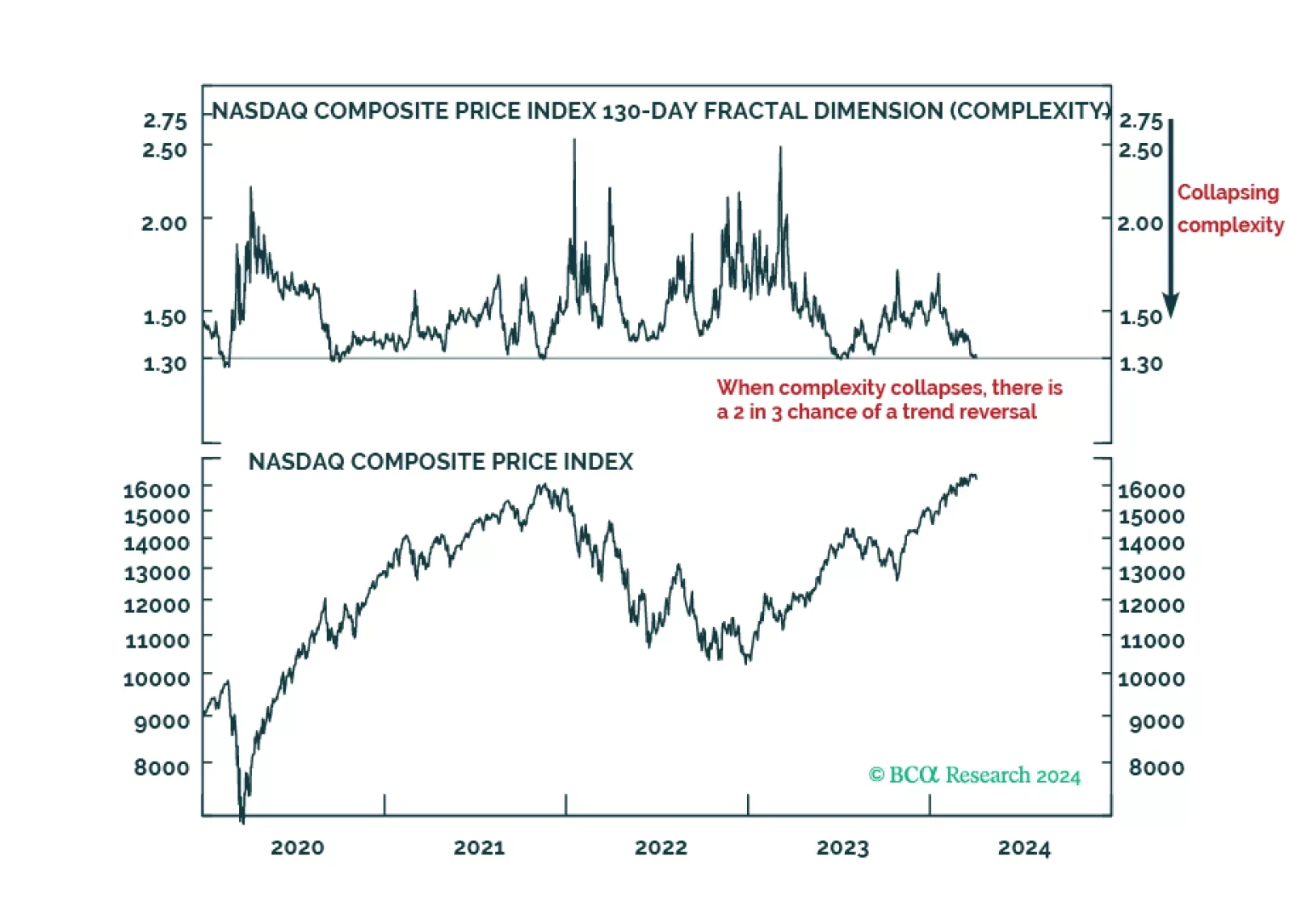

The analysis of complexity is a massive competitive advantage in investing, and from today, clients will be able to monitor the complexities of the world’s 17 major investments on our webpage in real-time.

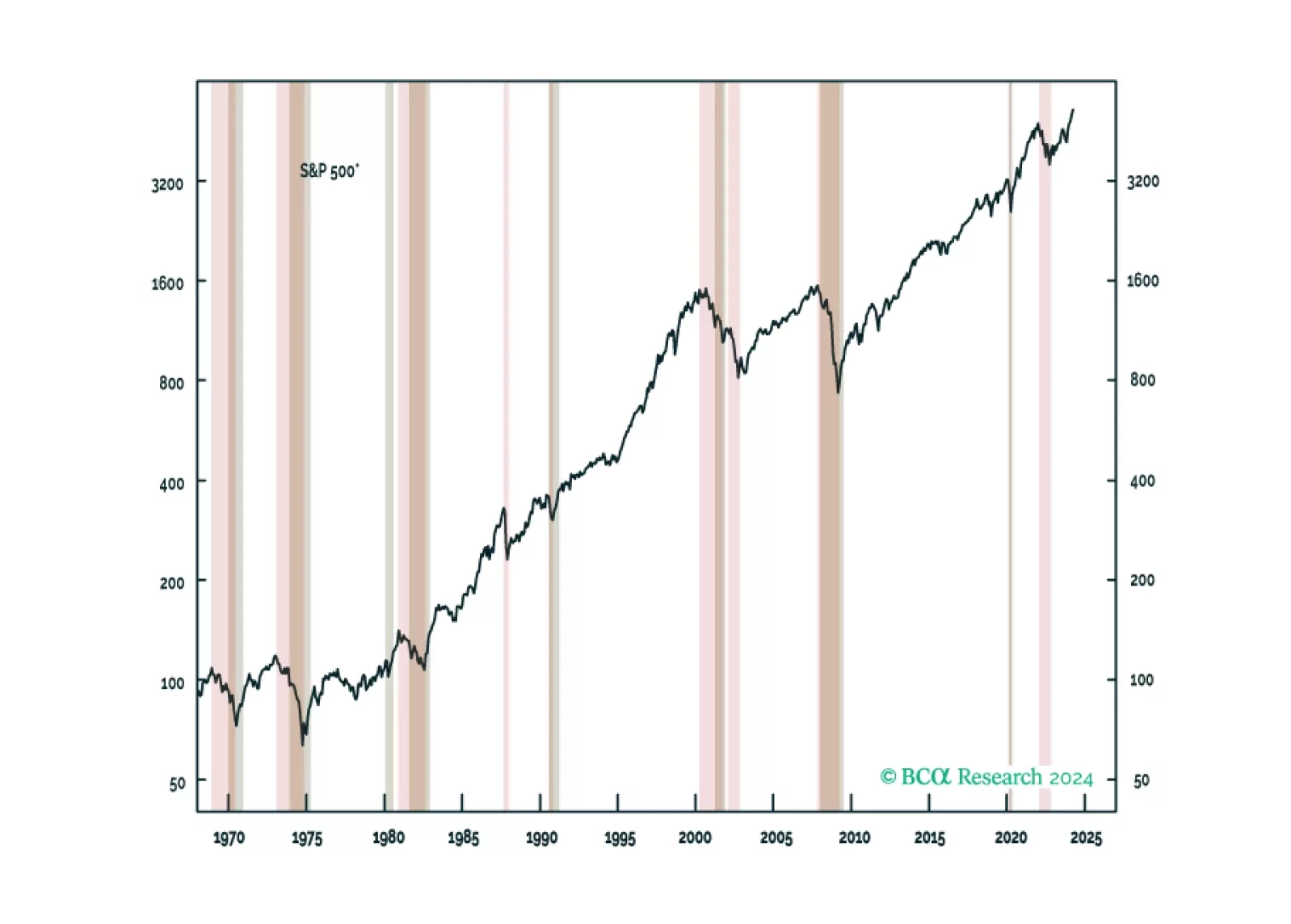

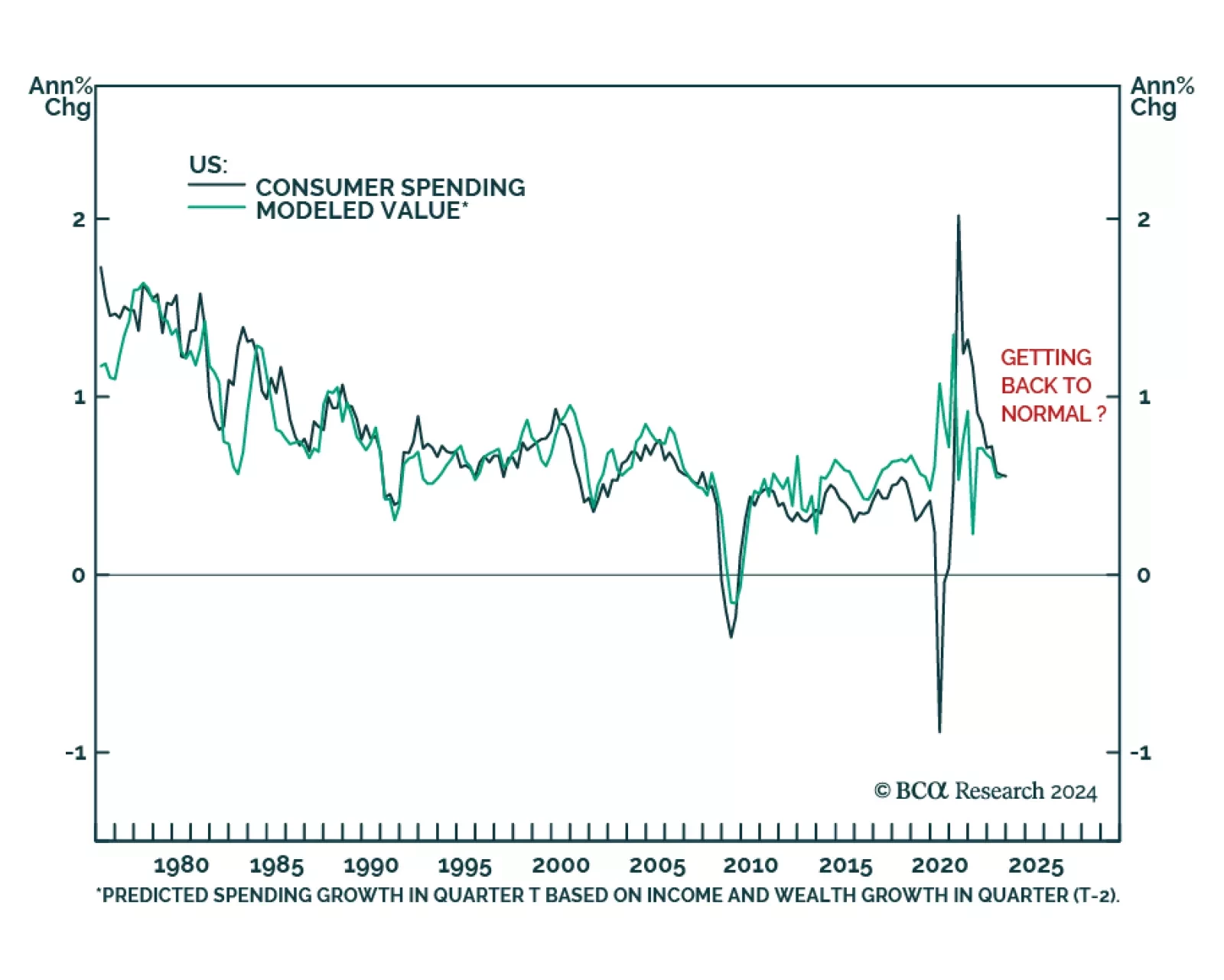

BCA Research’s US Investment Strategy service is watching households, the labor market and consumer credit for signs of a business cycle inflection and the all-clear signal to underweight equities. Equity bear markets…

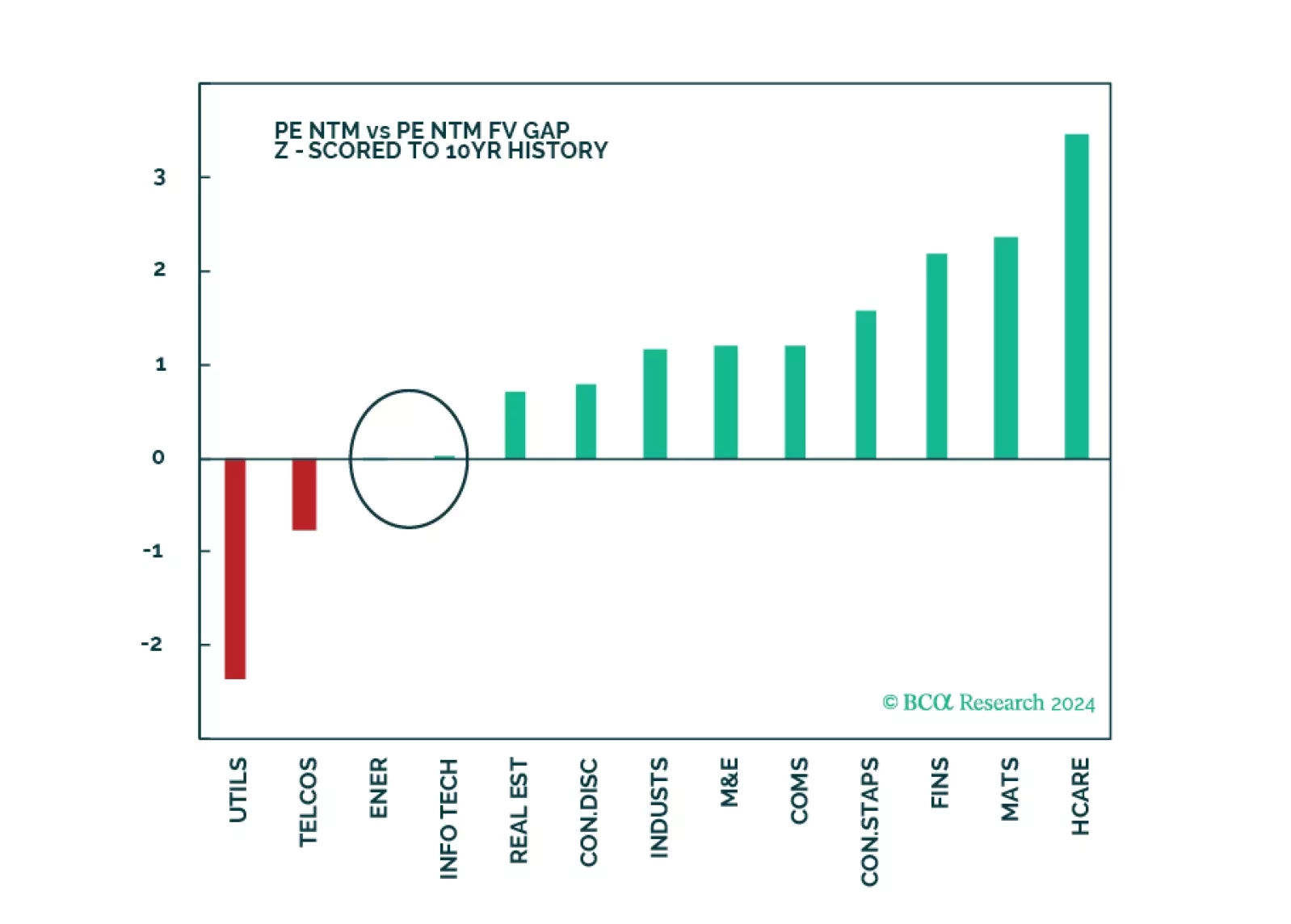

The equity rally extended into March as hard landing outcome was priced out. It has broadened, as money flowed into less over-loved pockets of the market. Our models signal that margins are about to stabilize, and earnings growth…

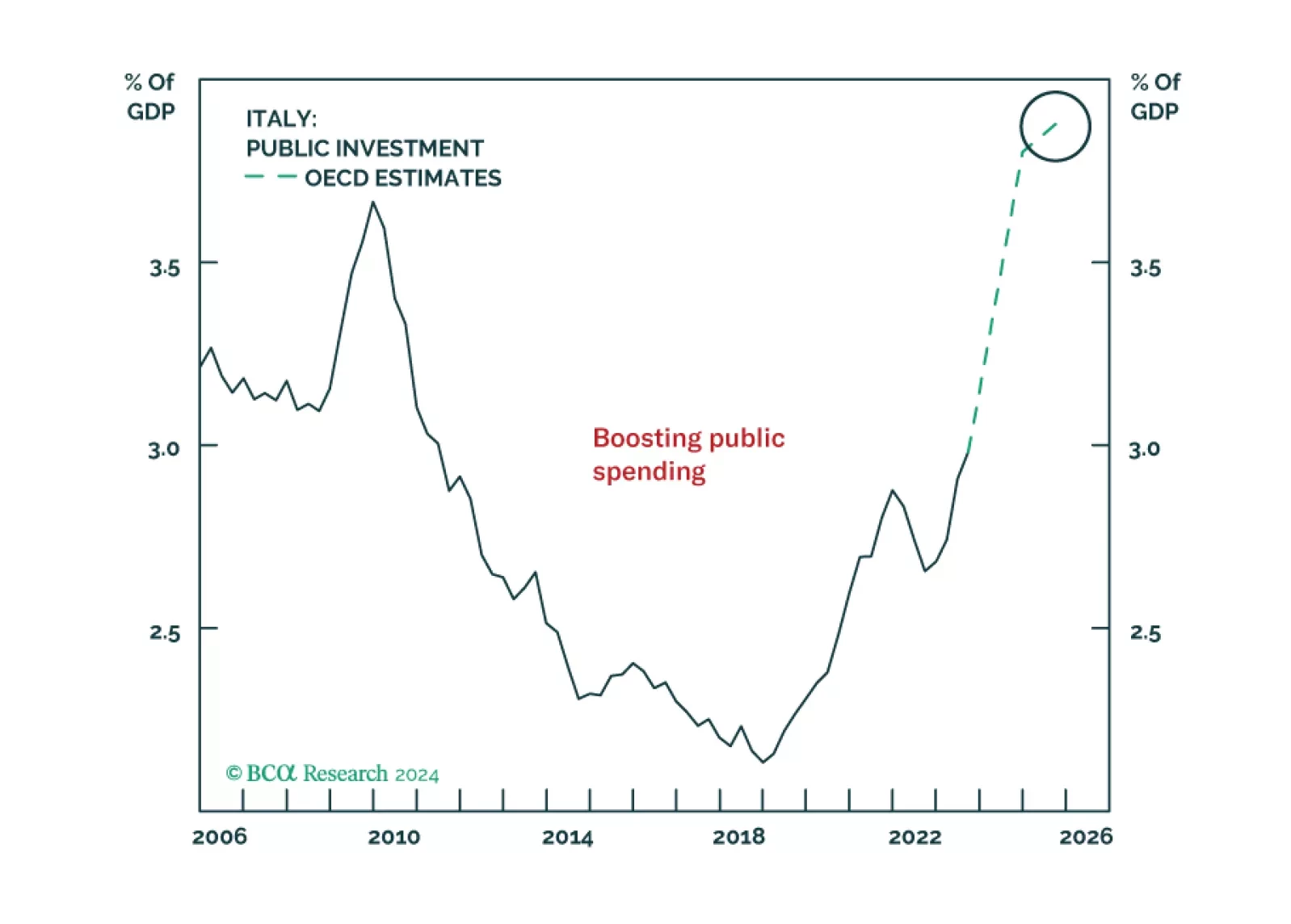

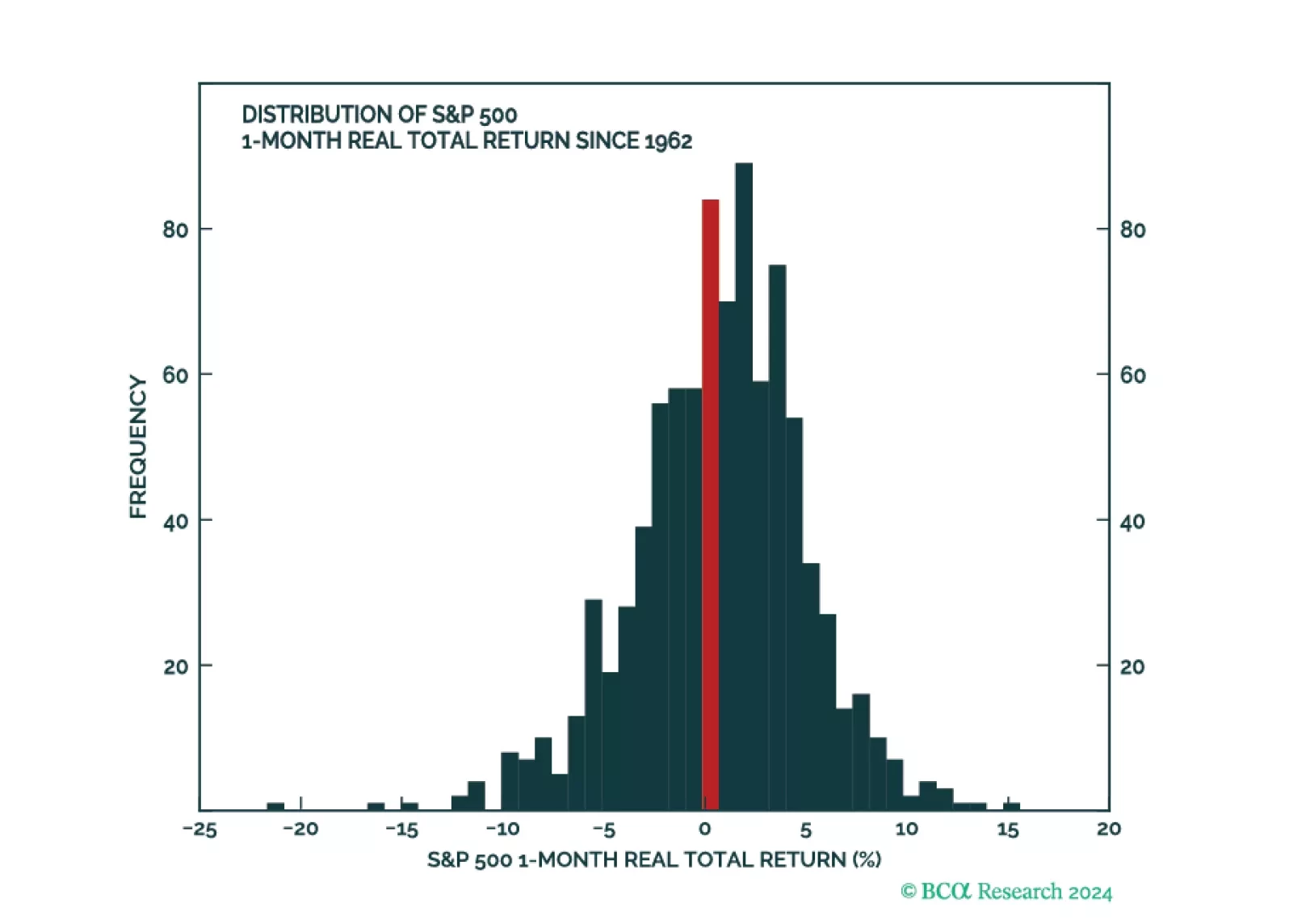

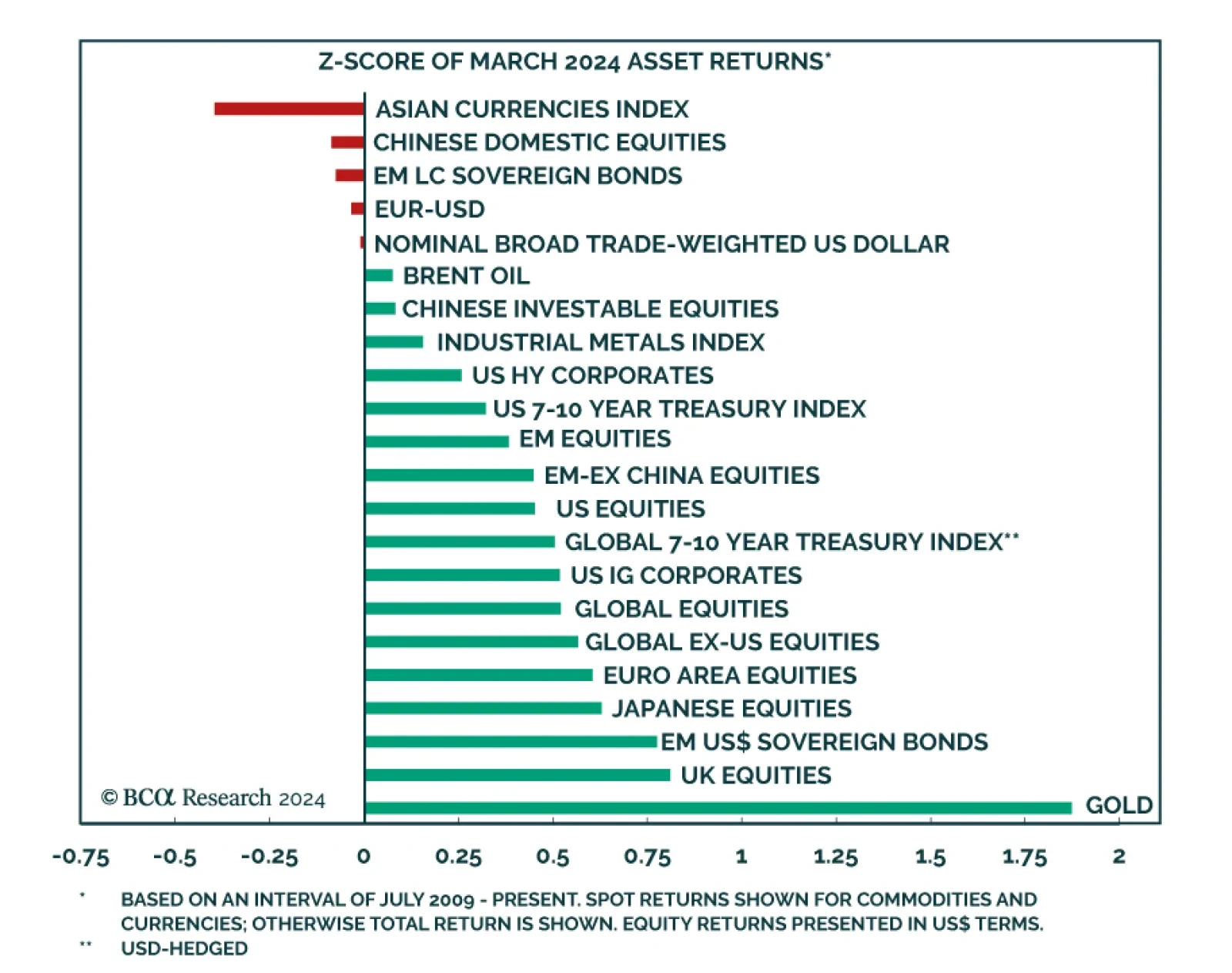

The soft-landing narrative dominated the behavior of financial markets in March, with most major global risk assets posting above average returns. In particular, the burgeoning ‘risk on’ sentiment led to a rally…

We are not yet ready to downgrade equities on a tactical basis but continue to expect we will eventually do so. We present a checklist of indicators that we are watching to determine when to de-risk.

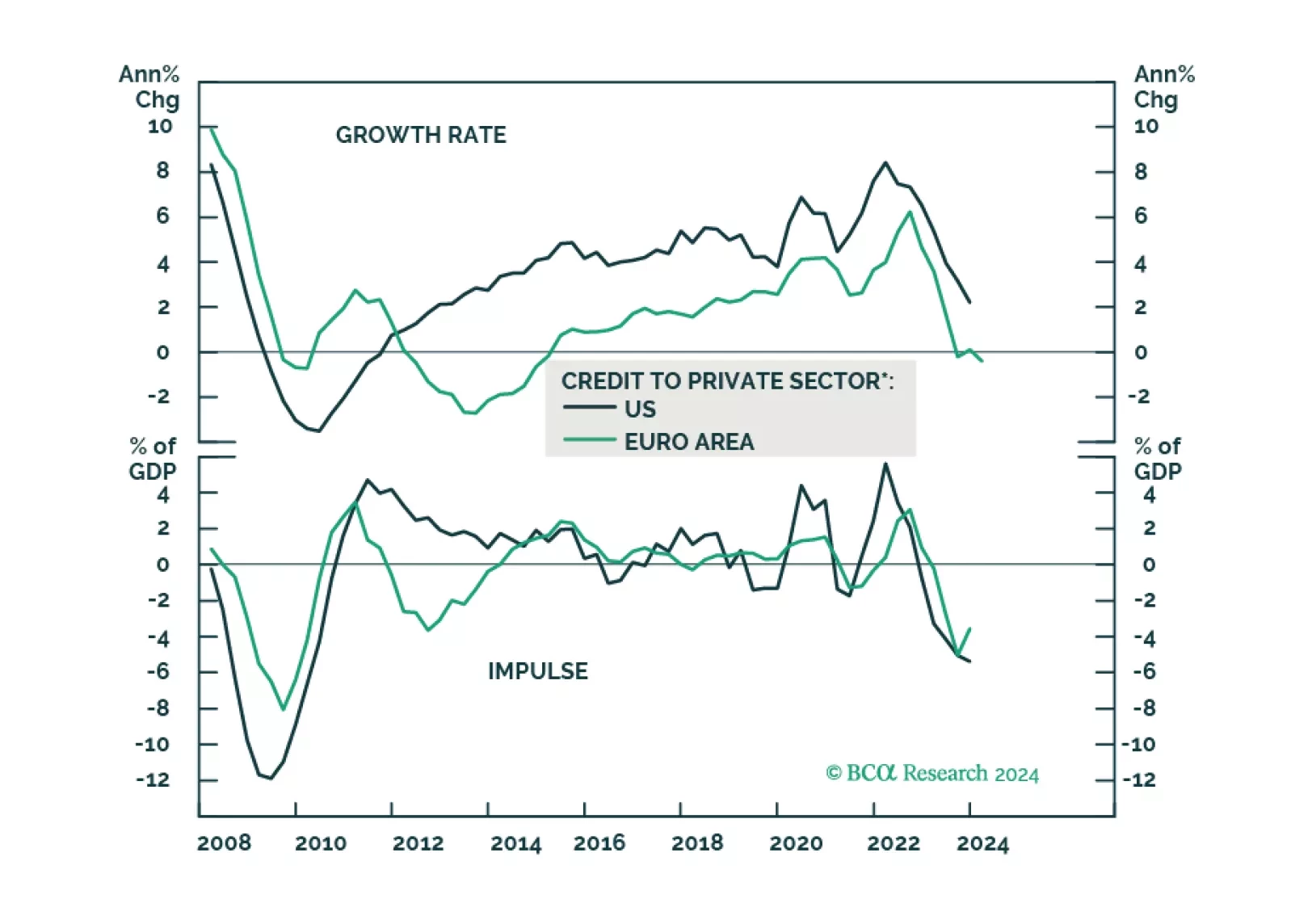

The global economy is wobbling precariously between slowing growth and reaccelerating inflation. This is unlikely to end well. Stay cautious, and hedge against both recession and inflation.

MacroQuant downgraded equities from overweight to neutral on a 1-to-3 month horizon. The model maintains a negative view on stocks over a 12-month horizon.

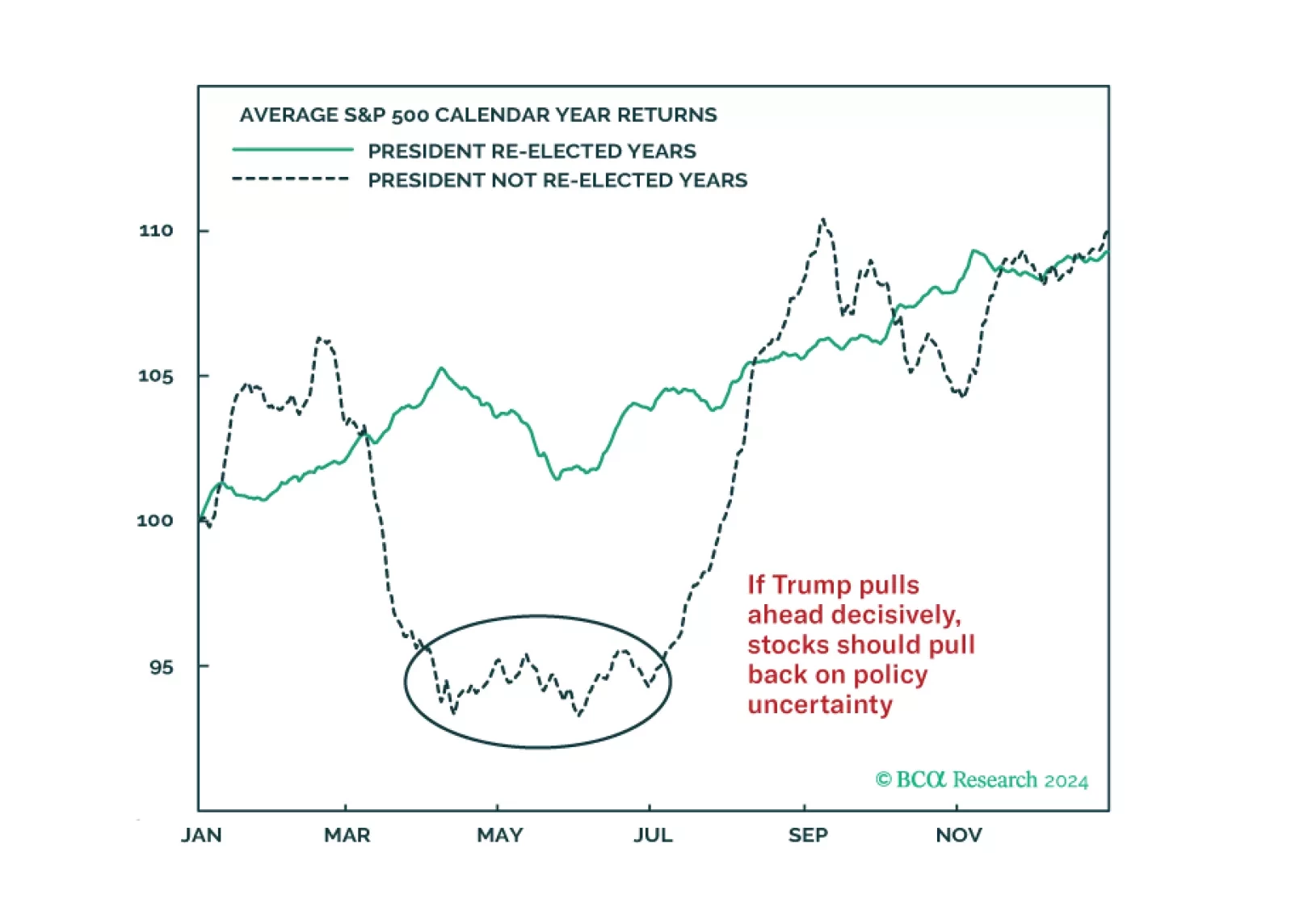

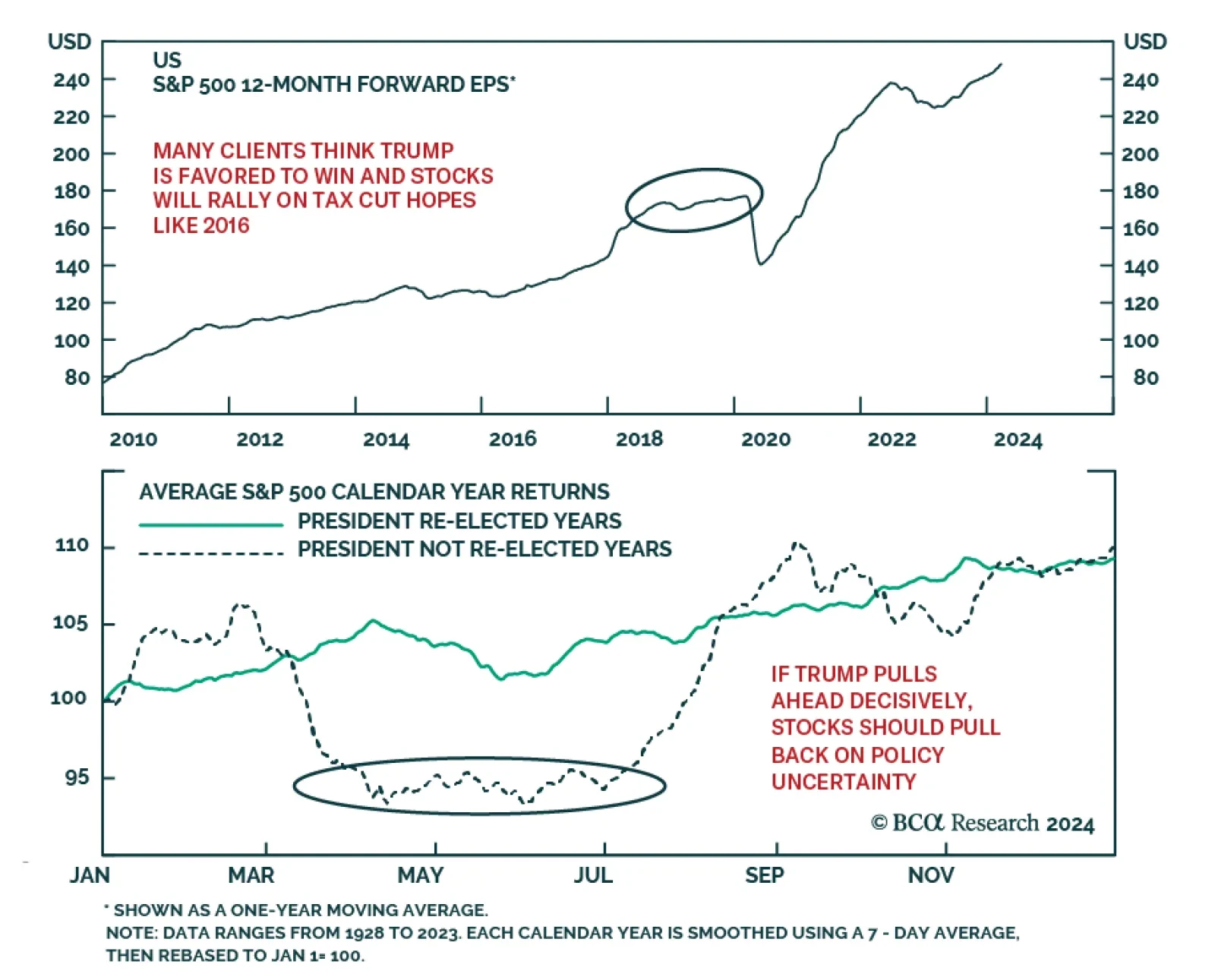

According to BCA Research’s Geopolitical Strategy service, Trump’s agenda is structurally inflationary and would eventually be needed to be discounted by markets, if he wins. Most retail investors – and many…

Investors around Europe and North America are concerned that the stock market is increasingly overbought and vulnerable to exogenous risks. We agree and have good reasons to fear that festering geopolitical risks and the US election…