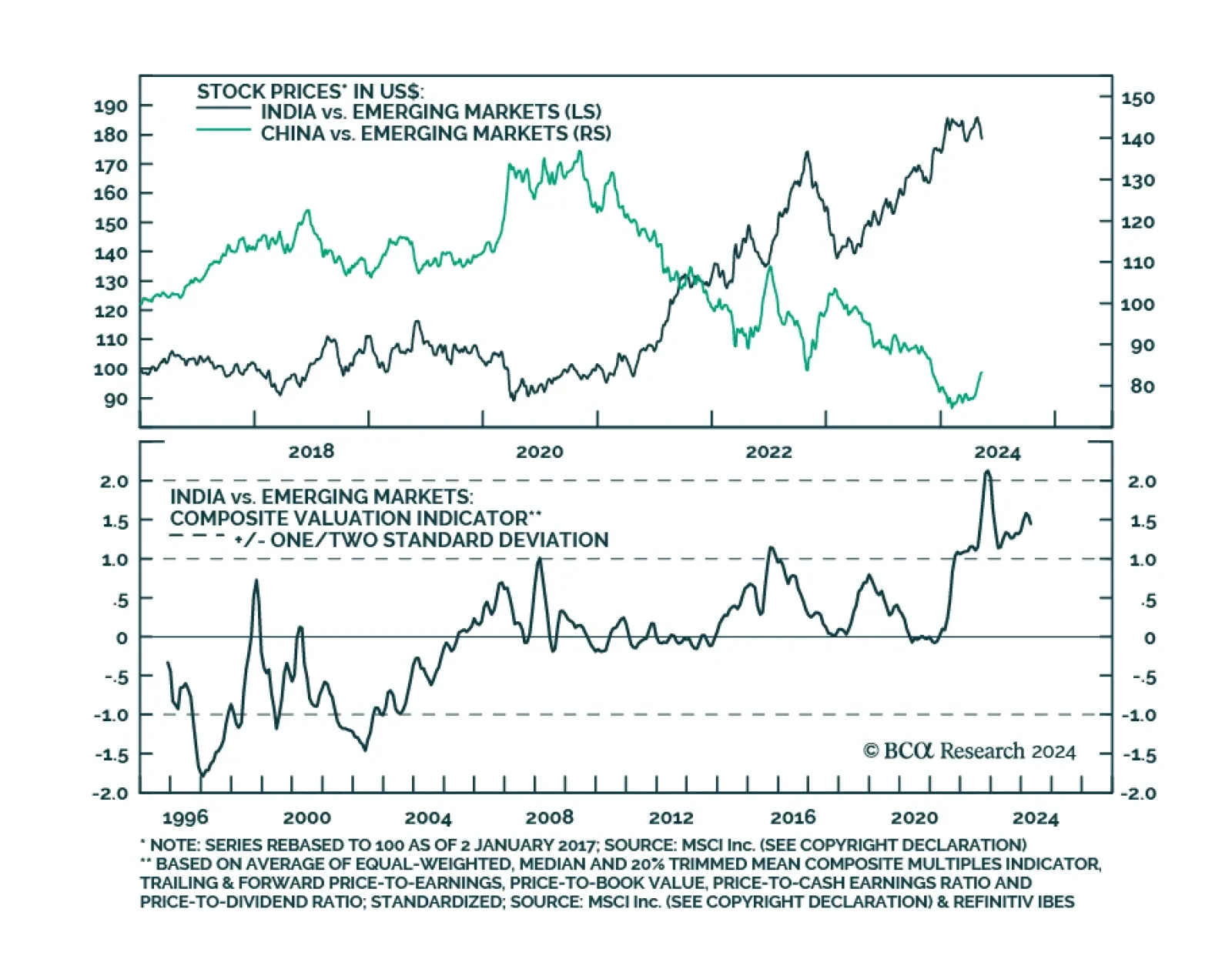

Upward growth revisions for China and India have led the IMF to recently upgrade its 2024 growth forecast for Asia to 4.5% from 4.2%. The regional growth forecast for 2025 remains unchanged at 4.3%. The IMF now expects the…

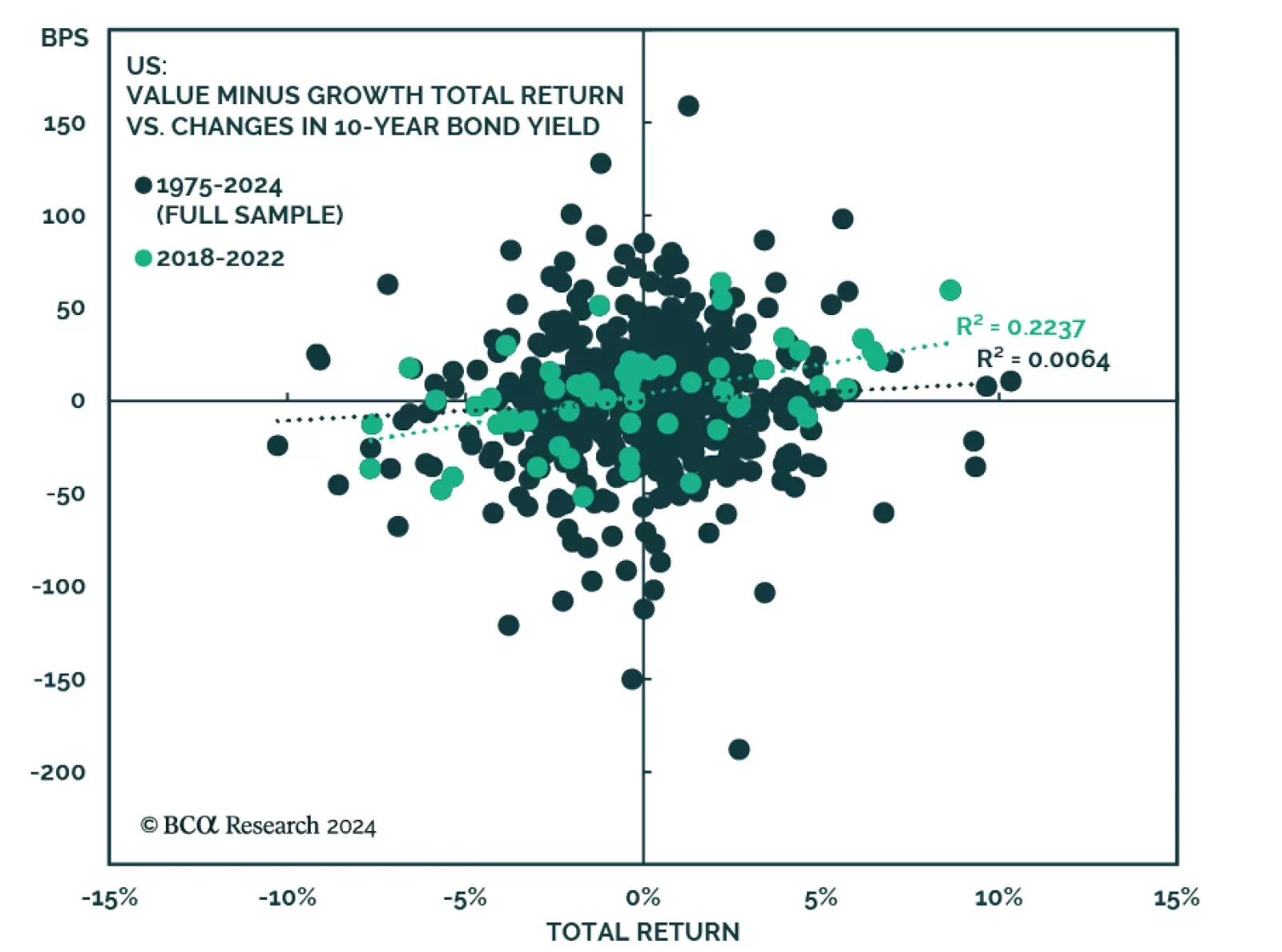

The idea that rising interest rates benefit value at the expense of growth has become consensus amongst market participants. The rationale is simple: Most of the cashflow that shareholders will receive from growth stocks are…

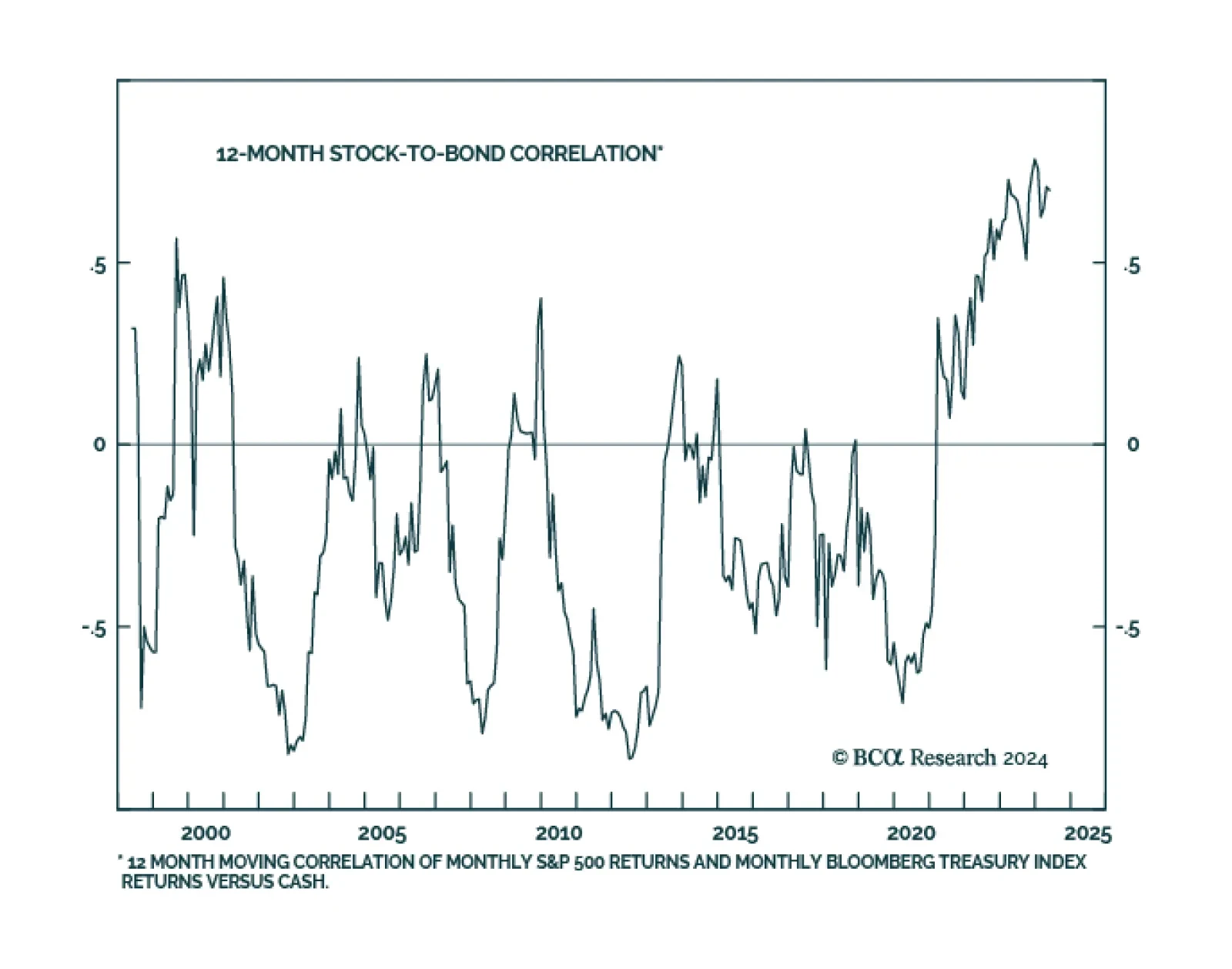

According to BCA Research’s US Bond Strategy service, investors should look to the stock-to-bond ratio to time the breakout in yields. The strong positive correlation between stock and bond returns has been a consistent…

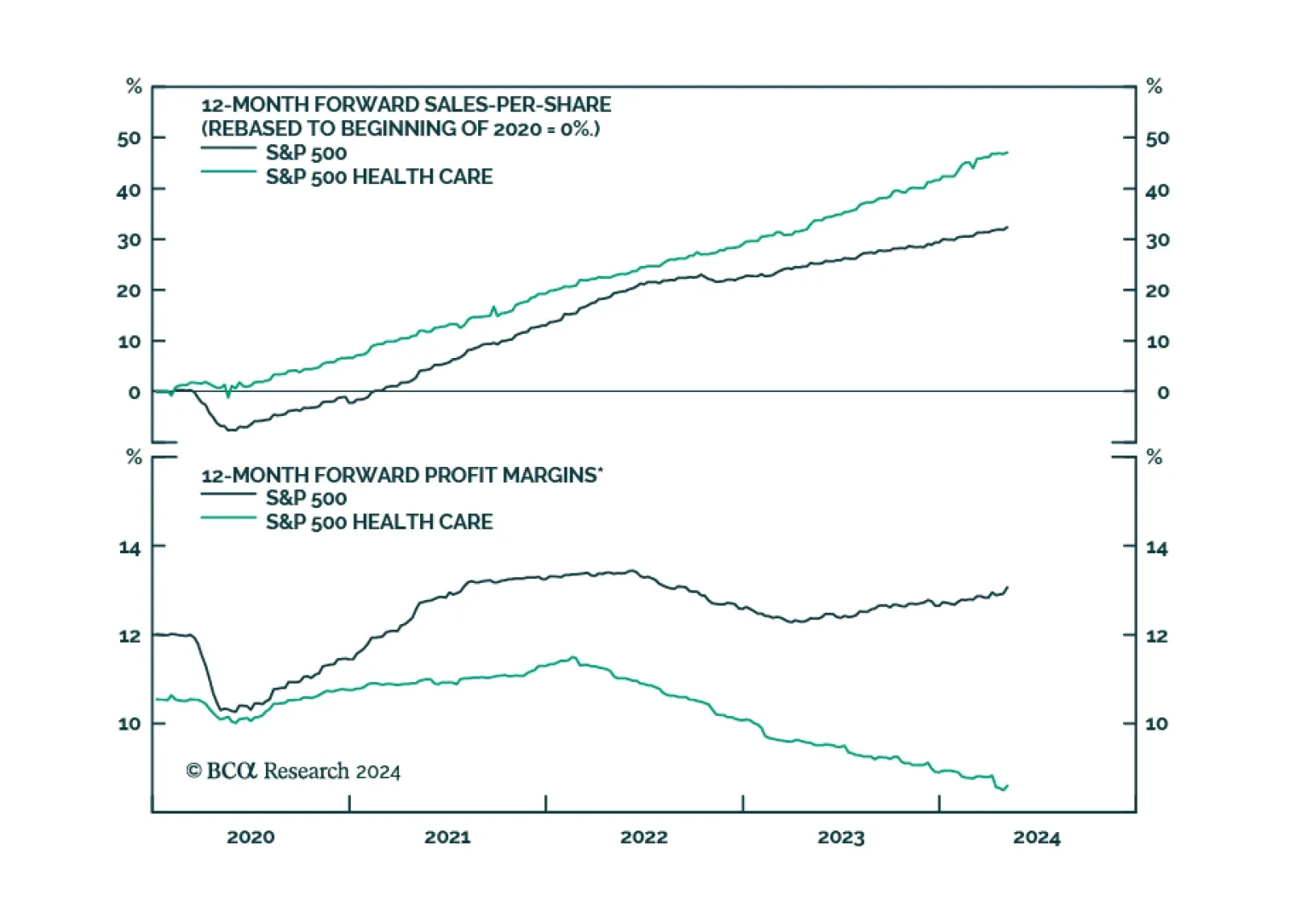

Health care stocks have underperformed the US broad market by over 20% since the beginning of 2023. Indeed, vaccination campaigns during the pandemic years had initially boosted health care companies’ earnings. However,…

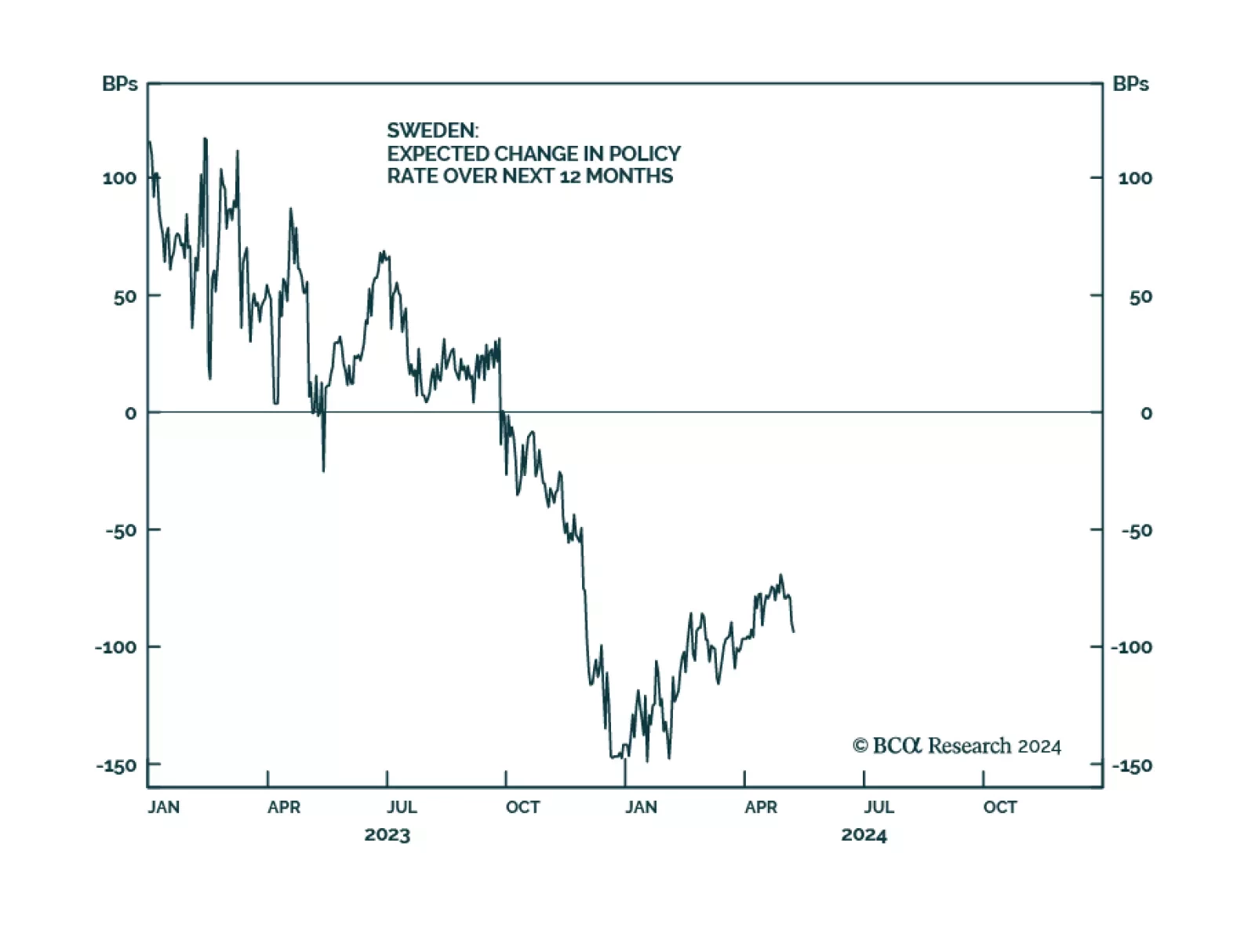

In a widely expected move, the Riksbank cut its policy rate by 25 basis points on Wednesday from 4% to 3.75%. The policy statement highlighted that inflation is approaching its 2% target, that leading indicators are pointing to…

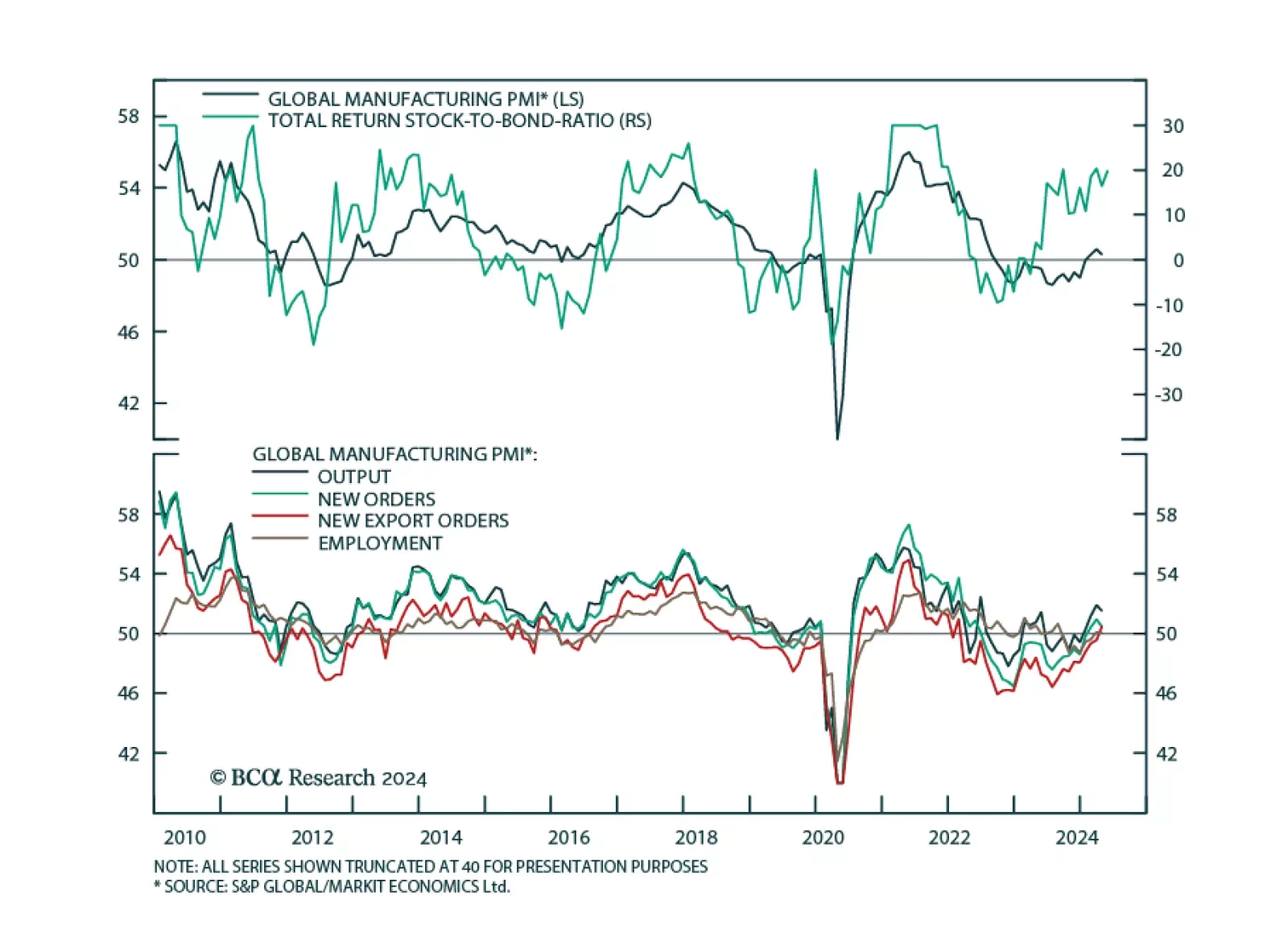

The revival in global growth momentum continued in April. The JPM Global Manufacturing PMI came in at 50.3, marking its third consecutive month of expansion. Details underscored solid demand conditions. Output and new orders…

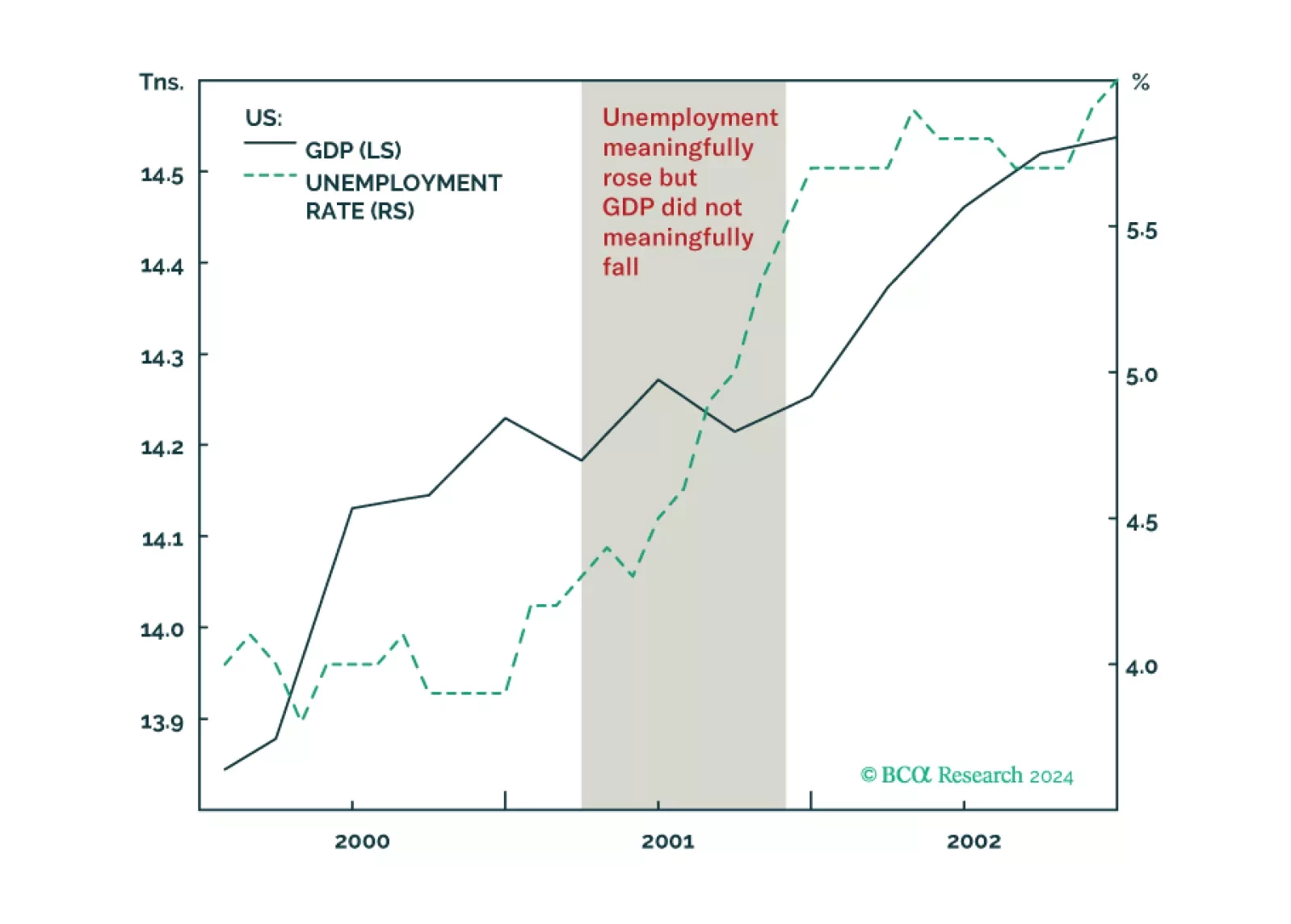

Why the US could get a jobs recession without a GDP recession, as happened in 2001, and what it means for stocks and bonds. Plus, an update on the Joshi rule.

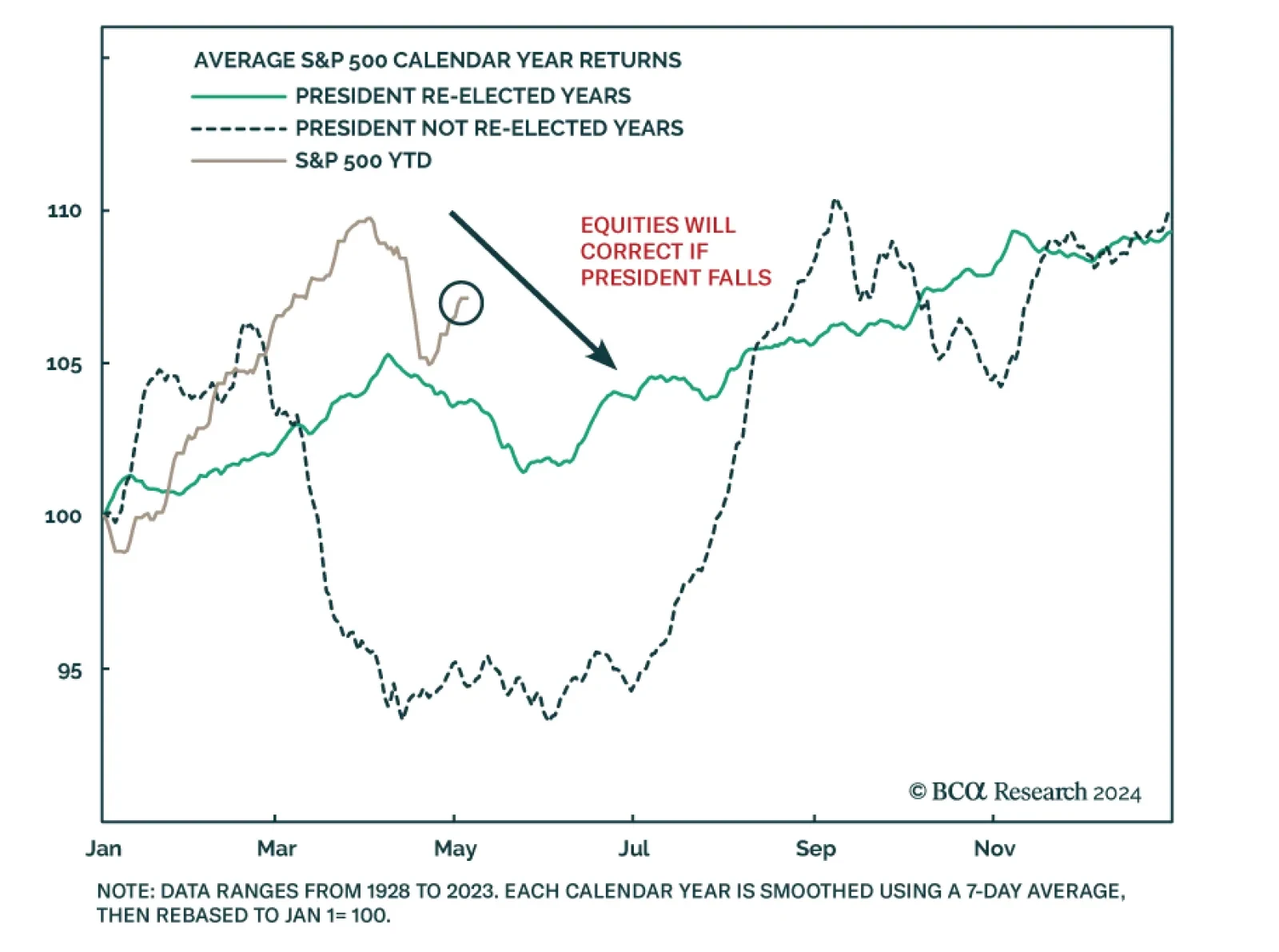

According to BCA Research’s US Political Strategy service, US politics this decade will follow three strategic themes for the decade: (1) generational change, (2) peak polarization, (3) limited big government.…

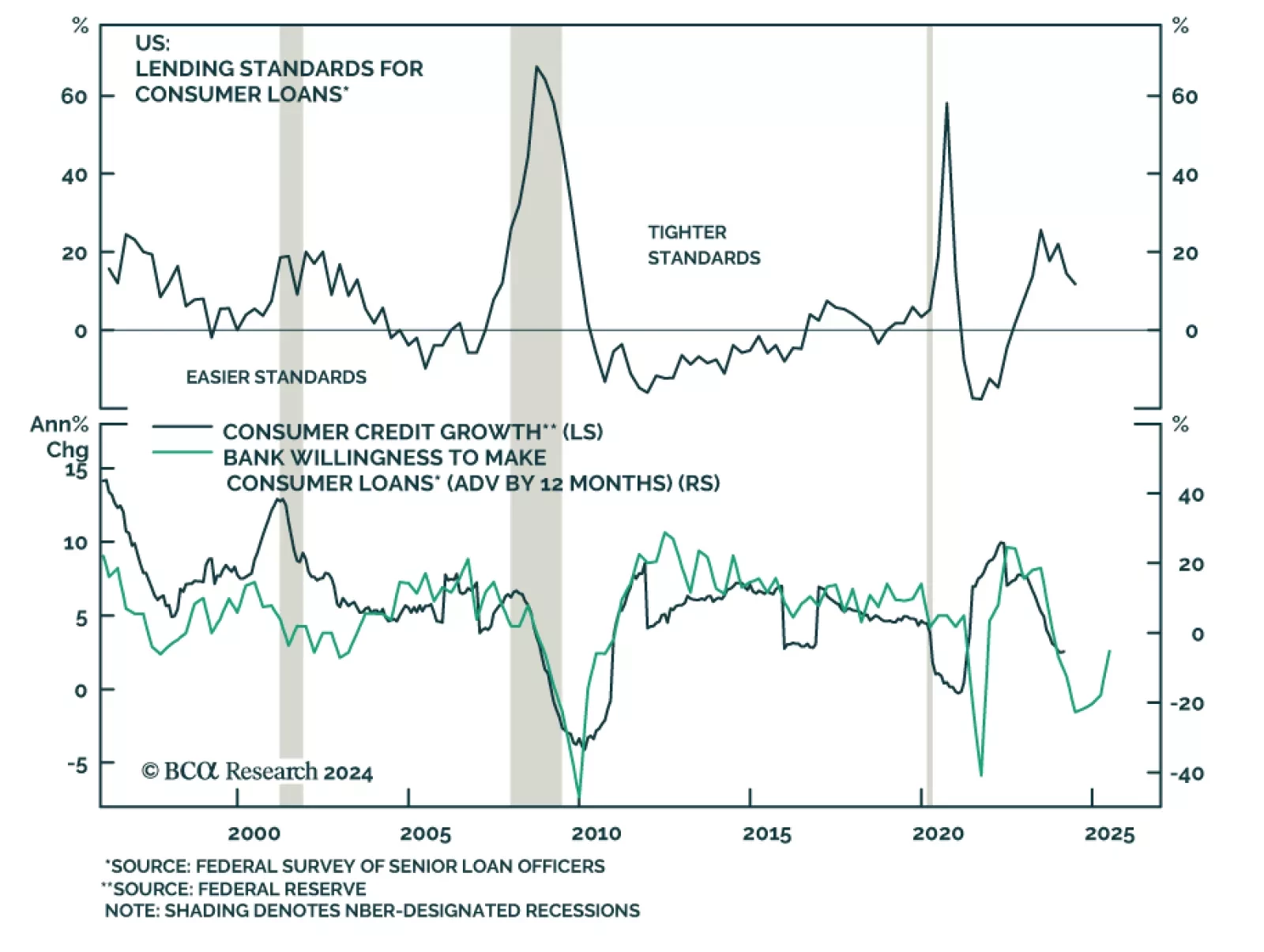

Lending standards continued to tighten for most loan categories in Q1 2024. US banks reported tightening lending standards for C&I and CRE. For real-estate-backed loans to households, lending standards tightened further…