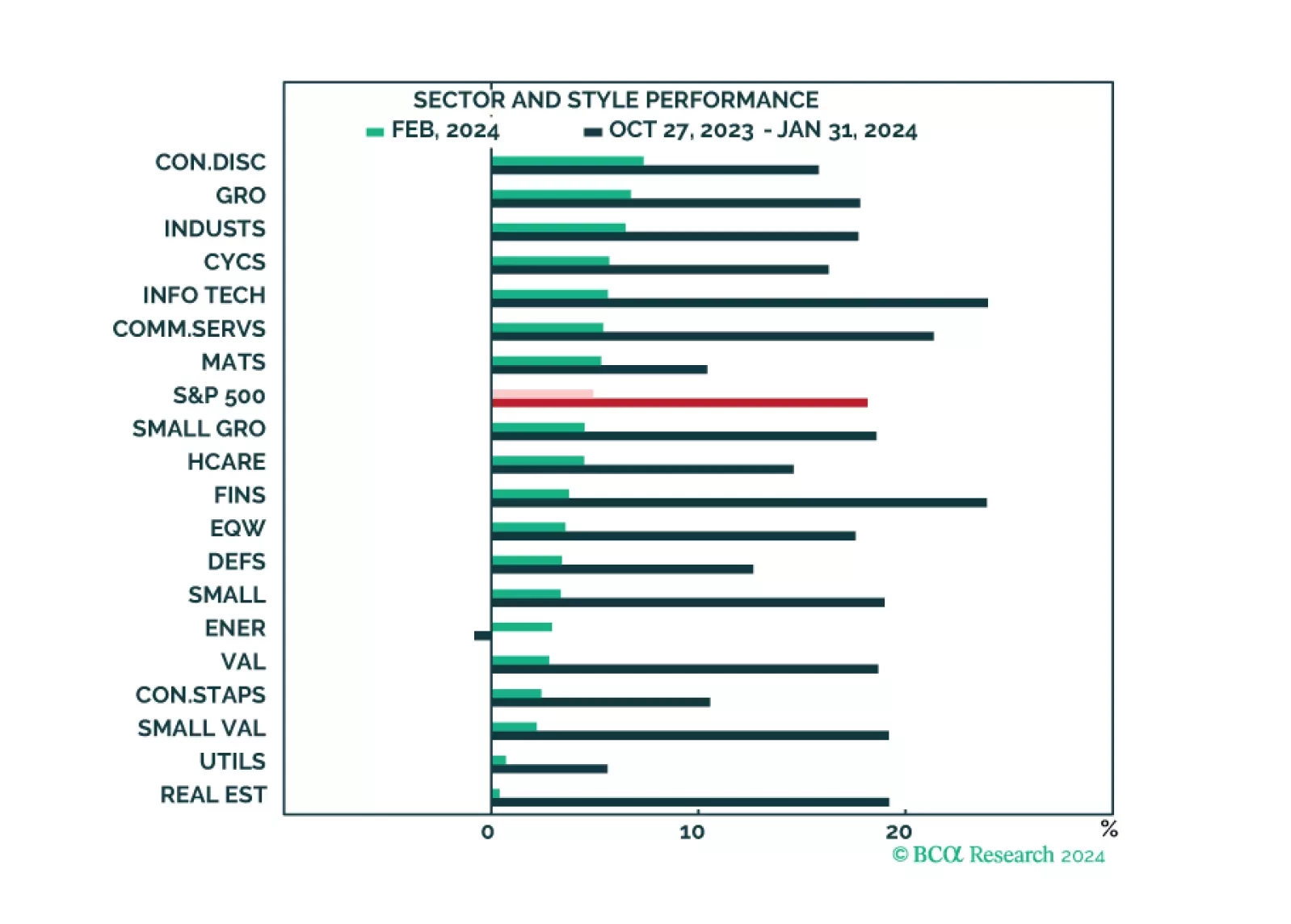

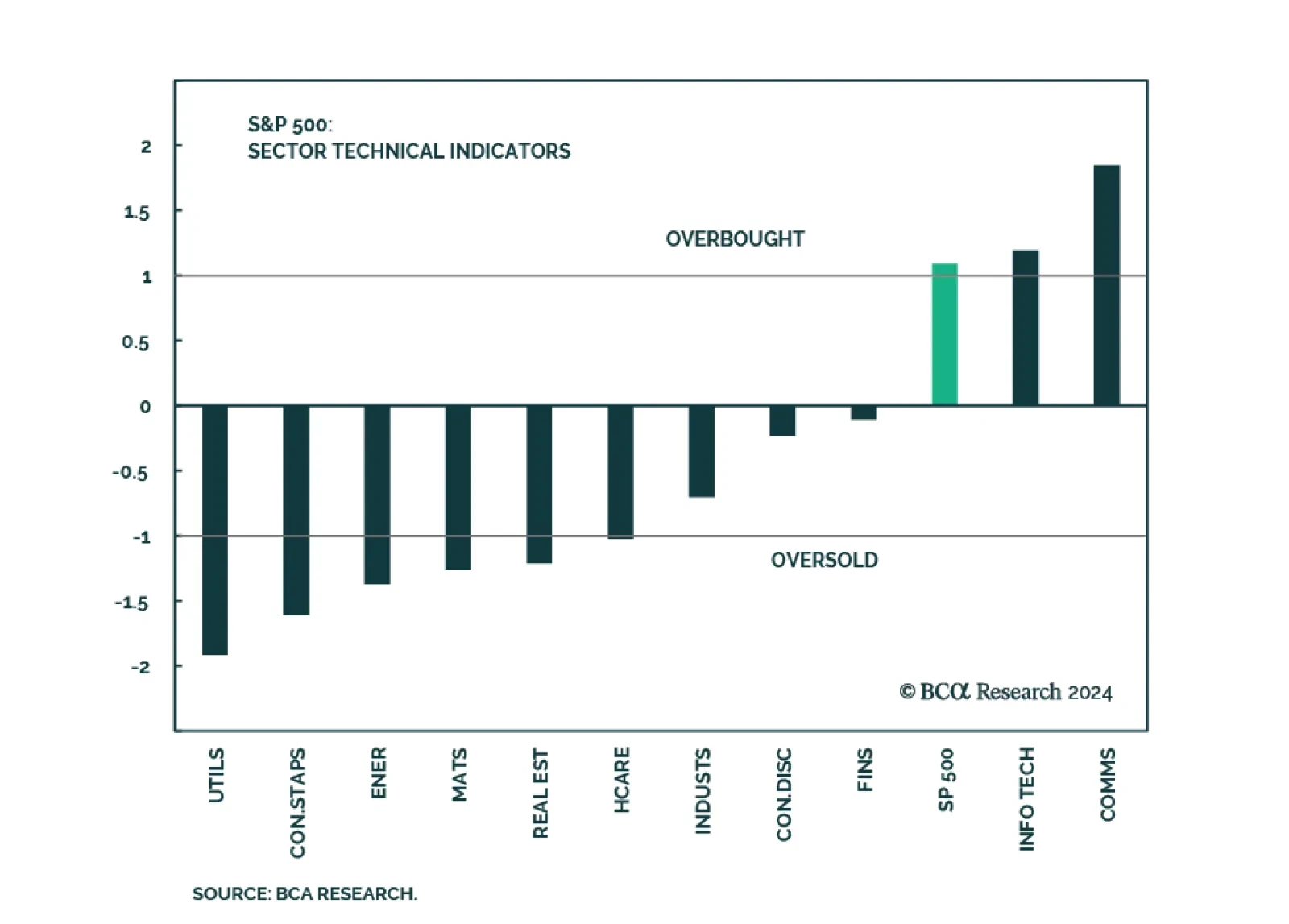

Our US Equity Strategy service released their Sector Chart Pack where they took stock of the recent earnings season and developments in the S&P 500. They observed that this February marked the strongest performance in the…

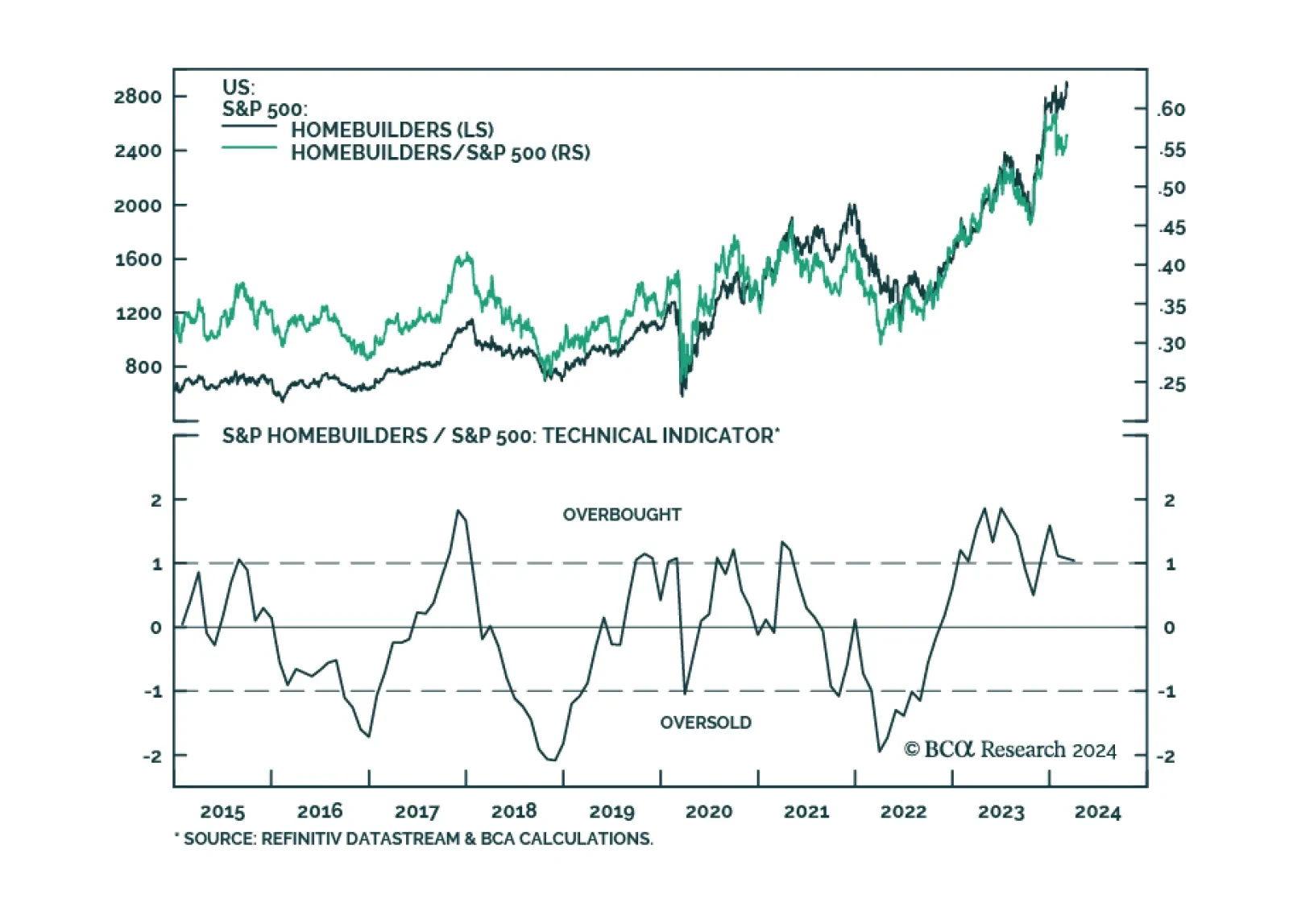

The S&P 500 Homebuilders index has returned a whopping 50% since October and outperformed the overall market by 24% over this period. Tight US housing supply is placing a floor under construction activity and constitutes a…

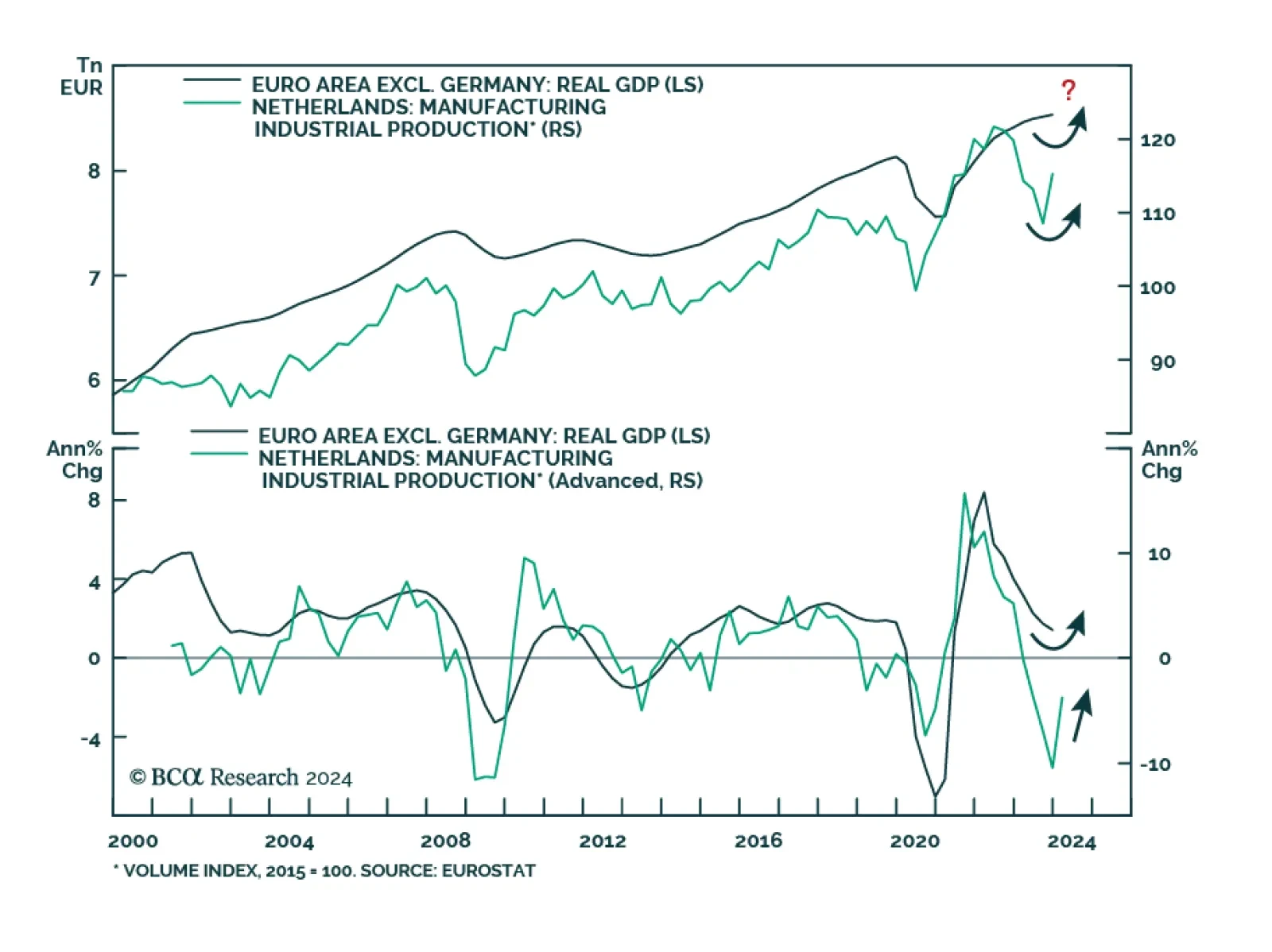

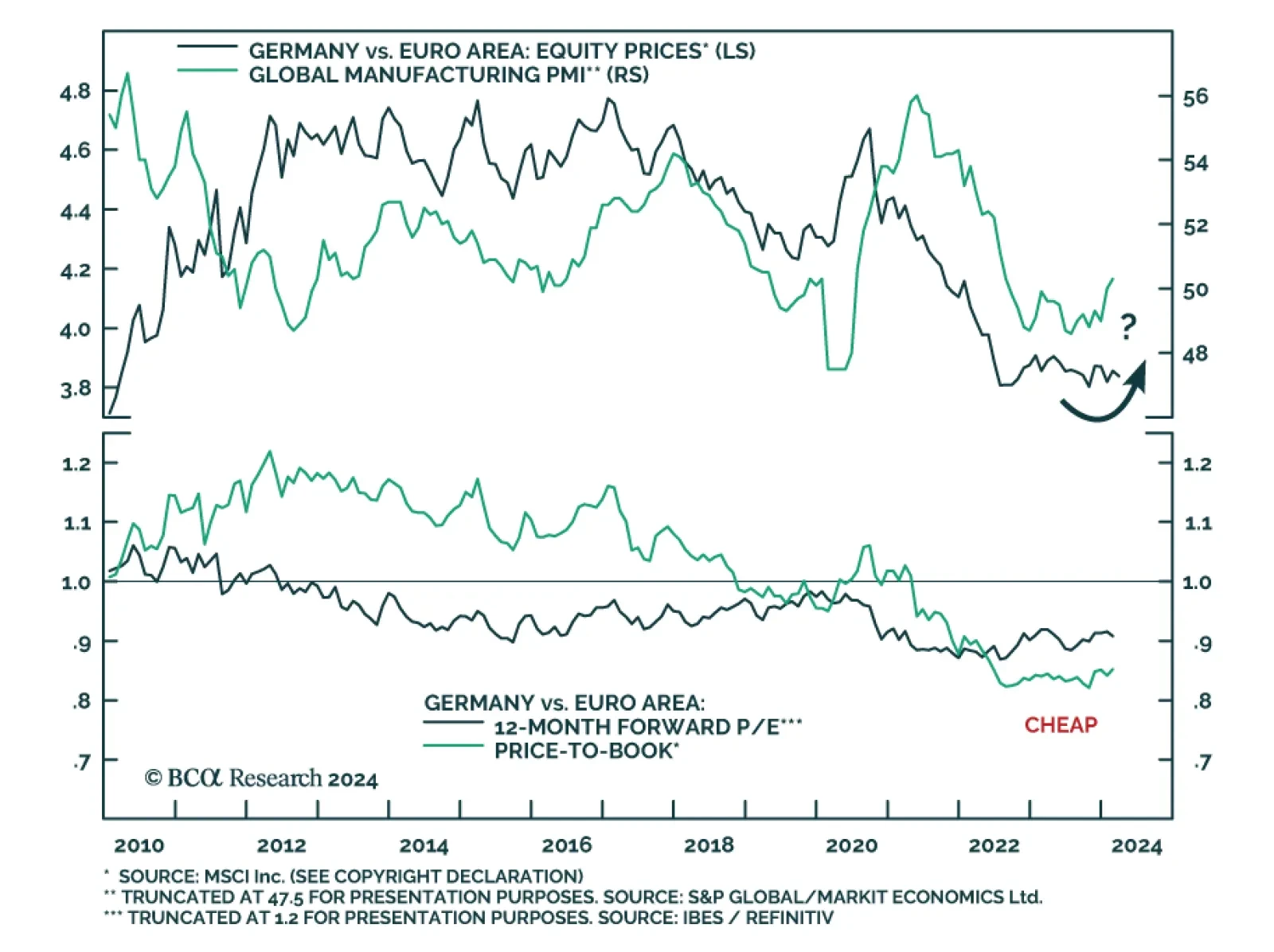

BCA’s European Investment Strategy team continues to expect the German economy to trail that of the rest of Europe. Since 2020, Germany has fallen behind, with its real GDP lagging that of the broader Eurozone by 5%. The…

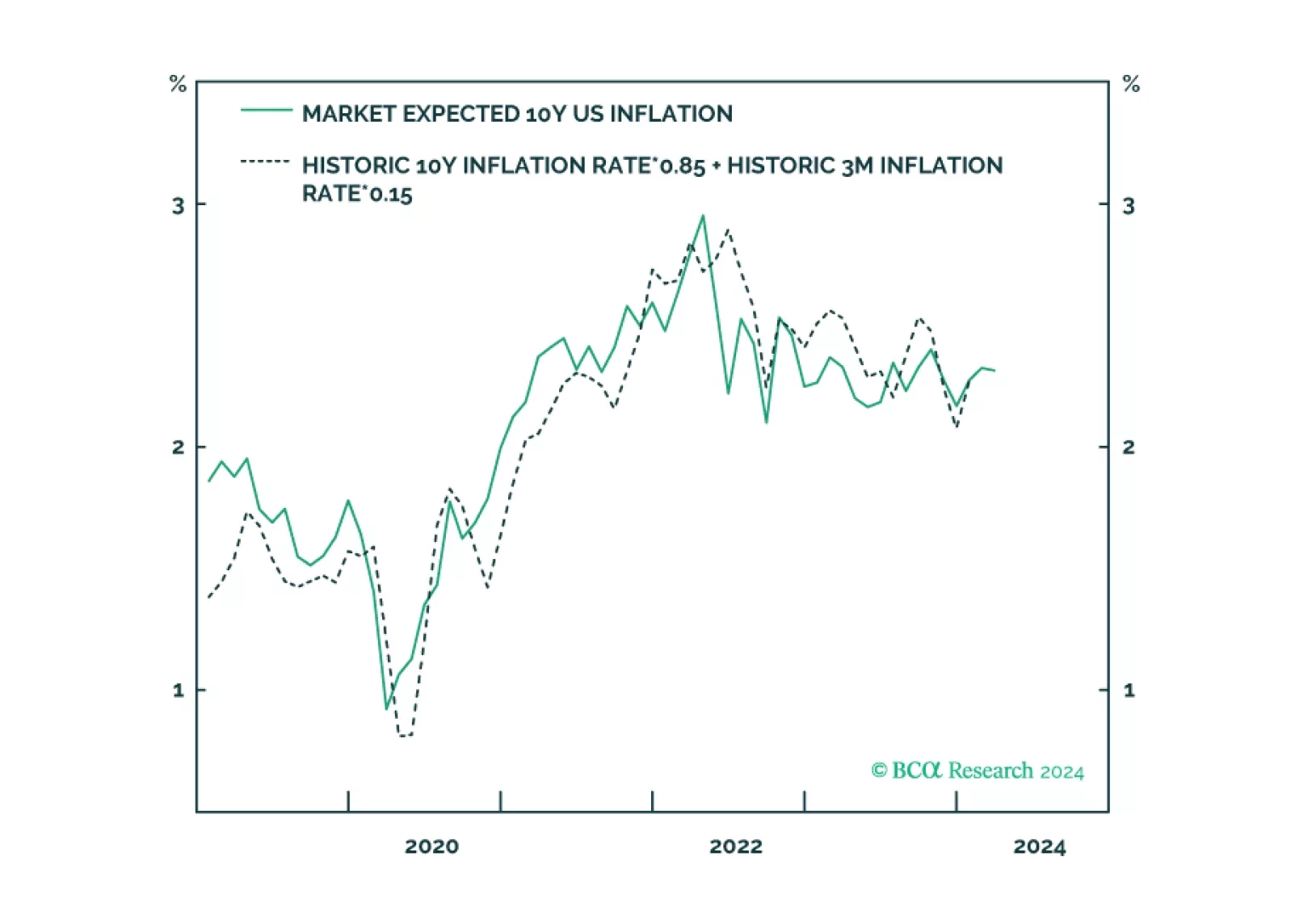

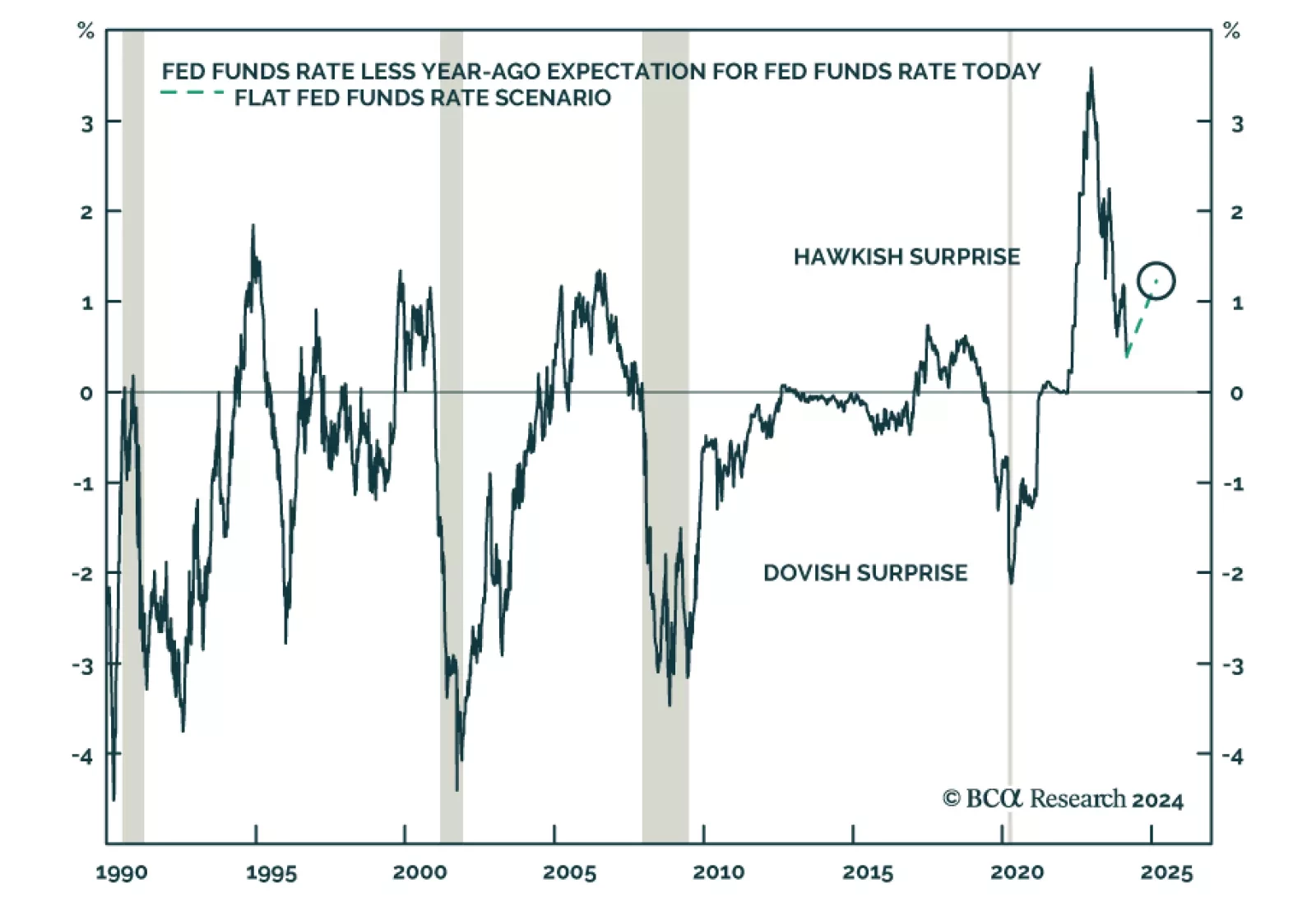

Expected inflation has surged to its highest level in a year. This has surprised many people, but expected inflation is behaving just as expected. Expected inflation is not a prophecy, it is just a mathematical function of delivered…

The stock market of the Eurozone’s largest economy keeps grinding higher with the DAX 40 closing at new highs last week. Since its October low, the index of German blue-chip companies advanced by 20%. Does this rally…

We noted in a previous Insight that recent comments from Raphael Bostic, President of the Federal Reserve Bank of Atlanta, may reflect a growing realization among policymakers that they have inadvertently caused a…

The market narrative continues to be dominated by the Magnificent Six, which drove both market performance and strong Q4 earnings results. While all sectors and styles have recently turned green, the rally is still mostly narrow.…